Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

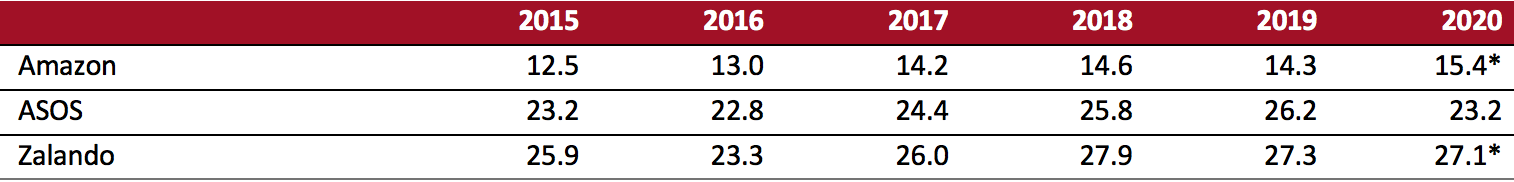

In the New Year Will Come the Reckoning for the E-Commerce Boom Like US retail overall across 2020, holiday retail demand looks to be holding up solidly overall—despite remaining pockets of weakness, such as department stores. However, as we have outlined previously, this demand is being channeled online in outsized volumes and those online sales typically come with inflated costs. Fulfillment Cost Challenges Remain Significant in E-Commerce The big cost headwind in online retailing is fulfillment, and this holiday season, shipping surcharges imposed by major US carriers will only compound the additional costs. In recent weeks, management at a number of retailers—including American Eagle Outfitters, Best Buy, Macy’s, Nordstrom and Williams-Sonoma—have pointed to fourth-quarter margin pressure from fulfillment costs and/or shipping surcharges. For store-based retailers, variable fulfillment costs come on top of the fixed costs of operating stores, so the switch to e-commerce is adding more cost while also deleveraging fixed store costs. A sustained channel switch implies tipping many physical stores into losses or marginal profitability. Coupled with the pressures from online fulfillment costs, this suggests that retailers will seek to rationalize store bases further. Amazon, ASOS and Zalando indicate the kind of fulfillment-cost ratios that pure plays face in (predominantly) nonfood retail. Not only does fulfillment capture a large share of revenue, but this share has tended to trend upward as consumer expectations of enhanced delivery have increased. Only in recent periods have we seen this upward trend reverse at selected retailers. Fulfillment-Cost Ratio: Selected Online Retailers [caption id="attachment_120606" align="aligncenter" width="700"] *First nine months of 2020

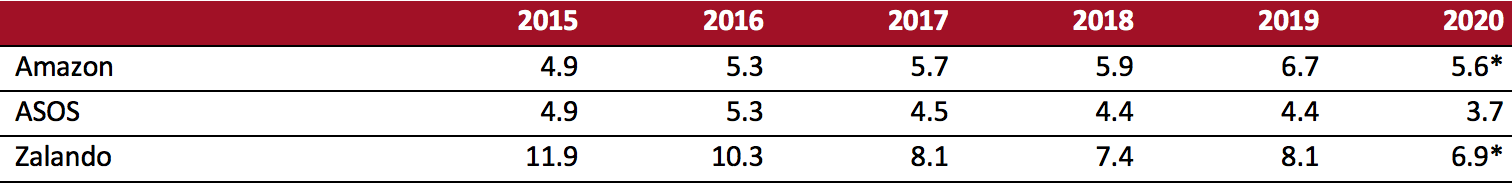

*First nine months of 2020Source: Company reports[/caption] Marketing Cost Pressures Could Catch Up with Multichannel Retailers Customer acquisition has long been pointed to as a further sustained cost challenge for online-only retailers; companies with stores have less need to pour cash into advertising to get their names in front of shoppers. However, a sustained move in demand away from stores and toward e-commerce could mean that shoppers see those physical shopfronts less often. While we have not seen major store-focused retailers point to increased marketing costs as they report third-quarter earnings, the structural shifts imply that we may see elevated spend on marketing by multichannel retailers into 2021 and beyond. Again, to give an indication of the costs borne in the pure-play space, we show data for selected companies below. Across the pure-play space, we have tended to see a downward trend in the marketing-cost ratio over the medium term. Marketing-Cost Ratio: Selected Online Retailers [caption id="attachment_120607" align="aligncenter" width="700"]

*First nine months of 2020

*First nine months of 2020Source: Company reports[/caption] The Outlook Many retailers are regaining momentum in their top lines—in fact, several major names are reporting very strong sales growth. However, in the new year, we expect many of these to report margin compression as recovered sales are disproportionately online. Alongside the deleveraging of fixed store costs, this cost pressure is likely to underpin further store closures, predominantly across nonfood retail. Over the medium term, should consumers retain digital-first shopping habits—and in the context of shuttered stores—multichannel retailers could start to see some of the marketing costs traditionally associated with their online-only rivals.

