albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Four Global Inflection Points to Watch in the First Half of 2019 Retailers in the U.S. may have enjoyed a bumper holiday season, but their counterparts elsewhere in the world have been experiencing greater uncertainty. In China, the pace of economic growth has slowed, while in Germany, shoppers have shown renewed caution. Meanwhile, in the U.K., details on Brexit remain unclear, even though the exit date is now less than three months away – raising the real possibility of a deal-less Brexit. Across the U.S., Europe and Asia, macroeconomic and political uncertainty threatens to persist for at least the first few months of 2019. In this week’s note, we look at four inflection points we expect could significantly impact the economy and consumer sentiment in various countries. 1. U.S.-China Tariff Agreement by March 2 When U.S. President Donald Trump and Chinese President Xi Jinping declared a tariff truce on Dec. 2, they gave themselves 90 days, or until March 2, to come to a more permanent agreement. Should the two countries not agree to a resolution by that date, the U.S. could carry out its threat to hike tariffs on many Chinese imports from 10 percent to 25 percent. Trade representatives from the two countries have been meeting this week as they scramble to avoid an escalation of the dispute. The pressure to solve the disagreement is increasing for both parties, as recent weeks have been marked by stock market volatility in the U.S. and a slowing of many economic metrics in China. U.S. officials are also negotiating with EU counterparts on a deal on cars from the EU. In July 2018, Trump postponed planned tariffs on EU cars while the two parties sought a new agreement. 2. Further Rate Rises from the Fed? When the U.S. Federal Reserve hiked its benchmark interest rate by a quarter point on Dec. 19, it indicated it would likely raise rates twice in 2019, down from previous guidance for three increases. The Fed meets again on Jan. 29-30, though a rate rise at that time looks highly unlikely, given recent global economic volatility and the recency of the latest hike. Watch the Fed meetings on March 19-20, April 30-May 1 and June 18-19. 3. Brexit on March 29 The U.K. will leave the EU on March 29 — whether or not the country’s politicians approve Prime Minister Theresa May’s controversial Brexit withdrawal agreement. In December, with the final agreement facing certain defeat in the House of Commons, May delayed the vote on it, and Parliament is now expected to vote on the agreement around Jan. 15. But the plan still faces substantial opposition in the House of Commons, and if it is defeated, the current lack of clarity on Brexit could last right up to the country’s departure from the EU. The tough trading reported by some U.K. retailers in later 2018 is a sign of heightened British consumer caution — and we can expect more of it in early 2019. A “no deal” exit would result in softer consumer demand, although the U.K. and the EU would probably work to minimize the near-term impact on consumers. 4. EU Elections in May Could See Populists Surge Brexit is not the only headache for EU incumbents: European Parliament elections scheduled for May 23-26 promise to bring in a new wave of populists. The common thread connecting the disparate interests and demands of groups under the populist banner is Euroskepticism. The good news is that, in many cases, the populists call for reform rather than for a U.K.-style departure. Populist parties expected to gain seats include the National Rally in France, Alternative for Germany, and the League and the Five Star Movement in Italy. The election of Euroskeptics would be more than symbolic: Think tank Carnegie Europe says a populist surge could disrupt the traditional groupings of parties in the European Parliament, block decisions on crucial issues and ultimately threaten the smooth functioning of the EU. These four key events carry with them global uncertainty as we start the year. The upside is that there are hard deadlines for the U.S.-China tariff discussions and Brexit, so leaders in the U.S., China, the EU and the U.K. face some urgency to find solutions.

U.S. RETAIL & TECH HEADLINES

![]() U.S. Gadget Love Forecast to Grow Despite Trust Issues

(Jan. 7) VOANews.com

U.S. Gadget Love Forecast to Grow Despite Trust Issues

(Jan. 7) VOANews.com

- The trade group behind CES (formerly the Consumer Electronics Show), taking place in Las Vegas this week, has forecast that U.S. consumers’ love of gadgets will grow despite issues around trust and privacy.

- Among the tech offerings on display at CES this week were superhigh-resolution 8K TVs, blazingly fast 5G wireless Internet, and virtual assistants such as Google Assistant and Amazon’s Alexa.

