albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

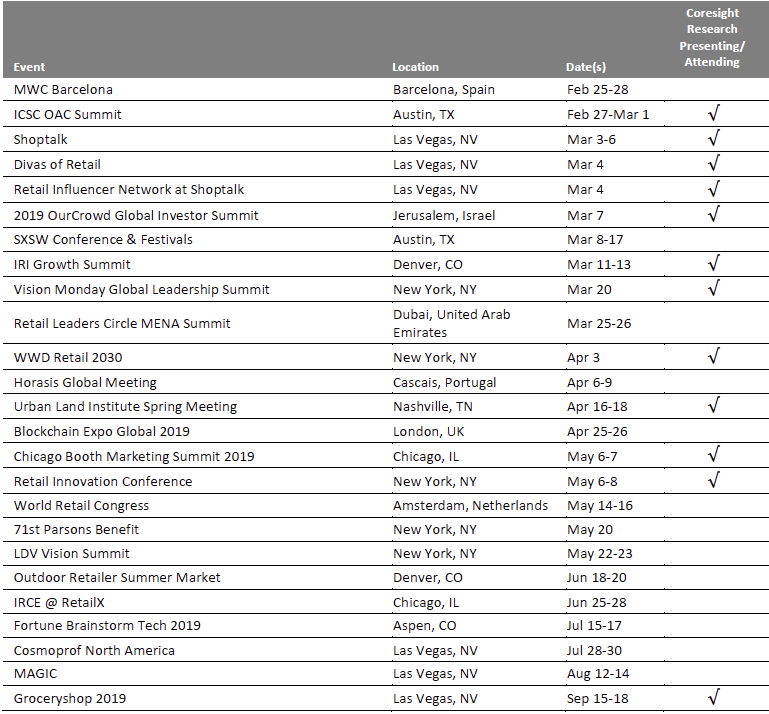

What Happened to US Retail over the Holiday Season? After a long delay due to the government shutdown, the U.S. Census Bureau finally released its holiday trading data last week, and it painted a picture of a miserable December for U.S retail. A number of retailers saw growth slow over the period — yet the country’s biggest retailer, Walmart, posted a barnstorming 4.2% increase in holiday-quarter comparable sales. So, what happened over the holidays? What the US Census Bureau Reported Excluding gasoline and automobiles, U.S. retailers grew total sales by just 1.0% year over year in December, according to our analysis of the Census Bureau’s data. This resulted in total year-over-year holiday-period sales growth of only 2.9%, which was below almost all estimates, including our own. We note that the Census Bureau’s much-delayed figures are advance estimates and are typically revised later. [caption id="attachment_77417" align="aligncenter" width="746"] Through Dec. 31, 2018; data are not seasonally adjusted.

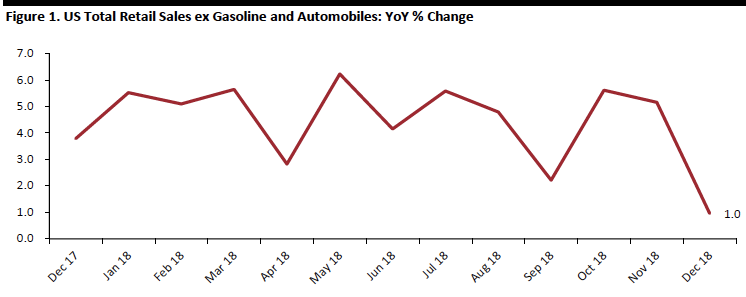

Through Dec. 31, 2018; data are not seasonally adjusted.Source: U.S. Census Bureau/Coresight Research[/caption] What Retail Bellwethers Reported Amazon was among the retailers to report a slower holiday quarter: The company’s North America sales growth slowed from 35.0% in the third quarter to 18.3% in the fourth quarter. These figures exclude Amazon’s high-growth Amazon Web Services (AWS) business and, so, should closely reflect its retail and marketplace revenues. Costco saw growth soften over the period, too. Excluding gasoline, Costco grew U.S. sales by 7.1% year over year in December, versus 10.1% in November. Department stores such as Macy’s, Kohl’s and Nordstrom also saw a slowing trend. The real struggle lies in reconciling the figures from America’s biggest retailer, Walmart, with the figures from the Census Bureau. In its core U.S. retail segment, Walmart grew fourth-quarter comparable sales by 4.2%, compared with 3.4% in the prior quarter. CFO Brett Biggs said on the company’s fourth-quarter earnings call that, on a two-year stack, Walmart’s U.S. comp growth of 6.8% was the strongest in nine years and that a timing shift in Supplemental Nutrition Assistance Program (SNAP) benefits from February into late January boosted comps by 40 basis points in the quarter, which ended Jan. 31 — although we note that boost came after the holiday period. Biggs said that another “100-180” basis points of comp growth came from e-commerce. What Can We Take Away from This? It’s difficult to account for the scale of the slowdown recorded by the Census Bureau, but we think it certainly reflects heightened consumer caution over the holiday period due to stock-market volatility, the government shutdown (which began Dec. 22) and uncertainty over global trade prospects. Prosper Insights & Analytics tracks consumer sentiment each month, and it has recorded a consistent downward trend since September, as shown in the graph below. This decline has been driven by more affluent households.

