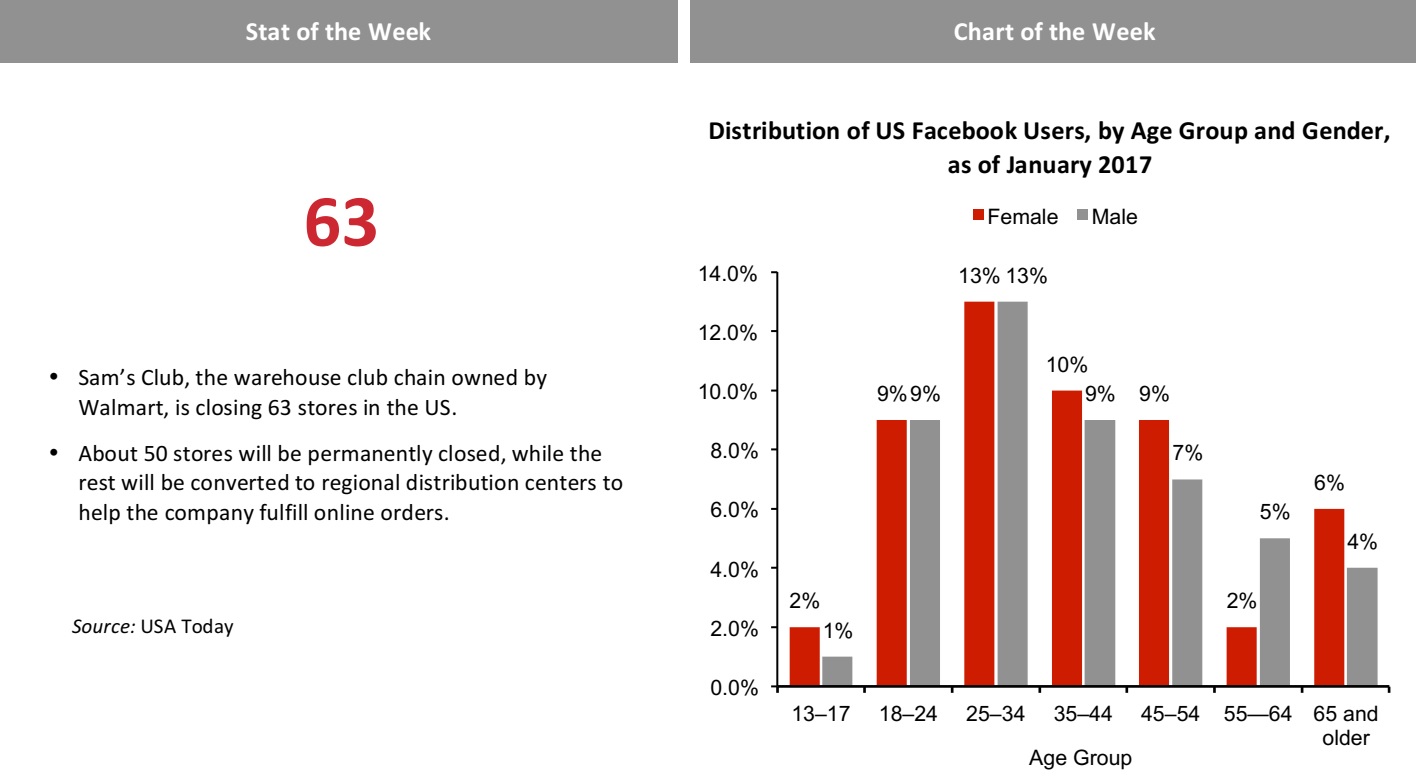

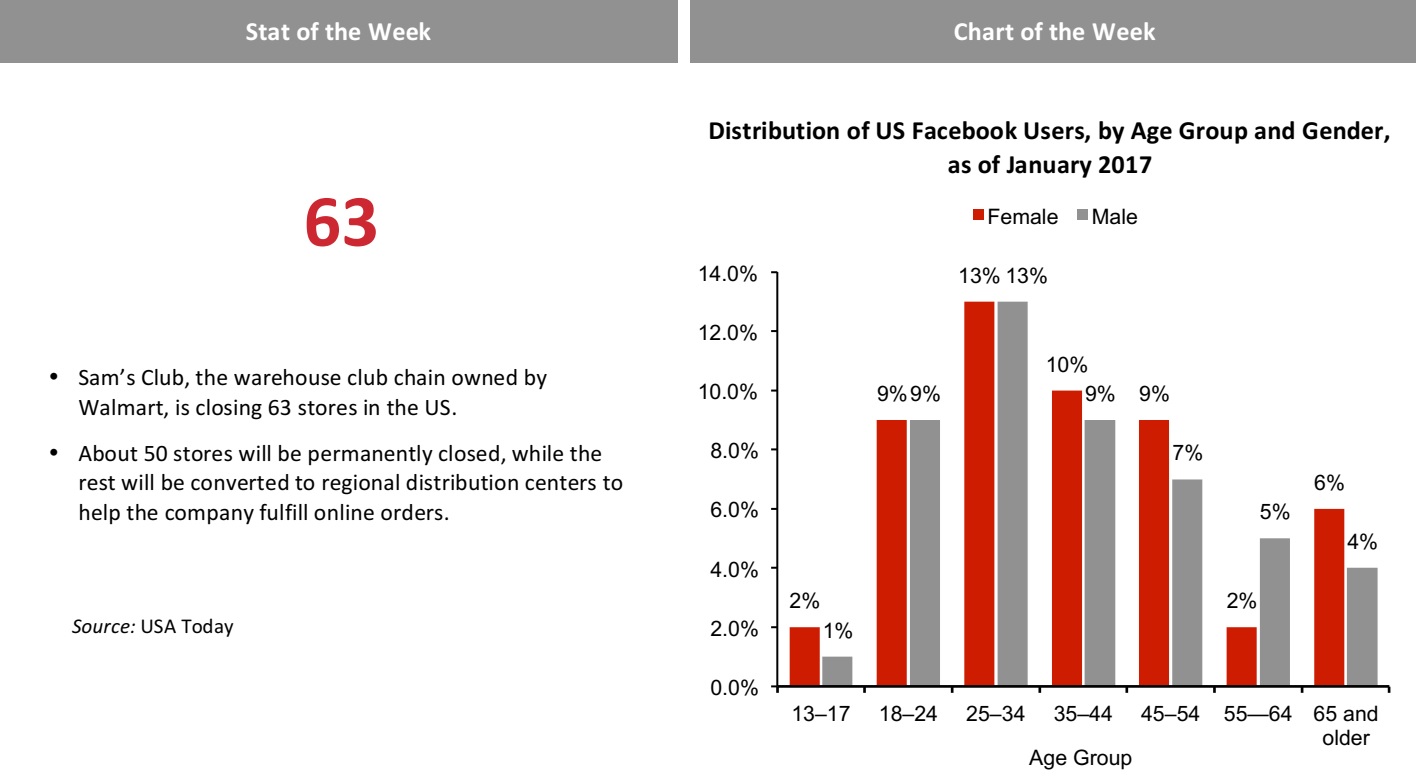

Source: USA Today & We Are Social/Hootsuite

From the Desk of Deborah Weinswig

CES 2018 Wrap-Up: Lots of Nice Toys, but No Killer Apps This Year

The FGRT team attended this year’s CES trade show in Las Vegas last week. From the preshow press days through the final day of exhibits, it was, as usual, a whirlwind experience. There seemed to be no new killer apps at the show this year, though, and even the keynote addresses seemed subdued. Still, various companies demonstrated several incremental advances in technology and we saw some notable new arrivals.

Chinese tech companies have officially arrived. While Chinese vendors have participated in CES for several years and have even held press conferences at the show, this year was the first time that a Chinese company gave a major keynote address at CES. That company, Huawei, wowed attendees with the advanced, leading-edge specifications of its new Mate 10 Pro smartphone, which is set to arrive in the US in February. The keynote ended on a bit of a sour note, however, as expected carrier support for the phone had been withdrawn at the last minute, torpedoing the announcement that was supposed to celebrate the company’s arrival. Nevertheless, other Chinese companies and brands such as Alibaba, Baidu, Hisense, Honor (a Huawei brand) and TCL had a strong presence at the show.

Self-driving cars made incremental progress. Whereas self-driving cars were the focus of last year’s CES, announcements about the cars and the technology that powers them were subdued at this year’s show. Ford was a keynote speaker again this year, and the company elected to discuss its platform for managing a city’s transportation infrastructure in a world that likely requires fewer vehicles due to ride sharing. Nvidia discussed its Nvidia Drive platform and announced partnerships with Uber and

Volkswagen. Toyota introduced a self-driving store format called e-Palette and showed its Concept-i car again. Startup Byton announced its new, all-electric self-driving vehicle, although the company’s presentation was light on details. Baidu mentioned that it plans to begin volume production on a Level 3 autonomous vehicle this year before moving on to Level 4 vehicles next year.

