From the Desk of Deborah Weinswig

“Will that Be Cash, Credit, WeChat Pay or Alipay?”

Some 40 years ago, American Express told its credit card holders, “Don’t leave home without it.” If that famous ad campaign were created today, it would likely refer to users’ smartphones, not their credit cards. That is because electronic payment systems that work via smartphone are already hugely popular in China, and are beginning to replace hard plastic credit cards across some Western markets, too.

In just a few years, China has evolved from a country where cash was king to one that runs on electronic payment systems—Tencent’s WeChat Pay and Alibaba’s Alipay, specifically. Meanwhile, Western countries, with their legacy payment systems, have lagged behind. These days, Chinese consumers do everything from making restaurant reservations, to booking taxis, to buying train tickets, to paying for small purchases within apps such as WeChat. And Alibaba has launched the Hema chain of supermarkets and other stores in China that do not accept cash at all. Some homeless people in China even accept donations via WeChat Pay.

It might seem highly unlikely that Westerners will ever enjoy the ease and convenience of mobile payments at the same rates as their Chinese counterparts. In the West, the payment culture has been highly fragmented and based on credit cards, and adoption of Apple Pay and other, less-successful platforms (such as CurrentC, Google Wallet, Chase Pay and Samsung Pay) has been slow. Apple Pay offers convenience, but the platform was recently passed by Walmart Pay in terms of users thanks to the large number of consumers who shop at Walmart. This week, Target also joined the fray, integrating mobile payments into a revamped version of its shopping app. One promising contender is Amazon Pay, whose reach is expanding. The platform has been undergoing testing at TGI Fridays restaurants and will be expanded to other restaurants through integration with the Clover point-of-sale system.

In the meantime, the Chinese electronic payment platforms have been expanding. Several examples follow.

Hong Kong, as a Special Administrative Region of China, seems a logical adjacent market for Chinese electronic payment systems. However, the region has long enjoyed and benefited from its Octopus smart card system. Octopus has been slow to embrace mobile commerce, though, and WeChat Pay will start being accepted at Hong Kong Mass Transit Railway ticket machines this month, with Alipay to be accepted “in the near future.”

Other places that see a large number of Chinese tourists have started to accept WeChat Pay and Alipay for the convenience they provide to users. For example, London’s Camden Market started accepting WeChat Pay in November, after having seen its percentage of Chinese visitors double from 5% in September 2016 to 10% in March 2017. According to VisitBritain, Chinese tourists spent £513 million ($686 million) in the UK last year.

WeChat Pay announced in July 2017 that it would expand into Continental Europe, and the company plans to go live there in November, partnering with German payments firm Wirecard. Alipay launched in Europe in 2015. It is understandable that Europe and other regions want to support the spending of Chinese tourists, who spent a total of $261 billion abroad in 2016, according to the United Nations World Tourism Organization. Tencent has said it has 600 million active WeChat Pay users and Alipay recently reported that it has 450 million active users, so accepting payment through these platforms means catering to a market of more than a billion users.

What about the US? While Alipay operator Ant Financial has seen its proposed acquisition of MoneyGram held up by US government agencies, Tencent and Alibaba continue to push forward in expanding their payment platforms in the US. Thanks to a partnership between WeChat Pay and Silicon Valley startup Citcon, Chinese tourists can now use their smartphones to pay for their purchases at brick-and-mortar stores in the US with WeChat Pay. In addition, Alipay recently announced a deal with payment processor First Data that covers the US, and about 4 million merchants across the country now accept Alipay as a form of payment. Finally, Alipay is welcome in New York City. As of November, about two-thirds of the city’s 14,000 yellow cabs accept Alipay, and most Las Vegas taxis already accept payment through the platform, too.

Although WeChat Pay and Alipay are hardly household names in the US, they have already begun to gain a foothold in the country, and could revolutionize the wide-open US mobile payment landscape.

