Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

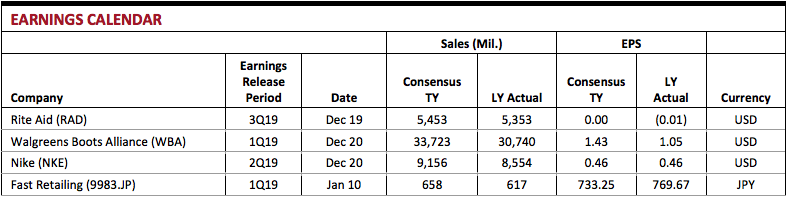

Americans Are Spending More Time Consuming Media, but Also Getting Healthier Americans’ media consumption habits have changed markedly over the past three years. They’re now spending less time watching TV and listening to the radio each day, but more time viewing apps and media on their smartphones. They’re also spending more time consuming media altogether each day. Despite this increase, Americans are also showing signs of getting healthier: the proportion of the US population that smokes continues to decline, while gym membership numbers are growing, as is demand for organic food. And more Americans are raising pets and spending extra time with them each day, which has proven health benefits. The table below breaks down Americans’ daily media consumption habits in the first quarter of 2015 and the first quarter of 2018, based on survey results from Nielsen. The results show that the number of hours Americans spent watching live TV and listening to the radio decreased over the three years, but that those hours were more than offset by time spent viewing apps or media on smartphones. Also, the total number of hours Americans spent consuming media each day increased by 14% over the period, although it’s possible that there is some overlap in the figures due to multitasking, i.e., viewing apps or the web on a smartphone while also watching TV or listening to the radio. [caption id="attachment_85024" align="aligncenter" width="720"] Other includes DVD/Internet on a desktop computer and DVR/time-shifted TV.

Other includes DVD/Internet on a desktop computer and DVR/time-shifted TV.*Some figures may not sum due to rounding.

Source: Nielsen Total Audience Report/Coresight Research[/caption] Other data points also show that Americans are spending more time online. For example, subscriptions to video-streaming services have increased, as have Amazon Prime memberships and online grocery-shopping rates. The number of US video-streaming users is expected to exceed 150 million next year, according to data from Statista, which would mark an increase of more than 50% from 2016. The number of Amazon Prime memberships can serve as an indicator for both online shopping frequency and video streaming, since Prime subscribers receive both free shipping and Amazon media content. Membership in the program hit 95 million in the second quarter, more than triple the number four years earlier, according to data from Consumer Intelligence Research Partners. Meanwhile, Americans are growing increasingly comfortable with buying groceries online: the proportion of US adults who shop for groceries online increased to 13.5% in September 2018 from 7.6% in September 2014, according to survey data from Prosper Insights & Analytics. Although Americans are spending more time each day consuming media, they are also taking measures to get healthier, such as quitting smoking, buying organic foods, joining gyms, wearing fitness trackers and spending time with pets. The percentage of Americans who smoke cigarettes declined by more than 20% between 2013 and 2017, from 17.8% to 13.9%, according to the US Centers for Disease Control and Prevention. Over the same period, the number of memberships at gyms and health clubs increased by more than 15%, to nearly 61 million, according to data from the International Health, Racquet and Sportsclub Association. Finally, the percentage of people owning animals and pets has been growing, albeit with a noticeable gap in ownership rates between women and men. In 2017, 19.4% of women owned animals and pets, compared with 15.7% of men, according to data from the US Census Bureau. These trends create significant challenges and opportunities for retailers. Americans are spending more time viewing content on their smartphones each day, which favors online and mobile advertising and lessens retailers’ opportunities to reach them via TV and radio. Yet even as their daily media consumption increases, Americans are showing more interest in healthy living and in keeping pets, presenting particular opportunities in the markets for health-related and pet-related products.

