Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

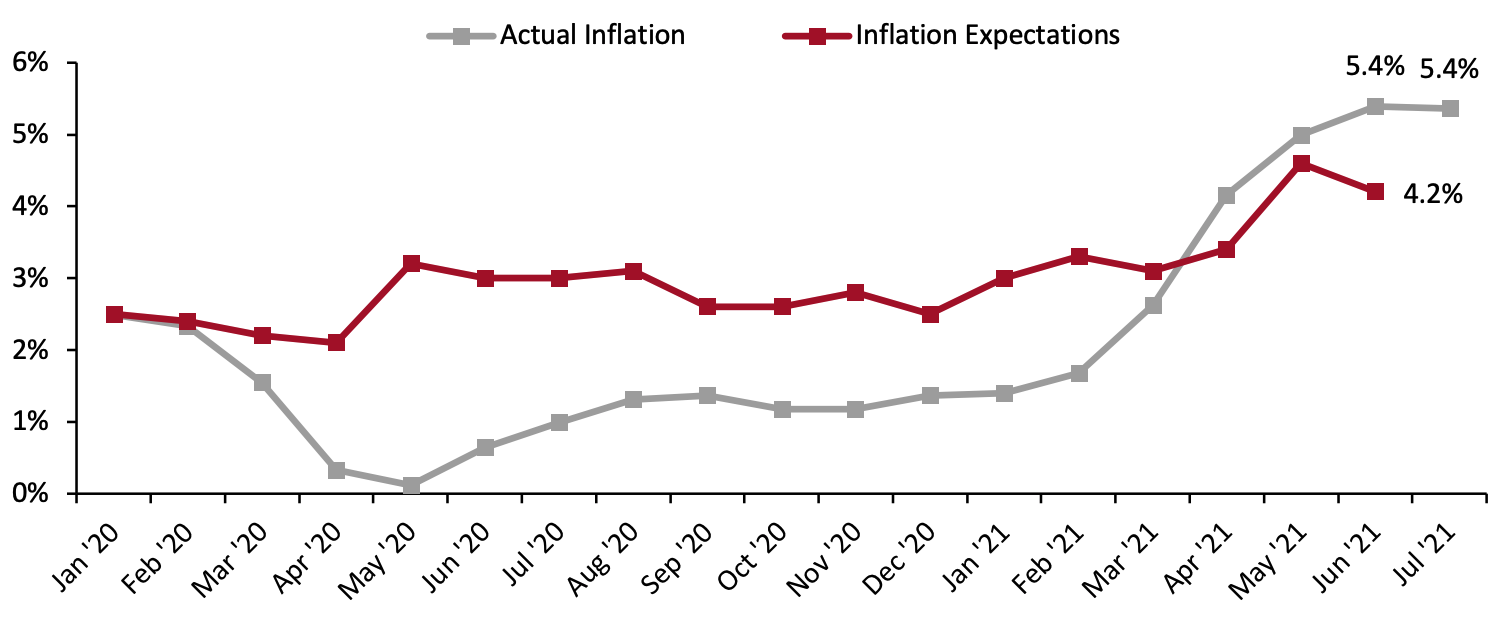

Heading Toward a Disruptive “IOS” Fall as Retailers Boost Inventories and Charter Ships and Planes The challenges in retail keep mounting up: Port shutdowns in China, reduced imports at the Port of Los Angeles, unusually strong and shifting consumer demand, and unpredictable consumer behavior amid the Delta surge. We are heading for an “IOS” (inflationary pressures, out-of-stocks and staying more at home) fall, possibly lasting into the holiday season—with stay-at-home trends feeding back into the shape of inflation and inventories. Inflation Reflecting strong global demand and supply chain constraints, producer price indices and import price indices are rising—but consumer price inflation (CPI) is tending to outpace them, fueled by rising domestic operating costs in addition to the cost of goods sold. There are signs that overall inflation may be plateauing: As charted in Figure 1, unadjusted CPI in July remained level with June’s 5.4% rate, while consumers’ expectations of future CPI dipped in June (latest). Meanwhile, the Organisation for Economic Co-operation and Development (OECD) currently forecasts a fall back in US CPI to 3.8% in the third quarter and 3.7% in the fourth quarter—although the extent of that dip may be optimistic given the number of moving parts in the equation. The greatest current upward pressures in CPI are from nonretail categories including energy (+23.8% in July), used cars (+41.7%) and airline fares (+19.0%), per the Bureau of Labor Statistics (BLS). Still somewhat raised, although much lower than those peaks, are apparel at +4.2% in July. Food-at-home inflation has recently been low but jumped to 2.6% in July from 0.9% in June. As we note below, consumer behavior is changing and should the shape of demand shift meaningfully, then CPI trends are likely to respond.Figure 1. US Consumer Prices Inflation vs. Consumers’ Inflation Expectations (YoY % Change) [caption id="attachment_131623" align="aligncenter" width="700"]