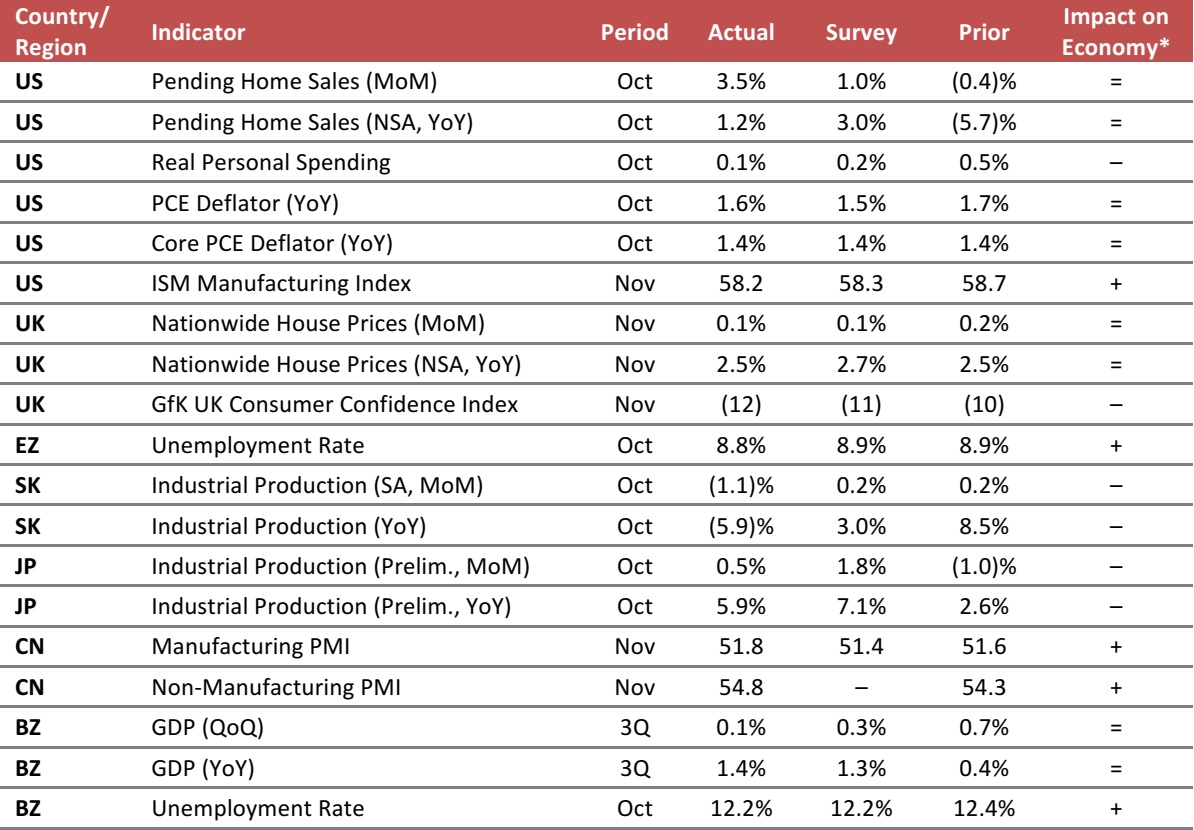

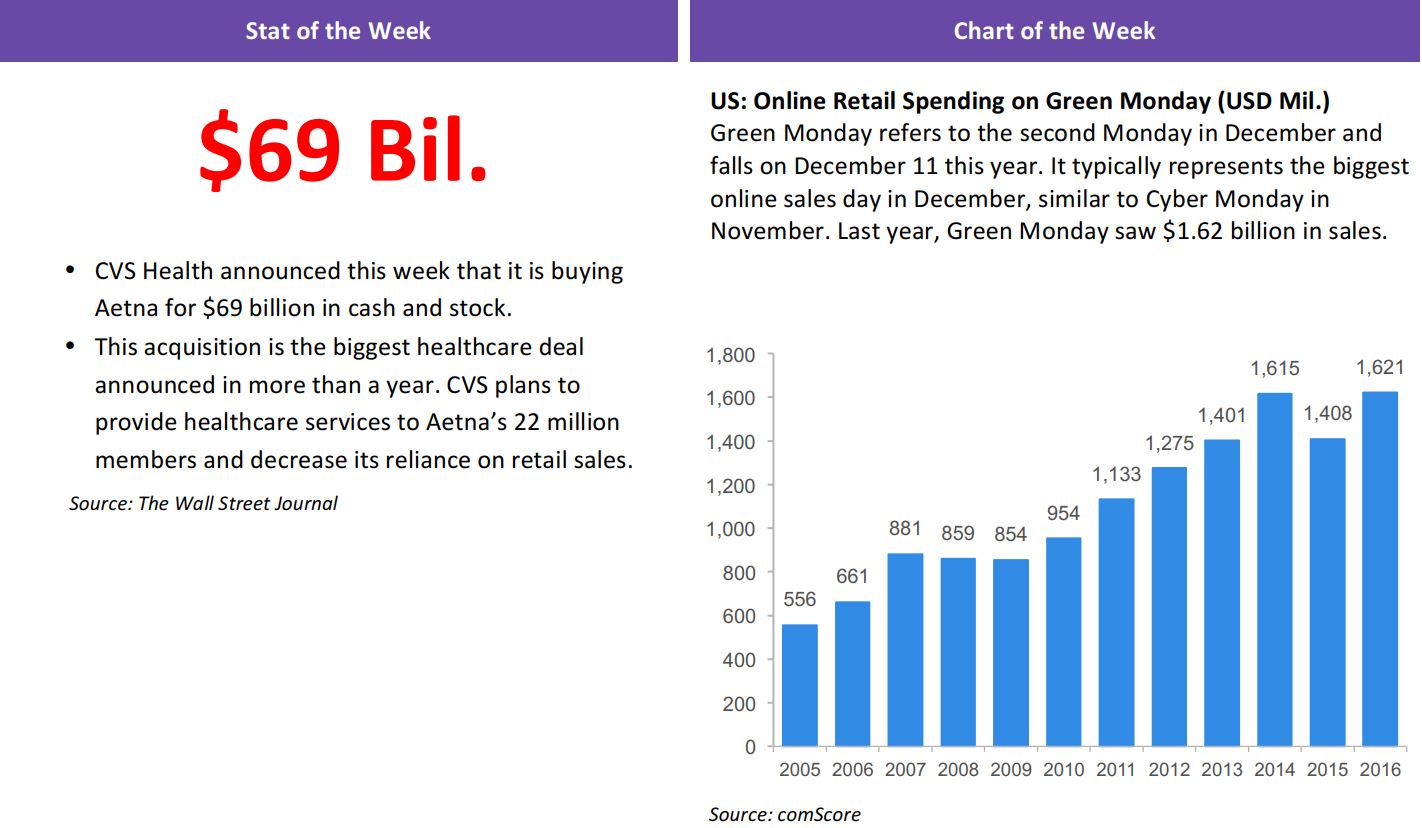

US RETAIL EARNINGS

Source: Company reports/FGRT

US RETAIL & TECH HEADLINES

Hudson’s Bay Posts Wider-than-Expected Loss on Lower Retail Sales

(December 6) Reuters.com

Hudson’s Bay Posts Wider-than-Expected Loss on Lower Retail Sales

(December 6) Reuters.com

- Canadian department store operator Hudson’s Bay Company reported a wider-than-expected quarterly loss, missing analysts’ estimates amid lower retail sales as it battles with a challenging retail environment.

- Comparable sales during the quarter were impacted by lower traffic, deeper discounts and the effects of the hurricanes in Texas, Florida and Puerto Rico. Consolidated sales fell by 3.2% on a comparable basis, the company said, with its off-price unit seeing the biggest decline, of 7.6%. Digital sales rose by 2.1%.

