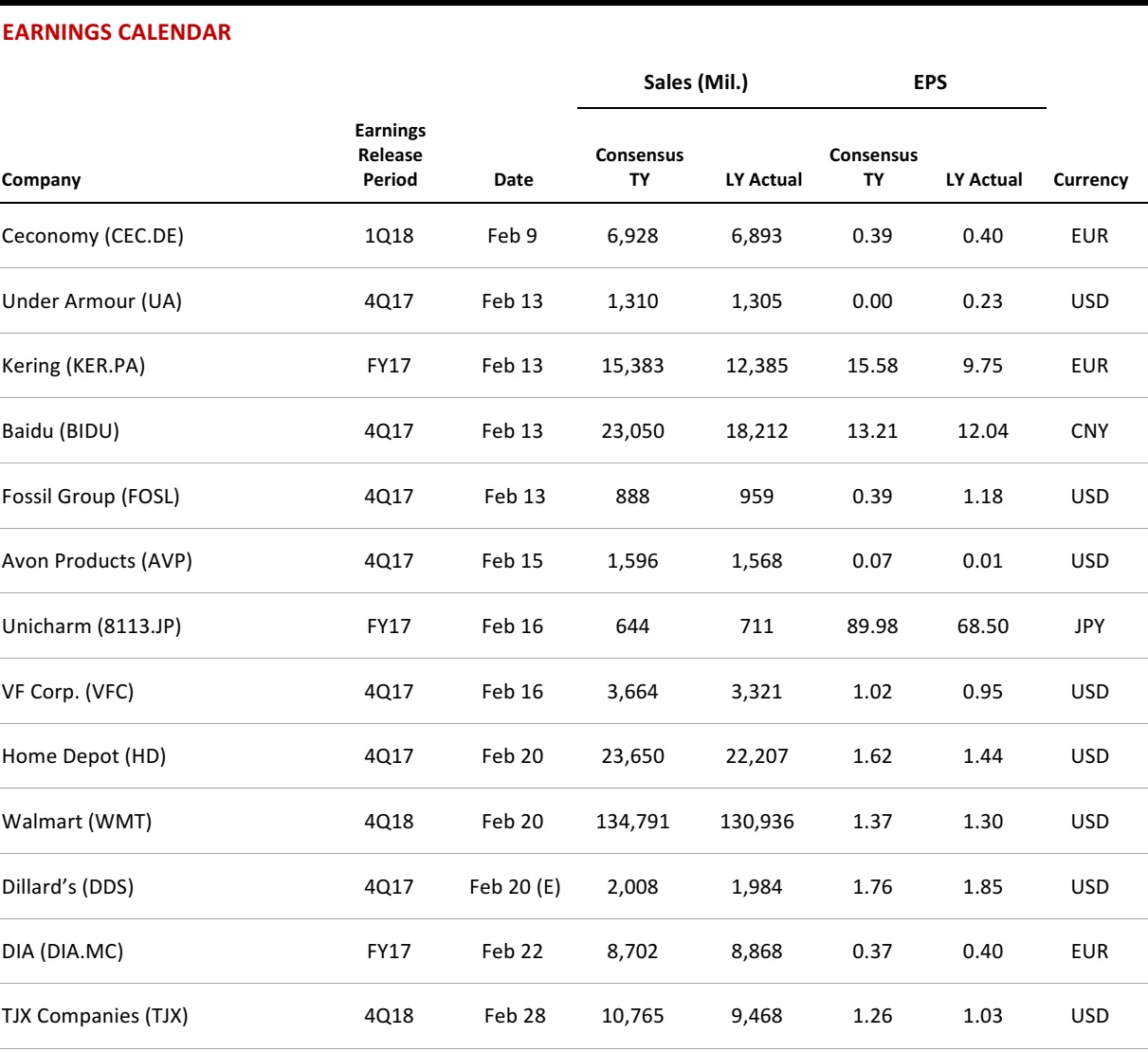

From the Desk of Deborah Weinswig

Taking a Dive into Amazon’s 2017 Metrics

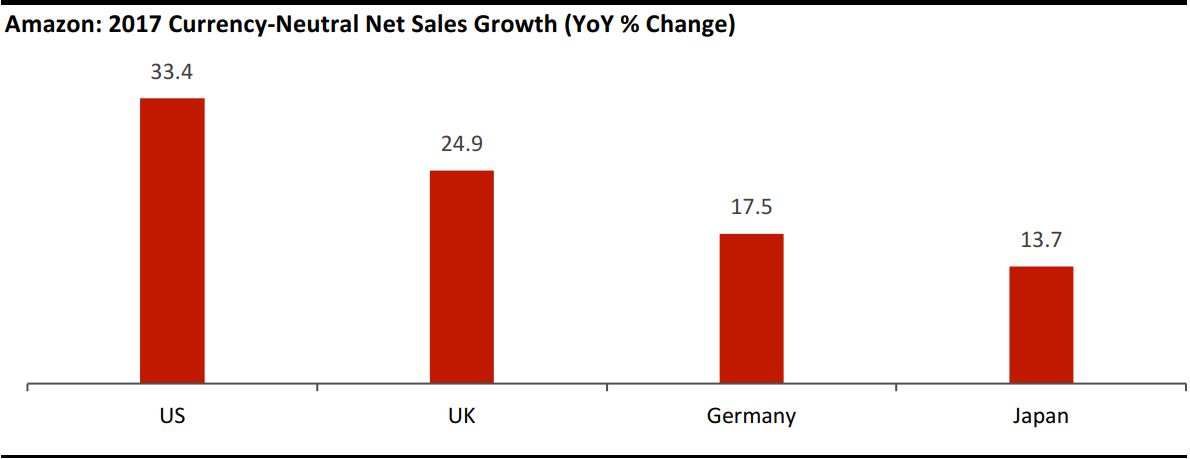

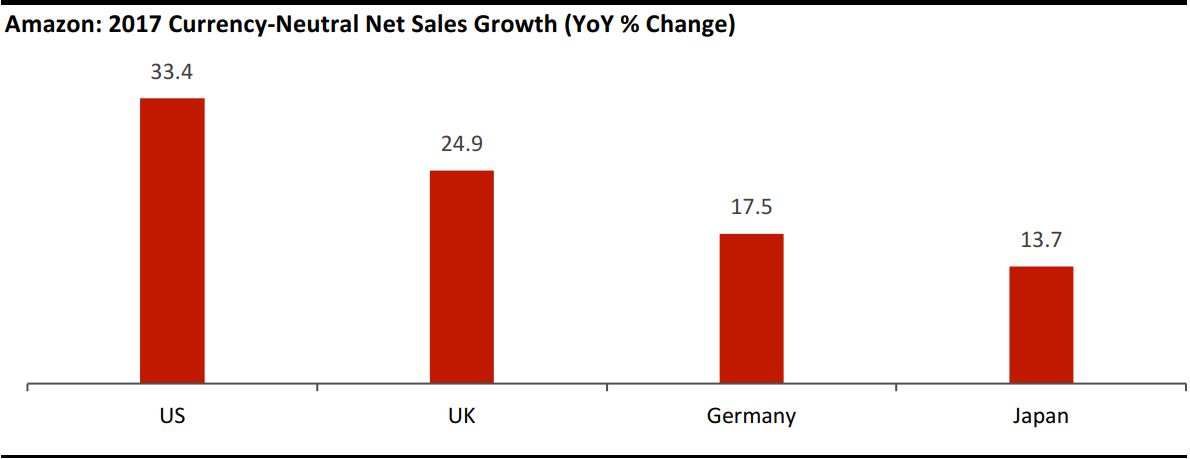

Amazon wowed analysts and investors last week with a dramatic earnings beat on the back of remarkable fourth-quarter sales growth of 38%. Amazon provides updates on sales in specific international markets only when it reports its full-year results, as it did last week, so the most recently announced yearly figures give us a chance to review how the company is growing by region.

The US accounts for two-thirds of Amazon’s net sales, Germany just under 10%, the UK 6% and Japan nearly 7%. So, the company’s non-US operations are minor but meaningful. As we chart below, Amazon’s very strong performance in the US in 2017 was complemented by strong growth in the UK. The company’s growth also substantially outpaced that of the total online market in both countries.

