FROM THE DESK OF DEBORAH WEINSWIG

Increasing Gas Prices and Supply Chain Hiccups Could Hinder Summer Travel and Consumer Purchases

Although businesses are starting to reopen around the US and in-person events are gradually returning, a combination of global cross-industry disruptions could put a damper on summer 2021’s return to “normality.” Consumers are facing higher prices for gas and longer lead times for items, such as home appliances, due to hold-ups in global supply chains.

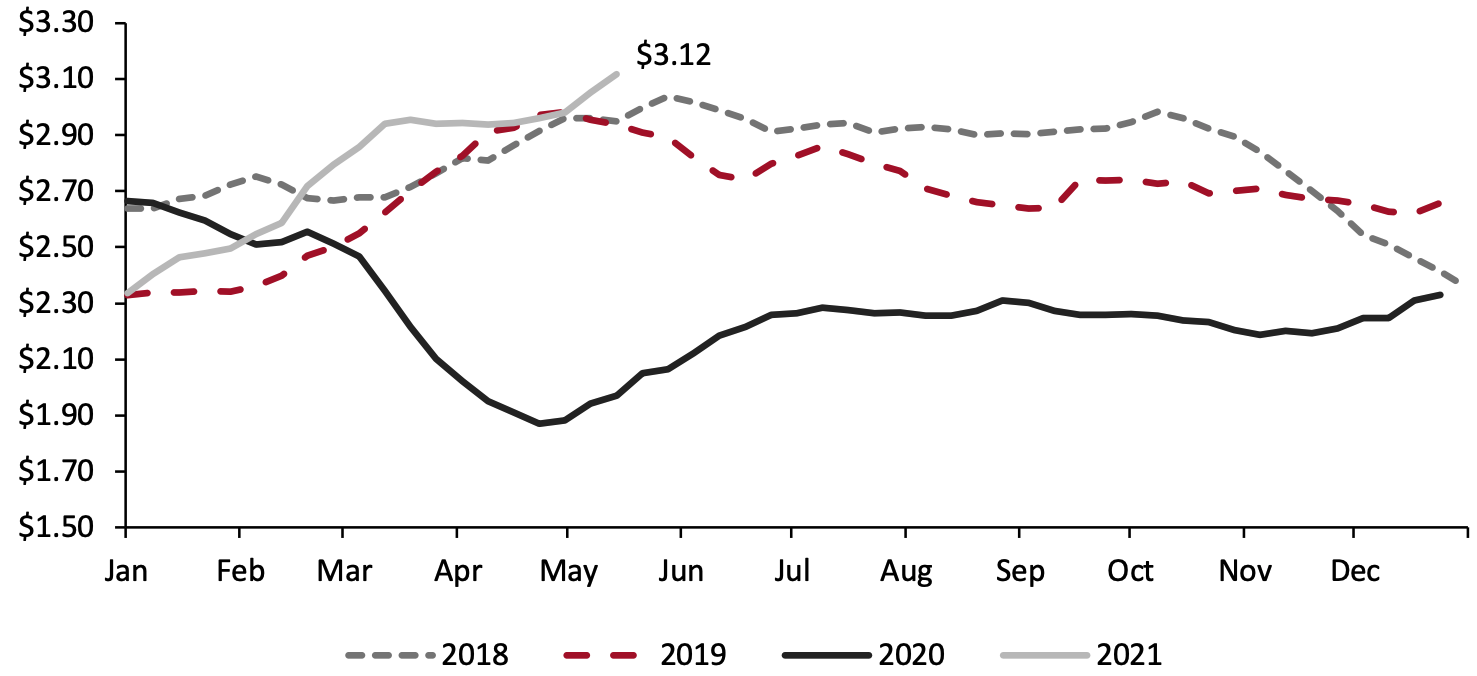

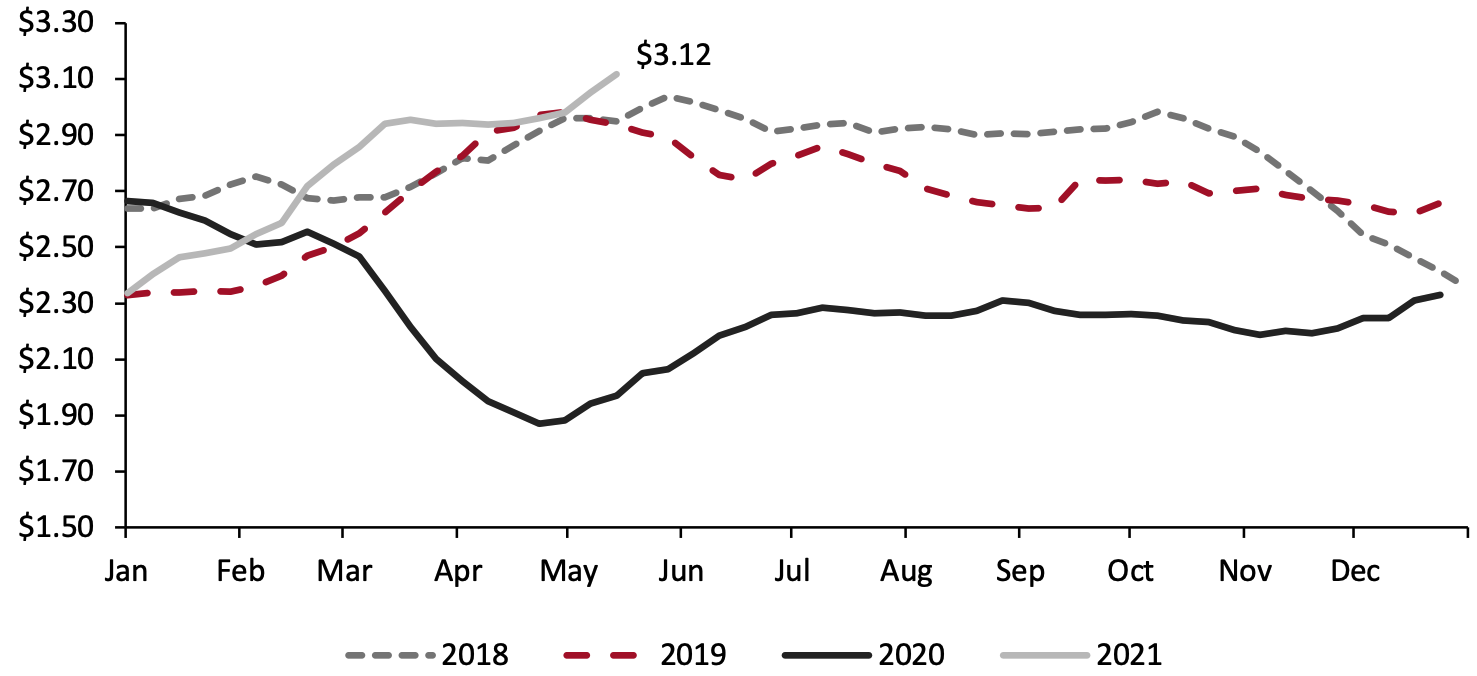

Gas prices have been on the move so far in 2021, in the direction that reduces consumers’ disposable income. The US average gas price hit $3.12 a gallon in the week ended May 17, according to the US Energy Information Administration—a rise of 6% over the previous month, 17% compared to January and 63% compared to one year ago. As shown in Figure 1, the steady increase in gas prices this year builds on the partial recovery of late 2020 from pandemic-led declines earlier in the year. Typical seasonal shifts in gas prices can be seen in the more “normal” years of 2018 and 2019.

Figure 1. US: Average Retail Gas Prices—All Formulations (USD per Gallon)

[caption id="attachment_127576" align="aligncenter" width="720"]

Source: US Energy Information Administration

Source: US Energy Information Administration[/caption]