- Reflecting the impact of global tensions, 77.5% of respondents surveyed by Prosper in December said they were concerned that the ongoing trade war will cause prices the pay to increase.

- At the same time, more consumers are viewing stock-market investments with skepticism, and Prosper’s surveys have found that more affluent households have registered the biggest declines in stock-market confidence.

Base: 7,000 U.S. Internet users ages 18+, surveyed in each month

Base: 7,000 U.S. Internet users ages 18+, surveyed in each monthSource: Prosper Insights & Analytics[/caption] We think consumer caution is likely to have driven some shoppers to trade down over the holiday season, boosting value-focused retailers such as Walmart while paring gains for middle-ground stalwarts such as department stores. While we do not see the Census Bureau’s December figures as heralding a slump in retail growth, we do think U.S retail is unlikely to see the kind of heady gains in 2019 that it did in 2018. The good news? On Tuesday this week, the Federal Reserve Bank of New York reported that its latest survey of U.S. consumers found they plan to increase spending solidly in 2019. The New York Fed’s December data (latest) showed consumers expect to grow total spending 2.9% in the coming year, versus 2.2% in the prior survey, which was conducted in August.

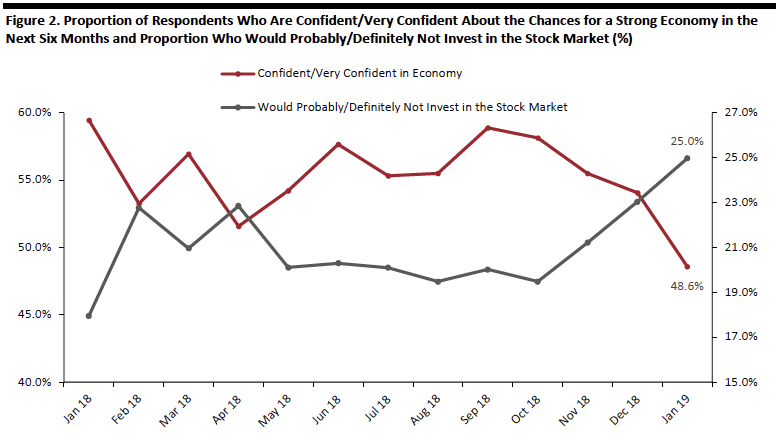

QUESTION OF THE WEEK

US RETAIL EARNINGS

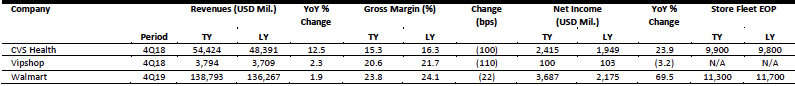

[caption id="attachment_77420" align="aligncenter" width="795"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- Walmart’s holiday sales blew past expectations, signaling the retailer can more than hold its ground against Amazon. Sales at U.S. stores open at least a year grew 4.2% over the holiday stretch compared with last year, while U.S. digital sales rose 43%.

- Walmart said its rollout of grocery pickup to stores across the country boosted online sales. The company also expanded delivery service to reach more shoppers.

- Kroger and Ocado have named central Florida and the Mid-Atlantic as the next two areas where they will build automated warehouses for online grocery fulfillment.

- The companies have now announced the locations of three of the 20 customer fulfillment centers they aim to build over the next three years. The first center will be located in a suburb just north of Cincinnati, Ohio.

- U.S. retail sales in December 2018 totaled a seasonally adjusted $505.8 billion, down 1.2% from November 2018, the biggest drop since 2009.

- Year over year, seasonally adjusted December sales rose just 2.1%, and sales growth slowed in most sectors. Considering 2018’s full-year retail growth was around 5%, December’s performance was underwhelming.

