Web Developers

From the Desk of Deborah Weinswig

Amazon Finally Opens Its Amazon Go Store…in a Changed, Crowded World

On January 22, Amazon finally opened its unstaffed, cashless Amazon Go retail store to the public, and long lines of consumers queued up to get a glimpse of the future of retail. The store achieves its cashier-free magic by relying on a multitude of machine vision cameras located over customers’ heads. Amazon initially announced the store via a YouTube video in December 2016, and it followed that announcement with a period of exclusive testing by Amazon employees. Rumors of technical problems ensued—for example, the technology was said to have difficulty distinguishing purchases when the store was full of shoppers. So far, visitors have generally made positive comments about the store. However, one CNBC reporter visited the store and put six items in her basket, only to find that she had been charged for just five of them. When she approached management to correct her bill, she was told that she could just keep the missed item. Another reporter deliberately attempted to fool the store’s cameras, but was unable to. In our 18 Retail Trends for ’18: Preparing for Another Year of Change report, we noted that we expect to see many more automated, cashier-free stores in 2018. Just one month into the year, Amazon Go has already joined a raft of Chinese companies offering their versions of cashless, unstaffed convenience stores. In 2015, long before Amazon announced its Amazon Go concept on YouTube, China’s Alibaba began working on its Hema stores, a chain of unstaffed, cashless supermarkets. It had opened 13 Hema stores by mid-2017 and operated a total of 25 as of the beginning of this year. Alibaba plans to open another 30 Hema stores in Beijing alone by the end of 2018 (the city currently has five). The elegant simplicity of these stores is likely what has enabled Alibaba to open so many of them. Rather than using sophisticated machine vision technology, Hema stores allow shoppers to simply scan a barcode when they place an item in their cart. Alibaba has also opened a cashierless Tao Cafe in the city of Hangzhou, where it is headquartered. In addition, the company has revealed futuristic concepts such as a vending machine for automobiles and it is currently building a new shopping mall that will include elements of its “new retail” concept. There are likely many more announcements of unstaffed, cashless stores to come, particularly in China, where consumers have rapidly adopted mobile payments. Startup research firm ITjuzi reported that cashier-less convenience stores in China received ¥1 billion ($156 million) in funding in the third quarter of 2017 alone. BingoBox has 200 unstaffed, cashless shops that use RFID tags to track items in 29 cities in China, and the company just raised $80 million in new funding. Other unstaffed stores in China include Moby Mart and F5 Future Store. In December, JD.com announced a partnership with Hong Kong real estate developer China Overseas Land & Investment to open hundreds of unstaffed D-Mart convenience stores in China that rely on technology that is reportedly even more sophisticated than Amazon Go’s. Also late last year, consumer electronics and technology company Hisense announced plans to work with French retailer Auchan to open several hundred Auchan Minute stores in China. Finally, Chinese retailer Suning has already opened five of its automated Biu stores in China, and the company demonstrated a sample Biu store at the CES 2018 trade show in January. Amazon has not yet disclosed its expansion plans for its Amazon Go format, and the company has plenty on its plate from its Whole Foods Market acquisition. But it is likely that some company or companies will import other Chinese automated store concepts into the US, which will increase convenience and options for American consumers. We will continue to follow developments in the automated store space and other retail trends in China and around the world.US RETAIL EARNINGS