- In the US, total online retail sales grew by just over 16% in 2017, we estimate based on US Census Bureau data. Amazon grew its total US sales by about double that rate last year—although the company’s figures include services such as cloud computing (which would not be included within retail sales) and reflect a sales boost of some $6 billion from the acquisition of (predominantly offline) Whole Foods Market.

- In the UK, total Internet retail sales grew by 17.7% in 2017, according to our analysis of data from the UK’s Office for National Statistics. Amazon comfortably outpaced that growth rate, too.

Source: Company reports

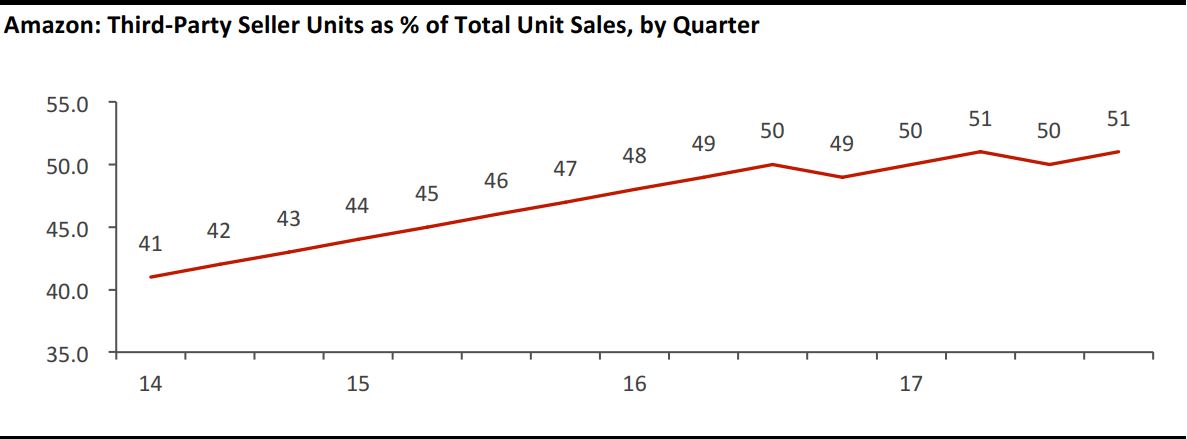

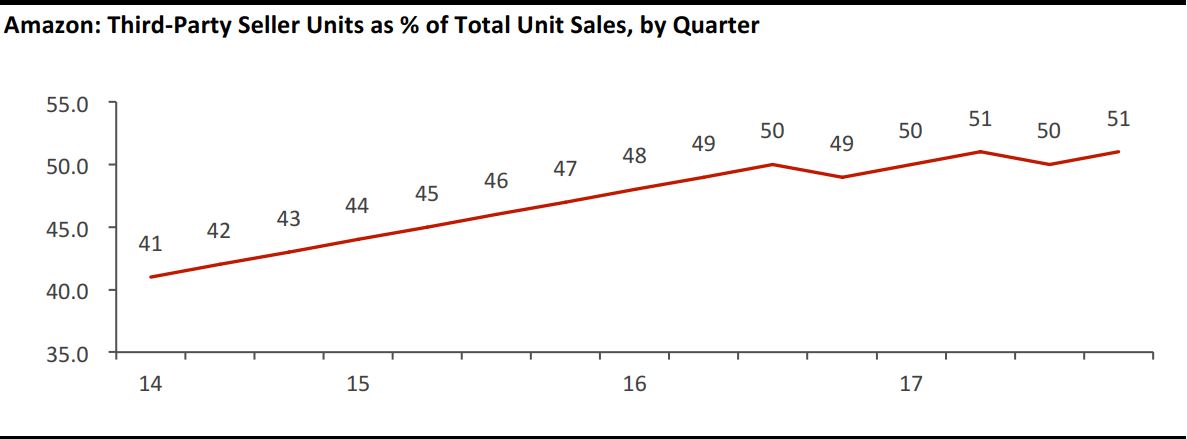

The revenue booked by Amazon does not directly reflect total sales through the site, because third-party sellers account for much of what is sold on Amazon. As it does each quarter, Amazon stated in its most recent announcement the proportion of total unit sales that were made by third-party sellers, which we chart below. In the fourth quarter, this figure showed a small sequential uplift, to 51%, but third parties’ contributions to sales have shown a plateauing trend since the second half of 2016

