Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

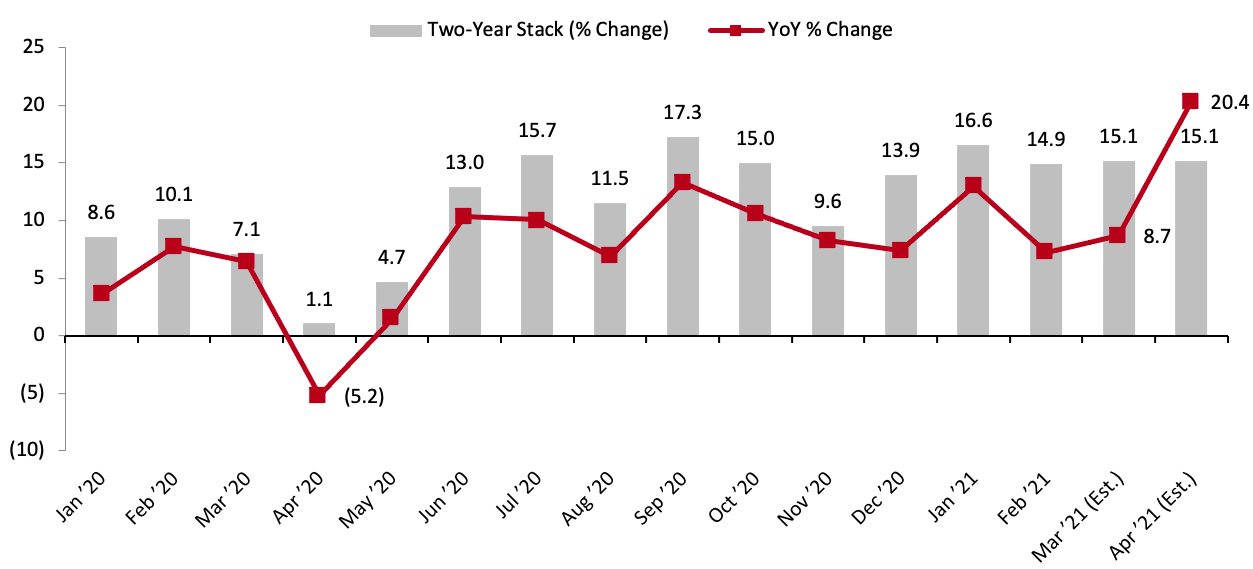

Get Ready as We Annualize the Great Disruption US retail is on the cusp of annualizing an exceptional period of upheaval. As the pandemic hit America and lockdowns hit retail, April 2020 saw a 5% year-over-year drop in total retail sales—a surprisingly modest impact but with many sectors seeing much deeper declines as the total was buoyed by strong grocery demand. In the coming weeks, retailers in those impacted nonfood sectors are likely to see a major jump in sales on a year-over-year basis. The real consideration will be how much of the 2020 slump these retailers recover. Supported by tax refunds and stimulus measures, US retail sales have recently proved very strong. Total sales, excluding automobiles and gasoline, were up 7.2% in February (reported this week by the Census Bureau), maintaining a two-year stack of mid-teens percentage increases. This two-year stack averaged 15.1% across December, January and February. Should this pace be sustained, we will be on track for a circa-9% year-over-year increase in total sales in March 2021 and an approximate 20% year-over-year increase in April 2021 as we lap the 5.2% decline of April 2020. US Total Retail Sales (ex. Automobiles and Gasoline): Two-Year % Change Stack and YoY % Change [caption id="attachment_124761" align="aligncenter" width="720"] March and April 2021 estimates assume that the 15.1% two-year stack average for December 2020, January 2021 and February 2021 is maintained

