albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Three Ways China Will Lead Digital Retail Trends in 2019 — and Why These Trends Are Likely to Drive Consolidation Among Major Platforms China continues to lead the world in the integration of online and offline retail, most notably through Alibaba Group’s New Retail concept. We predict that retailers in the U.S. and Europe will increasingly adopt elements of New Retail in 2019. But what else is worth keeping an eye on in Chinese digital retail? This week, we discuss three digital trends we expect to see in 2019, and we note that all three are likely to strengthen the competitive advantages enjoyed by China’s market-leading apps and platforms, such as WeChat, Douyin (also known as TikTok) and Tmall.

Leading in Social Commerce WeChat Mini Programs are mini apps that operate within Tencent’s WeChat social media app. They allow users to perform a variety of functions without having to download a company’s separate app. WeChat Mini Programs have become more sophisticated over the last two years, and their lower production costs have encouraged brands and third-party developers to create them. As of June 2018, there were a million Mini Programs available, according to Tencent.

McDonald’s and KFC are among the companies to have launched Mini Programs that allow customers to pay in-store, request delivery and participate in loyalty programs. As more brands and retailers develop Mini Programs, the appeal of WeChat’s ecosystem over stand-alone apps is growing among consumers.

Leading in Content E-Commerce Content e-commerce refers to the monetization of highly trafficked user-generated content, such as popular posts, articles or videos, through online purchases. Short-video apps have become the major driver of content e-commerce in China. According to consulting firm iResearch, the market for short-video apps in China will be worth ¥30 billion ($4.78 billion) by 2020. Douyin, known as TikTok outside China, is the most widely used short-video app both in China and overseas, according to app download data from analytics firm Sensor Tower.

Some brands have started using Douyin for marketing campaigns. Michael Kors was the first luxury brand to partner with Douyin, and the brand leveraged key opinion leaders to convince 30,000 Douyin users to post short videos of themselves doing their own “catwalks” while modeling Michael Kors products. Since March 2018, Douyin has incorporated external links into the Alibaba Taobao marketplace accounts of content publishers with over a million followers. These links allow users to easily purchase products featured in the short videos, and we expect this in-app purchase feature to become more prevalent this year.

Leading in Mobile Commerce In China, mobile commerce is e-commerce. Euromonitor International estimates that retail sales made via mobile devices will account for 82% of all Chinese internet retail sales in 2019, but only about 30% of all such sales in the U.S. Last year in China, mobile accounted for 93.6% of total sales on all e-commerce platforms during Singles’ Day, the country’s largest annual online shopping event, according to China-based data services company Syntun.

Why does mobile matter? We think the shift to mobile devices could provide shoppers with another reason to browse and buy on multibrand, multiseller platforms such as Alibaba’s Tmall and Taobao — because mobile devices’ smaller screens make it more challenging to compare product specifications and prices between retailers’ and brands’ stand-alone websites or apps. As mobile internet retailing captures greater share in the West, we may see a similar gradual consolidation of traffic to one-stop-shopping platforms.