Source: Company reports

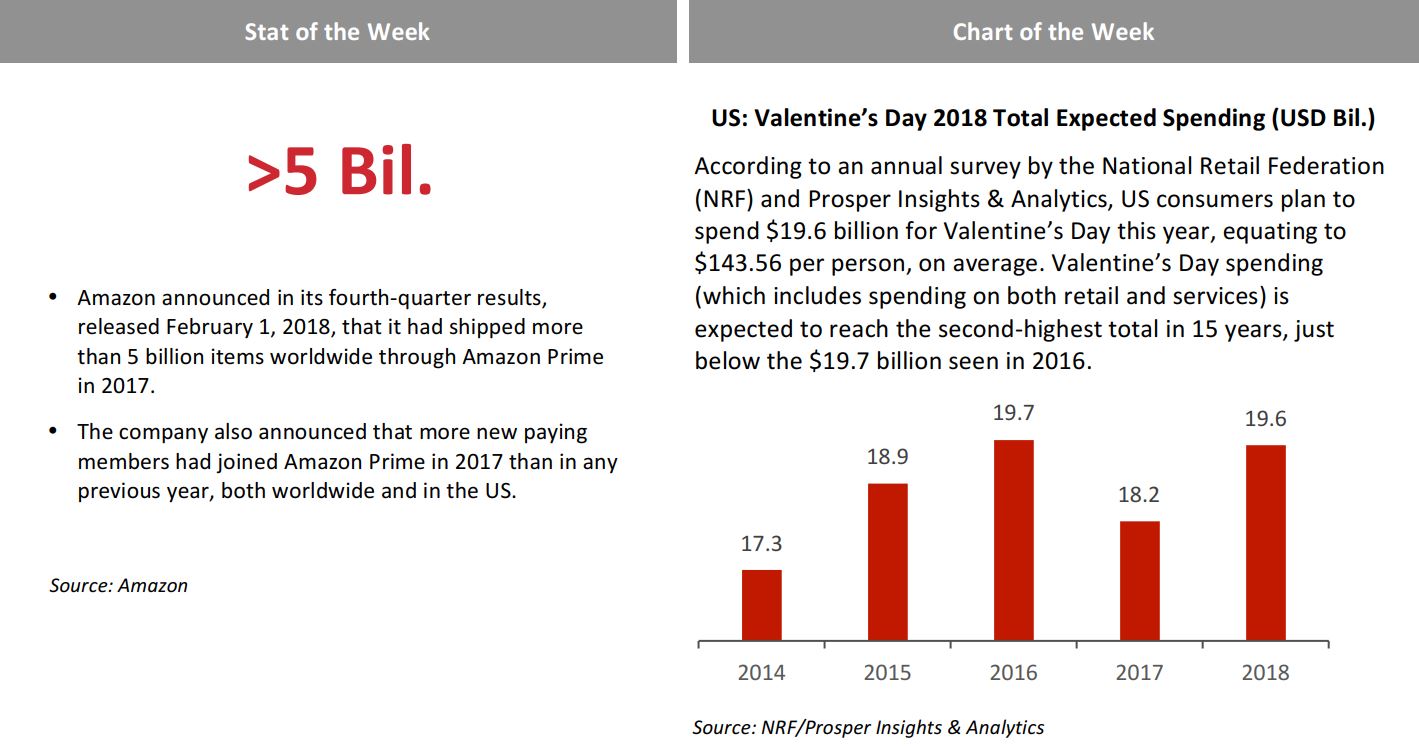

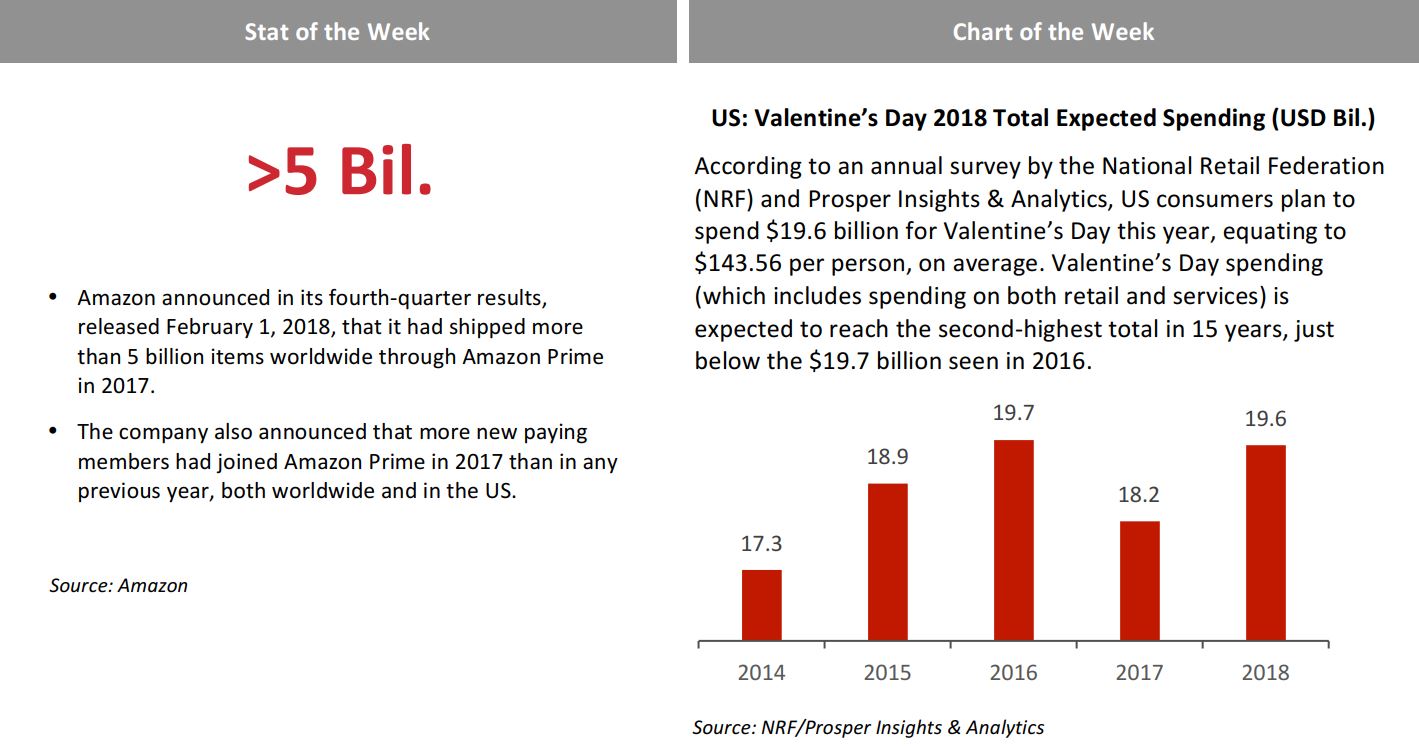

Lastly, a note on Prime: Amazon said that it shipped more than 5 billion items worldwide with Prime in 2017 and that more new members joined Prime last year than in any previous year, both in the US and worldwide. The company also launched Prime in the Netherlands, Luxembourg and Singapore in 2017, and Prime in India expanded to include 25 million products from third-party sellers.

