albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Robots: Moving Beyond Warehouses into the Stores and the Streets Robots burst into the consciousness of the retail industry when Amazon acquired warehouse-robot-maker Kiva Systems for $775 million in May 2012. Since then, many other retail companies have followed Amazon’s example and deployed robots in their own warehouses. These robots are not the kind that walk and talk; they’re flat, faceless machines that scoot across a warehouse floor, delivering a shelf of goods to a fulfillment center, where a human packer then completes the order. While many imagine that warehouses and fulfillment centers are already completely automated, most operate using human-machine teams, which are likely the most efficient and cost-effective solution. Over the past several years, the use of robots in retail has expanded well beyond warehouses and fulfillment centers, and the machines now appear in stores and even on the streets, where they are being used to deliver goods to customers’ homes. Walmart is among the retailers actively deploying in-store robots. Starting in 2017, the company began offering click-and-collect service via in-store Pickup Towers enabled by technology from an Estonian company called Cleveron. Walmart customers who choose the pickup service enter the store and then enter their order information at the 16-foot tower, into which their goods have been preloaded. The tower uses a robotic arm to transfer their items into a bay, and customers simply collect the products and leave. The company is also using robots made by Bossa Nova to scan store shelves and maintain current inventory logs in 50 Walmart stores. These narrow machines, tall as a human, cruise down the aisles and use computer vision to identify what is on the shelves, alerting managers to shortages and misplaced items in real time. These shelf-scanning robots enable retail stores to house inventory that can be used to fulfill e-commerce orders, reducing warehouse costs. Since stores are typically located much closer to customers’ homes than warehouses are, the robots can also help retailers reduce shipping times, increasing customer satisfaction and bringing down the overall cost of e-commerce operations. In addition to handing goods and scanning shelves, robots are also mopping floors at Walmart stores. In December, the retailer announced that it would launch an army of 360 floor-scrubbing robots powered by software from Brain Corp. These robots use sensors and artificial intelligence (AI) to avoid obstacles, so they can even clean floors when customers are in the store. Amazon recently announced a couple of additions to its fleet of robots. The company is outfitting employees at more than 25 of its fulfillment centers with Robotic Tech Vests, which are laden with sensors that inform robots that a human is nearby, so the robots can slow down and avoid accidents. This technology supplements Amazon’s existing grid-based approaches that restrict robots’ movement within a specific area in a facility. The company is also testing a ground-based delivery robot called the Amazon Scout in suburbs near its Seattle headquarters. The device, which will be deployed during daylight hours Monday through Friday, has six wheels, is larger than a breadbox and looks similar to robots made by U.K.-based Starship Technologies that are currently being tested in the U.K. The Amazon Scout travels at a walking pace and can move around people, pets and other obstacles. The ground-based, autonomous vehicles represent a change in direction for Amazon, which gained much notoriety when it demonstrated delivery using an aerial drone during an episode of the 60 Minutes television news program in 2013. With advances in computer vision and AI, the testing and deployment of robots is accelerating in retail. Meanwhile, retailers are opening more unstaffed store formats, such as Amazon Go in the U.S. and BingoBox in China, offering customers convenience and speed enabled by technology. In these and other instances, humans are increasingly being taken out of the retail equation. Other examples include robotic burger makers that require no human operator and the self-contained, automated bread-baking module that we saw at this year’s CES trade show. In addition to reducing costs, increased use of automation and robots promises to help retailers shorten the length of time customers have to spend waiting for service or delivery and frees employees to focus on using human skills to provide better customer service.

QUESTION OF THE WEEK

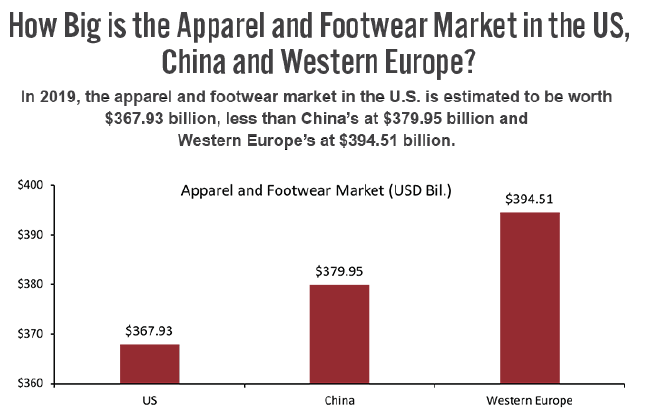

[caption id="attachment_68849" align="aligncenter" width="646"] Source: Euromonitor International[/caption]