CPI data are unadjusted

CPI data are unadjustedSource: BLS/University of Michigan[/caption] Out-of-Stocks Strong demand and constrained supply equates to more out-of-stocks, and US shoppers are becoming more familiar with stockouts on store shelves. With the risk of these continuing through the fall and into the holiday peak, the very biggest retailers have ramped up their inventories and shipping capabilities to try to minimize the impacts. Target management this week downplayed the risk of out-of-stocks on its shelves, with John Mulligan, Chief Operating Officer at Target, telling analysts that inventory was up 26% year over year: “Our team has been successfully addressing supply chain bottlenecks, which are affecting both domestic freight and international shipping. Steps include expedited ordering and larger upfront quantities in advance of a season, mitigating the risk that replenishment could take longer than usual.” Mulligan noted that in-stocks have “improved meaningfully” compared with a year ago but noted that shoppers are still seeing some empty shelves: “In some of those situations, we've simply sold beyond our expectations, and our team is working quickly to secure additional quantities. In other cases, the vendors themselves are facing constraints in their ability to deliver product. And we're collaborating with them to address these constraints together, securing as much product as possible on behalf of our guests.” At Walmart, CFO Brett Biggs noted that quarter-end inventory was up 20% as it annualized Covid-related effects from last year and amid strong sales growth in 2021:

We continue to monitor industry trends related to transit and port delays. Our merchants continue to take steps to mitigate challenges, including adding extra lead time to orders and chartering vessels specifically for Walmart goods. Out-of-stocks in certain general merchandise categories are running above normal, given strong sales and supply constraints.

