From the Desk of Deborah Weinswig

Fewer Happy Returns in Retail Land as Companies Tighten Generous Return Policies

Retailers have finally started to scale back liberal return policies in the face of a litany of abuses by customers. Although there are many legitimate reasons for returns—including receipt of a damaged product, the wrong item or a product that looks different from the one on the retailer’s website—there is also much fraud associated with returns. According to the National Retail Federation, returns cost retailers a total of $260 billion in 2015, and that figure could reach $285 billion this year, if returns grow proportionally to retail sales, which eMarketer estimated would grow by nearly 10% between 2015 and 2018.

Return rates are higher for online purchases, at about 30%, than for brick-and-mortar purchases, at less than 9%, according to conversion optimization firm Invesp, and many of us know people who purchase 10 pairs of shoes online, only to return nine. In fact, retailers often cite returns as a major cause of lower margins on e-commerce sales. CNBC hired retail consultant AlixPartners to build a business model for a brick-and-mortar store versus an online store, and the model showed a 32% operating margin for the physical store versus a 30% margin for the online store, although the margins for locations offering in-store pickup and ship-from-store services were lower.

Fraudulent returns have become a major problem in recent years, and have prompted some retailers to curtail liberal return policies and even blacklist abusers. Retail analytics firm Appriss Retail estimates that 10.6% of returns made last year were fraudulent in nature, costing retailers $22.8 billion. Common types of fraud include returns of stolen (shoplifted) merchandise, return fraud by employees or employees collaborating with thieves, fraudulent or stolen payments, organized retail crime, and “renting” or “wardrobing” (using or wearing purchases before returning them). In addition to costing retailers, fraud deprives states and cities of sales tax.

Following an increase in the incidence of abuse of return policies, many retailers are saying, “Enough!” Most recently, L.L.Bean put a limit on its policy of accepting returns. For more than 100 years, the company accepted returns of any of its products after any period of time if customers were unsatisfied for any reason, but abusers, particularly over the past five years, took the company’s return policy as a replacement program to offset normal wear and tear. In the most egregious cases, consumers returned items purchased from thrift stores or fished out of trash cans. These abuses have cost L.L.Bean $250 million over the last five years, leading it to institute a new, still-generous policy that allows customers to return goods within a year of purchase as long as they have a receipt or proof of purchase.

Some retailers have gone so far as to subscribe to a national database that tracks consumers’ returns. Many large retailers, including Best Buy, Home Depot, JCPenney and nine other of the top 50 retailers in the country, subscribe to a service called The Retail Equation, which maintains a separate database of user returns for each retailer (the information is not shared among the retailers). The purpose of the system is to reduce fraud, but if a customer makes too many returns within a given time period, the retailer can decline to accept further returns from that person.

There are also several startups that mitigate the effects of returns. Returnly is a fintech platform that turns product returns into repurchases for online retailers and marketplaces, enabling merchants to offer shoppers a seamless online product return experience. Riskified is an all-in-one e-commerce fraud-prevention solution and chargeback protection service for high-volume and enterprise merchants. It gives retailers a definitive “approve” or “decline” recommendation for every order they review. The Retail Equation, mentioned above, which has merged with Appriss Retail, offers advanced analytics solutions and artificial intelligence models that help retailers increase sales, enhance the customer return experience, reduce loss, tackle sales-reducing activities and improve performance.

The cost of returns to retailers has been mounting due to egregious consumer behavior and outright fraud, and the era of “return anything, anytime” is slowly coming to a close as companies pull back on liberal return policies.

