Source: Mastercard Advisors/Mastercard SpendingPulse

From the Desk of Deborah Weinswig

New Year Preview: 2018 Is Likely to Look a Lot Like 2017

Here we are again, at the outset of a brand new year that’s full of promise. Many of us have made New Year’s resolutions to exercise more, save money or make improvements in other areas of our lives and, whether we keep those resolutions or not, it’s the appropriate time to take a quick look back and a longer look forward to see what the signs augur for retail in 2018.

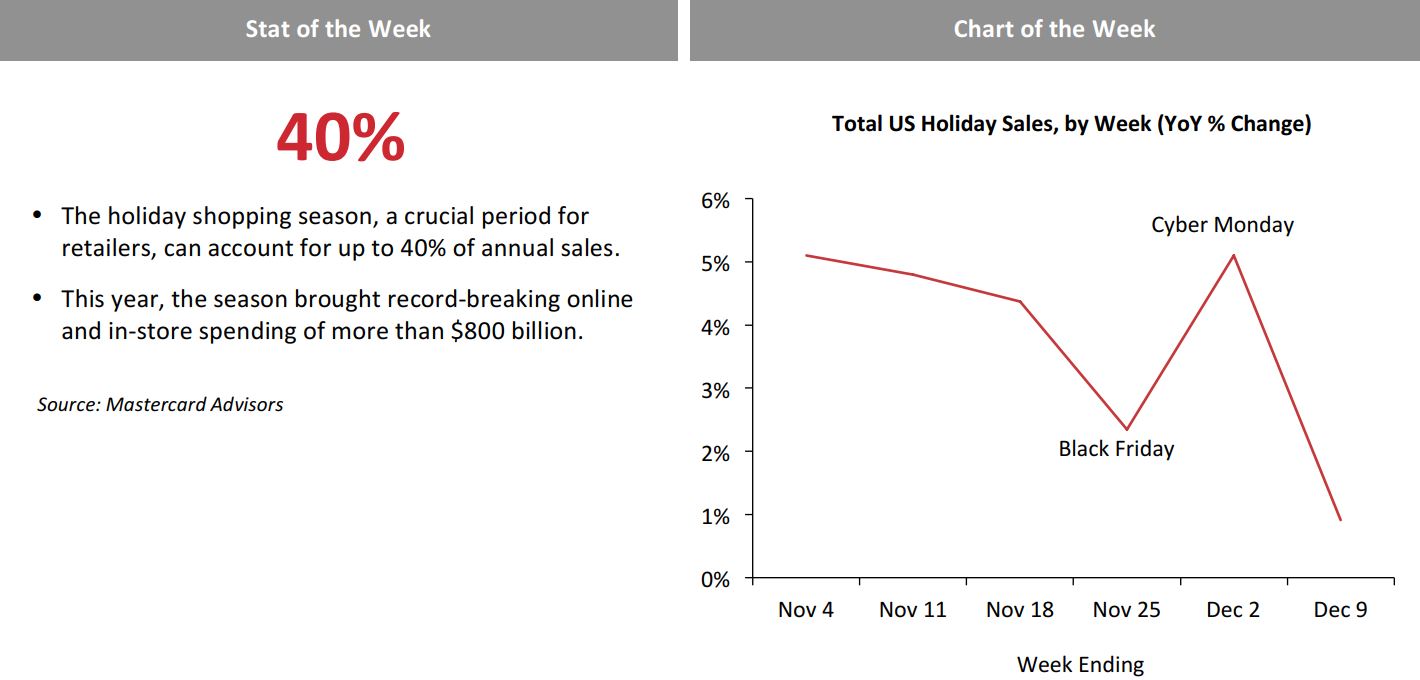

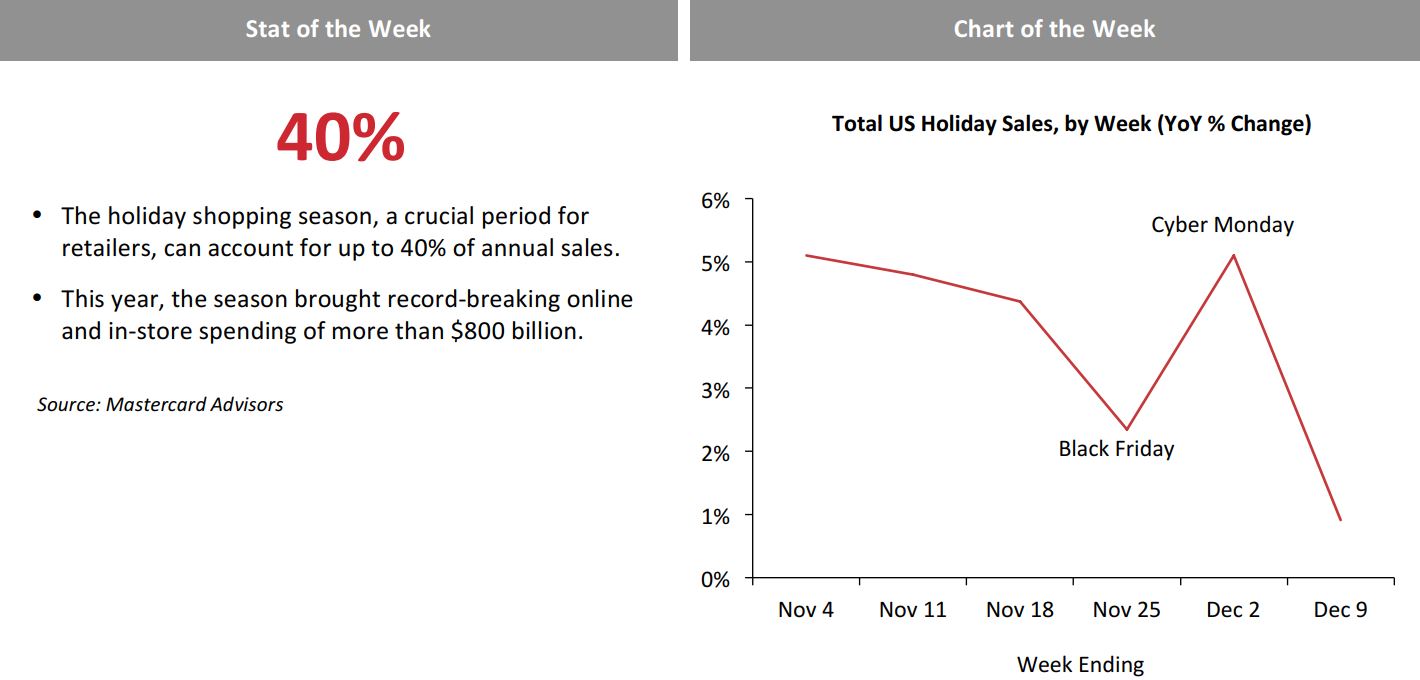

Retail went out with a bang in 2017. Mastercard SpendingPulse figures show that US holiday retail sales increased by 4.9% year over year, indicating strong consumer spending. Embedded in this cheery figure was an 18.1% increase in online sales, from which we can draw two conclusions: e-commerce grew faster than total retail, indicating further share gains, and e-commerce’s share gains probably accelerated a bit in the fourth quarter, since the channel’s growth rate exceeded the 14.2% rate logged in the fourth quarter of the previous year.

Although these year-over-year increases show strong consumer demand—which was fueled by high employment, low inflation and higher credit-card usage—they reveal nothing about the actual state of retail. And while the surge in spending in the fourth quarter provided a welcome boost for retailers, it did nothing to change the fundamental drivers, so we are likely to see retail trends from 2017 continue, and perhaps accelerate, in the new year.

