FROM THE DESK OF DEBORAH WEINSWIG

The New Trend in Physical Stores: Small Is Beautiful

There is a new trend in designing and outfitting physical stores—making them smaller, particularly those in city centers. The trend is a positive for retail, as the US is heavily overstored, with an average of 23.5 square feet of retail space per capita. That figure compares with 16.4 square feet per capita in Canada and 11.1 square feet per capita in Australia, and is six times the average in Europe and Japan, according to Morningstar data. This extra store space supplements the virtually unlimited store capacity that exists on e-commerce sites.

Major retailers are now experimenting and attempting to remedy this oversupply by opening small-format stores, particularly in high-density areas, and by finding alternative uses for some existing space. Kohl’s, Target and IKEA are among the retailers that have been opening smaller stores, and even Macy’s is rejiggering the allocation of space within its stores.

Kohl’s is leading the way in finding alternative uses for unneeded store space as part of its store optimization strategy. Last year, Kohl’s announced an innovative partnership with Amazon to market Amazon’s consumer electronics products and accept Amazon returns in Kohl’s stores. Kohl’s has also moved to adjust the size of its existing stores, making them operationally smaller with less inventory and leasing or selling the excess square footage. Kohl’s has opened 12 new stores that are just 35,000 square feet in size. These are the retailer’s smallest formats to date and represent 60% less space and inventory than a typical Kohl’s store. Earlier this year, Kohl’s announced that it would pilot offering space in certain stores to fast-growing German supermarket chain Aldi.

Target has been opening small-format stores in urban neighborhoods, near college campuses and in locations too small for a standard-sized store. The company started testing this format back in 2012 and finalized the model in 2014. In 2017, Target opened 30 small-format stores and set a goal of operating 130 such stores in the US by the end of 2019. These new stores average 30,000 square feet.

In October 2017, Target opened a new small-format store in Herald Square in New York City. The location features food to go, tourist items and self-checkout counters on the ground floor, with grocery, apparel and household items available on the floor below. In August this year, Target announced that it would offer same-day delivery in New York City via Shipt, and the company plans to open a total of six stores in Manhattan, bringing its New York City store count to 17.

IKEA, which has full-size stores in Brooklyn and Elizabeth, New Jersey, recently announced that it will open its first city-center store in Manhattan in the spring of 2019. Interestingly, the new store, which will be IKEA’s first Planning Studio in the US, will be located at 999 Third Avenue, across the street from the Bloomingdale’s flagship store on 59th Street and close to Home Depot and CB2 stores. IKEA announced that the new store will focus on smart solutions for urban living and small spaces and will give customers the opportunity to discover, select and order products for home delivery. The new store will supplement IKEA’s e-commerce click-and-collect capabilities as well as its service offerings, which include financial services and furniture assembly via TaskRabbit. IKEA also recently opened a new customer fulfillment center on Staten Island.

Macy’s is increasingly allocating store space to other brands as well as to Backstage, its own off-price division. The company’s Herald Square flagship in New York City includes a Starbucks and Sunglass Hut and Finish Line stores. Macy’s launched Backstage in 2015 with five stores and has rapidly accelerated Backstage openings this year, adding 121 stores so far in 2018, including 60 in the third quarter, for a total of 166. The company commented recently that when it adds a Backstage to a Macy’s store, the entire store sees a sales lift.

Although downsizing square footage may appear to be a step backwards for retailers, it enables them to present more curated, relevant product assortments for in-store shoppers while also leveraging much larger stores on their e-commerce sites.