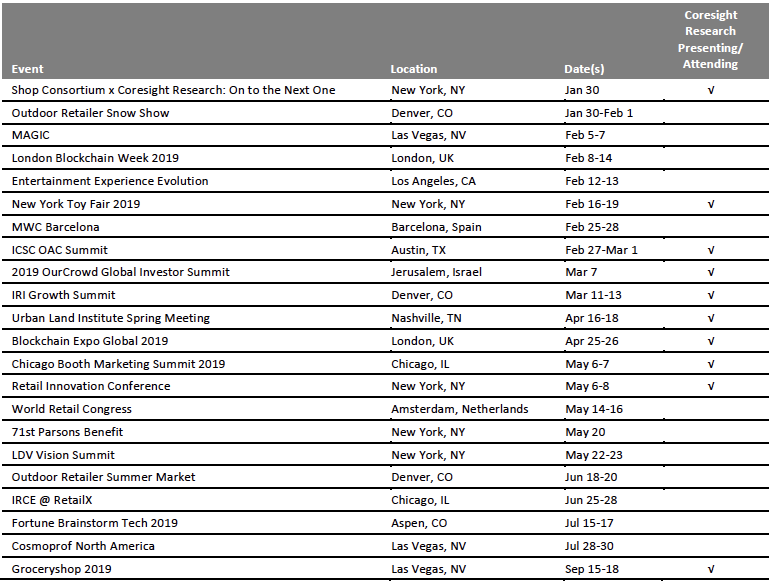

QUESTION OF THE WEEK

[caption id="attachment_67117" align="aligncenter" width="756"] Base: 7,320 U.S. adults age 18 and above

Base: 7,320 U.S. adults age 18 and aboveSource: Prosper Insights & Analytics[/caption]

US RETAIL & TECH HEADLINES

![]() Vans Parent Lifts Guidance on Strong Sneaker Sales

(Jan. 21) InsideRetail.com.au

Vans Parent Lifts Guidance on Strong Sneaker Sales

(Jan. 21) InsideRetail.com.au

- VF Corp. has increased its outlook for fiscal year 2019 after posting strong third-quarter results on Jan. 18. The U.S. apparel company, which owns and operates a range of brands, revealed that revenue grew 8% in the third quarter.

- The gain was driven largely by the Vans footwear brand, which saw revenues increase 25% in the quarter, as well as by outdoor brand The North Face, which saw a 14% increase.

![]() Tiffany Holiday Sales Fall as Dollar Crimps Chinese Tourists’ Spending

(Jan. 18) CNBC.com

Tiffany Holiday Sales Fall as Dollar Crimps Chinese Tourists’ Spending

(Jan. 18) CNBC.com

- Luxury jeweler Tiffany and Co. tempered its yearly profit forecast on Jan. 18 following an unexpected drop in holiday sales. The company attributed the decline to lower global spending by Chinese tourists due to a stronger dollar and to softer demand in Europe and the U.S. due to “uncertainties and volatility.”

- During the crucial November-December period, Tiffany’s worldwide same-store sales fell 2%, while net sales dipped 1%; the company had expected modest increases in both metrics.

![]() Gymboree Files for Chapter 11 as More Retailers Restructure Debt

(Jan. 18) Reuters.com

Gymboree Files for Chapter 11 as More Retailers Restructure Debt

(Jan. 18) Reuters.com

- Children’s retailer Gymboree Group Inc. has filed for Chapter 11 bankruptcy protection, joining a growing list of brick-and-mortar retailers trying to restructure their debt under court supervision.

- Gymboree will close more stores following the move, its second request for Chapter 11 protection. The company shuttered selected stores and cut its debt by $900 million after emerging from its first bankruptcy in September 2017.

![]() Walmart Ramps Up Grocery Delivery with Four New Service Providers

(Jan. 18) RetailDive.com

Walmart Ramps Up Grocery Delivery with Four New Service Providers

(Jan. 18) RetailDive.com

- Walmart Inc. announced on Jan. 17 that it will add four last-mile delivery providers to its grocery delivery fleet. Point Pickup, Skipcart, AxleHire and Roadie will soon start delivering Walmart grocery orders to customers in four states.

- Customers will continue to place orders through Walmart’s site, and the company’s dedicated personal shoppers will continue to pick and pack online orders, which the new delivery partners will transport to customers’ doors. Walmart offers delivery from 800 stores and plans to add the service to another 800 stores this year.

![]() Supermarket Giant Is Undertaking One of the Largest In-Store Robot Rollouts in the US

(Jan. 14) ChainStoreAge.com

Supermarket Giant Is Undertaking One of the Largest In-Store Robot Rollouts in the US

(Jan. 14) ChainStoreAge.com

- Ahold Delhaize USA, a division of Koninklijke Ahold Delhaize NV, is bringing in-store robots named Marty to nearly 500 of its Giant/Martin’s and Stop & Shop supermarkets. The deployment follows a pilot that the company said had resulted in improved in-store efficiencies and safety.