The End-of-the-Year Retail Bump Is a Lie We’ve Been Told for Decades

(December 5) BusinessInsider.com

The End-of-the-Year Retail Bump Is a Lie We’ve Been Told for Decades

(December 5) BusinessInsider.com

- Traditional narratives insist that the fourth quarter is the most important time of the year for retailers. But just 26.73% of US retail sales occurred in the fourth quarter in 2016, and that number has not exceeded 27.88% since 1992.

- Fourth-quarter retail myths persist because it is the only time of the year when everyone’s gift-giving schedules align, so it feels like everyone is shopping more than they actually are.

Dollar Stores Are Dominating Retail by Betting on the Death of the American Middle Class

(December 5) BusinessInsider.com

Dollar Stores Are Dominating Retail by Betting on the Death of the American Middle Class

(December 5) BusinessInsider.com

- Dollar General and other dollar stores are thriving while department stores such as Macy’s and Sears close hundreds of locations. Dollar stores’ sales grow as more Americans struggle economically, with retailers betting on a “permanent underclass in America.”

- Dollar General’s CEO said the American economy “is continuing to create more of our core customer”—households making less than $40,000 a year.

Amazon’s Pop-Up Stores Could Be Retail’s Future

(December 5) U.S. News & World Report

Amazon’s Pop-Up Stores Could Be Retail’s Future

(December 5) U.S. News & World Report

- Amazon and its massive e-commerce platform have forever changed the retail landscape. However, its latest experiment with partner Calvin Klein provides investors with a glimpse of where Amazon may be taking the retail business next.

- This holiday shopping season, Amazon is teaming with Calvin Klein to open holiday-themed brick-and-mortar pop-up stores in New York City and Los Angeles. The technology Amazon is testing may serve as a blueprint for its long-term approach to retail.

Retail Sector Leads Commercial Spending on AR/VR in 2018, Says IDC

(December 5) EnterpriseInnovation.net

Retail Sector Leads Commercial Spending on AR/VR in 2018, Says IDC

(December 5) EnterpriseInnovation.net

- Worldwide spending on augmented reality and virtual reality (AR/VR) is forecast to reach $17.8 billion in 2018, an increase of nearly 95%, according to IDC.

- The analysts predict a steady CAGR of 98.8% from 2017 through 2021. “There is currently a huge appetite from companies that see tremendous potential in the technology, from product design to retail sales to employee training,” said Tom Mainelli, IDC’s Program Vice President for Devices and AR/VR.

EUROPE RETAIL & TECH HEADLINES

Marks & Spencer May Abandon Dozens of Mall Developments

(December 2) ThisIsMoney.co.uk

Marks & Spencer May Abandon Dozens of Mall Developments

(December 2) ThisIsMoney.co.uk

- Marks & Spencer could abandon dozens of building projects, including shopping malls and town-center regeneration projects, across the UK. Property sources estimate that the company is involved in up to 60 building projects.

- The company has already announced plans to close about 30 underperforming stores and slow planned openings for its Simply Food chain as it seeks to turn around performance.

Retail Spending Bounces Back in November

(December 5) BRC press release

Retail Spending Bounces Back in November

(December 5) BRC press release

- Following a weak October, UK retail sales bounced back in November. According to the British Retail Consortium (BRC), retail sales grew by 0.6% on a comparable basis and by 1.5% in total in November. Total growth was in line with the 12-month average.

- The BRC breaks down sales by food and nonfood retail only on a three-month basis. In the three months through November, food sales grew by 2.8% on a comparable basis and by 4.0% in total, supported by higher inflation. Nonfood retail sales fell by 1.2% on a comparable basis and by 0.6% in total over the same three months. In the week of Black Friday, nonfood sales were more than 40% higher than in the other weeks of November.

