FROM THE DESK OF DEBORAH WEINSWIG

The Last Letter of 2018: Looking Back, Looking Ahead

As 2018 comes to a close, this is an ideal time to look back at the key events in retail this year and examine the outlook for 2019. For the industry in aggregate, the recent surge in retail sales has provided a sorely needed respite from the pain of the last several years. Retail sales increased 0.2 percent month over month in November and increased 5.3 percent year to date through November.

These figures are so strong that it prompts the question, “Are we experiencing peak retail?” Macro indicators such as GDP growth, unemployment, wages, and housing prices and starts show no signs of derailing the retail celebration at present. The only negative has been gas prices, yet gas is up only a couple of percentage points year to date.

Still, not every retailer has been enjoying the benefits of the strong environment. Coresight Research’s

Weekly Store Openings and Closures Tracker recorded nearly 5,500 U.S. store closure announcements year to date through December 21, which more than offset the nearly 3,000 opening announcements. There have also been several notable retail bankruptcy announcements, including Bon-Ton Stores Inc. and Sears Holdings Corp., as well as the liquidation of Toys “R” Us Inc.

At the same time, e-commerce continues to relentlessly nibble away at brick-and-mortar retail. E-commerce accounted for 9.8 percent of total U.S. retail sales in the third quarter (based on seasonally adjusted figures), up 14.5 percent year over year — and the relevant figure is even higher than the U.S. government’s calculation. During

Thanksgiving weekend, in-store traffic continued its negative trend, and e-commerce growth was in the 20 percent range, showing consumers’ increasing comfort with and enjoyment of online shopping, particularly on mobile devices, which accounted for nearly 40 percent of all e-commerce traffic during Thanksgiving weekend.

So, what is the outlook for 2019? Unless there is a major economic or political shock—particularly with regard to U.S.-China trade and political frictions—2019 is likely to look much like 2018. Store closures and bankruptcies are likely to continue as retailers continue to prune unprofitable or less-profitable stores, and the advance of e-commerce will persistently pressure physical stores.

Physical retail is seeing a comeback, however, as retailers are taking advantage of the surge in sales to reinvest in their businesses and renovate their stores. Moreover, many brands and retailers are opening new flagships to promote their brands. For example, CoverGirl (owned by Coty Inc.) and FAO Schwarz (owned by ThreeSixty Group Ltd.) have opened new flagships in New York City, which now also boasts a Starbucks Corp. Roastery store.

The grocery sector will likely remain hot in 2019 as grocers and e-commerce companies move into the adjacent prepared-meal space. U.S. grocers are increasingly offering delivery, including same-day delivery, and The Kroger Co. recently started delivering groceries by robotic vehicle. Amazon.com Inc. is now expanding its base of lightly staffed Amazon Go shops, which aim to capture share of the food-to-go market, and the company is reportedly considering bringing these futuristic stores to airports. Other retailers are also deploying automated stores in various regions around the world, particularly in China.

Newly created shopping holidays will continue to proliferate in 2019. The gross marketplace value of Singles’ Day in China exceeded that of Black Friday and Cyber Monday combined, and Singles’ Day is expanding around the globe. In China, retailers have created many other shopping holidays derived from other occasions. Even in the U.S., the hoopla surrounding Amazon Prime Day has prompted other major retailers to create their own shopping events.

We expect retail to evolve in fits and starts in 2019. While not all retailers will enjoy the same level of success, we expect the industry to continue to surprise and entertain.

