albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

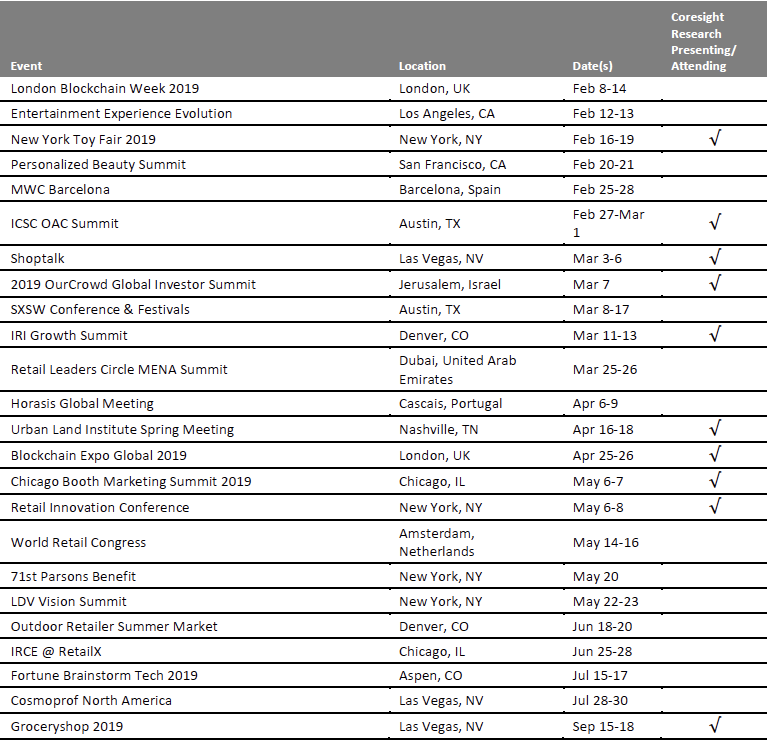

Amazon’s 2018 in Three Charts Late last week, Amazon filed its 10-K full-year financial report. This yearly update gives us a chance to review selected metrics from one of the world’s most-talked-about retailers. International Progress Proved Consistent Amazon’s international performance proved generally stable in 2018, with most major regions reporting revenue growth similar to 2017 levels.- In the U.K., Amazon revenues grew 23.3% in 2018, outperforming the 14.5% growth in total U.K. internet retail sales, according to our analysis of data from the U.K.’s Office for National Statistics. However, Amazon’s figures include non-e-commerce revenues, such as from Amazon Web Services (AWS), the company’s B2B cloud-computing service.

- In Germany, Amazon’s revenue growth slowed as consumer uncertainty triggered by Brexit, international disputes and rising inflation resulted in tepid demand for nonfood categories.

Revenues include nonretail revenues, such as from AWS.

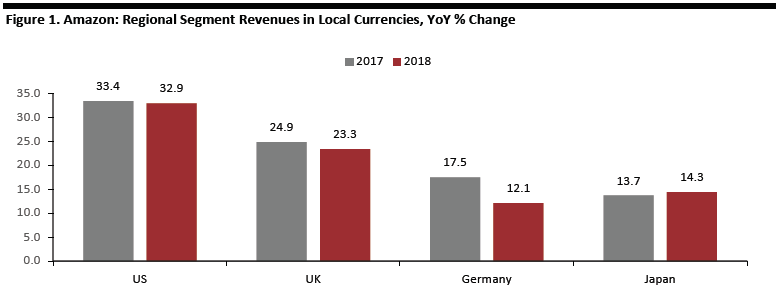

Revenues include nonretail revenues, such as from AWS.Source: Company reports/S&P Capital IQ/Coresight Research[/caption] Non-E-Commerce Segments Drove Growth AWS supported total company growth again in 2018 — a familiar story by now. But, so, too, did other nontraditional segments, namely subscription services, which include Prime as well as digital-content subscriptions, and fees from third-party sellers, including fees for orders completed under the Fulfilled by Amazon program. The “online stores” segment, which comprises first-party sales by Amazon, grew revenues 13.5% year over year. Amazon’s total revenues grew 30.9% in 2018, which means the online stores segment’s contribution to full-year revenues declined from 60.9% in 2017 to 52.8% in 2018. We don’t have enough data to show 2018 year-over-year growth for Amazon’s physical stores, as the company acquired Whole Foods Market only partway through 2017. But, in the final quarter of 2018, sales declined 2.7% year over year at Amazon’s physical stores, which include Amazon Go stores, bookstores and 4-star stores as well as Whole Foods stores. [caption id="attachment_71983" align="aligncenter" width="776"]

