albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

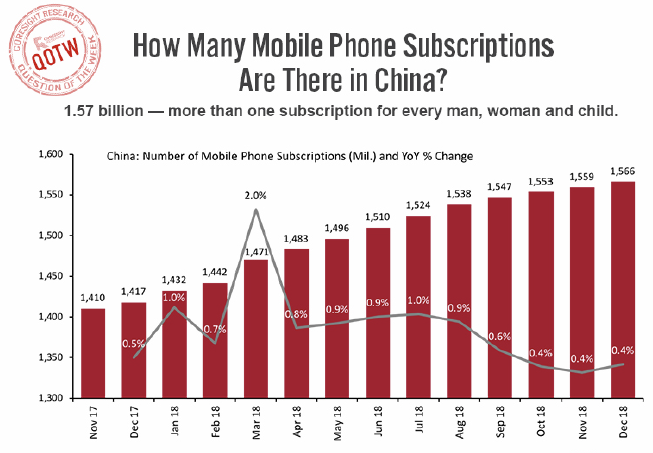

Eight Things We Can Learn from China As part of the High-Tech Retailing track at the recent CES trade show in Las Vegas, I gave a presentation titled “Understanding the Asian Retail Market,” in which I described Coresight Research’s CORE framework, which refers to communications, optimization of pricing, rationalization of inventory and experiential retail. I also talked about eight things we can learn about retailing from China:- China features smartphone-connected consumer communities. The country ranks No. 1 globally in terms of total mobile phone users, with more than 788 million, according to government statistics. Some 98% of the country’s Internet users are mobile users and more than half of Chinese consumers shop on a mobile device weekly.

- China has evolved into a walletless society. Just a few years ago, Chinese consumers often made purchases with wads of cash. Today, the two main Chinese mobile payment platforms — WeChat Pay and Alipay — hold penetration rates of 84.3% and 63.6%, respectively, according to China Internet Watch. WeChat has become a Chinese super app with more than 1 billion active accounts. Besides making payments through the app, users can also chat, post photos, make video calls, book restaurants and make travel reservations. Restaurants, taxis, grocery stores, public transit systems and even panhandlers in China have unique QR codes for accepting mobile payments.

- Consumption is booming beyond tier-1 cities. Populations are growing faster in lower-tier Chinese cities, and these consumers have stronger consumption appetites than their peers in first-tier cities. The population increase in lower-tier cities has driven the growth of the e-commerce platform Pinduoduo.

- China has embraced shopping festivals. Shopping festivals in China have dwarfed similar events in the U.S. The Singles’ Day shopping festival on Nov. 11, 2018, generated a total of $45 billion in sales in 24 hours, more than 10 times what Amazon Prime Day generated in 36 hours in July.

- Chinese retailers are focusing on last-mile delivery. In China, retailers are offering delivery via drone, bicycle and autonomous robot. They are also using robots to sort goods and automate warehouses, while optimizing supply chains for speedy delivery of fresh food.

- Brands are adapting recipes and creating new products for the China market. Global brands, including makers of packaged food, fast food, and health and beauty items, are adapting products to match local tastes in China. Examples include the Spicy Snickers from Mars, the sesame KitKat from Nestlé, Dragon Dumplings from Starbucks and many more.

- Retail 2.0 encompasses many store formats in China. Retail 2.0 blurs the line between online and offline stores. JD.com’s “Boundaryless Retail” offering enables consumers to get whatever they want whenever they want it. In Alibaba’s Hema “New Retail” stores, customers can select and eat fresh seafood in the store or have groceries delivered in 30 minutes within a three-kilometer radius. Many other Chinese retailers are launching unstaffed convenience and retail stores. Retail 2.0 is estimated to have accounted for 22.4% of total consumer commodity sales in China in 2018, and that figure is forecast to reach 33% by the end of 2023, according to Mintel.

