Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

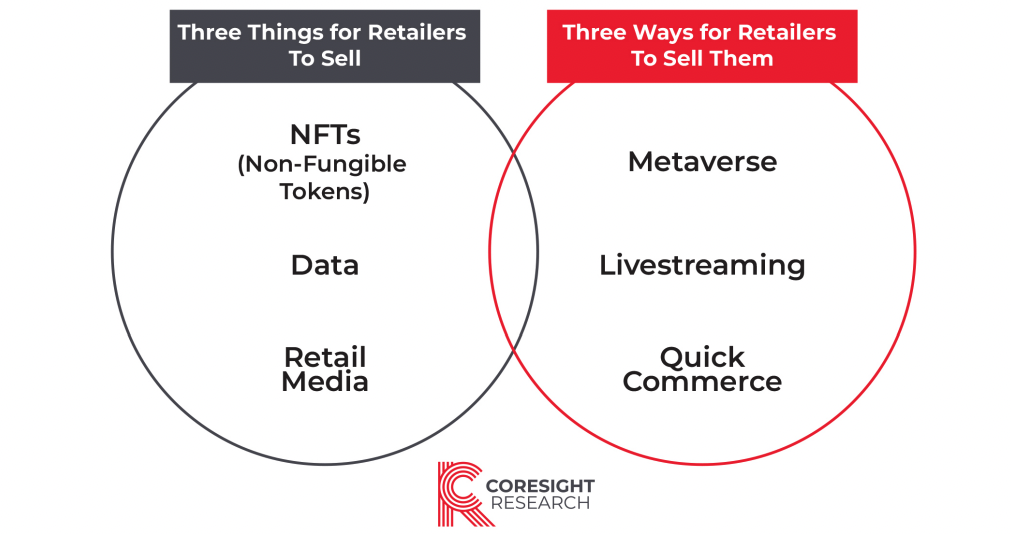

Introducing Coresight Research’s 3x3 Framework: Three New Products and Three New Ways to Sell Them Although we often write about the challenges retailers face—supply chains, competition from e-commerce and labor shortages, among others—they also have a new set of products and opportunities to draw on. Retailers are in a unique, exciting position to unlock the value of their data, brands and platforms to generate revenue from these new channels. To understand these new opportunities, Coresight Research has defined the 3×3 Framework, illustrated below. Some of these opportunities amplify each other—for example, quick-commerce retailers can sell data, operate media networks and sell NFTs, as well as employ livestreaming strategies or develop a presence in the metaverse.Figure 1. Coresight Research’s 3×3 Framework [caption id="attachment_152512" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Looking at new products, numerous factors have converged to monetize the many assets that retailers possess, driven by new technologies and the advent of the metaverse.

Data. There is a veritable ocean of data that passes retailers’ way every day: how many customers enter their stores, their demographics, where they go, what they try on and what they buy and do not buy, in addition to data gleaned online from website visits, dwell times, page views, what items end up in shopping carts and what consumers ultimately buy. This data has historically been trapped in siloes, but there is significant value in retailers sharing it with their supply chain partners. When aggregated and anonymized, this data becomes a hidden treasure to be harvested.

Media. Retailers have begun to understand the value of the time consumers spend on their websites, leading up to the key purchase moment. While Google’s business has long been based on selling advertising revenue to consumers on its various platforms, many retailers, including Amazon, Kroger, Walmart and “instant needs” player Gopuff, have launched their own retail media networks to monetize consumers’ attention during the shopping process. Coresight Research estimates that more than $75 million in global retail media advertising revenues will be generated in 2022, up more than 80% from last year.

NFTs. Retailers are unlocking the value of non-fungible tokens (NFTs) connected to their brands. For example, NIKE and Adidas consistently top sales lists for avatar NFTs, while Macy’s dropped its first-ever NFT collection last fall in connection with its 95th annual Thanksgiving Parade. In addition to being a revenue opportunity, NFTs are a key building block of the metaverse.