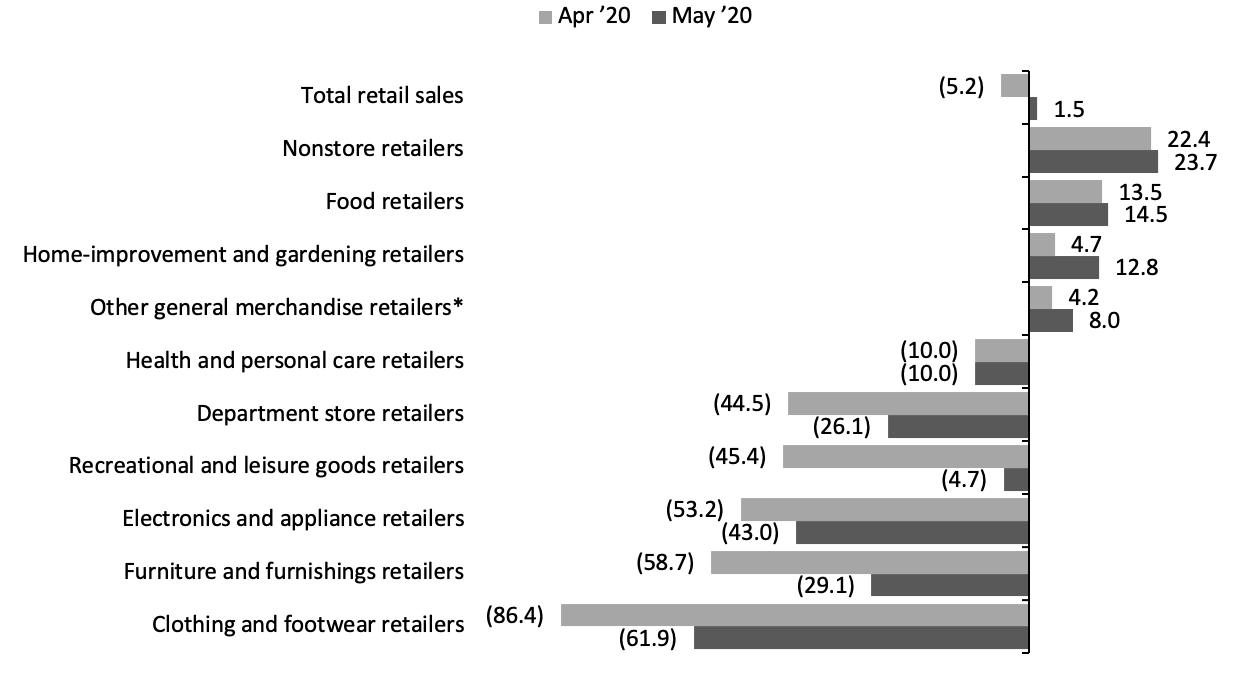

March and April 2021 estimates assume that the 15.1% two-year stack average for December 2020, January 2021 and February 2021 is maintainedSource: US Census Bureau/Coresight Research[/caption] In theory, those that fell the furthest have the most to gain in the months ahead—although that assumption is based on consumer demand springing back to precrisis patterns as well as precrisis volumes. In practice, that won’t happen—for instance, we do not expect total consumer demand for apparel to recover to 2019 levels until 2022. Based on recent trajectories, and versus the spring 2020 slumps, we expect strong year-over-year bouncebacks in the coming months for:

- Recreational and leisure goods retailers—reflecting this sector’s strength, in February 2021, sector sales were fully 18.5% higher than the comparable month in 2019, in other words, before the crisis hit.

- Furniture and furnishings retailers—where February 2021 sales were 14.4% ahead of precrisis February 2019 levels.

- Health and personal care stores—which were up 5.7% in February 2021 versus two years earlier.

The nonstore sector includes online sales from some store-based retailers that separate their online businesses from their store-based operations.

The nonstore sector includes online sales from some store-based retailers that separate their online businesses from their store-based operations.*Other than department stores; includes mass merchandisers, warehouse clubs, dollar stores, etc.