- Successful marketing trends include leveraging a new generation of influencers. In China, key opinion leaders (KOLs), video consumption and word of mouth are driving shopping culture, and social shopping apps such as Little Red Book have become extremely popular. The KOL economy is anticipated to hit $18.3 billion in China this year, according to CBNData, and 63% of internet users in the country say they are receptive to KOLs. Moreover, China represents 38% of global luxury spending, making multiform marketing strategies that incorporate KOLs, rewards, WeChat mini programs, gamification and video livestreaming key to success in the sector.

QUESTION OF THE WEEK

[caption id="attachment_75876" align="aligncenter" width="653"] Source: National Bureau of Statistics of China[/caption]

Source: National Bureau of Statistics of China[/caption]

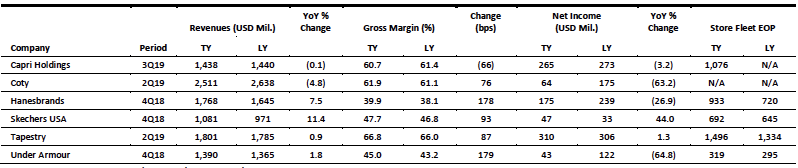

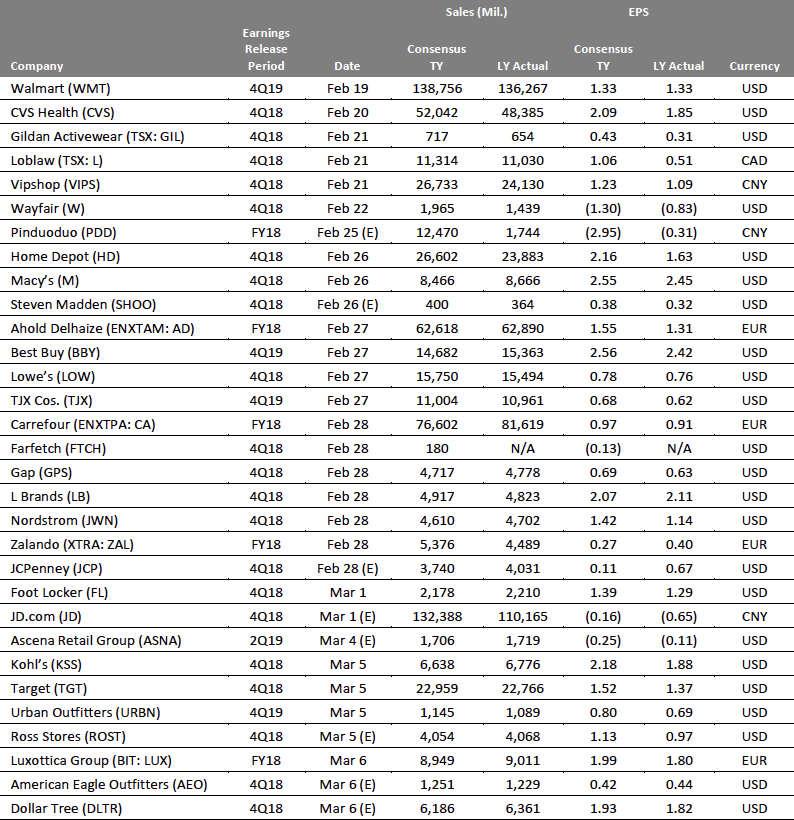

US RETAIL EARNINGS

[caption id="attachment_75877" align="aligncenter" width="798"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- Toys “R” Us liquidated its business last year, unable to emerge from bankruptcy after a crippling 2017 holiday season. Its lenders took control of the company’s intellectual property.

- As of Jan. 20, several former Toys “R” Us executives began running a company called Tru Kids to manage those brands, said Richard Barry, the new president of Tru Kids and former chief merchandising officer of Toys “R” Us.

- Specialty athletic retailer Foot Locker is making a $100 million strategic minority investment in Goat Group, a managed marketplace for secondary sales of authentic sneakers.

- The partners expect to make joint efforts across digital and physical retail platforms to create exclusive experiences for their customers to elevate customer engagement.

- Walmart is laying claim to a growing market for furniture products sold online with a new private-label brand called MoDRN. The brand is geared toward customers who want trendier furniture at lower prices.