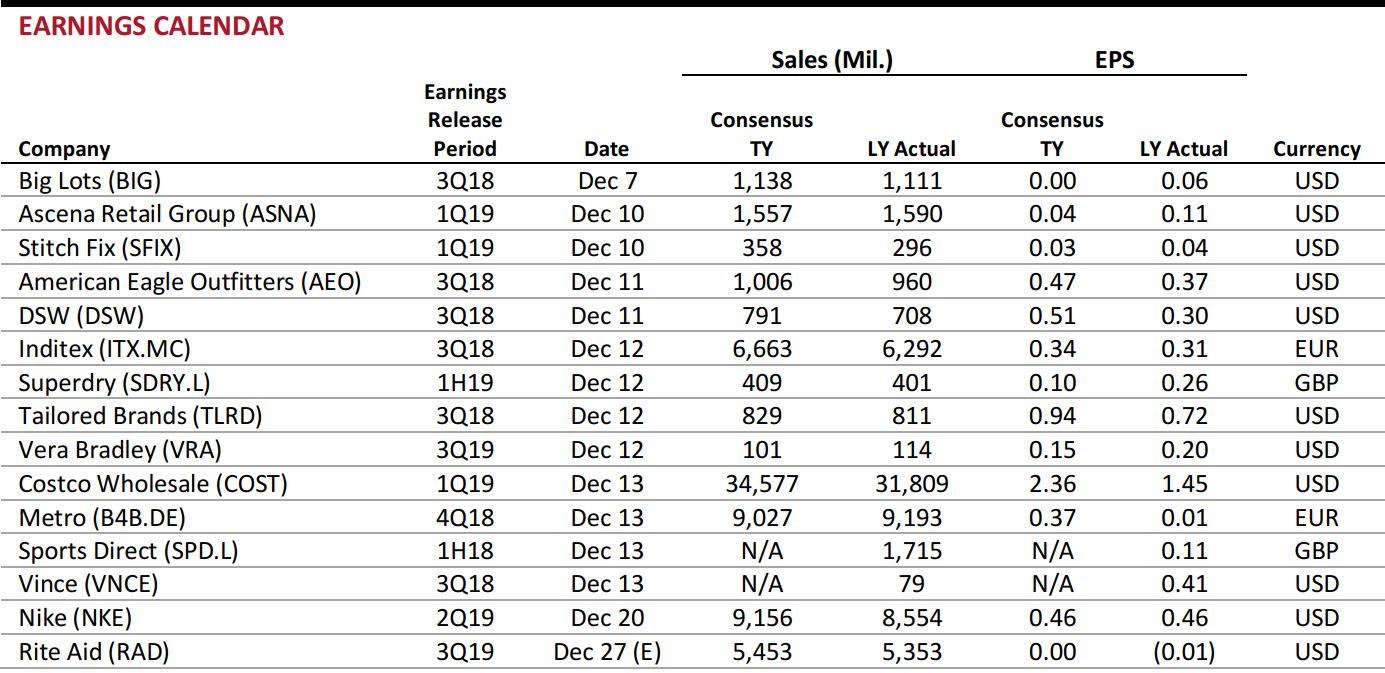

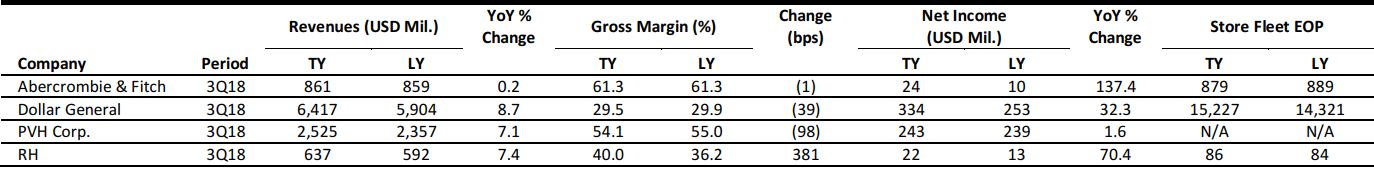

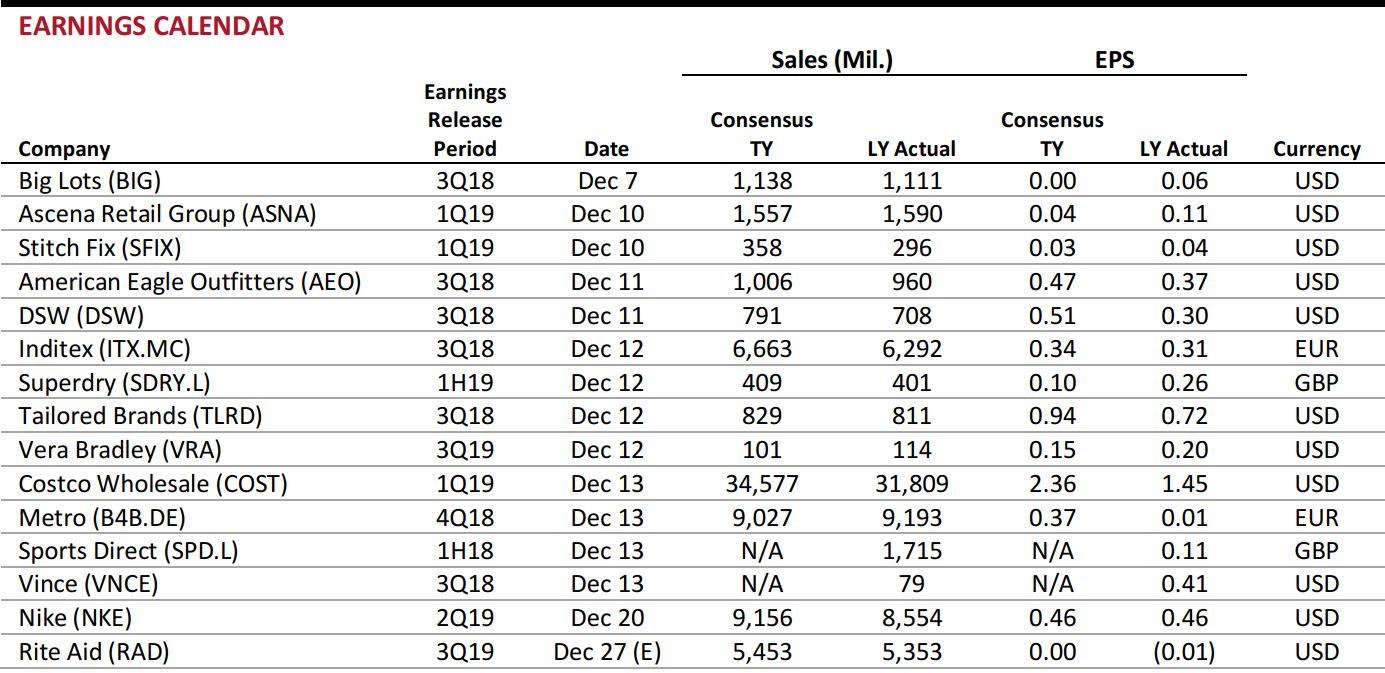

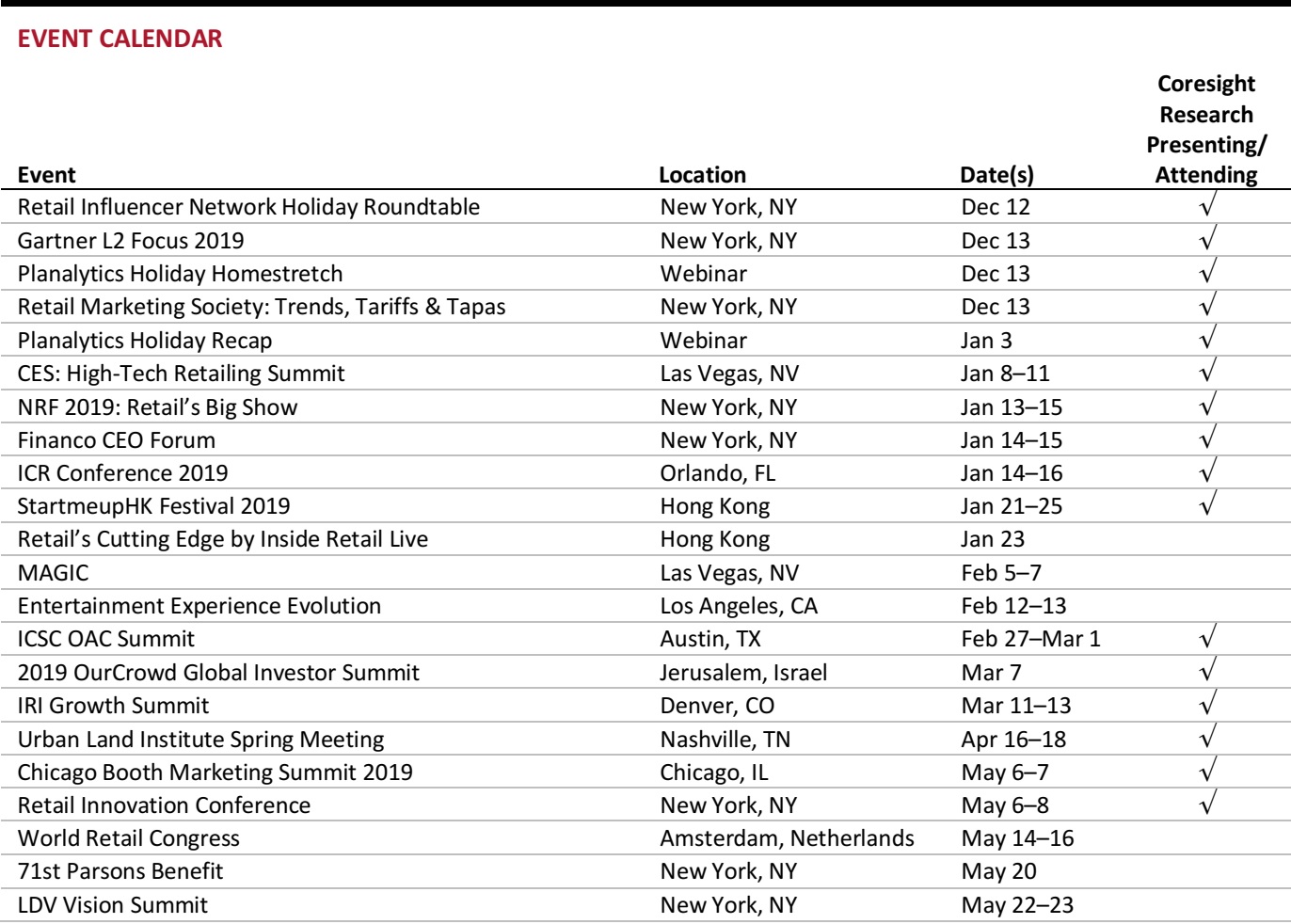

US RETAIL EARNINGS

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Amazon Tests Its Cashierless Technology for Bigger Stores

(December 2) WSJ.com

Amazon Tests Its Cashierless Technology for Bigger Stores

(December 2) WSJ.com

- Amazon.com is testing its cashierless checkout technology for bigger stores. The online retail giant is experimenting in a larger space formatted like a big store, trialing its systems that track what shoppers pick from shelves and then automatically charge them when they leave a store.

- It’s unclear whether Amazon intends to deploy the technology in Whole Foods stores, although that’s the most likely application if the tests are successful. Amazon has previously said that it has no plans to use the technology in Whole Foods locations.

