From the Desk of Deborah Weinswig

It’s All About India as Amazon, Walmart and Alibaba Go Head to Head

The Amazon-Walmart-Alibaba battle is no longer focused on China. Now, it’s all about India as these three firms go head to head in the second-most-populous country on earth. In just the past week, Amazon has become the first foreign e-commerce firm to launch a food retail operation in India and reports have come out that Walmart is in talks to acquire 40% of Indian e-commerce giant Flipkart. In addition, over the past year, Alibaba has made significant investments in Indian firms specializing in e-commerce, online grocery and logistics.

Retail giants are now racing to build out their Indian interests, supported by a liberalization of ownership rules. For a long time, restrictions on foreign direct investment (FDI) stymied global retailers’ ventures into India: since 2012, foreign retailers have been allowed to own only up to 51% of multibrand retail operations, such as department stores and supermarkets, in India. In 2016, however, the Indian government indicated that it would allow 100% FDI in food-only retail as long as the food is produced and packaged in India.

Amazon

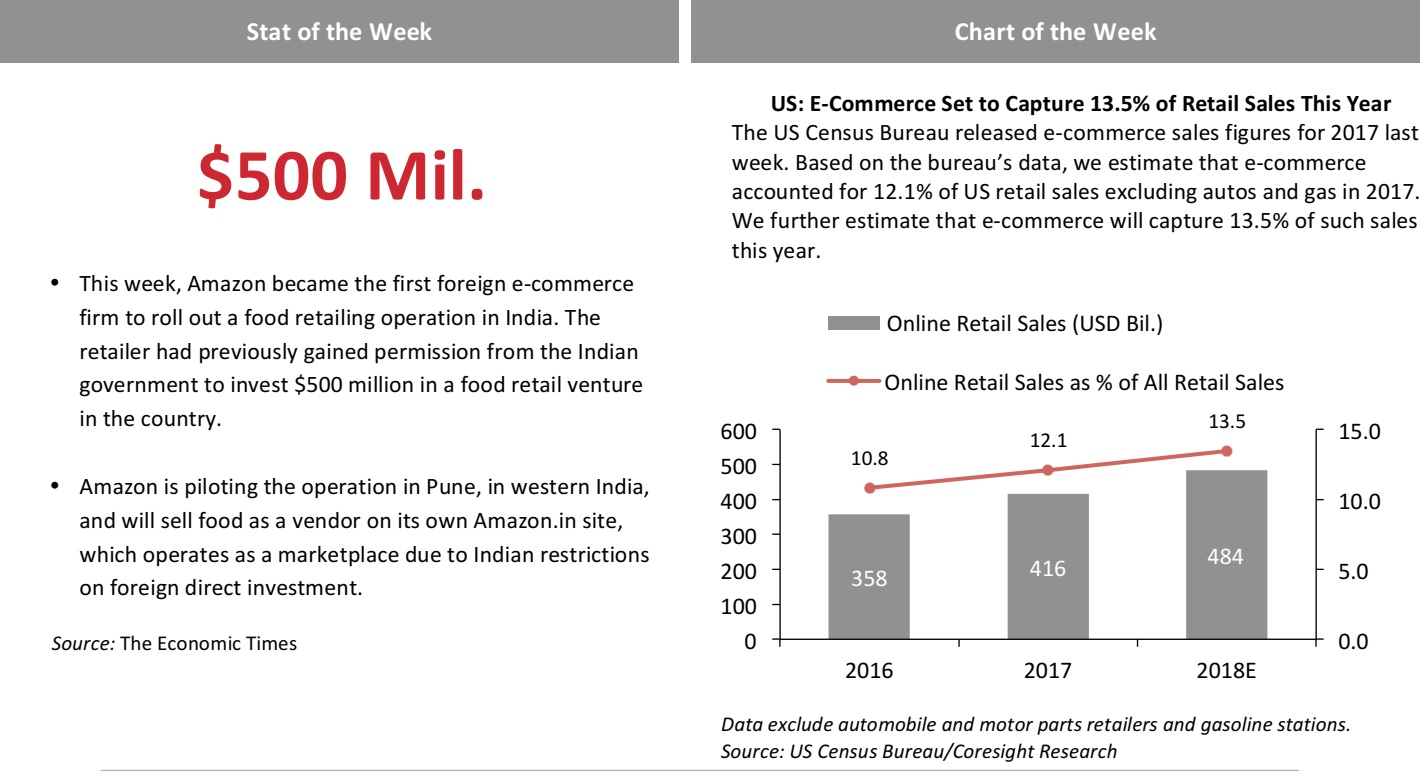

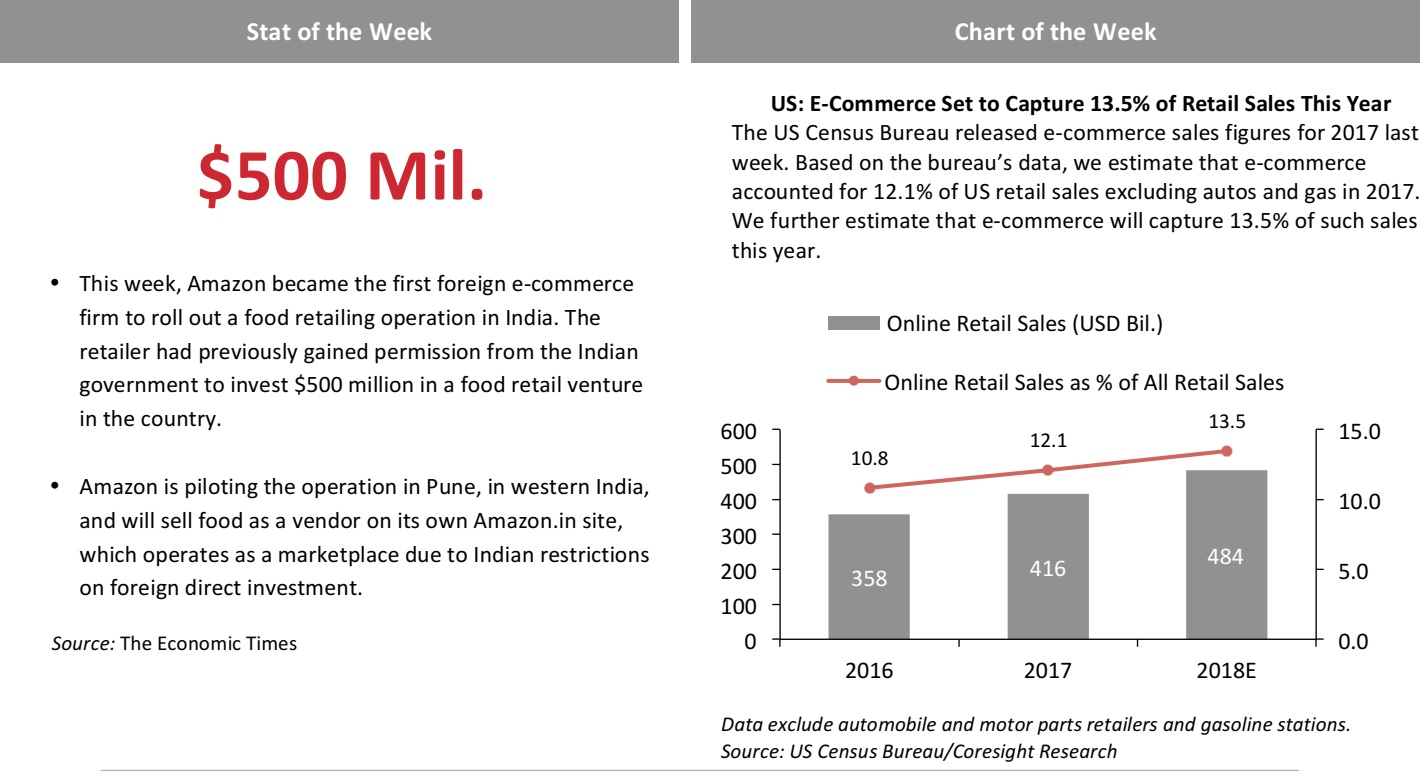

While Amazon operates as a retailer elsewhere in the world, FDI restrictions in India forced the company to operate its Amazon.in site as a pure marketplace of third-party sellers. However, India’s recent liberalization of FDI rules in food retailing has allowed Amazon to launch its new, solely owned, food retail venture in the country. This month, Amazon launched a pilot in Pune, in western India, under which it will sell food products on its own Amazon.in marketplace.