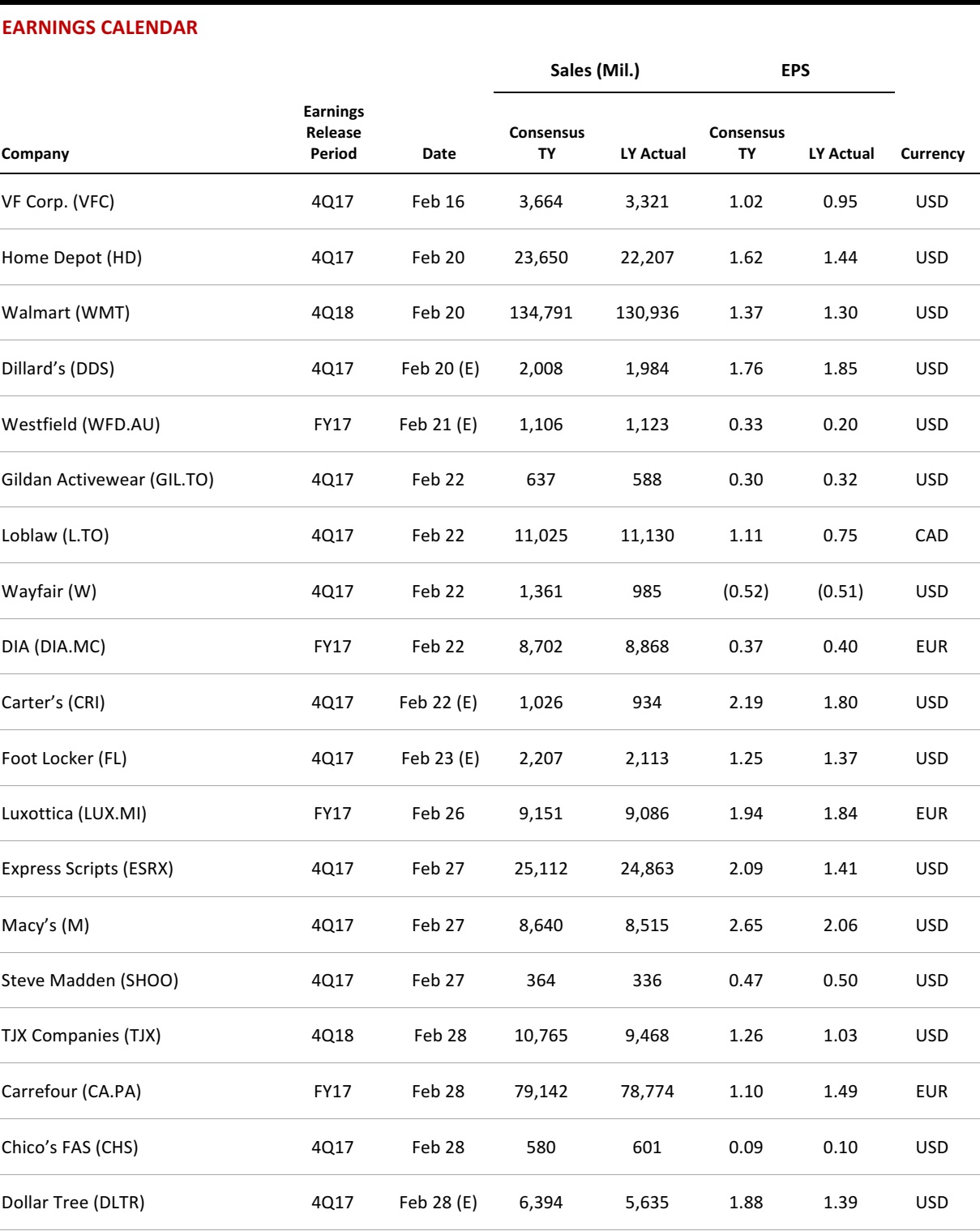

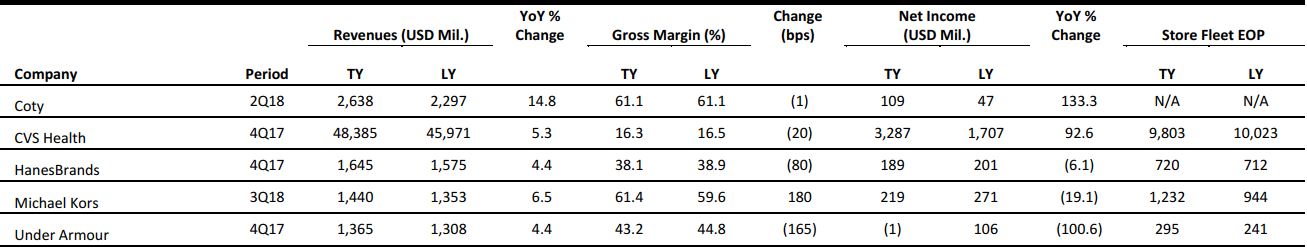

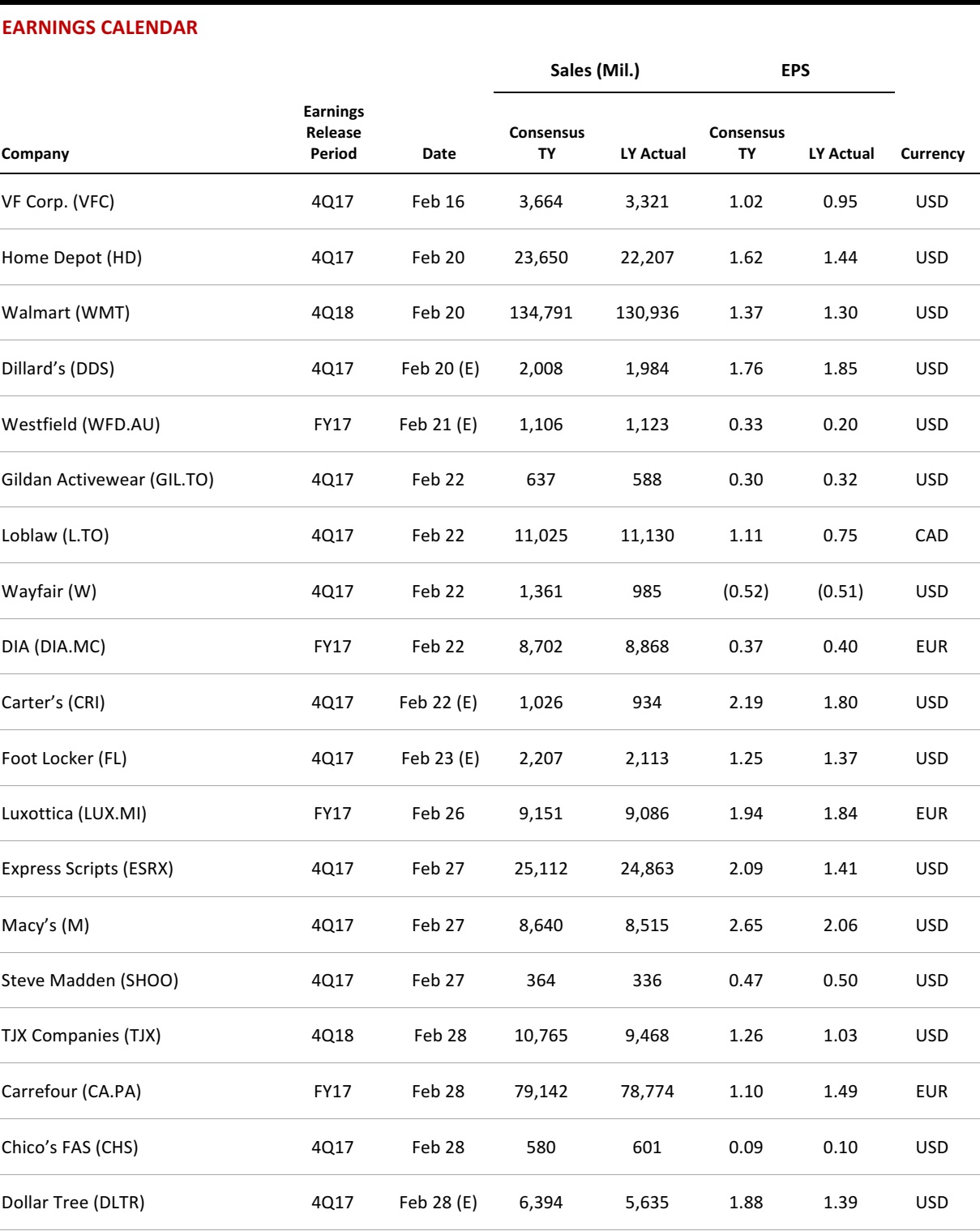

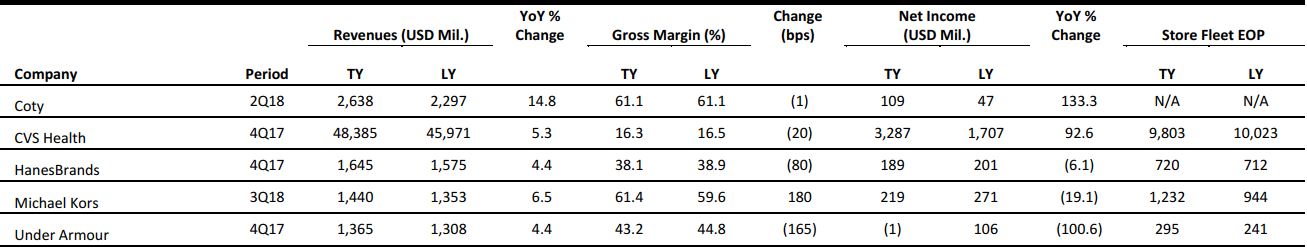

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

US Retail Gas Prices Finally Moving Lower

(February 13) UPI.com

US Retail Gas Prices Finally Moving Lower

(February 13) UPI.com

- US retail gasoline prices moved lower for the first time this year, following broader markets and sector metrics, but relief might not last. Motor club AAA reported a national average retail price of $2.57 per gallon, only 3 cents lower than last week.

- Crude oil prices followed broader stock indices lower last week, erasing all of the gains for the year. The price for Brent crude oil was around $63 per barrel early Tuesday, about $3 per barrel lower than where it started the year and well below the 2018 peak.

Is America in a Retail Apocalypse? Ask Yelp

(February 13) Bloomberg.com

Is America in a Retail Apocalypse? Ask Yelp

(February 13) Bloomberg.com

- Things did not appear to go well for retail landlords in 2017. Big chains announced thousands of store closings and filed for Chapter 11 bankruptcy protection at a record rate, leading analysts to predict that hundreds of malls were on the verge of closing. How bad is it really? One way to measure recent retail closings is to ask local review website Yelp.

- Since its launch in 2004, Yelp has compiled millions of US business listings. So what does Yelp’s data say about the retail apocalypse? Stores closed at a faster pace than they opened in 2017, the only time that has happened in the four years of data that the company provided to Bloomberg.

As Sears Shutters More Stores, These Retailers Could See Gains

(February 12) CNBC.com

As Sears Shutters More Stores, These Retailers Could See Gains

(February 12) CNBC.com

- As Sears Holdings shutters more of its department stores under the Sears and Kmart banners, three retailers are poised to gain the most of those lost sales. Taken together, Home Depot, Lowe’s and Best Buy should capture a majority of sales of appliances, home improvement items and electronics as Sears moves out of the mall and other locations.