Robot Janitors Are Coming to Mop Floors at a Walmart Near You

(December 3) Bloomberg.com

Robot Janitors Are Coming to Mop Floors at a Walmart Near You

(December 3) Bloomberg.com

- Walmart, the world’s largest retailer, is rolling out 360 autonomous floor-scrubbing robots in some of its US stores by the end of January. San Diego–based Brain Corp. makes the machines, which can clean floors on their own even when customers are around.

- Walmart has already been experimenting with automated shelf scanners that search for out-of-stock items and machines that haul products from storage for online orders. Brain’s robots are equipped with an array of sensors that let them gather and upload data.

Millennials Aren’t Frugal—They Just Have Less Wealth than Previous Generations

(November 30) FootwearNews.com

Millennials Aren’t Frugal—They Just Have Less Wealth than Previous Generations

(November 30) FootwearNews.com

- Millennials’ peculiar spending habits are the subject of constant scrutiny, and headlines suggest that the generation is killing everything from marriage to malls as their preferences shift away from the traditional milestones their parents celebrated.

- A new US Federal Reserve study published this week, however, confirms what many young people have likely known all along: if they’re spending less than previous generations, it’s because they have less money to spend. The report says that millennials (defined as those ages 21 to 37) “have substantially lower real net worth than earlier cohorts when they were young.”

Sears Asks for Rent Cuts, Identifies 505 Stores It Plans to Sell

(November 28) DallasNews.com

Sears Asks for Rent Cuts, Identifies 505 Stores It Plans to Sell

(November 28) DallasNews.com

- Sears, operating under bankruptcy protection since October, has identified 505 stores and leases to be sold as a group early next year in an attempt to keep the brand alive.

