Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

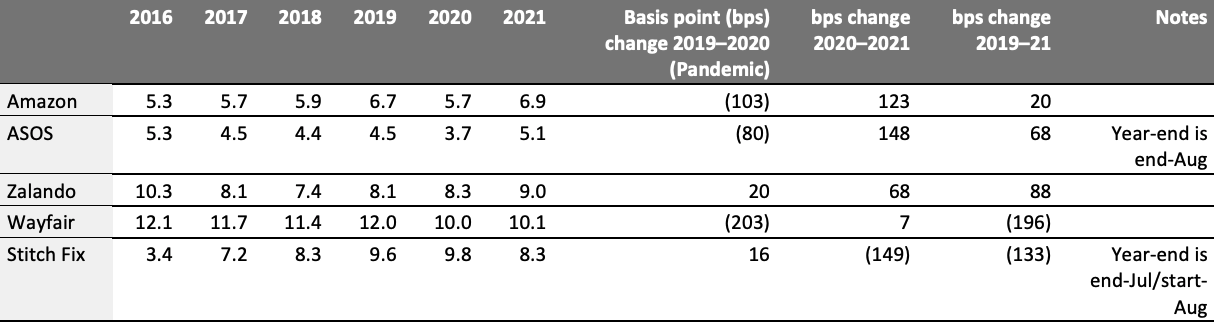

E-Commerce Retailers Fight for Eyeballs Using Two Strategies as Digital Costs Rise Representing bad news for online retailers, digital marketing costs are rising as competition for eyeballs from retailers intensifies. In the US, a tougher economic context, the ending of stimulus payments to consumers, an incremental return to shopping in physical stores and the annualization of a bumper 2021 for retail is making growth harder to achieve for online-only or digital-first retailers. The absence of more organic discovery channels—such as physical storefronts—has long made marketing costs a burden for digital-first retailers. The jump in demand for e-commerce amid the pandemic’s first phase yielded a golden period for digital pure plays—as reflected in the shifts in their marketing cost ratios (marketing costs represented as a percentage of revenues). As shown in Figure 1, marketing cost ratios across a handful of US and European digital-first retailers tended to fall meaningfully in 2020—and then increased in 2021 as shoppers returned to stores. We expect an acceleration in marketing spend across the digital retail space this year as companies have to fight harder for discretionary dollars (or euros or pounds).Figure 1. Selected US and European Digital-First Retailers: Marketing Cost Ratios (%) [caption id="attachment_146335" align="aligncenter" width="700"]

Apart from ASOS and Stitch Fix, the companies all have December fiscal year-ends

Apart from ASOS and Stitch Fix, the companies all have December fiscal year-endsSource: Company reports/S&P Capital IQ/Coresight Research[/caption] Subsequent to the fiscal years shown in Figure 1:

- For the six months to February 28, 2022, ASOS reported that it was seeking “to capture the significant long-term opportunities by increasing its marketing investment to 6.0% as a percentage of sales, up from 5.5% in the comparator period [one year earlier].” Management noted that marketing, along with supply chain, had seen particular cost increases. ASOS outlined an “objective to build our awareness and consideration among US and European consumers” which drove a 50-bps increase in its marketing cost ratio in the first half of fiscal year 2022.

- At Stitch Fix, advertising spending in the second fiscal quarter (latest) was 6.8% of revenue, down 149 bps from one year earlier and down 188 bps from the first quarter. The company pulled back on advertising in the second quarter as it faced challenges with onboarding and converting shoppers.

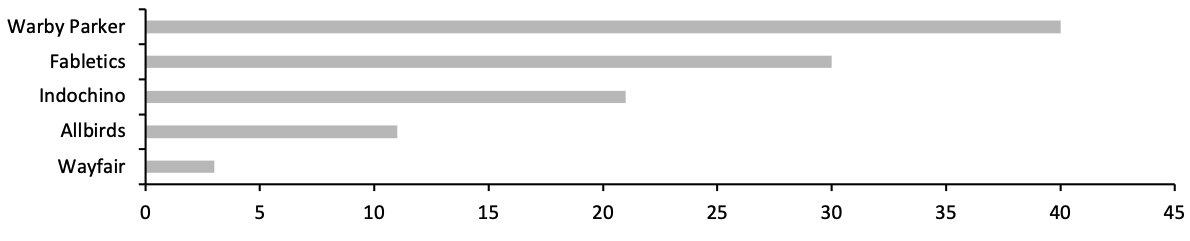

Figure 2. US: Select Digital-First Retailers’ Announced Store Openings for 2022 [caption id="attachment_146336" align="aligncenter" width="700"]

Data as of April 28, 2022. Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur.