This is the latest step in Amazon’s effort to build share in the high-growth Indian market. Last July, the company

launched its Prime Day promotions to Indian shoppers for the first time, and it has steadily built out a network of distribution centers in India: in February 2018, research firm MWPVL recorded that Amazon had 41 fulfillment centers, 25 sortation centers and 150 smaller delivery stations in the country. Amazon India reported a 66% increase in gross merchandise volume (GMV) for the six months ended September 30, 2017.

Walmart/Flipkart

Flipkart is the undisputed homegrown leader in Indian e-commerce—although the company and Amazon dispute which of them is the largest e-commerce player overall. If Walmart were to purchase 40% of Flipkart, it would value the latter at $12 billion, according to Reuters, which broke the news. Morgan Stanley had valued Flipkart at $5.6 billion in November 2016, down from a peak valuation of $15.2 billion in 2015.

Flipkart has evolved its business model over time. It launched with a consignment format, which meant that it procured stock on demand based on the orders it received, but it later became a conventional retailer, holding its own inventory. Now, Flipkart operates as a marketplace and it does not own the inventory sold on its platform. The privately owned firm reported a 43% increase in GMV in the six months ended September 30, 2017, according to a LiveMint.com report.

Alibaba

Across 2017 and the early part of this year, Alibaba Group made a number of investments in the Indian market. In February 2017 and again in October, it increased its stake in marketplace Paytm Mall. In December 2017, it became the biggest investor in online grocery retailer BigBasket via a $146 million investment—meaning that Alibaba and Amazon will now be competing head to head in India’s online grocery sector. And in January 2018, Alibaba invested $100 million in logistics firm XpressBees, according to

The Economic Times.

The competition between Amazon, Walmart and Alibaba will make India one of the most fought-over of the developing e-commerce markets. The e-commerce situation is different in China. There, Alibaba and JD.com dominate the channel, Walmart’s e-commerce operations are now closely tied to JD.com, and Amazon is a minnow with just a 1% share of the country’s Internet sales in 2017, per Euromonitor International.

There remains plenty to fight over in India.

E-commerce accounted for 5% of Indian retail sales in 2015, equivalent to $30 billion, according to the India Brand Equity Foundation, but the organization expects that share to grow to 12% in 2020, quadrupling in absolute terms to $120 billion.

- Readers can find an abundance of reports on Indian retail and technology on our website, and we will continue to cover developments in this market.

US RETAIL & TECH HEADLINES

Albertsons to Buy Rite Aid in Deal that Could Remake US Retail and Healthcare Industries

(February 21) ChicagoTribune.com

Albertsons to Buy Rite Aid in Deal that Could Remake US Retail and Healthcare Industries

(February 21) ChicagoTribune.com

- Grocer Albertsons will buy drugstore chain Rite Aid in a deal that would accelerate the remaking of the US retail and healthcare industries.

- The combined entity will have about 4,900 stores, including 4,350 pharmacy locations, in 38 states, the companies said in a statement. The Albertsons pharmacies will be rebranded under the Rite Aid name. The companies have a combined value of around $24 billion, including debt.

Walmart Hits with Grocery, Misses Big Online

(February 21) Pymnts.com

Walmart Hits with Grocery, Misses Big Online

(February 21) Pymnts.com

- After three consecutive quarters of e-commerce growth that was north of 50%, Walmart’s digital sales grew by less than half of that last quarter—and investors were less than thrilled. That was on top of news that Walmart’s increased profit-margin pressure was pushing an annual revenue estimate for 2018 that missed investor expectations.

- Despite the concern, CEO Doug McMillon told analysts he remains confident that the company’s 2018 digital sales performance will be on par with its 2017 performance. According to Walmart’s official figures, e-commerce growth averaged 44% for 2017.

An Unexpected Retailer Is Surging to Be More Popular than H&M, Kohl’s and Macy’s

(February 20) BusinessInsider.com

An Unexpected Retailer Is Surging to Be More Popular than H&M, Kohl’s and Macy’s

(February 20) BusinessInsider.com

- Lane Bryant has won over the hearts of American shoppers. The plus-size store, which is owned by Ascena Retail Group, placed second on a list of Americans’ favorite premium fashion stores, gaining seven percentage points of favorability over the year prior.

- Lane Bryant was second only to Nordstrom, which survey respondents voted their favorite for the sixth year running. Those surveyed praised Lane Bryant for its customer service, store atmosphere and checkout speed as well as the ease with which shoppers were able to find the correct sizes.