Intel has built its own film studio for 360-degree movies. Intel’s keynote address focused on its virtual reality (VR) cameras and software, which can improve sports viewing. Its matrix of wide-angle cameras can map out an area, capturing the “vixels” (like pixels, but in 3D, with the “v” standing for volume), thereby enabling a spectator to view a field from the point of view of any of the players—without the need for the players to have cameras in their helmets. This type of setup generates an enormous amount of data, and data was the overall theme of Intel’s keynote. To develop 3D movies, the company has created its own film studio, which has a sound stage outfitted with high-definition, wide-angle cameras. Intel showed a short clip of a Western in which it had changed the point of view solely by manipulating the data. With traditional filmmaking techniques, changing the point of view requires reshooting.

5G wireless will change the world in new, unanticipated ways. 5G connectivity is coming soon, and it will enable many new telecom, industrial, automotive and healthcare applications that were previously impossible to develop. 5G connectivity is 50 times faster than the current 4G, and short-term development is expected to be completed this year, with longer-term development extending through 2020. 5G is also an enabler of autonomous vehicles, which will generate an enormous amount of data on traffic, road conditions, weather and other factors and will need to stay in constant contact with traffic management platforms and media servers that provide passengers with entertainment while the cars are doing the driving.

Artificial intelligence was on everyone’s mind, but everyday applications will take time. One type of artificial intelligence that is expanding rapidly is voice control, and most major American, Chinese and South Korean consumer electronics companies have developed their own intelligent digital assistants. There were some interesting applications of image processing on display at CES, such as Alibaba’s “pay with a smile” technology and retail stores that identify entering customers, eliminating the need for them to provide means of payment. Alibaba also demonstrated a clever device that not only uses facial recognition technology to log visitors, but also works as an electronic employee time tracker that operates in concert with its DingTalk enterprise communication and organization platform.

The FGRT team will continue to follow these and other interesting innovations from CES throughout the year.

US RETAIL & TECH HEADLINES

US Holiday Shoppers Spend Record $108 Billion Online: Adobe

(January 16) Reuters.com

US Holiday Shoppers Spend Record $108 Billion Online: Adobe

(January 16) Reuters.com

- US shoppers spent a record $108 billion snapping up discounts on Amazon and other websites during the 2017 holiday season, with more people using smartphones and tablets, Adobe Analytics said on Tuesday. Adobe said that the amount was 14.7% higher than last year’s holiday season total.

- Mobile platforms accounted for 52% of traffic to retail websites during the November–December period and were responsible for a third of all online spending.

US Retail Sales Rise, While Core Sales Are Revised Sharply Higher

(January 12) CNBC.com

US Retail Sales Rise, While Core Sales Are Revised Sharply Higher

(January 12) CNBC.com

- US retail sales increased in December as households bought a range of goods. Figures for the prior month were revised higher. The US Commerce Department said that retail sales rose by 0.4% last month. Data for November were revised to show sales gaining 0.9% instead of the previously reported 0.8%.

- Retail sales in December rose 5.4% from a year ago. They advanced 4.2% in 2017 compared with 3.2% in 2016.

Amazon Seized 4% of All US Retail Sales in 2017, More Growth in 2018

(January 16) ESellerCafe.com

Amazon Seized 4% of All US Retail Sales in 2017, More Growth in 2018

(January 16) ESellerCafe.com

- Amazon accounted for at least 4% of all US retail sales and about 44% of all US e-commerce sales in 2017, according to a new study by One Click Retail. The fastest-growing product groups on the site included luxury beauty and pantry items. The company’s sales performance grew from at least $149 billion to $197 billion in the span of one year.

- One Click Retail’s study that showed that the fastest-growing categories on Amazon.com were luxury beauty (up 47% year over year), pantry items (up 38%), grocery items (up 33%) and furniture (up 33%).

Retailers on a Tech Spending Spree as They Innovate in the Face of Challenges

(January 15) USAToday.com

Retailers on a Tech Spending Spree as They Innovate in the Face of Challenges

(January 15) USAToday.com

- From artificial intelligence apps to store cameras with computer vision to dozens of other innovations that promise to make stores easier to shop, technology dominated the three-day National Retail Federation’s Retail’s Big Show at the Javits Convention Center in New York.