Source: Company reports/Coresight Research[/caption]

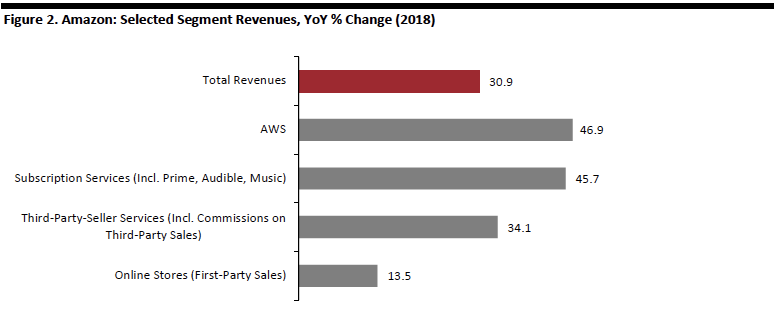

Third-Parties’ Share of Total E-Commerce Sales Plateaued

Finally, 2018 was a year when third-party sales leveled off as a share of total sales on Amazon. As we chart below, the company ended the year with third-party sellers accounting for 52% of unit sales on its sites, the same proportion as reported in the first quarter of 2018 and down from 53% in the second and third quarters.

This marks a distinct shift, as third-party sellers previously showed a consistent trend of capturing more sales on Amazon sites. It also comes despite third-party-seller services outperforming total revenue in terms of annual growth, as highlighted in the graph above. We think part of the reason third-party sales leveled off even though they outperformed total sales is that a greater proportion of sellers signed up for the Fulfilled by Amazon service, which allows Amazon to book a double fee — a commission on the sale and a fee for fulfilling the order.

[caption id="attachment_71984" align="aligncenter" width="778"]

Source: Company reports/Coresight Research[/caption]

Third-Parties’ Share of Total E-Commerce Sales Plateaued

Finally, 2018 was a year when third-party sales leveled off as a share of total sales on Amazon. As we chart below, the company ended the year with third-party sellers accounting for 52% of unit sales on its sites, the same proportion as reported in the first quarter of 2018 and down from 53% in the second and third quarters.

This marks a distinct shift, as third-party sellers previously showed a consistent trend of capturing more sales on Amazon sites. It also comes despite third-party-seller services outperforming total revenue in terms of annual growth, as highlighted in the graph above. We think part of the reason third-party sales leveled off even though they outperformed total sales is that a greater proportion of sellers signed up for the Fulfilled by Amazon service, which allows Amazon to book a double fee — a commission on the sale and a fee for fulfilling the order.

[caption id="attachment_71984" align="aligncenter" width="778"] Excludes the impact of Whole Foods Market

Excludes the impact of Whole Foods MarketSource: Company reports/Coresight Research[/caption] In summary, 2018 was a year when Amazon continued its shift away from its e-commerce roots. AWS grew its share of revenues (and pushed up margins) last year, even as Amazon experienced its first full year as a significant brick-and-mortar retailer.