The successful ransomware attack against the Colonial Pipeline, which carries fuel from Texas to New York, has certainly not helped gas prices, leading to shortages and hoarding in certain parts of the US. The gas shortage was so severe that some airlines temporarily added stops to long-haul flights to gas up their planes outside of regions usually served by the pipeline.

Last summer, many consumers could not travel due to lockdowns, or they vacationed close to home. This year, amid case numbers easing and vaccinations being rolled out, consumers are likely to be more willing and able to travel for their vacation—but higher fuel prices may well drain holiday budgets.

Still, the pipeline company did pay the ransom so gas is flowing again. Unfortunately, many other products are not. The combination of inclement weather, the blockage of the Suez Canal, the port-capacity shortage on the US West Coast, and the global chip scarcity has impacted the prices and availability of a range of consumer goods. Moreover, supply chains are having to adjust to changes in direction as consumers resume purchases of out-of-favor items, such as apparel, which is likely to cause new disruptions this year.

US RETAIL AND TECH HEADLINES

Amazon in Discussions To Acquire MGM

(May 19) BBC News

- Amazon has entered into discussions to purchase Metro-Goldwyn-Mayer (MGM) Studios, one of Hollywood’s most famous film and TV studios, for approximately $9 billion.

- Parent company MGM Holdings has been exploring options to sell MGM Studios since 2020. With this deal, Amazon’s Prime streaming service will gain access to MGM’s vast catalog of movies and TV series.