US RETAIL AND TECH HEADLINES

Ascena Retail Group Wins Court Approval To Sell its Brands to Private-Equity Firm Sycamore Partners (December 8) Wsj.com- Ascena Retail Group has received US Bankruptcy Court approval to sell its Ann Taylor, Lane Bryant, LOFT and Lou & Grey retail brands out of bankruptcy to private-equity firm Sycamore Partners for around $1 billion. The deal is expected to close next week.

- The sale deal was approved despite objections raised by the US Department of Justice—known as the US government’s bankruptcy watchdog—about the quick sale to Sycamore Partners without a bidding process or bankruptcy auction.

- The apparel retail chain Francesca’s announced plans to shut an additional 97 stores after it filed for bankruptcy protection on December 3, causing another blow to mall owners. The company previously announced that it will close around 140 of its 700 stores—approximately half of which will be in US shopping malls. Francesca’s top landlords include Brookfield, CBL & Associates, Pennsylvania and Simon Property Group.

- The company said that it aims to complete the sale by late January 2021 and currently has a takeover offer from Terra Mar Capital, which is serving as the stalking horse bidder in its sale process.

- Gap Inc. has joined the US Cotton Trust Protocol and the Textile Exchange 2025 Sustainable Cotton Challenge as part of its commitment to use 100% sustainably sourced cotton across all its brands by 2025, including Athleta, Banana Republic and Old Navy.

- The US Cotton Trust Protocol will help Gap to achieve its goal by providing verified data on the sustainability practices used on cotton farms in six key areas: energy use, greenhouse gas emissions, land use efficiency, soil carbon, soil loss and water use. Similarly, the Textile Exchange non-profit organization will help Gap by providing a list of recognized organic and sustainable cotton initiatives for eliminating hazardous pesticides and synthetic fertilizers, reducing water usage and improving soil health.

- US-based manufacturer and distributor of consumer products K7 Design Group filed an $85 million lawsuit against Kroger for reportedly refusing to accept a large order of hand sanitizers and antibacterial soaps that the grocery retailer made in the early months of the pandemic when consumer demand for personal protective equipment was surging nationwide.

- K7 said that it fulfilled a hand-sanitizer order worth $5 million for Kroger at the onset of the pandemic. A Kroger spokesperson said, “We are disappointed by this vendor’s claims and intend to vigorously defend against their accusations.”

- Online personal styling service provider Stitch Fix reported sales growth of 10.3% in its first quarter of fiscal 2021, ended October 31, 2020—versus 2.6% growth in its previous quarter. The company’s total active clients increased by 10% year over year to 3.8 million. For its second quarter of fiscal year 2021, the company expects sales growth of 12–14%. For its full fiscal year 2021, Stitch Fix expects sales growth of 20–25%.

- Stitch Fix announced the appointment of Dan Jedda as CFO, effective from December 9, 2020. Jedda joins the company from Amazon where he worked for 15 years, most recently as VP and CFO for Digital Video (including Amazon Studios).

EUROPE RETAIL AND TECH HEADLINES

Asda Stores’ Takeover by Issa Brothers Faces Probe from the Competition and Markets Authority (December 8) Retailgazette.co.uk- The Competition and Markets Authority (CMA)—the UK competition watchdog—has launched a Phase 1 investigation into the takeover of supermarket giant Asda by the Issa brothers. The proposed £6.8 billion ($8.0 billion) takeover of Asda by brothers Mohsin and Zuber Issa, along with private-equity firm TDR Capital, was announced on October 2, 2020.

- The CMA has set a deadline of December 22 for interested parties to comment on the proposals. The UK competition watchdog will have to reach a decision on the first stage of its investigation by February 18, 2021.

- Puma Private Equity, the private equity division of Puma, has invested £3.5 million ($4.7 million) in French menswear brand Ron Dorff as part of Puma’s initiative to provide growth capital to small and medium-sized businesses across the UK.

- Ron Dorff stated that the funds will help it expand its business across the globe. Currently, Ron Dorff has a presence in 80 countries worldwide.

