From the Desk of Deborah Weinswig

Reviewing Retail in 2017, Part 1: Mergers, Acquisitions and Investments

2017 was a more eventful year in retail than many probably expected. This week and next, we will review the year, and consider what its developments tell us about the state of the sector and the strategies retailers are adopting to win (or maybe just survive). In this week’s note, we look at mergers, acquisitions and investments; next week, we will review collaborations.

Mergers, Acquisitions and Investments

Legacy retailers invest in Internet brands: Walmart bought a string of Internet-focused apparel brands and retailers this year: ShoeBuy in January, Moosejaw in February, ModCloth in March and Bonobos in June. In May, Target invested an unconfirmed $75 million in direct-to-consumer mattress brand Casper, according to technology news website Recode, and Target started selling Casper products in its stores. Grocery retailer Albertsons acquired meal-kit firm Plated for an undisclosed sum in September.

- Key takeaway: Long-standing retailers are not simply seeking to accelerate their e-commerce revenues; they have recognized that consumers are turning to distinctive, specialized brands that resonate with their lifestyles, and have acquired some of these brands as a result.

Healthcare retailers seek new opportunities: In September, Walgreens Boots Alliance finally acquired just under half of Rite Aid’s store network, following a protracted effort to buy the chain outright. Walgreens stated that the acquisition would boost Rite Aid’s provision of integrated frontline care. Then, in December, CVS Health announced plans to acquire health-services provider Aetna, promising a “uniquely integrated, community-based healthcare experience.”

- Key takeaway: Prompted by an aging society and consumer demand for value-for-money health services, healthcare retailers appear to have spotted opportunities to strengthen their presence in services.

Online to offline: In November, Alibaba Group announced that it was buying a major (though not majority) stake in Chinese hypermarket group Sun Art Retail for $2.9 billion. Alibaba announced a new strategic alliance with Sun Art’s major shareholders—Auchan Retail, a France-based international retail group, and Taiwanese conglomerate Ruentex—to explore new retail opportunities. And, of course, we cannot discuss online-to-offline moves without mentioning the Amazon-Whole Foods Market deal that closed in late August.

- Key takeaway: These two acquisitions confirm that grocery stands apart from nonfood categories in terms of online versus offline retailing. Even the biggest players in e-commerce appear to have acknowledged that cracking the grocery market in the foreseeable future requires ownership of a substantial brick-and-mortar network.

Online luxury: In June, Chinese e-commerce giant JD.com invested $397 million in luxury marketplace Farfetch. At the same time, the firms signed a strategic partnership agreement designed to help grow Farfetch in China. In September, private equity firm Apax Partners acquired a majority stake in luxury retailer Matchesfashion.com for a reported, though unconfirmed, figure of $1 billion. Matchesfashion.com operates some physical stores in the UK, but 95% of its revenues are generated online, and 80% of those online sales are made outside the UK, according to industry news site The Business of Fashion.

- Key takeaway: Online multibrand portals are a growth area in the still-immature luxury e-commerce market. LVMH launched its own multibrand site, 24 Sèvres, this year and Tmall launched its Luxury Pavilion site, providing further evidence of the segment’s growth. We see such portals catering to consumer demand for a compelling mix of authenticity and trusted brands, a strong service proposition and wide choice. A number of high-end department stores, boutiques and monobrand websites will need to invest in strong service offerings in order to compete effectively with these multibrand portals.

The dog that didn’t bark: Finally, we note the absence of any significant acquisitions by hard-hit department store retailers this year. Against a background of store closures and declining sales, no US department store chains sought to follow Walmart and Target by buying or investing in brands that could increase their relevance, drive traffic or even just convince investors that they are on the front foot rather than in retreat. We did, however, see some notable collaborations, such as between Kohl’s and Amazon and between Hudson’s Bay Company and WeWork—and we will discuss some of those in next week’s note.

