Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

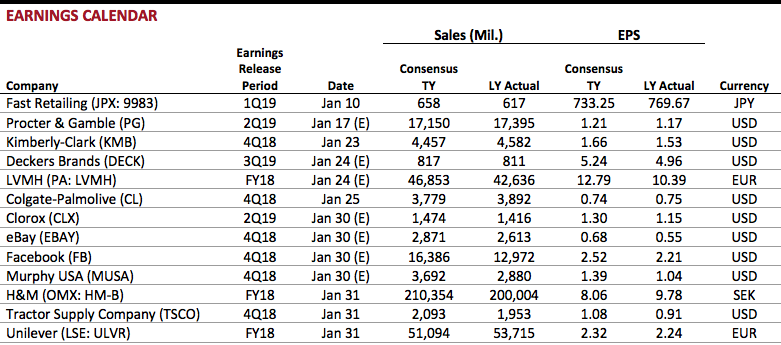

We’re in the Holiday Homestretch! As we enter the holiday homestretch, the signs indicate that US retailers will enjoy another strong season—albeit with growth slowing from last year’s exceptional rates. In this week’s note, we round up recent metrics that give us some final pointers on the direction of trading this holiday season. US retail sales data released this week confirmed that total spending continued to grow solidly in November, with total sales excluding automobiles and gasoline up by just over 5% year over year. That growth is down from last November’s spectacular 6.5% rate, but against such a demanding comparative, spending growth of 5% is quite impressive. Surveys routinely find that apparel is the most-bought product during the holidays, and clothing specialty stores and department stores turned in meaningfully softer growth this November compared with the same month last year, further underlining the more cautious growth in discretionary spending. [caption id="attachment_85254" align="aligncenter" width="720"] *Excluding automobiles and gasoline

*Excluding automobiles and gasolineSource: US Census Bureau/Coresight Research[/caption] Other indicators point to a benign economic context and sustained consumer demand over the holiday peak:

- Data from the Thanksgiving weekend show that US consumers have been spending freely online. According to Adobe Analytics, year over year, online sales rose by 27.9% on Thanksgiving, by 23.6% on Black Friday and by 19.3% on Cyber Monday.

- One negative indicator in November was the greater-than-expected decline in consumer sentiment, according to the University of Michigan’s monthly index. The decrease came in the wake of stock-market jitters, which apparently caused sentiment to weaken among wealthier Americans; sentiment increased sequentially among the lowest earners.

- More positively, jobless claims fell by more than expected in the week ended December 8. Claims saw their largest weekly drop since 2015 that week, taking the unemployment rate close to a 49-year low.

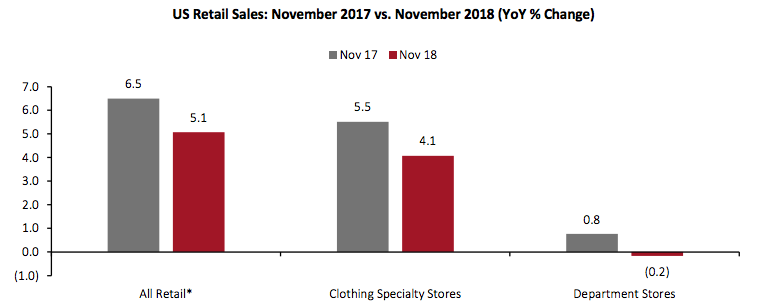

- The rate of consumer prices inflation eased from 2.5% in October to 2.2% in November, with consumers experiencing a welcome slowdown in year-over-year gasoline inflation, from 16% in October to 5% in November. We also saw sustained ultralow inflation in food, which freed up consumers’ cash for discretionary purchases.

- Wage growth slowed in November, too, although it remained ahead of inflation and followed several months of the wages-versus-prices gap widening, as we chart below.

Source: US Bureau of Labor Statistics/Coresight Research[/caption]

Overall, the indicators remain positive for retail. However, should more affluent consumers retain the caution they showed in November, some retailers at the high end may feel the impact in December. The momentum this holiday season is almost certain to be slower than last year’s, but the signs continue to point to solid real-term growth in discretionary spending.

Source: US Bureau of Labor Statistics/Coresight Research[/caption]

Overall, the indicators remain positive for retail. However, should more affluent consumers retain the caution they showed in November, some retailers at the high end may feel the impact in December. The momentum this holiday season is almost certain to be slower than last year’s, but the signs continue to point to solid real-term growth in discretionary spending.