- The friendly looking, seven-foot-tall robots are now being deployed in stores to help mitigate risks caused by spills and enable associates to spend more time interacting with customers. Other Ahold Delhaize USA brands are also testing autonomous robots in selected stores.

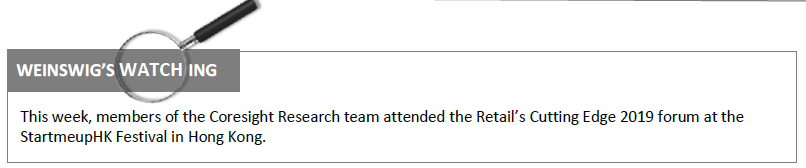

EUROPE RETAIL EARNINGS

[caption id="attachment_67118" align="aligncenter" width="866"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

![]() Marks & Spencer Launches Online Photo Search Feature

(Jan. 21) Company press release

Marks & Spencer Launches Online Photo Search Feature

(Jan. 21) Company press release

- British retailer Marks & Spencer Group PLC (M&S) has launched an online search feature called Style Finder that enables customers to search for a product on their mobile device with an image of the product rather than by typing in text.

- The feature, which is available across womenswear and menswear categories, was developed by Syte – Visual Conception Ltd., a company that creates AI-enabled visual search technology.

![]() House of Fraser Sales Plunge in the Last Quarter of 2018

(Jan. 21) Telegraph.co.uk

House of Fraser Sales Plunge in the Last Quarter of 2018

(Jan. 21) Telegraph.co.uk

- British department store House of Fraser PLC experienced a 60% year-over-year decline in sales for the 12-week period ended Dec. 31, 2018, according to Kantar Worldpanel figures.

- After taking over House of Fraser, Sports Direct International PLC owner Mike Ashley spent £31.5 million ($40.9 million) to keep the retailer afloat and provide its suppliers with cash advances amid financial uncertainty.

![]() Flexciton Raises £2.5 Million in Funding Round Led by Backed VC

(Jan. 21) TechCrunch.com

Flexciton Raises £2.5 Million in Funding Round Led by Backed VC

(Jan. 21) TechCrunch.com

- London-based startup Flexciton Ltd. has raised £2.5 million ($3.2 million) in its latest funding round, led by Backed VC. Flexciton’s AI algorithms help manufacturers optimize the performance of industrial machinery in factories.

- The startup currently has customers in the textile, food, automotive and semiconductor sectors.

![]() Casino Group Sells Stores and Real Estate to Reduce Debt

(Jan. 21) RetailDetail.eu

Casino Group Sells Stores and Real Estate to Reduce Debt

(Jan. 21) RetailDetail.eu

- France’s Casino Guichard Perrachon SA (Casino Group) has reached an agreement with hypermarket chain E. Leclerc SA to sell six loss-making Géant hypermarket stores for €100.5 million ($114.86 million).

- The group has also sold 13 Géant Casino stores, three Casino hypermarkets and 10 Casino supermarkets to Fortress Investment Group LLC.

Aldi Increases Hourly Wages, Becoming the UK’s Best-Paying Supermarket

(Jan. 22) RetailGazette.co.uk

Aldi Increases Hourly Wages, Becoming the UK’s Best-Paying Supermarket

(Jan. 22) RetailGazette.co.uk

- Supermarket retailer Aldi Stores Ltd. has become the U.K.’s highest-paying supermarket after increasing the minimum wage it pays its store assistants from £8.85 to £9.10 ($11.40 to $11.70) nationally and from £10.20 to £10.55 ($13.20 to $13.60) in London.

