Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

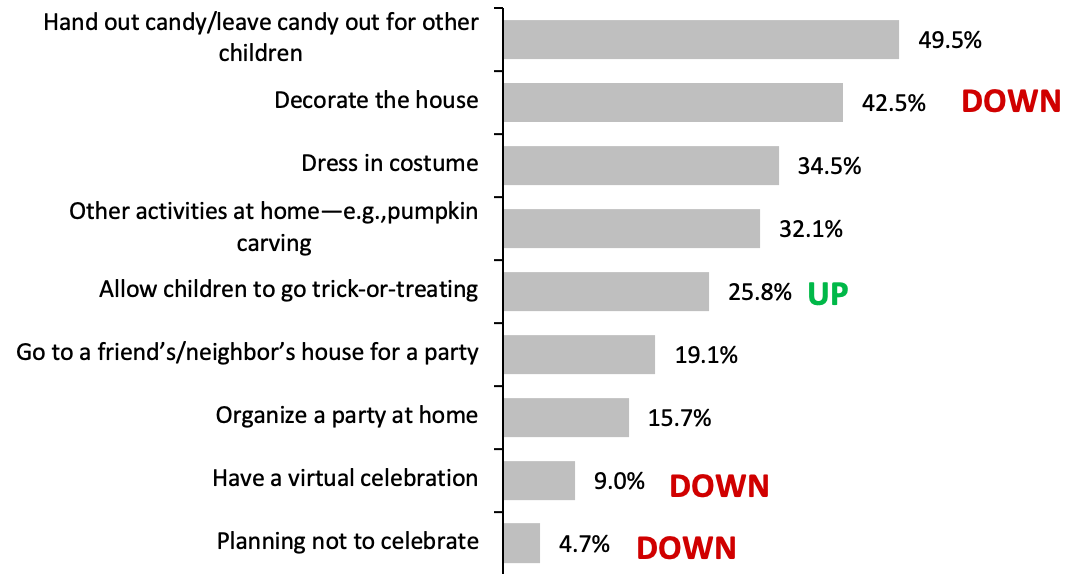

Halloween Is Here—In-Person and In-Store Halloween is almost here, and it is likely to be much closer to a normal year than 2020 was. We take a look at two trends shaping the season: Consumers returning to more in-person events and shoppers returning to physical stores. In-Person Expectations to go trick-or-treating are up year over year, while the proportions of consumers planning to decorate the house, attend virtual events and opt out are all down versus 2020, according to Coresight Research data. The return to in-person celebrations is supporting more positive spending expectations: last year, our Halloween survey found 40% expected to spend less and 16% expected to spend nothing (that’s as a proportion of survey respondents that usually celebrate Halloween—showing the high degree of opting out in 2020). This year, our survey found 22% of those who usually celebrate expect to spend less and only around 4% expect to spend nothing. Given continued consumer caution, reflected in our avoidance metrics, we don’t anticipate a full return to pre-pandemic behaviors for Halloween—but against weak comparatives from fall 2020, we do expect much stronger participation, equating to a solid uplift in sales.Figure 1. Respondents Who Usually Celebrate/Take Part in Halloween or Who Have Children Who Do So: How They Intend To Celebrate (% of Respondents and YoY Trend for Selected Options) [caption id="attachment_134781" align="aligncenter" width="700"]

Base: 299 US respondents aged 18+ who usually celebrate/take part in Halloween or have children who do so, surveyed on September 20, 2021