- About 80% of Sears’ US stores today are within a 15-minute drive of a Home Depot, Lowe’s and/or Best Buy location. Some appliance sales could shift to Amazon, according to UBS analyst Michael Lasser, but he doesn’t anticipate that the category will make a drastic shift online.

US Retail Giant Macy’s to Launch Clothing Range Including Hijabs

(February 9) TheNational.ae

US Retail Giant Macy’s to Launch Clothing Range Including Hijabs

(February 9) TheNational.ae

- American retail giant Macy’s is to launch a collection of modest women’s clothes, including hijabs, as it looks to capture a slice of the increasingly lucrative Muslim clothing market.

- Its new Verona Collection will appear in stores on February 15. The line features long cardigans and full-coverage sweaters that mix elegance with modesty. It will mark the first time a nationwide department store has sold hijabs. The items will sell for $13–$85.

Team USA Launches Omnichannel Strategy for Olympic Retail

(February 6) Pymnts.com

Team USA Launches Omnichannel Strategy for Olympic Retail

(February 6) Pymnts.com

- Fanatics, a company that sells Team USA merchandise, has taken a novel approach to Olympic retail this year with a physical store in a major US city. Through a pop-up store in New York City, consumers are able to browse and buy gear from official Olympic sponsors, such as Nike, Swatch and Oakley.

- The store marks a milestone for Team USA: it’s their first in-person retail store outside the Olympic Training Center in Colorado. It will stay open through the end of the Games on February 25.

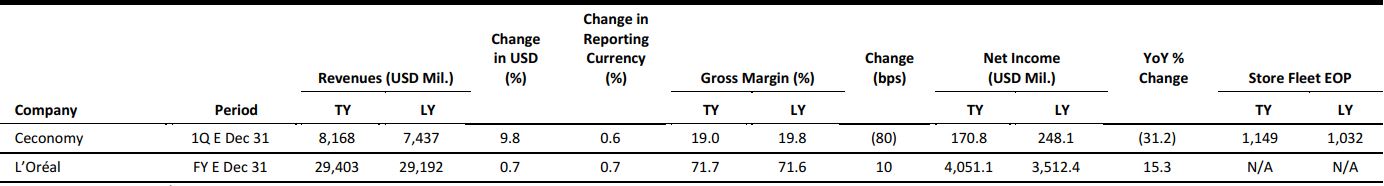

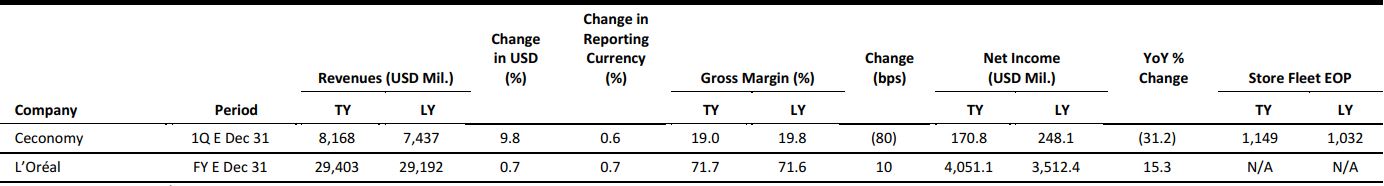

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Tesco “Set to Launch New Discount Chain” to Take on Aldi and Lidl

(February 11) TheTimes.co.uk

Tesco “Set to Launch New Discount Chain” to Take on Aldi and Lidl

(February 11) TheTimes.co.uk

- Britain’s biggest supermarket chain, Tesco, is set to launch a separate grocery brand to take on discounters Aldi and Lidl, according to industry sources who spoke to The Sunday Times. The new banner is expected to match the German retailers on price and offer a smaller range of products than the average Tesco store.

- Aldi and Lidl continue to capture market share from mainstream grocers and control a combined 11.9% of the UK market, according to data from market measurement firm Kantar Worldpanel for the 12 weeks ended January 28, 2018. During the same period, Tesco held a 27.8% market share, declining from 28.1% in the year-ago period, when the German retailers held a combined 10.7% share.

Footfall Grows at UK Retail Parks While Declining at Other Shopping Destinations

(February 12) BRC press release

Footfall Grows at UK Retail Parks While Declining at Other Shopping Destinations

(February 12) BRC press release

- UK total retail footfall declined by 1.6% year over year in the four weeks ended January 27, 2018, according to the British Retail Consortium (BRC). The decline was deeper than the 1.3% drop seen in January 2017.

- Shopping centers performed the worst in January, with footfall declining by 3.1%, followed by the high street, where footfall declined by 1.9%. Footfall grew by 0.9% at retail parks, which were the only shopping destination to see a footfall increase in the four-week period.