US Retail Sales in the Doldrums as Consumers Cut Back

(February 20) GlobalCosmeticsNews.com

US Retail Sales in the Doldrums as Consumers Cut Back

(February 20) GlobalCosmeticsNews.com

- The US Commerce Department recorded a 0.3% month-over-month drop in US retail sales for the first month of the year, contrasted with expectations of a 0.2% rise. Data for December 2017 were also revised, from a 0.4% rise to flat versus the previous period.

- Excluding automobiles, gas, building materials and food services, retail sales were flat. Declines were seen across consumer spending categories, including furniture and health and personal care.

January’s Lousy Retail Sales Are “Poppycock”: Former Hudson’s Bay CEO

(February 15) CNBC.com

January’s Lousy Retail Sales Are “Poppycock”: Former Hudson’s Bay CEO

(February 15) CNBC.com

- Retail sales declined in January, but former Hudson’s Bay Company CEO Jerry Storch said that that was to be expected. A better metric, he said, is comparing year-over-year retail sales, which were up 3.6%.

- Meanwhile, retailers will benefit from modest inflation, Storch said, with price hikes that can quickly be passed on to consumers.

EUROPE RETAIL & TECH HEADLINES

Sir Philip Green Denies Sale Reports

(February 19) Company press release and TheTimes.co.uk

Sir Philip Green Denies Sale Reports

(February 19) Company press release and TheTimes.co.uk

- Sir Philip Green on Monday issued a denial of a report in The Sunday Times that he was planning to sell all or part of the Arcadia Group. The newspaper had reported that the billionaire owner was believed to be in talks with Shandong Ruyi, a Chinese textiles giant that has been rapidly expanding into European fashion.

- Green and the Arcadia board stated, “Neither Sir Philip nor any of the directors of Arcadia have ever met or had any contact with Shandong Ruyi,” and attributed the report to a “personal vendetta” by journalist Oliver Shah. Arcadia added, “[F]or the avoidance of doubt, the group is not in discussions with any party regarding a partial or total disposal.”

N Brown Announces that Tesco’s Matt Davies Will Be Company’s New Chairman

(February 19) Company press release

N Brown Announces that Tesco’s Matt Davies Will Be Company’s New Chairman

(February 19) Company press release

- British apparel group N Brown announced that Tesco’s UK boss, Matt Davies, will become chairman of N Brown on May 1. He will succeed Andrew Higginson, who will retire from the board on the same date.

- Tesco had already announced that Davies would step down after its deal to acquire wholesaler Booker closes.

Groupe Casino Acquires Footwear Pure Play Sarenza

(February 19) Company press release

Groupe Casino Acquires Footwear Pure Play Sarenza

(February 19) Company press release

- France’s Group Casino announced on Monday that its Monoprix banner was in exclusive negotiations to acquire online footwear retailer Sarenza. Casino said that the acquisition is part of the digitalization strategy of Monoprix. The retailer had already agreed to a tie-up with the UK’s Ocado Group to launch online grocery deliveries.

- Jean-Charles Naouri, Chairman and CEO of Groupe Casino, said, “By acquiring Sarenza and its expertise, Casino Group will consolidate its position as French leader in urban online retail.”

Dunelm Disappoints in First Half

(February 20) Company press release

Dunelm Disappoints in First Half

(February 20) Company press release

- Shares in UK furniture retailer Dunelm slumped on Tuesday morning after the company revealed margin pressures and lower profits in the first half of its fiscal 2018 year. Underlying pretax profit fell by 8.0% and came in below expectations.

- Gross margin declined by 180 basis points year over year, which the company attributed to the “mix effects” of the acquired Worldstores banner and a higher proportion of end-of-season and seasonal products. The weak bottom-line performance was in spite of total sales growth of 18.4% and comparable sales growth of 6.0%. The company also announced that CFO Keith Down will step down on June 15.

Chanel Buys Stake in Farfetch, but Will Not Sell on the Platform

(February 19) Reuters.com

Chanel Buys Stake in Farfetch, but Will Not Sell on the Platform

(February 19) Reuters.com

- Chanel has taken a minority stake in London-based luxury platform Farfetch as part of a tie-up to develop digital services to connect Chanel’s clients with store assistants. Under the deal, Chanel will not sell its products through Farfetch, but will work with the platform on digital innovations linked to customer services, said Bruno Pavlovsky, Chanel’s fashion president.

