Source: US Bureau of Labor Statistics/Company reports

From the Desk of Deborah Weinswig

US Department Stores Look Set for a Better Year

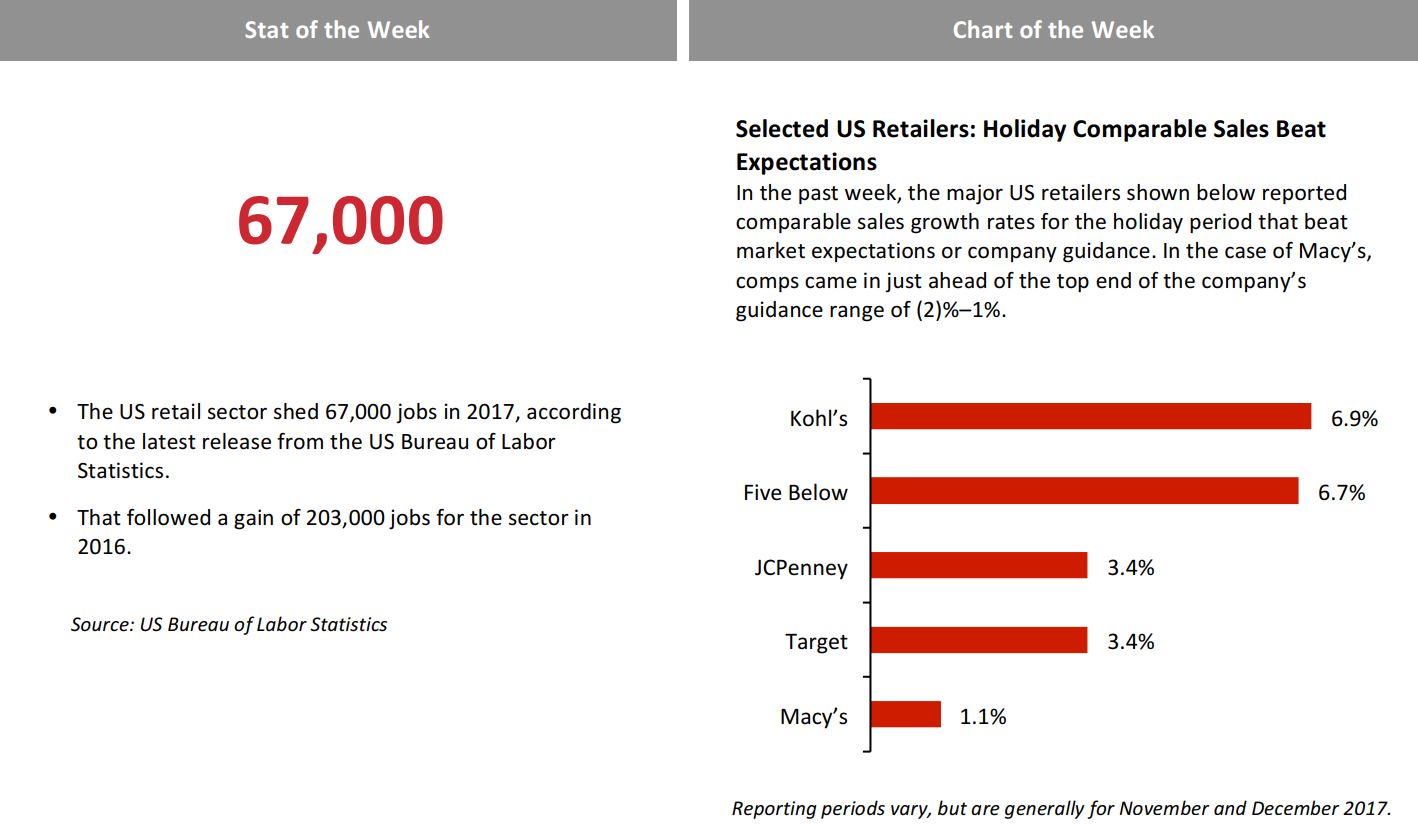

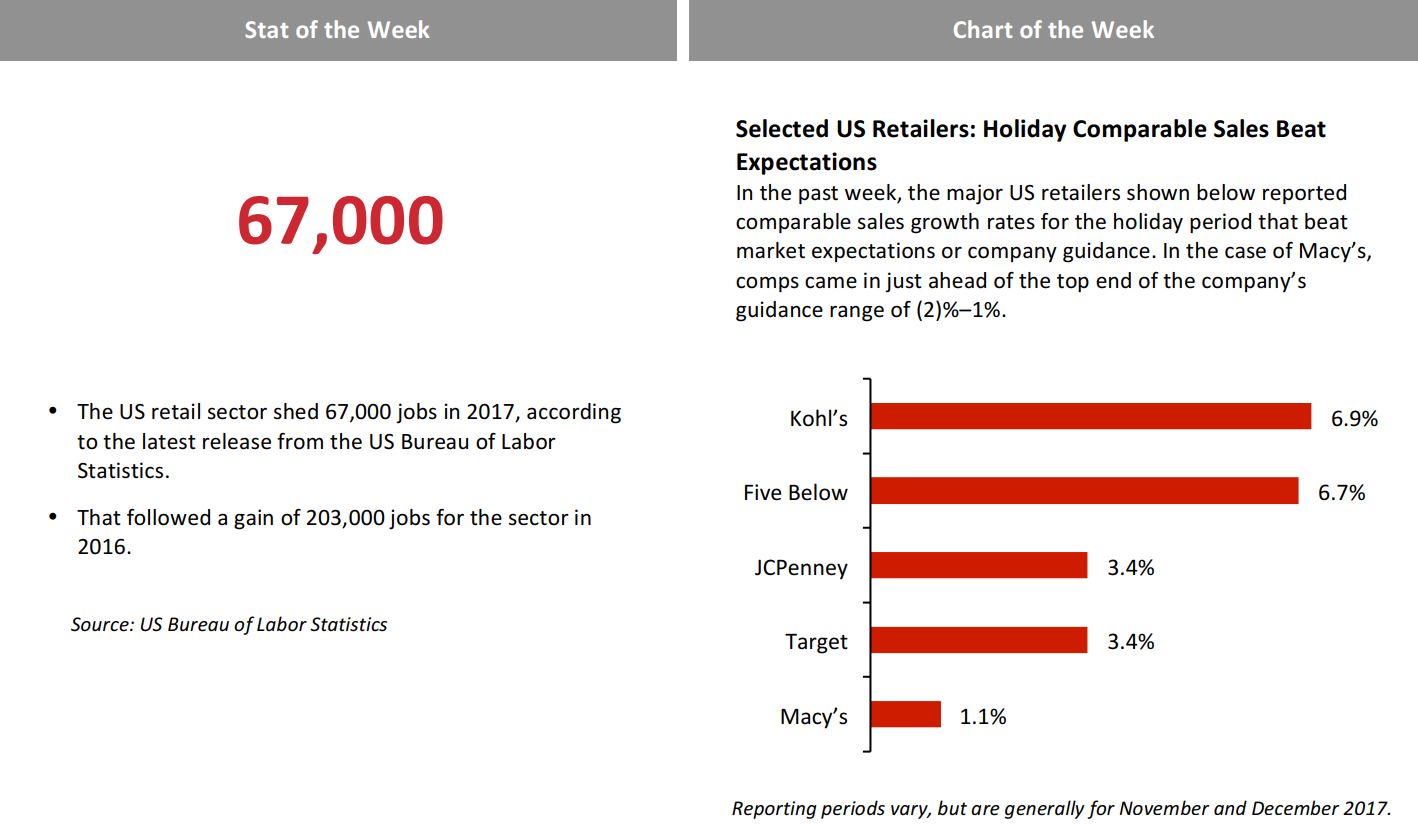

Kohl’s was among the retailers that wowed analysts and commentators this week when it reported a very strong increase in sales for November and December: comparable sales and total sales were both up 6.9%, the retailer’s strongest quarterly comp in a number of years. The Kohl’s report followed JCPenney’s announcement of its own, surprisingly solid, 3.4% increase in comparable-store sales for the nine weeks ended December 30.