Toys“R”Us to Close More than One-Quarter of Its UK Stores

(December 4) Telegraph.co.uk

Toys“R”Us to Close More than One-Quarter of Its UK Stores

(December 4) Telegraph.co.uk

- Toys“R”Us UK has announced plans to close more than a quarter of its stores: it will shut at least 26 of its 84 UK outlets beginning in the spring of 2018. The company has put forward a company voluntary agreement, which requires 75% of its creditors to vote in favor of the shop closures, to cut its rental burdens. If creditors do not approve the agreement, Toys“R”Us UK could face insolvency.

- Steve Knights, managing director of Toys“R”Us UK, said, “The warehouse-style stores we opened in the eighties and nineties, while successful in the early days, are too big and expensive to run in the current retail environment.”

Amazon Dominates New UK Warehouse Space

(December 3) Telegraph.co.uk

Amazon Dominates New UK Warehouse Space

(December 3) Telegraph.co.uk

- Amazon has taken five times as much new UK warehousing space as its next-fastest-growing rival so far this year. According to research from property agency Savills, Amazon has grown its UK distribution network by 4 million square feet to date in 2017—equivalent to 20% of all new warehouse stock this year.

- The next-fastest-growing retailer was Lidl, which took 754,000 square feet of warehouse space.

Carrefour and Fnac Darty Discuss Purchasing Alliance

(December 4) Reuters.com

Carrefour and Fnac Darty Discuss Purchasing Alliance

(December 4) Reuters.com

- Grocery retailer Carrefour and electronics retailer Fnac Darty are discussing forming an alliance to negotiate better terms when buying electronic goods from suppliers. A source said that Carrefour was in talks with other retailers, too.

- Fnac Darty confirmed the discussions on December 4. Alexandre Bompard, the former boss of Fnac Darty, took over as CEO at Carrefour in July.

ASIA RETAIL & TECH HEADLINES

Xiaomi Seeks Valuation of at Least $50 Billion in IPO

(December 4) Bloomberg.com

Xiaomi Seeks Valuation of at Least $50 Billion in IPO

(December 4) Bloomberg.com

- Xiaomi, a Chinese smartphone maker that was once the most valuable startup in the world, is in talks with investment banks about a possible IPO and is seeking a valuation of at least $50 billion, according to people familiar with the matter. The Beijing-based company is considering an offering as soon as next year, with banks suggesting Hong Kong as the most likely destination.

- While banks have talked up Xiaomi’s prospects while seeking to win the mandate, they have concerns about whether the company can reach the $50 billion level, much less a $100 billion target that some top executives have embraced, the people said. Xiaomi last raised money in 2014 at a $46 billion valuation.

Uber’s Indian Rival, Ola, Begins Offering a Bicycle-Sharing Service

(December 1) TechCrunch.com

Uber’s Indian Rival, Ola, Begins Offering a Bicycle-Sharing Service

(December 1) TechCrunch.com

- Ola, the company battling Uber in India, has turned to pedal power after introducing a bike-sharing service. China’s Didi Chuxing and Southeast Asia’s Grab have invested in bike-sharing companies, which offer dockless bikes that users can pick up across a city and leave anywhere they want when they are done. Now, Ola—which recently raised $1.1 billion in fresh capital—has jumped into the saddle.

- Ola Pedal, as the service is called, is initially limited to a number of university campuses in India, including IIT Kanpur, but the company is in discussions to expand availability “in the weeks ahead,” it said. The idea is to offer an option for trips that are too short for a taxi ride but too long for a walk.

Alibaba Is Buying Israeli Startup Visualead’s Tech to Establish a Tel Aviv R&D Center

(December 1) TechCrunch.com

Alibaba Is Buying Israeli Startup Visualead’s Tech to Establish a Tel Aviv R&D Center

(December 1) TechCrunch.com

- Alibaba announced a massive, $15 billion research DAMO Academy project focused on R&D last month, and it is laying the groundwork for an office in Tel Aviv through a deal to acquire technology and talent from Israeli startup Visualead. Visualead developed a new kind of “dotless” QR code that Alibaba has used for its business in China.