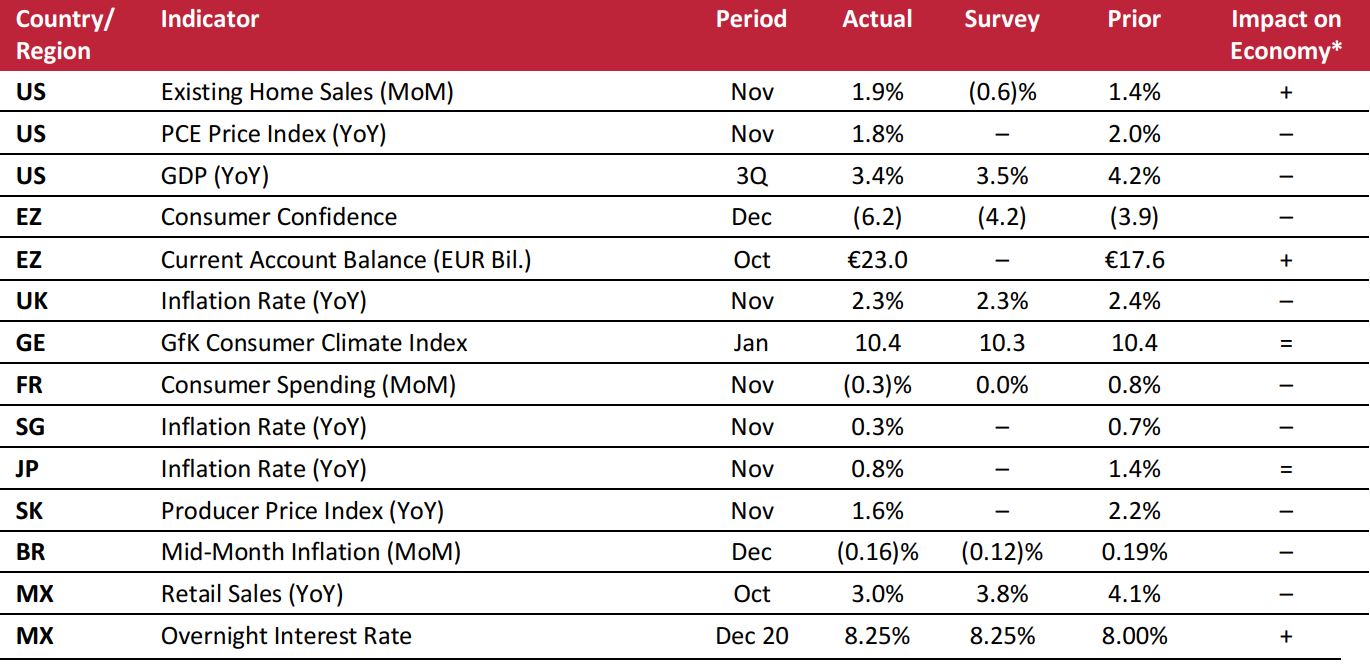

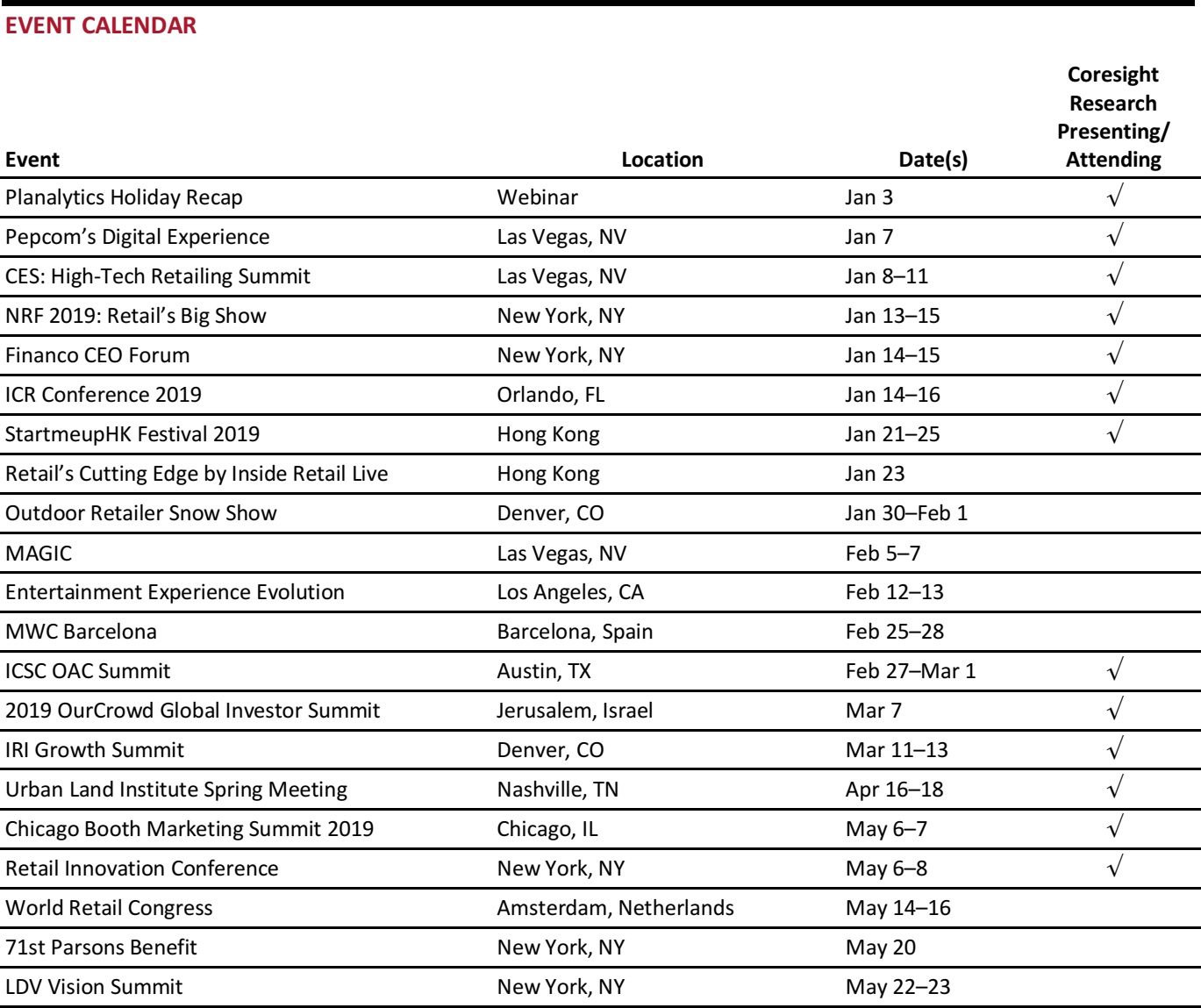

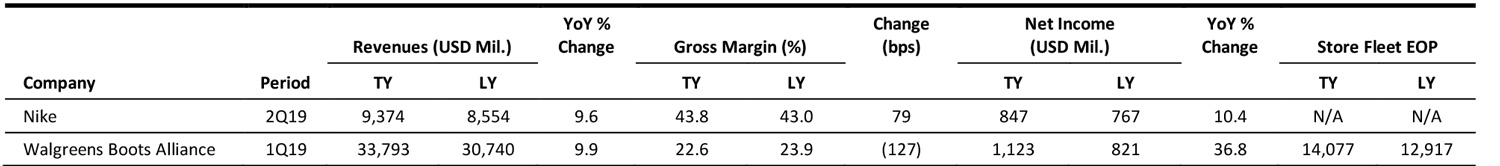

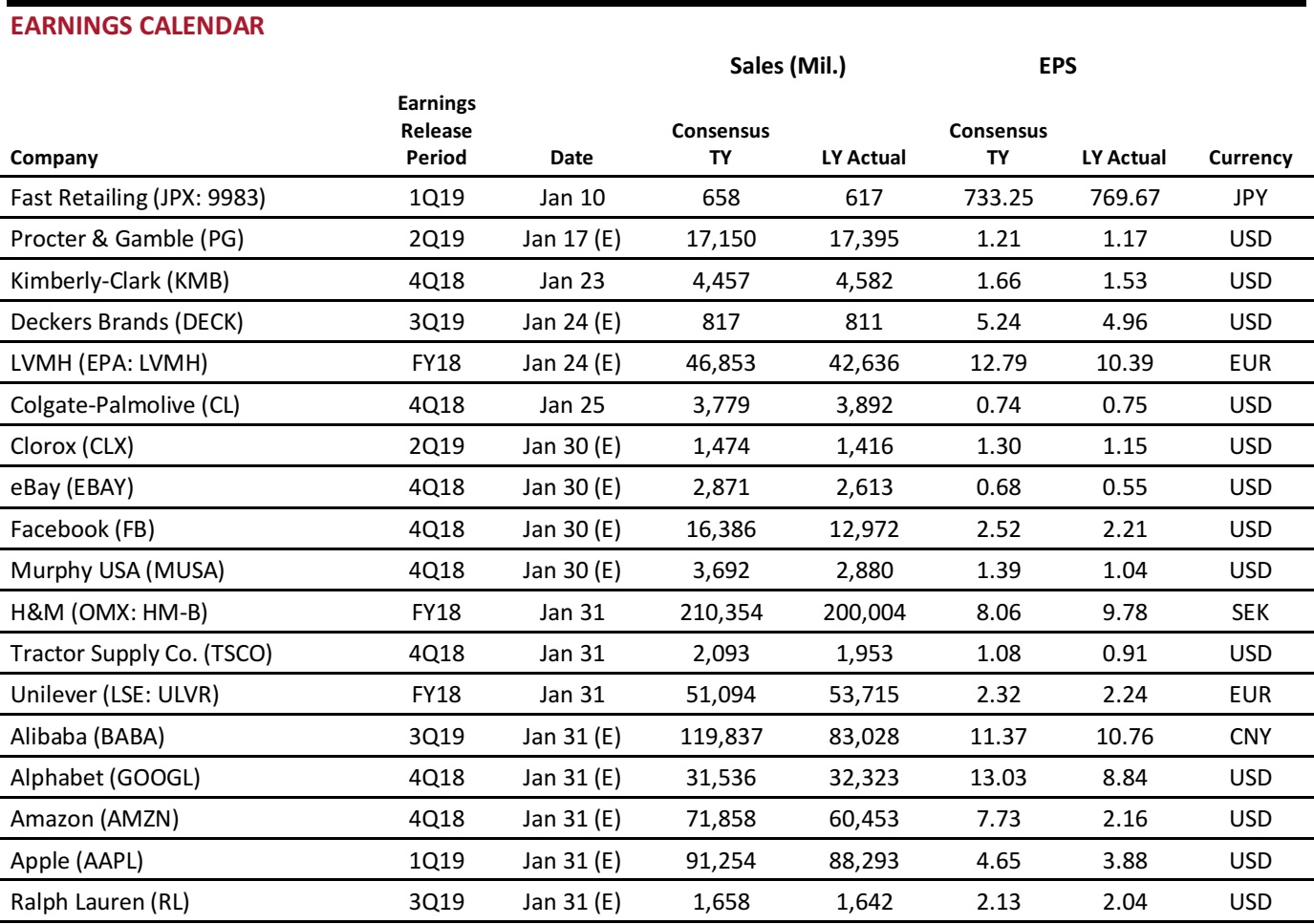

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Calvin Klein Chief Creative Officer Raf Simons Resigns

(December 24) RetailGazette.co.uk

Calvin Klein Chief Creative Officer Raf Simons Resigns

(December 24) RetailGazette.co.uk

- Calvin Klein’s first-ever Chief Creative Officer, Raf Simons, announced his resignation from the upmarket brand and retailer after two years in the role. His fashion shows included many celebrities and received acclaim.

- Calvin Klein will not feature in the February 2019 installment of New York Fashion Week and has not yet announced a replacement. Simons is currently working on his eponymous menswear label.

Finishing the Holidays on a High Note

(December 23) WSJ.com

Finishing the Holidays on a High Note