- Digital innovations could include smartphone apps that allow people to flag their preferences and sizes before they enter a store, enabling store assistants to assist them better, Pavlovsky told Reuters

ASIA RETAIL & TECH HEADLINES

Google’s Tez Payments App Now Lets Users Handle Their Utility Bills and More

(February 19) TechCrunch.com

Google’s Tez Payments App Now Lets Users Handle Their Utility Bills and More

(February 19) TechCrunch.com

- Google’s Tez payment service in India has gotten a major update that allows users to pay their utilities and other bills via the app. The service was launched last September for iOS and Android and it initially allowed for payments between bank accounts using India’s unified payments interface protocol. Now, the app supports bill payments to more than 80 organizations—including national and state electric, gas and water utilities and TV and Internet services—with more to come soon.

- In the case of recurring bills, the app notifies the user when a new payment is due and fetches the bill. The app also lists previously paid bills and supports multiple accounts. “We’ve designed bill payments to be the most convenient way to manage life’s expenses, so you can pay right from your bank account in just a few taps. We can’t wait for you to try it out and see how much time you save,” Google wrote in a blog post.

India’s Zoomcar Raises $40 Million, Led by Automotive Giant Mahindra & Mahindra

(February 16) TechCrunch.com

India’s Zoomcar Raises $40 Million, Led by Automotive Giant Mahindra & Mahindra

(February 16) TechCrunch.com

- India’s Zoomcar, which operates an on-demand car rental service, has raised a $40 million series C round of funding led by Mahindra & Mahindra, a 70-year-old Indian corporation that specializes in the automotive sector. Ford and other existing investors also took part in the round, Zoomcar confirmed. CEO and Cofounder Greg Moran added that the round is still open and may be extended.

- The deal values Zoomcar at around $170 million, according to Mahindra & Mahindra, which confirmed it has bought a 16% share in the startup for approximately $27.5 million. As it stands, the new capital takes Zoomcar to around $100 million from investors to date, according to Crunchbase. Its last round was a $24 million series C round in 2016, which was led by Ford and included an undisclosed investment from China’s Cyber Carrier that was added later that year.

How Eduardo Saverin’s New $360 Million Fund Addresses the Series B Gap

(February 16) TechinAsia.com

How Eduardo Saverin’s New $360 Million Fund Addresses the Series B Gap

(February 16) TechinAsia.com

- Venture capital firm B Capital Group announced last week that it completed the closing of its first fund, raising $360 million. The firm, cofounded by investor and Facebook cofounder Eduardo Saverin and investor Raj Ganguly, initially targeted a fund size of $250 million. B Capital is addressing the growth stage of tech companies related to financial services, healthcare, transportation, industrial goods and consumer enablement.

- The firm has long talked about bridging the “series B gap,” one of the major hurdles to growth for local startups. After 11 investments, and with three or four more set to be announced in coming weeks, the firm feels it has gained more clarity in terms of the companies it wants to back.

Toyota Readies Cheaper Electric Motor by Halving Rare Earth Use

(February 20) Bloomberg.com

Toyota Readies Cheaper Electric Motor by Halving Rare Earth Use

(February 20) Bloomberg.com

- Toyota Motor is readying electric motors that include as much as 50% less in rare earths amid concern of a supply crunch as automakers race to expand their electric vehicle lineups. Asia’s biggest carmaker has developed a magnet for the motors that as much as halves the use of a rare earth called neodymium and eliminates the use of others called terbium and dysprosium.

- In their place, Toyota will use the rare earths lanthanum and cerium, which cost 20 times less than neodymium. The carmaker plans to ask suppliers to manufacture the magnets. By 2030, Toyota aims to sell 5.5 million electrified vehicles, including 1 million wholly battery-powered or hydrogen-powered cars, accounting for half of its projected deliveries. Motors with the magnets can be used in any electrified powertrain.

LATAM RETAIL & TECH HEADLINES

Oracle Hires Former Salesforce Brazil Head

(February 19) ZDNet.com

Oracle Hires Former Salesforce Brazil Head

(February 19) ZDNet.com

- Former Salesforce Brazil head Mauricio Prado was hired by Oracle as Vice President for Business Applications. In his new role, Prado will be competing with his old employer in the market for customer relationship management systems as well as with SAP and Microsoft in enterprise resource planning applications.