Prime drives sales at Amazon—that is clear. In particular, Prime encourages members to shop on the site for nontraditional Amazon categories such as apparel and groceries. So, a bumper year for Prime membership in 2017 suggests that Amazon will see sustained sales momentum into 2018.

- FGRT covers Amazon frequently and in depth. Our upcoming reports include a deep-dive analysis of our Amazon apparel consumer survey findings, a review of Amazon’s US patents and an exclusive, item-level analysis of Amazon’s product and brand offering in clothing.

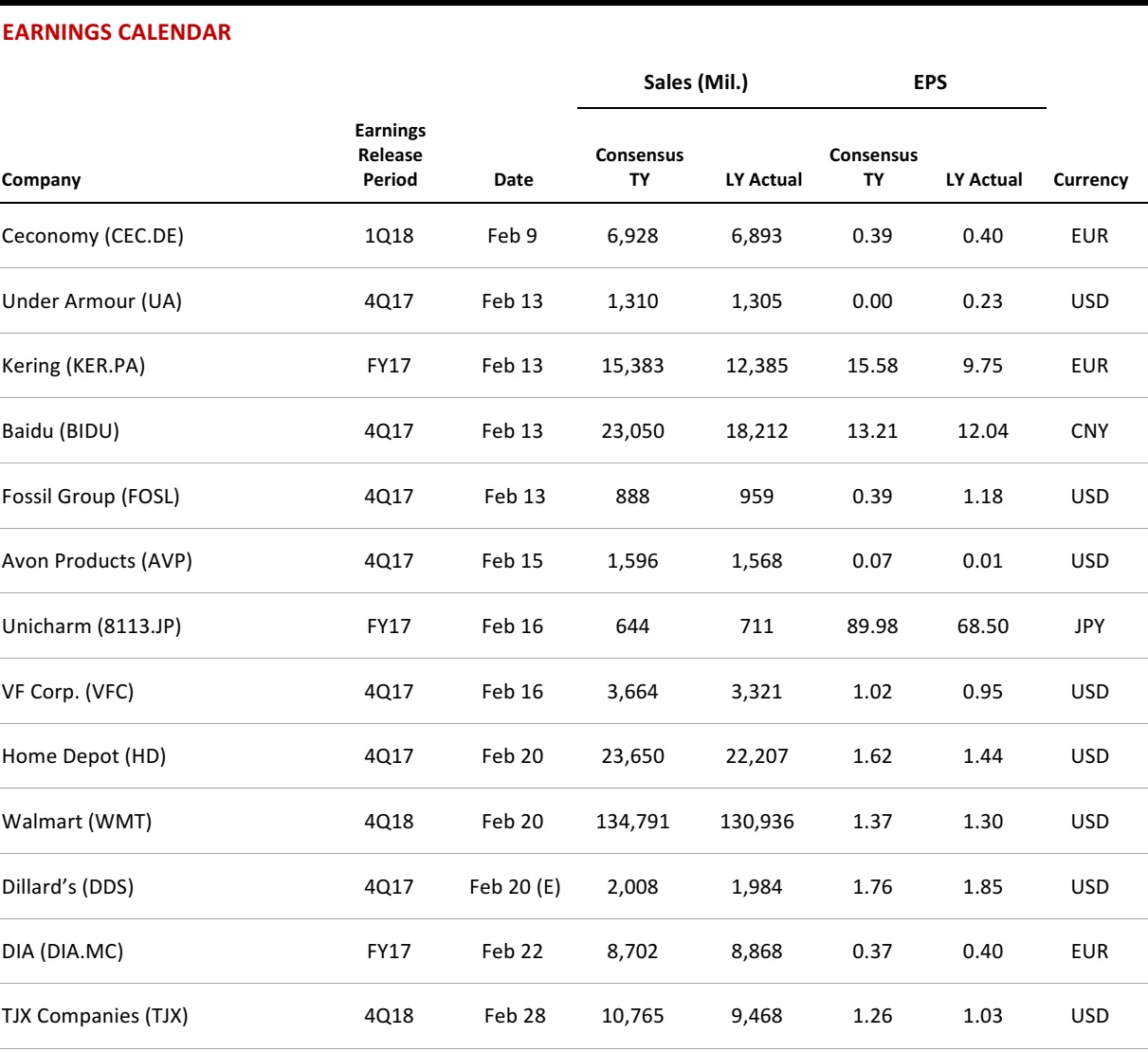

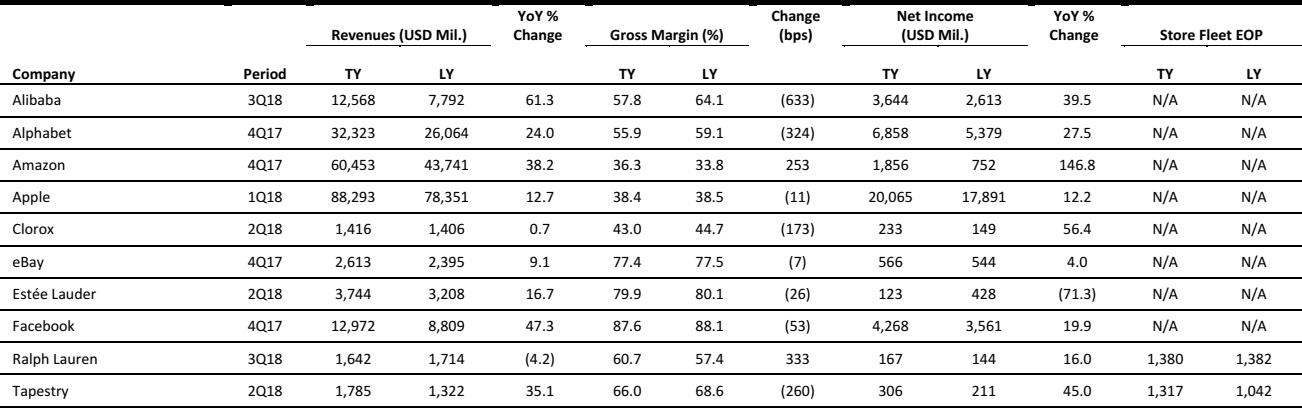

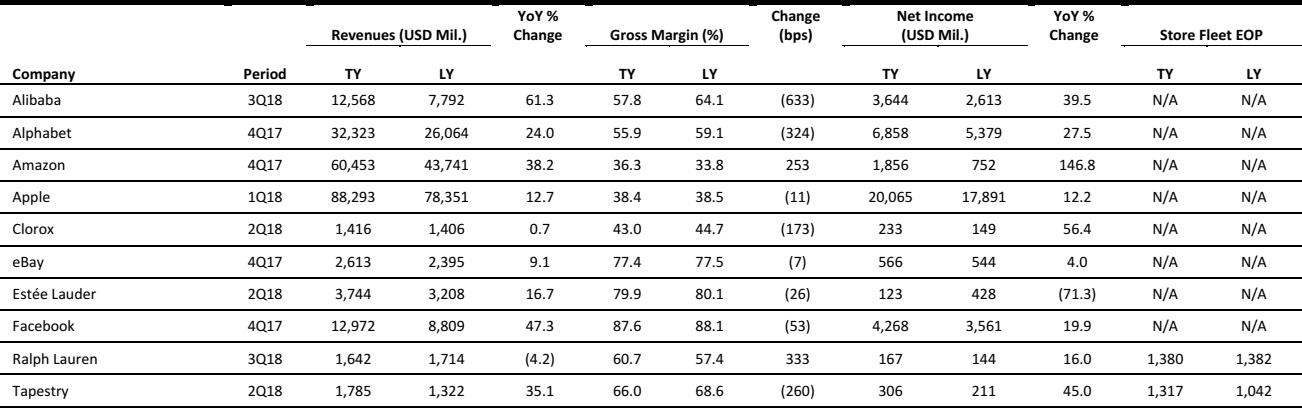

US RETAIL EARNINGS

Source: Company reports/FGRT

US RETAIL & TECH HEADLINES

eMarketer: E-Commerce Approaching 10% of Retail Sales

(February 7) HomeWorldBusiness.com

eMarketer: E-Commerce Approaching 10% of Retail Sales

(February 7) HomeWorldBusiness.com

- eMarketer has looked at the year ahead, and it expects total retail sales to grow by 3.7%, to about $5.3 trillion in the US, with the e-commerce channel gaining 16%, to reach $526.09 billion in sales. Growth in e-commerce should bring its share of total US retail sales to 10% for the first time, according to eMarketer.

- The company added that mobile commerce sales should reach $208.29 billion, up more than 32% year over year. M-commerce will account for up to 39.6% of e-commerce sales and 4% of total retail sales in the US this year, the firm noted.

US Retail Gasoline Prices Getting Higher and Higher

(February 6) UPI.com

US Retail Gasoline Prices Getting Higher and Higher

(February 6) UPI.com

- Rising crude oil prices and strong consumer demand have pushed the national average price for a gallon of gas to something of a record, retail analysis found. Motor club AAA listed an average retail price of $2.61 for a gallon of regular unleaded gasoline on Tuesday, unchanged from Monday, but almost 5%, or 11 cents per gallon, more than one month ago.

- “Strong demand coupled with steadily rising oil prices means filling up will continue to cost consumers more this month,” a spokeswoman for AAA said in a statement. “In fact, the last time the national gas price average was this high, but under $3 per gallon in February, was in 2010,” the spokeswoman said.

Toys“R”Us Store-Closing Sales Start as Soon as Wednesday

(February 6) USAToday.com

Toys“R”Us Store-Closing Sales Start as Soon as Wednesday

(February 6) USAToday.com