![]() Lampert’s Bid to Purchase Sears Reportedly Fails

(Jan. 7) InsideRetail.com.au

Lampert’s Bid to Purchase Sears Reportedly Fails

(Jan. 7) InsideRetail.com.au

- Bankrupt U.S. retailer Sears is reportedly preparing to wind down. Chairman Eddie Lampert’s last-ditch, $4.4 billion bid to revive the struggling retailer fell short of the mark, according to CNBC.

- People close to the situation said the offer raised a number of red flags, as it did not cover fees and vendor payments the business owes, making it “administratively insolvent.”

![]() Blake W. Nordstrom, Scion of Retail Family, Dies at 58

(Jan. 3) NYTimes.com

Blake W. Nordstrom, Scion of Retail Family, Dies at 58

(Jan. 3) NYTimes.com

- Blake W. Nordstrom, a co-president of Nordstrom, the chain of upscale clothing and shoe stores that grew out of a single establishment founded by his great-grandfather, died on Jan. 2 in Seattle. He was 58.

- Mr. Nordstrom started his career in the 1970s as a schoolboy working in the stockroom in the company’s store in downtown Seattle. He became president of Nordstrom in 2000, and his brothers joined him as co-presidents in 2015.

Whole Foods Introduces Special Dietary Search Tool for Online Shoppers

(Jan. 4) RetailGazette.com.uk

Whole Foods Introduces Special Dietary Search Tool for Online Shoppers

(Jan. 4) RetailGazette.com.uk

- Whole Foods has introduced a new website and mobile tool that allows customers with special dietary needs to search for products.

- The search tool will allow customers to filter tens of thousands of products according to whether they are keto-friendly, paleo-friendly, vegan, kosher, low sodium or dairy-free.

![]() U.S. Retail Vacancies Rise Marginally in Fourth Quarter

(Jan. 3) Reuters.com

U.S. Retail Vacancies Rise Marginally in Fourth Quarter

(Jan. 3) Reuters.com

- Many feared that retail vacancy rates would soar and rents would plummet, given the store closure announcements by Sears, Kmart and JCPenney at the end of 2017, but in the fourth quarter of 2018, U.S. retail vacancies rose only marginally.

- The small increase in vacancies underscores the fact that the retail sector has withstood many store closures across the country, real estate research firm Reis Inc. said in a report.

EUROPE RETAIL & TECH HEADLINES

![]() Missguided Reports £46.7 Million ($59.3 Million) in Losses

(Jan. 7) RetailGazette.co.uk

Missguided Reports £46.7 Million ($59.3 Million) in Losses

(Jan. 7) RetailGazette.co.uk

- British women’s clothing retailer Missguided reported a net income loss of £46.7 million ($59.3 million) in the 12 months ended April 1, 2018, according to accounts filed with the U.K.’s registrar of companies.

- Despite last year’s concerning results, company founder Nitin Passi described the current year as a transitional year, with revenues rising, and affirmed management’s vision for future operations from stores and the e-commerce business.

Galeria Inno to Shut Its Webshop at the End of January

(Jan. 3) RetailDetail.eu

Galeria Inno to Shut Its Webshop at the End of January

(Jan. 3) RetailDetail.eu

- Belgian department store chain Galeria Inno, a division of Galeria Kaufhof, will shut its webshop at the end of January, the company informed customers via email last week.

- E-commerce Director Jok Junius told reporters the decision to terminate e-commerce operations came from Galeria Inno’s parent company.

![]() Whistles Turns Profitable After Strong Sales Increase

(Jan. 8) DrapersOnline.com

Whistles Turns Profitable After Strong Sales Increase

(Jan. 8) DrapersOnline.com

- British clothing brand Whistles turned profitable after registering a 16.1 percent increase in sales for the fiscal year ended March 2018.

- Whistles registered a pretax profit of £5 million ($6.4 million) versus a loss of £1.6 million ($2.0 million) last year. Online sales rose 28 percent during the period.