- Visualead was founded in 2013 and it landed investment from Alibaba in 2015. Now, however, Alibaba is buying the startup’s computer vision technology and using an undisclosed number of Visualead’s core engineering team to create a DAMO—which stands for “discovery, adventure, momentum and outlook”—office in Tel Aviv, according to sources with knowledge of the deal.

COMB+ Announces a $77 Million Fund to Help AI Startups Enter China

(December 1) TechCrunch.com

COMB+ Announces a $77 Million Fund to Help AI Startups Enter China

(December 1) TechCrunch.com

- Artificial intelligence (AI) is a hot topic in the tech industry, with China—alongside the US—emerging as a key market for talent, innovation and companies. While many AI firms head to the US or set up operations there, China is a harder market to crack for overseas companies.

- That is where a new fund wants to help. China-based accelerator firm COMB+ is launching a €65 million ($77 million) fund aimed at helping promising international AI firms enter China.

LATAM RETAIL & TECH HEADLINES

Brazil’s First Online Bank Ramps Up Innovation

(December 4) ZDNet.com

Brazil’s First Online Bank Ramps Up Innovation

(December 4) ZDNet.com

- Brazil’s first online bank is working on new innovation initiatives as challenger institutions enter the market to provide services to a tech-savvy customer base. Banco Original launched its retail banking operation in 2016 as an entirely digital bank supported by a robust infrastructure platform in a distributed, high-performance environment.

- According to the bank’s CIO, Wanderley Baccala, Banco Original’s technology portfolio sits on an architecture based on systemic interaction and access availability. This provides an advantage over traditional banks struggling with legacy portfolios. “We exploit everything that the Internet can offer, especially the possibility to ‘be everywhere at all times,’” Baccala said.

Brazil Kicks Off Startup Internationalization Plan

(December 1) ZDNet.com

Brazil Kicks Off Startup Internationalization Plan

(December 1) ZDNet.com

- The Brazilian government will invest R$3 million ($920,000) a year in a program to internationalize startups. Dubbed StartOut Brasil, the program will select up to 15 ventures per immersion cycle to participate in “missions” abroad.

- The first mission will take place December 3–8 in Paris. Some 14 startups will participate, many of them biotechnology and healthcare-related ventures. During the program, the startups will have access to consulting focused on international business development, mentoring from specialists in the target market and pitch training.

HPE’s Aruba Hires New Country Manager for Brazil

(November 29) ZDNet.com

HPE’s Aruba Hires New Country Manager for Brazil

(November 29) ZDNet.com

- Hewlett Packard Enterprise (HPE) has named a new country manager for the Brazilian operations of its network solutions business, Aruba. Eduardo Gonçalves will be responsible for leading the company’s business in Brazil across several segments, including telecom operators, and expanding its presence within large companies as well as small and medium-sized organizations.

- Despite having a predominantly Brazil-focused remit, Gonçalves will be tasked with increasing Aruba’s foothold in Latin America and positioning the firm as a reference across the corporate mobility, connectivity and security segments. Gonçalves joined HPE six years ago and has served as a sales manager since then. He previously held senior roles in a number of IT and telecom firms, including Cisco, 3Com and Telefónica.

Why Amazon Orders in Mexico Need Cash and the Corner Store

(November 30) Bloomberg.com

Why Amazon Orders in Mexico Need Cash and the Corner Store

(November 30) Bloomberg.com

- In Mexico, it turns out the key to online shopping is offline payments. In a nation where just about everyone prefers to pay cash, Amazon and Walmart de Mexico are pushing a hybrid payment system to encourage more shoppers to go online. Amazon is letting people pay for goods ordered on its website at the corner convenience store, while Walmart’s local unit has set up kiosks at megastores that work much the same way.

- Behind the shift is a population slow to set up formal banking accounts, with less than half of all adults in Mexico carrying around credit cards. While China and India have faced similar challenges, their work-around—allowing delivery people to accept cash payments—is not an option in Mexico because of the nation’s sky-high rates of assault and robbery.