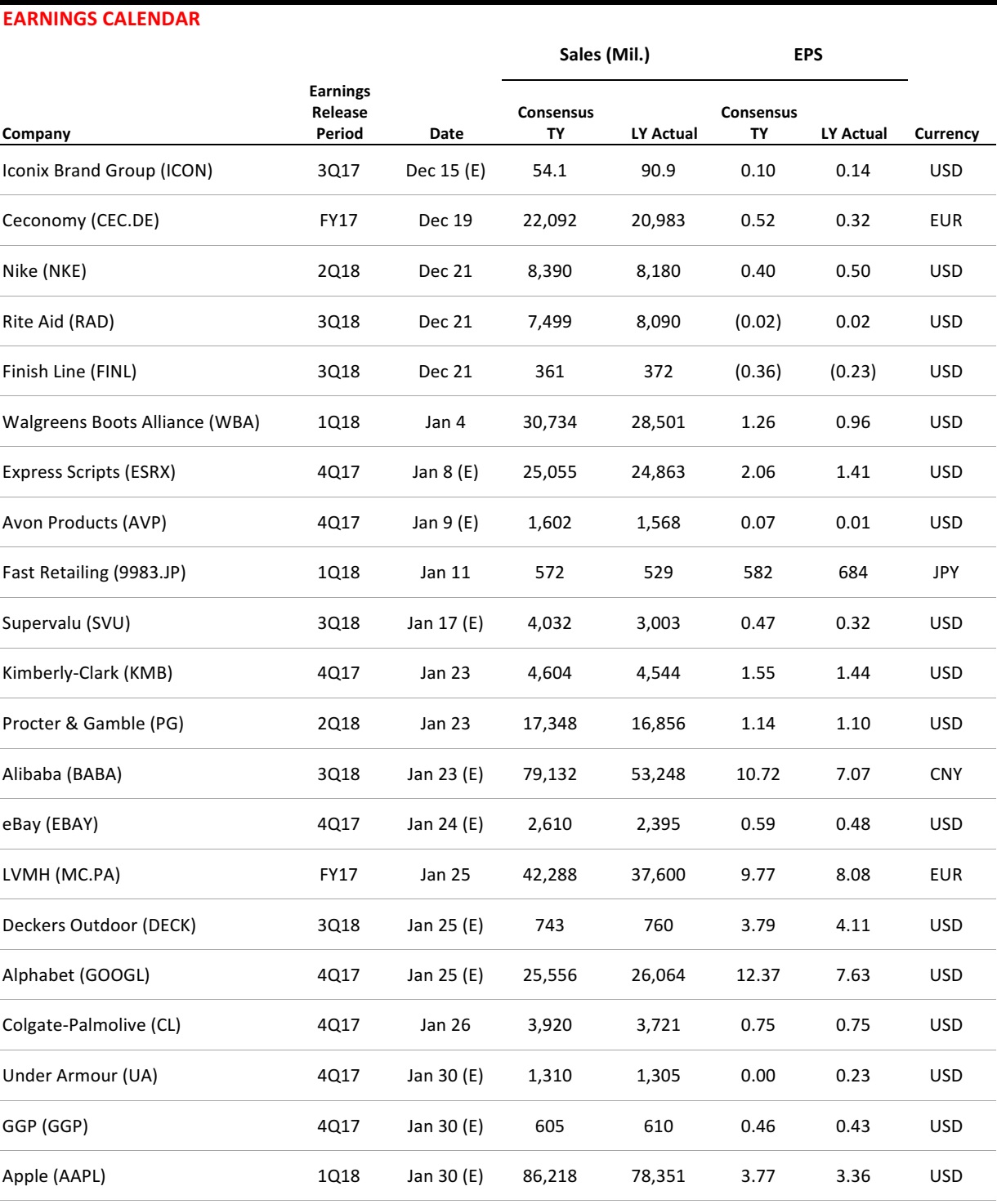

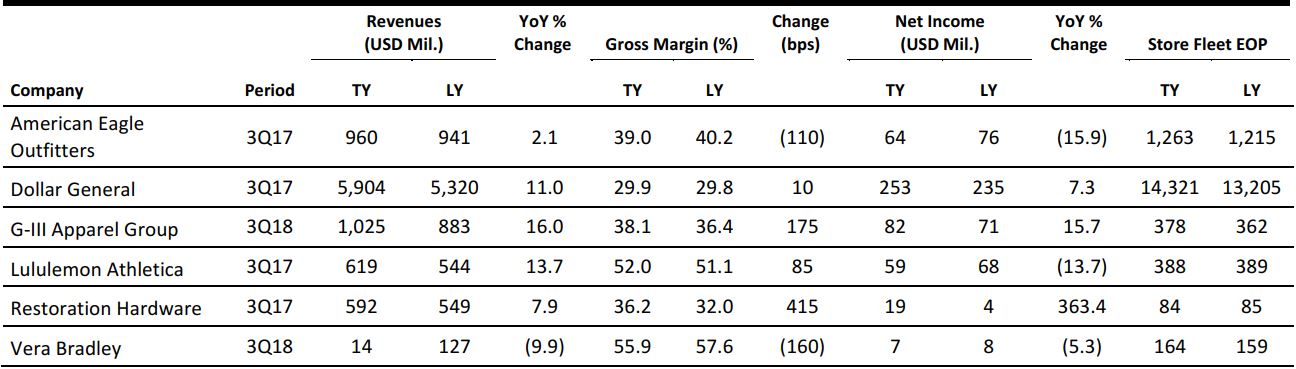

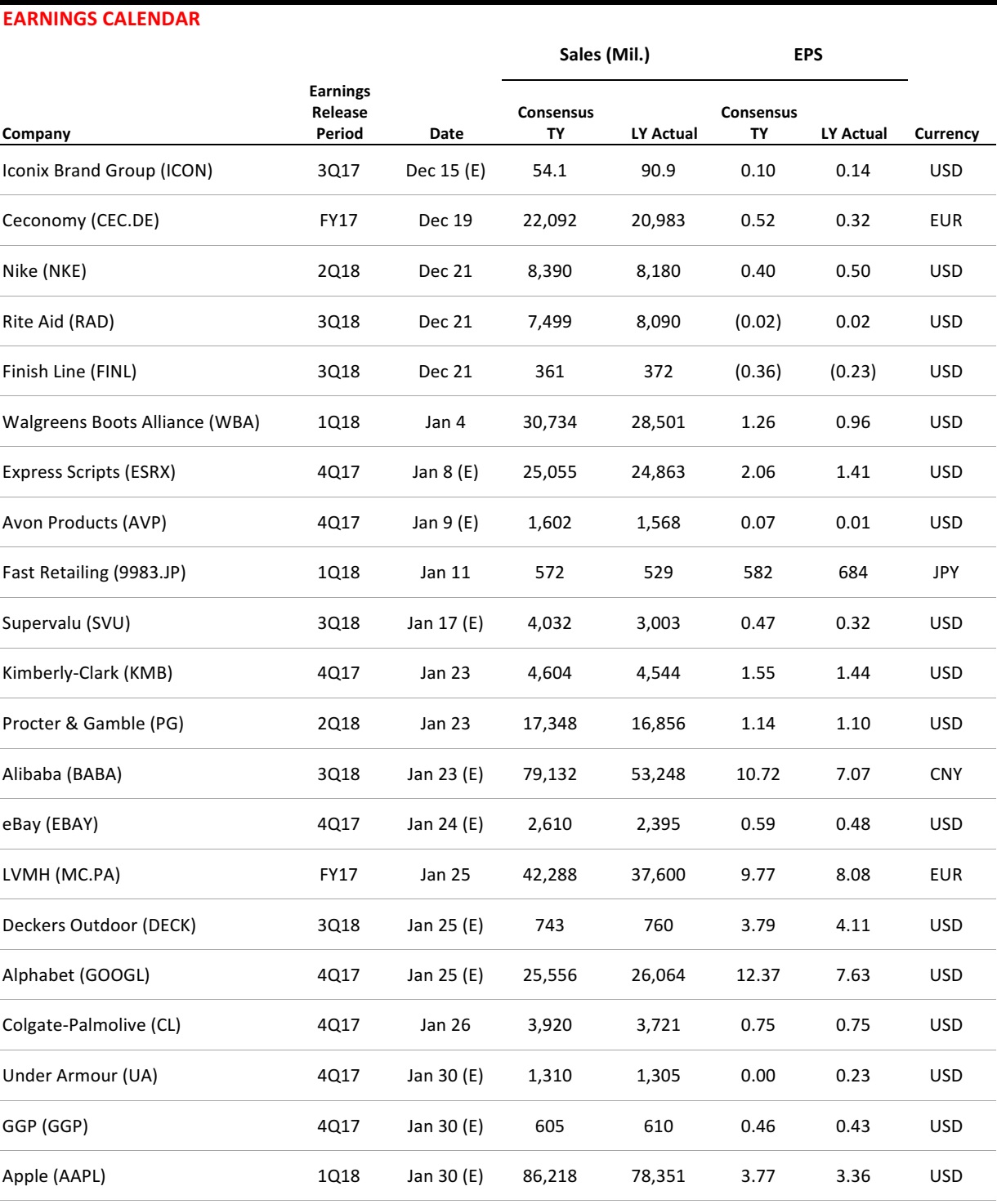

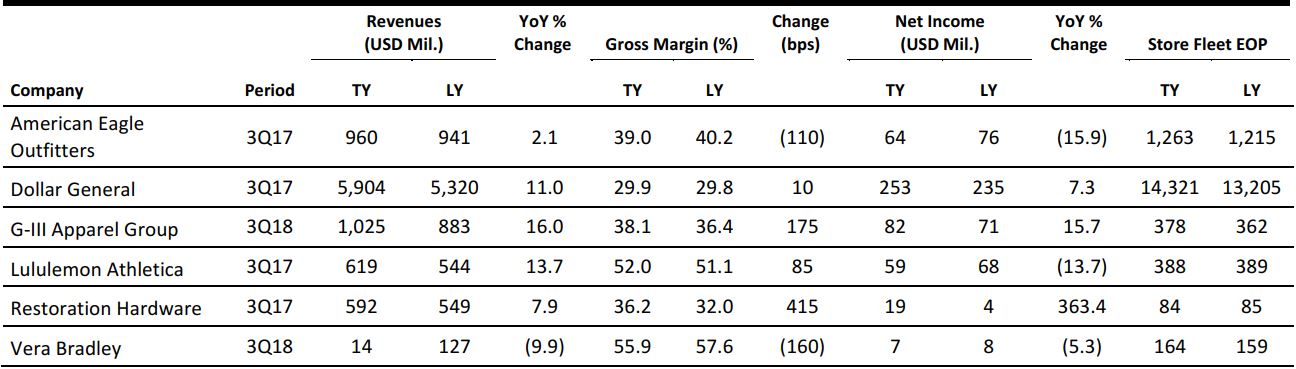

US RETAIL EARNINGS

Source: Company reports/FGRT

US RETAIL & TECH HEADLINES

Retailers Are Using Online Reviews from Other Sites to Fight Amazon

(December 12) USAToday.com

Retailers Are Using Online Reviews from Other Sites to Fight Amazon

(December 12) USAToday.com

- With 8.4% of all US retail shopping now done on the web, according to the Department of Commerce, reviews will only become more important, raising the urgency for companies to offer plentiful, crowd-sourced insight.

- For consumers that rely on these reviews to choose between one brand or model and another, it is important to know that a bounty of reviews does not necessarily mean killer demand for a certain toy or appliance. And few probably realize that a company, behind the scenes, has a hand in distributing reviews to various sites.

Retail Jobs Increased in US During November 2017: NRF

(December 12) Fibre2Fashion.com

Retail Jobs Increased in US During November 2017: NRF

(December 12) Fibre2Fashion.com

- The retail industry in the US has seen an increase in employment in 2017, and 12,900 retail jobs were created in November versus a loss of 10,300 jobs in October. However, clothing and clothing accessories stores, including online stores, recorded a decrease in employment.