Livestreaming. Livestreaming enables brands and retailers to reach and sell to consumers wherever they are, showcasing products in a live, authentic and engaging format. After becoming a phenomenon in Asia, the adoption of livestreaming is growing in the US, and we estimate that the market will grow from $20 billion in 2022 to $68 billion in 2026.

Metaverse. Building upon artificial and virtual reality (AR/VR), blockchain and NFT technology, the metaverse has sparked a great deal of excitement and investment among retail players looking to stake a claim in this potentially enormous opportunity. The decentralized essence of the metaverse unlocks the creativity of content creators, who can build virtual worlds that transcend the laws of physics, which will naturally include brands and retailers. Coresight Research estimates that metaverse retail sales will hit $2.3 billion by the end of 2022 and double each year for the next five years thereafter. These new experiences will take brand recognition, engagement and loyalty to a new level.

Quick commerce. Midtown Manhattan is currently replete with storefronts from Getir, Gopuff and other quick commerce (or instant needs) retailers, whose offers of 15‒30 minute grocery delivery have resonated with consumers. These retailers also offer hyper-localized assortments, which can vary significantly by neighborhood. With quick commerce, consumers are looking at their screens and receptive to advertising as they ready their purchase, driving higher conversion rates, according to Gopuff. We estimate the US quick-commerce market hit $20‒25 billion last year, representing 10%‒13% of 2021 online CPG sales.

Despite the challenges brought on by the pandemic and its aftermath, business and technological innovation have presented retailers with new products and channels, offering new revenue opportunities, many of which monetize the value they have built over the years in collecting data and building their brand identities. As retail is constantly evolving, the definition of a successful retailer could also evolve to mean one that generates a significant portion of revenue from media and selling products via livestreaming and in the metaverse.

Source: Coresight Research[/caption]

Looking at new products, numerous factors have converged to monetize the many assets that retailers possess, driven by new technologies and the advent of the metaverse.

Data. There is a veritable ocean of data that passes retailers’ way every day: how many customers enter their stores, their demographics, where they go, what they try on and what they buy and do not buy, in addition to data gleaned online from website visits, dwell times, page views, what items end up in shopping carts and what consumers ultimately buy. This data has historically been trapped in siloes, but there is significant value in retailers sharing it with their supply chain partners. When aggregated and anonymized, this data becomes a hidden treasure to be harvested.

Media. Retailers have begun to understand the value of the time consumers spend on their websites, leading up to the key purchase moment. While Google’s business has long been based on selling advertising revenue to consumers on its various platforms, many retailers, including Amazon, Kroger, Walmart and “instant needs” player Gopuff, have launched their own retail media networks to monetize consumers’ attention during the shopping process. Coresight Research estimates that more than $75 million in global retail media advertising revenues will be generated in 2022, up more than 80% from last year.

NFTs. Retailers are unlocking the value of non-fungible tokens (NFTs) connected to their brands. For example, NIKE and Adidas consistently top sales lists for avatar NFTs, while Macy’s dropped its first-ever NFT collection last fall in connection with its 95th annual Thanksgiving Parade. In addition to being a revenue opportunity, NFTs are a key building block of the metaverse.

Livestreaming. Livestreaming enables brands and retailers to reach and sell to consumers wherever they are, showcasing products in a live, authentic and engaging format. After becoming a phenomenon in Asia, the adoption of livestreaming is growing in the US, and we estimate that the market will grow from $20 billion in 2022 to $68 billion in 2026.

Metaverse. Building upon artificial and virtual reality (AR/VR), blockchain and NFT technology, the metaverse has sparked a great deal of excitement and investment among retail players looking to stake a claim in this potentially enormous opportunity. The decentralized essence of the metaverse unlocks the creativity of content creators, who can build virtual worlds that transcend the laws of physics, which will naturally include brands and retailers. Coresight Research estimates that metaverse retail sales will hit $2.3 billion by the end of 2022 and double each year for the next five years thereafter. These new experiences will take brand recognition, engagement and loyalty to a new level.