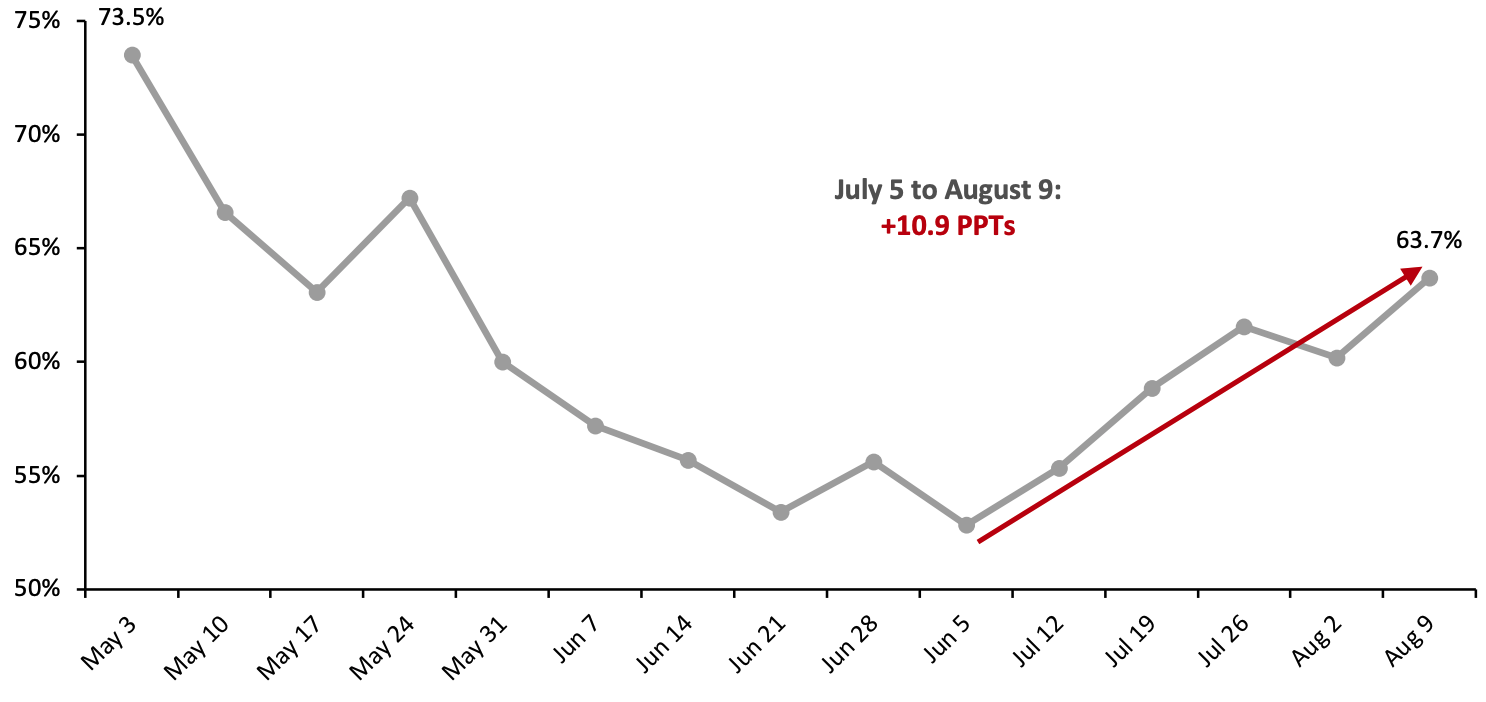

John Furner, CEO and President of Walmart US, remarked that Walmart had chartered vessels and “secured capacity” for the third and fourth quarter. Staying at Home More Consumers are retreating from public places, such as shops, malls, restaurants and transportation. Between July 12 and August 9, 2021, Coresight Research’s weekly US consumer surveys recorded a 12-percentage-point increase in the proportion of respondents avoiding malls, an increase of nine percentage points in the proportion avoiding restaurants, bars and coffee shops, and a rise of eight percentage points in the avoidance of shops in general. Overall avoidance has returned to levels seen in May. This suggests that we will not see a steady return to ever-greater levels of normality, which would have shifted demand from food retail to food service, from spending on the home to spending on leisure services, or from athleisure to more formal clothing. Any sustained avoidance of retail stores will once again strengthen e-commerce and drive a consolidation of shopping trips, supporting mass merchants and other generalists that combine essentials and discretionary goods.Figure 2. US Respondents: Proportion That Are Avoiding Any Public Places (2021) [caption id="attachment_131624" align="aligncenter" width="700"]

Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption] We look to be on course for an unpredictable and possibly disruptive fall, including the tail end of the back-to-school season, which may evolve into a volatile holiday season. We continue to expect total retail demand to be solid, but should consumers continue their retreat through the fall and into the winter, their demands will shift again, as they did in 2020, which is likely to compound supply, inventory and last-mile challenges for those retailers that planned on a greater degree of renormalization.

US RETAIL AND TECH HEADLINES

7-Eleven Partners with Minibar Delivery (Aug 17) Company press release- Convenience store chain 7-Eleven has launched a pilot program with US-based alcohol delivery company Minibar Delivery to deliver beer and wine across Florida, Texas and Virginia¬. The company aims to expand the service to more markets by the end of 2021, claiming to offer delivery within 30–60 minutes.

- The partnership comes as part of 7-Eleven’s strategy to enhance its on-demand delivery services and improve customer satisfaction.

- US-based sustainable footwear brand Allbirds has launched an activewear line, ahead of its initial public offering (IPO) expected later this year¬. The footwear brand entered the clothing industry in October 2020.

- The new activewear line is made from materials such as eucalyptus tree fiber and merino wool, which the company claims will allow it to reduce its environmental impact. The collection includes biker shorts, high-waisted leggings, lightweight running shorts, moisture-wicking t-shirts and a running tank with a built-in bra.

- Home-improvement retailer Home Depot reported $41.1 billion in total revenues in its second-quarter 2021 results, ended August 1, 2021. The company saw 8.1% revenue growth year over year, with its comparable sales increasing by 4.5%.

- The company recorded net earnings of $4.8 billion, 11.0% higher than its second-quarter 2020 net earnings.

- Walgreens has introduced a credit card program, myWalgreens, offering two cards issued by Synchrony Bank—myWalgreens Mastercard and myWalgreens Credit Card.

- The company describes the cards as retail health and wellness credit cards, aiming to encourage customers to make healthy choices by offering reward points for customers’ wellbeing choices. The cards can be used at more than 9,000 Walgreens locations, Walgreens.com, the Walgreens mobile app and wherever Mastercard is accepted.

- Walmart generated total revenues of $141.1 billion, up 2.4% year over year, in its second quarter of fiscal 2022, ended July 31, 2021. The company’s total operating income increased by 21.4% to $7.4 billion, with consolidated operating income as a percentage of net sales increasing by 83 percentage points.