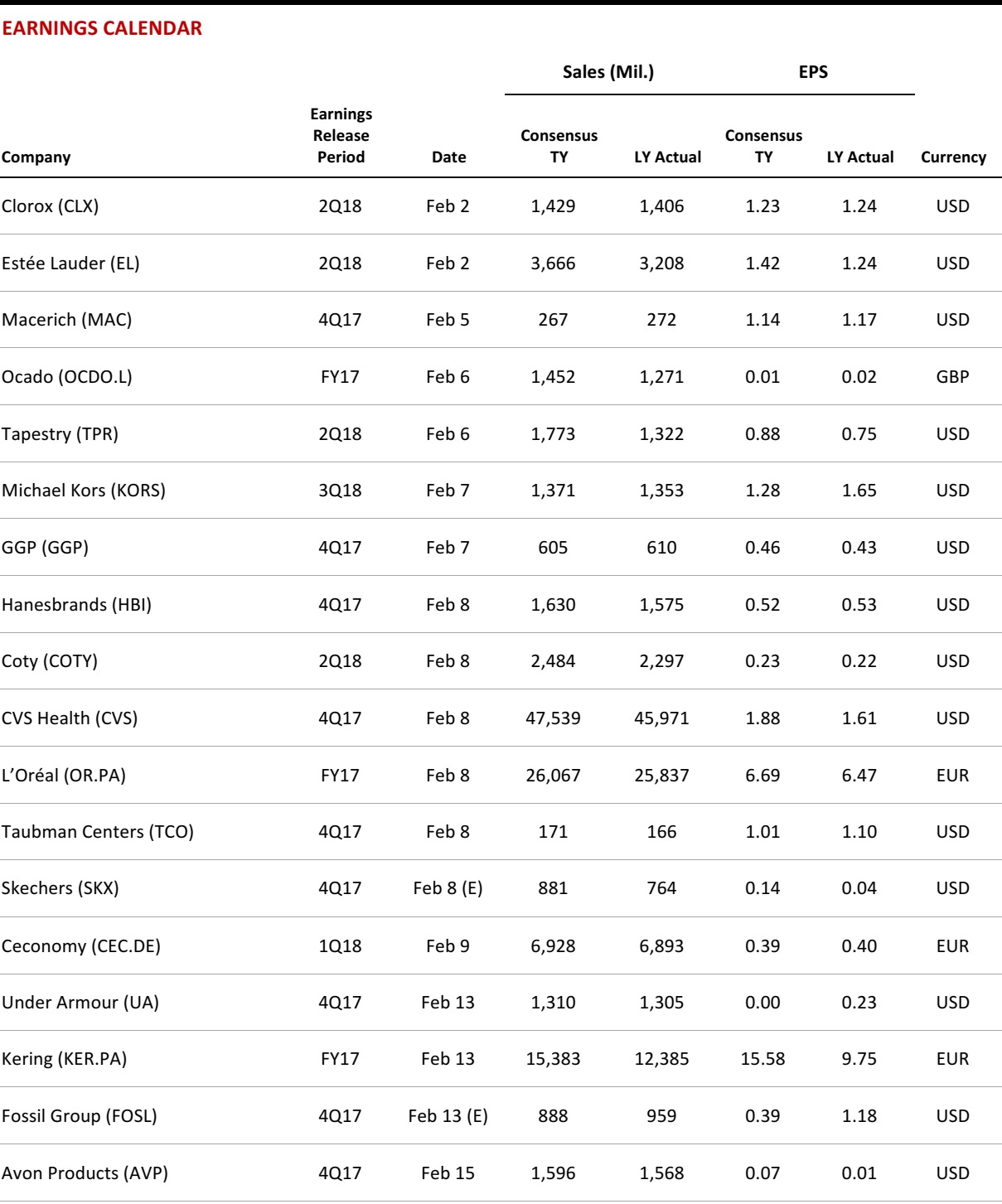

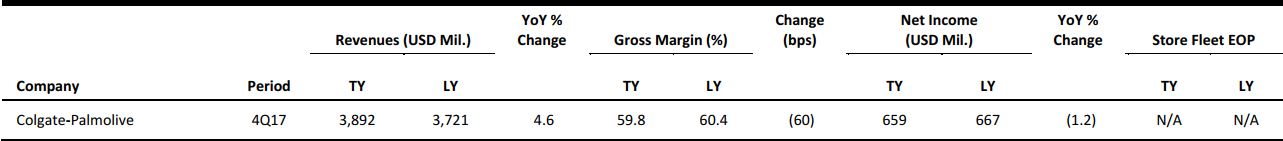

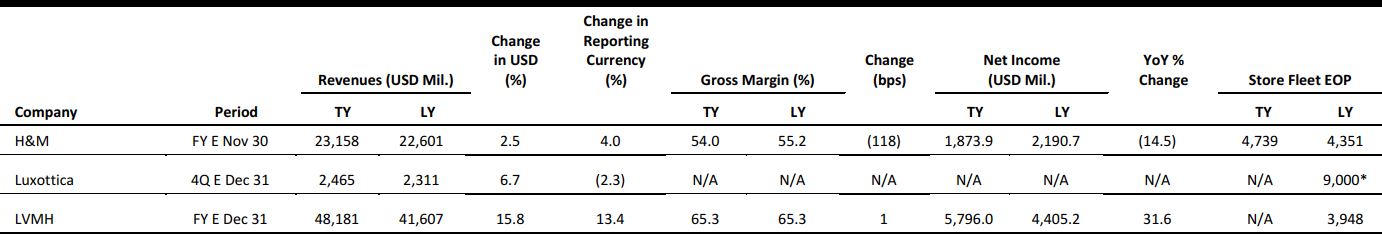

Source: Company reports/FGRT

US RETAIL & TECH HEADLINES

- Off-price retailer Stein Mart said on Monday that it was beginning to “explore all opportunities” to improve sales and that it would “identify potential strategic alternatives” to its current business model.

- Stein Mart said it had formed a special committee, appointed by the company’s board, to aid in the review process. The company added that there was no set timeline regarding when other details might be announced.

Retail Rents Decline in Big US Cities as Landlords Succumb to the Retail Storm

(January 30) WSJ.com

Retail Rents Decline in Big US Cities as Landlords Succumb to the Retail Storm

(January 30) WSJ.com

- The retail storm pounding weaker real estate markets is starting to lash America’s biggest cities. Malls in smaller cities have been suffering for years from store closures as retailers have adjusted their store footprints to changing consumption habits and rising online sales.

- Now retail rents in some of the priciest cities in the US are falling back to earth after years of strong growth as the retail reckoning spreads to properties once considered immune. Over the past 12 months, rents in New York, Washington and Boston have declined by 0.4%–1.4%, while rents have been roughly flat in Chicago and San Francisco.

Amazon and Berkshire Hathaway Partner to Take on Healthcare

(January 30) RetailDive.com

Amazon and Berkshire Hathaway Partner to Take on Healthcare

(January 30) RetailDive.com

- If there’s a sector in the US that is ripe for disruption, it’s healthcare. The complexity, opacity and expense in the private side of the system have vexed employers, healthcare providers and consumers for decades. Now, Amazon, Berkshire Hathaway and JPMorgan Chase are partnering on ways to address healthcare for their US employees, with the aim of improving employee satisfaction and reducing costs.