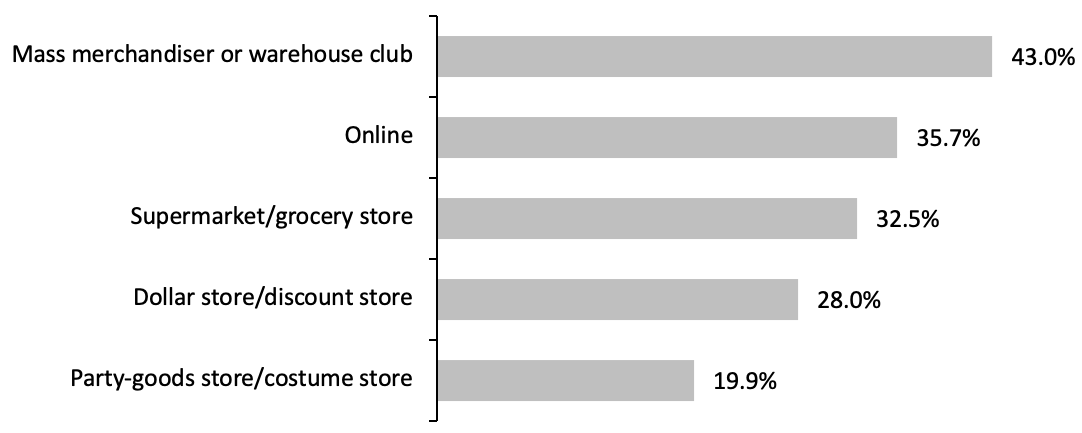

Base: 299 US respondents aged 18+ who usually celebrate/take part in Halloween or have children who do so, surveyed on September 20, 2021Source: Coresight Research[/caption] In-Store Online is a popular channel for Halloween purchases, and overall e-commerce demand this year remains considerably higher than before the pandemic. However, for Halloween, e-commerce is beaten to the top spot by mass merchandisers (such as Walmart and Target) and warehouse clubs, from which 43% of Halloween shoppers expect to make purchases (see Figure 2). For the majority of shoppers this year, purchasing Halloween products is an in-store experience, and one that will be consolidated within regular shopping trips for essentials such as groceries—whether that is at the supermarket, dollar store or warehouse club. It is also a shopping trip in which convenience and price are significant drivers, hence the prominence of dollar and discount formats. Specialist party-goods and costume stores rank relatively highly, attracting one in five Halloween shoppers—likely the more dedicated cohort. Capitalizing on consumers’ return to stores, this year, Party City is opening 80–100 Halloween pop-up stores, up from just 25 last year but down on the 150 it opened in 2019. Spirit Halloween appeared to hold the number of seasonal pop-ups level year over year, at roughly 1,400 including Canada (although private ownership limits disclosure); the surfeit of US store closures in 2019 and 2020 will have opened up more opportunities for pop-up stores.

Figure 2. Respondents Who Usually Celebrate/Take Part in Halloween or Who Have Children Who Do So: Where They Expect To Purchase (% of Respondents) [caption id="attachment_134783" align="aligncenter" width="700"]

Base: 299 US respondents aged 18+ who usually celebrate/take part in Halloween or have children who do so, surveyed on September 20, 2021

Base: 299 US respondents aged 18+ who usually celebrate/take part in Halloween or have children who do so, surveyed on September 20, 2021Source: Coresight Research[/caption] Despite supply chain challenges, our channel checks confirm that major retailers have stocked up for solid Halloween demand with offerings designed to cater to wider participation in in-person events (such as strong collections of masks and outfits) as well as continued strength in home decorations. While it still won’t be a completely “normal” Halloween for many consumers, and we expect e-commerce demand to remain somewhat elevated versus pre-pandemic, it is likely to be considerably closer to normal than last year for retailers, in terms of both sales mix and channel demand.

US RETAIL AND TECH HEADLINES

Albertsons Companies Reports Second-Quarter Results; Revenues Up by 4.4% (October 18) Company press release- Grocer Albertsons Companies has reported $16.5 billion in total revenues for its second quarter (ended September 11, 2021), up 4.4% year over year. The company registered a net income of $295.2 million, up 3.8% year over year. Revenue growth was fueled by a 1.5% rise in the company’s identical sales and by increased fuel sales.

- The group has increased its quarterly common stock dividend by 20% to $0.12 per share. However, it reduced its growth expectations for fiscal 2021 (ending February 27, 2022) to 2.5%–3.5% from its previously announced 5.0%–6.0%. Adjusted EPS is forecast to be in the range of $2.50–$2.60 per share, higher than previous expectations of $2.20–$2.30.

- Department store chain Belk has launched a new private-label womenswear brand, Wonderly, to replace the company’s previous private-label brand, New Directions.

- The new brand will offer athleisure and clothing catering to different body sizes. The entire assortment will be sold in over 100 Belk stores and on the retailer’s website.

- Discount store Dollar Tree has partnered with retail planning technology company Relex Solutions to enhance its supply chain communications, demand forecasting and replenishment processes across its Dollar Tree and Family Dollar discount retail banners.

- The company plans to introduce Relex Solutions technology in all its 15,800 stores and 26 distribution centers in North America, aiming to strengthen collaboration between stores and corporate central planning.

- Grocery delivery company Instacart has announced plans to acquire Caper AI, an artificial intelligence (AI)-powered shopping cart and checkout technology company, for $350 million. The acquisition of Caper AI will help Instacart create a unified shopping experience in store and online.

- Instacart will use Caper’s AI’s smart carts to allow customers to scan items in grocery stores and pay for them directly using the cart to avoid checkout lines. As well as its own channels, the company plans to integrate Caper AI’s technology into its retail partners’ e-commerce channels too. This will enable customers to create online shopping lists and browse recipes ahead of time so they can check off items as they shop.

- Luxury department store chain Saks Fifth Avenue has announced plans to launch an initial public offering (IPO) for its e-commerce unit. The company is targeting a $6.0 billion valuation during the first half of 2022.