Store closures could continue in 2018. The good news is that many of the nearly 7,000 store closures announced in 2017 were one-offs, with retailers doing some housekeeping by disposing of stores that had underperformed either for a long time or egregiously over a shorter period. Another rash of bankruptcy filings and closure announcements is expected early this year, once retailers have reviewed their 2017 books and looked ahead to their 2018 operations.

Mergers and acquisitions are likely to continue at a healthy pace. There were several notable acquisitions and asset transfers in 2017, and various retail companies are likely to continue to engage in such activities as conditions intensify. On the heels of its Jet.com acquisition in 2016, Walmart picked up Bonobos, Moosejaw, ModCloth, Shoebuy, Hayneedle and Parcel in 2017. Amazon completed the largest acquisition of the year, acquiring Whole Foods Market for $13.7 billion. At the end of the year, Target acquired delivery platform Shipt for $550 million. Another notable 2017 transaction was Lord & Taylor’s sale of its New York flagship store to WeWork for $850 million.

Walmart has hit its e-commerce stride. Walmart leveraged its Jet.com acquisition to boost its e-commerce business significantly in 2017, and the company’s e-commerce revenue and gross market value increased by 50% and 54%, respectively, year over year in the most recent quarter. Management commented at the company’s annual investor meeting that e-commerce revenue could grow another 40% in 2018. These healthy figures are sparking much discussion about a looming clash of the retail titans, Amazon and Walmart.