![]() Ve Global Acquires Analytics Platform Divvit in a Cash and Equity Deal

(Jan. 7) Tech.eu

Ve Global Acquires Analytics Platform Divvit in a Cash and Equity Deal

(Jan. 7) Tech.eu

- British marketing technology company Ve Global has acquired Divvit, a Swedish e-commerce analytics platform. Ve Global has also made a financial commitment of £500,000 ($635,174) to integrate Divvit’s solutions into its products.

- The deal is the first strategic acquisition by Ve Global, which stated that many more should be expected.

![]() Joules Registers Solid Uplift in Christmas Sales

(Jan. 8) TheRetailBulletin.com

Joules Registers Solid Uplift in Christmas Sales

(Jan. 8) TheRetailBulletin.com

- British lifestyle fashion brand Joules registered a robust, 11.7 percent year-over-year increase in sales in the seven weeks ended Jan. 6.

- Online sales accounted for almost half of total retail sales. The retailer saw a period of good performance through its digital channels and its concession partners’ websites.

ASIA RETAIL & TECH HEADLINES

![]() Ermanno Scervino Opens Store in Hangzhou, China

(Jan. 8) RetailNews.asia

Ermanno Scervino Opens Store in Hangzhou, China

(Jan. 8) RetailNews.asia

- Italian fashion house Ermanno Scervino has opened a new boutique in Hangzhou Tower shopping center in Hangzhou, China. The Florence-based company also recently opened a store in Hong Kong.

- The new Hangzhou store is spread over 1,500 square feet and offers women’s and men’s ready-to-wear lines as well as accessories.

![]() Mothercare Operator in Malaysia Plans for an IPO

(Jan. 8) InsideRetail.asia

Mothercare Operator in Malaysia Plans for an IPO

(Jan. 8) InsideRetail.asia

- Kim Hin Joo, which operates Mothercare in Malaysia, is planning an IPO on Bursa Malaysia’s ACE market to fund further expansion and ongoing expenditures.

- The move will see a public issue of 76 million new shares and an offer of 57 million existing shares, of which 47 million will be reserved for selected investors.

![]() Crabtree & Evelyn to Close All Its Singapore Stores

(Jan. 7) RetailNews.asia

Crabtree & Evelyn to Close All Its Singapore Stores

(Jan. 7) RetailNews.asia

- Crabtree & Evelyn is closing all 12 of its stores in Singapore. The fragrances and home care products retailer is expected to continue to operate two stores in Singapore until Jan. 31, after which it will sell only online in the city-state.

- The closures were announced after the company’s Canadian business entered bankruptcy protection a month ago.

![]() HMV Likely to Offer Products at Massive Discounts in Its Liquidation Sale

(Jan. 7) SCMP.com

HMV Likely to Offer Products at Massive Discounts in Its Liquidation Sale

(Jan. 7) SCMP.com

- British entertainment retailer HMV is expected to hold the biggest liquidation sale in a decade in Hong Kong. The move is expected to follow the company’s meeting with creditors on Jan. 10.

- Mat Ng, a liquidation expert and managing director of JLA Asia, said, “For a big retail music chain like HMV, which has a big stock of CDs, DVDs, audio equipment and lifestyle products, the most likely option is to have a big liquidation sale day to sell the outstanding stock at a heavily discounted price.”

![]() Baidu’s Voice Assistant Is Active on over 200 Million Devices

(Jan. 7) TechCrunch.com

Baidu’s Voice Assistant Is Active on over 200 Million Devices

(Jan. 7) TechCrunch.com

- Chinese artificial intelligence (AI) and technology specialist Baidu says its voice assistant DuerOS is now on over 200 million devices.

- Voice interaction technology is part of Baidu’s long-term strategy as it shifts from a heavy focus on search toward AI.

![]() Toys “R” Us Asia to Open 60 New Stores in 2019

(Jan. 3) SCMP.com

Toys “R” Us Asia to Open 60 New Stores in 2019

(Jan. 3) SCMP.com

- Toys “R” Us Asia plans to open 60 new stores in 2019, in contrast to its former U.S. parent, which filed for bankruptcy and was forced to shut stores. The toy retailer plans to open three stores in Hong Kong and several more in mainland China.

