DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

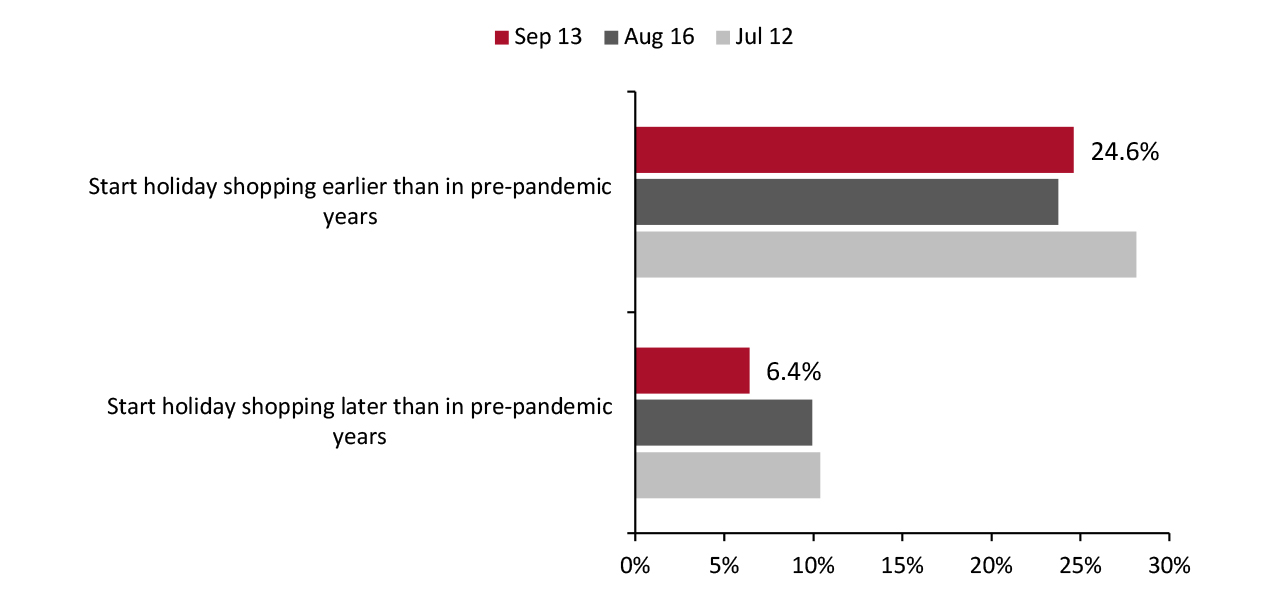

Holiday Season Is Here, Earlier Than Ever! October 10 is here, and with it comes Coresight Research’s second annual 10.10 Shopping Festival. Early October and 10.10 now mark the start of the holiday shopping season in earnest, although 10.10 is not alone in pulling forward shopping. Since our event was confirmed for 2021, Amazon and Target have been among others announcing shopping events for early October. Target announced that its Deal Days will also start on October 10 this year while Amazon subsequently sought to pre-empt these events by announcing the launch of “Black Friday-worthy” deals on October 4 that will run for an indeterminate time during the holiday season. Also, Shipt ran its Dealivery Days promotional event on October 2–4. Shop Early, Shop Often! Consumer demand for early shopping is there. Coresight Research’s surveys confirm that many consumers plan to shop earlier than they did prior to the pandemic (we asked versus pre-pandemic in part because they shopped earlier than usual last year, too). As shown in Figure 1, four times as many holiday shoppers in our September 13 survey expect to start earlier than later, and the proportion expecting to shop later has recently declined. Fueling this shift, we also find sizeable proportions of holiday shoppers (around one-third) are concerned about product availability, price rises on holiday goods and getting online orders delivered in time.Figure 1. US Consumer Surveys: Agreement with Statements on Shopping Earlier vs. Later Than Pre-Pandemic (% of Respondents) [caption id="attachment_134195" align="aligncenter" width="725"]