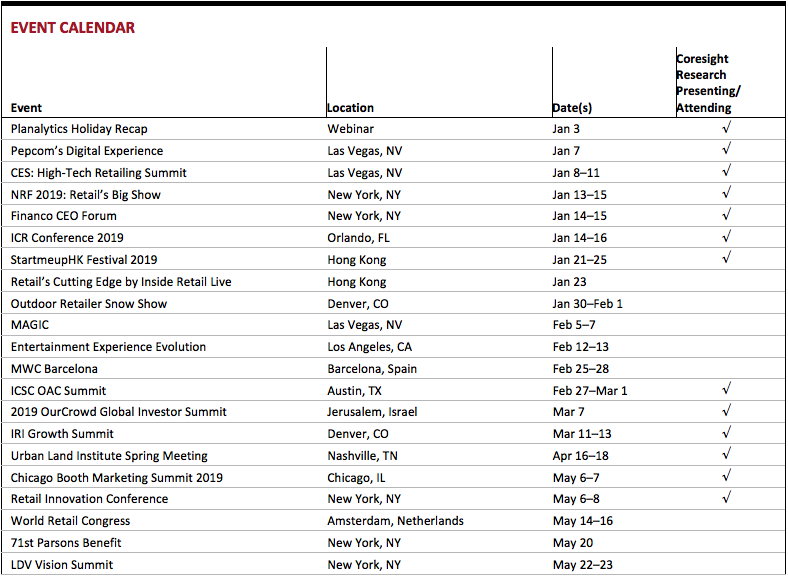

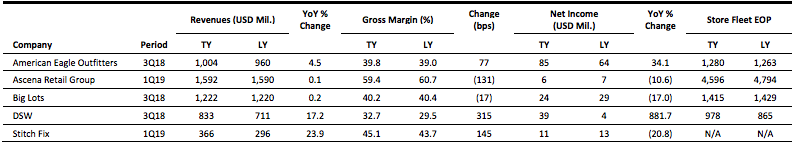

US RETAIL EARNINGS

[caption id="attachment_85052" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- As US retailers look to sidestep credit-card companies, which this year will charge more than $90 billion in swipe fees, some believe the answer lies in retailer payment apps.

- While shoppers have mostly shunned mobile payments offered by third-party providers such as Apple, retailers including Walmart, Starbucks and Kohl’s have seen some success by making digital wallet apps part of their loyalty programs.

- Walmart announced that it will acquire the assets of Art.com, the largest online retailer of art and wall décor, for an undisclosed amount. The assets include Art.com’s catalog, IP, trade name and US operations, and the deal is expected to close in early 2019.

- com was founded in 1998 and offers some 2 million curated images, including a growing number of exclusive images. Walmart has moved to boost its digital home goods sales, including by launching a digital home-shopping experience earlier this year, and the Art.com deal supports these efforts.

- Amazon is looking to expand its checkout-free store format to airports in order to serve travelers in a hurry, according to public records and a person familiar with the strategy.

- For months, Amazon has been expanding its Amazon Go format, where customers scan their smartphones to enter the store, and then cameras identify what they take from the shelves. When shoppers are finished, they simply exit the store and Amazon automatically bills their account.

- Dollar General is growing at a breakneck pace, and shows no signs of slowing down. The discount chain has become one of the largest retailers in the US, with 15,227 stores across 44 states.

- Walmart, by comparison, has 5,352 US stores, while CVS has 9,800, Kroger 2,765, Target 1,850 and Home Depot more than 2,200. Dollar General has more stores than even McDonald’s and Starbucks now. Its archrival, Dollar Tree, comes in a close second, with 14,962 stores.

- With almost 200 Sears and Kmart locations closing this year, and the ongoing saga of Toys R Us, it’s easy to buy into the widespread “retail apocalypse” narrative, but experts say the story has been overblown for some time now.

- Vacancy rates have fallen to their lowest level in 15 years or more, according to commercial real estate brokerage Marcus & Millichap. Retail construction has fallen since 2007, and new supply has been limited. In the third quarter, the retail vacancy rate in the US remained at 4.5%, according to real estate services company JLL.

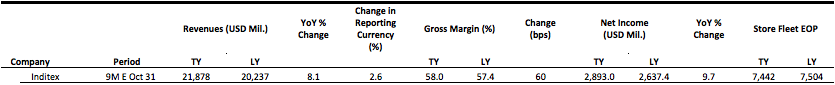

EUROPE RETAIL EARNINGS

[caption id="attachment_85061" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

- British retail footfall fell by 3.2% in November, according to figures from Springboard and the British Retail Consortium. Shopping centers and retail parks saw footfall drop by 3.8% and 1.4%, respectively, in November, while high-street footfall slid by 3.8%.