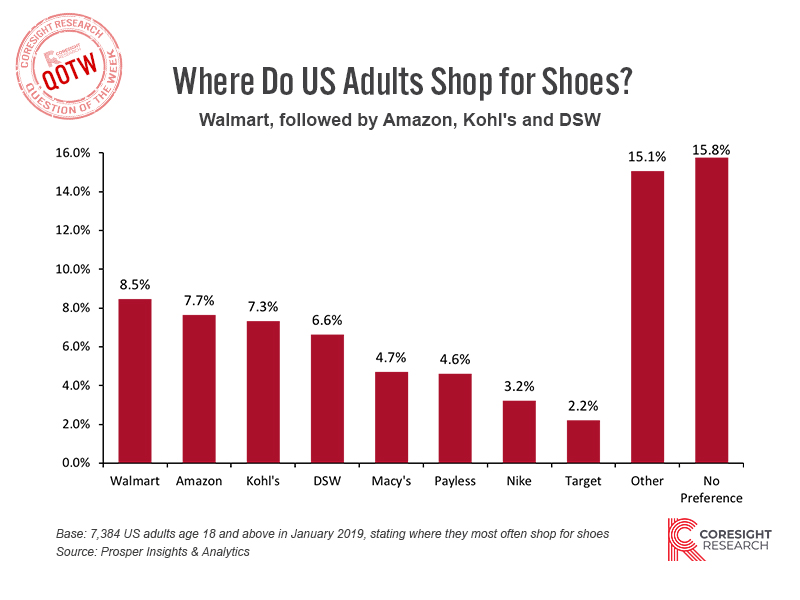

QUESTION OF THE WEEK

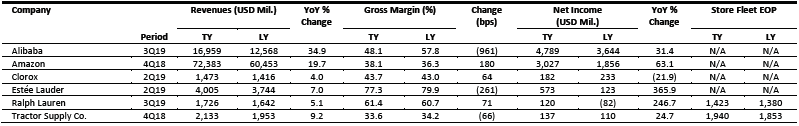

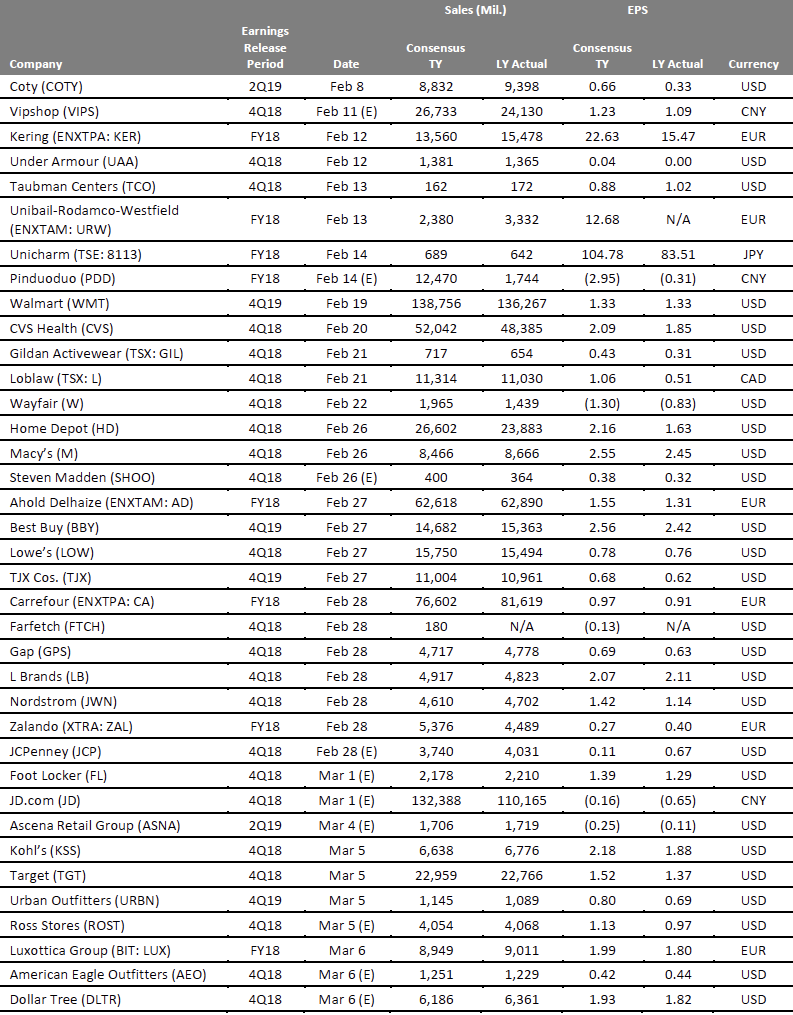

U.S. RETAIL EARNINGS

[caption id="attachment_71987" align="aligncenter" width="799"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

U.S. RETAIL & TECH HEADLINES

- Simon Property Group, the largest mall owner in the U.S., has been grappling with how to deal with an onslaught of store closures from tenants big and small, ranging from Sears to Starbucks’ Teavana. CEO David Simon said in a call with analysts on Feb. 1 that the company was “concerned about a few” retail bankruptcies that may occur in the first quarter, although he did specify any names.