- Prado left Salesforce in December. At the time, local reports cited internal sources as saying that his departure was linked to a fancy dress competition held as part of the company’s holiday festivities. The winning employee wore a costume deemed offensive, which prompted the dismissal of Prado and two other staff members.

Brazil Makes Progress on IPv6 Adoption

(February 16) ZDNet.com

Brazil Makes Progress on IPv6 Adoption

(February 16) ZDNet.com

- According to data released by Google, Brazil is making progress in the adoption of IPv6, the next-generation protocol for Internet networking. Google says that 23.6% of Brazilian Internet users now access the Internet through the new addressing protocol.

- As well as solving the issue of IPv4 address exhaustion, IPv6 adds a number of additional features in areas such as mobility, auto-configuration and overall extensibility, supporting a much wider range of devices that can be directly connected to the Internet. Back in 2015, Anatel, the Brazilian national telecom agency, announced that Internet operators would have to provide IPv6 addresses to consumers as part of a set of initiatives to move faster to the new standard.

Brazilian IT Market Gathers Momentum in 2018

(February 15) ZDNet.com

Brazilian IT Market Gathers Momentum in 2018

(February 15) ZDNet.com

- The end of the recession appears to be on the horizon for the Brazilian IT market, as research firm IDC predicts that growth in the sector could reach 5.8% in 2018. Brazil will choose its next president in October, but technology decision makers are investing again even amid the usual uncertainties of an electoral year, driven by pressure to digitally transform their businesses.

- “Last year, we warned that it was no longer possible to postpone transformation and innovation projects and, now, with a calmer and more predictable economic scenario, we are stressing not only Brazil’s need but also the urgency to resume its investments in technology,” said IDC Brazil’s country manager, Denis Arcieri.

Mexico’s Walmex Posts Fourth-Quarter Growth Despite High Inflation

(February 16) Reuters.com

Mexico’s Walmex Posts Fourth-Quarter Growth Despite High Inflation

(February 16) Reuters.com

- Mexico’s biggest retailer, Walmex, reported fourth-quarter net profit and sales growth despite rising inflation in Mexico last year that crimped consumer spending. The company said its fourth-quarter net profit rose by 1.7% year over year, boosted by same-store sales across Mexico and Central America.

- Its net profit of MXN 10.6 billion ($538 million) was exactly in line with analysts’ expectations, according to a Reuters poll. Quarterly revenue rose by 6.8% from a year earlier, to reach MXN 168.2 billion. Walmex CEO Guilherme Loureiro said that the company had grown in 2017 despite economic headwinds, natural disasters and temporary store closures in Mexico due to protests over gasoline prices.