- The annual hiring of temporary holiday workers is on track to meet the National Retail Federation’s forecast, which called for 500,000–550,000 seasonal positions.

Charming Charlie Files for Chapter 11 Bankruptcy

(December 11) Reuters.com

Charming Charlie Files for Chapter 11 Bankruptcy

(December 11) Reuters.com

- Fashion jewelry chain Charming Charlie said on Monday it had filed for Chapter 11 bankruptcy and entered into a restructuring agreement with lenders and equity sponsors.

- The retailer said it had secured $20 million in debtor-in-possession financing from a majority of its existing term-loan lenders and entered into a $35 million asset-backed loan with current lenders. Charming Charlie plans to roll out a “back to basics” strategy, close underperforming locations and simplify its business operations.

Watch Out, Amazon and Walmart: Kroger Is Also Building an Advertising Business

(December 11) Digiday.com

Watch Out, Amazon and Walmart: Kroger Is Also Building an Advertising Business

(December 11) Digiday.com

- Kroger is selling its suppliers ad units and solutions, and it is developing a programmatic platform that will go live next year.

- Like Walmart, Kroger boasts that its loyalty program data and purchase data gathered from its mobile apps, brand websites and around 2,800 stores across 35 states in the US can help its suppliers (mostly consumer packaged goods companies such as Procter & Gamble) serve targeted ads on Kroger’s properties and the open web.