- The retailer said that it is reducing debt and operating costs through its court-supervised reorganization, but that it also needs help from shopping center owners. The company is asking landlords for rent reductions to help it keep profitable stores open.

Canadian Retailer Plans Aggressive US Store Growth

(November 27) ChainStoreAge.com

Canadian Retailer Plans Aggressive US Store Growth

(November 27) ChainStoreAge.com

- Showcase is a Canadian retailer that has built a thriving business by leveraging emerging trends in health, beauty, toys and home. The retailer has 108 stores in Canada and is now looking to expand in the US.

- The company launched its first US store in July and plans to have 10 US locations by January. Showcase plans to use these stores to identify regional differences in demand, price elasticity and other factors. The retailer will adapt its model based on these stores’ performance, and open an additional 90 locations starting in 2019.

EUROPE RETAIL & TECH HEADLINES

UK Retail Sales Weaken Further in November, Growth at Lowest Level in Seven Months

(December 4) BRC.org.uk

UK Retail Sales Weaken Further in November, Growth at Lowest Level in Seven Months

(December 4) BRC.org.uk

- Retail sales in the UK grew by 0.5% year over year in November, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales fell by 0.5% as aggressive promotional activity proved futile to luring shoppers.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended November, total food sales grew by 1.8%, while nonfood sales growth remained unchanged.

Online Marketplace Floom Raises $2.5 Million in Seed Funding

(December 2) TechCrunch.com

Online Marketplace Floom Raises $2.5 Million in Seed Funding

(December 2) TechCrunch.com

- London-headquartered Floom, an online marketplace for florists and a software-as-a-service provider for individual florists, has raised $2.5 million in seed funding. The funding round was led by Firstminute Capital, a London-based financial services platform and seed fund.

- Floom will use the funds to expand in the US, where it currently operates in New York and Los Angeles, and to strengthen its software offerings.

Hamleys Marks Entry into Japan by Opening Two Outlets

(November 30) RetailGazette.co.uk

Hamleys Marks Entry into Japan by Opening Two Outlets

(November 30) RetailGazette.co.uk

- Hamleys has marked its entry into Japan by opening two outlets based on a theme park concept. The stores are located in Yokohama City near Tokyo and Fukuoka in western Japan.

- The stores are a result of a £300 million ($389.6 million) joint venture between Hamleys and Japanese video game company Bandai Namco that was brokered by Intralink, a business development consultancy.

Tesco Partners with Volkswagen to Build an Electric Vehicle Charging Network

(November 30) Company press release

Tesco Partners with Volkswagen to Build an Electric Vehicle Charging Network

(November 30) Company press release

- British retailer Tesco and German auto manufacturer Volkswagen announced the development of the UK’s largest retail charging network for electric vehicles. Pod Point, a UK-based infrastructure provider for charging solutions, will power the network.

- The agreement will see 2,400 electric vehicle charging bays added across 600 Tesco stores in the next three years. Pod Point said that the agreement will lead to a 14% increase in the number of public charging stations in the UK.

House of Fraser’s Kendals Store Dodges Closure as Landlord Agrees to New Terms

(December 3) RetailGazette.co.uk

House of Fraser’s Kendals Store Dodges Closure as Landlord Agrees to New Terms

(December 3) RetailGazette.co.uk

- House of Fraser’s flagship Kendals store has avoided closure after the landlord and Sports Direct, the department store retailer’s new owner, agreed to new terms. The store was scheduled to close on January 28, 2019, according to a Sports Direct spokesperson.

- The Manchester City Council played a pivotal role in the agreement, which indicated that the landlord had changed its stance on the closure, saving 568 jobs.

Karstadt and Galeria Kaufhof Merger Deal Closes

(December 3) Retail-Insight-Network.com

Karstadt and Galeria Kaufhof Merger Deal Closes

(December 3) Retail-Insight-Network.com

- Department store chains Karstadt, owned by Austrian real estate company Signa, and Galeria Kaufhof, owned by Hudson’s Bay Company (HBC), closed their merger deal after receiving approvals from relevant parties last month. The merged entity, which is present in 43 locations and employs 32,000 people, is expected to generate pro-forma annual revenues in excess of €5 billion ($5.7 billion).