Not all department stores are growing as fast, though, and it is notable that Kohl’s is not a typical, mall-based department store, as most of its stores are in off-mall locations. Macy’s reported comp growth of just 1.1% for the holiday quarter and announced further store closures, as did Sears. But, overall, the picture that is emerging is one of a very strong holiday season for US retail. Mastercard SpendingPulse noted a 4.9% increase in total US retail sales from November 1 through December 24. The US Census Bureau will release its top-line figure for December as we go to press on January 12, and it will follow up with more details later.

A Strong 2017 Holiday Heralds a Solid 2018 for US Retail

We expect 2018 to be a robust year for US retail, with sales growth (excluding autos and gas) comfortably in excess of 4% versus an estimated 3.9% for 2017. Retail sales expansion will likely be supported by macroeconomic strengths such as robust consumer confidence, low unemployment and, particularly, income tax cuts that will boost the disposable incomes of many consumers.

Opportunities for Department Stores in 2018

As Aristotle said, “One swallow does not a summer make,” and we must not kid ourselves that the structural challenges facing US department stores have disappeared. But we see a few levers that department stores could pull to retain and attract customers in 2018, in addition to benefiting from the expected general rising tide of retail sales this year.

First, retailers can use the major reform of US tax law to revive their propositions and, so, jump-start growth. In the best case, the cuts to income and corporate taxes could yield a virtuous circle, whereby shoppers’ increased spending and retailers’ lower taxes result in investments in “better retail” by department stores. These retailers could choose to spend on upgrading store environments, lowering prices, investing in store staff, enhancing marketing, or improving omnichannel services such as mobile offerings or in-store technologies.

Second, personalization offers an opportunity for generalist retailers to heighten their relevance to consumers. Department stores could provide customers with personalized home pages, email campaigns, videos and promotions, and recommendations and communications that flex based on location and daypart as well as by customer. Artificial intelligence (AI) will be a springboard for personalization this year, and we think that it will prove particularly useful for US department stores, which can deploy the technology to surface highly relevant products for individual shoppers from an unwieldy inventory. In other words, the most generalist of retailers can begin addressing a consumer segment of one.

Third, we see sustained opportunities for collaboration between department stores and brands and other retailers. Department stores could follow Target’s lead in bringing formerly online-only brands such as mattress maker Casper and shaving products purveyor Harry’s to physical stores. They could also agree to the kind of tie-up that saw Kohl’s begin to sell Amazon technology products and accept returns on Amazon’s behalf in its stores last year.

So, after the dominant narrative of store closures in 2017, this year offers some promise of stronger demand for a number of US department stores. The scale of the improvement is partially dependent on the retailers’ willingness to invest and, particularly, to reinvest proceeds from tax reform into better propositions that strengthen their hand, rather than simply cashing their gains.

US RETAIL & TECH HEADLINES

Retail Workers Feel Disruption from Shifting Shopper Habits (January 8) APNews.com

(January 8) APNews.com

- The retail industry is being radically reshaped by technology, and nobody feels that disruption more starkly than 16 million American shelf stockers, salespeople, cashiers and others. The shifts are driven, like much in retail, by the Amazon effect—the explosion of online shopping and the related changes in consumer behavior and preferences.

- As tasks such as checkout and inventory are automated, employees are trying to deliver the kind of customer service the Internet cannot match.

Wave of Store Closures and Retail Bankruptcies in the US to Benefit Giants Like Amazon and Walmart (January 8) SCMP.com

(January 8) SCMP.com

- A wave of store closings and retailer bankruptcies in the US is due soon this year, as the industry is deteriorating faster than analysts had expected a year ago, according to Credit Suisse Group.

- The retail business’s “large and undeniable transformation” will crimp rents and vacancy rates this year, strategists Roger Lehman and Benjamin Rozyn wrote in a note. Bonds backed by these loans are likely to weaken, they Meanwhile, a few major retailers, including Amazon, Walmart and Home Depot, are expected to reap an oversized share of the industry’s gains.