- The real estate investment trust is in a unique position with the Sears bankruptcy, as Simon is also a member of an unsecured creditors committee now arguing Sears can’t be saved.

Amazon and Walmart Face New Threats in India

(Feb. 1) CNN.com

Amazon and Walmart Face New Threats in India

(Feb. 1) CNN.com

- E-commerce restrictions that took effect in India on Feb. 1 will prevent global retailers such as Amazon and Walmart from using their massive scale to drive down prices in the country. The new rules look likely to curb practices like steep discounts.

- The rules state that foreign online retailers can no longer strike deals with companies to offer products that are not available elsewhere. They also prevent e-commerce platforms from selling products distributed by companies in which they have invested.

- Walmart has partnered with licensed sports merchandise seller Fanatics, which has licensing agreements with all the major North American sports leagues.

- The agreement makes Fanatics the exclusive provider of officially licensed sports merchandise on Walmart.com, allowing Walmart to sell hundreds of thousands of licensed products, including apparel and collectibles.

- Visa has renewed its sponsorship agreement with the NFL through the 2025 season, and the company envisions the first cashless Super Bowl happening sometime during the period covered by the agreement.

- This year, 50% of concession stands at the Super Bowl were cashless. The NFL likes the idea because cashless payments provide fans with greater security and convenience.

- FedEx, looking beyond Amazon for growth in e-commerce, is introducing a new late-night shipping option for retailers that want to quickly send orders directly to online customers. The program will offer retailers the option to deliver items the next day when they are purchased online as late as midnight.

- Less than 1.3% of the FedEx’s total revenue comes from Amazon, and the courier company doesn’t expect that to increase. It sees better prospects in helping customers compete against the e-retailing behemoth.

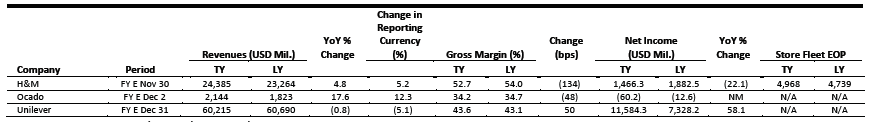

EUROPE RETAIL EARNINGS

[caption id="attachment_71989" align="aligncenter" width="870"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

U.K. Retail Sales Growth Supported by Food and Grocery Sales

(Feb. 5) BRC.org.uk

U.K. Retail Sales Growth Supported by Food and Grocery Sales

(Feb. 5) BRC.org.uk

- U.K. total retail sales grew 2.2% year over year in January, the strongest growth since June, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales increased by 1.8% year over year, driven by strong food sales and price inflation.

- The BRC splits food and nonfood retail sales on a three-month basis. In the three months ended January, total food sales grew 2.4% year over year, while nonfood sales declined 0.4%.

- British retailer Marks & Spencer (M&S) and startup incubator Founders Factory have selected ChargedUp, a mobile phone battery sharing service, as the first participant in their joint accelerator program.

- ChargedUp allows customers to rent a power bank from a vending station and return it to any station across its network after use. There are currently 250 ChargedUp stations in London and the company’s active user base numbers 20,000.

- German supermarket chain Lidl has opened a new £70 million ($90.3 million) regional distribution center in Doncaster, England. The 624,306-square-foot center is the company’s largest distribution center in the U.K. and approximately 3,900 pallets of products are expected to pass through the location daily.

- The warehouse will initially support 53 Lidl stores across South Yorkshire, Lincolnshire and The Midlands.

- London-based fintech startup Bud has raised $20 million in its series A funding round, led by banks that include HSBC, Goldman Sachs, ANZ, Investec (through its INVC fund) and InnoCells. Lord Stanley Fink and 9Yards Capital also participated in the round.