- Jo Hall, the company’s chief commercial officer for Greater China and Southeast Asia, remarked that Toys “R” Us Asia is “cautiously optimistic” and will “continue to invest in refurbishing existing and opening new stores.”

- Toys “R” Us Asia was founded 32 years ago as a joint venture between Fung Retailing and Toys “R” Us Inc. After a debt-for-equity restructuring deal, Fung Retailing raised its stake from 15 to 21 percent, the rest owned by creditors of Toys “R” Us Inc.

LATAM RETAIL & TECH HEADLINES

![]() Walmart Installs First Self-Service Kiosks in Chile

(Dec. 31) Df.cl

Walmart Installs First Self-Service Kiosks in Chile

(Dec. 31) Df.cl

- Walmart has launched its first self-service store in Chile, a Lider Express supermarket located in Providencia.

- The store houses five self-service kiosks that allow shoppers to scan and check out items, although staff are available to advise shoppers on purchases. Walmart plans to roll out the service to other stores if the inaugural store proves successful.

![]() Mercado Libre App One of the Most Downloaded Worldwide

(Jan. 4) Mx.FashionNetwork.com

Mercado Libre App One of the Most Downloaded Worldwide

(Jan. 4) Mx.FashionNetwork.com

- The shopping app offered by Argentine e-commerce company Mercado Libre is the eighth-most-downloaded e-commerce app in the world, surpassing apps from firms such as Letgo and Groupon, according to the latest rankings by mobile applications intelligence firm Apptopia.

- In April 2018, Mercado Libre confirmed it had reached 100 million downloads. Shopping app Wish led the rankings in 2018 with 197 million downloads.

![]() Birkenstock Opens Ninth Mexico Store, Moves Ahead with Expansion Plan

(Jan. 8) Mx.FashionNetwork.com

Birkenstock Opens Ninth Mexico Store, Moves Ahead with Expansion Plan

(Jan. 8) Mx.FashionNetwork.com

- German footwear brand Birkenstock has opened its ninth store in Mexico, in Jalisco. The sustainable sandal brand already has stores in key locations in Mexico City, Playa del Carmen and Guadalajara, and plans to expand further into other Mexican cities.

- Birkenstock has seen double-digit sales growth in Mexico since it began operating there in 2010.

![]() Empresas La Polar General Manager Andrés Eyzaguirre Resigns

(Jan. 4) America-Retail.com

Empresas La Polar General Manager Andrés Eyzaguirre Resigns

(Jan. 4) America-Retail.com

- Andrés Eyzaguirre, the general manager at Chilean retailer Empresas La Polar, has resigned. Effective Feb. 1, he will be replaced by Manuel José Severin, who currently manages the company’s clothing and footwear division.

- In a statement to the Chilean financial markets commission, La Polar stated that Eyzaguirre’s resignation was due to personal reasons.

![]() Argentine Retail Sales Slide 6.9 Percent in 2018

(Jan. 1) ElEconomista.com.ar

Argentine Retail Sales Slide 6.9 Percent in 2018

(Jan. 1) ElEconomista.com.ar

- Retail sales volume in Argentina slid 6.9 percent in 2018, according to a survey by the Argentinian Confederation of Medium-Sized Enterprises. In December, sales fell for the 12thconsecutive month, declining by 9.9 percent year over year.

- Online sales rose 3.1 percent in December, while sales at physical stores fell 11.2 percent.Online sales account for approximately 8 percent of total sales and were not adequate to offset the impact of store sales declines.