- Berkshire Hathaway Chairman and CEO Warren Buffett noted in a statement on Tuesday that “the ballooning costs of healthcare act as a hungry tapeworm on the American economy.” The leaders of the three companies admitted that their project will therefore be massive.

(January 29) WashingtonPost.com

- “Just walk out,” say the signs at the entrance and store windows at Amazon’s newest concept store. “No lines. No checkout. (No, seriously.)” Amazon Go opened in Seattle last week with much fanfare, raising a host of questions about the future of retail. Among them: How will the company handle shoplifting?

- One of the store’s first patrons took to Twitter on January 22 to report that Amazon Go had failed to charge her for a container of vanilla yogurt. “I think I just shoplifted??,” CNBC reporter Deirdre Bosa wrote on the social media platform using the hashtag #freestuff.

- com, China’s second-largest e-commerce retailer after Alibaba, is working on financing in order to invest in the US and is mulling the establishment of a fulfillment center in Los Angeles to facilitate same-day delivery, Bloomberg reports.

- According to Reuters, JD.com CEO Richard Liu complained at the World Economic Forum in Davos, Switzerland, last week about the difficulty of entering the US market and warned that it would ultimately hurt the US economy.

EUROPE RETAIL EARNINGS

Source: Company reports/FGRT

EUROPE RETAIL & TECH HEADLINES

- UK fashion pure play ASOS reported that total revenues and total retail sales grew by 30%, or 28% at constant currency, in the four months ended December 31, the first quarter of the company’s 2018 fiscal year.

- ASOS grew UK retail sales by 23% year over year at constant currency and grew international retail sales by 32%. Management said that it remains confident in the full-year guidance it provided in its fiscal year 2017 results, which called for reported sales growth of 25%–30% and an EBIT margin of 4%.