Source: Euromonitor International[/caption]

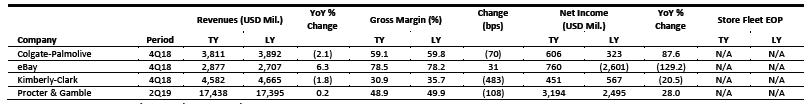

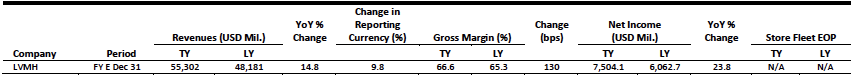

US RETAIL EARNINGS

[caption id="attachment_68850" align="aligncenter" width="808"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- Google Trends data signal that U.S. retail sales, a key economic indicator that’s been delayed by the government shutdown, probably remained healthy in December, along with household consumption, according to a report by Renaissance Macro Research.

- Inquiries on the search engine indicate that retail sales excluding autos and gas rose 0.3% in December month over month, putting fourth-quarter personal-consumption growth on track to accelerate to a 3.7% pace, according to the report.

- Digitally native furniture and home decor brand Article announced the launch of an in-house delivery service called Article Delivery Team. The company will offer the service in New York and Los Angeles at first and expand to other major cities over 18 months, according to a press release.

- Article said it can improve and adapt to customers’ needs better by owning last-mile delivery. “Negative feedback has been reduced by as much as 83% in ADT pilot program service areas,” according to the release.

- Things Remembered, a U.S. retailer that sells engraved gifts and keepsakes, is preparing to file for bankruptcy protection in the coming days and shutter most of its roughly 400 stores, according to sources familiar with the matter.

- The company employs roughly 2,500 people in the U.S. and Canada, and is reportedly hoping to sell its brand and online business during bankruptcy proceedings. Things Remembered is also seeking buyers for some of its stores, according to the sources.

- U.S. retail giant Walmart is looking to add more domestic workers to drive its fleet of trucks amid a nationwide shortage. The company announced that in addition to the 1,400 truck drivers it added last year, it is hoping to hire “hundreds more” in 2019.

- To entice more drivers to join its team, Walmart is raising pay. On average, its drivers will make about 89 cents per mile – or $87,500 per year.

- Apple is rolling out its Apple Pay digital wallet service to thousands of new retail locations in the U.S. The tech giant announced that it has inked Apple Pay support agreements with Target, Taco Bell and Jack in the Box, resulting in more than 10,000 new points of acceptance for the service.

- With these additions, 74 of the top 100 U.S. merchants and approximately 65% of all retail locations across the country now support Apple Pay.

EUROPE RETAIL EARNINGS

[caption id="attachment_68851" align="aligncenter" width="852"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

- British grocery retailer Tesco has announced plans to cut positions at its fresh-food counters, staff canteens and head office, putting some 9,000 jobs at risk. However, the retailer expects to redeploy half of the affected employees in other customer-facing roles. The company said that, contrary to media reports, it does not plan to make any significant changes to its in-store bakeries this year.

- Jason Tarry, CEO, UK and ROI, said, “In our four years of turnaround, we’ve made good progress, but the market is challenging, and we need to continually adapt to remain competitive.”

- German supermarket chain Lidl has partnered with Italian delivery firm Supermercato24 to provide Lidl customers in Italy with one-hour delivery service.

- The retailer will offer delivery service for more than 4,000 products, 85% of which are reportedly private-label goods.

- British retailer Marks & Spencer (M&S) is reportedly discussing a partnership with online supermarket and technology provider Ocado. The talks are at an early stage, according to sources cited by the Financial Times. The Mail on Sunday suggested that M&S could replace Waitrose as a key supplier to Ocado.

- M&S reported a 2.1% decline in grocery same-store sales over the Christmas trading period, and a partnership with Ocado could help the retailer scale its nascent online grocery offering.