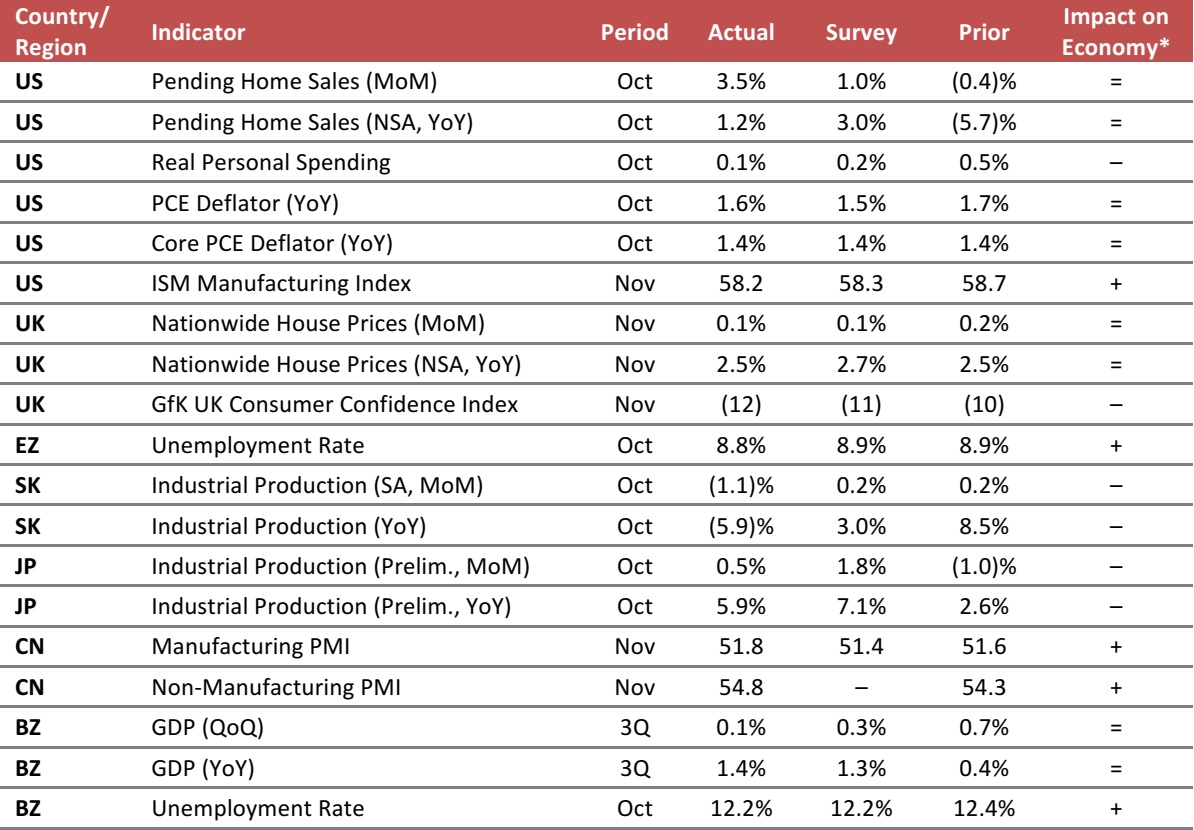

MACRO UPDATE

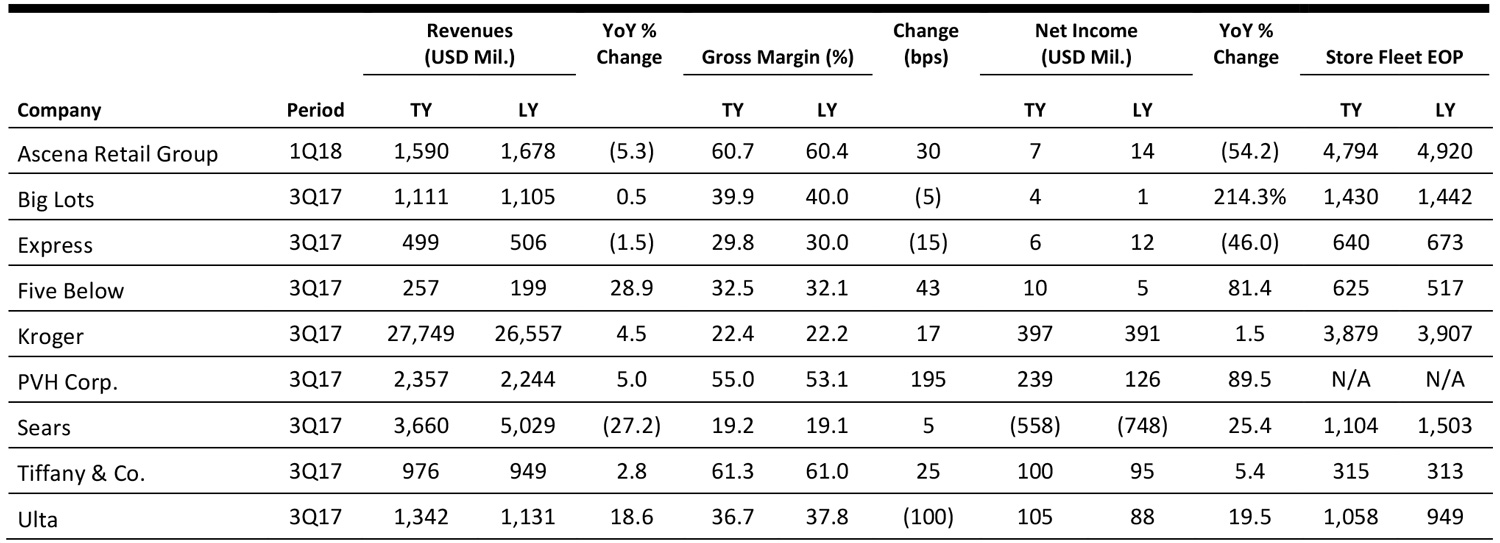

Key points from global macro indicators released November 29–December 6, 2017:

- US: Pending home sales increased by 3.5% month over month in October. Real personal spending edged up by 0.1% in October, while the core personal consumption expenditure (PCE) deflator remained unchanged at 1.4%. The ISM Manufacturing Index stayed above the expansion threshold of 50.0 in November.

- Europe: In the UK, nationwide house prices increased by 0.1% month over month in November. The GfK UK Consumer Confidence Index deteriorated to (12) in November. In the eurozone, the unemployment rate edged down by 0.1% in October, to 8.8%.

- Asia-Pacific: In South Korea, industrial production dropped by 1.1% month over month in October. In Japan, industrial production edged up by 0.5% month over month in October. In China, the Manufacturing and Non-Manufacturing Purchasing Managers’ Indexes (PMIs) stayed above 50.0 in November, signaling that the economy remains in an expansionary state.

- Latin America: In Brazil, GDP in the third quarter increased by 0.1% quarter over quarter, which was slightly weaker than the consensus estimate, and by 1.4% year over year. The unemployment rate in Brazil edged down to 12.2% in October.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Bureau of Economic Analysis/Institute for Supply Management (ISM)/Nationwide Building Society/GfK/Eurostat/Statistics Korea/Japan Ministry of Economy, Trade and Industry/China Federation of Logistics and Purchasing/Instituto Brasileiro de Geografia e Estatística/FGRT

Carrefour and Fnac Darty Discuss Purchasing Alliance

(December 4) Reuters.com

Carrefour and Fnac Darty Discuss Purchasing Alliance

(December 4) Reuters.com

Brazil Kicks Off Startup Internationalization Plan

(December 1) ZDNet.com

Brazil Kicks Off Startup Internationalization Plan

(December 1) ZDNet.com

HPE’s Aruba Hires New Country Manager for Brazil

(November 29) ZDNet.com

HPE’s Aruba Hires New Country Manager for Brazil

(November 29) ZDNet.com