- Spanish fashion chain Zara has opened a digitally focused concept store at London’s Westfield Stratford City mall. The store spans 2,152 square feet and was built specifically for click-and-collect orders. It is the first Zara store to carry a dedicated online section and will be open until May, when a refurbished Zara store will open in the mall.

- The store also offers a selected range of men’s and women’s clothing for online purchase. Staff members equipped with tablets are available to assist shoppers with purchases and customers can choose to pay through a Bluetooth-powered card payment terminal, their mobile phone, the retailer’s app or a self-checkout kiosk.

- German electronics retailer MediaMarktSaturn is set to pilot a checkout-free store in Austria in March. The concept is akin to Amazon’s checkout-free store in the US, Amazon Go, but it runs on a different technology.

- While Amazon’s system uses on-shelf sensors and cameras, MediaMarktSaturn’s store will allow shoppers to scan products and pay with their smartphone.

Galeries Lafayette to Open Luxembourg Flagship in Late 2019

(January 30) WWD.com

Galeries Lafayette to Open Luxembourg Flagship in Late 2019

(January 30) WWD.com

- French department store group Galeries Lafayette announced that it will open a flagship store in Luxembourg in late 2019 as part of its international expansion.

- The store is being developed in partnership with European real estate developer Codic and will span 100,000 square feet across six floors. Outside France, the group has eight flagship stores and it hopes to open 20 new stores in key cities globally over the next five years.

Heetch Raises $20 Million in Bid to Compete with Uber

(January 26) TechCrunch.com

Heetch Raises $20 Million in Bid to Compete with Uber

(January 26) TechCrunch.com

- French ride-sharing service Heetch has raised $20 million to expand its brand across Europe and stay competitive against Uber. The startup launched as a peer-to-peer ride-sharing service in 2013, but French regulators forced it to shut down in March 2017 until it changed its operating model.

- Heetch relaunched later in the year, working only with professional drivers and offering services 24 hours a day, seven days a week. Heetch is currently available in 10 cities in five countries—France, Belgium, Italy, Sweden and Morocco. It hopes to use the fresh funds to launch in London soon and to build a larger engineering team.

ASIA RETAIL & TECH HEADLINES

- Alibaba’s cloud-computing business is set to deploy its big data services package in Kuala Lumpur to help Malaysia’s government with the running of its capital city and potentially other parts of the country in the future.

- City Brain is an Alibaba Cloud service that uses big data and artificial intelligence on its cloud-computing infrastructure. It will be put to use in Kuala Lumpur following an agreement with the local city council.

Goxip Raises $5 Million Led by Meitu to Build an Influencer Marketing Platform for Fashion in Asia

(January 29) TechCrunch.com

Goxip Raises $5 Million Led by Meitu to Build an Influencer Marketing Platform for Fashion in Asia

(January 29) TechCrunch.com

- Goxip, a Hong Kong–based social-shopping service, has raised $5 million to branch out into influencer marketing. The investment was led by Meitu, a $6 billion Hong Kong–listed company that develops selfie apps and selfie-optimized phones, with participation from Hong Kong conglomerate Nan Fung Group via its inaugural Mills Fabrica Fund.

- Others who took part include a trio of young female investors from major monied families: Chryseis Tan, an existing investor who is the daughter of Malaysian billionaire Vincent Tan; Sabrina Ho, the daughter of Macau-based casino magnate Stanley Ho; and Iman Allana, from Indian multibillion-dollar food giant Allana Group.

Why Tencent and Sequoia Are Pouring Millions into China’s Rental Space

(January 30) Bloomberg.com

Why Tencent and Sequoia Are Pouring Millions into China’s Rental Space

(January 30) Bloomberg.com

- In its attempt to cool what are among the fastest-rising property prices in the world, China is pushing its people to rent instead of buy. That’s prompting venture capitalists to pour millions into an old-fashioned sector that’s being uprooted by technology: rental management.

- Tencent, Warburg Pincus and Sequoia Capital are among the venture capital firms betting on startups to win a slice of the market, which is expected to grow to ¥2 trillion ($664 billion) by 2030, according to estimates from Orient Securities. That’s equivalent to almost half of total home sales in 2017.