Online Sales Help Ceconomy’s Performance in the First Quarter

(February 8) Company press release

Online Sales Help Ceconomy’s Performance in the First Quarter

(February 8) Company press release

- German consumer electronics retail group Ceconomy reported sales growth of 0.6%, to €6,935 million ($8,168 million), in the first quarter of its current fiscal year, which ended December 31, 2017. Growth was led by a 12% rise in e-commerce sales.

- The company’s gross margin contracted by 80 basis points, to 19.0%, while net profit fell by 31.2%, to €145.0 million ($170.8 million). For fiscal year 2018, Ceconomy expects “a slight increase in total sales compared to the previous year.”

Sports Direct to Install Gaming Concessions in About Half of Its Stores

(February 12) RetailGazette.co.uk

Sports Direct to Install Gaming Concessions in About Half of Its Stores

(February 12) RetailGazette.co.uk

- British firm Sports Direct has bought a 50% stake in Belong, the e-sports division of video games retailer Game, for about £3.2 million ($4.4 million). Sports Direct plans to install gaming concessions across its store estate.

- Along with the rollout of gaming concessions in its stores, Sports Direct will lend Game’s Spanish business £55 million ($76.1 million) to fund the expansion of more arenas.

Sofology Boosts First-Half Sales Growth at DFS

(February 8) Company press release

Sofology Boosts First-Half Sales Growth at DFS

(February 8) Company press release

- British furniture retailer DFS posted gross sales growth of 4.0% year over year in the first half ended January 27, 2018. Excluding Sofology, which DFS acquired in December 2017, the group’s gross sales fell by 3.5%.

- DFS stated that sales across its online channels grew “strongly” over the period and that comparable sales strengthened through the first half. Management expects the momentum to continue and “lead to a stronger year-on-year gross sales trend” in the second half.

ASIA RETAIL & TECH HEADLINES

Alibaba Invests Another $1.3 Billion into Its Offline Retail Strategy

(February 12) TechCrunch.com

Alibaba Invests Another $1.3 Billion into Its Offline Retail Strategy

(February 12) TechCrunch.com

- Alibaba is furthering its physical retail footprint, investing another billion dollars into projects to develop its “New Retail” strategy, which combines online and offline operations. The dominant e-commerce player in China, Alibaba gobbled up a 15% stake in Beijing Easyhome Furnishing for ¥45 billion, or around $867 million, and pumped $486 million into a big data retail firm in two deals announced over the weekend. Beijing Easyhome operates 223 physical home furnishing and DIY-style stores across 29 provinces in China. The company claims it is the second-largest chain of its kind in the country.

- Reuters reports that the second outlay is for a 38% stake in Shiji Retail Information Technology, which works with hotels and high-street retailers on data-related services to increase customer footfall, grow engagement and more.

Google Fined $21.1 Million for Search Bias in India

(February 9) TechCrunch.com

Google Fined $21.1 Million for Search Bias in India

(February 9) TechCrunch.com

- India’s competition commission has issued a penalty of INR 1.36 billion (~$21.1 million) on Google for abusing its dominant position in the local search market for online general web search and web search advertising services.

- “Google was leveraging its dominance in the market for online general web search to strengthen its position in the market for online syndicate search services. The competitors were denied access to the online search syndication services market due to such…conduct,” the Competition Commission of India stated in a press release.

Toyota Invests $69 Million in Japanese Uber Rival Backed by the Taxi Industry

(February 8) TechCrunch.com

Toyota Invests $69 Million in Japanese Uber Rival Backed by the Taxi Industry

(February 8) TechCrunch.com

- Auto giant Toyota said it will invest ¥5 billion ($69 million) into JapanTaxi, an Uber-like service owned by Ichiro Kawanabe, who runs Japan’s largest taxi operator, Nihon Kotsu, and heads up the country’s taxi federation. Toyota is also an Uber investor and it previously backed JapanTaxi via a $4.5 million investment from its Mirai Creation Fund, according to Bloomberg.

- The new funds will go toward developing the service further, and Toyota said that it plans “cooperation and business collaboration in such areas as connected terminals for taxis, the joint development of vehicle-dispatch support systems, and big data collection.” JapanTaxi also offers a fare calculator app and an app for booking rides for children.

In a Change of Mind, China to Retain Local Electric Vehicle Subsidies

(February 12) Bloomberg.com

In a Change of Mind, China to Retain Local Electric Vehicle Subsidies

(February 12) Bloomberg.com

- China’s government is leaning toward allowing provinces to continue with local subsidies for electric vehicles to sustain the rising domestic demand for new-energy automobiles. Authorities are in favor of abandoning an earlier proposal to scrap local incentives.

- In the latest amended nationwide policy on subsidies, which is in the final stages of discussion, local funding would continue to be capped at 50% of the aid provided by the central government. The finance ministry did not respond to a fax sent by Bloomberg News seeking comments.