- Aldi’s new national pay rate exceeds the Living Wage Foundation’s “real living wage” rate of £9 ($11.60) per hour nationally and is in line with £10.55 ($13.60) hourly rate for workers in London.

ASIA RETAIL & TECH HEADLINES

Reliance to Compete with Walmart and Amazon

(Jan. 18) FT.com

Reliance to Compete with Walmart and Amazon

(Jan. 18) FT.com

- Indian conglomerate Reliance Industries Ltd. is set to compete with e-commerce giants Amazon.com Inc. and Walmart Inc. through the launch of a new e-commerce platform focused on small retailers, according to an announcement by Reliance Chairman Mukesh Ambani.

- The new platform will be launched in the Indian state of Gujarat and will “empower and enrich 1.2 million small retailers and shopkeepers” in the state, according to Ambani’s statement.

![]() Amazon Partners with Vietnam’s Ministry of Trade

(Jan. 21) InsideRetail.asia

Amazon Partners with Vietnam’s Ministry of Trade

(Jan. 21) InsideRetail.asia

- E-commerce behemoth Amazon.com Inc. has entered into a partnership with Vietnam’s Ministry of Trade that will enable Vietnamese merchants to join Amazon’s Global Selling network and gain access to international customers.

- The agreement will grant Vietnamese businesses access to Amazon’s customer base of approximately 300 million and help the businesses reach wholesale buyers across the U.S., Japan and Europe. The partnership represents Amazon’s first e-commerce operation in the region.

![]() Decathlon Opens Its Largest Store in Singapore

(Jan. 18) StraitsTimes.com

Decathlon Opens Its Largest Store in Singapore

(Jan. 18) StraitsTimes.com

- French sporting goods retailer Decathlon SA opened its fourth and largest store in Singapore on Jan. 19. The new store is called the Decathlon Singapore Lab and is located in the Kallang district.

- The new, 24-hour store spans 53,800 square feet and includes an indoor area with four different surfaces to test running shoes, an in-store conveyor belt that transports products ordered online so they can be delivered to customers in two hours and a robot that monitors in-store inventory.

![]() The Body Shop Plans to Open 20 New Stores in India

(Jan. 16) RetailNews.asia

The Body Shop Plans to Open 20 New Stores in India

(Jan. 16) RetailNews.asia

- British cosmetics, skincare and perfume retailer The Body Shop International Ltd. plans to launch 20 new stores in India in 2019.

- The retailer, which has operated in India since 2006 and currently has around 175 stores in the country, also expects to grow its e-commerce business by 12% this year, according to a statement from Vishal Chaturvedi, the company’s General Manager of Retail for India, Sri Lanka and Bangladesh.

Nojima Bids for Courts Asia

(Jan. 18) ChannelNewsAsia.com

Nojima Bids for Courts Asia

(Jan. 18) ChannelNewsAsia.com

- As it seeks to gain a strong foothold in Southeast Asia, Japanese electronics chain Nojima Corp. has initiated a conditional takeover bid for Singapore-headquartered electronics and furniture retailer Courts Asia Ltd.

- Nojima is offering SG$0.205 (US$0.151) per share for Courts Asia’s business, which translates to a 35% premium over the closing share trading price on Jan. 16, before the bid was revealed. The deal is estimated to be valued at around SG$80 million (US$59 million).

LATAM RETAIL & TECH HEADLINES

![]() Mercado Libre Chile Set to Launch QR Code Payments in 2019

(Jan. 21) Pe.FashionNetwork.com

Mercado Libre Chile Set to Launch QR Code Payments in 2019

(Jan. 21) Pe.FashionNetwork.com

- E-commerce giant Mercado Libre Inc. announced it will introduce QR code payments in Chile this year. The service will be available in partner stores during the first quarter of the year, once the retailer launches its offline channel.

- Mercado Libre will enable customers to access QR codes from the Mercado Libre mobile app, and physical stores that provide the payment option will receive instant credit when they are paid, without commission cost.