- British retail group Frasers is in discussions to buy the Debenhams department store chain out of administration. This news comes after Arcadia Group, the largest concessions operator in Debenhams, comprising around 5% of Debenhams’ sales, fell into administration on December 1.

- A previous shareholder in Debenhams, Frasers stated that a deal could be struck, but it warned that “there is no certainty that any transaction will take place, particularly if discussions cannot be concluded swiftly.”

- Home and DIY giant Kingfisher has agreed to return around £130 million ($175 million) to the UK government in business relief rates related to coronavirus. Following this decision, the company expects its adjusted profits for 2020 to include £85 million ($114 million) in non-recurring cost savings, down from prior guidance of £175 million ($235 million).

- The company also announced that it repaid the £23 million ($31 million) that it received from the UK government as part of the Coronavirus Job Retention Scheme.

- Online fashion retailer Zalando announced that Rubin Ritter, one of its three co-CEOs, will step down from his position in 2021, more than two years before his contract ends, due to personal reasons.

- Ritter has been with Zalando since 2010 and has been instrumental in helping the company grow from a startup to one of the world’s top online fashion retailers, with net profit of €100 million ($121 million) in 2019.

- UK retail sales increased by 0.9% year over year in November, compared to a 0.9% year-over-year decline in November 2019, according to the British Retail Consortium’s BRC-KPMG Retail Sales Monitor. Comparable sales (excluding temporarily closed stores) remained in decline.

- The British Retail Consortium splits food and nonfood retail sales on a rolling three-month basis. In the three months ended November 2020, total food sales grew by 7.0% and total nonfood sales were up by 1.3%.

ASIA RETAIL AND TECH HEADLINES

Kontoor Brands Teams Up with Ace Turtle as Its India License Partner (December 8) Economictimes.com- Kontoor Brands has reportedly signed e-commerce technology provider Ace Turtle as its India license partner for its Lee and Wrangler brands. Ace Turtle will have the rights to manufacture and sell Lee and Wrangler brands in India for 10 years. The company plans to focus specifically on omnichannel strategies for both brands.

- Until now, Kontoor Brands had sold both Lee and Wrangler products through its wholly owned India subsidiary but wanted to move away from direct distribution and marketing to a long-term licensee partnership model in the country.

- Indian farm-to-home grocery startup RuralBasket has raised $5 million from investor Nativelead Foundation. The company will use the cash to expand its reach across the Indian state of Tamil Nadu by scaling its operations to 22 retail outlets by 2022. The company kickstarted its expansion plans by launching its third store in Tamil Nadu at Medavakkam, Chennai.

- RuralBasket directly sources naturally grown products from farmers by working in partnership with 15 Farmer Producer Organizations and 50 female-led Self-Help Groups. It offers more than 500 grocery products in its stores.

- Luxury fashion brand Cole Haan has launched its Grandshop concept store in the Harajuku district of Tokyo. The two-story, 1,776-square-foot store will serve as the brand’s flagship in the popular shopping district and marks its third Grandshop in Japan.

- The store features numerous high-tech flourishes, including a transparent LED screen integrated with the second-floor window, a selfie station and digital touchpoints such as QR codes.

- JD.com announced that it has become the first online platform to accept China’s homegrown digital currency known as digital yuan. The move is part of a pilot by the People’s Bank of China (which controls and issues digital yuan) and will see the bank hand out ¥20 million ($3 million) in digital currency to Suzhou residents via a lottery system.

- Suzhou residents can use the digital yuan to buy select products on JD.com as well as offline in JD’s outlets.

- Bangkok-based multichannel fashion brand Pomelo has debuted in Indonesia with the launch of its first store, at Central Park Mall in Jakarta. The new store features a selection of exclusive collections, including collaborations with Thai designers Milin Yuvacharuskul and Pomelo’s collection with Barbie. The company said that around 90% of the waste produced in the store is recyclable and that the store was fitted out using sustainable materials.

- Customers can use the “Tap, Try, Buy” feature, which enables them to shop online, try on items in stores and only pay for the items they keep. The store opening in Indonesia comes as the company accelerates its expansion in Southeast Asia.

- German wholesaler Metro Cash and Carry announced that it will open more small-format stores in India with assortments specially designed for kirana shops (local convenience stores).

- These stores will employ around 200 people and cover an area of 20,000–25,000 square feet, almost half the size of its large-format stores. The wholesale chain currently operates 28 stores in India that cater to kiranas, hotels, restaurants and hospitality businesses.