- The agreement will provide Signa a 50.01% stake in the resulting entity and HBC a 49.99% stake. Additionally, HBC and Signa have completed a joint venture deal that gives Signa a 50% stake in HBC’s German real estate portfolio.

ASIA RETAIL & TECH HEADLINES

Esprit Announces Significant Global Restructuring Plan

(November 29) RetailDetail.com

Esprit Announces Significant Global Restructuring Plan

(November 29) RetailDetail.com

- Clothing chain Esprit announced a global restructuring plan aimed at enhancing its relevance in the market. The company will cut around 40% of jobs, close several global outlets and downsize its Hong Kong headquarters from three stories to just one story, according to the South China Morning Post.

- Meanwhile, Esprit plans to expand in China by opening 220 new stores in the country by 2023 along with 78 additional stores across the rest of Asia.

Alibaba and El Corte Inglés Enter into Partnership

(November 29) Alizila.com

Alibaba and El Corte Inglés Enter into Partnership

(November 29) Alizila.com

- E-commerce behemoth Alibaba and Spanish department store chain El Corte Inglés have signed a partnership agreement to explore new business opportunities within a digital retail and omnichannel common framework.

- The collaboration will encompass multiple areas of interest across commerce and retail, cloud-computing services, digital innovation and smart payments.

Easyship Raises $4 Million in Funding

(November 30) TechCrunch.com

Easyship Raises $4 Million in Funding

(November 30) TechCrunch.com

- Hong Kong–based startup Easyship, which facilitates international shipping for e-commerce sellers, has raised $4 million in a series A funding round. The funds will be used to develop the company’s technology and add more shipment and logistics partners, with a view to broaden customer reach, primarily in the US.

- Sources in the funding round include Maximilian Bittner, founder and former CEO of Lazada, and Richard Lepeu, former CEO of luxury firm Richemont and board member of Yoox Net-A-Porter.

LF Beauty Rebrands as Meiyume

(December 3) InsideRetail.hk

LF Beauty Rebrands as Meiyume

(December 3) InsideRetail.hk

- LF Beauty, the Fung Group’s beauty-focused subsidiary, has rebranded itself as Meiyume. As part of the rebranding, Meiyume’s business will be structured as three divisions: packaging and turnkey solutions, retail solutions, and brands.

- “The new brand positioning is based on the idea of Meiyume as the catalyst shaping opportunities and transforming visions into reality. The look and feel of Meiyume is modern and sophisticated, with black, white and gray brand colors that are classic and timeless and with a touch of vibrant red representing Meiyume’s origins with Li & Fung,” according to the company’s press release.

October Retail Sales in Hong Kong Register a Strong Recovery

(November 30) Reuters.com

October Retail Sales in Hong Kong Register a Strong Recovery

(November 30) Reuters.com

- In October, retail sales in Hong Kong rose by 5.9% year over year, more than double the pace of growth in September (when sales were affected by Typhoon Mangkhut). Total retail sales by value in October were HK$39.7 billion (US$5.1 billion), according to the Hong Kong Census and Statistics Department.

- Retail sales in Hong Kong for the first 10 months of 2018 increased by 10.6% year over year, whereas volume sales (netting out inflation) grew by 9.1% over the period.

LATAM RETAIL & TECH HEADLINES

Rappi to Launch RappiPay Payment System in Chile

(December 3) America-Retail.com

Rappi to Launch RappiPay Payment System in Chile

(December 3) America-Retail.com

- On-demand delivery startup Rappi expects to launch its RappiPay payments app in the Chilean market within the next two weeks. The company’s objective is to unify different payment methods within a single wallet.

- Isaac Cañas, Rappi’s General Manager in Chile, said, “Next year there will be new business verticals for Rappi Chile, where the biggest bet will be RappiPay, which will be launched in two weeks.”

Liverpool Plans to Open Around 30 Suburbia Stores in Mexico in 2019

(December 3) America-Retail.com

Liverpool Plans to Open Around 30 Suburbia Stores in Mexico in 2019

(December 3) America-Retail.com

- Department store and shopping mall operator Liverpool plans to open around 30 Suburbia stores in Mexico in 2019. Liverpool bought the clothing and footwear chain from Walmex for MXN 15.7 billion ($834 million).