Amazon keeps getting bigger…and bigger…and bigger. In 2017, Amazon reported that it had its best Prime Day ever and that sales on Cyber Monday represented its biggest shopping day ever. Sales in Amazon’s North America segment (which excludes the International and Amazon Web Services businesses) grew by a healthy 28.5% during the first nine months of the year, and more than 4 million people signed up for Prime trial memberships during the holiday season. In 2018, we will be looking to see how Amazon is leveraging its Whole Foods acquisition. Though the company hit the ground running with the acquisition, offering Amazon consumer electronics in Whole Foods stores and slashing prices on selected groceries immediately after the deal closed, Amazon now faces a significant amount of work in integrating the two companies and creating the special offers for Prime members that it has promised.

Retail is likely to be an exciting place in 2018, chock-full of acquisitions, store closures and downsizings, and management changes, along with innovation. In addition, we will have a front-row seat as we watch Amazon and Walmart duke it out. Still, as in recent years, the consumer will be the ultimate winner amid the disruption in 2018.

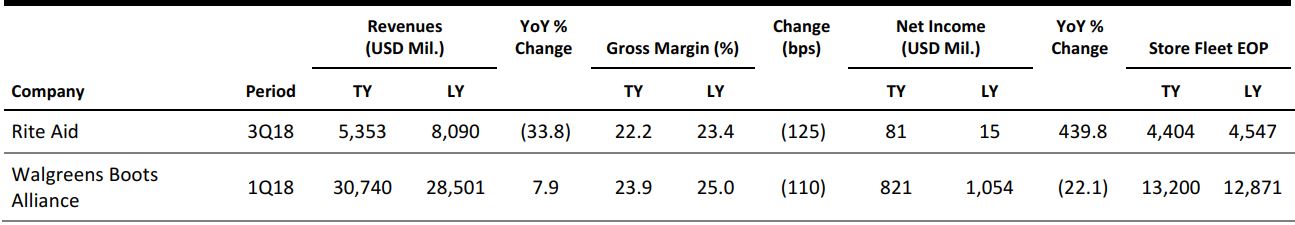

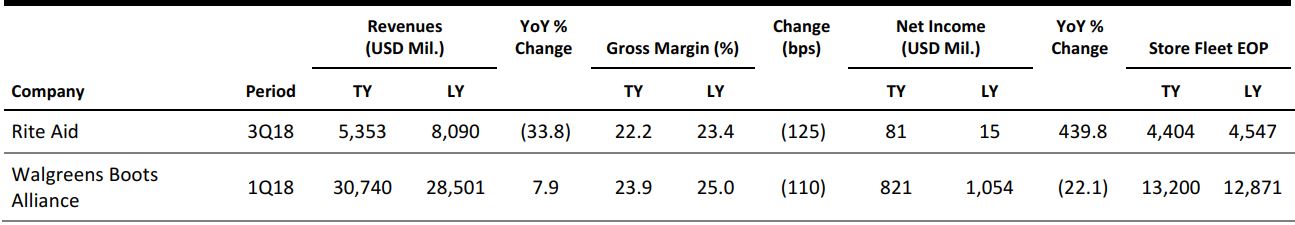

US RETAIL EARNINGS

Source: Company reports/FGRT

Source: Company reports/FGRT

US RETAIL & TECH HEADLINES

Why Retail Is the Hottest Target for Hackers (January 2) RetailTouchPoints.com

(January 2) RetailTouchPoints.com

- Five trillion dollars in US retail spending is very attractive to cybercriminals. The large volumes of financial data continuously processed by payment and retail vendors is highly valued and can provide criminals with easy payouts.

- This is a big cause for concern, as Trustwave’s Global Security Report found that the retail industry was the most compromised sector for a fifth year in a row, and that the primary target is payment card data, which is most commonly stolen through point-of-sale breaches.

Amazon Will Buy US Retailer Target, Analyst Says (January 2) TechCentral.co.za

(January 2) TechCentral.co.za

- com’s shake-up of the retail landscape may not be over, according to one well-known technology analyst. The Internet giant will acquire Target, Loup Venture Cofounder Gene Munster wrote, highlighting eight predictions for the technology industry in 2018. Amazon made waves in retailing last year with its purchase of Whole Foods Market.

- “Target is the ideal offline partner for Amazon for two reasons: shared demographic and manageable but comprehensive store count,” Munster wrote, noting that both companies focus on mothers and families.

A Tsunami of Store Closings Is About to Hit the US—and It’s Expected to Eclipse the Retail Carnage of 2017

(January 1) BusinessInsider.com

- More than 12,000 stores are expected to close in 2018—up from roughly 9,000 in 2017, according to Cushman & Wakefield. A rash of bankruptcy filings and store closures is expected at the start of the year, when retailers are flush with cash from the holiday season.