The Retail Apocalypse Is Fueled by No-Name Clothes

(December 11) Bloomberg.com

The Retail Apocalypse Is Fueled by No-Name Clothes

(December 11) Bloomberg.com

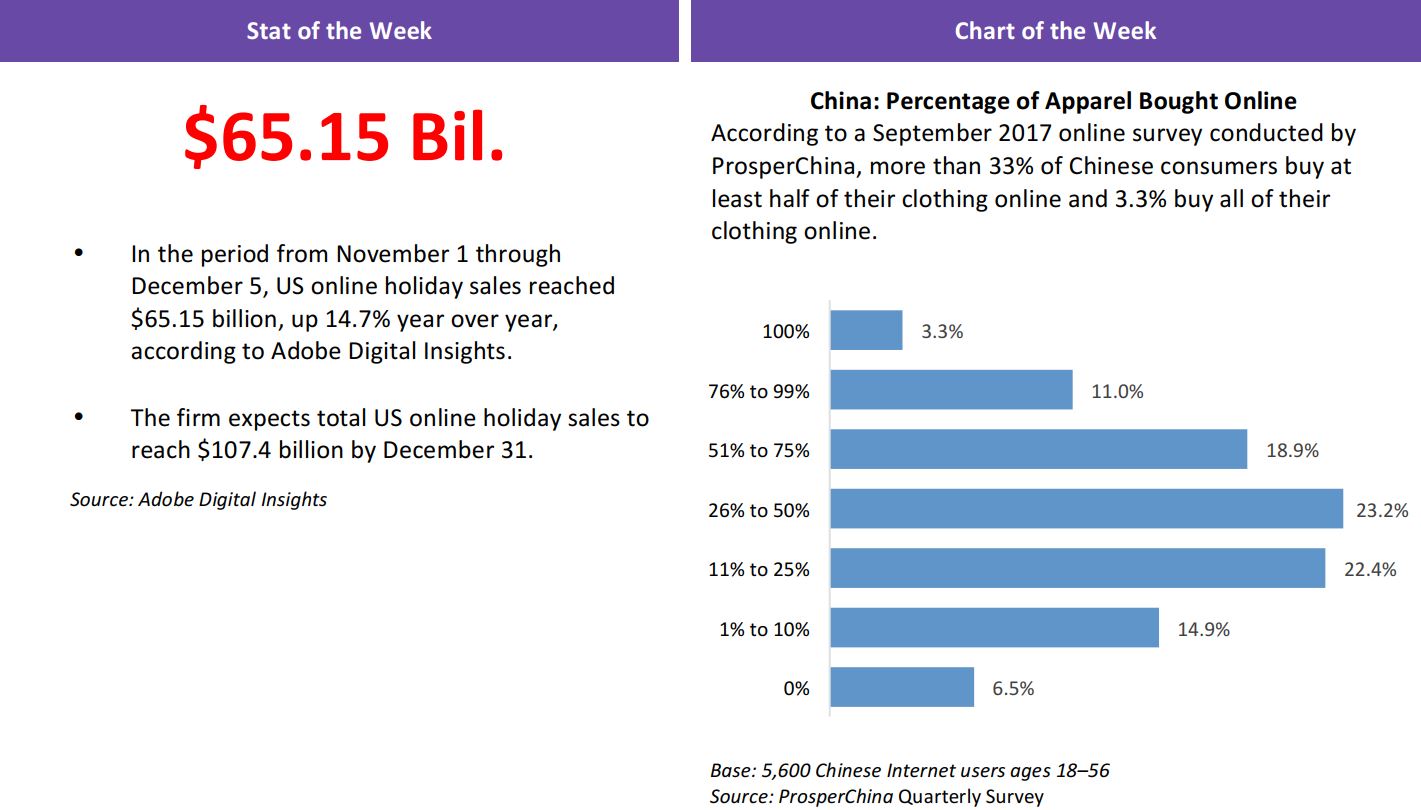

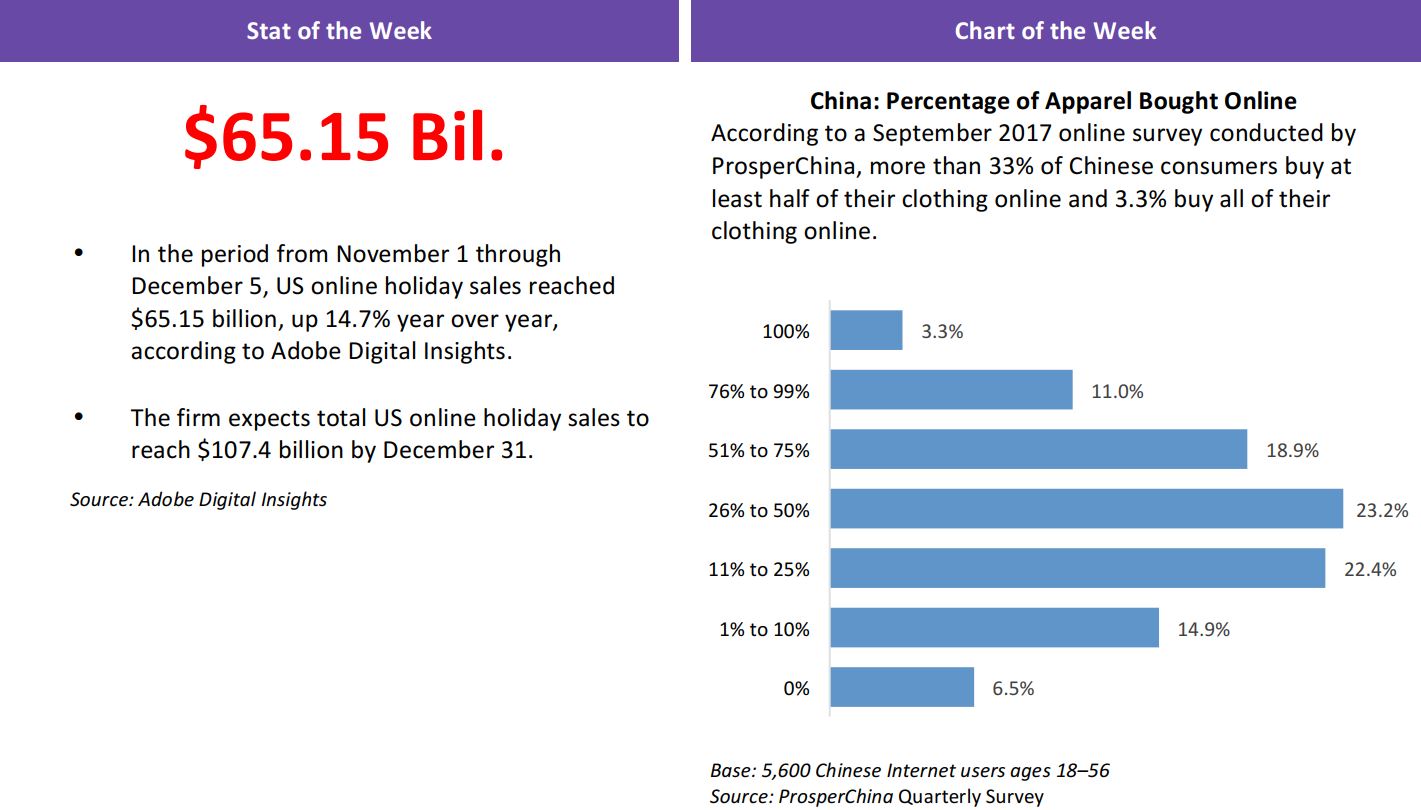

- This year, Amazon will leapfrog T.J.Maxx owner TJX Companies and Macy’s to become the second-biggest seller of apparel and footwear in the US, Wells Fargo estimates. In some categories, private labels combined account for 20% of the market, according to The NPD Group.

- That makes store brands in aggregate larger than any single brand, which should strike fear in the executive suites of Lululemon Athletica, Nike and Under Armour.

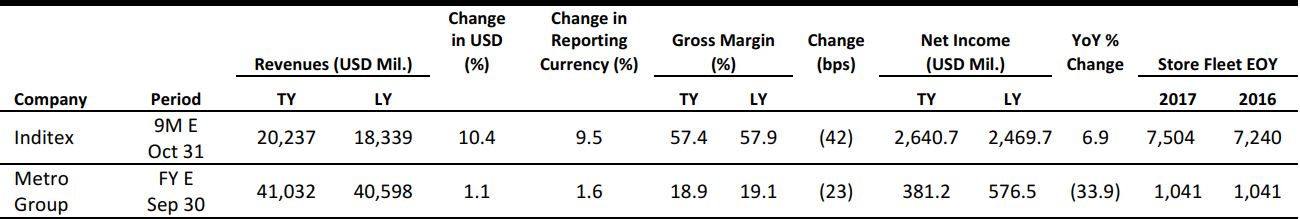

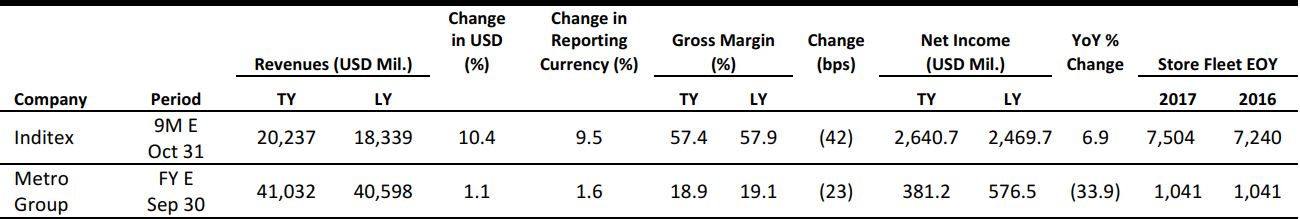

EUROPE RETAIL EARNINGS

Source: Company reports/FGRT

EUROPE RETAIL & TECH HEADLINES

Amazon Introduces Its Treasure Truck to Manchester and London

(December 9) Company press release

Amazon Introduces Its Treasure Truck to Manchester and London

(December 9) Company press release

- Amazon has introduced its Treasure Truck in the UK for the first time, bringing another new retail experience to the country following its recent Black Friday pop-up shop in London. The trucks, which feature a range of exclusive, limited-quantity offers, will run through Manchester and London.

- The trucks will travel across both cities several times a month and be stationed at prominent spots where shoppers can play games, participate in seasonal events, win prizes and sometimes meet celebrities.

UK Retail Footfall Rises in Run-Up to Christmas

(December 11) BRC press release

UK Retail Footfall Rises in Run-Up to Christmas

(December 11) BRC press release

- UK retail footfall grew by 0.2% year over year in the four weeks ended November 25, 2017, according to the British Retail Consortium (BRC). As it was mainly driven by Black Friday sales, this “welcome” improvement after four consecutive months of declines does not indicate “a reversal of the longer-term trend,” BRC Chief Executive Helen Dickinson said.

- Shopping centers performed the worst, while high-street footfall grew in all but three regions in the UK. Retail park footfall continued to grow, but at a slower rate of 0.3%.

Joules Sees First-Half Sales Grow

(December 12) Company press release

Joules Sees First-Half Sales Grow

(December 12) Company press release

- British clothing and lifestyle brand Joules posted group revenue growth of 18.2%, to £96.2 million ($128.1 million), in the 26 weeks ended November 26, 2017. At constant currency, the company grew revenue by 17.5%.