US Tax Plan a Pick-Me-Up for Struggling Retailers (January 8) WSJ.com

(January 8) WSJ.com

- In its early stages, Republicans wanted their tax plan to include a border-adjusted tax on imports that would have been disastrous for the retail industry, which sources much of its merchandise overseas.

- That did not make it into the final plan. Instead of coal for Christmas, retailers got a war chest. Their corporate tax rate of 35% will drop to 21%, handing them a free-cash-flow boost as they fight for survival in the Amazon era.

Retailers Get Bump from Holiday Season (January 8) WSJ.com

(January 8) WSJ.com

- After a year marked by same-store sales declines and store closures across the sector, retailers are reporting strong sales for the critical holiday shopping period from November through December. Kohl’s said that its comparable sales over the holidays jumped by 6.9%, compared with a 2.1% decline a year earlier.

- Kohl’s, helped by stronger store traffic, is the latest retailer to feel the holiday cheer. Its report comes after last week’s announcements by Macy’s and JCPenney that sales improved in the holiday period, benefiting from a healthy economy and strong consumer spending.

Lululemon Makes Strides in Menswear, Boosts Outlook After Strong Holiday Season (January 8) Business.FinancialPost.com

(January 8) Business.FinancialPost.com

- Lululemon Athletica has buoyed reports of a strong retail holiday season by hiking its revenue and earnings guidance. COO Stuart Haselden said that the company has made strides in expanding its men’s business.

- The company expects that its menswear line will account for 25% of its business by the time it hits an estimated $4 billion in sales by 2020. Once primarily a business based on women’s yoga pants and accessories, Lululemon is now more of a “dual gender” brand, Haselden said.

EUROPE RETAIL & TECH HEADLINES

UK Retail Sales Continue Growth in December (January 9) BRC press release

(January 9) BRC press release

- In December, UK total retail sales grew by 1.4%, which was slightly lower than November’s 1.5% increase, according to the British Retail Consortium (BRC). Comparable sales growth was 0.6%, flat versus the November figure.

- The BRC breaks down sales by food and nonfood retail only on a three-month basis. In the three months ended December, food sales rose by 2.6% on a comparable basis and by 4.2% on a total basis, which was the highest rate seen since June and above the 12-month total average of 3.4%. Nonfood retail sales fell by 1.9% on a comparable basis and by 1.4% on a total basis, which was the lowest rate seen since March 2009 and below the 12-month total average of 0.0%.

Morrisons Reports Strong Sales Growth During Christmas Quarter (January 9) Company press release

(January 9) Company press release

- Morrisons, the UK’s fourth-largest grocery retailer, reported comparable sales growth of 2.8% in the 10 weeks ended January 7, accelerating from 2.5% growth in the prior quarter and versus a strong Christmas period in the prior year, when comps grew by 3.3%. The company’s comparable sales growth exceeded the consensus expectation of 1.7%.

- Performance was particularly strong over the core six-week holiday period ended January 7, with comps rising by 3.7% in the period, driven by strong sales of Morrisons’ premium own-brand ranges, 50% growth in food to order, and a wider selection in the Free From and Morrisons Makes It ranges.

Sales Decline at Debenhams Prompts Profit Warning

(January 4) Company press release

Sales Decline at Debenhams Prompts Profit Warning

(January 4) Company press release

- British department store retailer Debenhams reported that group comparable sales sank by 1.3% in the 17 weeks ended December 30, versus a strong, 3.5% comparative in the corresponding period of the previous year. At constant currency, comps fell by 1.8%, compared with a 0.4% rise in the year-ago period.

- Total group gross transaction value fell by 0.8% in the 17-week period. Debenhams said that beauty and food sales grew, but that seasonal gift sales fell. This led to increased promotions that are likely to deplete the company’s gross margin by 150 basis points in the first half of fiscal year 2018. Previously, the company guided for a gross margin decline of 25 basis points in the first half.

Next Reports Stronger-than-Expected Sales During Holiday Trading (January 3) Company press release

(January 3) Company press release

- UK fashion retailer Next reported that total full-price sales growth stood at 1.5% in the 54 days ended December 24. The figure was up from 1.3% in the prior quarter and ahead of guidance published in early November that called for a full-price sales decline of 0.3% during the period.