- Although retailers arrived in an exuberant mood after enjoying the best holiday sales growth since 2010, they are still spooked from the unprecedented number of store closings and retail bankruptcies in 2017. The three-day trade show was expected to draw 36,000 people from 90 countries.

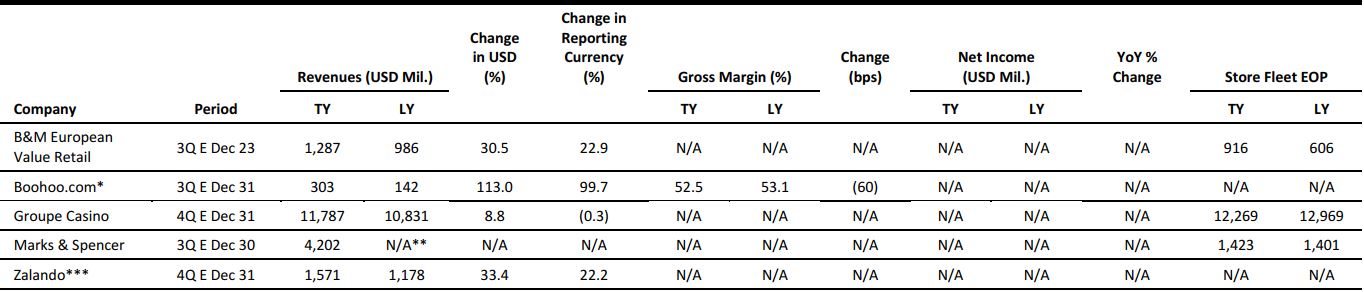

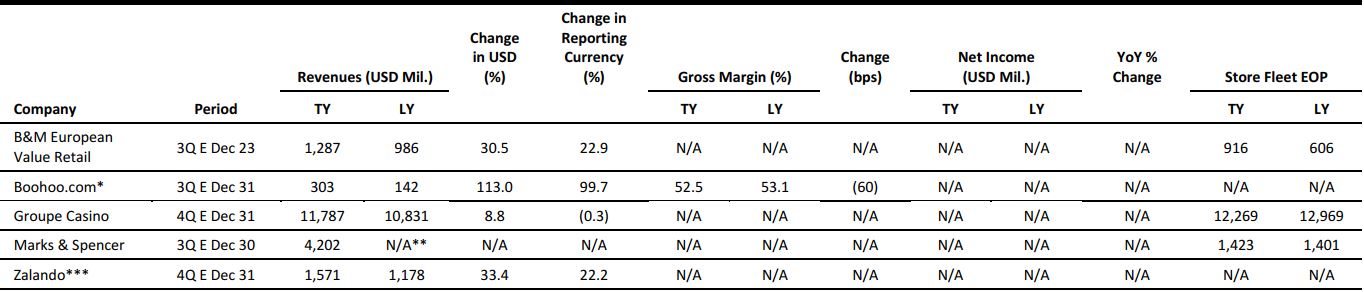

EUROPE RETAIL EARNINGS

*Boohoo.com’s third quarter included four months.

**Marks & Spencer did not state absolute revenues for 3Q17.

***Zalando provided a revenue range in its latest quarterly update. The midpoint has been considered for this table.

Source: Company reports/FGRT

EUROPE RETAIL & TECH HEADLINES

Hypermarket Recovery and Growth in Food Business Drive Solid Comp at Tesco

(January 11) Company press release

Hypermarket Recovery and Growth in Food Business Drive Solid Comp at Tesco

(January 11) Company press release

- British grocery market leader Tesco grew comparable sales in its core UK operations by 2.3% and grew group comps by 0.9% in its third quarter ended January 6. Excluding fuel, total UK sales rose by 2.5% and total group sales rose by 1.1% at constant currency.

- In the core six-week Christmas period ended January 6, Tesco’s UK comp growth slowed to 1.9% and group comp growth slowed to 0.1%.

Sainsbury’s Sales Grow Modestly During Christmas Quarter

(January 11) Company press release

Sainsbury’s Sales Grow Modestly During Christmas Quarter

(January 11) Company press release

- The UK’s second-biggest grocery retailer, Sainsbury’s, reported comparable sales growth of 1.1%, excluding fuel, in the 15 weeks ended January 6. The figure includes sales under its general merchandise banner, Argos.