(December 23) WSJ.com

- U.S. retailers wrapped up one of the strongest holiday seasons in years, with shoppers crowding stores for last-minute Christmas gifts and delivery companies able to keep up with the surge in online orders as the holiday neared.

- Stores have met the lofty sales expectations set by analysts and industry groups, according to early data. Total U.S. retail sales, excluding automobiles, rose by 5.2 percent year over year from November 1 through December 19, according to Mastercard SpendingPulse, which tracks both online and in-store spending.

Trump Tariff War with China Sends US Retailers on Buying Binge

(December 21) BusinessTimes.com

Trump Tariff War with China Sends US Retailers on Buying Binge

(December 21) BusinessTimes.com

- Over a dozen customs brokers, retailers, vendors, analysts and supply chain experts told Reuters that retailers have been stockpiling inventory from China to avoid higher tariffs that may kick in next year.

- Warehouses throughout the U.S. are at record capacity with Chinese imports of all kinds. Recent data from the National Retail Federation and Hackett Associates show that imports at major U.S. retail container ports surged 13.6 percent, to a record 2.04 million containers, in October.

Gump’s, Historic San Francisco Department Store, Closing After 157 Years

(December 20) SanFrancisco.CBSLocal.com

Gump’s, Historic San Francisco Department Store, Closing After 157 Years

(December 20) SanFrancisco.CBSLocal.com

- San Francisco’s oldest department store, Gump’s, closed its doors on December 23 after 157 years in business. Gump’s was founded in 1861 as a frame and mirror shop.

- It transformed itself into an exclusive store, located in the city’s Union Square neighborhood. But, as San Francisco changed, Gump’s mostly stayed the same. Earlier this year, Gump’s filed for bankruptcy.