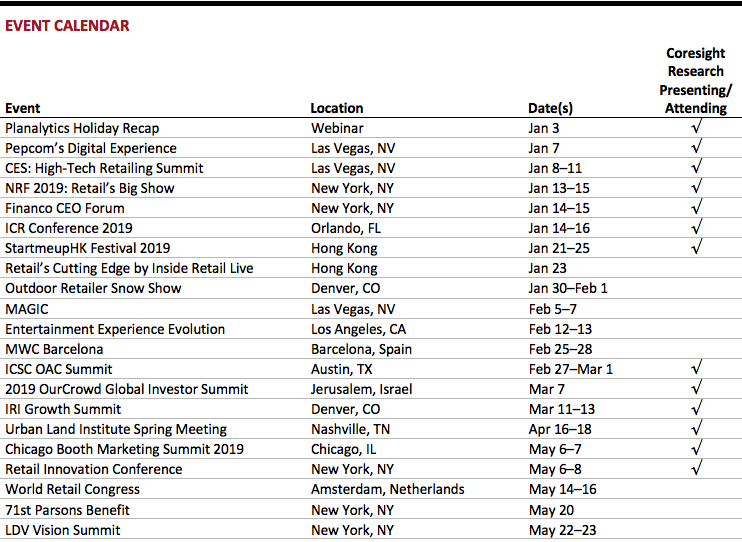

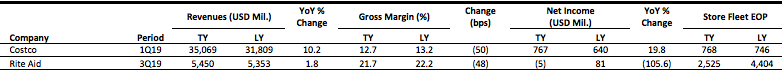

US RETAIL EARNINGS

[caption id="attachment_85257" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- US retail sales figures signaled that consumer spending, the biggest part of the economy, is poised to drive another quarter of strong growth. The value of overall sales beat forecasts, rising by 0.2% in November, Commerce Department data showed.

- Americans took advantage of lower fuel prices and Black Friday sales that kicked off the holiday-shopping season last month, setting up household consumption for a stronger-than-expected quarterly increase following the best back-to-back gains in four years.

- Retailers are doubling down on toys amid a gap in the market left by the bankruptcy of Toys“R”Us. UK toy retailer Hamleys is nearing a deal for a space of approximately 30,000 square feet at 2 Herald Square in New York City. The store could open in 2020, although no deal has yet been finalized.

- Last month, legendary toy retailer FAO Schwarz opened a flagship store in New York City, marking its return to the city. Prior to the opening, it was reported that the retailer’s new 30 Rockefeller Plaza location would include multiple experiential retail components.

- At the largest retail real estate conference on the East Coast, put on by ICSC, landlords spoke about how demolishing a Sears store would be a cheaper and faster option than back-filling the existing structure. But as many mall owners look to find new tenants to replace Sears, the process likely won’t be so easy.

- Sears stores are typically more than 100,000 square feet and can occupy multiple levels. There are few retailers still growing today that would fit directly into that space. Some, if not lots, of construction is going to be needed.

Christmas Shipping Deadlines: The Last Day to Send Gifts with FedEx, UPS and USPS

(December 17) USAToday.com

Christmas Shipping Deadlines: The Last Day to Send Gifts with FedEx, UPS and USPS

(December 17) USAToday.com

- To ship gifts for guaranteed delivery by Christmas Eve, Monday was the deadline for FedEx’s ground and home delivery, while Tuesday was the deadline for UPS 3 Day Select. The deadline for free shipping on Amazon orders was also Tuesday.

- The Postal Service’s deadline for its priority and first-class mail was more generous— packages needed to be mailed out on Thursday. The week through December 23 is expected to be the service’s busiest week for mailing, shipping and delivery.

- Amazon appears to be developing private-label toys, according to a blog post on Amazon-tracking site TJI Research. The blog noted that there were four toy items from the e-commerce giant’s popular AmazonBasics line available.

- While Amazon is at a disadvantage in terms of toy sales compared with legacy brick-and-mortar retailers like Target and Walmart, it does have reams of data that it can use to develop its private-label and exclusive assortments. The retailer has developed private-label and exclusive products in several categories, including apparel, pet food, snacks and mattresses, but this is its first private-label toy offer, according to TJI Research owner Justin Smith.