LATAM RETAIL & TECH HEADLINES

Qualcomm Ramps Up IoT Business in Brazil

(February 9) ZDNet.com

Qualcomm Ramps Up IoT Business in Brazil

(February 9) ZDNet.com

- Qualcomm is betting on the development of the Internet of Things (IoT) ecosystem in Brazil, and the company made two noteworthy announcements this week. First, Qualcomm said that it has signed an agreement with the government of São Paulo State to operate a factory under a joint venture with Taiwanese company USI. The factory will be located in the technology hub of Campinas and will focus on production of processors used for IoT applications. According to Qualcomm, the factory is to begin manufacturing activities in 2020.

- Qualcomm also announced that it intends to launch a reference center for the development of smart cities products in Brazil. The initiative is aimed at “fostering the IoT ecosystem and accelerat[ing] its adoption in Brazil” as well as demonstrating the value of the innovations and providing support to mayors as they apply smart technologies to public services.

“Internet for All” Plan Advances in Brazil

(February 10) ZDNet.com

“Internet for All” Plan Advances in Brazil

(February 10) ZDNet.com

- Brazilian authorities will begin implementing a plan to address lack of connectivity in remote regions of Brazil before the end of the first quarter of 2018. According to the Brazilian Ministry of Science, Technology, Innovation and Communications (MCTIC), there are 57 million people currently without Internet access in the country.

- The “Internet for All” plan will use Brazil’s first satellite to deliver Internet access to the digitally excluded areas. The satellite, launched last May, cost the government around R$3 billion ($912 million) and more is being spent on maintenance. Most of the satellite’s capacity is currently underutilized, according to the MCTIC.

Amazon Eyes New Warehouse in Brazil E-Commerce Push

(February 12) Reuters.com

Amazon Eyes New Warehouse in Brazil E-Commerce Push

(February 12) Reuters.com

- com is looking to lease a 50,000-square-meter warehouse just outside São Paulo as it steps up its push into Latin America’s biggest retail market, Brazil. The logistics investment, which would be four times the size of Amazon’s current book-shipping operation in the country, is a sign that the online retailer may soon handle distribution of electronics and other goods sold on its Brazilian website.

- That would be the first step of its kind for Amazon in Latin America’s largest economy, where it currently relies on third parties to ship their own goods sold on its marketplace, and it underscores the seriousness of the e-commerce giant’s renewed push into Brazil. While an estimated two-thirds of Brazil’s 209 million people have Internet access, online retail was slow to take off in the country, given concerns over security and complications with taxes and logistics.

