albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Notes from NRF 2019: Retail’s Big Show: Physical Stores Still Part of the Consumer Equation The Coresight Research team attended NRF 2019: Retail’s Big Show in New York City this week. Attendance this year was much higher than in recent years, as many retailers likely felt the confidence to send more people to the show based on the upturn in sales in 2018. Offline stores were the center of many discussions at the show, despite all the talk we’ve heard recently about how physical stores don’t matter much anymore.

Physical stores remain essential for many retailers, even amid booming online sales, but companies need to understand the differences in customers’ decision-making processes when shopping online versus offline, as well as the differences in customers by location and the different skill sets required for online versus offline retailing.

Many brands are opening new flagships that reimagine the physical store. Levi Strauss & Co., for example, recently opened its largest Levi’s store in the world, in New York City’s Times Square. The 17,000-square-foot Levi’s flagship focuses on personalization and customization, and features a large Levi’s Tailor Shop with four on-site tailors who customize garments for customers. When the concept was tested in London, shoppers loved the idea of having their name, sports team or favorite number embroidered on a jean jacket. The store also leverages technology: Levi’s site visitors can view the new store online through a 360-degree, 3D virtual shopping experience.

While traditional retailers are embracing technology, many digital brands are opening physical stores. Mattress maker Casper Sleep Inc. created a “nap tour” of pop-up shops where customers could test the company’s products, which led to the opening of Casper’s first physical store. The company seeks to make online and offline shopping feel like a single store experience. Other online brands, such as shirt maker UNTUCKit LLC, are also opening physical stores, even as many traditional retailers are closing stores. Bonobos is another example of a digital brand successfully transitioning into the physical world; Walmart Inc. acquired the men’s fashion brand in 2017.

The term “omnichannel” has been hot for several years, but actually executing omnichannel retail operations remains an aspiration for many. The term originally referred to the merger of online and offline operations, but it has come to mean frictionless retail, where shoppers don’t even have to think about whether they’re ordering online or offline. With this kind of boundaryless retail, consumers mix physical and digital retail interactions, and either have their goods delivered or pick them up from a location that’s convenient. Target Corp.’s online sales have been growing at a 25 percent clip annually, while its same-store sales have averaged 5 percent growth in recent years. But management considers Target’s physical stores a competitive advantage, as many customers order online for in-store pickup.

Gaming is one of the few industries in which companies are fully delivering on frictionless purchases. Digital gaming brands have a unique ability to “pop down,” i.e., move into the physical world to create experiences.

Sustainability is another increasingly important topic in retail. While customers generally enter stores looking for style, they may choose to buy based on a company’s sustainability or social responsibility efforts. An industry of repurposing and recycling apparel is emerging, represented by companies such as ThredUP Inc., which calls itself “the largest online thrift store.” ThredUP has upcycled 60 million fashion items, from Gao to Gucci.

After a couple of tough years, retail is seeing renewed attention and excitement, and we expect 2019 to be an interesting year for the industry as it continues to change and evolve at a rapid pace.

US RETAIL & TECH HEADLINES

![]() Walmart Plans to Add 2,000 Staffers in Technology Group in 2019

(Jan. 13) Bloomberg.com

Walmart Plans to Add 2,000 Staffers in Technology Group in 2019

(Jan. 13) Bloomberg.com

- Walmart Inc. plans to hire 2,000 technology experts this year to support its efforts in stores and online, boosting the group’s ranks by more than a fourth.

- The world’s biggest retailer is looking for data scientists, software engineers, designers and others to work in nine offices in locations ranging from Silicon Valley to Bangalore. The technology group currently has about 7,500 employees, including 1,700 who were hired last year.

![]() Why a Wacky Discount Store Is Buying Up the Remains of Toys “R” Us

(Jan. 11) CNN.com

Why a Wacky Discount Store Is Buying Up the Remains of Toys “R” Us

(Jan. 11) CNN.com

- You may have never heard of Ollie’s Bargain Outlet Holdings Inc., but the eccentric discount chain wants to open hundreds of new stores across the country. Ollie’s pokes fun at itself to win over customers and boasts that it has “semi-lovely” stores. It doesn’t sell online.

- Ollie’s is currently capitalizing on the liquidation of Toys “R” Us Inc. It has bought 12 former Toys “R” Us sites and is leasing another six. In November, Ollie’s opened its 300th store at a former Toys “R” Us location in Maryland.