- Retail revenue jumped 16.2%, to £65.9 million ($87.9 million), driven by both in-store and online sales growth and the opening of 10 new stores during the period. Wholesale revenue grew by 23.0% (20.6% at constant currency), to £30.1 million ($40.2 million), reflecting expansion in the company’s target international markets.

Currys PC World Launches Same-Day Delivery

(December 11) RetailGazette.co.uk

Currys PC World Launches Same-Day Delivery

(December 11) RetailGazette.co.uk

- British electrical goods retailer Currys PC World has introduced same-day delivery as part of its multichannel offering for customers in the UK. Customers placing orders for small items before 4 p.m. will see two-hour delivery time slots displayed on the checkout page.

- The service costs £9.95 ($13.30) and is available every day of the week to customers whose addresses are within a 10-mile radius of a Currys PC World UK store.

Unibail-Rodamco to Buy Westfield

(December 12) Reuters.com

Unibail-Rodamco to Buy Westfield

(December 12) Reuters.com

- French commercial property giant Unibail-Rodamco is set to buy Australian mall operator Westfield in a cash and share deal valued at $24.7 billion. Westfield owns 35 malls in the UK and the US, and is developing a mall in Italy.

- Unibail-Rodamco said it will pay Westfield shareholders $7.55 a share, which is an 18% premium to its last trade. The combination of these two companies will create a global retail real estate giant worth around $72 billion, with 104 properties across Europe, Australia and the US.

ASIA RETAIL & TECH HEADLINES

Spotify and Tencent Agree to Swap Stakes in Their Music Businesses

(December 8) TechCrunch.com

Spotify and Tencent Agree to Swap Stakes in Their Music Businesses

(December 8) TechCrunch.com

- Tencent Music Entertainment (TME), the subsidiary that manages Tencent’s music-streaming and karaoke services, will make an undisclosed minority investment in Spotify through new shares, while Spotify will buy a similar undisclosed stake in TME. Tencent will also make its own investment in Spotify by purchasing secondary shares from existing backers.

- “Following these transactions, Spotify will hold a minority stake in TME, and both Tencent and TME will hold minority stakes in Spotify,” the companies said in a joint statement. Spotify’s IPO is hotly anticipated and may take place as soon as next year. The company could opt for a direct listing, going public without holding an IPO, meaning that only insiders, not the company, would sell shares to the stock market.

Alipay’s Double 12 Launches in 15 Countries

(December 11) InsideRetail.Asia

Alipay’s Double 12 Launches in 15 Countries

(December 11) InsideRetail.Asia

- Mobile payment and lifestyle platform Alipay has launched its latest Double 12 Global Shopping Festival in 15 countries spanning four continents. Alipay is run by Ant Financial (part of Alibaba Group), whose strategic partners in Hong Kong, India, Thailand and the Philippines will introduce campaigns for their local e-wallet users for the first time. These partners include Paytm in India, TrueMoney in Thailand and GCash in the Philippines.

- “In short, we call it ‘glocalization’,” said Ant Financial President of International Business Douglas Feagin. “This concept is about developing Alipay globally while also developing localized service offerings. Working with our global merchants network, we also continue to focus on enhancing the Alipay mobile payment experience for Mainland Chinese tourists wherever they travel.”

China’s JD Partners with Accelerator Program Plug and Play to Reach US Startups

(December 7) TechCrunch.com

China’s JD Partners with Accelerator Program Plug and Play to Reach US Startups

(December 7) TechCrunch.com

- E-commerce giant JD.com, the closest rival to Alibaba in China, is broadening its presence in Silicon Valley after announcing a collaboration with accelerator firm Plug and Play to seek out and work with promising US startups.

- The e-commerce giant said it will share technologies, including artificial intelligence, cloud and smart supply chain tech, with the program generally and work together with Plug and Play to launch a new cohort of startups that taps into its extensive presence in China. Plug and Play will control the selection, with JD on hand to offer expertise, mentorship, technology and more.

Alibaba to Invest $200 Million In Indian Online Grocer

(December 8) Bloomberg.com

Alibaba to Invest $200 Million In Indian Online Grocer

(December 8) Bloomberg.com

- Alibaba, China’s e-commerce giant, plans to invest about $200 million in India’s largest online supermarket, Bigbasket, leading a $280 million funding round in the startup, according to people familiar with the negotiations.

- Alibaba is taking a stake of about 25% in Bigbasket after months of negotiations, said the people, who asked not to be identified because the matter is private. The Bangalore-based grocery business had previously been in talks for an investment from e-commerce pioneer Amazon.com, which agreed in June to acquire US grocer Whole Foods Market.

LATAM RETAIL & TECH HEADLINES

Google Partners with LatAm Telcos to Launch RCS-Based Messaging

(December 11) ZDNet.com

Google Partners with LatAm Telcos to Launch RCS-Based Messaging

(December 11) ZDNet.com

- Google is working with some of the largest mobile operators in Latin America to launch Rich Communication Services (RCS) via its Jibe cloud hub. The web giant has partnered with América Móvil, AT&T Mexico, Oi and Telefónica to roll out the RCS initiative in the next few months to users in Latin America.

- According to Google’s head of RCS, Amir Sarhangi, as RCS messaging rolls out, people who already have the Android Messages app on their phone will automatically get access to RCS services, which will be updated over time. In addition, Sarhangi pointed out that RCS will also enable brands to send “more useful and interactive messages” by helping customers “access richer messages from the businesses they care about.”