- Full-price sales fell by 6.1% year over year in the store-based Next Retail segment and rose by 13.6% in the online and catalog-based Next Directory segment. On the back of improved sales trends, Next raised its guidance for fiscal 2018 pretax profit to £725 million ($981 million) from £717 million ($970 million) previously. The company raised its full-year total full-price sales guidance to 0.3% from (0.3)% previously.

Lidl Unveils Warehouse Plans for London (January 9) RetailGazette.co.uk

(January 9) RetailGazette.co.uk

- German grocery retailer Lidl has unveiled plans to construct its largest UK warehouse yet, which will span about 1 million square feet. The facility will generate at least 1,000 jobs and will be Lidl’s 16th warehouse in the UK and its fourth to service Greater London.

- The warehouse will form part of the retailer’s expansion plans, which include investing £1.45 billion ($1.96 billion) in its UK operations between 2017 and 2018.

ASIA RETAIL & TECH HEADLINES

Singapore’s oBike Reaches 10 Million Rides, but Lags Far Behind Rivals (January 4) TechinAsia.com

(January 4) TechinAsia.com

- oBike, a bike-sharing startup founded in Singapore a year ago, has just reached 10 million rides. However, the company still lags behind Ofo and Mobike, its far-larger rivals from China. Ofo, backed by Alibaba, announced in December last year that it saw 32 million rides a day. Meanwhile, Mobike clocked 20 million daily rides as of April 2017 and has Tencent in its corner.

- In terms of funding from external investors, both Ofo and Mobike have outraised oBike by many multiples, Tech in Asia data show, even though oBike raised one of the largest series B rounds in Southeast Asia’s history. oBike declined to name its investors, though it said a “transportation platform” was involved.

India’s National ID Database Is Reportedly Accessible for Less than $10 (January 4) TechCrunch.com

(January 4) TechCrunch.com

- The nightmare is a reality in India. Reports from the country suggest that the government’s national ID system—Aadhaar, which holds personal data belonging to more than a billion people—was compromised.

- The access hole was publicized after Indian newspaper The Tribune paid a man less than $10 in exchange for administration access to the database. Reporters from the paper were then given a username and password that allowed them to access information on any citizen by entering the person’s 12-digit ID number.

WeWork Banks on a Local Approach and “Powered by We” to Crack Southeast Asia (January 4) TechCrunch.com

(January 4) TechCrunch.com

- WeWork charged into Asia two years ago, but it finally moved into Southeast Asia in the second half of 2017 through the acquisition of Spacemob and the opening of its first space in Singapore, its 200th location worldwide. Now, the company is relying on a formula with two key focuses to further its push and conquer the coworking space in this emerging region.

- Online consumer spending in Southeast Asia is set to quadruple by 2025 and Chinese companies are already flocking to the region to get in early with an audience of over 600 million consumers who are coming online rapidly. The region now has more Internet users than the US has people, according to a report coauthored by Google. All of this spells opportunity for WeWork, and the company is ready to tap into it after laying roots in more lucrative markets such as China, South Korea, Japan and India.

E-Commerce Startup Citiesocial Raises $2.75 Million, Led by Alibaba’s Fund for Taiwanese Entrepreneurs (January 9) TechCrunch.com

(January 9) TechCrunch.com

- Citiesocial, a Taipei-based startup that helps emerging brands break into Asia’s e-commerce market, has raised $2.75 million, led by Alibaba Entrepreneurs Fund, a nonprofit backed by Alibaba Group to support local startups. CDIB Capital and returning investor Cherubic Ventures also participated. The capital will be used to expand Citiesocial into China, South Korea and Japan this year through strategic partnerships.

- Citiesocial focuses on young companies with innovative or unusual products that see an opportunity in Asia but need help getting there. Launched in 2011 as a group buying site, Citiesocial now has 600,000 users in Taiwan and Hong Kong. The startup currently manages sales for about 2,000 brands and more than 60,000 products, serving as a fixer and helping with branding, marketing and customer support.