Quick commerce. Midtown Manhattan is currently replete with storefronts from Getir, Gopuff and other quick commerce (or instant needs) retailers, whose offers of 15‒30 minute grocery delivery have resonated with consumers. These retailers also offer hyper-localized assortments, which can vary significantly by neighborhood. With quick commerce, consumers are looking at their screens and receptive to advertising as they ready their purchase, driving higher conversion rates, according to Gopuff. We estimate the US quick-commerce market hit $20‒25 billion last year, representing 10%‒13% of 2021 online CPG sales.

Despite the challenges brought on by the pandemic and its aftermath, business and technological innovation have presented retailers with new products and channels, offering new revenue opportunities, many of which monetize the value they have built over the years in collecting data and building their brand identities. As retail is constantly evolving, the definition of a successful retailer could also evolve to mean one that generates a significant portion of revenue from media and selling products via livestreaming and in the metaverse.

US RETAIL AND TECH HEADLINES

Albertsons Reports Strong First-Quarter Sales Growth (July 26) Company press release- Supermarket chain Albertsons has reported sales growth of 9.4% year over year in its first quarter of fiscal 2022, ended June 18, 2022. Its gross margin declined by 100 basis points (bps) year over year to 28.1% due to fewer Covid-19 vaccinations and inflationary increases in product and supply chain costs. Adjusted EPS increased by 12.4% year over year.

- For fiscal 2022, the company expects comparable sales to increase by 3.0–4.0% year over year, up from its previous guidance of 2.0–3.0% growth. Albertsons expects its adjusted EPS to decline by 3.9–8.8% year over year, up from prior guidance of a 7.2–12.1% decline.

- Electronics retailer Best Buy has opened its first small-format, digitally focused store as part of its experiment with new store models. The store opened in Monroe, North Carolina, and spans 5,000 square feet.

- The new store includes products across the home theater, computing, wearables, fitness, cell phones, cameras, smart home devices and small appliances categories. Customers will be able to shop and get advice while in the store, as well as check out digitally.

- Athletic sports retailer Lids has introduced Lids University (Lids U), a new retail concept focused on collegiate sports products and apparel. The retailer will open Lids U locations in shopping centers and outlets in major college markets across the US.

- Lids U will sell National Collegiate Athletic Association (NCAA) merchandise, including headwear, apparel and accessories from local, regional and national university and collegiate teams. Each Lids U store will also have custom zones where shoppers can place an order for custom embroidery.

- Apparel and footwear company Skechers reported year-over-year sales growth of 12.4% in its second quarter of fiscal 2022, ended June 30, 2022. Its wholesale sales grew 18.3%, and its direct-to-consumer (DTC) sales increased by 4.3% year over year. Meanwhile, its EPS decreased by 34.1% year over year. The company’s gross margin declined by 330 bps year over year to 48.1% due to higher per-unit freight costs, partially offset by average selling price increases.

- For fiscal 2022, Skechers reiterated its sales growth guidance of 14.3–17.5% year over year. However, it revised down its year-over-year EPS guidance growth from (37.6)–(41.9)% to (42.9)–(45.0)%.

- Apparel specialty retailer Urban Outfitters is set to launch its DTC underwear brand, Parade, in its 25 US stores and on its website starting August 1, 2022.

- The Parade assortment features an 18-piece collection, including four exclusive bralette and underwear designs. Items will be priced from $9 to $36. The company stated that 1% of total Parade sales will be donated to the Trans Law Center, a transgender-led civil rights organization.

EUROPE RETAIL AND TECH HEADLINES

LVMH Reports Strong Second-Quarter Sales Growth; Remains Optimistic About US Market Sales Growth (July 26) Company press release- French luxury giant LVMH reported sales growth of 27.0% year over year in its second quarter of fiscal 2022, ended June 30, 2022. Robust US growth and the recovery in Europe offset declining revenue in Asia, where lockdowns in China disrupted business. The company’s comparable sales grew 19.0% year over year and its operating margin increased by 130 bps year over year to 27.9%.