Data as of April 28, 2022. Coresight Research attributes store openings and closures to the year in which they occurred or are expected to occur.Source: Company reports/Coresight Research[/caption] Advertising Spend Is Now a Two-Way Flow Finally, multibrand retailers no longer just buy ads—they sell ads, too. In 2021, Amazon sold $31.2 billion of ads on its platforms, while spending $32.6 billion on marketing. At Zalando, 2021 saw its Marketing Services revenues equate to around 2% of GMV in its core Fashion Store segment by year-end—which we estimate means a run-rate in retail media sales of around €250 million (around $265 million, converting from euros at April 27, 2022 rates). Gross, that will have offset a substantial proportion of Zalando’s €930 million ($986 million) marketing spend in 2021. While selling ads will incur costs, too, the ad business is considered margin-rich compared to retail and especially compared to selling lower-margin everyday goods online: Walmart President and CEO Doug McMillion said on the company’s February 2022 earnings call that “opportunities like advertising enable us to grow earnings and make key investments at the same time.” Monobrand retailers will remain at a disadvantage—they do not enjoy the benefits of selling ad space to the kind of brands that sell on multibrand sites. They will, however, continue to have to spend big to capture discretionary spending as inflation-hit shoppers tighten the purse strings.

- Look out for our report The Evolution of Retail Media, publishing next week, and our forthcoming Databank on Digitally Native Vertical Brands, coming soon to Coresight.com.

US RETAIL AND TECH HEADLINES

Skechers Reports Strong Revenue Growth in Its First Quarter (April 26) Company press release- Apparel and footwear company Skechers has reported sales growth of 26.8% year over year in its fiscal 2022 first quarter (ended March 31, 2022). Its wholesale segment sales increased by 33.0% and direct-to-consumer (DTC) segment sales increased by 16.0% year over year. Diluted EPS increased by 22.2%.

- The company’s gross margin declined by 250 bps year over year to 45.3%, due to higher per-unit freight costs. For fiscal 2022, the company expects mid-to-high-double-digit sales growth and a diluted EPS decline of 37.6%–41.9% year over year.

- Grocery retailer and wholesale food distributor SpartanNash has partnered with hosted food distribution provider Specialty Food Partners to offer its independent grocers and customers a new hosted online platform called SpartanNash SpecialtyDirect.

- SpartanNash’s 2,100 independent grocer customers will be able to search products, place orders and pay consolidated invoices on the SpartanNash SpecialtyDirect platform. The aim of the collaboration is to make SpartanNash’s independent grocery customers more competitive by increasing access to specialty, seasonal and local items.

- DTC intimates brand ThirdLove has acquired Kit Undergarments, an intimates brand launched in 2019 by celebrity stylists Jamie Mizrahi and Simone Harouche. The acquisition comes amid ThirdLove’s business expansion, including new physical locations and new category launches.

- Kit Undergarments was relaunched as Kit Undergarments for ThirdLove on April 26 and is available on the ThirdLove website. ThirdLove plans to open six to 10 stores by the end of the year.

- Walmart has launched an outdoor furniture and décor collection in collaboration with builder-designer duo Dave and Jenny Marrs, known for their roles on the home remodeling TV show Fixer to Fabulous.

- The Walmart-exclusive collection debuts with 30 outdoor home and décor items, including pendant lights, planters, lanterns, outdoor furniture and rugs. According to the company, the collection features neutral colors, natural wood and clay, chunky open weaves and antique brass, which reflect Dave and Jenny's personal home décor style.

- Supermarket chain Wegmans Food Markets is set to expand its New York territory with a store opening in Lake Grove, on Long Island. The construction and opening dates are yet to be determined.