MACRO UPDATE

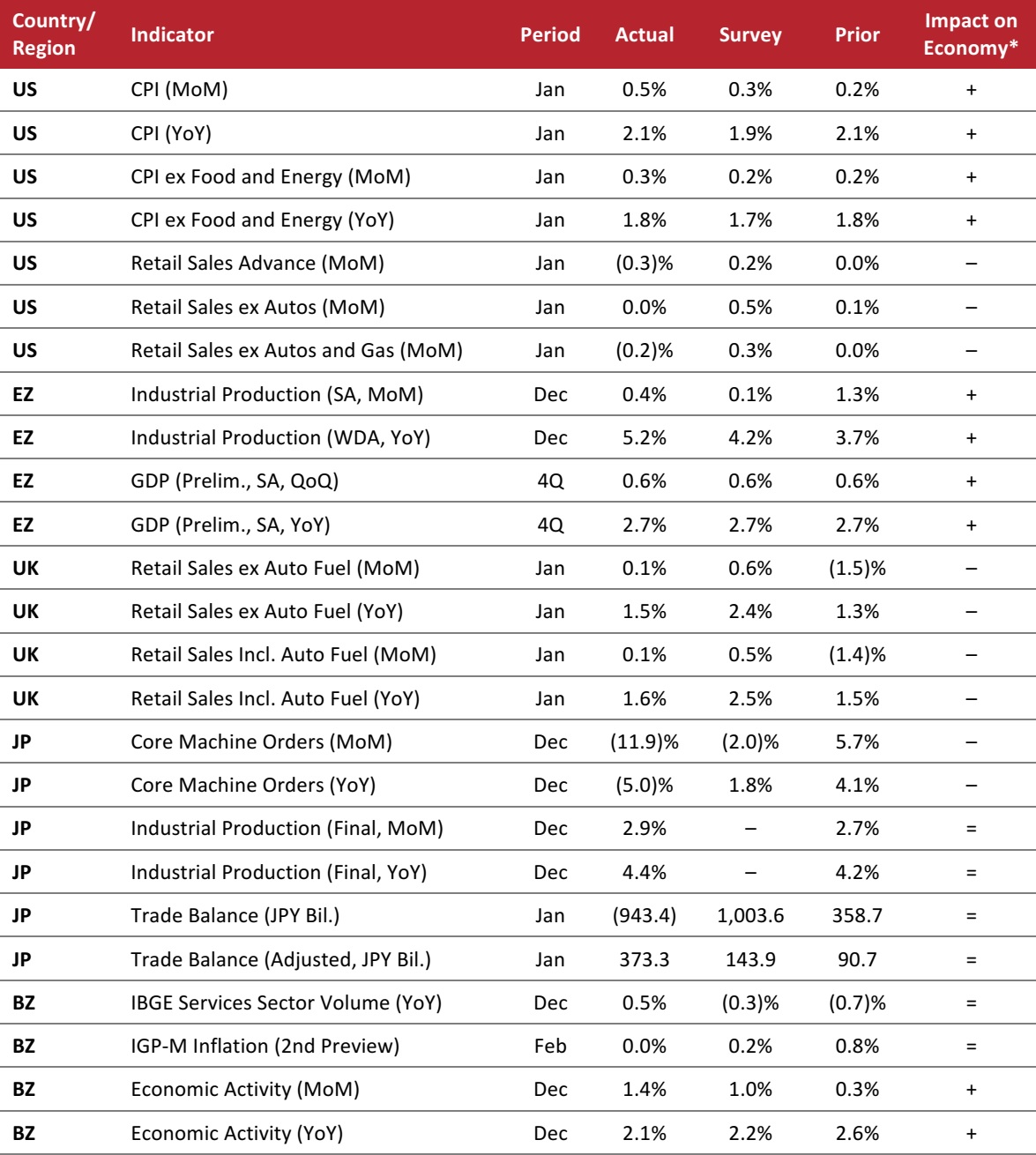

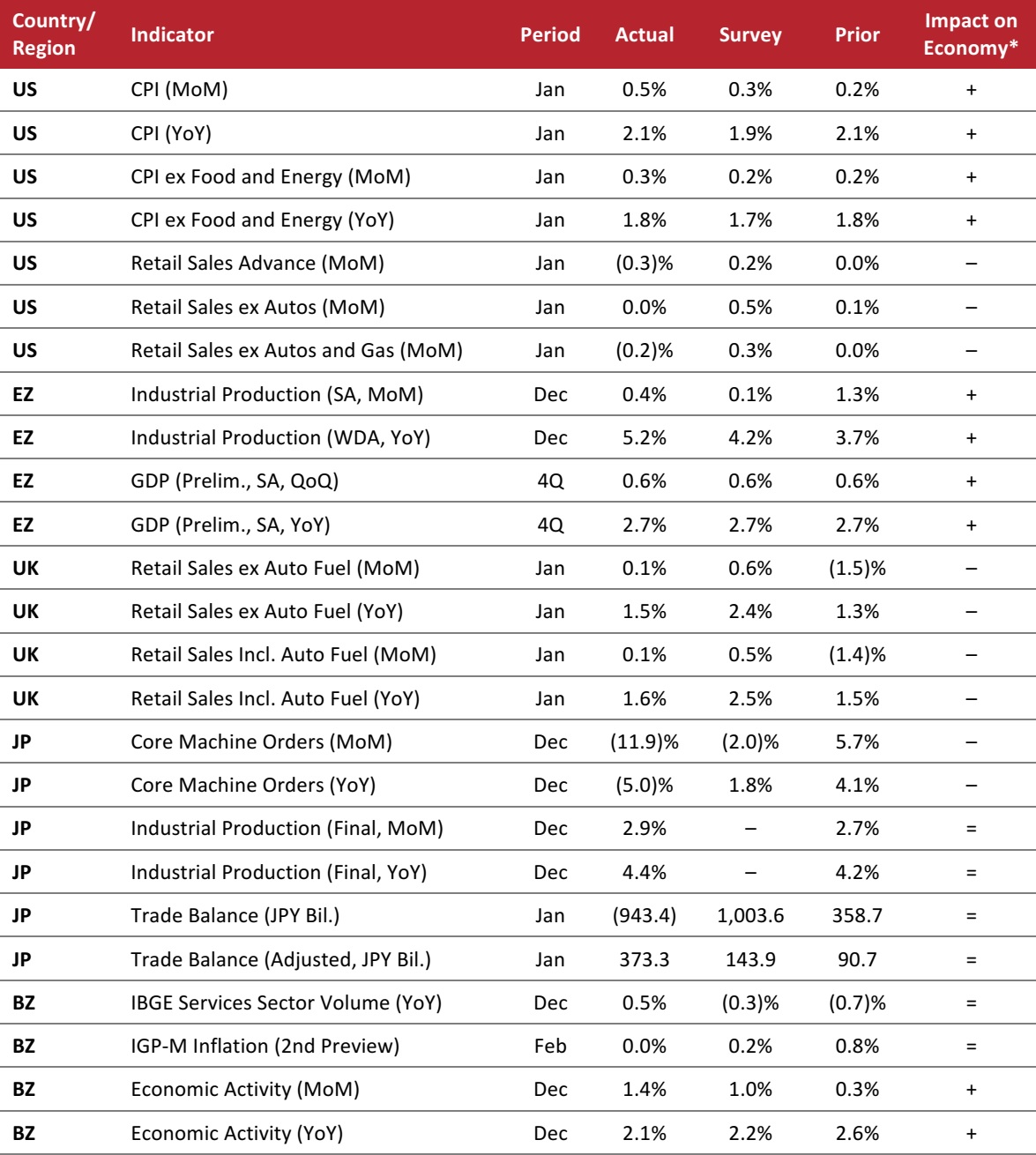

Key points from global macro indicators released February 14–21, 2018:

- US: The Consumer Price Index (CPI) increased by 2.1% year over year in January, rising by more than the consensus estimate of 1.9%. The CPI excluding food and energy prices increased by 1.8% year over year in January. Retail sales decreased by 0.3% month over month in January, coming in below the market’s expectation of a 0.2% increase.

- Europe: In the eurozone, industrial production increased by 0.4% month over month in December. Eurozone GDP in the fourth quarter increased by 0.6% quarter over quarter. In the UK, retail sales excluding auto fuel increased by 0.1% month over month in January and by 1.5% year over year, missing the consensus estimate for both periods.

- Asia-Pacific: In Japan, core machine orders fell by 11.9% month over month and by 5.0% year over year in December. Industrial production in Japan increased by 2.9% month over month in December.

- Latin America: In Brazil, the IBGE Services Sector Volume gauge increased by 0.5% year over year in December. Economic activity in Brazil increased by 1.4% month over month in December, exceeding the consensus estimate. Economic activity in the country increased by 2.1% year over year in December, just missing analysts’ expectations.