- In the third quarter, total retail sales expanded by 1.2%. Grocery sales grew by 2.3%, while clothing sales were up 1.0% and general merchandise sales, which mainly comprise sales at Argos, were down 1.4%. The company guided for fiscal full-year 2018 underlying profit to come in moderately ahead of the company-compiled consensus estimate of £559 million ($769 million).

Shop Direct Reports Bumper Performance During the Holiday Period

(January 16) Company press release

Shop Direct Reports Bumper Performance During the Holiday Period

(January 16) Company press release

- Shop Direct, the owner of online pure plays Very.co.uk, Littlewoods.com and VeryExclusive.co.uk, grew group revenue by 6.3% year over year in the seven weeks ended December 22. Group revenue growth was driven by 16.8% year-over-year sales growth under the Very brand, the group’s largest and fastest-growing brand.

- Sales under the Littlewoods.com banner were down 12.6% in the period. Electrical goods performed best, with 16% sales growth driven by 45% growth in gaming, 37% growth in smart tech and 31% growth in cell phones.

Carrefour Acquires Stake in Showroomprive

(January 11) ESMMagazine.com

Carrefour Acquires Stake in Showroomprive

(January 11) ESMMagazine.com

- French retailer Carrefour announced that it will acquire a 17% stake in online fashion flash-sale retailer Showroomprive from furniture retailer Conforama for about €79 million ($96.4 million).

- Carrefour said that the new partnership will help the company accelerate its digital strategy and develop a cutting-edge omnichannel offering that covers areas such as commercial operations, marketing, logistics and data.

NA-KD Raises $45 Million in Series B Funding

(January 16) EU-Startups.com

NA-KD Raises $45 Million in Series B Funding

(January 16) EU-Startups.com

- NA-KD, a Swedish direct-to-consumer online fashion company, has raised $45 million in series B funding, led by venture capital firm Partech Ventures, which has previously invested in UK-based Made.com and France-based ManoMano. NA-KD’s existing investors and US-based investment firm FJ Labs also participated.

- NA-KD was founded in 2015 by serial entrepreneur Jarno Vanhatapio and it markets its clothes to millennials, mainly through social media influencers. The company secured €14 million ($17 million) in January 2017 and its sales grew by more than 150% through 2017.

ASIA RETAIL & TECH HEADLINES

Xiaomi Chooses Morgan Stanley, Goldman Among IPO Banks

(January 15) Bloomberg.com

Xiaomi Chooses Morgan Stanley, Goldman Among IPO Banks

(January 15) Bloomberg.com

- Xiaomi selected Morgan Stanley and Goldman Sachs among international banks for its planned IPO, which could see the company target a valuation of as much as $100 billion. The Beijing-based company is still considering Chinese underwriters and has yet to decide on the timing and location of the share sale.

- Xiaomi, which raised money at a $45 billion valuation in 2014, could be the biggest IPO since Alibaba’s $25 billion debut. After a disastrous 2016, when Xiaomi saw its market share plunge, the smartphone maker has bounced back by revamping its sales model and pushing heavily into India, where it rivals Samsung as the biggest vendor. Xiaomi topped its annual ¥100 billion ($15 billion) sales target by the end of October last year.

China Escalates Crackdown on Cryptocurrency Trading

(January 15) Bloomberg.com

China Escalates Crackdown on Cryptocurrency Trading

(January 15) Bloomberg.com

- China is escalating its clampdown on cryptocurrency trading, targeting online platforms and mobile apps that offer exchange-like services. While authorities banned cryptocurrency exchanges last year, they’ve recently noted an uptick in activity on alternative venues. The government plans to block domestic access to homegrown and offshore platforms that enable centralized trading.

- Authorities will also target individuals and companies that provide market-making, settlement and clearing services for centralized trading, sources said, asking not to be named because the information is private. Small peer-to-peer transactions aren’t being targeted, they said.

Alibaba Blames Politics as Taobao Retains Place on US Government Naughty List

(January 16) TechCrunch.com

Alibaba Blames Politics as Taobao Retains Place on US Government Naughty List

(January 16) TechCrunch.com

- It hasn’t been a great couple of weeks for Alibaba in the US. First, its affiliate, Ant Financial, saw its proposed acquisition of MoneyGram collapse due to objections from the US government. Now, its Taobao service has the dubious honor of again being featured on the United States Trade Representative’s (USTR’s) naughty list.