National Retail Chains Closing at a Rapid Rate in NYC

(December 18) NYPost.com

National Retail Chains Closing at a Rapid Rate in NYC

(December 18) NYPost.com

- For the first time in 11 years, national retail chains are closing more stores in New York City than they’re opening. With rents rising and Amazon continuing its expansion, the number of local chain-store locations shrank by 0.3 percent, to 7,849, in 2018.

- A record 18 chains, including Aerosoles, Nine West, Easy Spirit, Toys R Us, Quiznos and DKNY, exited all of their New York sites in 2018, and most of them filed for bankruptcy protection.

EUROPE RETAIL & TECH HEADLINES

New Look Seeking to Cut £1.3 Billion Debt

(December 24) RetailGazette.co.uk

New Look Seeking to Cut £1.3 Billion Debt

(December 24) RetailGazette.co.uk

- British fashion retailer New Look is examining options to cut its £1.3 billion ($1.6 billion) debt, including a debt-for-equity swap at the start of 2019.

- The company has enlisted advisers to help solve its problem and is hoping to finalize a plan in the next three months. A debt-for-equity swap will give New Look’s bondholders a share of the business and will help cut down cash being spent on interest payments.

H&M Brand Arket Announces Second Belgian Store and New Food Concept

(December 20) RetailDetail.eu

H&M Brand Arket Announces Second Belgian Store and New Food Concept

(December 20) RetailDetail.eu

- Arket, a brand from Swedish fashion group H&M’s stable, announced the opening of a second store in Belgium. The store will be located in the center of Antwerp’s shopping district and will open next spring.

- The store will also feature a restaurant serving Scandinavian dishes prepared in line with the New Nordic Food Manifesto—a movement that seeks to define a new Scandinavian kitchen through conscious food production, sourcing and cooking.

“Super Saturday” Sees Subdued Traffic

(December 23) BBC.com

“Super Saturday” Sees Subdued Traffic

(December 23) BBC.com

- The Saturday before Christmas, or “Super Saturday,” saw an incremental boost in shoppers, according to data from consumer insights firm Springboard. High-street footfall rose by 1 percent year over year, but overall footfall fell by 0.7 percent.

- Springboard Marketing and Insights Director Diane Wehrle remarked that Christmas shoppers have been holding out for last-minute bargains, but hard discounts have not elicited the same interest as they previously did.

Richemont Joins Alibaba’s Anti-Counterfeiting Alliance (AACA)

(December 24) FashionNetwork.com

Richemont Joins Alibaba’s Anti-Counterfeiting Alliance (AACA)

(December 24) FashionNetwork.com

- Swiss luxury group Richemont has joined the AACA, an association of firms established by Alibaba to protect intellectual property rights on Alibaba platforms.

- Richemont is one of 115 members from 16 countries and is the latest company from the luxury sector to partner with Alibaba. The group will share its knowledge and expertise to support the partnership’s efforts.

Aldi Nord Incurs Loss for the First Time

(December 20) RetailDetail.eu

Aldi Nord Incurs Loss for the First Time

(December 20) RetailDetail.eu

- German retailer Aldi Nord has incurred a loss in its home market for the first time ever. The retailer had forecast 3.5 to 4.0 percent turnover growth, but it came in at less than 1 percent.

- The lower-than-expected turnover and large investment costs for renovating existing stores and opening new stores led to the loss of “eight digits,” equivalent to at least €10 million ($11.42 million).

ASIA RETAIL & TECH HEADLINES

Pomelo Fashion Unveils Menswear Range in Thailand

(December 24) InsideRetail.Asia

Pomelo Fashion Unveils Menswear Range in Thailand

(December 24) InsideRetail.Asia

- This month, JD.com-backed clothing brand Pomelo Fashion is debuting a new menswear line, Pomelo Man, in Thailand.

- The brand’s measurement service, which will launch exclusively through its mobile app, allows a shopper to walk into a Pomelo store, get measured by staff and then have the information stored in his account, so he can easily pick the right sizes while shopping online.

Bilibili and Taobao Partner on Content Creation and Commercialization Initiatives

(December 20) Alizila.com

Bilibili and Taobao Partner on Content Creation and Commercialization Initiatives

(December 20) Alizila.com

- Bilibili, the owner of a popular website in China for streaming anime and games videos, and Alibaba’s Taobao marketplace have partnered to launch initiatives to better connect users, merchandise and content creators from both sites.