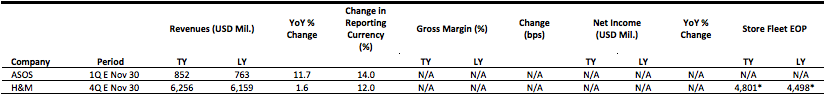

EUROPE RETAIL EARNINGS

[caption id="attachment_85286" align="aligncenter" width="720"] *As of the end of the company’s second fiscal quarter

*As of the end of the company’s second fiscal quarterSource: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

- British fashion pure play Boohoo issued a statement assuring stakeholders that its performance was “comfortably in line with market expectations” and boasted of record Black Friday sales. The group will report its trading update for the four months ending December 31 on January 15, 2019.

- Boohoo’s announcement follows an announcement by its competitor, ASOS, which pulled forward a trading update to issue a warning on sales and profits. ASOS lowered its sales growth forecast to 15% from 20%–25% and guided for retail gross margin contraction of 150 basis points versus previous guidance of flat growth.

- British fashion and furniture retailer Laura Ashley is set to close 40 of its 160 UK stores as its owner, Malayan United Industries (MUI), looks to ramp up expansion in Asia.

- MUI Chairman Andrew Khoo said that the company will increase the size of the remaining stores and take on some staff whose jobs will be at risk due to the closures. Khoo indicated plans to open stores in Asia, including in China, if online sales gain traction.

- Less than two years after launching a company voluntary arrangement, British menswear retailer Blue Inc has entered administration following failed attempts to find a new owner to rescue the business. The company hired corporate recovery consultancy Begbies Traynor last month to find a buyer and advise on its future after struggling despite implementing restructuring and cost-cutting measures.

- “We can confirm that Blue Inc entered administration on Monday, December 10, 2018. The remaining 31 stores will continue trading while discussions are in progress regarding the future of the brand,” said Begbies Traynor in a statement.

- British toy retailer The Entertainer has expanded its European footprint with the acquisition of Spanish toy retailer Poly. As part of the deal, The Entertainer will acquire all 57 Poly stores and retain the Spanish retailer’s staff of more than 350.

- The Entertainer acquired Poly, which has stores in shopping centers and high streets across Spain, via a competitive bid that was managed by an administrator.

- French luxury goods conglomerate LVMH Moët Hennessy Louis Vuitton announced that it has acquired luxury travel company Belmond for an equity valuation of $2.6 billion in a transaction that puts the latter’s enterprise value at $3.2 billion, according to an LVMH press release.

- “Belmond delivers unique experiences to discerning travelers and owns a number of exceptional assets in the most desirable destinations. …This acquisition will significantly increase LVMH’s presence in the ultimate hospitality world,” said LVMH CEO Bernard Arnault. The acquisition highlights the growing importance of experiences in the luxury market and LVMH’s attention toward them.

ASIA RETAIL & TECH HEADLINES

- E-commerce firm JD.com and technology giant Intel have opened a lab in China that will explore the use of the Internet of Things (IoT) in retail. The Digitized Retail Joint Lab will build new-age vending machines, media and advertising tools, and technologies for futuristic stores based on Intel’s architecture.

- The lab will also leverage data generated by JD.com’s technology. Scientists at the lab have already combined Intel’s technologies with JD’s computer vision algorithms to examine customer traffic and in-store purchasing habits.

- Dickson Concepts, the owner of department store Harvey Nichols, plans to revamp its store and online banner in Hong Kong and has earmarked around HK$1 billion (US$128 million) for the project.

- Executive Director Pearson Poon said that the plan includes cutting the space of the flagship Harvey Nichols store by half, increasing the product range by three times and improving the shopping experience through personal stylist services.

- Chinese e-commerce startup LemonBox, which imports American vitamins and other health supplements to China, has raised $2 million to develop its business. Customers mainly order through the WeChat messaging app and a website, but the startup may eventually launch a stand-alone app.

- LemonBox graduated from seed accelerator Y Combinator’s most recent program and has attracted the funds from 10 investors, including 122 West Ventures, Tekton Ventures, Scrum Ventures, Cathexis Ventures and Partech.

Lotte to Open The Conran Shop in South Korea Next Year

(December 18) InsideRetail.Asia

Lotte to Open The Conran Shop in South Korea Next Year

(December 18) InsideRetail.Asia

- South Korean conglomerate Lotte has partnered with high-end British furniture company The Conran Shop to open a new store in South Korea next year.

- The store will span approximately 25,000 square feet and will be located in Seoul’s upscale Gangnam district.

- E-commerce platform Shopee, which serves customers in Southeast Asia and Taiwan, logged record sales on the third anniversary of its founding, December 12. More than 450,000 brands and sellers participated in the event, which generated more than 12 million orders across the region.