- MoDRN will be sold through Walmart.com, Jet.com and Hayneedle, with prices ranging from $199 to $899. Product categories will include sofas, beds, bar furniture, indoor and outdoor dining, and chairs.

- Amazon is taking on QVC with the launch of Amazon Live, which features livestreamed video shows from Amazon talent and from brands that broadcast their own livestreams through the Amazon Live Creator app.

- The hosts of the shows talk about and demonstrate products available for sale on Amazon. Multiple videos stream on Amazon Live at the same time, so shoppers can tune in to the one that most interests them.

- JCPenney announced it will stop selling appliances and furniture in its U.S. stores as of Feb. 28. The company will continue to sell appliances and furniture on its website and in some stores in Puerto Rico.

- The company said customers will receive free basic delivery and installation for orders over $299 and that manufacturers’ warranties and store protection plans will remain in effect.

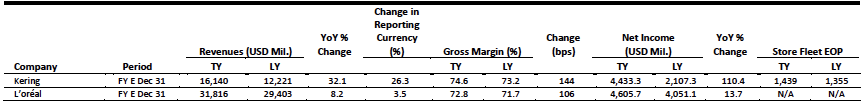

EUROPE RETAIL EARNINGS

[caption id="attachment_75878" align="aligncenter" width="861"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

- British department store Debenhams announced it has secured a 12-month credit facility totaling £40 million ($52 million) from some of its current lenders. The agreement will act as a catalyst to broader refinancing and recapitalization.

- As part of operational improvements, Debenhams has also entered into an agreement with Hong Kong-based supply chain manager Li & Fung. Debenhams expects the partnership to improve private-label product quality, lead time, margins and working capital efficiency.

- Belgian supermarket chain Colruyt is testing a system that will allow customers to create shopping lists through Google Assistant. The system will suggest products based on previous purchases.

- Once customers create a list, they can either forward it to the Collect&Go feature and pick up the order from a store or use the list while shopping in-store.

- House of Fraser’s store in Belfast, Ireland, is no longer facing closure, following a new deal with landlord Commerz Real, saving 500 jobs. As a part of the deal, the 120,000-square-foot store will undergo a £10 million ($13 million) refurbishment beginning in mid-2019.

- Sports Direct founder Mike Ashley vowed to save 47 of 59 House of Fraser stores after taking over the embattled chain. The Belfast store deal means that 42 stores have extended their leases since Sports Direct’s takeover.

- Paris-headquartered car rental startup Virtuo has raised €20 million ($22.6 million) in its series B funding round, led by Iris Capital, Balderton Capital and Raise Ventures. The funds will be used to expand across the U.K. and other European countries.

- Virtuo said it plans to expand to Spain and Germany in 2019 to create a “truly pan-European rental option.” The company currently operates in France, Belgium and the U.K. (in London).

CMA Delays the Deadline for Final Verdict on Sainsbury’s-Asda Merger

(Feb. 11) RetailGazette.co.uk

CMA Delays the Deadline for Final Verdict on Sainsbury’s-Asda Merger

(Feb. 11) RetailGazette.co.uk

- The U.K.’s Competition and Markets Authority (CMA) confirmed that its final decision on a proposed merger between Sainsbury’s and Asda has been extended to Apr. 30, 2019. The investigation period was originally due to expire on Mar. 5.

- The regulatory agency’s confirmation comes after Sainsbury’s and Asda challenged the timeframe initially proposed by the CMA. The supermarket retailers stated that the “unprecedented scale and complexity” of the deal required additional time for review.

ASIA RETAIL & TECH HEADLINES

- Singapore-based online fashion marketplace Zilingo announced it has raised $226 million through a series D fundraising round. The company will use the funds to expand in the Philippines, Indonesia and Australia.

- Sequoia Capital, Temasek Holdings, Burda Principal Investments, Sofina and EDBI were among the investors that participated in the funding round. Zilingo is valued at around $970 million, per unnamed sources familiar with the matter.

- Amazon has put its plans to purchase a stake in India’s Future Group on hold as it assesses the damage caused by recent changes to foreign direct investment regulations for e-commerce in India. New rules stipulate that if an e-commerce marketplace has an equity stake in a retailer, that retailer cannot sell its products on the marketplace.