- Spanish voice-assistant startup Sherpa.ai has raised $8.5 million in a funding round led by Mundi Ventures. Chairman and CEO of British Airways Alex Cruz also participated in the round.

- Sherpa.ai said in a press release that its voice-enabled AI platform is designed for manufacturers of consumer products such as cars, home appliances and electronic accessories. The company stated that it will announce additional partnerships with multinational companies in the coming months.

- German apparel e-commerce company Zalando announced that it is expanding its partner program beyond Germany for the first time, launching in the Netherlands. Under the program, partner retailers process Zalando orders from their own stock. In the Netherlands, partners will initially deliver purchased items to customers, rather than offer both in-store pickup and delivery services.

- The company expects to roll out the program in the Netherlands by the end of the first quarter. Zalando has not yet confirmed which retailers will participate, but they will most likely be international brands.

ASIA RETAIL & TECH HEADLINES

- Thai luxury property developer Sansiri has launched its first hybrid retail concept, Siri House, in Singapore, its third-largest market. Located in the Dempsey Hill area, Siri House incorporates a showroom, restaurant and bar, retail space, and gallery. It will serve as a test for a planned flagship in Bangkok that is set to open by March.

- The retail store in the venue presently offers seven brands in categories such as homewares, souvenirs, crafts and ceramics.

Walmart and Amazon Request Extension for E-Commerce Compliance in India

(Jan. 28) RetailNews.asia

Walmart and Amazon Request Extension for E-Commerce Compliance in India

(Jan. 28) RetailNews.asia

- Facing a compliance deadline of Jan. 31, Walmart and Amazon have both sought a six-month extension from the Indian government to comply with new foreign direct investment regulations in India. The Department of Industrial Policy and Promotion has not been in favor of the companies’ proposals, but has not yet made a final decision, according to a representative from the department.

- Meanwhile, domestic merchants have threatened a nationwide protest should the extension be granted.

- K-beauty startup Memebox announced that it has completed a $35 million series D funding round led by Johnson & Johnson Development Corp. The e-commerce platform has now raised $190 million in total.

- The company said it plans to use the funds to spur growth and “build the next generation of personal care brands by leveraging Korean technology across beauty categories.”

- Integrated property developer SM Prime plans to open four new malls in the Philippines this year. The malls will be located in Zamboanga City, Dagupan, Butuan and Olongapo and have an aggregate gross floor area of 1.9 million square feet.

- The new openings, along with the planned expansion of other properties, will take the company’s gross floor area to 113 million square feet by the end of 2019, a 9% increase year over year.

Global Brands Group Signs Licensing Agreement with Bikkembergs

(Jan. 28) WWD.com

Global Brands Group Signs Licensing Agreement with Bikkembergs

(Jan. 28) WWD.com

- Hong Kong-headquartered branded apparel, footwear and accessories company Global Brands Group (GBG) has signed a licensing agreement with Milan-based fashion brand Bikkembergs to produce and distribute the latter’s footwear internationally. The partnership will commence in the fall.

- “The Bikkembergs partnership is an important initiative as part of our strategy to grow GBG’s portfolio of European brands. By leveraging our design and distribution expertise, we see significant opportunities for global growth, across both men’s and women’s footwear,” said Mike Hiscock, GBG’s Managing Director for European Footwear and Accessories.

LATAM RETAIL & TECH HEADLINES

- Amazon has begun selling merchandise directly to customers in Brazil following months of delays owing to logistics complications and a complex tax system. The company, which previously operated in the region primarily as a marketplace for third-party sellers, stated that it will offer 11 categories of merchandise from more than 800 suppliers as of Jan. 22.

- Amazon’s decision to launch its in-house fulfillment and delivery network in Brazil is likely to increase competition for quick delivery of goods in the country as it emerges from recession.

- Japanese accessories and decor retailer Miniso has opened its 100th store in Mexico, in the El Dorado shopping center in San Luis Potosí. The store is the company’s first in the city.

- The retailer also plans to open another 100 stores by the end of the year as part of its Latin America expansion plans. The company’s global expansion plan targets a network of 6,000 locations by 2020.