- On January 15, a public hearing took place in the southern Chinese metropolis of Shenzhen. Instead of having to jump through the usual bureaucratic hoops, participants dialed in virtually via China’s most popular social app, WeChat, which is owned by Tencent. In the past, they would have had to submit a sign-up form via email or in person, wait a few days for approval and then turn up in person at the designated venue on the day of the hearing.

- “Now you sign up on the WeChat official account of the Shenzhen Legislative Affairs Office,” says a participant, referring to the government agency’s WeChat equivalent of a Facebook Page. “And you would get a notification regarding your sign-up status. When the time arrives, you enter a live chat room through the official account and start typing in your views. ”

LATAM RETAIL & TECH HEADLINES

WhatsApp Business Becomes Available in Brazil

(January 29) ZDNet.com

WhatsApp Business Becomes Available in Brazil

(January 29) ZDNet.com

- WhatsApp has launched WhatsApp Business, its dedicated Android app for small business owners, in Brazil. The app aims to provide businesses with tools that make it easier to connect with their customers and grow. Owners who create a business profile can get access to messaging statistics and the ability to provide initial feedback to customer queries automatically.

- WhatsApp Business was initially available in Indonesia, Italy, Mexico, the UK and the US. The app is free and will be launched in other countries within the next few weeks.

More than Half of Connected Brazilians Suffered Cyberattacks

(January 24) ZDNet.com

More than Half of Connected Brazilians Suffered Cyberattacks

(January 24) ZDNet.com

- More than 60% of the Brazilian population with Internet access has been targeted by cybercriminals, according to a report by Symantec. That means that some 62 million Brazilians have suffered such attacks. Each victim has spent about 34 hours dealing with the consequences of the incident, according to the report.

- Cyberattacks generated losses of $22 billion in Brazil in 2017, says the report, making the country second only to China in terms of financial impact from cyberattacks. Millennials are the most frequent victims, with 26% of those polled saying that they do not use any method to protect their devices. In addition, millennials are most likely to share their passwords.

Samsung Pay Now Available in Mexico

(January 29) PhoneArena.com

Samsung Pay Now Available in Mexico

(January 29) PhoneArena.com

- Mobile payment service Samsung Pay is now making its way to Mexico. While Samsung Pay works with retailers that have near-field communication installed on their point-of-sale systems, it is also equipped with magnetic secure transmission (MST) technology. That allows Samsung Pay to work with any retailer that allows consumers to swipe their credit cards to make a payment.

- Samsung says that its mobile payment service uses three different levels of security: biometrics authentication (fingerprint or iris recognition), tokenization (the use of virtual information that is created with each transaction but not stored on the user’s Samsung handset) and Samsung Knox (employed to make sure that there is no suspicious activity on a user’s phone).

Brazil Could Call Upon Blockchain to Combat Corruption

(January 26) Cryptovest.com

Brazil Could Call Upon Blockchain to Combat Corruption

(January 26) Cryptovest.com

- Brazil, which has been hit by the world’s biggest bribery and corruption investigation, could use blockchain technology to fight corruption and fraud. At the end of 2017, state-owned tech firm Serpro launched a blockchain platform and it now wants to promote it to different industries and niches in Brazil.

- “It is a good tool to reduce corruption and fraud. I see it as one more way for us to help citizens, businesses (and) the government to improve their controls, reduce their fraud and improve their records,” said Gloria Guimaraes, director-president of Serpro.