Macy’s, Kohl’s Lead Shift from Retail Boom to Post-Holiday Gloom

(Jan. 10) Bloomberg.com

Macy’s, Kohl’s Lead Shift from Retail Boom to Post-Holiday Gloom

(Jan. 10) Bloomberg.com

- Bellwether chains Macy’s Inc., Kohl’s Corp. and Target Corp. all tumbled in premarket trading on Jan. 10 after Macy’s cut its annual earnings forecast and Kohl’s reported disappointing seasonal sales growth.

- Target performed better than the other two retailers during the critical holiday period, but it wasn’t enough for the company to escape the sector’s wider carnage.

![]() US Retail Imports Level Off After China Tariff-Avoidance Rush

(Jan. 8) Reuters.com

US Retail Imports Level Off After China Tariff-Avoidance Rush

(Jan. 8) Reuters.com

- Imports at major U.S. container ports are leveling off after retailers rushed for months to bring in Chinese merchandise before higher tariffs hit, according to a retail trade report issued on Jan. 8.

- The latest available data show that major U.S. ports handled 1.81 million 20-foot-long cargo containers in November 2018, up 2.5 percent year over year, but down 11.4 percent from a record 2.04 million in October.

EUROPE RETAIL & TECH HEADLINES

![]() New Look Plans Debt-for-Equity Swap

(Jan. 14) ThisIsMoney.co.uk

New Look Plans Debt-for-Equity Swap

(Jan. 14) ThisIsMoney.co.uk

- British fashion retailer New Look Retail Group Ltd. Issued a profit warning following lackluster performance over the Christmas period, when the company’s comparable sales declined 5.7 percent.

- Now, New Look says it intends to opt for a debt-for-equity swap as part of a restructuring plan that includes trimming its debt from £1.35 billion to £350 million ($1.74 billion to $450 million).

![]() Shop Direct Reports Solid Christmas Performance

(Jan. 14) DrapersOnline.com

Shop Direct Reports Solid Christmas Performance

(Jan. 14) DrapersOnline.com

- British multibrand online retailer Shop Direct Group Ltd. reported strong Christmas results, driven by a stellar performance at its Very banner. Overall sales for Shop Direct grew 3.7 percent year over year in the seven weeks ended Dec. 28 and the Very business recorded impressive 8.8 percent growth over the period.

- Shop Direct attributed the solid results to positive performances across all product categories, including clothing and footwear, electrical, seasonal, furniture, and homewares.

![]() Takeaway.com’s Orders Grow More than 50 Percent in Fourth Quarter

(Jan. 10) RetailDetail.eu

Takeaway.com’s Orders Grow More than 50 Percent in Fourth Quarter

(Jan. 10) RetailDetail.eu

- Dutch meal delivery company Takeaway.com N.V. reported that orders increased 55 percent year over year in the fourth quarter, bringing its full-year order growth to 38 percent. The company delivered more orders in Germany than in its home market of the Netherlands for the first time ever in the fourth quarter.

- Takeaway.com is optimistic that Germany will continue to be a growth driver, given that the online meal delivery market is less developed in Germany than in other European countries. The company also recently announced that it would acquire Delivery Hero SE, a German competitor, in a €930 million ($1.1 billion) deal set to be concluded by July.

![]() Germany Declares Amazon’s Dash Buttons Illegal

(Jan. 14) RetailGazette.co.uk

Germany Declares Amazon’s Dash Buttons Illegal

(Jan. 14) RetailGazette.co.uk

- Amazon.com Inc.’s Dash buttons, which enable customers to reorder household items at the push of a button, are no longer legal in Germany. A higher state court in the country ruled that the buttons failed to provide sufficient information to customers regarding what they were buying. Amazon plans to appeal the ruling.

- The court order took effect after German consumer watchdog Verbraucherzentrale NRW legally challenged Amazon over its terms of service, contending that they allowed the retailer to change a customer’s original selection and substitute a higher-priced alternative.

UK Retail Sales Register Flat Growth in December

(Jan. 10) BRC.org.uk

UK Retail Sales Register Flat Growth in December

(Jan. 10) BRC.org.uk

- Retail sales growth in the U.K. was flat year over year in December, while comparable sales declined 0.7 percent, despite retailers slashing prices, according to the British Retail Consortium-KPMG Retail Sales Monitor. Retail traffic declined 2.6 percent during the month. Traffic on high streets and in retail parks declined 2.1 percent, while shopping-center traffic fell 3.9 percent.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended December, total food sales grew 1.8 percent and total nonfood sales declined 0.4 percent.