Falabella Announces Linio Exit from Ecuador and Panama

(Jan. 23) Df.cl

Falabella Announces Linio Exit from Ecuador and Panama

(Jan. 23) Df.cl

- Chilean retailer Falabella has announced that its e-commerce subsidiary, Linio, will end operations in Ecuador and Panama and that it will remain in those markets only until it liquidates its available inventory and fulfills existing transactions.

- “The decision is part of Falabella’s strategy to focus its efforts in those countries where it has strategic capabilities to improve the value proposition of its market platform,” according to a company statement.

3Sixty and Avianca Collaborate to Create Online Market Platform

(Jan. 23) TrBusiness.com

3Sixty and Avianca Collaborate to Create Online Market Platform

(Jan. 23) TrBusiness.com

- Duty-free specialty retailer 3Sixty (formerly known as DFASS) has partnered with Colombian airline company Avianca Holdings on a joint business agreement to launch an online duty-free and duty-paid market platform for Avianca in-flight concessions. The new platform will enable customers to preorder goods and services for onboard and ground-based delivery.

- Beginning with airline operators Avianca (Colombia), Aerogal (Ecuador), Taca (Peru) and Lacsa (Costa Rica), 3Sixty plans to expand the joint agreement to include other Avianca partner airlines in the Americas.

- Venezuelan pharmacy and convenience store chain Farmatodo has entered Argentina, launching two points of sale in Buenos Aires. The outlets will operate under the Farma 365 banner, registered under the domain of Daniel Selma, the former owner of the chain of Farma 365 pharmacies.

- Farmatodo, whose most profitable base is Colombia, is reportedly testing the market with a view to launch more widely in Argentina.

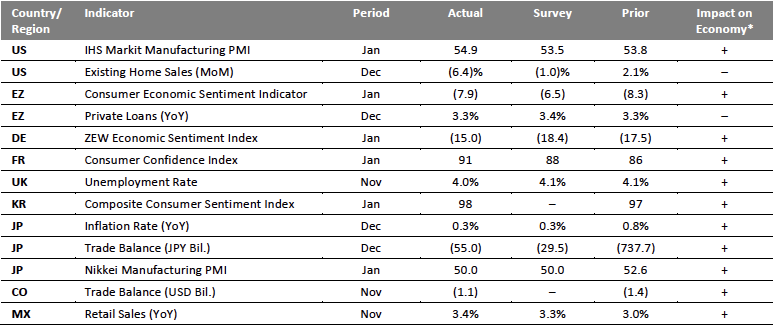

MACRO UPDATE

Key points from global macro indicators released Jan. 23-29, 2019:- U.S.: In the U.S., the IHS Markit Manufacturing Purchasing Managers’ Index (PMI) increased to 54.9 in January from 53.8 in December, beating the consensus estimate of 53.5. Existing home sales in the U.S. fell 6.4% month over month in December following 2.1% growth in November.

- Europe: In the eurozone, the Consumer Economic Sentiment Indicator registered (7.9) in January, below the consensus estimate of (6.5) and slightly above the previous month’s (8.3). In Germany, the ZEW Economic Sentiment Index improved to (15.0) in January from (17.5) in December and was ahead of the consensus estimate of (18.4).

- Asia Pacific: In South Korea, the Composite Consumer Sentiment Index increased to 98 in January from 97 in December. In Japan, annual inflation registered 0.3% in December, in line with the consensus estimate and down from 0.8% in November. The trade balance in Japan stood at ¥(55.0) billion in December, below the consensus estimate of ¥(29.5) billion, but marking an improvement from ¥(737.7) billion in November.

- Latin America: In November, the trade balance in Colombia registered $(1.1) billion, up from $(1.4) billion in October. Retail sales in Mexico increased 3.4% year over year in November, versus 3.0% growth in October and the consensus estimate of 3.3%.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: IHS Markit/National Association of Realtors/Eurostat/ZEW – Leibniz Centre for European Economic Research (Germany)/International Labour Organization/Office for National Statistics (UK)/Bank of Korea/Ministry of Finance (Japan)/National Administrative Department of Statistics (Colombia)/National Institute of Statistics and Geography (Mexico)/Coresight Research[/caption]