Brazil Sees Mobile Phone Sales Slowdown in 3Q

(December 8) ZDNet.com

Brazil Sees Mobile Phone Sales Slowdown in 3Q

(December 8) ZDNet.com

- The Brazilian mobile phone market saw a slowdown in the third quarter of 2017, according to analyst firm IDC. Some 12.4 million devices were sold over the period, 2% less than in the third quarter of 2016. Of the total, 11.7 million were smartphones (5% more than in the third quarter of 2016).

- Feature phone sales dropped by half in the third quarter, with 700,000 units sold between July and September. According to IDC, one factor influencing the decline was that consumers were saving their cash for Black Friday and Christmas purchases.

Brazilian Driving Licenses to Adopt Chip-and-Pin Card Model

(December 6) ZDNet.com

Brazilian Driving Licenses to Adopt Chip-and-Pin Card Model

(December 6) ZDNet.com

- Brazilian driving licenses will resemble a chip-and-pin plastic bank card by 2019, according to the country’s authorities. The main goal of the initiative is to reduce fraud, as the current, paper-based documents are relatively easy to counterfeit.

- Another improvement expected from the new license model—which has already been in place for decades in Europe and the US—is that driving records will be integrated with those of other countries. Current licenses will be progressively replaced with the new plastic version as they expire.

Walmex Expands Wi-Fi in Mexican Stores, Pushing Online Shopping

(December 7) Reuters.com

Walmex Expands Wi-Fi in Mexican Stores, Pushing Online Shopping

(December 7) Reuters.com

- Walmart de Mexico said that it will install Wi-Fi throughout all but one of its chains in Mexico by next summer in an attempt to collect user data and drive online sales by familiarizing shoppers with technology. Walmex will bring the service to every store except warehouse-style Bodega Aurrera Express stores by mid-2018.

- The retailer hopes that free access will help Internet-resistant shoppers become more comfortable online and ultimately boost its nascent e-commerce business, which represented less than 1% of sales in the third quarter. Many retailers in Mexico, including Amazon, are competing for online sales in a country where shoppers are wary of credit card fraud and often earn their living in paper currency.