- The closings would push hundreds of shopping malls to the brink of death.

Coming to a Mall Near You in 2018: Craft Brewers, Children’s Theaters, Gyms and Other Unorthodox Uses

(December 28) CNBC.com

- Malls are getting makeovers—so much so that they might not be called malls anymore. US retail landlords, which own some of the most profitable malls in America, are focused on redeveloping their properties and ditching antiquated occupants in the coming months.

- Many of these property owners don’t exactly have a choice. As department stores fire off store closure announcements and as countless specialty apparel retailers file for bankruptcy, real estate investment trusts have to find replacements elsewhere, and quickly.

US Holiday Sales Set to Break Records in Surprise Boon to Retail

(December 27) FoxBusiness.com

- The US holiday shopping season is on track to break sales records on the back of surging consumer confidence and increased use of mobile devices, presenting an unexpected boon for retailers and the delivery companies they rely on.

- The holiday shopping season, a crucial period for retailers that can account for up to 40% of annual sales, brought record-breaking online and in-store spending of more than $800 billion this year, according to Mastercard’s analytics arm.

EUROPE RETAIL & TECH HEADLINES

Marks & Spencer Sells Business in Hong Kong and Macau

(January 2) TheRetailBulletin.com

- Marks & Spencer has sold its 27-store retail business in Hong Kong and Macau to UAE-based Al-Futtaim Group, a longtime franchise partner. Al-Futtaim now runs 72 Marks & Spencer stores across 11 markets in Asia and the Middle East.

- The sale follows a strategic review by Marks & Spencer to focus on its existing franchise and joint venture partnerships and to operate with fewer wholly owned markets.

Whistles Incurs Loss, but Online Sales Boost Turnover (December 29) Companies House (Gov.uk)

(December 29) Companies House (Gov.uk)

- British fashion chain Whistles posted turnover growth of 18%, to £68.9 million ($91.8 million), in the year ended April 1, 2017, while its losses narrowed by 34%, to £3.8 million ($5.1 million). Whistles was acquired by TFG Brands (London), a subsidiary of South Africa’s The Foschini Group, on March 23, 2016.

- Contributing to the increase in turnover were growth of 35% in the company’s online business and an additional 10 weeks in its reporting period, which was altered to align with that of its ultimate parent company.

Co-Op Food to Open 100 New Stores in the UK in 2018 (January 2) Independent.co.uk

(January 2) Independent.co.uk

- Co-Op Food, the food retail business of the consumer co-operative movement in the UK, is set to open 100 new food stores in the country in 2018. It is expected to spend about £160 million ($217 million) on the new stores and on revamping a further 150 existing stores.

- Co-op said an estimated 1,600 jobs will be created as a result of the store development, which will include about 20 new stores in London and 18 in Scotland.

MuscleFood.com Secures Undisclosed Sum from Private Investors (January 2) RetailTimes.co.uk

(January 2) RetailTimes.co.uk

- UK venture capital firm Business Growth Fund has invested an undisclosed sum in Nottingham-based MuscleFood.com, an online retailer that sells high-protein foods, including lean meats and sports nutrition supplements. The investment comes after the retailer, valued at £50 million ($68 million), sought funds to expand further into UK supermarkets.

- com already sells through Sainsbury’s, Spar and Co-Op in the UK and is present in over 300 Musgrave-owned stores in Ireland. It launched in 2013 and reached sales in excess of £100 million ($136 million) within four years.

DFS Furniture Buys Assets from Failed Rival Multiyork (December 28) BBC.com

(December 28) BBC.com

- In a deal worth £1.2 million ($1.6 million), British furniture retailer DFS bought eight store leases, as well as product designs, marketing databases and other intellectual property, from rival Multiyork, which went into administration in late November 2017.

- Six of the acquired stores will be converted to operate under the Sofa Workshop banner and the other two will become DFS stores. Administrators did not comment on what would happen to Multiyork’s remaining stores and its factory.

ASIA RETAIL & TECH HEADLINES

SoftBank Succeeds in Tender Offer for Uber Shares (December 29) Reuters.com

(December 29) Reuters.com

- A consortium led by SoftBank will buy a large number of shares of Uber in a deal that values the ride-services firm at $48 billion, Uber said. The offer is a victory for new Uber CEO Dara Khosrowshahi.

- The price is roughly a 30% discount to Uber’s most recent valuation of $68 billion. The deal will trigger a number of changes in the way the board oversees the company, which is dealing with federal criminal probes, a high-stakes lawsuit and an overhaul of its workplace culture.