Base: US respondents aged 18+ who spend on the holidays

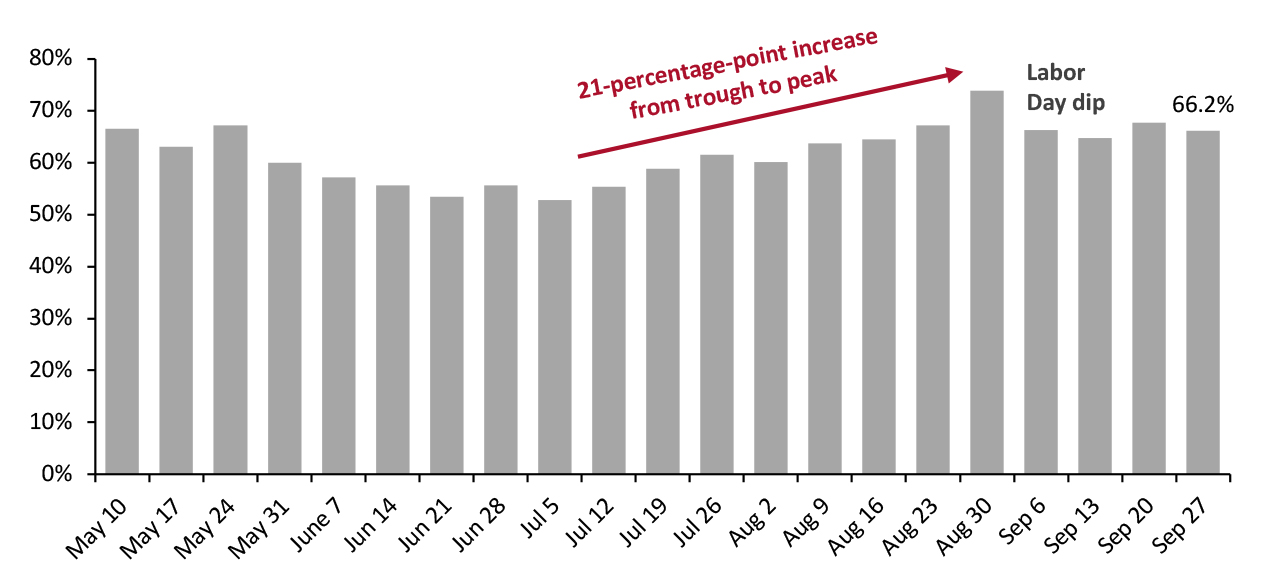

Base: US respondents aged 18+ who spend on the holidays Source: Coresight Research [/caption] The 10.10 Shopping Festival is designed to help retailers pull forward some holiday spending and thus help to alleviate supply chain pressures, such as in fulfillment. In the context of creaking supply chains, out-of-stocks on shelves and still-strong e-commerce demand, it is to retailers’ benefit to even out holiday demand over an extended period. An additional advantage is the opportunity to drive higher total holiday-season spend among those that start shopping earlier, through impulse purchases and “top-up” gifts. Another Digital-First Holiday Dovetailing the abundance of digital-focused shopping festivals, e-commerce is set to remain at an elevated level this holiday season. Our consumer data confirms overwhelming demand for online shopping while substantial numbers of consumers currently plan to limit their use of physical stores given high Covid-19 cases. As shown in Figure 2, these expectations come amid raised levels of avoidance of public places in general since early July, per our weekly surveys. These trends will support another solid holiday season for digital channels.

Figure 2. US Consumer Surveys: Percentage Avoiding Any Public Places [caption id="attachment_134196" align="aligncenter" width="726"]

Base: US respondents aged 18+

Base: US respondents aged 18+ Source: Coresight Research [/caption] The 10.10 Shopping Festival taps not only digital expansion but also growth opportunities in the still-emerging livestreaming channel. Our new survey of consumers’ holiday shopping plans, undertaken in late September, found that around one in 11 among younger age groups (all those aged 18–44) actively expect to use livestreaming e-commerce for holiday shopping. We see opportunities to drive that higher by capturing those that don’t yet expect to use this channel—through introducing livestreaming e-commerce to uninitiated shoppers and by encouraging more regular usage among those that have already tried it. For retailers and brands, the benefits include driving impulse purchases, reducing returns rates and elevating the shopper experience to strengthen connections with customers. In an extended holiday season, there remain opportunities for retailers to adjust their strategies and so gain a competitive advantage in digital channels.

US RETAIL AND TECH HEADLINES

Bed Bath & Beyond Introduces Private-Label Brand Studio 3B (October 4) Company press release- Bed Bath & Beyond has launched a new private-label brand, Studio 3B. It targets urban consumers living in smaller spaces and offers an assortment of around 600 products at an affordable price point, including accent furniture, bath products, bedding and décor.

- Studio 3B is the seventh private-label brand launched by Bed Bath & Beyond this year. The company plans to launch one more in 2021.

- Best Buy has unveiled a new membership program, TotalTech, offering members holiday perks and special discounts. The new program is priced at $199.99 per year.

- As part of the program, the company will offer free technical support for all technology in a member’s home, even if it was purchased from a different store, as well as access to 24/7 phone and online chat teams. It will also provide early access to special discounts.

- Gap has acquired artificial intelligence (AI) startup Context-Based 4 Casting Ltd. (CB4), which leverages AI and machine learning to enhance retail operations using predictive analytics and demand sensing.

- The company’s aim for the acquisition is to improve sales and inventory management, as well as enhance the customer experience. All CB4’s employees will now work for Gap under the acquisition agreement. Gap has strategically increased its investment in technology after its transfer to the cloud in October 2020.

- Rent the Runway has for an initial public offering (IPO) with the US Securities and Exchange Commission, with plans to list its stock on the Nasdaq Global Select Market under the ticker symbol “RENT.”