- Toy retailer Toys“R”Us won US Bankruptcy Court approval Tuesday to begin going-out-of-business sales at about 170 of its stores across the country. Liquidation sales could begin as early as Wednesday, according to a plan that US Bankruptcy Judge Keith Phillips approved.

- The sales would be completed by April 15, according to the plan. The toy company, which is based in Wayne, New Jersey, filed a motion on January 23 to close up to 182, or about a fifth, of its 880 stores in the US. Since then, it has taken at least a dozen stores off the closing list.

For Bon-Ton, Founded in the 19th Century, an Uncertain Retail Future

(February 5) USAToday.com

For Bon-Ton, Founded in the 19th Century, an Uncertain Retail Future

(February 5) USAToday.com

- Bon-Ton Stores, saddled with debt and faltering sales, entered the week beside a throng of other retailers under bankruptcy protection, seeking a buyer for pieces or all of a department store that was founded at the tail end of the 19th century.

- The company has survived a score of severe economic downturns, including the Great Depression, but finds itself in uncharted territory today. While Amazon.com has revolutionized the way people shop, the behavior of Americans had already been diverging radically in terms of what they buy and where they buy it.

Landlords, Brands Brace for Less Shopping at the Mall

(February 5) CNBC.com

Landlords, Brands Brace for Less Shopping at the Mall

(February 5) CNBC.com

- E-commerce platforms will account for a third of total retail sales by 2030, according to a new report by consulting group A.T. Kearney. The rapid transformation is leading traditional brands to rethink how they arrange their stores. Landlords are reconsidering their tenant mixes, bringing in more food and entertainment options.

- Part of that transition is retail landlords scaling back on apparel. American Dream Meadowlands, a massive retail development under way in New Jersey that is set to include an indoor ski slope and KidZania, is just one example of that, said Michael Brown, the author of the A.T. Kearney report.

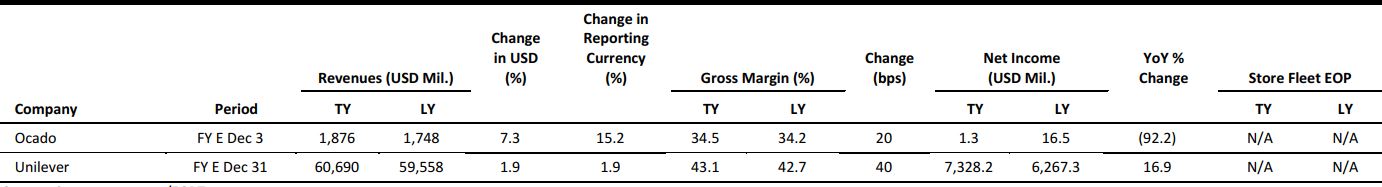

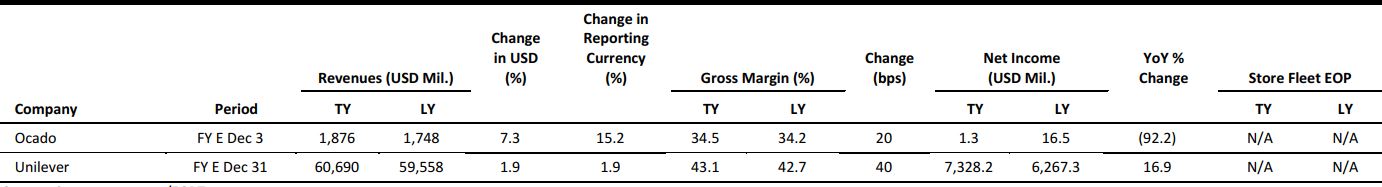

EUROPE RETAIL EARNINGS

Source: Company reports/FGRT

EUROPE RETAIL & TECH HEADLINES

Morrisons to Launch Own-Brand Clothing Range Online

(February 5) RetailGazette.co.uk

Morrisons to Launch Own-Brand Clothing Range Online

(February 5) RetailGazette.co.uk

- British grocer Morrisons is set to launch its Nutmeg own-brand clothing range online for the first time. The brand was launched offline in March 2013.