Avon Set to Become a Digital Brand in Colombia and Brazil

(Jan. 21) America-Retail.com

Avon Set to Become a Digital Brand in Colombia and Brazil

(Jan. 21) America-Retail.com

- London-headquartered beauty retailer Avon Products Inc. has partnered with on-demand delivery startup Rappi SAS to allow customers in Colombia and Brazil to order from a range of about 100 products from the Avon catalog and have orders delivered within two hours. The service will be available beginning Jan. 25.

- “With this alliance, Avon becomes a digital beauty brand, responding to the varying demand of customers who look for an easy and dynamic e-commerce platform when buying their products,” said Ricardo Hinojosa, General Manager of Avon Andean Market Group.

Cencosud, Falabella and El Puerto de Liverpool Rise in Global Retail Giants Rankings

(Jan. 21) America-Retail.com

Cencosud, Falabella and El Puerto de Liverpool Rise in Global Retail Giants Rankings

(Jan. 21) America-Retail.com

- In Deloitte’s Global Powers of Retailing 2019 report, Chilean retailer Cencosud SA ranked 61st, advancing three positions since last year. Fellow Chilean retailer Falabella SA occupied the 90th position, climbing five places.

- Mexican department store retailer El Puerto de Liverpool SAB de CV made a significant jump, rising 25 positions to rank 171st.

![]() Tottus Hypermarket Opening Exclusive Store in Peru to Fulfill Online Orders

(Jan. 21) America-Retail.com

Tottus Hypermarket Opening Exclusive Store in Peru to Fulfill Online Orders

(Jan. 21) America-Retail.com

- Chilean hypermarket chain Hipermercados Tottus SA is launching an exclusive store in Lima, Peru, that will function primarily as a collection center for online purchases.

- “Tottus Hypermarket is offering its customers the first out-of-store pickup point for purchases made on Tottus.com. It is the first time that a supermarket in Peru is providing this type of service,” said a company representative.

![]() Cencosud Seeks Registration of Its Shopping Center Subsidiary from CMF

(Jan. 21) ElMercurio.com

Cencosud Seeks Registration of Its Shopping Center Subsidiary from CMF

(Jan. 21) ElMercurio.com

- Chilean retailer Cencosud SA has asked Chile’s financial markets commission (CMF) to register its shopping center subsidiary, Cencosud Shopping Centers SA, so the subsidiary can float its shares independently on the country’s stock market.

- The company confirmed to Chilean newspaper El Mercurio Inversiones that it has filed the registration prospectus with the CMF and that it hopes to pay down debt with the fresh funds.

MACRO UPDATE

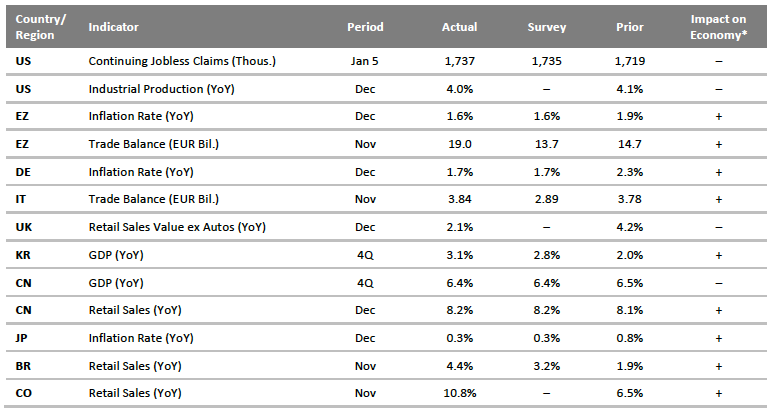

Key points from global macro indicators released Jan. 15-22, 2019:

- U.S.: Continuing jobless claims in the U.S. increased to 1.74 million in the week ended Jan. 5 from 1.72 million in the previous week, slightly above the consensus estimate. U.S. industrial production increased 4% year over year in December, slightly below November’s 4.1% growth.