- Amazon was reportedly set to close the deal by the end of the first quarter of 2019, according to sources, but it is now looking for more clarity on regulations before moving forward.

- China’s retail sales during the Lunar New Year holiday grew 8.5% year over year, according to China’s Ministry of Commerce, but the pace of growth over the holiday period was the slowest since the government started publishing the data in 2005.

- Retail and catering businesses generated total revenue of more than ¥1 trillion ($148.3 billion) over the Feb. 4-10 holiday period. The increase was attributed to rapid growth in sales of new-year gifts, traditional foods, electronic products and local specialty products over the holiday.

- Indian conglomerate Reliance Industries (RIL) has raised its stake in luxury apparel companies Future101 Design and Genesis Colors as it seeks to solidify its foothold in the retail industry. The acquisition of shares did not require any regulatory approvals.

- RIL subsidiary Reliance Brands has invested 19.9 million rupees ($300,000) in Future101 Design, taking its total stake in the company to 15%. Another RIL subsidiary, Reliance Retail Ventures, increased its stake in Genesis Colors to 29.1% with an infusion of 450 million rupees ($6.3 million).

- Chinese e-commerce giant JD.com reported strong sales growth of 42.7% year over year during the Feb. 3-8 Chinese New Year holiday period. The company noted consumers stepped up online shopping for food and gifts.

- JD.com’s top three categories in terms of sales value during the holiday period were smartphones, computers and home appliances. Cooking utensils recorded the strongest growth, at 399% year over year, and customers showed a preference for higher-end products in the category, the company said.

LATAM RETAIL & TECH HEADLINES

- American department store retailer Sears plans to open two new stores and remodel 10 others in Mexico this year as it continues to make inroads in the country in partnership with Grupo Carso, owned by Carlos Slim.

- Along with its offline expansion, Sears also has plans to accelerate its Mexican e-commerce business, which has been in operation for around two years.

- Brazilian apparel retailer Lojas Renner reported annual profit of over R$1 billion ($269 million) in 2018, spurred by double-digit revenue growth that has continued into the first weeks of 2019.

- “We see good customer traffic and the same pace we had at the end of last year,” said CFO Laurence Gomes in a telephone interview with Reuters. He also said that the company still plans to open three new stores in Argentina in the second half of 2019.

- The Indian subsidiary of Chilean multinational department store chain Falabella announced a partnership with ThoughtWorks India, a global software consultancy, to enhance Falabella’s digital capabilities across markets.

- “Our partnership with ThoughtWorks will give us the added impetus to accelerate our digital commerce journey to provide our end customers with a seamless shopping experience,” said Ashish Grover, head of e-commerce for Falabella and the company’s India technology head.

- Brazilian fashion retail giant Hering is set to open three new stores in Uruguay in 2019, two in Montevideo and one in Maldonado. The new stores in Montevideo are scheduled to open on July 18 and Oct. 8.

- The retailer currently operates nine stores in Uruguay on a franchise basis through entrepreneur Lourdes Alvarez, according to Spanish newspaper El País.

Blue Star Group Launches New Todomoda Store in Toluca, Mexico

(Feb. 8) Mx.FashionNetwork.com

Blue Star Group Launches New Todomoda Store in Toluca, Mexico

(Feb. 8) Mx.FashionNetwork.com

- Argentinian retail giant Blue Star Group launched a new store under its Todomoda banner on Feb. 1 in downtown Toluca, Mexico. Todomoda specializes in women’s accessories.

- The new store is the fourth in Mexico that showcases the new image of Todomoda, according to Oscar Rodríguez Venancio, regional director of operations for Blue Star in Mexico. The company introduced the new image in June last year at the Oasis Coyoacán shopping center in Mexico City.