ASIA RETAIL & TECH HEADLINES

![]() Alibaba Unveils A100 Strategic Partnership to Help Companies Accelerate Digital Operations

(Jan. 11) Alizila.com

Alibaba Unveils A100 Strategic Partnership to Help Companies Accelerate Digital Operations

(Jan. 11) Alizila.com

- Alibaba Group Holding Ltd. has launched a new program called the A100 Strategic Partnership to help corporations accelerate their digital transformation. The program offers companies a new services package that bundles Alibaba’s technology infrastructure offerings into a holistic, one-stop solution.

- The package will enable Alibaba’s corporate partners to leverage Alibaba’s services across 11 different business operations, ranging from product development and branding to sales to logistics and supply chain.

![]() Amazon Has 1,300 Job Vacancies in India

(Jan. 14) TimesofIndia.IndiaTimes.com

Amazon Has 1,300 Job Vacancies in India

(Jan. 14) TimesofIndia.IndiaTimes.com

- Amazon.com Inc.’s expansion in India into areas such as payments, food retail, content, digital voice assistance and customer support has resulted in nearly 1,300 job listings in the country, the highest number of Amazon job openings in the Asia-Pacific region.

- The company has nearly three times more jobs available in India as in China. At the end of 2018, Amazon India directly employed more than 60,000 staff, accounting for some 10 percent of Amazon’s global workforce of 610,000.

China’s Xiaomi Plans to Invest $1.5 Billion in Smart Home Technology over the Next Five Years

(Jan. 11) TechCrunch.com

China’s Xiaomi Plans to Invest $1.5 Billion in Smart Home Technology over the Next Five Years

(Jan. 11) TechCrunch.com

- On Jan. 11, Chinese budget phone manufacturer Xiaomi Corp. announced plans to invest at least ¥100 billion ($1.48 billion) over the next five years in the “AIoT” sector, which refers to internet of things devices that deploy artificial intelligence.

- In his annual address to Xiaomi employees, CEO Lei Jun said that more home appliances will soon be replaced by smart devices and that “there will be an AIoT network that infiltrates every second and scenario of people’s lives, collecting mountains of users, traffic and data.”

![]() Neeman’s and The Woolmark Co. Launch New Line of Wool Shoes in India

(Jan. 14) RetailNews.asia

Neeman’s and The Woolmark Co. Launch New Line of Wool Shoes in India

(Jan. 14) RetailNews.asia

- Neeman’s, India’s first footwear brand to create shoes made of natural and biodegradable fibers, has launched a new collection of shoes made from 100 percent Merino wool. The brand follows a direct-to-consumer strategy and its products are sold exclusively through its website, Neemans.com.

- Neeman’s launched the new line in collaboration with The Woolmark Co., a subsidiary of Australian Wool Innovation, a global nonprofit that conducts R&D and marketing for Australian wool worldwide.

Lululemon Debuts in Macau

(Jan. 9) RetailNews.asia

Lululemon Debuts in Macau

(Jan. 9) RetailNews.asia

- Premium athletic apparel brand Lululemon Athletica Inc. has opened its first store in Macau, at the Venetian Macau luxury resort. The 2,110-square-foot store offers Lululemon’s full collection of products for running, yoga, cycling, water sports and other activities.

- Lululemon’s local team curates a community bulletin board within the store that provides information on free workshops shoppers can take as well as local fitness and cultural points of interest.

LATAM RETAIL & TECH HEADLINES

![]() Walmart Says Product Supply in Mexico Is Assured amid Ongoing Fuel Shortage

(Jan. 12) DineroEnImagen.com

Walmart Says Product Supply in Mexico Is Assured amid Ongoing Fuel Shortage

(Jan. 12) DineroEnImagen.com

- Gabriela Buenrostro, a spokesperson for Wal-Mart de Mexico S.A.B. de C.V., told reporters that product supply at the retailer’s stores in Mexico has not been affected by the ongoing fuel shortage in Mexico.

- Buenrostro said that the company is constantly monitoring its logistics and that it’s able to access all its stores and clubs in Mexico for restocking. She said that there have been no incidents of “panic purchases,” as the stores are adequately stocked.

Linio Gains Momentum After Integration with Falabella, Opens Tech Hub in India

(Jan. 11) Modaes.com

Linio Gains Momentum After Integration with Falabella, Opens Tech Hub in India

(Jan. 11) Modaes.com

- Chilean retail group Falabella S.A. acquired Mexican e-commerce platform Linio in August 2018, and Linio has since expanded and furthered its innovation efforts, including by opening a technology hub in India.