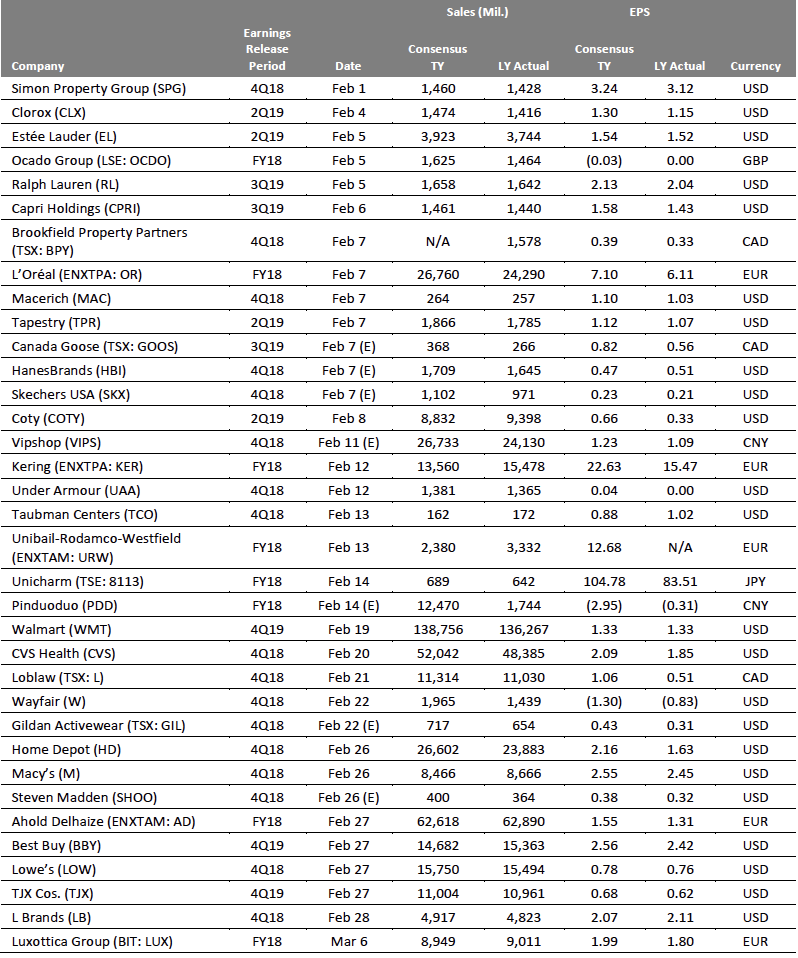

EARNINGS CALENDAR

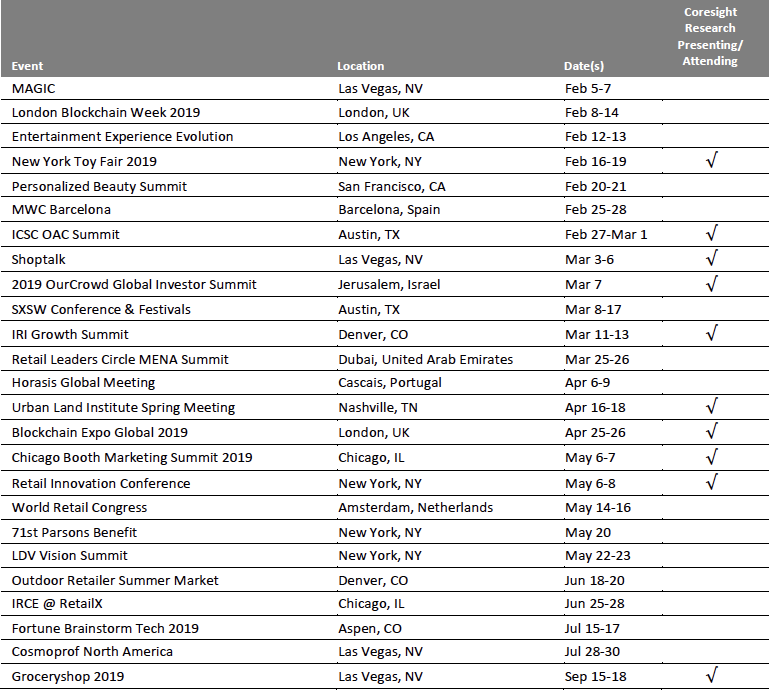

EVENT CALENDAR