- Beginning in September, shoppers will be able to buy Nutmeg clothing through Morrisons’ website, on mobile devices and in-store through click-and-collect. Currently, the range consists of clothing for women, babies and children and is stocked in about 500 stores.

UK Retailers See Sales Grow in January

(February 5) BRC press release

UK Retailers See Sales Grow in January

(February 5) BRC press release

- In January, UK total retail sales grew by 1.4%, the same rate as seen in December, according to the British Retail Consortium (BRC). Comparable sales grew by 0.6%, level with the December figure. The growth was against undemanding comparatives: in January 2017, total sales grew by 0.1% and comparable sales fell by 0.6%.

- The BRC breaks down sales by food and nonfood retail only on a three-month basis. In the three months ended January, food sales rose by 2.9% on a comparable basis and by 4.1% on a total basis, above the 12-month total average of 3.7% and the highest rate seen since November 2012. Nonfood retail sales fell by 1.2% on a comparable basis and by 0.6% on a total basis, below the 12-month total average of (0.1)% and representing the first 12-month average decrease since September 2009.

Sales Slump at New Look

(February 6) Company press release

Sales Slump at New Look

(February 6) Company press release

- British fashion retailer New Look reported a group revenue decline of 6.3%, to £1,069 million ($1,494.1 million), in the 39 weeks ended December 23, 2017. Group comparable sales fell by 10.6%, while UK comps fell by 10.7%. Sales on the company’s own website contracted by 15.0%.

- Executive Chairman Alistair McGeorge remarked that it was a difficult trading period, “with sales and margins impacted by the high level of discounts.” New Look intends to complete the current financial year without excess stock in order to be in a position to start the next year with a full-price offering.

H&M to Launch Marketplace for Discounted Fashion and Lifestyle Products

(January 31) Company press release

H&M to Launch Marketplace for Discounted Fashion and Lifestyle Products

(January 31) Company press release

- Swedish fashion retailer H&M announced that it will launch a new online marketplace for discounted fashion and lifestyle products in 2018. Called Afound, the website will feature collections for men and women from external brands as well as from H&M’s portfolio.

- The retailer also plans to open physical stores to complement the website. H&M will unveil the first store, in Stockholm, Sweden, at the same time that it launches the Afound website.

Urban Farming Startup Infarm Raises $25 Million in Series A Funding

(February 6) TechCrunch.com

Urban Farming Startup Infarm Raises $25 Million in Series A Funding

(February 6) TechCrunch.com

- German startup Infarm, which designs smart vertical-farming tech platforms for grocery stores and restaurants, has raised $25 million in series A funding. The round was led by London-based venture capital firm Balderton Capital and includes participation from at least five other firms.

- Infarm was established with the idea of bringing freshly grown produce and artisanal food closer to consumers. The startup hopes to use the new funds to further develop its Berlin R&D center and to grow in Germany and internationally.

ASIA RETAIL & TECH HEADLINES

Alibaba Buys Stake in Wanda Film in $1.2 Billion Share Sale

(February 5) Bloomberg.com

Alibaba Buys Stake in Wanda Film in $1.2 Billion Share Sale

(February 5) Bloomberg.com

- Alibaba Group has agreed to buy a stake in Dalian Wanda Group’s cinema operator as billionaire Wang Jianlin’s real estate-to-entertainment conglomerate turns to another Chinese tech giant and a government-backed company for investments totaling about ¥7.8 billion ($1.2 billion).

- Alibaba is to pay ¥68 billion for a 7.66% stake in Wanda Film, making the e-commerce giant the second-biggest shareholder, Wanda Film said Monday in a regulatory filing. Beijing Cultural Investment Holdings, controlled by the Beijing government, will pay ¥3.12 billion for a 5.11% stake.

How Go-Jek Compares to Other “Super Apps” Like WeChat

(February 7) TechinAsia.com

How Go-Jek Compares to Other “Super Apps” Like WeChat

(February 7) TechinAsia.com

- Asia’s increasingly crowded tech space has spurred the creation of super apps—applications that consolidate versatile, multifunctional features such as chat, social media, mobile payments, games and more. Some of the most notable examples include WeChat, Facebook Messenger and Line. One rising star in the super app space is Indonesian transportation service Go-Jek.

- Go-Jek originally aimed to provide inexpensive motorcycle rides to users. Over time, the company’s offering has evolved to include services and the transportation of people and goods. Indonesians are mobile-first consumers. The vast majority of the country’s Internet traffic originates from mobile devices, and Go-Jek is thriving within this framework.

Baidu’s iQiyi Wants to Become China’s Disney, but It’s Up Against Tough Rivals

(February 7) TechinAsia.com

Baidu’s iQiyi Wants to Become China’s Disney, but It’s Up Against Tough Rivals

(February 7) TechinAsia.com

- US-based streaming services Netflix and Amazon are doubling down on original content to square off against the powerful Disney empire, which wrote the playbook for how to both create and distribute content. In China, a similar trend has emerged. Local players such as iQiyi are racing to become the Middle Kingdom’s version of Disney.

- A unit of Baidu, which is China’s largest search engine, iQiyi is reportedly mulling a US IPO in the first half of 2018. “iQiyi wants to become an online Hollywood, a great business that lasts for hundreds of years, like Disney,” iQiyi founder and CEO Gong Yu said in 2016.

Singapore Airshow Focuses on Drones and Cybersecurity Technology

(February 5) Asia.Nikkei.com

Singapore Airshow Focuses on Drones and Cybersecurity Technology

(February 5) Asia.Nikkei.com

- As the global aviation industry undergoes a major transformation, the Singapore Airshow, the largest of its kind in Asia in terms of exhibitors, opened on Tuesday with plans to showcase innovative drone and cybersecurity technologies.

- China’s Chengdu Aircraft Industry Group will feature two of its unmanned aerial vehicles, including its latest military drone, the Wing Loong II, at the airshow, as the company is looking to expand exports. European aircraft maker Airbus is putting up a life-size mock-up of Skyways, an autonomous parcel delivery drone, which is at an advanced stage of development.