- During the event, Shopee recorded 48 million visits and users shopped more than 60 million deals across all categories. In Singapore, beauty and personal care, home and living, and mobile and gadgets were the three most popular purchase categories.

LATAM RETAIL & TECH HEADLINES

- Chilean retailer Cencosud has appointed Matías Videla as CFO to replace Rodrigo Larraín, who will leave the company on December 31 along with HR Officer Rodrigo Hetz.

- Videla is currently the manager of Cencosud’s Shopping Centers segment and is overseeing the segment’s imminent stock exchange listing.

- Some 51% of businesses that participated in Mexico’s annual El Buen Fin festival said that they saw sales increase compared with the 2017 edition, while a quarter said that sales remained roughly flat versus last year and around 19% said that sales fell, according to the Mexican National Institute of Statistics and Geography.

- El Buen Fin is short for “El Buen Fin de Semana,” which means “the good weekend.” The Mexican Council of Business Coordination, the federal government and private sector companies began the initiative in 2011 to boost the Mexican economy by encouraging consumption.

- Mexican retail group Innovasport has opened three stores under its Innvictus urban fashion banner, taking its total store count to 50 in Mexico.

- Two of the Innvictus stores are in Guadalajara and the third is in Mexico City, where the company already operated 15 Innvictus stores.

- Colombian lingerie, beach and loungewear retailer Touché has recently opened its first store in Panama, despite announcing its plans for expansion across South America over a year ago. The store spans approximately 600 square feet.

- Touché was established in 1987 and opened its first store abroad in 2010, in Mexico, where it now has a number of stores as well as concessions at department store retailer El Palacio de Hierro. Across the Atlantic, Touché sells through concessions at Spanish department store retailer El Corte Inglés.

- The Mexican federal government revealed its Economic Package for 2019 on December 15. The package includes MXN 622 million ($31 million) allocated to the Ministry of Communications and Transportation for the “Internet for All” program.

- The program involves promoting and developing high-performance telecom networks and guaranteeing access and affordability to schools, small and medium-sized enterprises, and social and community organizations.

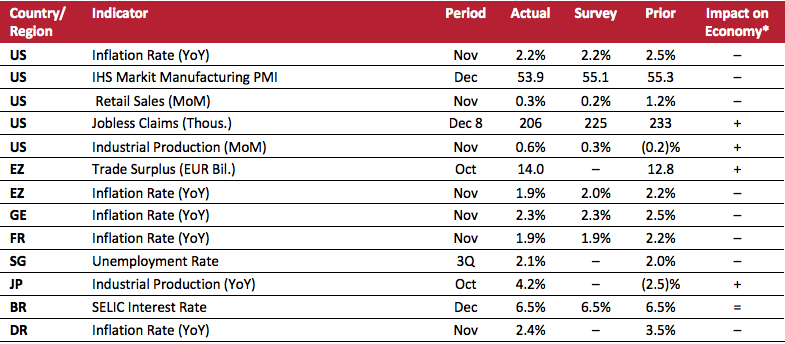

MACRO UPDATE

Key points from global macro indicators released December 12–18, 2018:- US: The annual inflation rate in the US fell to 2.2% in November from 2.5% in October, matching market expectations. The US Manufacturing Purchasing Managers’ Index (PMI) fell to 53.9 in December from 55.3 in November and was below market expectations of 55.1.

- Europe: The trade surplus in the eurozone increased to €14.0 billion in October from €12.8 billion in September. Germany’s annual inflation rate slowed to 2.3% in November from a 10-year high of 2.5% in October and was in line with the consensus estimate.

- Asia-Pacific: Singapore’s unemployment rate increased to 2.1% in the third quarter from a two-year low of 2% in the previous quarter. Industrial production in Japan grew by 4.2% year over year in October, following a contraction of 2.5% in September.

- Latin America: The Central Bank of Brazil kept its benchmark lending rate at 6.5% on December 12, a move that had been widely expected. The annual inflation rate in the Dominican Republic decreased to 2.4% in November from 3.5% in October.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Bureau of Labor Statistics/IHS Markit/US Census Bureau/US Department of Labor/US Federal Reserve/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics and Economic Studies (France)/Ministry of Manpower (Singapore)/Ministry of Economy, Trade and Industry (Japan)/Central Bank of Brazil/Central Bank of the Dominican Republic/Coresight Research[/caption]