- Payless ShoeSource will begin to close its U.S. stores as it prepares for what could be another bankruptcy filing. The retailer is also winding down its e-commerce operations.

- Founded in in 1956 in Topeka, Kansas, Payless has more than 2,700 North American stores, according to its website. The liquidation will not impact its franchised or Latin American stores, the company said in a statement.

- Canada Goose boosted its annual forecast for the second time in six months, signaling its premium parkas remain popular with Chinese shoppers amid a diplomatic spat between China and Canada.

- Based on the “strength” of the nine months ended Dec. 31, Canada Goose said revenue will rise in the mid-to-high 30s percentage range, compared with a November forecast of at least 30%.

EUROPE RETAIL & TECH HEADLINES

Albert Heijn and Hema to Open Two Pilot Stores

(Feb. 12) RetailDetail.eu

Albert Heijn and Hema to Open Two Pilot Stores

(Feb. 12) RetailDetail.eu

- Dutch supermarket retailers Hema and Albert Heijn will open two pilot stores later this year in the Netherlands. Customers will be able to shop for both retailers’ ranges at the same time in the stores. The companies have not announced the exact locations.

- Hema CEO Tjeerd Jegan said the partnership is part of Hema’s new growth strategy and an important step in realizing its goals.

- French supermarket chain Carrefour plans to downsize five of its 51 hypermarkets in Italy. The stores are located in Venice, Udine, Turin, Bologna and Roma-La Romanina.

- The retailer is reviewing its large stores as it shifts its focus to smaller formats. Carrefour is also investing €400 million ($452 million) as part of the operation to develop smaller stores and customer services, expand its assortments and launch a marketplace that will carry both food and nonfood items.

- British retailer JD Sports Fashion bought an 8.3% stake in shoe and clothing retailer Footasylum. After the news was reported, Footasylum’s share price more than doubled, rising to 75 pence (97 cents) before closing at 55.2 pence (71 cents) on Feb. 18.

- JD Sports said it acquired the stake for investment purposes and does not intend to make a buyout offer to its smaller rival.

- Paris-based digital health insurance startup Alan has raised $45 million in its series B funding round led by Index Ventures, with participation by DST Global. Alan will use the funds to hire more than 100 employees by the end of this year.

- The startup aims to create a well-designed insurance product with transparent pricing to make healthcare more accessible. Employees in France are covered by the national healthcare program for basic reimbursements and by private insurance for more expensive treatments. Alan is the first health insurance company to obtain a new license in the country in over 30 years.

Makro Belgium Receives Funds and Final Warning from Parent Metro

(Feb. 15) RetailDetail.eu

Makro Belgium Receives Funds and Final Warning from Parent Metro

(Feb. 15) RetailDetail.eu

- Germany’s Metro has given its Makro Belgium cash-and-carry business a capital injection of €40 million ($45 million) along with a warning that the investment may be its last lifeline. Sources familiar with the matter say the business may face closure if it does not improve in 2019.

- Metro has invested hundreds of millions of euros in Makro Belgium in the last few years to mitigate losses, including a €80 million ($90 million) in the last year.

ASIA RETAIL & TECH HEADLINES

- QL Resources, which operates the FamilyMart chain of Japanese convenience stores in Malaysia, is proceeding with plans to launch 300 new stores by March 2022, despite a slowdown in Malaysia’s economy.

- “We still stick to our plan to open 300 stores in five years,” QL Resources Chairman Chia Song Kun told news site Nikkei Markets. The company opened 30 new outlets in its latest fiscal year and is targeting 90 store openings in the year ending Mar. 31, 2019.

Otsuka Kagu Partners with Yamada Denki

(Feb. 15) JapanTimes.co.jp

Otsuka Kagu Partners with Yamada Denki

(Feb. 15) JapanTimes.co.jp

- Struggling Japanese furniture retailer Otsuka Kagu and electronics retailer Yamada Denki have signed an agreement to share their respective furniture and home appliances sales expertise and collaborate on potential corporate sales opportunities.

- Otsuka Kagu will also sell 13.11 million new shares at ¥290.11 ($2.60) each as it seeks to raise ¥3.8 billion ($34.4 billion) in fresh capital to automate its warehouses and optimize its stores for e-commerce.

- Premium Indian leather bag brand Kompanero plans to open 100 outlets in India by 2025. The retailer currently has 30 stores in the country and is set to open four more this year.

- The company also plans to open its first store in Europe this year, although the location has not been announced. Kompanero’s products are currently sold in the U.K., Australia, Japan and South Korea via distribution networks and e-commerce portals.