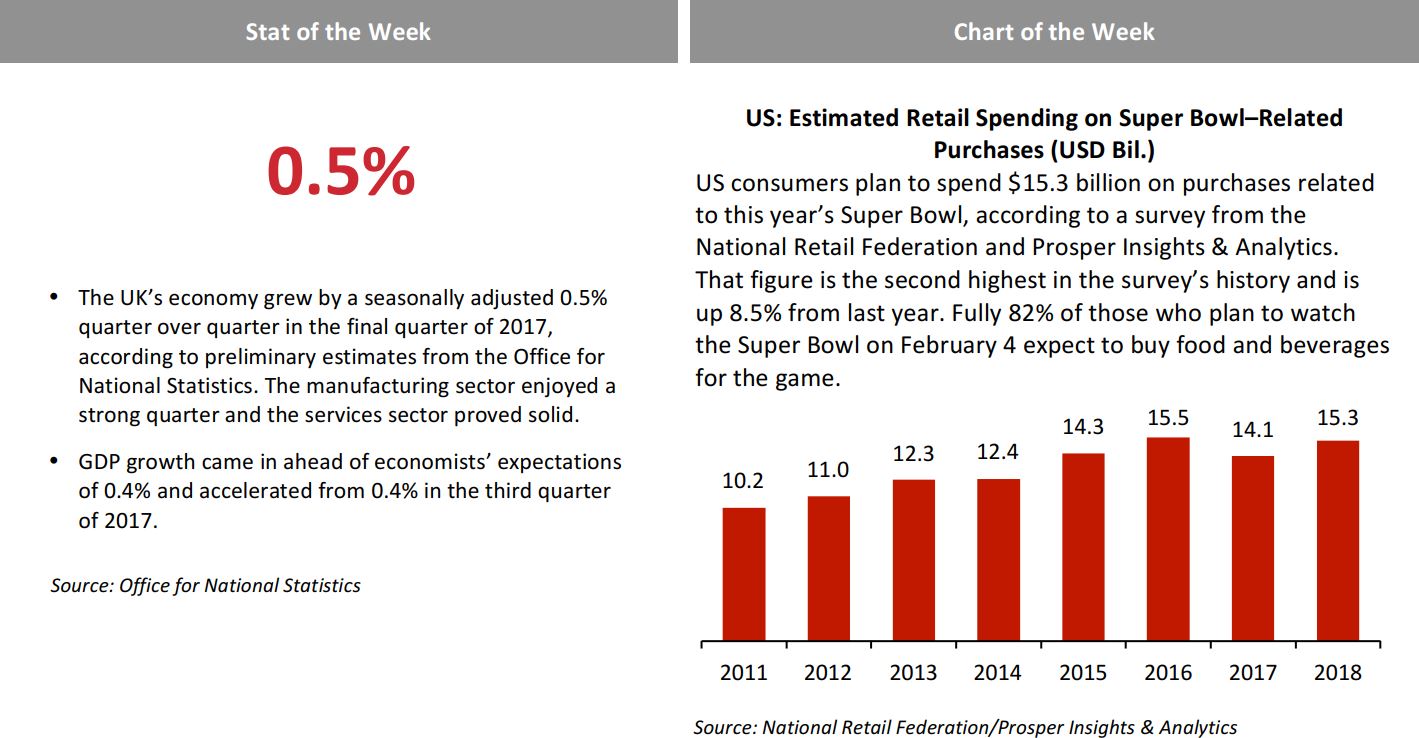

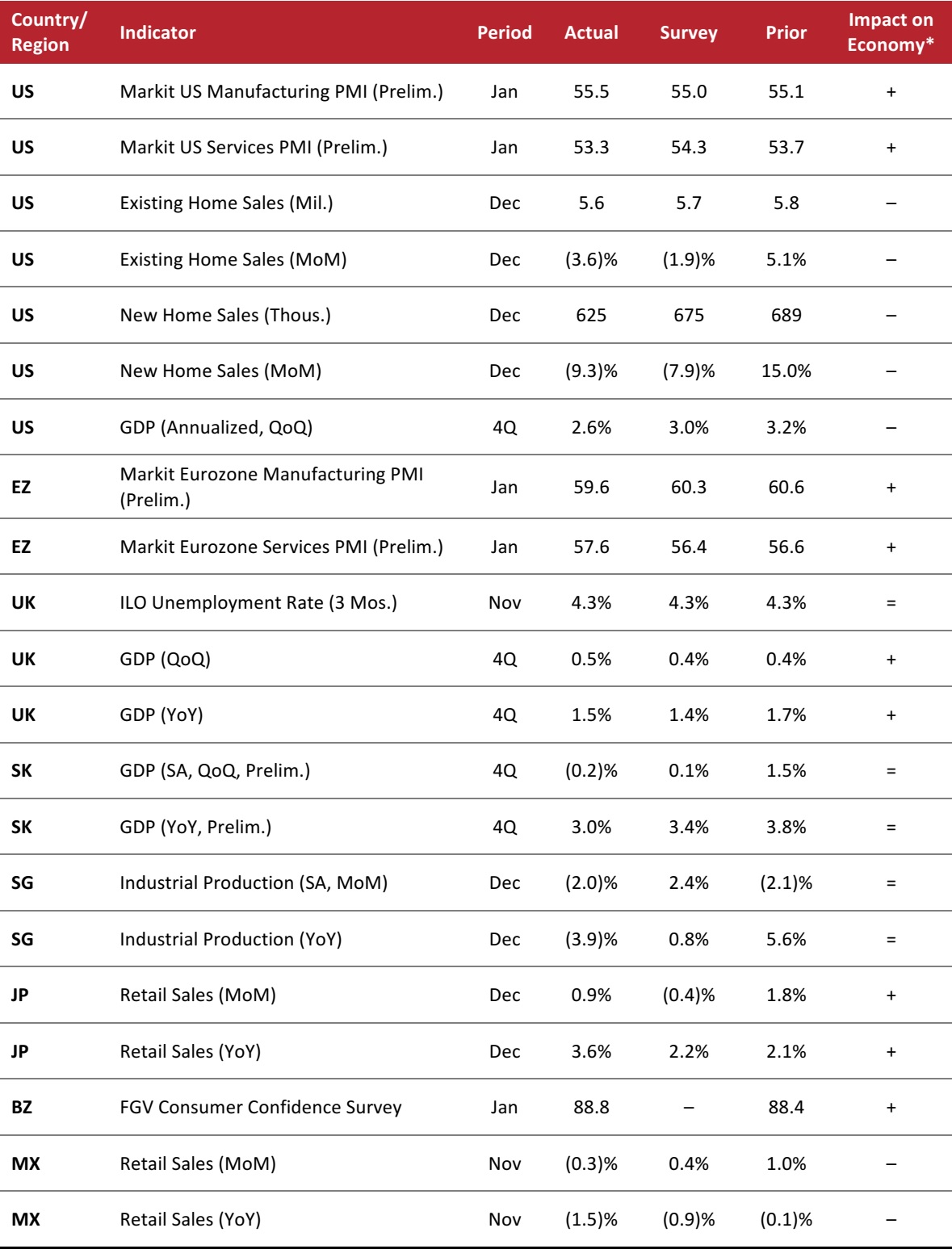

MACRO UPDATE

Key points from global macro indicators released January 24–31, 2018: 1) US: The Markit US Manufacturing and Services Purchasing Managers’ Indexes (PMIs) both stayed above the expansion threshold of 50.0 in January. Existing home sales decreased by 3.6% month over month in December, while new home sales decreased by 9.3% month over month. US GDP growth was slower than expected in the fourth quarter. 2) Europe: In the eurozone, the Markit Eurozone Manufacturing and Services PMIs stayed above the expansion threshold in January. In the UK, the unemployment rate remained at 4.3% in November. The UK’s GDP grew by 0.5% quarter over quarter in the fourth quarter. 3) Asia-Pacific: In South Korea, GDP dropped by 0.2% quarter over quarter in the fourth quarter. In Singapore, industrial production decreased by 2.0% month over month in December. In Japan, retail sales increased by 0.9% month over month in December. 4) Latin America: In Brazil, consumer confidence ticked up to 88.8 in January. In Mexico, retail sales dropped by 1.5% year over year in November, missing the consensus estimate of a 0.9% drop. *FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit/National Association of Realtors/US Census Bureau/US Bureau of Economic Analysis/European Central Bank/UK Office for National Statistics/Bank of Korea/Singapore Economic Development Board/Japan Chain Stores Association/Japan Ministry of Economy,Trade and Industry/Fundação Getulio Vargas/Instituto Brasileiro de Economia/Instituto Nacional de Estadística y Geografía/FGRT

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit/National Association of Realtors/US Census Bureau/US Bureau of Economic Analysis/European Central Bank/UK Office for National Statistics/Bank of Korea/Singapore Economic Development Board/Japan Chain Stores Association/Japan Ministry of Economy,Trade and Industry/Fundação Getulio Vargas/Instituto Brasileiro de Economia/Instituto Nacional de Estadística y Geografía/FGRT