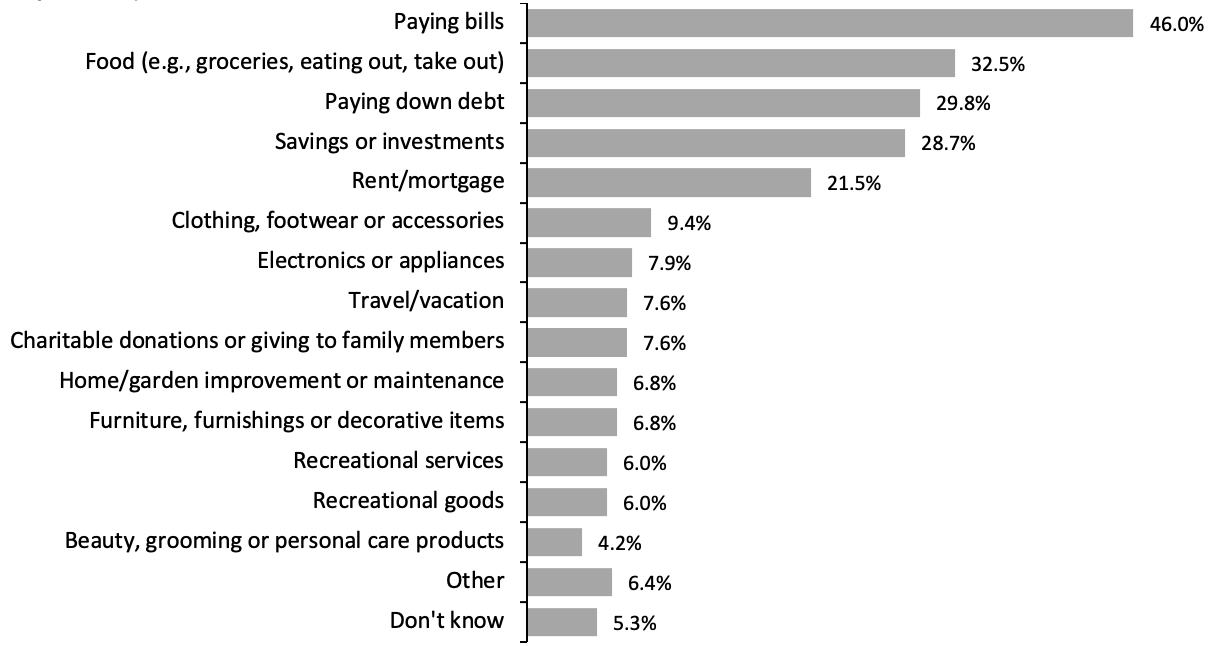

Source: US Census Bureau/Coresight Research[/caption] As we write, the US government is sending out a third round of stimulus checks, with 90 million direct deposits worth $242 billion made on March 17, according to The Washington Post. These will come on top of the annual round of tax refunds: In 2020, a total of 100.5 million refunds were issued as of July 17, handing a total of $276.1 billion back to consumers. Despite recent retail strengths, our surveys consistently find that product purchases are a low priority among recipients of stimulus payments. The most common uses of stimulus checks are essential payments, such as bills, debt, mortgages and rent, as well as food purchases. US Consumers Who Received a Second Stimulus Check: What They Expect To Spend a Third Stimulus Payment On (% of Respondents) [caption id="attachment_124763" align="aligncenter" width="720"]

Base: 265 US respondents who received a second stimulus payment, surveyed on February 8, 2021

Base: 265 US respondents who received a second stimulus payment, surveyed on February 8, 2021Source: Coresight Research[/caption] Although not a top priority, discretionary retail is undoubtedly benefitting from the significant cash deposits. In the coming months, these windfalls will help some retail sectors to recapture sales lost in spring 2020. In the coming months, we will begin to see with greater certainty how much of the crisis-driven losses or gains are recaptured—by individual retailers and by sectors. The most structurally challenged of those retailers and sectors are likely never to regain the total sales that they enjoyed before the crisis. But, with cash in consumers’ pockets for now, others will be on hand to capture those dollars. For more details on our sector analysts’ views of the year, see our 2021 Retail and Technology Outlook report from January.

US RETAIL AND TECH HEADLINES

Dick’s Sporting Goods Enters Men’s Athletic Apparel Market (March 16) RetailDive.com- Dick’s Sporting Goods has launched its own men’s athleisure brand named VRST. The company described the brand to be more akin to Lululemon than NIKE or Under Armour.

- The new brand debuted on Dick’s website, as well as a stand-alone site, on March 16, and the company stated that the brand’s product will roll out to more than 400 Dick’s stores in the coming weeks.

- Fabric retailer Joann and selling shareholders have raised around $131 million in an initial public offering (IPO), returning to the market a decade after being taken private in 2010 by buyout firm Leonard Green & Partners.

- The IPO nevertheless fell short of the company’s goal of raising funds in the region of $186 million.

- IKEA has launched an audio version of its final catalog, jumping on the podcast bandwagon to give its iconic catalog “one final hurrah.” In December 2020, Inter IKEA Systems B.V., the worldwide IKEA franchisor, announced its decision to discontinue the catalog.

- An IKEA spokesperson said “IKEA US is excited to launch the first-ever audio version of the catalog, which was made by transforming 286 print catalog pages into an auditory experience lasting three hours and 41 minutes for everyone to enjoy. The company stated that the IKEA US audio catalog contains tips and suggestions to improve home design. It is available on the IKEA US website as well as on AudioBooks, Spotify and YouTube.”

- Toys“R”Us parent company Tru Kids has sold a controlling stake in the company to brand management company WHP Global. Tru Kids acquired the Toys“R”Us brands and intellectual property after the latter filed for Chapter 11 bankruptcy protection in September 2017.

- WHP Global, which is backed by two prominent investment firms, and also owns the Anne Klein and Joseph Abboud brands, intends to open a number of Toys“R”Us stores again in the US, ahead of this year’s holiday season.

- Walmart has announced the appointment of acclaimed fashion designer Brandon Maxwell, as Creative Director of its fashion brands Free Assembly and Scoop, as part of the company’s plan to elevate its fashion reputation.

- Maxwell will be responsible for the collection design, offer input into material selection, and will also oversee marketing initiatives and campaigns for the two private-label brands, according to a company press release.