China’s Huawei Flags Slower Smartphone and Overall Revenue Growth (December 29) Reuters.com

(December 29) Reuters.com

- China’s Huawei flagged overall and smartphone revenue figures for 2017 that represented its slowest growth in four years, and vowed to extend its global reach with more premium products in 2018. The telecom equipment and smartphone maker expects 2017 revenue to rise by 15%, to ¥600 billion ($92.08 billion).

- The expectation represents the slowest growth since 2013 for Huawei. Its fast revenue growth in recent years has been slowing as Chinese telecom carriers complete the construction of the world’s largest 4G mobile network and as competition intensifies in the smartphone market. Huawei’s smartphone shipments in 2017 totaled 153 million units and its global market share topped 10%, cementing its position as the world’s third-largest smartphone maker.

China Asks for Stronger Action on Illegal, Vulgar Online Games

(December 29) Xinhuanet.com

China Asks for Stronger Action on Illegal, Vulgar Online Games

(December 29) Xinhuanet.com

- China has recently set out on another round of action against online games with illicit conduct and inappropriate content. Departments should carry out investigations immediately, mainly on games that have large numbers of players and big social influence, according to a guideline issued by eight government departments.

- Authorities should handle games with prohibited content such as violence and obscenity firmly, shutting down operators that lack permissions, and blocking overseas games with content that breaches Chinese law, the government said.

Fast-Growing Chinese Media Startup ByteDance Enters 2018 with Some Uncertainty

(January 3) TechCrunch.com

Fast-Growing Chinese Media Startup ByteDance Enters 2018 with Some Uncertainty

(January 3) TechCrunch.com

- ByteDance, the new media firm behind news app Toutiao and the owner of Musical.ly courtesy of a $1 billion deal, had a bumpy ride into 2018 after falling afoul of China’s Internet censors for the first time. Toutiao, a one-stop app for news in China, and Hong Kong–based Phoenix Television were shut down for a day because they had “exerted a bad influence on online opinion,” according to the Beijing Internet Information Office. The two were said to have promoted “pornographic and vulgar content.”

- The company picked up a number of international services—including Musical.ly and News Republic for $86 million—and began to execute an ambitious plan to expand beyond China, where Toutiao alone claims 120 million users. That international expansion might be a little more urgent now after Toutiao, its flagship service, was taken offline for 24 hours in the run-up to New Year’s Eve, the South China Morning Post

LATAM RETAIL & TECH HEADLINES

Digital Transformation Spend to Reach $57 Billion in LatAm by 2020 (December 30) ZDNet.com

(December 30) ZDNet.com

- Spending related to digital transformation in Latin American markets should reach $57 billion within the next two years, according to research by analysis firm IDC. This represents about 40% of all information technology spending as companies in the region accelerate projects related to digitizing products, services and back-office functionality.

- Noteworthy progress will be seen in the retail, banking and insurance sectors, whereas the public sector will lag behind. IDC says that about a third of the digital transformation projects led by Latin American firms will use artificial intelligence technology, which will power half of all apps.

Citrix Holds High Hopes for Brazil (December 27) ZDNet.com

(December 27) ZDNet.com

- Citrix will ramp up channel training in Brazil to support its goal of achieving threefold growth in local sales in 2018. The company’s current bullish moment in Brazil follows a slowdown that lasted for nearly three years, according to Luis Banhara, the country director at Citrix Brazil.

- “We have gone through many ups and downs in Brazil since we began operations here 17 years ago, but even in the toughest moments we have never reconsidered our commitment to our local clients and we are here to stay,” Banhara said.

Amazon, Alibaba and Walmart Are Investing Heavily South of the Border (January 1) DailyCaller.com

(January 1) DailyCaller.com

- Online shopping in Mexico has been slower to catch on than in the US. But with online sales in Mexico expected to more than double, to nearly $18 billion, over the next three years, the major global e-commerce players are moving into high gear. Amazon, Walmart and Alibaba are all making significant investments to capture a larger share of Mexico’s fast-growing market.

- Amazon is building a warehouse of 1 million square feet near Mexico City, tripling its current distribution space in Mexico. Walmex announced a $1.3 billion investment in distribution centers that will be used primarily for e-commerce fulfillment. And the Mexican government announced an agreement with Alibaba to help Mexican small and medium-sized enterprises expand into China and other international markets using the company’s B2B trading platform, Alibaba.com.

Google’s Master Plan to Foster LatAm Tech Startups in 2018 (January 2) ZDNet.com

(January 2) ZDNet.com

- Google will invest in the development of its São Paulo–based startup center to widen its footprint in founder communities in Latin America in 2018. The company already has about a billion users across its product portfolio and believes the next billion will come from emerging countries rather than from developed economies.