- Taobao, Alibaba’s hugely popular marketplace, is among 25 e-commerce sites on the latest USTR Notorious Markets list. The list, released annually, roots out physical and digital marketplaces that are judged to be “engaging in and facilitating substantial copyright piracy and trademark counterfeiting.”

India’s Razorpay Nabs $20 Million, Led by Tiger Global, for Its Stripe-Like Payment Gateway

(January 16) TechCrunch.com

India’s Razorpay Nabs $20 Million, Led by Tiger Global, for Its Stripe-Like Payment Gateway

(January 16) TechCrunch.com

- Razorpay, an Indian startup that aims to make it easier to take and make payments online, has announced a significant round of funding. E-commerce remains among the biggest tech opportunities in India, one of the world’s most highly populated countries, where over 500 million people are now connected to the Internet.

- Razorpay has built a payments gateway for businesses to quickly integrate payments services into their websites and apps by way of an API. The company has raised another $20 million at what sources say is a valuation of over $100 million to fuel its next stage of growth. Tiger Global led the series B round, with participation from Y Combinator’s Continuity fund and Matrix Partners.

LATAM RETAIL & TECH HEADLINES

Brazil and Switzerland Renew R&D Agreement

(January 15) ZDNet.com

Brazil and Switzerland Renew R&D Agreement

(January 15) ZDNet.com

- Brazil and Switzerland have renewed their ongoing R&D agreement for another three years.The countries’ joint science and technology committee, in place since 2009, also signed a related agreement between the Brazilian Center for Science and Technology Development and the Swiss National Fund.

- The agreement between the two countries includes an updated action plan and deadlines for the delivery of joint R&D projects by 2020.Some 47 projects have been financed by Switzerland so far, with Brazilian scientists offering input since 2012. In addition, over 200 Brazilian scientists have received scholarships from the Swiss government.

NEC Brazil Head Steps Down

NEC Brazil Head Steps Down

(

January 12) ZDNet.com

- The president for Brazilian operations at Japanese technology firm NEC has stepped down. Daniel Mirabile joined NEC in 2015 and led a restructuring process that included cuts to spending and staff as well as a boost of the company’s offerings in Brazil. “Mirabile, who was responsible for a successful cycle of reformulation of the company in Brazil, will take on new challenges in his career,” NEC said in a statement.

- NEC’s head of Latin America, Masazumi Takata, will be the interim head of the company’s Brazilian operations. The firm also pointed out that “the strategy of the Brazilian operation is completely aligned with those of the parent company in Japan” and that “local growth and business plans remain unchanged.” NEC is mainly focused on providing equipment to telcos in Brazil along with a service portfolio, which the company is looking to diversify.

Motorola LatAm President Becomes European Head

(January 10) ZDNet.com

Motorola LatAm President Becomes European Head

(January 10) ZDNet.com

- Lenovo-owned smartphone maker Motorola has appointed Brazilian executive Sergio Buniac to lead its European operations. Buniac joined Motorola in 1996 and was named head of the Brazil business in 2007. He became head of the Southern Cone in 2011 and was promoted to the post of Latin America president a year later. He will now lead both the Europe and Latin America businesses.

- Prior to joining Motorola, Buniac held leadership roles at IBM and consulting firm Booz Allen Hamilton. His appointment could be an attempt by Lenovo to replicate in Europe the positive mobile phone sales results it has seen in Brazil.

NRF 2018: Elektra Uses In-Store Education to Encourage Mexican Shoppers Online

(January 15) EssentialRetail.com

NRF 2018: Elektra Uses In-Store Education to Encourage Mexican Shoppers Online

(January 15) EssentialRetail.com

- In a session titled “Powerhouse Playbooks: Lessons from Global Retail Leaders” at the NRF 2018 trade show in New York City, Juan Carlos Garcia, Director of Global E-Commerce and Omnichannel at Grupo Elektra, spoke about using brick-and-mortar stores to try to direct customers online. Elektra is a leading financial services company and specialty retailer in Latin America.

- “We are using more than 1,800 points of contact with our customers to teach them how to buy online,” Garcia said. He explained that the company had created kiosks in stores to advertise Elektra’s online services and encourage shoppers to go online.