LATAM RETAIL & TECH HEADLINES

IBM Appoints New President for Brazil Operation (January 5) ZDNet.com

(January 5) ZDNet.com

- IBM has promoted company veteran Tonny Martins to take over as president of its Brazil operations. Martins had headed the company’s Mexico office since 2016, leading the local adoption of Watson in the healthcare sector and blockchain in insurance. The executive takes over the Brazil operations at a time that IBM considers to be crucial in terms of local adoption of artificial intelligence, cloud technology and security products.

- “I could not be more excited to take over the company at the beginning of its new centenary, at a time when the market yearns for innovation and transformation. I am very honored by this challenge and [to lead] a team that is extremely prepared and passionate about our customers’ success,” Martins said.

Didi Confirms It Has Acquired 99 in Brazil to Expand in Latin America

- Didi Chuxing and 99, a ride-sharing company in Brazil, have confirmed that Didi will acquire 99 as part of its plan to expand its service into Latin America.

- "The success that [the] founders and team of 99 have achieved in Brazil embod[ies] the very spirit of entrepreneurship and innovation in the LatAm region,” said Cheng Wei, Founder and CEO of Didi. “Building on the deep trust between our two teams, this new level of integration will bring to the region more convenient, value-added mobility services,” he said.

Walmart de Mexico’s Sales Growth Lost Steam in 2017

- Sales at Walmart de Mexico, Mexico’s biggest retailer, slowed in 2017 after two consecutive years of double-digit growth, the company reported Monday. Walmex said that sales last year rose by 7.7%, to MXN 569.4 billion ($29.6 billion), the smallest expansion since 2014.

- Mexican retail sales slowed over the course of 2017 as a weaker peso against the US dollar and a jump in gasoline prices helped push inflation to its highest level since mid-2001, prompting the central bank to raise interest rates. Consumer credit growth also slowed.

Brazil’s Pão de Açúcar Introduces New Store Model (January 7) ESMMagazine.com

(January 7) ESMMagazine.com

- Brazilian supermarket chain Pão de Açúcar has launched a new store concept, which it has introduced in five of its outlets. Changes regarding store layout and the mix of products on offer have been implemented at four of the retailer’s stores in São Paulo and one in Campinas. Fruits, vegetables, seeds, dried fruit, cereals, coconut water, orange juice, and gluten-free, lactose-free and organic products are now grouped together in the Fresh section at the store entrance.

- “The exhibition of the products was rethought to highlight the freshness and quality of the selection and the unique variety of Pão de Açúcar,” said Marcelo Bazzali, the retail group’s executive director. “From this section, it is also possible to have an overview of the store, facilitating the customer’s search for products,” he said.