EUROPE RETAIL AND TECH HEADLINES

Deliveroo Aims To Raise £1 Billion in Its Upcoming IPO; Early Investors To Gain 60,000% (March 15) ChargedRetail.co.uk- Deliveroo plans to raise £1 billion ($1.4 billion) in its upcoming initial public offering (IPO). The company, which is now backed by Amazon, plans to sell both existing and new shares when the company goes public.

- Deliveroo is valued at an estimated £5–7 billion ($7–10 billion), marking the largest IPO on the London Stock Exchange in eight years. Early investors are expected to achieve a 60,000% return on their investment.

- Dutch online supermarket chain Picnic has partnered with Belgian hypermarket chain Cora to make its debut in Valenciennes, France, in the next few weeks. Picnic has already started the construction of a distribution center in Lesquin, France.

- With a presence in the Netherlands and Germany, France will be Picnic’s third market entry, and the company is looking to expand within France gradually.

- H&M reported a sales decline of 21% in the first quarter, ended February 28, 2021, versus a 10% decline in the prior quarter. The company noted that sales were substantially impacted by the pandemic-related restrictions and temporary closure of over 1,800 stores.

- H&M saw sales recovery in the first half of March, with sales increasing by 10% in the period March 1–13 as a large number of the company’s stores reopened in its major markets, such as Germany, with total closed stores standing at 900 on March 13.

- UK-based boot brand Hunter has appointed Paolo Porta as permanent CEO, with immediate effect. Porta held the position on an interim basis since June 2020. Under Porta’s leadership, Hunter has witnessed a 94% increase in e-commerce sales in the UK from the last quarter of 2020 to date.

- Prior to joining Hunter in June 2020, Porta worked in the luxury fashion industry, most recently serving as Senior Vice President of Merchandising and Licensing at Jimmy Choo.

- Zalando reported sales growth of 29.6% and gross merchandise value (GMV) growth of 38.0% in its fourth quarter, ended December 31, 2020. The company’s total number of active customers increased by 25.0% to 38.7 million in the quarter.

- Zalando substantially upgraded its growth ambition and now expects its GMV to grow to €30 billion ($36 billion) by 2025, from €11 billion ($13 billion) in 2020 (its previous target was to grow its GMV to €20 billion ($24 billion) by 2024). Furthermore, the company’s long-term target is to acquire a share of more than 10% share of the €450 billion ($539 billion) European fashion market.

ASIA RETAIL AND TECH HEADLINES

Hermès Opens New Flagship Store in Tokyo (March 17) InsideRetail.asia- Hermès has unveiled a new flagship store in the Omotesando district in Tokyo. The store spans 6,329 square feet across two floors and houses an extensive range of luxury bags, equestrian items, fragrances, leather goods, shoes and silk scarves on the ground floor, and a full range of men and women’s apparel on the first floor.

- The store is designed by Paris-based architecture agency RDAI, a longtime collaborator of Hermès. The Omotesando location is the brand’s first free-standing store opening in Tokyo since the opening of Maison Hermès in 2001.

- Electronics retailer Croma, which is owned by Indian multinational conglomerate Tata Group, has teamed up with Amazon to launch a new range of smart TVs with built-in Fire devices in India.

- The new products will allow users to stream content across 5,000 apps, including Amazon Prime Video, Disney+, Hotstar, Netflix, SonyLIV and Youtube. The Croma Fire TV Edition will be available in Croma stores in more than 60 Indian cities as well as on croma.com and amazon.in.

- Online food and grocery delivery platform FoodPanda has appointed Ryan Lai as the new Managing Director for its Hong Kong division. Lai will oversee the company’s business operations and contribute to strategic development of the e-commerce platform to enhance consumer experiences.

- Lai previously served as the Head of the Southeast Asia division and the Head of Category Management for automotive in Greater China with eBay.

- South Korean e-commerce marketplace Naver has partnered with omnichannel grocery chain operator Emart. The strategic alliance will enable Naver to boost its same-day and fresh food delivery services using Emart’s strong offline presence. The partnership will also enable Emart to significantly expand its lagging online business.

- The deal comes after Naver’s e-commerce rival Coupang launched a successful initial public offering (IPO) in New York. With its new alliance with Emart, Naver will be better positioned to compete with Coupang, which is referred to as the Amazon of South Korea.

- Japanese housing equipment company Lixil Group has adopted a direct-to-consumer approach, launching a flagship store in Singapore. The store covers 6,000 square feet and houses a full bathroom product line-up from its brands, which include American Standard, GROHE and INAX.

- The store offers an immersive retail experience for its consumers, featuring smart technologies, such as virtual reality for interior design planning. The company also sells smart products, such as touchless faucets and app-controlled shower systems.