- According to Campus São Paulo Director André Barrence, this was core to Google picking Brazil for its first tech startup hub in the Americas. “Brazil was chosen because of its adoption of Google products and also due to its strategic importance to the company—we have identified great potential here in terms of the local startup ecosystem,” Barrence said.

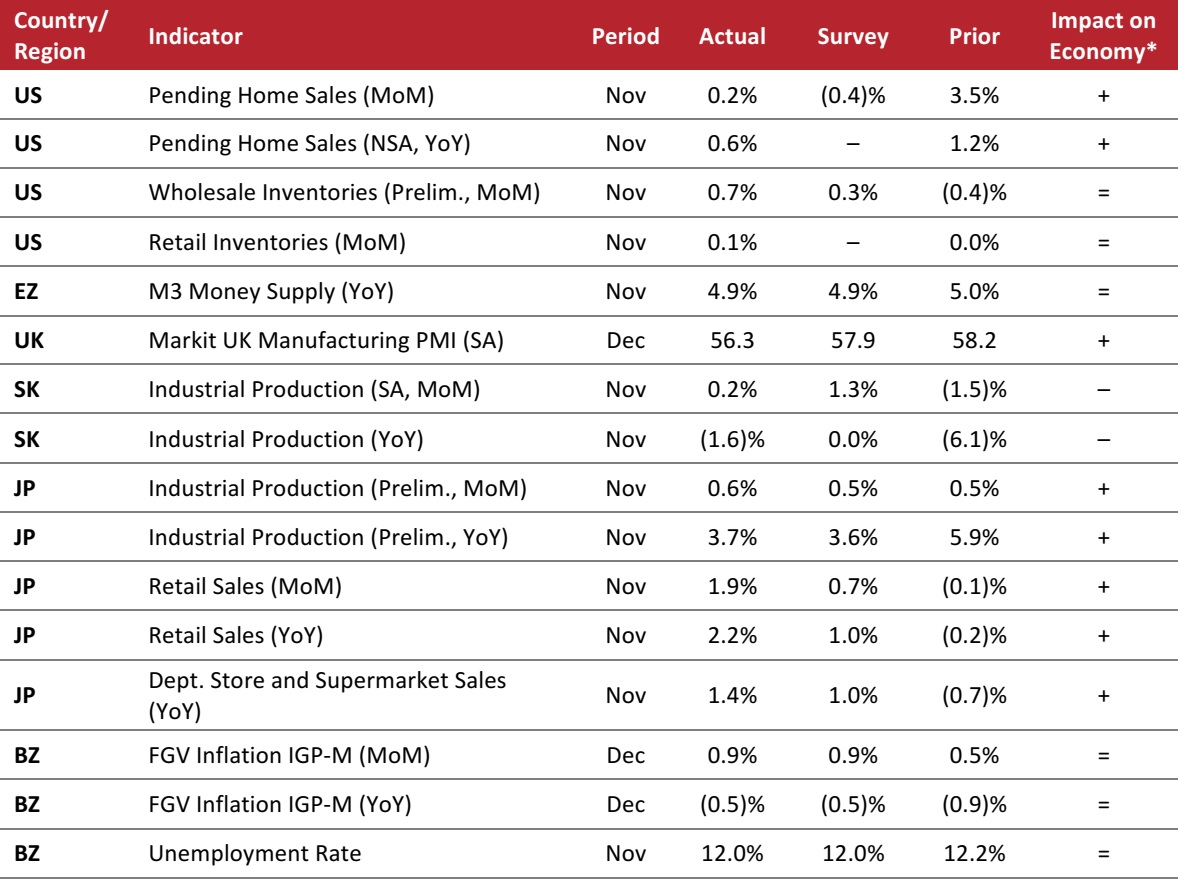

MACRO UPDATE

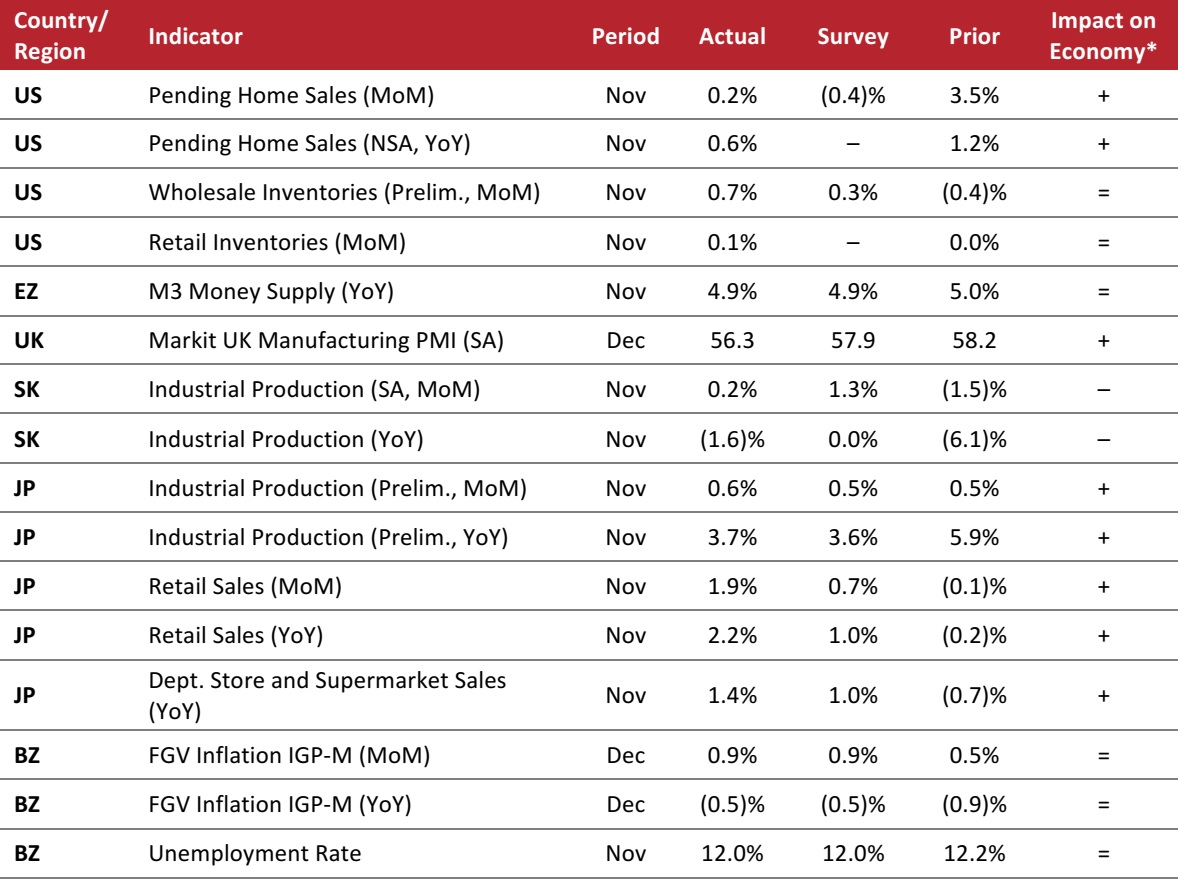

Key points from global macro indicators released December 27, 2017–January 3, 2018:

1) US: Pending home sales increased by 0.2% month over month and by 0.6% year over year in November. Wholesale inventories increased by 0.7% month over month and retail inventories edged up by 0.1% month over month in November.

2) Europe: In the eurozone, the M3 money supply increased by 4.9% year over year in November, in line with the market’s estimate. In the UK, the Manufacturing Purchasing Managers’ Index (PMI) remained above the expansion threshold of 50.0 in December, but ticked down to 56.3 from 58.2 in November.

3) Asia-Pacific: In South Korea, industrial production increased by 0.2% month over month in November. In Japan, industrial production also moderated upward in November, while retail sales increased by 1.9% month over month.

4) Latin America: In Brazil, the FGV inflation General Market Price Index (IGP-M) increased by 0.9% month over month and decreased by 0.5% year over year in December. The Brazilian unemployment rate was 12.0% in November, in line with the market’s estimate.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Census Bureau/European Central Bank/Markit/Statistics Korea/Ministry of Economy, Trade and Industry Japan/Fundação Getulio Vargas/Instituto Brasileiro de Geografia e Estatística/FGRT

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Census Bureau/European Central Bank/Markit/Statistics Korea/Ministry of Economy, Trade and Industry Japan/Fundação Getulio Vargas/Instituto Brasileiro de Geografia e Estatística/FGRT