- Liverpool’s goal is to double the number of Suburbia stores in Mexico to 250 over the next five years.

Chile’s Patagon Logistics Merges with Chinese Shipping Giant

(November 30) LatAmList.com

Chile’s Patagon Logistics Merges with Chinese Shipping Giant

(November 30) LatAmList.com

- Chilean logistics company Patagon Logistics has completed a merger deal with Chinese shipping company Sparx Logistics that will see Patagon operate under the Sparx name in Chile.

- “This merger allows us to transition from being a national company to becoming multinational, and we plan to open a Peruvian office in November, then open in other Latin American cities next year,” said Managing Director Juan Manuel Rojas.

Ripley Registers 10.5% Growth in Profits in September

(December 3) America-Retail.com

Ripley Registers 10.5% Growth in Profits in September

(December 3) America-Retail.com

- Ripley, a Chile-based department store, financial services and shopping mall management company, registered 10.5% year-over-year profit growth in September.

- Revenues for the first nine months of the year rose by 2.2% year over year.

Hugo Boss Launches Two Hugo Stores in Mexico

(December 1) Mx.FashionNetwork.com

Hugo Boss Launches Two Hugo Stores in Mexico

(December 1) Mx.FashionNetwork.com

- In November, German luxury fashion house Hugo Boss opened its first two independent stores under the Hugo banner in Mexico.

- The new stores are part of Hugo Boss’s restructuring strategy, which began in 2016, when the company introduced the Hugo label to target younger consumers.