- Bud connects banks’ apps and account data to third-party financial services. The company expects to deploy the funds to double its headcount to 124.

- Dutch supermarket chain Albert Heijn announced plans to open its fifth distribution center dedicated to online orders amid strong growth in its e-commerce business, particularly grocery delivery.

- The new center in Amsterdam will create about 1,000 jobs and process around 40,000 orders weekly.

ASIA RETAIL & TECH HEADLINES

Lazada to Integrate RedMart into Its Platform

(Jan. 31) StraitsTimes.com

Lazada to Integrate RedMart into Its Platform

(Jan. 31) StraitsTimes.com

- Alibaba-owned e-commerce company Lazada announced that it will integrate RedMart, a Singapore-based e-grocer, into its platform on Mar. 15. The move is part of Lazada’s efforts to grow its supermarket business in Southeast Asia. Lazada acquired RedMart in 2016 for an undisclosed sum.

- RedMart will continue to fulfill orders through its own app until midnight on Mar. 14, but users will need to switch to the Lazada app after that.

- Italian sports and fashion brand Fila announced plans to open around 100 stores in India over the next five years as it seeks to strengthen its presence in the country, where consumer preferences are shifting toward athleisure clothing.

- The retailer expects most of the new stores to be company-owned, but is also seeking franchise partners. Fila expects sales in India to increase more than 50% by the end of the company’s current fiscal year.

- Philippine retail chain Puregold will open 25 stores in the country this year to expand its national reach. Parent company Puregold Price Club also plans to open four more S&R Membership warehouse stores.

- John Marson Hao, Puregold’s VP for Investor Relations, said the company will use proceeds from the PHP 4.69 billion ($89.5 million) funding that it recently raised through a public offering to construct the new stores.

- Singapore-headquartered grocery delivery startup Honestbee gained approval from the government for its retail offering inside a designated industrial building. In October 2018, the company launched a tech-enabled grocery and dining concept called Habitat in an industrial building. Honestbee is still testing the concept, but plans to launch it in the seven other Asian markets in which it operates.

- The approval signals the government’s flexibility in dealing with new business models. “With support from Enterprise Singapore, we allowed ancillary retail uses for Honestbee to pilot new technologies and innovation for their business in an industrial premise,” said a spokesperson for the Urban Redevelopment Authority.

Shinsegae Launches Independent Store for New Cosmetics Brand

(Jan. 31) RetailinAsia.com

Shinsegae Launches Independent Store for New Cosmetics Brand

(Jan. 31) RetailinAsia.com

- South Korean travel retailer Shinsegae Group has opened an independent store for its Yunjac herb-based skincare brand. Shinsegae developed the brand in-house and launched it in October 2018. The new store is located in Shinsegae’s duty-free outlet in Seoul’s Myeong-dong shopping area.

- “The Myeong-dong store is a trendy shopping place where you can easily experience the world’s most popular brands. The line is targeting the global market, including China,” said a Shinsegae spokesperson.

LATAM RETAIL & TECH HEADLINES

- Walmart de Mexico’s bid to acquire Costa Rican supermarket chain Grupo Empresarial de Supermercados has been rejected by Costa Rica’s competition regulator, which said the acquisition could give the retailer enough market power to alter prices, exclude competitors or affect suppliers.

- Walmex operates 252 stores in the country. Had its acquisition bid gone through, it would have taken its store tally in Costa Rica to over 300.

Inditex Opens Fourth Zara Home Store in Chile

(Feb. 5) Modaes.es

Inditex Opens Fourth Zara Home Store in Chile

(Feb. 5) Modaes.es

- Spanish multinational retailer Inditex has opened a new Zara Home store in Chile, taking its store count in the country to four. The new store is located in Mall Marina Arauco in the town of Viña del Mar.

- The retailer last opened a Zara Home store in Chile at the end of 2017, in Santiago. Inditex operates a number of other retail banners, but has opened only Zara Home and Zara stores in Chile to date.