- The company is in the process of interviewing potential underwriters for the IPO, according to people familiar with the matter. Hudson’s Bay Co, the owner of Saks Fifth Avenue, launched the e-commerce segment as a separate business in March 2021. It received funding from US-based private equity firm Insight Partners, valuing the business at $2 billion on launch.

EUROPE RETAIL AND TECH HEADLINES

H&M Partners with Lablaco To Launch Blockchain Rental Service (October 19) ChargedRetail.co.uk- Swedish clothing retailer H&M has partnered with blockchain-based circular fashion company Lablaco to launch a new service in its Mitte Garten store in Berlin, that enables customers to rent and swap exclusive collections.

- Its first collection includes 12 fashion pieces and is available to rent from five days up to three weeks, with prices ranging from €5.0 to €9.0 ($5.8 to $10.5) per day. After the rental period, the customer returns the item to the store, where it is checked, cleaned and prepared for the next rental customer. Shoppers can trace a product’s journey using Lablaco’s blockchain technology and have the option to add memories and stories to individual garments by uploading their “looks” onto the platform.

- Swiss retail giant and supermarket chain Migros has announced expansion plans for its PickMup parcel service, aiming to add 70 additional self-service locations by the end of the year. The service allows easy collection of parcels without the need to queue or wait.

- The PickMup service currently has a network of more than 700 locations. The company plans to add collection boxes outside of stores in 2022 to enable customers to pick up parcels outside opening hours.

- UK-based sustainable underwear brand One Essentials has launched a new range of underwear marketed as biodegradable, natural and non-toxic. The move comes as a response to increased consumer demand for eco-friendly products, according to the company.

- The collection is designed to be affordable with a tiered pricing scheme. The company supports a circular business model and runs an end-of-life take-back scheme for customers.

- Dutch supermarket chain Spar has announced a new regional partnership program within Spar Hungary named “Regional Treasures.” The program aims to support small-scale domestic producers and businesses.

- Spar Hungary plans to invest €4.8 million ($5.6 million) into the program, integrating 100 suppliers and aiming to create new employment opportunities. It will also establish six regional supplier centers in major cities across the country by the end of 2021.

- UK supermarket Tesco has launched its new checkout-free store concept “GetGo” in High Holborn in London, allowing customers to shop in store and pay without scanning products or queuing.

- Tesco has partnered with seamless shopping specialist Trigo to open the store. Customers need to register on the Tesco.com app to complete checkout-free transactions.

ASIA RETAIL AND TECH HEADLINES

6IXTY8IGHT Expands Digital Presence in Japan (October 19) RetailinAsia.com- Hong Kong-based fashion brand 6IXTY8IGHT has expanded its digital presence in Japan, launching online stores on Shoplist and Amazon Japan. It also plans to open an online store on Locondo in mid-November this year.

- The company stated that its partnerships with the three platforms are a vital business growth strategy to make the brand more relevant to the Japanese market. Its launch on Amazon Japan marks its first Amazon launch anywhere in the world.

- New Zealand Trade and Enterprise (NZTE), the country’s trade promotion agency, has partnered with India-based online grocery supermarket Big Basket to make dairy, fast-moving consumer goods (FMCG) and grocery products from New Zealand available to Indian consumers.

- NZTE’s Trade Commissioner for South Asia, Ralph Hays, stated that apart from providing opportunities to New Zealand’s companies to expand in India, NZTE hopes to build a long-term base for other products from the country.

- Reliance Retail Ventures, the retail arm of India-based multinational conglomerate Reliance Industries, has acquired a 52% stake in Indian designer brand Ritu Kumar. The acquisition includes the purchase of a 35% stake from Ritika Private Limited, the brand’s owner.

- Reliance Retail Director Isha Ambani stated that Ritu Kumar has “strong brand recognition, potential for scale, and innovation in fashion and retail—all key ingredients to build a complete lifestyle brand.”

- China-based online shopping platform Taobao has rolled out a new version of its app that aims to make online shopping easier for its elderly users. The update features a “senior mode,” allowing for larger text and icons, simplified navigation and a voice-assisted search function.

- The app’s homepage also highlights games that are popular among older demographics. The company stated that in the future it will look to explore new ways to make online shopping easier for older customers, aiming to introduce functions to allow their children to assist browsing and product selection.

- Wellcome, one of the largest supermarket chains in Hong Kong, has introduced a new store concept, “Wellcome Fresh,” in the city’s Westwood shopping center. The store contains 23 themed zones and offers around 15,000 products, including locally farmed produce, seafood and wine.

- The new store spans over 50,000 square feet, making it the largest supermarket in Hong Kong. The store’s décor aims to replicate local traditional markets.