Japanese Fund Acquires Vietnamese Fashion Chain Elise

(Feb. 19) E.VNexpress.net

Japanese Fund Acquires Vietnamese Fashion Chain Elise

(Feb. 19) E.VNexpress.net

- Japanese investment fund Advantage Partners has acquired Elise Fashion, a leading women’s fashion chain in Vietnam, for an undisclosed sum. The acquisition is Advantage’s first in Vietnam and the fund plans to focus on accelerating Elise’s growth.

- Elise currently operates 95 stores across Vietnam and will soon launch new high-end fashion brands. The chain may also enter men’s fashion, although it will continue to focus on women’s fashion, according to Luu Thi Nga, the company’s founder and CEO.

- Chinese retail chain Suning.com announced it will acquire all 37 Wanda Department Store locations from commercial real estate developer Wanda Group. The move is part of Suning’s plan to expand its offline retail portfolio. Suning recently established a Department Store Group to accelerate its omnichannel development and improve the shopper experience.

- The two companies have been collaborating since 2015. In 2018, Suning acquired a small stake in Wanda’s commercial management subsidiary.

LATAM RETAIL & TECH HEADLINES

- Amazon is partnering with financial services company Western Union to enable customers in Colombia to pay for items on Amazon.com in local currency. Customers who choose the “PayCode” option at checkout receive a code and instructions for making payment at participating Western Union locations.

- “We are helping to unlock access to Amazon.com for customers who need and want items that can only be found online in many parts of the world. This is a great example of two global brands innovating and collaborating,” said Khalid Fellahi, GM of Western Union Digital.

El Puerto de Liverpool to Open Fewer Stores as It Shifts Focus to Omnichannel Operations

(Feb. 18) Modaes.com

El Puerto de Liverpool to Open Fewer Stores as It Shifts Focus to Omnichannel Operations

(Feb. 18) Modaes.com

- Mexican department store retailer El Puerto de Liverpool announced it will slow its rate of store openings this year to focus on its financial, digital and omnichannel operations. The company plans to open three new department stores and six stores under its Suburbia banner this year.

- The retailer also plans to expand its commercial park space by renovating locations that formerly housed Fábrica de Francia department stores.

- Danish jewelry group Pandora plans to open eight new stores in Colombia by 2020, for a total of 20 stores in the country. The retailer currently operates 11 stores in Colombia and plans to open another store, in Medellín, in April.

- Pandora recorded sales growth of 45% in Colombia during its 2018 fiscal year.

- Grupo Axo-owned Mexican retail chain Promoda has opened two new stores in Mexico as it continues its domestic expansion. The new stores are located in the Arcadia shopping center in Nuevo León and the Parque Vértice shopping center in Tlaxcala.

- The retailer now has more than 10 stores in Nuevo León and two in Tlaxcala.

- Mexican footwear retailer Flexi plans to open multiple stores this year and eventually expand its store network to 500, according to Dinero en Imagen.

- The retailer also plans to launch its own e-commerce platform in Mexico later this year. Flexi currently sells on other e-commerce marketplaces such as Amazon.