- Taobao will introduce Bilibili content creators to its site as part of the partnership. Taobao will also help the streaming site commercialize its intellectual property assets, including its official mascots, virtual idols, original documentaries and anime content.

Google Launches Shopping in India

(December 21) RetailNews.Asia

Google Launches Shopping in India

(December 21) RetailNews.Asia

- Tech giant Google has launched marketplace platform Google Shopping in India to cater to the country’s large and growing online shopper base. Users can shop through the Google Shopping homepage, a Shopping tab on Google search and through Google Lens.

- Google said that it aims to connect the complete retail ecosystem, from online-only retailers to large retailers to small, local shops.

China Expected to Record 9 Percent Retail Sales Growth in 2019

(December 24) ATimes.com

China Expected to Record 9 Percent Retail Sales Growth in 2019

(December 24) ATimes.com

- In 2019, China’s retail sales are expected to grow by 9 percent and contribute 65 percent to GDP growth, according to recent data from China’s Ministry of Commerce.

- Wang Bin, the Deputy Director of the Market Operation Department at the Ministry of Commerce, said that the government will develop more commercial districts, build more international consumer cities and promote digital commerce in rural areas in 2019.

Meituan Dianping Receives Ride-Hailing Permit in Beijing

(December 24) TechinAsia.com

Meituan Dianping Receives Ride-Hailing Permit in Beijing

(December 24) TechinAsia.com

- The Beijing transportation bureau has awarded Meituan Dianping a ride-hailing-service permit for the city. The on-demand platform for online food delivery, ticketing and other services attempted to roll out ride-hailing service in Beijing last year, but could not because it lacked a government license.

- The Beijing bureau’s decision comes after Meituan announced in September that it will scale back expanding its ride-hailing business.

LATAM RETAIL & TECH HEADLINES

Ripley Launches Mobile Point-of-Sale Kiosks in Stores to Enable Faster Checkout

(December 21) LaRepublica.pe

Ripley Launches Mobile Point-of-Sale Kiosks in Stores to Enable Faster Checkout

(December 21) LaRepublica.pe

- Chilean retailer Ripley has launched Ripley Express, a mobile point of sale, to help shoppers check out faster and ease the last-minute holiday shopping rush.

- Store associates will be present throughout the store with a handheld device to scan products and enable customers to pay for them. They will also have shopping bags to place purchases in to help shoppers check out faster.

Falabella Opens Third Sodimac Store in Mexico

(December 19) Df.cl

Falabella Opens Third Sodimac Store in Mexico

(December 19) Df.cl

- Chilean retail group Falabella has opened a new Sodimac store in Mexico. This is the third opening under the home improvement and construction banner since Falabella and supermarket retailer Soriana launched a joint venture in 2016 to open Sodimac stores in Mexico.

- The 113,000-square-foot store integrates Sodimac’s Homecenter and Constructor formats, which focus on home improvement and building contractors, respectively.

EPK Advances in Colombia

(December 21) Modaes.com

EPK Advances in Colombia

(December 21) Modaes.com

- Venezuelan childrenswear retailer EPK has opened its first store in the Colombian city of Manizales. The 750-square-foot store is located in the Mallplaza Manizales shopping center.

- EPK already has 60 stores in Colombia, in Barranquilla, Medellín, Sincelejo, Tuluá, Girardot and Cali. The company plans to raise its store count to 120 by 2020.

Surtimayorista to End the Year with 18 Stores

(December 21) America-Retail.com

Surtimayorista to End the Year with 18 Stores

(December 21) America-Retail.com

- Colombian retailer Grupo Éxito ends 2018 with 18 stores of its cash-and-carry brand Surtimayorista, including nine stores that were opened this year with an investment close to COP 16 billion ($5 million).

- In the year ended November, Surtimayorista made over 3 million transactions; 74 percent of them were for professional clients and 26 percent were for consumers. Surtimayorista will continue to expand in 2019 and proceed with its plans to open at least eight stores per year.

Mexicans Plan to Spend an Average of MXN 4,437 on Holiday Gifts this Year

(December 21) America-Retail.com

Mexicans Plan to Spend an Average of MXN 4,437 on Holiday Gifts this Year

(December 21) America-Retail.com

- This year, Mexican shoppers plan to spend some MXN 4,437 ($223) on holiday gifts, a 7 percent increase over last year, according to a research report from consumer intelligence firm Kantar TNS.