MACRO UPDATE

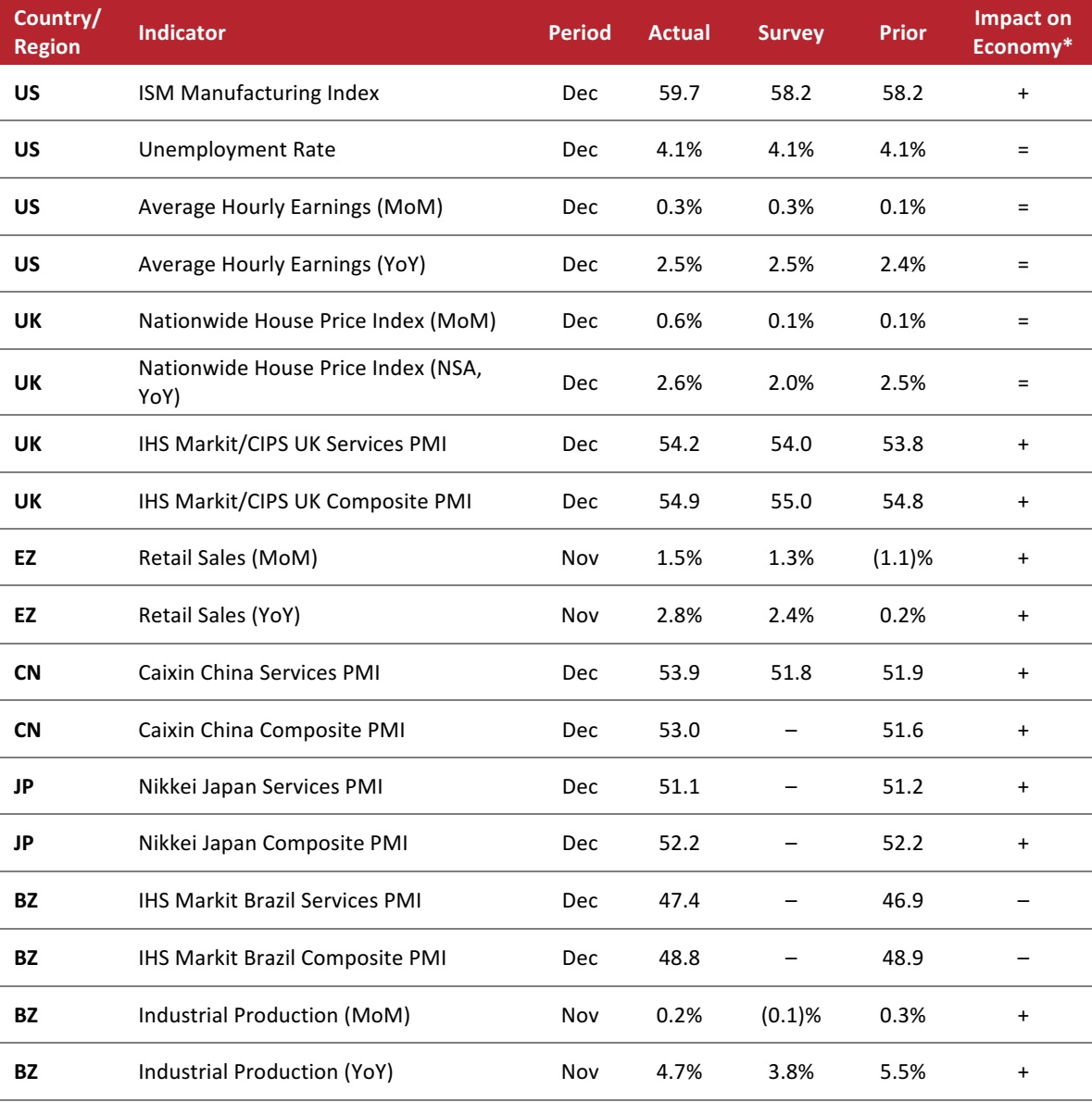

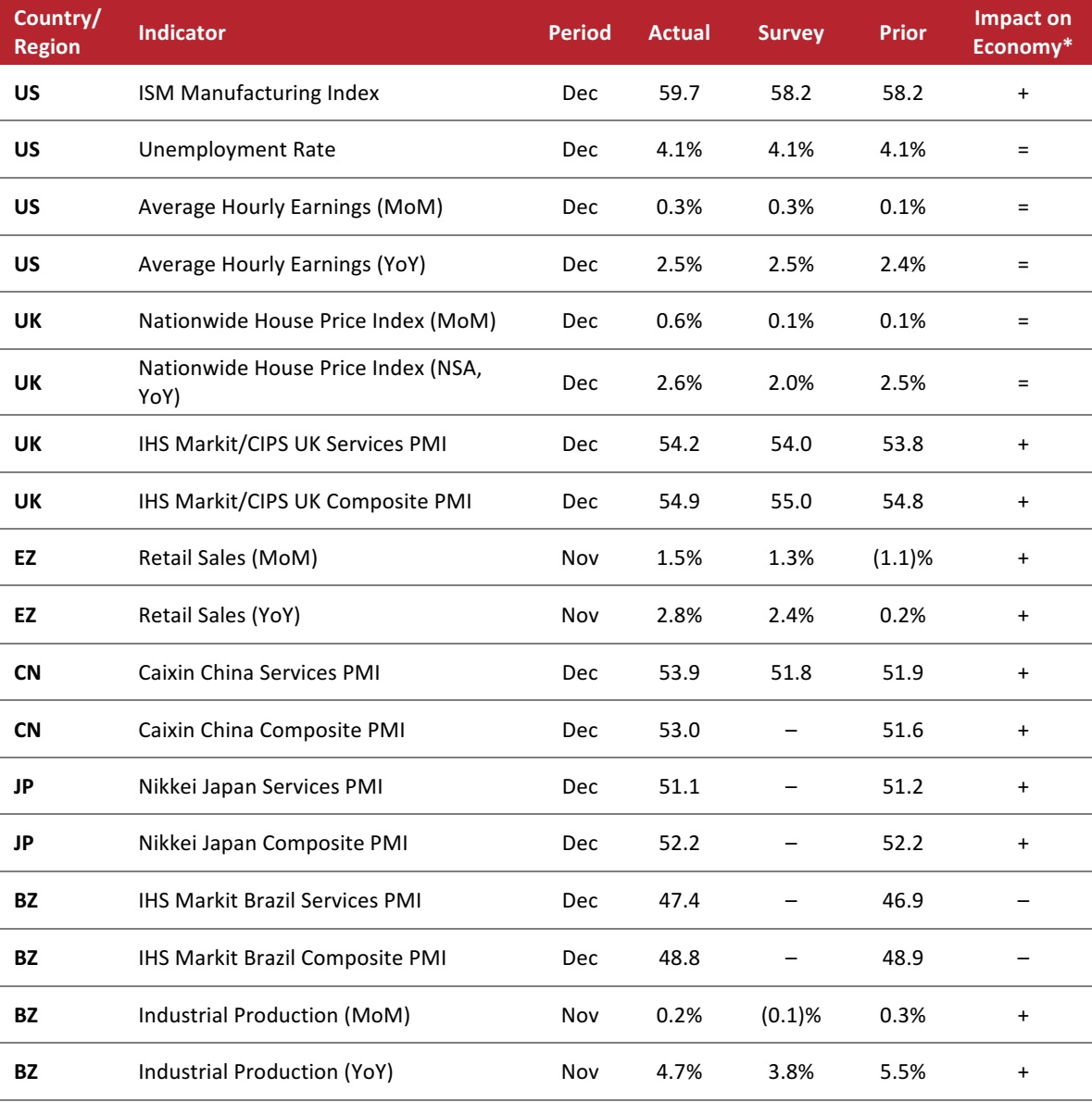

Key points from global macro indicators released January 3–10, 2018:

1) US: In December, the ISM Manufacturing Index reading was 59.7, slightly higher than the consensus estimate of 58.2, indicating that the manufacturing sector remained in an expansionary state. The unemployment rate stayed at 4.1% in December for the third consecutive month.

2) Europe: In the UK, the Nationwide House Price Index increased by 0.6% month over month and by 2.6% year over year in December. The IHS Markit/CIPS UK Services Purchasing Managers’ Index (PMI) stayed above the expansion threshold in December. In the eurozone, retail sales increased by 1.5% month over month and by 2.8% year over year in November.

3) Asia-Pacific: In December, the Caixin China Services PMI increased to 53.9, above both the consensus estimate of 51.8 and the previous reading of 51.9. In Japan, the Nikkei Services PMI stood above the expansion threshold in December.

4) Latin America: In Brazil, the IHS Markit Services PMI stayed below the expansion threshold in December. Industrial production in Brazil edged up by 0.2% month over month in November.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Institute for Supply Management (ISM)/US Bureau of Labor Statistics/Nationwide Building Society/Markit/Eurostat/Instituto Brasileiro de Geografia e Estatística/FGRT

(January 8) APNews.com

(January 8) APNews.com

(January 8) SCMP.com

(January 8) SCMP.com

(January 8) WSJ.com

(January 8) WSJ.com

(January 8) WSJ.com

(January 8) WSJ.com

(January 8) Business.FinancialPost.com

(January 8) Business.FinancialPost.com

(January 9) BRC press release

(January 9) BRC press release

(January 9) Company press release

(January 9) Company press release

(January 9) RetailGazette.co.uk

(January 9) RetailGazette.co.uk

(January 4) TechinAsia.com

(January 4) TechinAsia.com

(January 4) TechCrunch.com

(January 4) TechCrunch.com

(January 7) ESMMagazine.com

(January 7) ESMMagazine.com