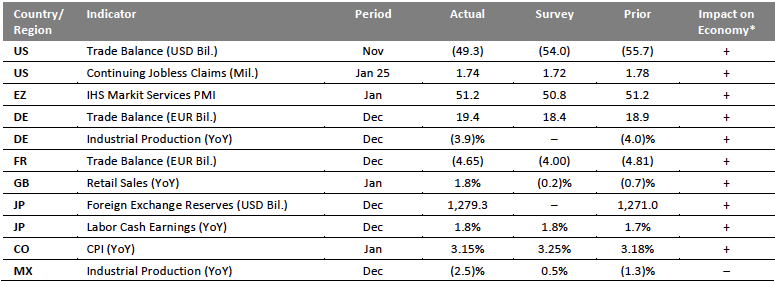

MACRO UPDATE

Key points from global macro indicators released Feb. 5-12, 2019:- U.S.: The trade deficit narrowed to $49.3 billion in November from $55.7 billion in October, missing the consensus estimate of $54.0 billion. Continuing jobless claims in the U.S. fell to 1.74 million in the week ended Jan. 25 from 1.78 million the previous week.

- Europe: The IHS Markit Services Purchasing Managers’ Index (PMI) remained at 51.2 in January. In Germany, the trade surplus increased to €19.4 billion in December from €18.9 billion in November, ahead of the consensus estimate of €18.4 billion.

- Asia Pacific: Japan’s foreign exchange reserves increased to $1.279 trillion in December, from $1.271 trillion in November. Year over year, labor cash earnings in Japan grew 1.8% in December, in line with the consensus estimate and following a 1.7% increase in November.

- Latin America: Colombia’s Consumer Price Index (CPI) increased 3.15% year over year in January, compared with 3.18% in December and the consensus estimate of 3.25%. Industrial production in Mexico fell 2.5% year over year in December after declining 1.3% in November, missing the consensus estimate of 0.5% growth.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impactSource: U.S. Census Bureau/U.S. Department of Labor/IHS Markit/Federal Statistical Office of Germany/Ministry for the Economy and Finance (France)/British Retail Consortium/Ministry of Finance (Japan)/Ministry of Health, Labour and Welfare (Japan)/Central Bank of Colombia/National Institute of Statistics and Geography (Mexico)/Coresight Research[/caption]

EARNINGS CALENDAR

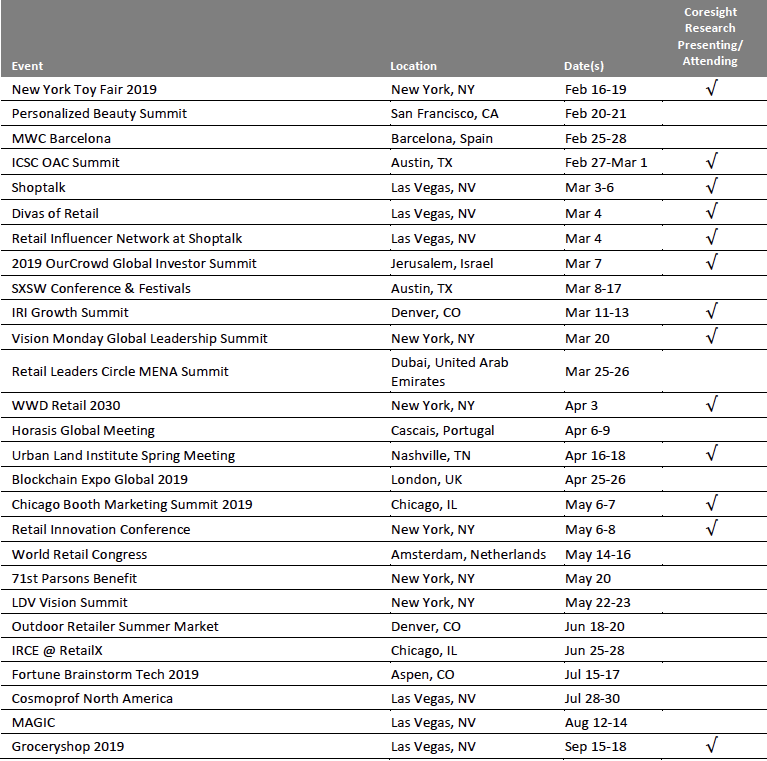

EVENT CALENDAR