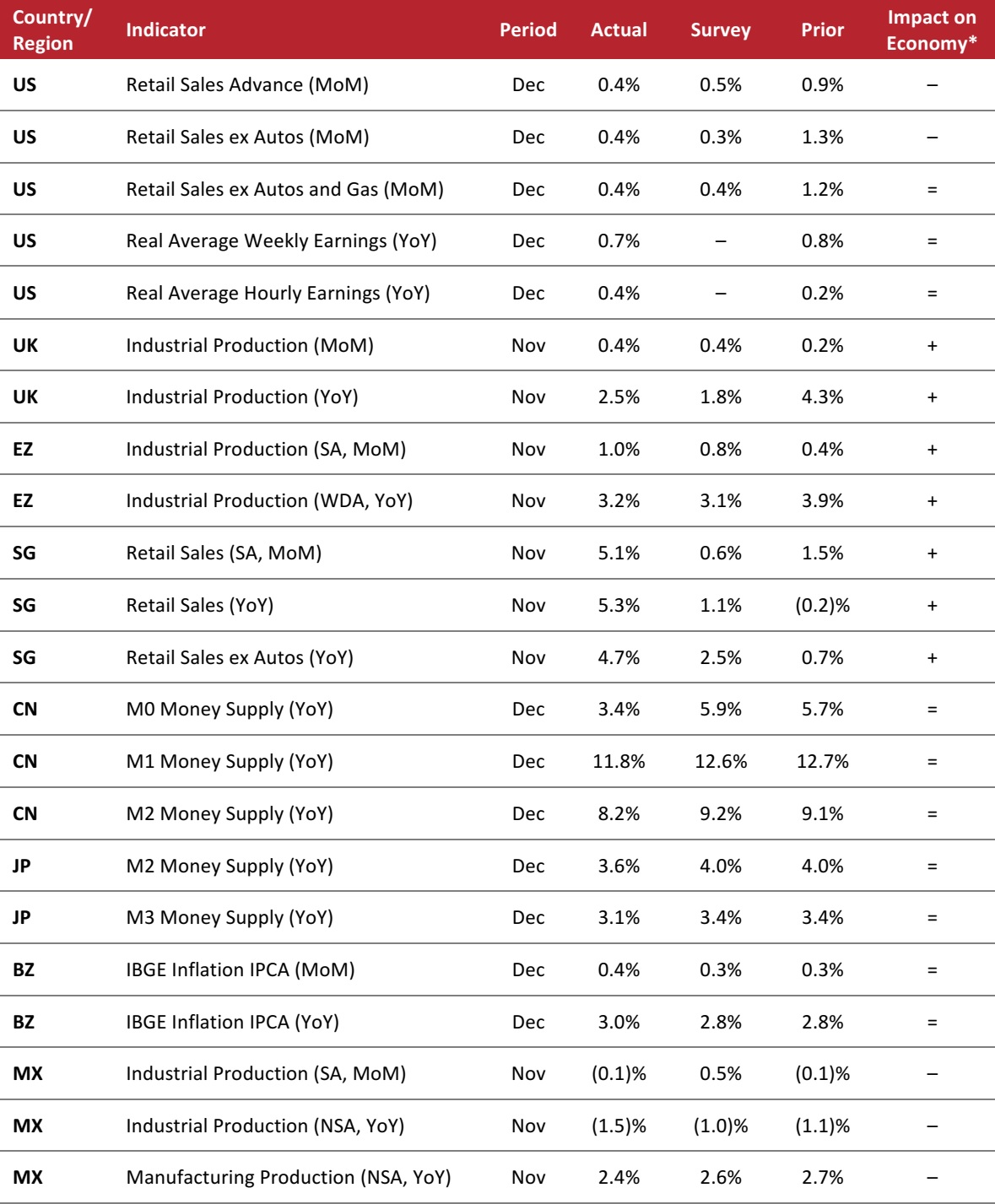

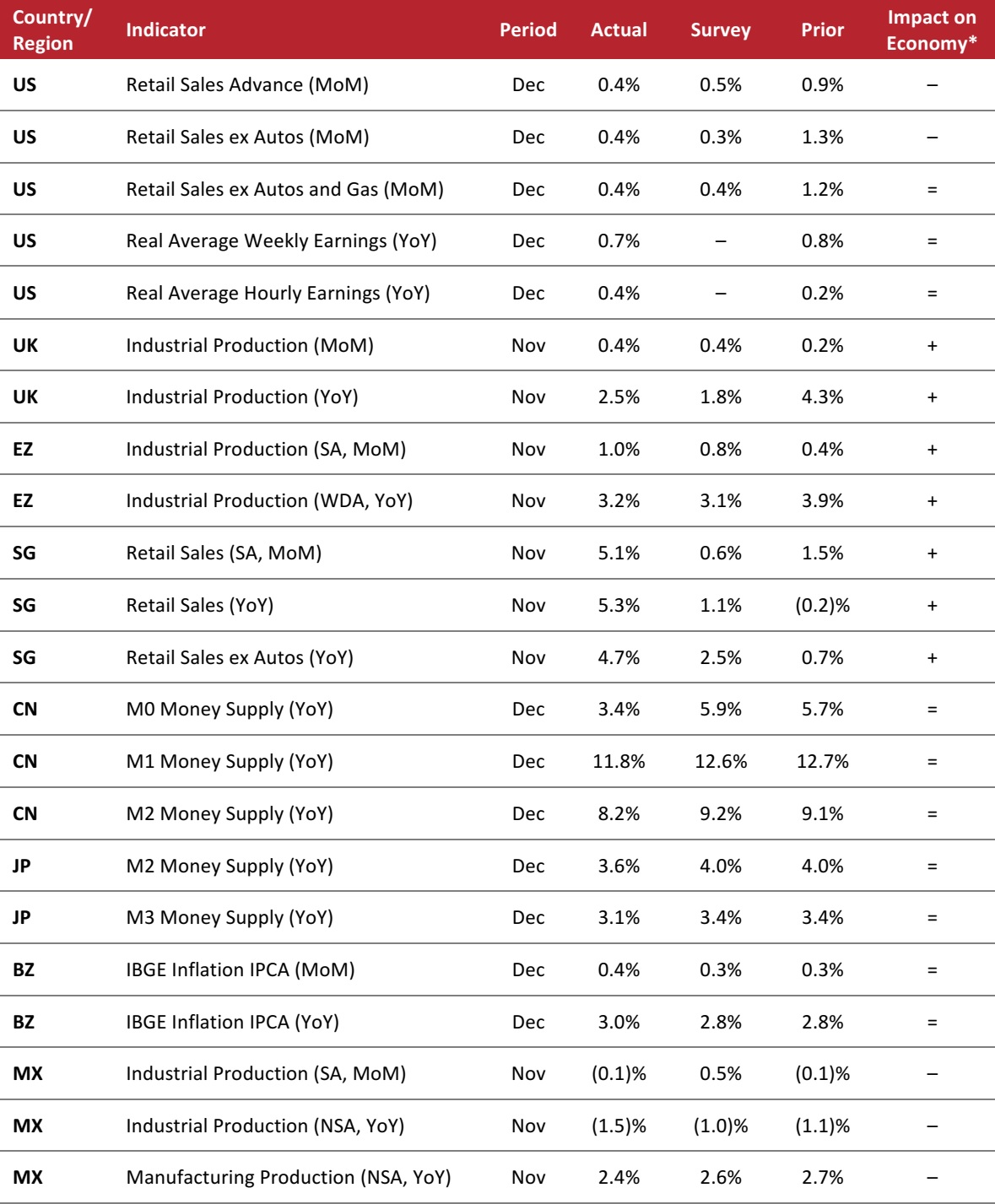

MACRO UPDATE

Key points from global macro indicators released January 10–17, 2018:

1) US: Month over month in December, retail sales grew by 0.4%, which was slightly below the consensus estimate. Real average weekly earnings increased by 0.7% year over year in December, while real average hourly earnings increased by 0.4% year over year.

2) Europe: In the UK, industrial production increased by 0.4% month over month and by 2.5% year over year in November. In the eurozone, industrial production increased by 1.0% month over month and by 3.2% year over year in November.

3) Asia-Pacific: In Singapore, retail sales increased by 5.1% month over month in November, well above the market’s expectation of a 0.6% increase. In China, money supply continued to grow in December, with the M2 money supply increasing by 8.2% year over year.

4) Latin America: In Brazil, inflation increased by 0.4% month over month and by 3.0% year over year in December. In Mexico, industrial production decreased by 0.1% month over month and by 1.5% year over year in November.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Bureau of Labor Statistics/UK Office for National Statistics/Eurostat/Singapore Department of Statistics/The People’s Bank of China/Bank of Japan/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/FGRT

Brazil and Switzerland Renew R&D Agreement

(January 15) ZDNet.com

Brazil and Switzerland Renew R&D Agreement

(January 15) ZDNet.com