- The November decline is the largest of any November since 2009, when Springboard first published footfall data. Moreover, footfall declined by 5.5% in the week of Black Friday, undermining the event’s importance for brick-and-mortar stores.

- British luxury retailer Flannels, owned by Mike Ashley, has received £125,000 ($160,025) in business rates relief from the local council to prevent its Doncaster store from remaining empty.

- The Doncaster council stated, “If we are unable to support this investment, the unit will remain empty and the area, in general, will continue to look undesirable to new investors.”

- Irish online food ordering and takeaway platform Flipdish has raised €4.8 million ($6.1 million) in series A funding, led by venture capital firm Global Founders Capital. Its platform allows restaurants to directly accept orders without leaning on marketplaces and aggregators.

- Flipdish stated that it will use the funds to accelerate growth by expanding its product offerings and providing better service to its worldwide customer base.

- German online fashion platform Zalando has expanded its premium brand offering by signing 17 brands, including Missoni for men and Mulberry, which will be onboarded over the next two months.

- Lena-Sophie Krups, Head of Buying, Premium, at Zalando, stated that the company will launch each brand separately. She also said that the premium segment is one of Zalando’s fastest-growing businesses.

- British retailer Marks and Spencer (M&S) has announced the appointment of Justin King as a Non-Executive Director, effective January 1, 2019. King will continue to serve as Vice Chairman of Terra Firma and on the Public Interest Body of accounting firm PwC.

- King served as CEO of Sainsbury’s for 10 years before stepping down in 2014 and was one of the pioneers of the development of Simply Food at M&S about 15 years ago.

ASIA RETAIL & TECH HEADLINES

JD.com and Intel Collaborate to Set Up Internet of Things (IoT) Lab Focused on “Smart Retail” Applications

(December 10) ZDNet.com

JD.com and Intel Collaborate to Set Up Internet of Things (IoT) Lab Focused on “Smart Retail” Applications

(December 10) ZDNet.com

- E-commerce behemoth JD.com and software giant Intel have established an IoT lab that will focus on developing next-generation retail applications, including vending machines and other technologies to modernize retail stores.

- The new research lab will combine the expertise of both companies and bring the online shopping experience to offline retail environments, offering a more personalized experience regardless of where consumers shop, according to Zhi Weng, JD.com VP and Head of the JD Big Data Platform.

- E-commerce leader Alibaba has signed an MOU with Belgium to bring the Electronic World Trade Platform (eWTP) to the country, making Belgium the first European member of the platform, which seeks to lower barriers to global trade for small and medium-sized businesses via e-commerce.

- “This will be a huge opportunity to boost exports and bring wide-reaching economic benefits to society, including employment opportunities to Liege,” said Belgian Prime Minister Charles Michel.

- A consortium spearheaded by Chinese branded sportswear company Anta Sports has made an offer to buy Finnish sporting goods company Amer Sports in a deal worth approximately €4.6 billion ($5.23 billion).

- According to a statement from Anta, the consortium intends to operate Amer Sports independently from Anta, with a separate board of directors.

- American department store chain Macy’s has stopped taking orders via Tmall after deciding to end its current contract with the platform, which expires on December 31. Macy’s China will end its operations by the end of this month.

- The company will continue to provide services to Chinese consumers through its American website, Macys.com. “We decided to wind down our Chinese e-commerce-only business and add more functionality to our flagship Macys.com site, which will now be able to service customers in China,” said Macy’s spokeswoman Emily Goldberg.

- Chinese investment fund Lunar Capital has acquired luxury fashion label Shanghai Tang. The acquisition represents a new strategic direction for the brand, which recently opened its first online retail space, a flagship store on JD’s Toplife luxury platform.

- Just last year, Italian entrepreneur Alessandro Bastagli and Hong Kong private equity firm Cassia Investments acquired Shanghai Tang from Swiss luxury goods company Richemont, one of the brand’s original investors and owners.

LATAM RETAIL & TECH HEADLINES

- Mexican retailer Soriana has agreed to exclusively distribute branded food from Spanish department store group El Corte Inglés in its 827 stores in Mexico.