MACRO UPDATE

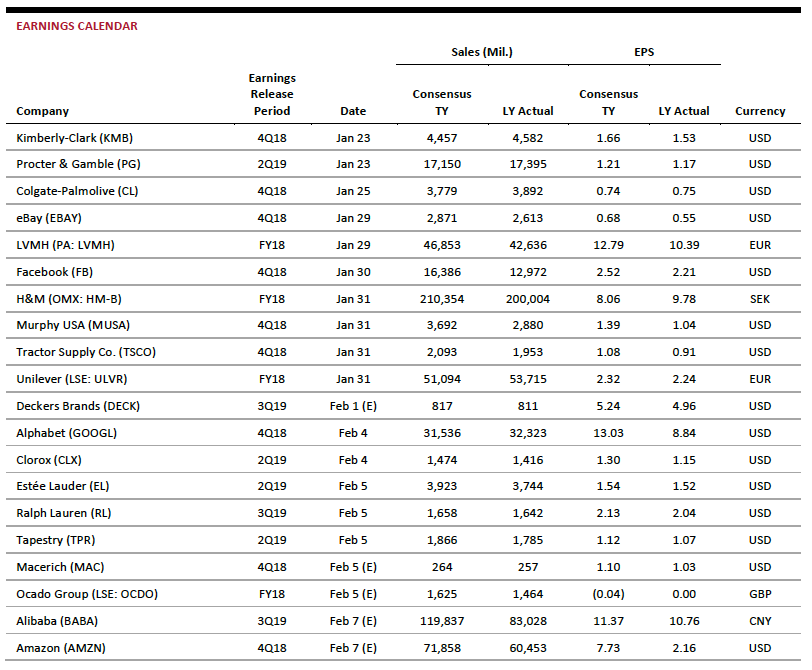

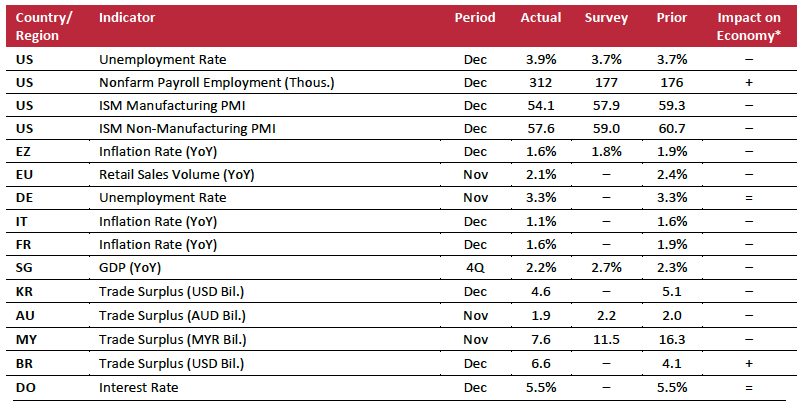

Key points from global macro indicators released Jan. 1-8, 2019:

- U.S.: The U.S. unemployment rate rose to 3.9 percent in December from a 49-year low of 3.7 percent in November, above market expectations of 3.7 percent. The ISM Manufacturing Purchasing Managers’ Index (PMI) fell to 54.1 in December from 59.3 in November; the December reading was the weakest since November 2016 and below the consensus estimate of 57.9.

- Europe: Annual inflation in the eurozone eased to 1.6 percent in December from 1.9 percent in November, below market expectations of 1.8 percent. Retail sales volume in the EU increased 2.1 percent year over year in November, compared with 2.4 percent in October.

- Asia-Pacific region: Singapore’s GDP grew 2.2 percent year over year in the fourth quarter, following a 2.3 percent expansion in the previous quarter but missing market expectations of 2.7 percent. South Korea’s trade surplus narrowed to $4.6 billion in December from $5.1 billion in November.

- Latin America: Brazil’s trade surplus widened to $6.6 billion in December from $4.1 billion in November. The central bank of the Dominican Republic left its benchmark interest rate unchanged at 5.5 percent at its December 2018 meeting.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: U.S. Bureau of Labor Statistics/Institute for Supply Management/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics (Italy)/National Institute of Statistics and Economic Studies (France)/Department of Statistics Singapore/Ministry of Trade, Industry and Energy (South Korea)/Australian Bureau of Statistics/Department of Statistics Malaysia/Central Bank of the Dominican Republic/Coresight Research [/caption]

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: U.S. Bureau of Labor Statistics/Institute for Supply Management/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics (Italy)/National Institute of Statistics and Economic Studies (France)/Department of Statistics Singapore/Ministry of Trade, Industry and Energy (South Korea)/Australian Bureau of Statistics/Department of Statistics Malaysia/Central Bank of the Dominican Republic/Coresight Research [/caption]