- The supermarket, which will span 100,000 square feet, will be located in the DSW plaza near the Smith Haven Mall, at the corner of Middle County Road and Moriches Road. The company has agreed to buy 8.5 acres of the existing 28-acre shopping center.

EUROPE RETAIL AND TECH HEADLINES

Amscan International Divests Its Irish Retail Stores (April 25) RetailTimes.co.uk- Amscan International, a UK-based wholesaler of party goods, has divested its Irish retail store and launched Party Delights, a franchise partner for its retail brand. The retail store was sold to Dublin-based party goods company Party HQ for an undisclosed sum.

- Party HQ is likely to open and manage Party Delight stores in Dublin as part of the deal. This strategy is in line with Amscan International’s growth plan of expanding e-commerce retail and wholesale opportunities.

- Swedish fashion retailer Arket, owned by H&M, has introduced third-party brands on its platform for the first time.

- The company has already launched accessories and ready-to-wear clothes including jackets, vests and T-shirts from Swedish outdoor wear and mountaineering equipment brand Klättermusen. Retail prices for accessories start from £40 ($50) and £290 ($365) for jackets.

- British supermarket chain Morrisons has announced price reductions for over 500 items, including eggs, beef, rice, beans and nappies. The company is also planning to introduce new multi-buy offers amid rising cost of living concerns in the UK.

- The lower prices cover 6.0% of Morrisons’ total volume sales, with an average saving of 13.0% across key items.

- Fashion retailer Oasis has partnered with UK-based rental website Hirestreet to launch its first clothing rental collection. Oasis’ rental collection includes more than 50 spring and summer designs.

- Rental prices for the items on Hirestreet are £10.00 ($12.60) for four days compared to from £52.00 ($65.30) to buy directly from Oasis.

- Dutch hypermarket and retail food chain Spar has partnered with Slovenia-based agricultural cooperative supermarket Agraria Koper to increase the availability of Slovenian products in Spar stores across the country and strengthen its partnership with local fresh fruit and vegetable suppliers.

- The new agreement will provide the retailer with a competitive advantage when purchasing locally grown fruits and vegetables from the agricultural cooperative.

ASIA RETAIL AND TECH HEADLINES

Arrow Raises $4.8 Million in Seed Round (April 26) TechinAsia.com- Singapore-based online checkout solution provider Arrow has raised $4.8 million in a seed round led by Sequoia Capital India and accompanied by Alpha JWC and Guillaume Pousaz's Zinal Growth.

- Arrow plans to utilize the funding to provide payment solutions that can be added to payment gateways for quick integration to create a hassle-free checkout experience for customers across Southeast Asia.

- Tops Online, an online supermarket owned by Thailand’s multi-category retailing platform Central Retail, has introduced a monthly membership program for unlimited delivery named Tops Prime. According to the company, Tops Prime is Thailand’s first subscription service on a grocery platform.

- Tops Prime offers standard and one-hour express deliveries when consumers spend $2.95 (THB 100) per month.

- Licious, an Indian DTC meat brand, has invested $1 million in Pawfectly Made, a fresh pet food startup, as its first strategic investment, indicating a shift away from fresh meat and seafood.

- Pawfectly Made will continue to operate as a separate entity with its own production processes and supply chain. Licious joins as a strategic partner, offering deep and nuanced knowledge of the fresh animal protein sector to help guide and scale Pawfectly Made.

- Chinese e-commerce platform Meituan has launched a new livestreaming assistance app for online merchants and influencers, named the Meituan Livestreaming Assistant.

- The Livestreaming Assistant service enhances existing livestreaming features, including sending out advance notices for livestreaming sessions and supporting hosts with sales strategies from group purchases to coupons and group orders.

- Chinese e-commerce platform Taobao, which is owned by Alibaba, has launched Homearch, a mobile app that allows users to purchase home furnishings, textiles, kitchenware and ornaments products from more than 100 third-party, factory and self-operated businesses.

- Homearch allows users to shop online using 3D rendering technology. Its 6,000-square-meter virtual store features over 180 sections and can facilitate in-app purchases, according to the company.