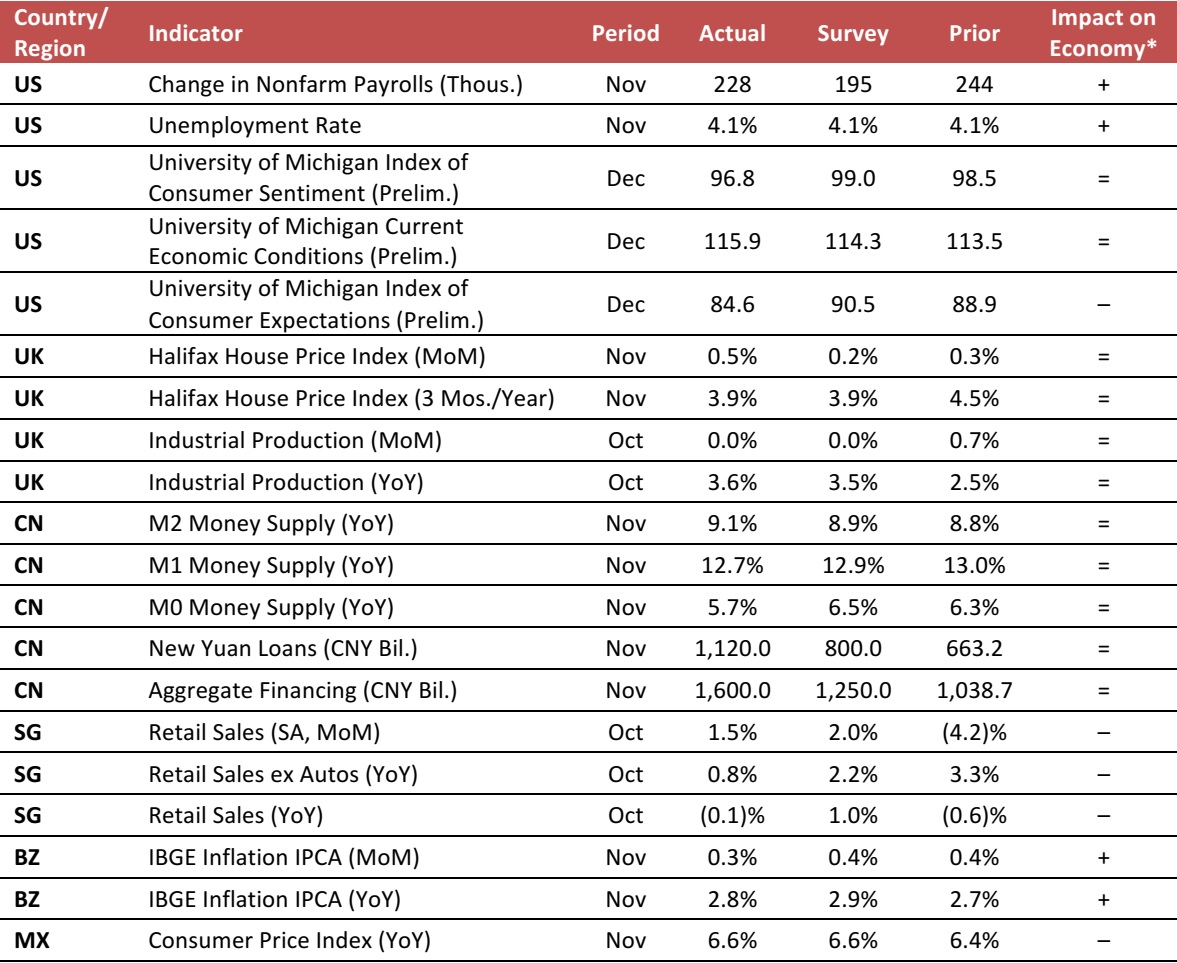

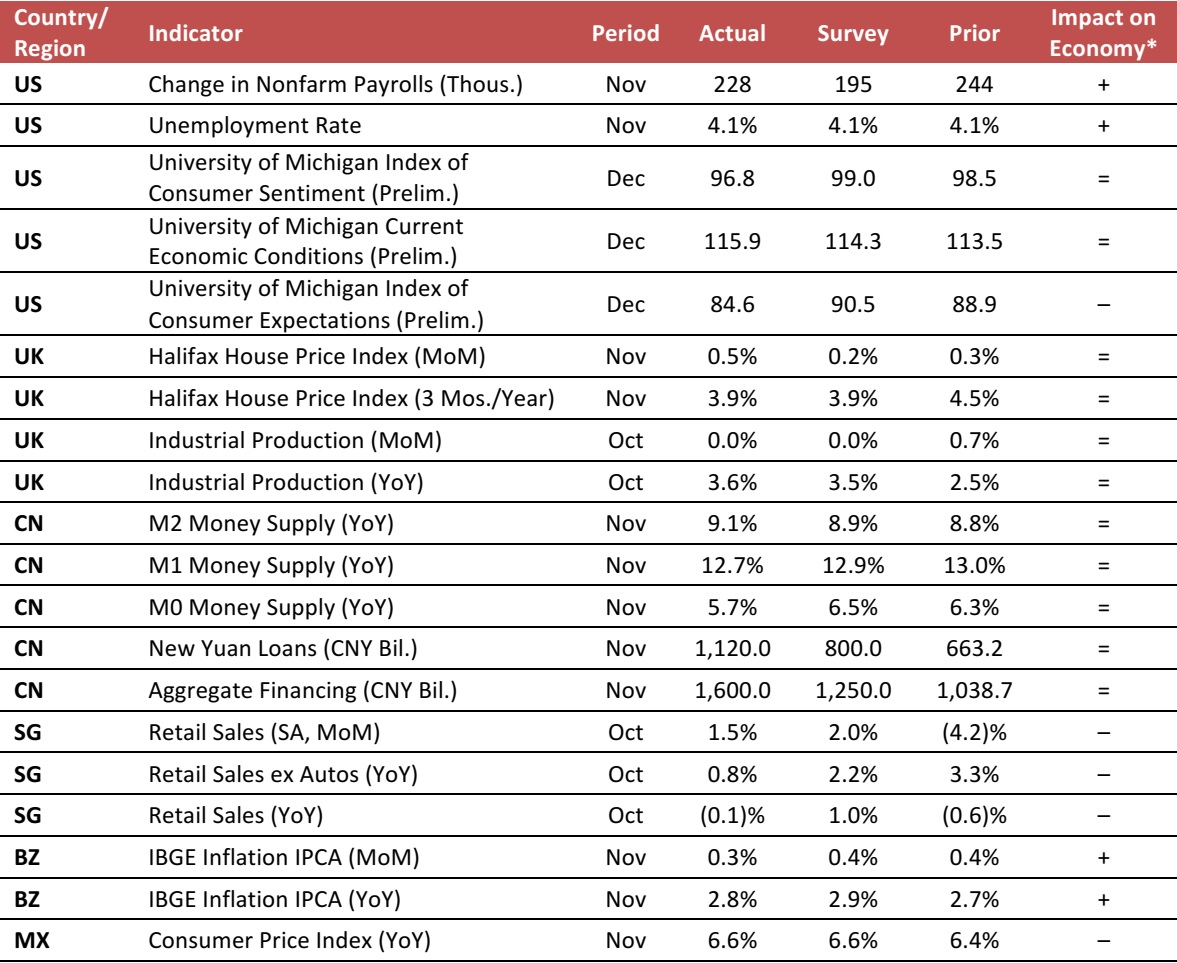

MACRO UPDATE

Key points from global macro indicators released December 6–13, 2017:

- US: In November, nonfarm payrolls increased by 228,000, ahead of the consensus estimate of 195,000. The unemployment rate remained at 4.1% in November. In December, the University of Michigan Index of Consumer Sentiment ticked down to 96.8, below the market’s estimate.

- Europe: In the UK, house prices edged up by 0.5% month over month in November, exceeding the market’s estimate of a 0.2% increase. Industrial production in the UK stayed flat month over month in October, in line with the market’s expectation.

- Asia-Pacific: In China, M2 money supply increased by 9.1% year over year in November versus the market’s expectation of an 8.9% increase. New yuan loans and aggregate financing in China both increased by more than the market had expected in November. In Singapore, retail sales growth was weaker than expected in October.

- Latin America: In Brazil, inflation grew by 2.8% year over year in November, indicating a healthy price environment. In Mexico, consumer prices increased by 6.6% year over year in November.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/University of Michigan/Markit/Halifax/UK Office for National Statistics/The People’s Bank of China/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/FGRT

Watch Out, Amazon and Walmart: Kroger Is Also Building an Advertising Business

(December 11) Digiday.com

Watch Out, Amazon and Walmart: Kroger Is Also Building an Advertising Business

(December 11) Digiday.com

Amazon Introduces Its Treasure Truck to Manchester and London

(December 9) Company press release

Amazon Introduces Its Treasure Truck to Manchester and London

(December 9) Company press release

Spotify and Tencent Agree to Swap Stakes in Their Music Businesses

(December 8) TechCrunch.com

Spotify and Tencent Agree to Swap Stakes in Their Music Businesses

(December 8) TechCrunch.com

Google Partners with LatAm Telcos to Launch RCS-Based Messaging

(December 11) ZDNet.com

Google Partners with LatAm Telcos to Launch RCS-Based Messaging

(December 11) ZDNet.com

Brazilian Driving Licenses to Adopt Chip-and-Pin Card Model

(December 6) ZDNet.com

Brazilian Driving Licenses to Adopt Chip-and-Pin Card Model

(December 6) ZDNet.com