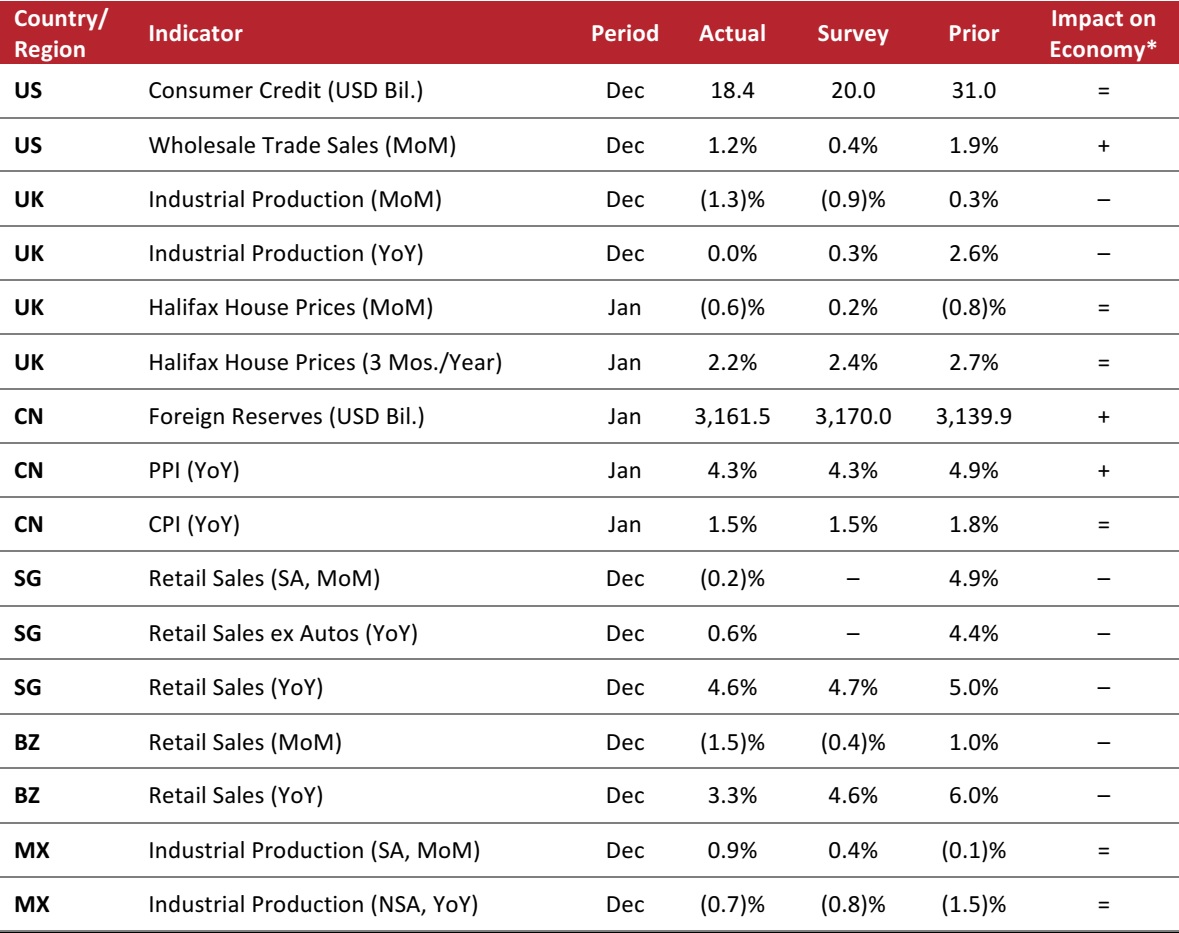

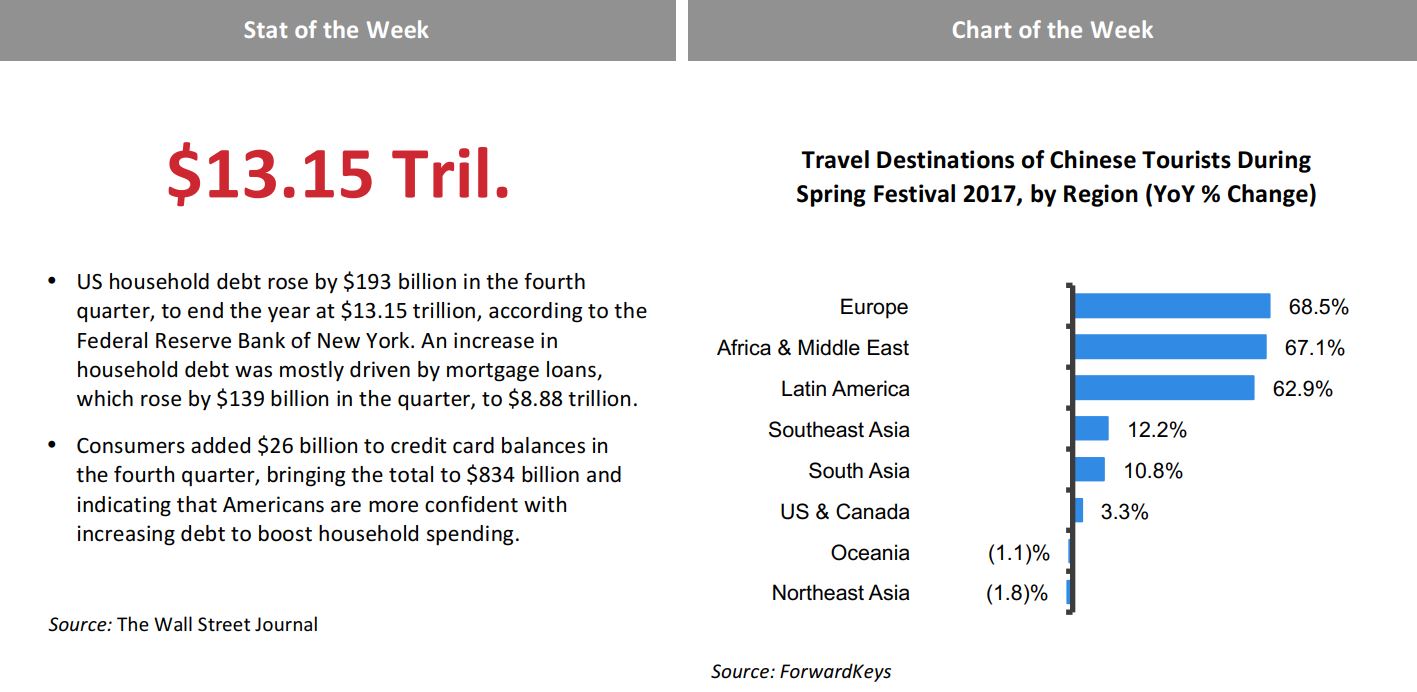

MACRO UPDATE

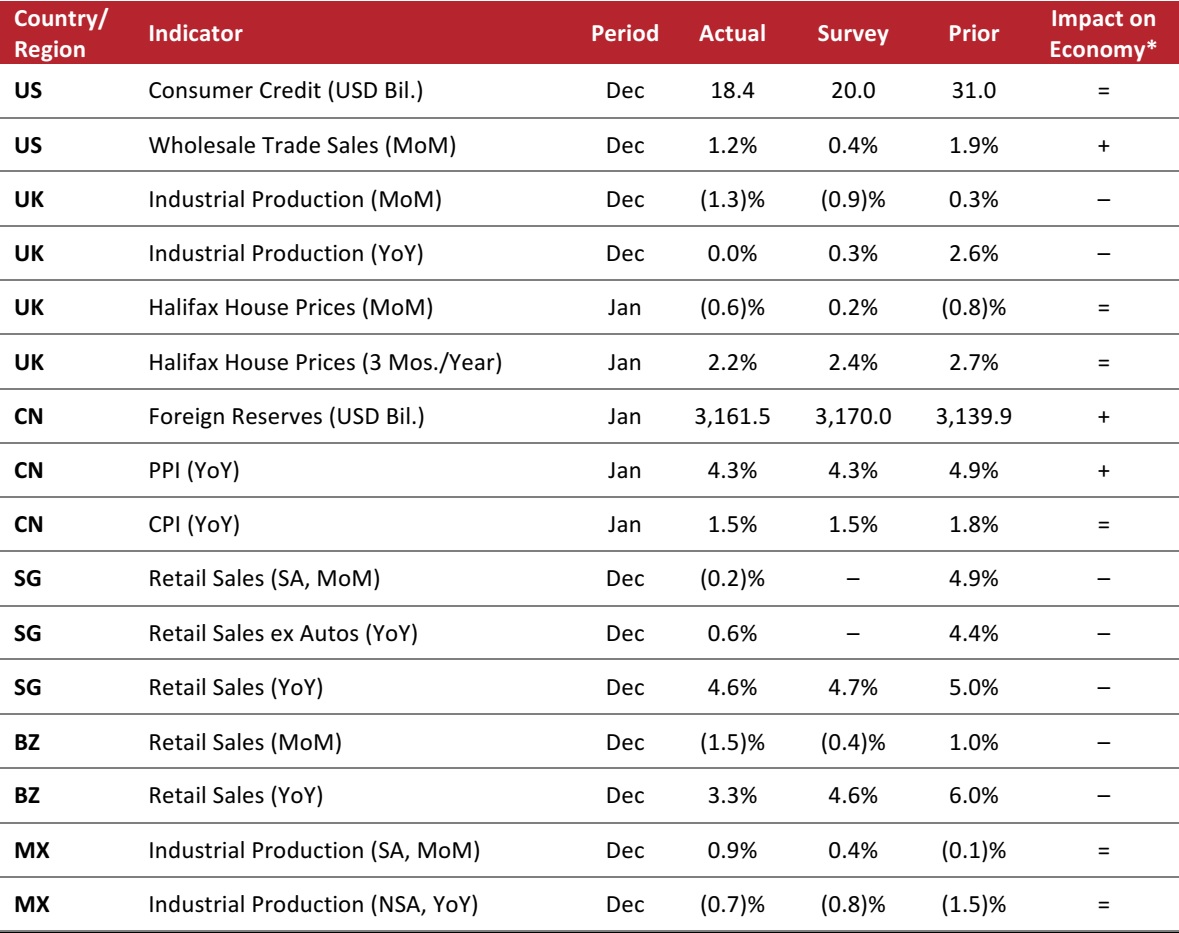

Key points from global macro indicators released February 7–14, 2018:

1) US: Consumer credit in December registered at $18.4 billion, below the consensus estimate of $20.0 billion. Wholesale trade sales increased by 1.2% in December, coming in above the market’s estimate of a 0.4% increase.

2) Europe: In the UK, industrial production dropped in December by 1.3% month over month, missing the consensus estimate of a 0.9% drop. House prices in the UK dropped by 0.6% month over month in January.

3) Asia-Pacific: In China, foreign reserves increased to $3.2 trillion in January. The Producer Price Index (PPI) in China increased by 4.3% year over year in January and the Consumer Price Index (CPI) increased by 1.5%. In Singapore, retail sales decreased by 0.2% month over month in December.

4) Latin America: In Brazil, retail sales dropped by 1.5% month over month in December, falling more than the expected 0.4%. In Mexico, industrial production increased by more than analysts had expected in December, growing by 0.9% month over month.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates anegligible or mixed impact.

Source: US Federal Reserve/US Census Bureau/UK Office for National Statistics/Markit/Halifax/The People’s Bank of China/NationalBureau of Statistics of China/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional deEstadística y Geografía/Coresight Research

Sports Direct to Install Gaming Concessions in About Half of Its Stores

(February 12) RetailGazette.co.uk

Sports Direct to Install Gaming Concessions in About Half of Its Stores

(February 12) RetailGazette.co.uk

Alibaba Invests Another $1.3 Billion into Its Offline Retail Strategy

(February 12) TechCrunch.com

Alibaba Invests Another $1.3 Billion into Its Offline Retail Strategy

(February 12) TechCrunch.com

Toyota Invests $69 Million in Japanese Uber Rival Backed by the Taxi Industry

(February 8) TechCrunch.com

Toyota Invests $69 Million in Japanese Uber Rival Backed by the Taxi Industry

(February 8) TechCrunch.com

“Internet for All” Plan Advances in Brazil

(February 10) ZDNet.com

“Internet for All” Plan Advances in Brazil

(February 10) ZDNet.com