Colloky Partners with Cornershop, Plans Two Store Openings in Peru

(Feb. 4) America-Retail.com

Colloky Partners with Cornershop, Plans Two Store Openings in Peru

(Feb. 4) America-Retail.com

- In an effort to improve its last-mile delivery capabilities, Chilean children’s footwear retailer Colloky has partnered with grocery delivery app Cornershop. The retailer is focused on enhancing its online channel and improving delivery times.

- Colloky also plans to launch two new stores in Peru, where it already has 14 locations. In addition, the company plans to open three stores in its home market of Chile and to enter a new international market in the near future.

El Palacio de Hierro Relaunches Prada’s “Made to Order” Service for Limited Period

(Feb. 4) Mx.FashionNetwork.com

El Palacio de Hierro Relaunches Prada’s “Made to Order” Service for Limited Period

(Feb. 4) Mx.FashionNetwork.com

- Upscale Mexican department store El Palacio de Hierro has partnered with Italian luxury fashion brand Prada to relaunch Prada’s “Made to Order” personalized service, which enables customers to create their own custom footwear, choosing colors, materials and heel height.

- The service will be available to customers until Feb. 14 at the Palacio de Hierro Polanco store in Mexico City.

- As of Feb. 3, Chilean multinational retailer Cencosud will no longer use plastic bags for delivery.

- The move is in line with the company’s sustainability strategy and follows the Chilean government’s August 2018 announcement that it would ban widespread commercial use of plastics bags. The government gave businesses a six-month grace period to adjust to the ban.

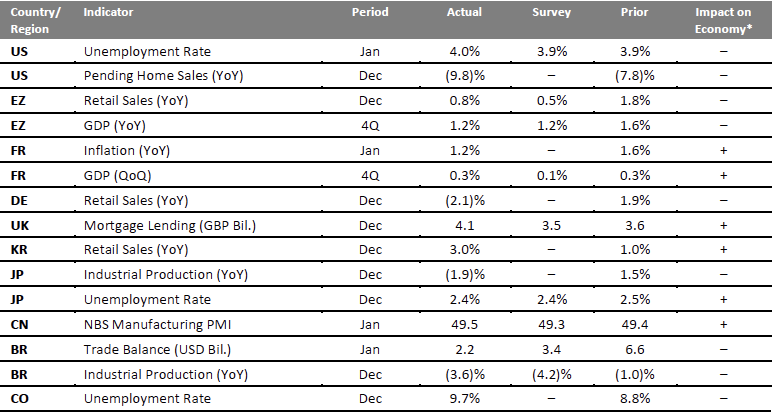

MACRO UPDATE

Key points from global macro indicators released Jan. 30-Feb. 5, 2019:- U.S.: The U.S. unemployment rate rose to 4.0% in January from 3.9% in December, slightly above the consensus estimate of 3.9%. U.S. pending home sales fell 9.8% year over year in December, following an upwardly revised 7.8% decline in November.

- Europe: In the eurozone, retail sales increased 0.8% in December, compared with 1.8% growth in November and the consensus estimate of 0.5%. Annual inflation in France eased to 1.2% in January from 1.6% in December. In Germany, retail sales fell 2.1% year over year in December after growing by an upwardly revised 1.9% in November.

- Asia Pacific: In South Korea, retail sales grew 3.0% year over year in December, following growth of 1.0% in November. In Japan, industrial production fell 1.9% year over year in December, contrasting with November’s 1.5% growth.

- Latin America: Brazil’s trade surplus narrowed to $2.2 billion in January from $6.6 billion in December, missing the consensus estimate of $3.4 billion. Industrial production in Brazil shrank 3.6% year over year in December, following a 1.0% decline in November and versus the consensus estimate of a 4.2% decline.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: U.S. Bureau of Labor Statistics/National Association of Realtors/Eurostat/National Institute of Statistics and Economic Studies (France)/Federal Statistical Office (Germany)/Office for National Statistics (U.K.)/Statistics Korea/Ministry of Internal Affairs and Communications (Japan)/Ministry of Economy, Trade and Industry (Japan)/National Bureau of Statistics of China/Brazilian Institute of Geography and Statistics/National Administrative Department of Statistics (Colombia)/Coresight Research[/caption]

EARNINGS CALENDAR

EVENT CALENDAR