- Europe: Inflation in the eurozone was in line with the consensus estimate of 1.6% in December, down from 1.9% in November. Inflation also subsided in Germany in December, when it registered 1.7%, versus 2.3% in November.

- Asia Pacific region: China reported year-over-year GDP growth of 6.4% in the fourth quarter, in line with expectations, while its annual GDP growth rate of 6.6% was the lowest since 1990. Retail sales in China grew 8.2% year over year in December, above the 8.1% growth recorded in November.

- Latin America: In November, Brazil registered solid year-over-year retail sales growth of 4.4%, which was above both the consensus estimate and the previous month’s 1.9% growth. Colombia’s retail sales grew a strong 10.8% in November, up from 6.5% in October.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: U.S. Department of Labor/Eurostat/Federal Statistical Office (Germany)/Italian National Institute of Statistics/Office for National Statistics (U.K.)/Bank of Korea/National Bureau of Statistics of China/Ministry of Internal Affairs and Communications (Japan)/Brazilian Institute of Geography and Statistics/National Administrative Department of Statistics (Colombia)/Coresight Research[/caption]

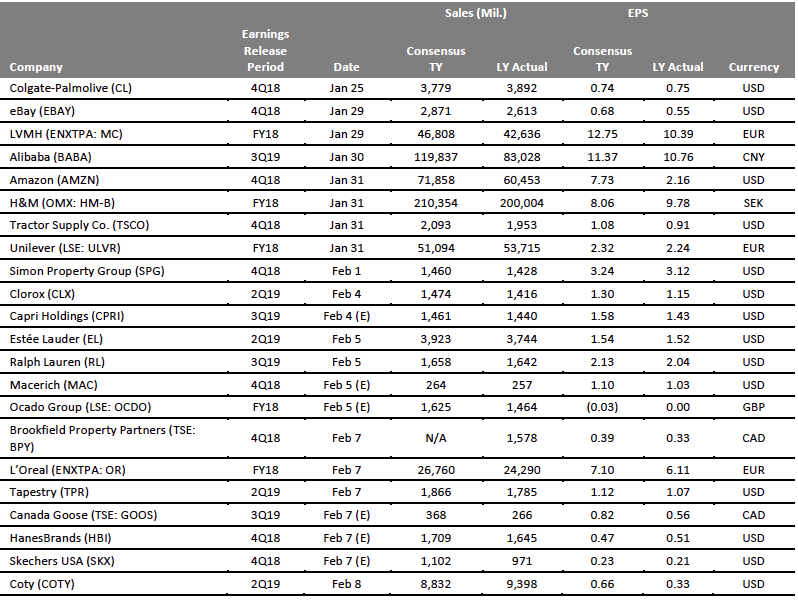

EARNINGS CALENDAR

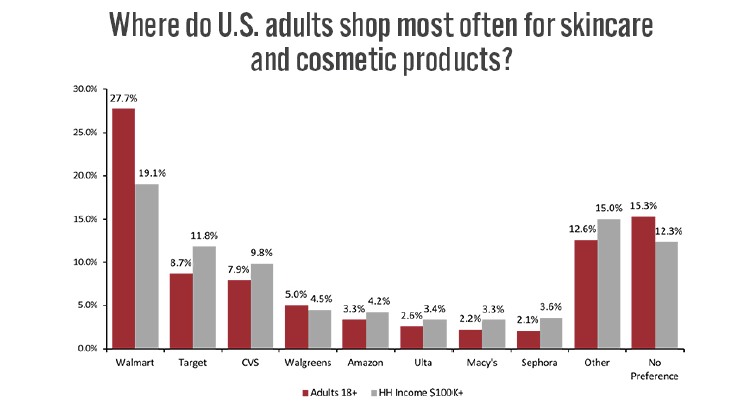

EVENT CALENDAR