- In its prospectus, the company warned that it has “a history of losses” and that it “may be unable to achieve or sustain profitability.” Rent the Runway reported losses of $171.1 million in fiscal 2020 (ended December 31, 2021) and $84.7 million during the first six months of 2021 (ended July 31, 2021). It has not yet disclosed the total number of shares offered or the price ranges for each share.

EUROPE RETAIL AND TECH HEADLINES

Albert Heijn Sells Advertising Space in Its Mobile App (October 5) ECommerceNews.eu- Albert Heijn has launched a sponsored product service on its mobile app, becoming the first Dutch supermarket chain to start selling advertising space within search results. The service is similar to sponsored search results on Google.

- The new service allows Albert Heijn’s partners to display offerings more prominently within the app’s search results. Advertisers can choose keywords to find their product and will be charged per click.

- Amazon has opened an Amazon 4-star store in Kent—the first of its kind outside the US. It will offer a range of products that are top online sellers, are rated four stars and above, or are trending.

- The company stated that the store’s assortment will be regularly updated to keep pace with consumer demand. Categories offered include books, consumer electronics, games, homeware, kitchen items and toys. It also offers Amazon devices, including Echo Dots, Fire Tablets and Kindles.

- Debenhams, owned by UK-based apparel e-commerce company Boohoo, has launched a new online marketplace carrying 70,000 products. The company believes that the online marketplace will quickly become the UK’s largest, offering thousands of beauty, fashion, homeware and sport products.

- The online store is powered by marketplace solution provider Mirakl. It will offer every brand that Debenhams and Boohoo currently sell, including 200 that have been introduced in the last three months.

- Spanish apparel retailer Desigual has partnered with Yoobic, a digital workplace solution platform, to streamline its operational management and increase in-store compliance among its frontline teams.

- Yoobic’s digital workplace platform will be used by the company’s 2,700 employees, who are spread across 107 countries and 10 sales channels. Around 500 members of staff are already using the platform to complete 35,000 task-based missions, according to the company.

- German apparel and lifestyle e-commerce company Zalando will introduce new business models to expand its circular offerings and to develop industry-wide circular initiatives. It will work with the Ellen MacArthur Foundation and Berlin-based start-up circular.fashion to establish industry-wide circular product standards.

- It will also expand its brand “redeZIGN for circularity,” adding a QR code to products to enable customers to learn where the product was made and how it can be repaired or traded back to Zalando. The initiatives are part of the company’s do.MORE sustainability strategy, which aims to extend the life of 50 million items by 2023.

ASIA RETAIL AND TECH HEADLINES

Alibaba’s Delivery Robots Reaches New Milestone, Carrying One Million Parcels in Under One Year (Oct 4) RetailAsia.net- China’s Alibaba Group’s celebrated a new milestone for its autonomous delivery robots, announcing that it hit one million automated package deliveries in China in less than a year since introducing the robot technology. Some 200 robots have delivered packages to over 200,000 consumers, across 52 cities in 22 Chinese provinces, according to the company.

- Each robot can carry 50 packages at once, covering over 62 miles per charge and delivering up to 500 items a day. Alibaba plans to expand its robot delivery fleet from 200 to 10,000 robots over the next three years.

- Indian retail conglomerate Future Retail and US-based convenience store chain 7-Eleven have mutually agreed to terminate their franchise agreement, which allowed Future Group to develop and operate 7-Eleven stores in India.

- The move comes as Future Group did not meet set targets for store openings and paying franchise fees. However, the company has stated that it has suffered no financial or business impact from the termination.

- Hong Kong plant-based grocery store and café chain Green Common has opened two new flagship stores, one in Shanghai and one in Hong Kong.

- Its Hong Kong store covers two floors. The ground floor features a coffee and drinks bar and a retail area, while its upper floor houses a restaurant serving Asian fusion cuisine and vegan wines. Its Shanghai flagship store is located in Shanghai’s Taikoo Li Qiantan wellness-themed retail complex.

- Indian direct-to-consumer meat and seafood company Licious has entered the unicorn club (startups valued at more than $1 billion) after raising $52 million in its latest funding round. The company’s valuation is now $1.1 billion. The Series G funding round was led by Indian financial services companies IIFL’s Late-Stage Tech Fund and Avendus.

- Licious plans to use the funding to grow its offline business, expand across geographies and augment its ready-to-eat product portfolio, according to Co-Founder Vivek Gupta.

- Indonesia-based business-to-business e-commerce firm Ula has secured $87 million in a Series B funding round, led by B Capital, Prosus Ventures and Tencent. Amazon Founder Jeff Bezos’s investment firm, Bezos Expeditions, also participated—the first time it has funded a Southeast Asian company.

- Ula currently offers 6,000 products and serves more than 70,000 traditional retailers in digitalizing their supply chain and inventory management. The company plans to use the funding to expand across Indonesia, add new product categories, increase its “buy now, pay later” offering, and strengthen its supply chain and logistics infrastructure.