CVS Health Appoints Shawn Guertin as CFO

(May 18) Company press release

- CVS Health has appointed Shawn Guertin as Executive Vice President and CFO, effective May 28, 2021. In his new role, Guertin will take charge of the company’s financial strategies and operations.

- Guertin previously held leadership roles at Aetna between 2011 and 2019 and spearheaded the merger of Aetna with CVS Health in 2018.

The Home Depot Announces 32.7% Jump in Sales During First Quarter of 2021

(May 18) Company press release

- The Home Depot has reported a sales increase of 32.7% year over year in its first quarter of fiscal 2021 (ended May 2, 2021), rising to $37.5 billion. Its net earnings during the quarter were $4.1 billion—84.6% higher than net earnings reported during its first quarter of 2020.

- In its first quarter, the company reported a 31.0% surge in global same-store sales, and online sales grew by 27.0%.

Macy’s Announces First-Quarter 2021 Results—Revenues Increase by 56%

(May 18) Company press release

- Macy’s has reported $4.7 billion in total revenues, up 56% (at constant exchange rates) year over year, in its first quarter of 2021 (ended May 1, 2021). The company registered a net profit of $103.0 million during the same period.

- Macy’s posted a 34.0% increase in revenues from digital channels, driven by new customers. The company gained total 4.6 million new customers during the quarter—47% through online channels.

Walmart Reports Decline in Net Income and Slow Revenue Growth During First Quarter

(May 18) Company press release

- Walmart generated total revenues of $138.3 billion, up 2.7% year over year, during its first quarter of 2021 (ended April 30, 2021). Total US comparable sales grew 6.0% during the same period. The company’s net income declined by 31.6%, down to $2.7 billion from $4.0 billion during the same period in 2020.

- Walmart US online sales grew 37.0% and contributed 360 basis points to comp sales. Sam’s Club comparable sales increased by 7.2%. Walmart’s International business segment reported an 8.3% decline in revenues; however, the segment’s e-commerce sales increased by 49.0%.

EUROPE RETAIL AND TECH HEADLINES

Amazon Opens Its Fourth Fresh Store in London

(May 19) ChargedRetail.co.uk

- Amazon has launched a Fresh store in Canary Wharf, London—its fourth in the city in just three months. The launch comes as part of the company’s rebrand of its Amazon Go grocery stores, aiming to simplify its expanding brick-and-mortar presence.

- The 2,500-square-foot store will feature the brand’s “Just Walk Out” cashierless shopping technology, which uses cameras, sensors and machine learning to register which items customers have taken and charge them accordingly.

ASOS Considers Potential Takeover of Cult Beauty and Feelunique

(May 19) RetailGazette.co.uk

- ASOS is reportedly among several potential bidders considering the takeover of online beauty retailers Cult Beauty and Feelunique.

- The move is not yet confirmed and ASOS may bid for one of the two businesses or not at all. German online retailer Zalando and British e-commerce company The Hut Group are also reportedly likely to bid for the beauty retailers.

Boohoo Launches New Dedicated E-Commerce Sites for Burton, Dorothy Perkins and Wallis Websites

(May 18) ChargedRetail.co.uk

- UK-based apparel e-commerce retailer Boohoo Group has launched new e-commerce websites for its brands Burton, Dorothy Perkins and Wallis. The move comes three months after acquiring the brands’ digital assets and intellectual property rights from Arcadia Group for £25.2 million ($35.8 million).

- The website relaunches will help Boohoo rapidly expand its brand roster. It was implemented by Boohoo’s long-term digital partner Astound Commerce, using the same core codebase as Boohoo’s central platform.

Lenta Plans To Buy Supermarket Chain Billa Russia for €215 Million ($262 Million)

(May 19) ESMMagazine.com

- Russian retailer Lenta has announced plans to acquire Billa Russia Supermarkets, in a deal worth €215 million ($262 million). The deal will boost Lenta’s presence in Moscow.

- Lenta plans to integrate Billa’s 161 supermarkets (concentrated around the Russian capital), its supply chain and its 5,400-plus employees into its own retail network. The Billa brand will be subsequently discontinued in Russia.

Tesco Set To Rebrand Its Metro Stores as Tesco Express Stores or Superstores

(May 19) RetailGazette.co.uk

- UK-based supermarket chain Tesco is reportedly planning to scrap its Metro format and rebrand stores as either Tesco Express or Tesco superstores. The move follows a two-year review of the company’s Metro format amid concerns about the rise of discounters.

- In total, 89 Metro stores will be rebranded as Tesco Express stores. The remaining 58 stores will become superstores.