- Mexicans are expected to give around seven gifts each this year, and 63 percent prefer to give gifts of clothing and footwear, with toys, perfumes and accessories the next most-popular gift categories.

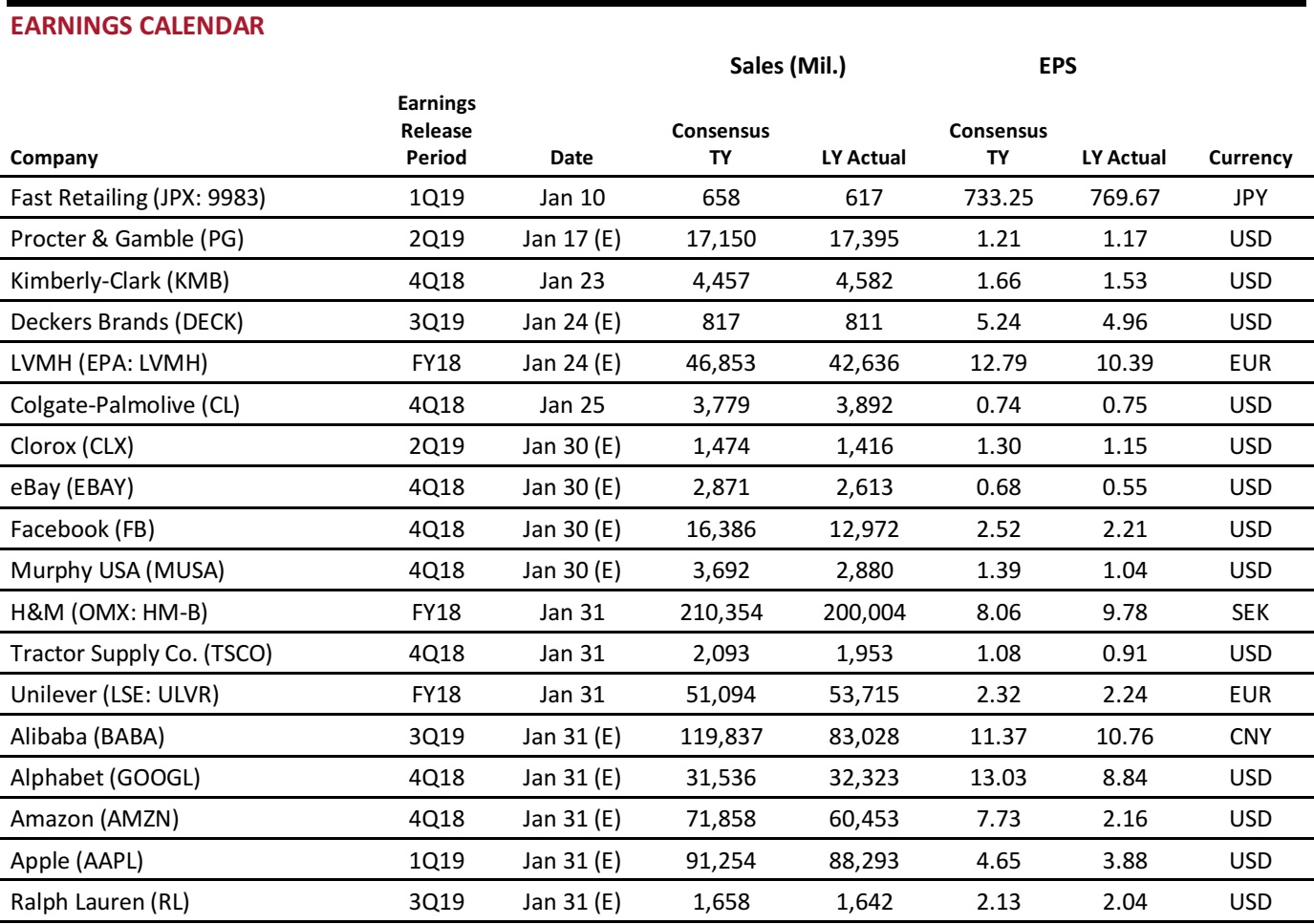

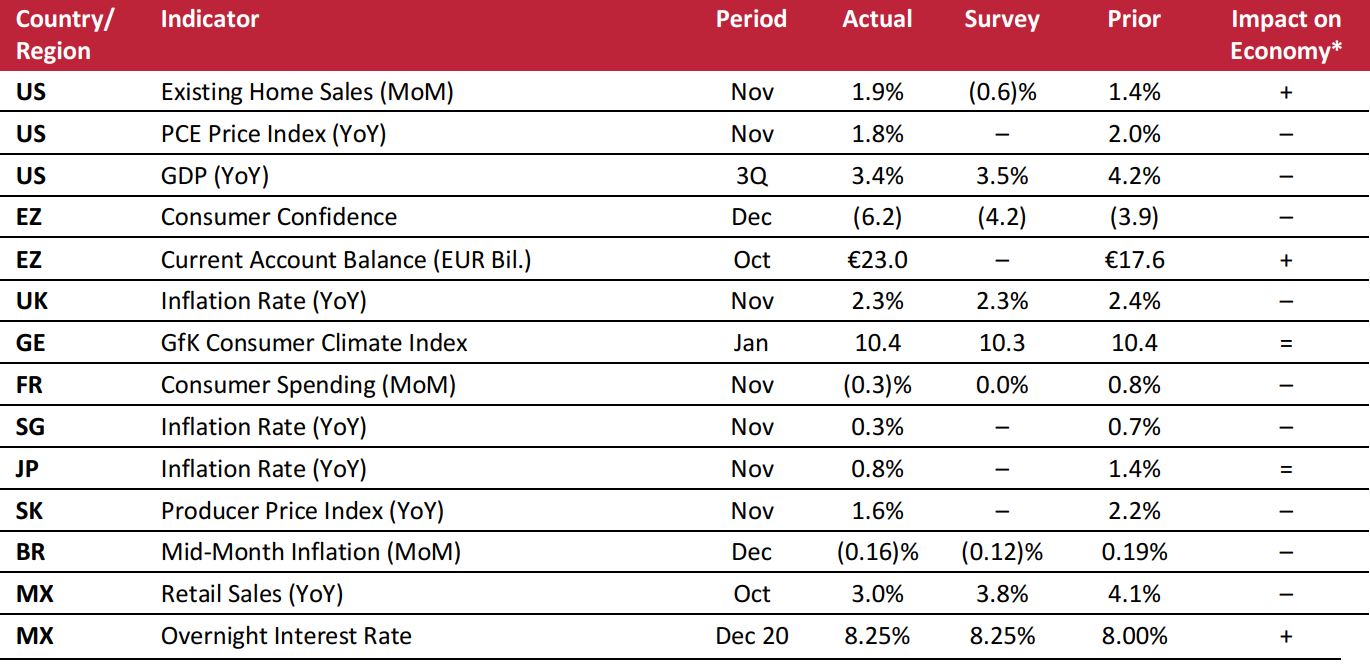

MACRO UPDATE

Key points from global macro indicators released December 19–24, 2018:

- U.S.: Existing home sales grew by 1.9 percent month over month in November, contradicting market expectations of a decline following 1.4 percent growth in October. Personal consumption expenditure increased by 1.8 percent year over year in November, slightly below the 2.0 percent growth recorded for October.

- Europe: The current account surplus in the eurozone increased to €23 billion in October from €17.6 billion in September. Consumer spending in France fell by 0.3 percent month over month in November following 0.8 percent growth in October.

- Asia-Pacific: Singapore’s inflation rate eased to 0.3 percent year over year in November from 0.7 percent in October. The inflation rate in Japan eased to 0.8 percent year over year in November from 1.4 percent in October.

- Latin America: In Mexico, retail sales increased by 3.0 percent year over year in October; the growth rate was significantly slower than the strong, 4.1 percent rate seen in September. On December 20, the Central Bank of Mexico raised its benchmark interest rate by a quarter of a percentage point, to 8.25 percent, the highest rate in over a decade.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/U.S. Bureau of Economic Analysis/Eurostat/Office for National Statistics (U.K.)/Federal Statistical Office (Germany)/National Institute of Statistics and Economic Studies (France)/Department of Statistics Singapore/Statistics Bureau (Japan)/Bank of Korea/Brazilian Institute of Geography and Statistics/National Institute of Statistics and Geography (Mexico)/Bank of Mexico/Coresight Research

National Retail Chains Closing at a Rapid Rate in NYC

(December 18) NYPost.com

National Retail Chains Closing at a Rapid Rate in NYC

(December 18) NYPost.com

EPK Advances in Colombia

(December 21) Modaes.com

EPK Advances in Colombia

(December 21) Modaes.com