LATAM RETAIL & TECH HEADLINES

Jail Sentences Wanted for Fake News Authors in Brazil

(February 5) ZDNet.com

Jail Sentences Wanted for Fake News Authors in Brazil

(February 5) ZDNet.com

- Ahead of the presidential elections in Brazil this year, a new bill has been proposed that would criminalize the disclosure of fake news, with a focus on content published on the Internet. According to the bill, which was proposed by Senator Ciro Nogueira, spreading false news online or operating hoax-spreading bots should lead to a jail sentence of one to three years.

- It is hoped that the Senate will vote on the bill before election campaigning starts in August. According to Nogueira, “The creation of the new criminal type will contribute to repress[ing] and prevent[ing] the disclosure of fake news.”

São Paulo Toughens Rules for Uber Drivers

(February 2) ZDNet.com

São Paulo Toughens Rules for Uber Drivers

(February 2) ZDNet.com

- Uber drivers operating in the Brazilian city of São Paulo will now have to comply with a series of new requirements to continue working. The new rules issued by the Mayor’s Office include a requirement that drivers complete a 16-hour online course with content similar to instruction for taxi drivers. Uber drivers must also officially register and meet other demands such as adhering to a dress code and posting identification on their cars.

- To help enforce the rules, the administration of São Paulo will have nearly 100 staff spread around the city to perform random checks. São Paulo Mayor João Doria has often talked about his smart city vision. “We aim to make São Paulo a global capital, not a province—and that includes making it a digital city,” Doria said at a financial services technology event last year.

IT Budgets in Brazil to Increase in 2018

(January 31) ZDNet.com

IT Budgets in Brazil to Increase in 2018

(January 31) ZDNet.com

- Investments in private sector technology will continue to increase in Brazil this year, according to new research. Of the 1,500 IT decision makers in medium-sized and large organizations polled by Brazilian analyst firm IT4CIO, 51% said their budgets will increase this year, while 23% said they will decrease.

- The study says that technology budgets are expected to increase by 5% overall in 2018. By comparison, in 2017, IT budgets in Brazil increased by 3.1% overall, slightly above the 2.8% inflation rate that had been projected for the year. According to IT4CIO, this was due to a 2.1% decrease in government IT budgets.

Sporting Goods Retailer Grupo Martí Boosts Business with New Inventory Controls

(February 1) FootwearNews.com

Sporting Goods Retailer Grupo Martí Boosts Business with New Inventory Controls

(February 1) FootwearNews.com

- Mexico-based sporting goods provider Grupo Martí—which operates more than 200 stores spanning seven brands—has tapped Oracle Retail technology to get products in stores faster, according to a spokesperson for Oracle. The result is an enhanced customer experience. Oracle Retail provides Grupo Martí with a single view of inventory and operations, providing the group with an array of new capabilities, the spokesperson said.

- “Martí immediately noticed positive results, due to more efficient processes, control and visibility. Budget optimization, order tracking and vendor communications have all improved,” said Manuel Martín, Grupo Martí’s CEO. “From day one, we experienced an accelerated purchasing process to get the right product into our stores in weeks instead of months.”