- Linio aims to raise its income to “triple digits” and expects the India hub to contribute to its growth. Falabella has earmarked $1.5 billion of its total budget until 2022 for upgrades to its online segment, which includes Linio.

Aguaclara Plans to Enter Mexico

(Jan. 14) Mx.FashionNetwork.com

Aguaclara Plans to Enter Mexico

(Jan. 14) Mx.FashionNetwork.com

- Peruvian luxury swimwear label Aguaclara, owned by Applauzi S.A., is seeking market entry partners to expand to Mexico. The brand operates stores in Peru, Panama and the Dominican Republic and has concessions at multibrand stores and department stores across the U.S., Europe, the Caribbean and the Middle East.

- Founders Jorge and Liliana Villalobos have hired consulting firm Lizan Retail Advisors to assist in their hunt for partners and will visit Mexico in February to meet with key retail groups in the country.

![]() Mastercard to Improve Online Payment Security in the LatAm Region

(Jan. 14) ZDNet.com

Mastercard to Improve Online Payment Security in the LatAm Region

(Jan. 14) ZDNet.com

- Mastercard Inc. is working to improve online payment security in Latin America and the Caribbean as e-commerce continues to grow in the two regions.

- The company is providing local banks, retailers and partners with guidelines and tools to improve security strategies and accelerate the adoption of security technologies.

![]() Agua Bendita Launches Its First Ready-to-Wear Collection

(Jan. 15) Modaes.com

Agua Bendita Launches Its First Ready-to-Wear Collection

(Jan. 15) Modaes.com

- Colombian swimwear specialist Agua Bendita S.A. has launched its first ready-to-wear collection of dresses, shirts and pants. The Agua by Agua Bendita line focuses on the luxury segment and will first be sold online and then later through the company’s physical stores.

- Agua Bendita plans to open two new stores in Colombia and four stores across the U.S., Mexico and Costa Rica this year.

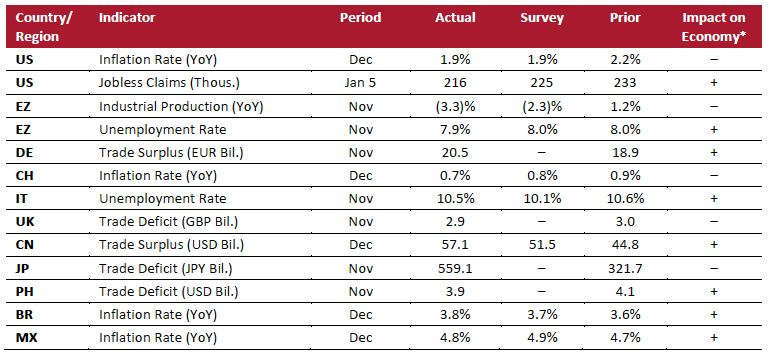

MACRO UPDATE Key points from global macro indicators released Jan. 9-15, 2018:

- U.S.: Annual inflation in the U.S. fell to 1.9 percent in December from 2.2 percent in November, matching market expectations. Jobless claims in the U.S. fell to 216,000 in the week ended Jan. 5 from 233,000 the previous week; the figure was below the consensus estimate of 225,000.

- Europe: Industrial production in the eurozone fell 3.3 percent year over year in November, following a 1.2 percent increase in October and missing market expectations of a 2.3 percent drop. Unemployment in the eurozone fell to 7.9 percent in November from 8.0 percent in October and was below market expectations of 8.0 percent.

- Asia-Pacific region: China’s trade surplus widened to $57.1 billion in December from $44.8 billion in November, exceeding the consensus estimate of a $51.5 billion surplus. Japan’s trade deficit widened to ¥559.1 billion in November from ¥321.7 billion in October.

- Latin America: The annual inflation rate in Brazil rose to 3.8 percent in December from 3.6 percent in November and came in slightly above market expectations of 3.7 percent. The annual inflation rate in Mexico rose to 4.8 percent in December from 4.7 percent in November and was slightly below market expectations of 4.9 percent.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: U.S. Bureau of Labor Statistics/U.S. Department of Labor/Eurostat/Federal Statistical Office (Germany)/Swiss Federal Statistical Office/Italian National Institute of Statistics/Office for National Statistics (U.K.)/General Administration of Customs (China)/Ministry of Finance (Japan)/National Statistics Office of the Philippines/Brazilian Institute of Geography and Statistics/National Institute of Statistics and Geography (Mexico)/Coresight Research[/caption]