- Walmart US witnessed comparable sales growth of 6.1% in the quarter. The company’s e-commerce sales grew 6.0% during its second quarter and 103.3% on a two-year stack, primarily due to a rise in demand for same-day delivery and curbside pickup. For fiscal 2022, Walmart expects its US comparable sales to fall by 5.0–6.0%.

EUROPE RETAIL AND TECH HEADLINES

Asda Joins Vaccine Uptake Drive with Voucher Offer (August 17) Company press release- UK-based supermarket chain Asda will offer consumers aged 18–30 a £10 ($14) voucher for its clothing brand George when they receive a Covid-19 vaccine at any of Asda’s three vaccination centers. To use the voucher, shoppers need to spend £20 ($28) or more in any Asda store.

- The voucher will be available at Asda’s vaccination sites from the week commencing August 23 and will be valid till October 31, 2021. Asda became the first supermarket chain in the UK to open a Covid-19 vaccine center in January 2020 and has since administered over 90,000 vaccines.

- Germany-based shoe retailer Deichmann has announced plans to double its UK store count from its existing portfolio of 109 stores in the country, with the goal of becoming a market leader for family footwear.

- Deichmann is also setting up a UK distribution center to serve stores and home-delivery for its online business.

- Netherlands-based online food delivery marketplace Just Eat Takeaway.com registered a 52% year-over-year increase in revenue in the first half of 2021, reaching €2.6 billion ($3.04 billion). The company posted an EBITDA loss of €190 million ($222 million) due to substantial investments in its business.

- The company invested heavily in branding awareness, expanding supply and delivery operations, and improving customer experience.

- Retailer Marks & Spencer has announced the launch of six guest clothing brands on its online store, M&S.com. Selected items will be available from outdoor and kids clothing brands Albaray, Celtic & Co, Craghoppers, FatFace, Frugi and Jones Bootmaker.

- The company believes that its omnichannel strategy will make M&S.com a go-to platform for consumers, reflecting customers’ appetite for online shopping and the convenience of delivery and click & collect.

- Swedish food and health retailer ICA Gruppen reported second-quarter results (ended June 30, 2021), posting an 0.8% improvement in operating profit through 1.5% growth in consolidated net sales, which reached Kr 32,401 million ($3.7 billion).

- Rimi Baltic, a subsidiary of ICA Gruppen operating in the Baltic states performed strongly, with 6.5% year-over-year growth. Its retail and pharmacy chain Apotek Hjärtat registered year-over-year growth of 7.8%.

ASIA RETAIL AND TECH HEADLINES

AirAsia Rolls Out Food Delivery Service Through Its Super App (Aug 18) BangkokPost.com- Malaysia-based AirAsia group has launched a food delivery service in Thailand through its AirAsia Super App. The delivery service is now available in four districts across Bangkok: Chatuchak, Din Daeng, Huai Khwang and Lat Phrao. The company plans to expand into other regions, including Phuket and Chiang Mai.

- The company has also launched a major incentive campaign to attract new customers, offering 30,000 free meals for 30 days through partners such as McDonald’s Flash Coffee and Café Amazon. It also provides free delivery on all orders within a four-mile radius.

- Online crowdsourcing logistics portal Dada-JD Daojia (JDDJ) has partnered with beauty retailer Sephora in China to provide a one-hour delivery service.

- Currently, over 70 Sephora stores have launched on JDDJ’s platform, which operates in China’s Tier 1 and Tier 2 cities. By the end of the year, all Sephora stores in China will be integrated on JDDJ.

- Walmart-owned Flipkart aims to create 4,000 jobs in Maharashtra, India, through the opening of four new fulfillment centers. The facilities, spread over 0.7 million square feet, will create 4,000 direct and indirect job opportunities and help local sellers access the pan-India market.

- With the new centers, Flipkart will operate 12 supply chain facilities in Maharashtra, spanning 2.3 million square feet. The company stated that the investment would cater to growing demand for e-commerce.

- Indian online grocery-delivery service provider Grofers has launched a 10-minute grocery delivery service in 10 cities in India. Grofers aims to continue developing by signing up more partners and building its delivery network.

- The company’s service is now available in Bengaluru, Delhi, Ghaziabad, Gurugram, Hyderabad, Jaipur, Kolkata, Lucknow and Mumbai.

- Canadian multinational fast-food restaurant chain Tim Hortons is set to go public in China through a merger deal with blank-check investment firm Silver Crest Acquisition Corp. The company expects to be valued at $1.7 billion on the deal’s completion at the end of the year.

- The deal will help Tim Hortons fund its plan to roll out more than 2,750 stores in China in the next five years. Tim Hortons currently operates 199 locations in China and plans to double the number by the end of 2021.