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/University of Michigan/Eurostat/UK Office for National Statistics/Economic and Social Research Institute/Japan Ministry of Economy, Trade and Industry/Ministry of Finance Japan/Instituto Brasileiro de Geografia e Estatística/Fundação Getulio Vargas/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/University of Michigan/Eurostat/UK Office for National Statistics/Economic and Social Research Institute/Japan Ministry of Economy, Trade and Industry/Ministry of Finance Japan/Instituto Brasileiro de Geografia e Estatística/Fundação Getulio Vargas/Banco Central do Brasil/Coresight Research

N Brown Announces that Tesco’s Matt Davies Will Be Company’s New Chairman

(February 19) Company press release

N Brown Announces that Tesco’s Matt Davies Will Be Company’s New Chairman

(February 19) Company press release

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/University of Michigan/Eurostat/UK Office for National Statistics/Economic and Social Research Institute/Japan Ministry of Economy, Trade and Industry/Ministry of Finance Japan/Instituto Brasileiro de Geografia e Estatística/Fundação Getulio Vargas/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/University of Michigan/Eurostat/UK Office for National Statistics/Economic and Social Research Institute/Japan Ministry of Economy, Trade and Industry/Ministry of Finance Japan/Instituto Brasileiro de Geografia e Estatística/Fundação Getulio Vargas/Banco Central do Brasil/Coresight Research