- While LVMH did not provide guidance for fiscal 2022, it stated that it remains optimistic about its US sales growth.

- Denmark-based logistics company Mobile Industrial Robots (MiR) has partnered with Modula, a US-based manufacturer of automated warehouses, to develop a fully automated system that can store, pick and move items within designated areas inside warehouses, production facilities and distribution centers, with or without human intervention.

- The solution can fully or partially automate item handling processes for retailers and enables considerable time and space savings, improving productivity and enhancing intralogistics, according to the two companies.

- British e-commerce retailer The Hut Group (THG) and Japanese investment giant SoftBank have abandoned their $1.6 billion deal, citing current global macroeconomic conditions, including high inflation and the Russia-Ukraine War.

- The deal was set to give SoftBank the option to acquire a 19.9% stake in Ingenuity, the technology and logistics platform of THG, for £900 million ($1.1 billion).

- Lithuanian resale platform Vinted had made an offer to acquire Rebelle, a German competitor that focuses on the luxury segment, for €30.0 million ($30.4 million).

- Rebelle was valued at €60 million ($60.7 million) in February this year, but its sales are declining sharply, while its marketing and personnel costs are rapidly rising.

- UK-based home-improvement retailer Wickes has revised down its adjusted pre-tax profit expectations for fiscal 2022, ending January 1, 2023. The company stated that shoppers have cut back on spending as inflation soars in the UK.

- The retailer had previously forecasted an adjusted pre-tax profit of or above £83 million ($99.9 million), but now expects its adjusted pre-tax profit to be in the range of £72 million ($86.6 million) to £82 million ($98.6 million).

ASIA RETAIL AND TECH HEADLINES

Alibaba Seeks Dual Primary Listing in New York and Hong Kong (July 26) Company press release- Chinese e-commerce giant Alibaba Group is applying to change its secondary listing to a primary listing on the Hong Kong Stock Exchange, while keeping its US listing. It expects the process to be finalized by the end of 2022.

- Alibaba Group Chairman and CEO Daniel Zhang said that the move was made “in the hopes of fostering a wider and more diversified investor base to share in Alibaba’s growth and future, especially from China and other markets in Asia.”

- Indian e-commerce company Flipkart, which is owned by Walmart, has partnered with local audio streaming start-up Pocket FM to join the audiobook market. Through Pocket FM, Flipkart will be able to make unique and licensed audiobooks available to its 400 million customers.

- According to Kanchan Mishra, Senior Director of FMCG, Home and General Merchandise at Flipkart, “audiobooks have gained great prominence during the pandemic in India and this collaboration with Pocket FM falls in line with our aim of catering to consumers’ evolving needs.”

- Sankyo Seiko, a Japanese wholesale and distribution company, has acquired Leonard Paris, a privately held French fashion house famous for its signature silk jerseys and patterns.

- Sankyo Seiko has worked with Leonard Paris for over 50 years, establishing the French brand in Japan, South Korea and Taiwan. The company plans to develop the Leonard Paris business in Asia further.

- Love, Bonito, a womenswear brand based in Malaysia, has opened a Hong Kong flagship store as part of its global expansion strategy.

- The flagship store, which spans 2,000 square feet, sells women’s clothes “with an Asian flair that [are] comfortable yet trendy.” The brand previously made its debut in Hong Kong with a pop-up store in 2019 and later launched a localized website for the city in 2021.

- Vestiaire Collective, a France-based tech start-up for fashion resale, is expanding into South Korea, choosing the country's growing luxury market as a launchpad for a deeper push into Asia.

- The company has also established a local office and a new authentication center in Seoul, its fifth after Tourcoing (France), New York, Hong Kong and London. The Vestiaire platform will be localized to the Korean language and currency.