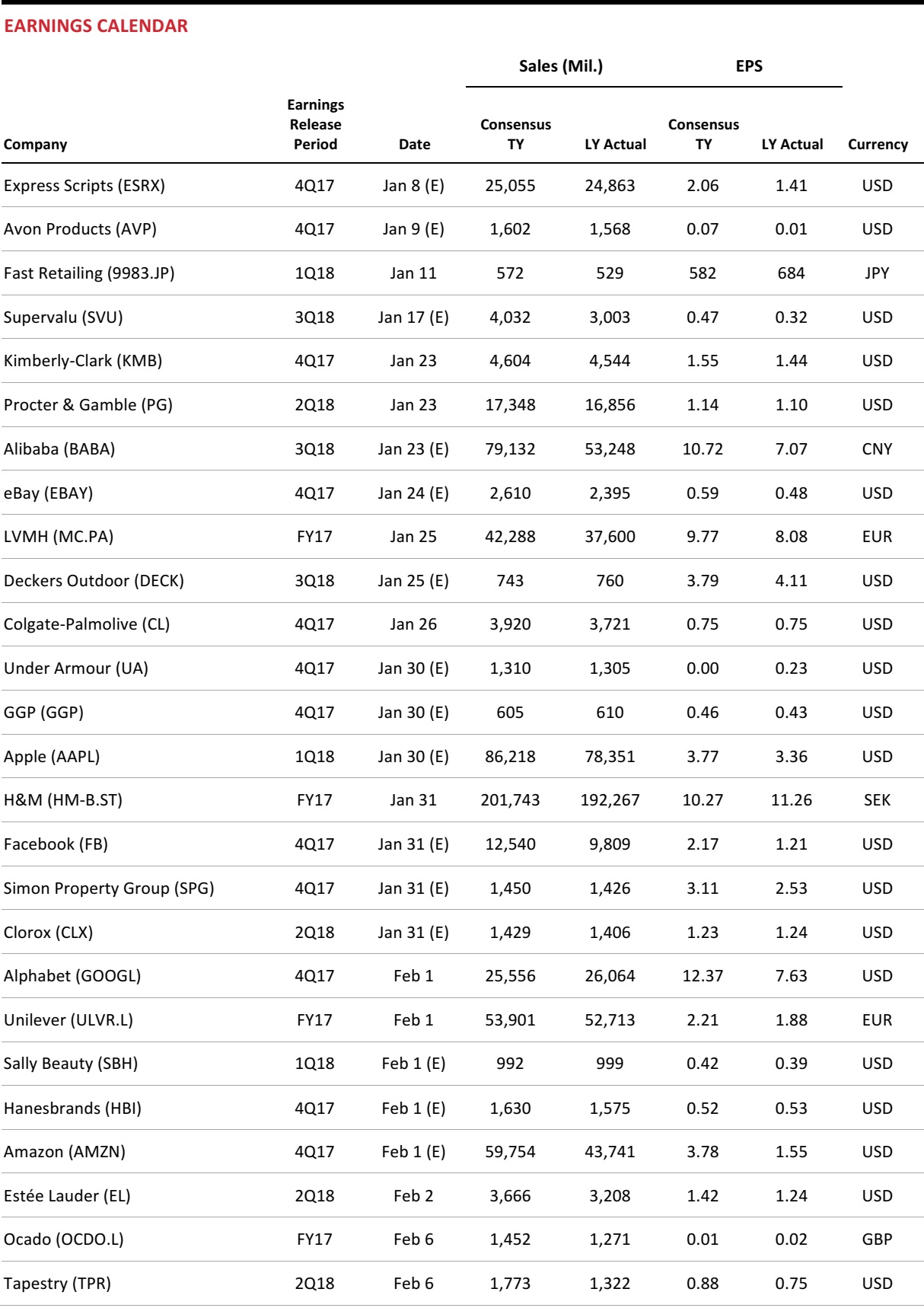

Source: Company reports/FGRT

Source: Company reports/FGRT (January 2) RetailTouchPoints.com

(January 2) RetailTouchPoints.com

(January 1) BusinessInsider.com

(January 1) BusinessInsider.com

(December 28) CNBC.com

(December 28) CNBC.com

(December 27) FoxBusiness.com

(December 27) FoxBusiness.com

(January 2) TheRetailBulletin.com

(January 2) TheRetailBulletin.com

(January 2) Independent.co.uk

(January 2) Independent.co.uk

(December 28) BBC.com

(December 28) BBC.com

(December 29) Reuters.com

(December 29) Reuters.com

(December 29) Reuters.com

(December 29) Reuters.com

China Asks for Stronger Action on Illegal, Vulgar Online Games

(December 29) Xinhuanet.com

China Asks for Stronger Action on Illegal, Vulgar Online Games

(December 29) Xinhuanet.com

(December 30) ZDNet.com

(December 30) ZDNet.com

(January 1) DailyCaller.com

(January 1) DailyCaller.com

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Census Bureau/European Central Bank/Markit/Statistics Korea/Ministry of Economy, Trade and Industry Japan/Fundação Getulio Vargas/Instituto Brasileiro de Geografia e Estatística/FGRT

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Census Bureau/European Central Bank/Markit/Statistics Korea/Ministry of Economy, Trade and Industry Japan/Fundação Getulio Vargas/Instituto Brasileiro de Geografia e Estatística/FGRT