ASIA RETAIL AND TECH HEADLINES

Alibaba Leads $400 Million Funding in Masan’s Retail Firm The CrownX

(May 18) Finance.Yahoo.com

- A consortium led by Alibaba and Baring Private Equity Asia has invested $400 million in The CrownX, a retail firm owned by Vietnamese conglomerate Masan Group. The consortium will acquire a 5.5% stake in The CrownX, while Masan will retain 80.2%.

- Masan stated that The CrownX will work closely with Alibaba-owned e-commerce platform Lazada in Vietnam and that it will offer customers an “all-in-one” platform for both offline and online purchases.

Dukaan Partners with Dunzo and Shiprocket To Bring Neighborhood Stores Online

(May 18) ETRetail.com

- Dukaan, an Indian startup that helps local stores manage their online businesses, has announced partnerships with Dunzo, a prepared food and grocery delivery platform, and Shiprocket, a logistics aggregation firm. The move will enable Dukaan to offer local merchants end-to-end solutions, spanning inventory, promotion, sales, payment and delivery.

- Dukaan currently works with around 3.5 million local merchants in over 3,500 Indian towns and cities, encompassing electronics, fashion and apparel, furniture, grocery and jewelry stores. The company is backed by investment firms Matrix Partners India and Lightspeed India Partners.

Gojek and Tokopedia Merges To Form GoTo Group

(May 17) TechCrunch.com

- Indonesian ride-hailing and payment firm Gojek and e-commerce marketplace Tokopedia have formally announced they have combined their businesses to form GoTo Group. This marks the largest ever merger in Indonesia.

- Gojek will own 58% of the merged entity, while Tokopedia will own the balance. GoTo Group is valued at $18 billion, and will offer courier services, food delivery, online shopping, ride hailing and other services.

High Street Essentials Raises ₹255 Million, Led by Existing Investors

(May 19) ETRetail.com

- Indian fashion house High Street Essentials, the parent company of women’s fashion brands FabAlley and Indya, has raised ₹255 million ($3.5 million)—the funding round is led by its current investors Elevation Capital, Indian Quotient and Dominor Holding. The deal values the retailer at around $75 million.

- The retailer stated that it will use the funds to expand the brands’ direct-to-consumer footprint, both in India and overseas, add more personalization features to its websites and apps, and increase its presence with international e-commerce businesses.

KKR To Invest $95 Million in Lenskart

(May 17) MoneyControl.com

- Private equity firm KKR has announced that it will invest $95 million in Indian omnichannel eyewear retailer Lenskart, through a secondary stake acquisition. Existing investors TPG Growth and TR Capital will each divest a portion of their holdings in the company.

- Lenskart stated that it will use the funds to expand its presence in India, scale its operations abroad and enhance its digital offerings by building its virtual and omnichannel experience.

Source: US Energy Information Administration[/caption]

The successful ransomware attack against the Colonial Pipeline, which carries fuel from Texas to New York, has certainly not helped gas prices, leading to shortages and hoarding in certain parts of the US. The gas shortage was so severe that some airlines temporarily added stops to long-haul flights to gas up their planes outside of regions usually served by the pipeline.

Last summer, many consumers could not travel due to lockdowns, or they vacationed close to home. This year, amid case numbers easing and vaccinations being rolled out, consumers are likely to be more willing and able to travel for their vacation—but higher fuel prices may well drain holiday budgets.

Still, the pipeline company did pay the ransom so gas is flowing again. Unfortunately, many other products are not. The combination of inclement weather, the blockage of the Suez Canal, the port-capacity shortage on the US West Coast, and the global chip scarcity has impacted the prices and availability of a range of consumer goods. Moreover, supply chains are having to adjust to changes in direction as consumers resume purchases of out-of-favor items, such as apparel, which is likely to cause new disruptions this year.

Source: US Energy Information Administration[/caption]

The successful ransomware attack against the Colonial Pipeline, which carries fuel from Texas to New York, has certainly not helped gas prices, leading to shortages and hoarding in certain parts of the US. The gas shortage was so severe that some airlines temporarily added stops to long-haul flights to gas up their planes outside of regions usually served by the pipeline.

Last summer, many consumers could not travel due to lockdowns, or they vacationed close to home. This year, amid case numbers easing and vaccinations being rolled out, consumers are likely to be more willing and able to travel for their vacation—but higher fuel prices may well drain holiday budgets.

Still, the pipeline company did pay the ransom so gas is flowing again. Unfortunately, many other products are not. The combination of inclement weather, the blockage of the Suez Canal, the port-capacity shortage on the US West Coast, and the global chip scarcity has impacted the prices and availability of a range of consumer goods. Moreover, supply chains are having to adjust to changes in direction as consumers resume purchases of out-of-favor items, such as apparel, which is likely to cause new disruptions this year.