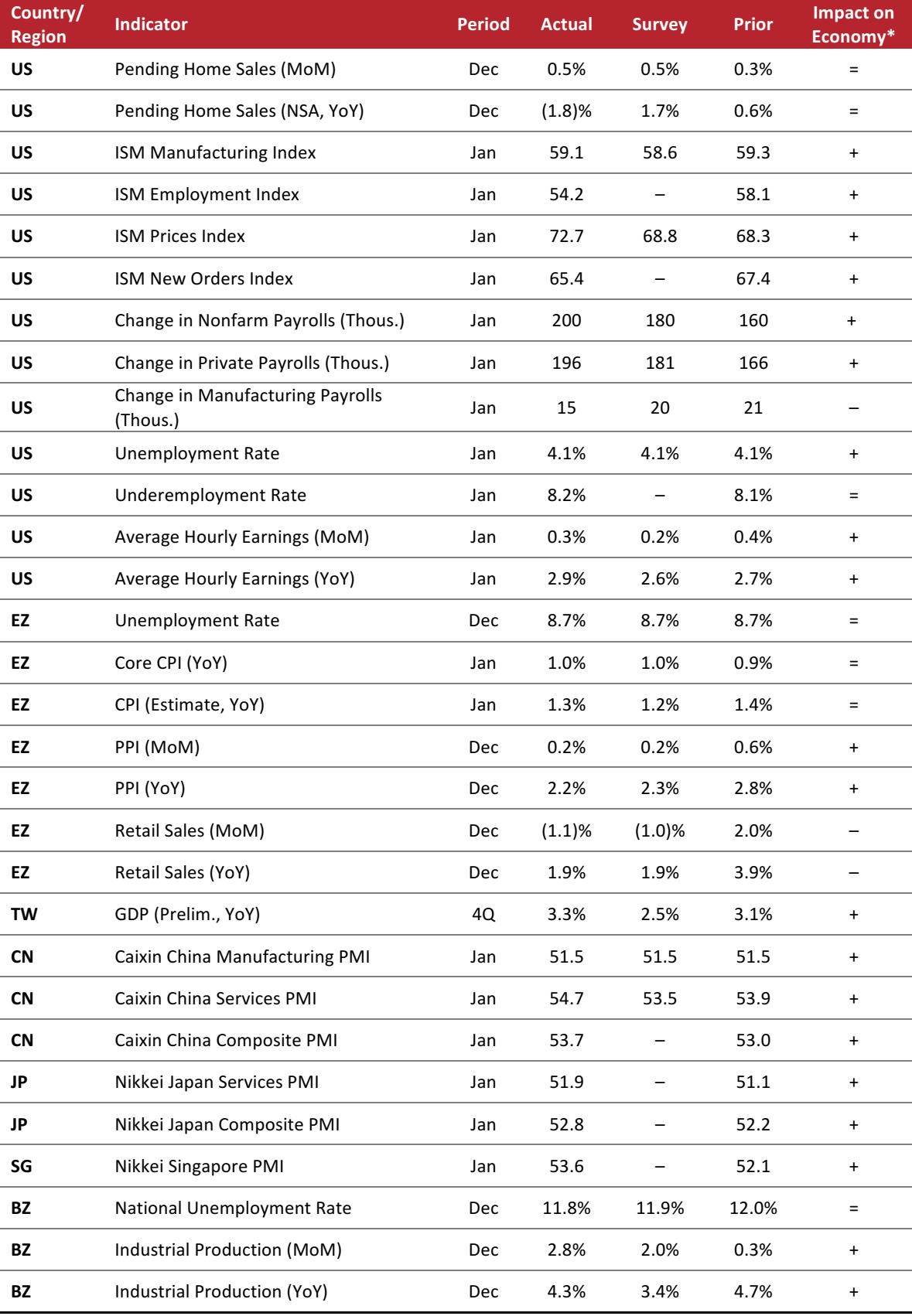

MACRO UPDATE

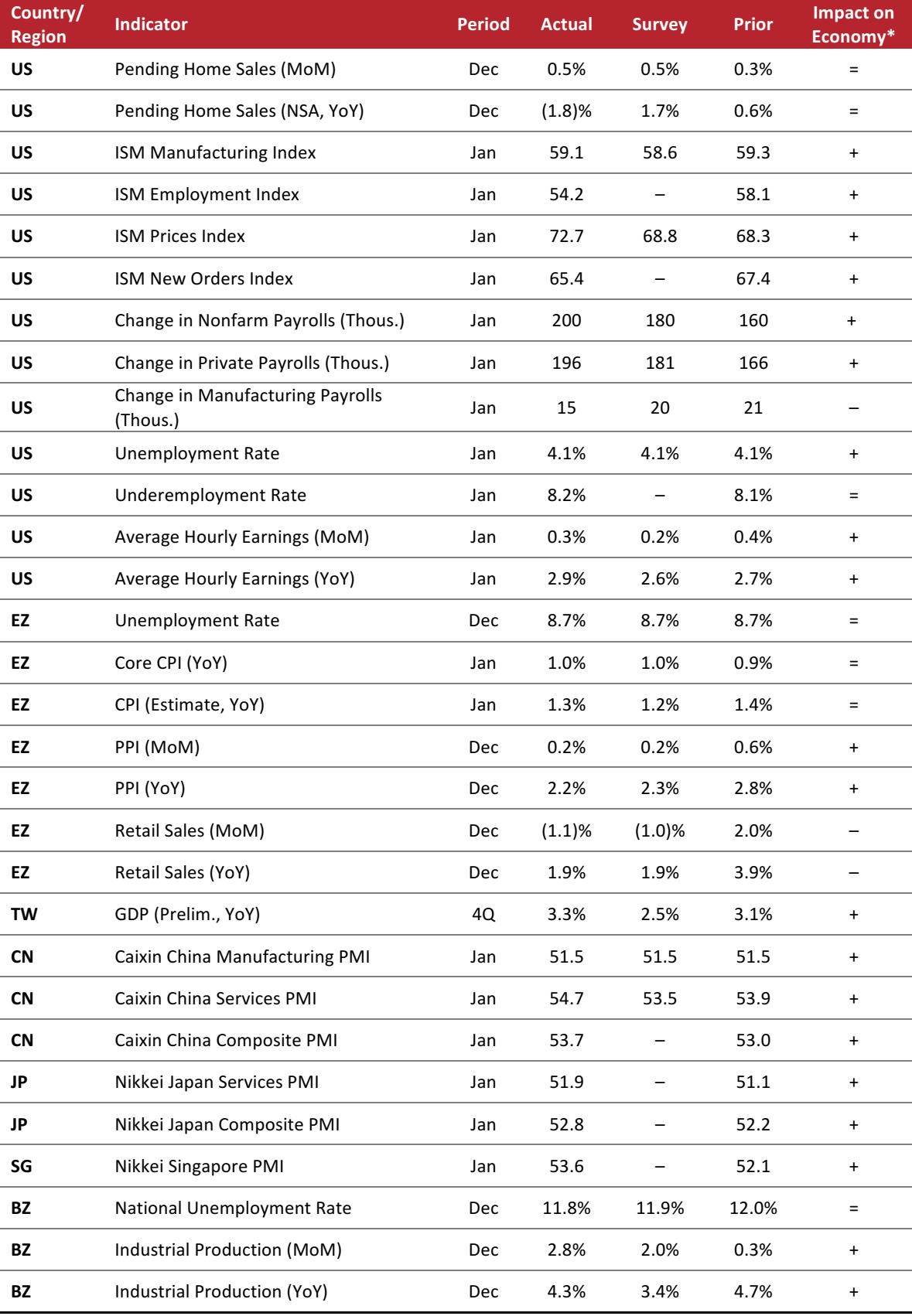

Key points from global macro indicators released January 31–February 7, 2018:

1) US: Home sales edged up by 0.5% month over month in December. The ISM Manufacturing Index stayed above the expansion threshold in January. The ISM Prices Index ticked up to 72.7 in January and labor market data were favorable to the economy, pushing up inflation pressure.

2) Europe: In the eurozone, unemployment stayed at 8.7% in December. The core Consumer Price Index (CPI) in the eurozone edged up by 1.0% year over year in January. The Producer Price Index (PPI) in the eurozone increased by 2.2% year over year in December.

3) Asia-Pacific: In Taiwan, GDP grew by 3.3% year over year in the fourth quarter, exceeding the consensus estimate. In China, Japan and Singapore, Purchasing Managers’ Indexes (PMIs) stayed above the expansion threshold in January, indicating a healthy state of the economy in the region.

4) Latin America: In Brazil, the unemployment rate edged down to 11.8% in December. Industrial production in the country ticked up by 2.8% month over month in December, coming in ahead of the consensus estimate.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/Institute for Supply Management (ISM)/US Bureau of Labor Statistics/Eurostat/Taiwan Directorate-General of Personnel Administration/Markit/Instituto Brasileiro de Geografia e Estatística/FGRT

Morrisons to Launch Own-Brand Clothing Range Online

(February 5) RetailGazette.co.uk

Morrisons to Launch Own-Brand Clothing Range Online

(February 5) RetailGazette.co.uk

H&M to Launch Marketplace for Discounted Fashion and Lifestyle Products

(January 31) Company press release

H&M to Launch Marketplace for Discounted Fashion and Lifestyle Products

(January 31) Company press release

Alibaba Buys Stake in Wanda Film in $1.2 Billion Share Sale

(February 5) Bloomberg.com

Alibaba Buys Stake in Wanda Film in $1.2 Billion Share Sale

(February 5) Bloomberg.com

Baidu’s iQiyi Wants to Become China’s Disney, but It’s Up Against Tough Rivals

(February 7) TechinAsia.com

Baidu’s iQiyi Wants to Become China’s Disney, but It’s Up Against Tough Rivals

(February 7) TechinAsia.com

Jail Sentences Wanted for Fake News Authors in Brazil

(February 5) ZDNet.com

Jail Sentences Wanted for Fake News Authors in Brazil

(February 5) ZDNet.com

São Paulo Toughens Rules for Uber Drivers

(February 2) ZDNet.com

São Paulo Toughens Rules for Uber Drivers

(February 2) ZDNet.com

IT Budgets in Brazil to Increase in 2018

(January 31) ZDNet.com

IT Budgets in Brazil to Increase in 2018

(January 31) ZDNet.com