- Soriana already sells 120 El Corte Inglés–branded items, including an assortment of oils, olives, canned vegetables, sauces, cookies and juices.

- In November, Walmex, Walmart’s business in Mexico and Central America, grew total sales by 6.8%. In Mexico, total sales grew by 7.0% and same-store sales grew by 5.9%.

- In Central America, total sales grew by 4.2% and same-store sales were flat. Walmex opened 11 stores of various formats across these regions in November.

- Peruvian fashion brand Topitop has opened a 5,380-square-foot store in Mall del Sur, a shopping center in Peru’s capital of Lima, and plans to open one more, in the city of Puerto Maldonado.

- These two openings take Topitop’s store count to 70 in Peru, making the company one of the largest in the country in terms of store numbers.

- DFA, a retailer that runs duty- and tax-free stores at airports and border crossings, has unveiled a state-of-the-art shopping complex spanning 107,640 square feet in Rio Branco, a Brazilian city near the Uruguayan border.

- The shopping center offers clothing from several well-known brands such as Tommy Hilfiger, Desigual, Polo Ralph Lauren, Under Armour, Nike and Calvin Klein, as well as accessories, perfumes, cosmetics, camping products, chocolates and electronics.

- American beauty group Estée Lauder plans to introduce its Tom Ford and Origins brands to Colombia and seeks to grow its sales by 20% over each of the next three years. The first Tom Ford and Origins products will be offered at local department store retailers such as Falabella.

- Estée Lauder also plans to open MAC makeup stores in the Colombian cities of Cartagena, Pereira and Cali and sell the brand online through the Mercado Libre and Linio marketplaces.

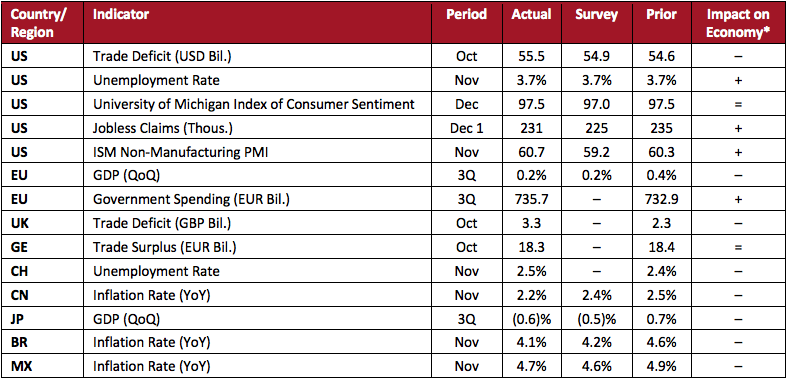

MACRO UPDATE

Key points from global macro indicators released December 5–11, 2018:- US: The US trade deficit widened to $55.5 billion in October from $54.6 billion in September and exceeded the $54.9 billion consensus estimate. The US unemployment rate stood at 3.7% in November, unchanged from October and in line with market expectations.

- Europe: The eurozone economy grew by 0.2% quarter over quarter in the third quarter, in line with the consensus estimate and following a 0.4% expansion in the previous quarter. The UK trade deficit widened to £3.3 billion in October from £2.3 billion in September.

- Asia-Pacific: China’s inflation rate slowed from 2.5% year over year in October to a four-month low of 2.2% in November and was below the consensus estimate of 2.4%. In Japan, GDP declined by 0.6% quarter over quarter in the third quarter, compared with a 0.7% increase in the previous quarter and versus market expectations of a 0.5% decline.

- Latin America: The inflation rate in Brazil eased to 4.1% year over year in November from 4.6% in October and was below market expectations of 4.2%. The inflation rate in Mexico decreased to 4.7% in November from 4.9% in October and was above the consensus estimate of 4.6%.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Census Bureau/US Bureau of Labor Statistics/University of Michigan/US Department of Labor/Institute for Supply Management/Eurostat/Office for National Statistics (UK)/Federal Statistical Office (Germany)/State Secretariat for Economic Affairs (Switzerland)/National Bureau of Statistics of China/Cabinet Office (Japan)/Brazilian Institute of Geography and Statistics/National Institute of Statistics and Geography (Mexico)/Coresight Research[/caption]