MACRO UPDATE

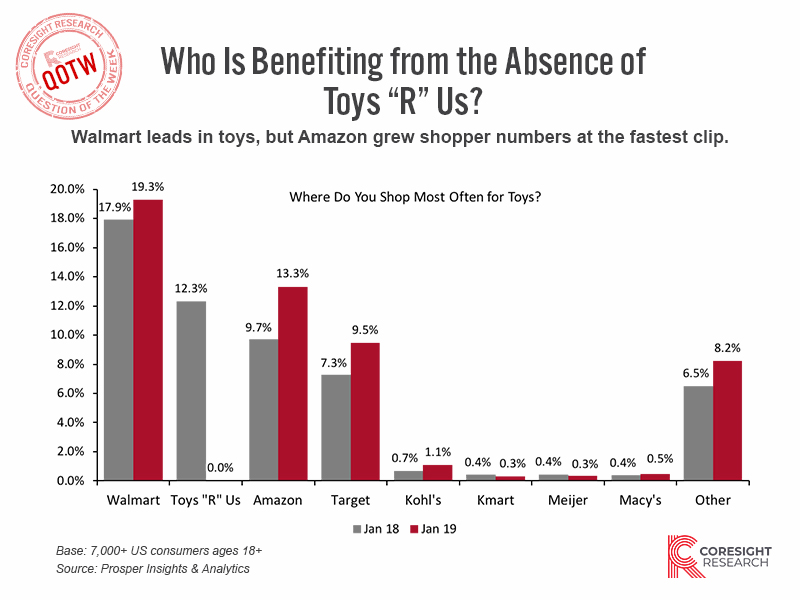

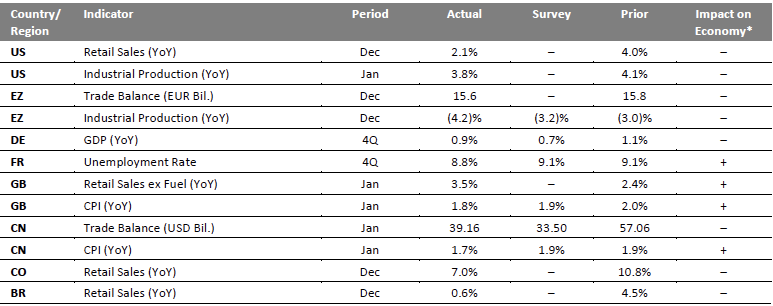

Key points from global macro indicators released Feb. 13-19, 2019: 1) U.S.: Total retail sales increased by a seasonally adjusted 2.1% year over year in December, versus 4.0% in November. Industrial production in the U.S. increased 3.8% year over year in January, following a 4.1% rise in December. 2) Europe: In the eurozone, the trade balance fell to €15.6 billion in December from €15.8 billion in November. Germany’s GDP grew 0.9% year over year in the fourth quarter, compared with 1.1% in the previous quarter and ahead of the consensus estimate of 0.7%. In the U.K., retail sales excluding automotive fuel grew 3.5% year over year in January, up from 2.4% in December. 3) Asia Pacific: In China, the trade balance decreased to $39.16 billion in January from $57.06 billion in December, but was above the consensus estimate of $33.50 billion. The Consumer Price Index (CPI) in China grew 1.7% year over year in January, compared with 1.9% in December. 4) Latin America: In Colombia, retail sales increased 7.0% year over year in December, following a 10.8% rise in November. In Brazil, retail sales increased 0.6% year over year in December, marking a steep decline from 4.5% growth in November. [caption id="attachment_77422" align="aligncenter" width="773"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impactSource: U.S. Census Bureau/U.S. Federal Reserve/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics and Economic Studies (France)/Office for National Statistics (U.K.)/National Bureau of Statistics of China/National Administrative Department of Statistics (Colombia)/Brazilian Institute of Geography and Statistics/Coresight Research[/caption]

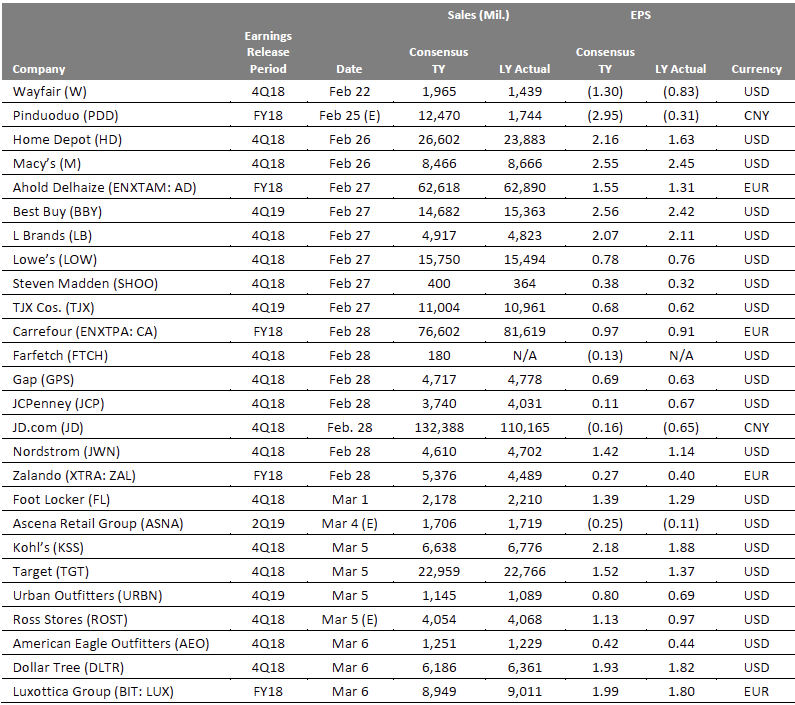

EARNINGS CALENDAR

EVENT CALENDAR