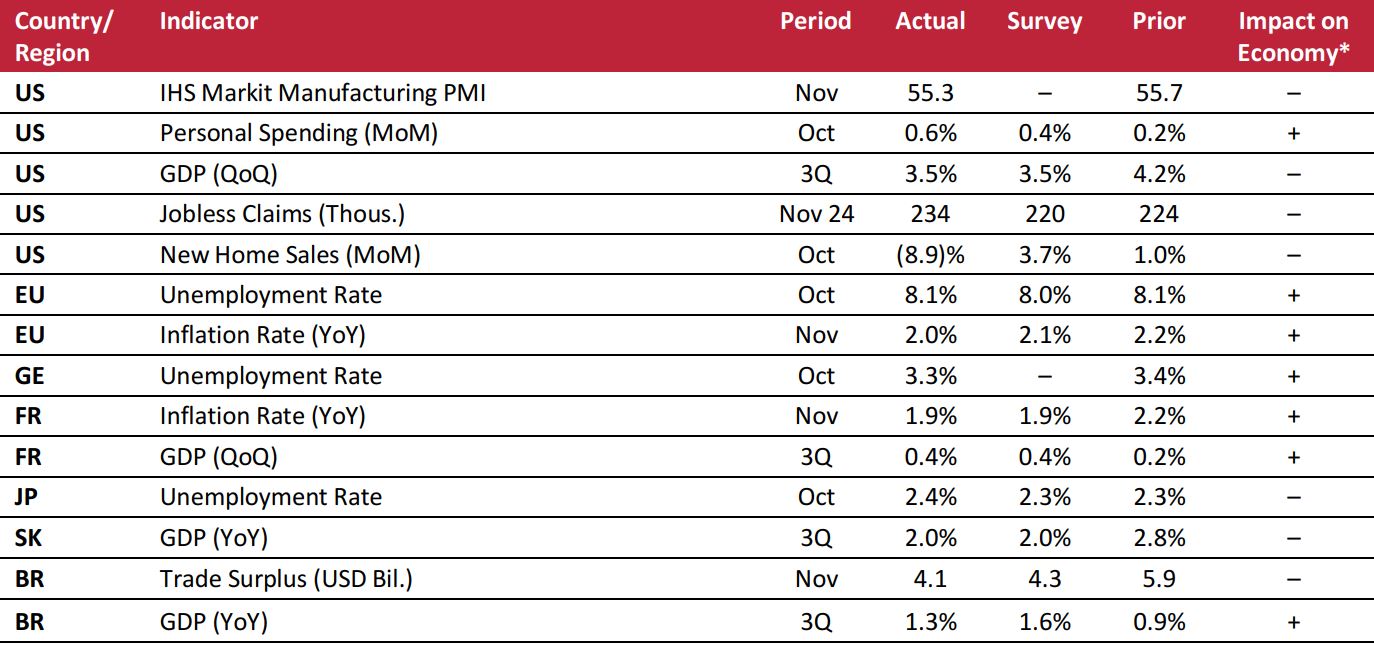

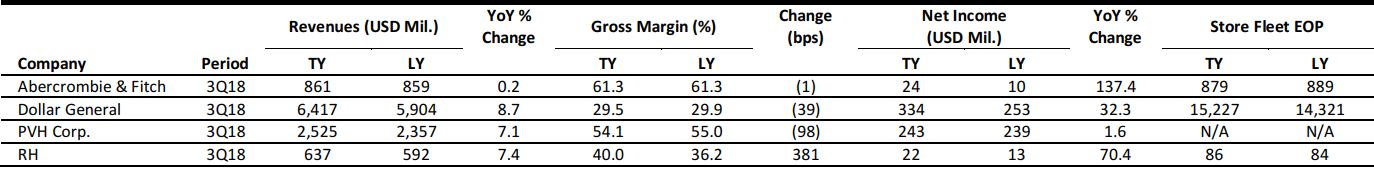

MACRO UPDATE

Key points from global macro indicators released November 28–December 4, 2018:

- US: The US Manufacturing Purchasing Managers’ Index (PMI) fell slightly, to 55.3, in November from 55.7 in October. Personal spending in the US rose by 0.6% month over month in October, following a 0.2% increase in September and beating the consensus estimate of a 0.4% gain.

- Europe: The unemployment rate in the eurozone stood at 8.1% in October, unchanged from September but above market expectations of 8.0%. The inflation rate in the eurozone eased to 2.0% in November from a six-year high of 2.2% in October and was slightly below market expectations of 2.1%.

- Asia-Pacific: The unemployment rate in Japan increased to 2.4% in October from a four-month low of 2.3% in September and was slightly above market expectations of 2.3%. In South Korea, GDP grew by 2.0% year over year in the third quarter, slowing from 2.8% growth in the previous quarter and in line with consensus expectations.

- Latin America: In Brazil, the trade surplus decreased to $4.1 billion in November from $5.9 billion in October, and was slightly below market expectations of $4.3 billion. Brazil’s GDP increased by 1.3% year over year in the third quarter, compared with 0.9% growth in the previous quarter and below the consensus estimate of 1.6% growth.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: IHS Markit/US Bureau of Economic Analysis/US Department of Labor/US Census Bureau/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics and Economic Studies (France)/Ministry of Internal Affairs and Communications (Japan)/Bank of Korea/Ministry of Industry, Foreign Trade and Services (Brazil)/Brazilian Institute of Geography and Statistics/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: IHS Markit/US Bureau of Economic Analysis/US Department of Labor/US Census Bureau/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics and Economic Studies (France)/Ministry of Internal Affairs and Communications (Japan)/Bank of Korea/Ministry of Industry, Foreign Trade and Services (Brazil)/Brazilian Institute of Geography and Statistics/Coresight Research

US RETAIL EARNINGS

US RETAIL EARNINGS

Tesco Partners with Volkswagen to Build an Electric Vehicle Charging Network

(November 30) Company press release

Tesco Partners with Volkswagen to Build an Electric Vehicle Charging Network

(November 30) Company press release

Esprit Announces Significant Global Restructuring Plan

(November 29) RetailDetail.com

Esprit Announces Significant Global Restructuring Plan

(November 29) RetailDetail.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: IHS Markit/US Bureau of Economic Analysis/US Department of Labor/US Census Bureau/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics and Economic Studies (France)/Ministry of Internal Affairs and Communications (Japan)/Bank of Korea/Ministry of Industry, Foreign Trade and Services (Brazil)/Brazilian Institute of Geography and Statistics/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: IHS Markit/US Bureau of Economic Analysis/US Department of Labor/US Census Bureau/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics and Economic Studies (France)/Ministry of Internal Affairs and Communications (Japan)/Bank of Korea/Ministry of Industry, Foreign Trade and Services (Brazil)/Brazilian Institute of Geography and Statistics/Coresight Research