From the Desk of Deborah Weinswig

Channel Swaps: Walmart Online vs. Amazon Offline

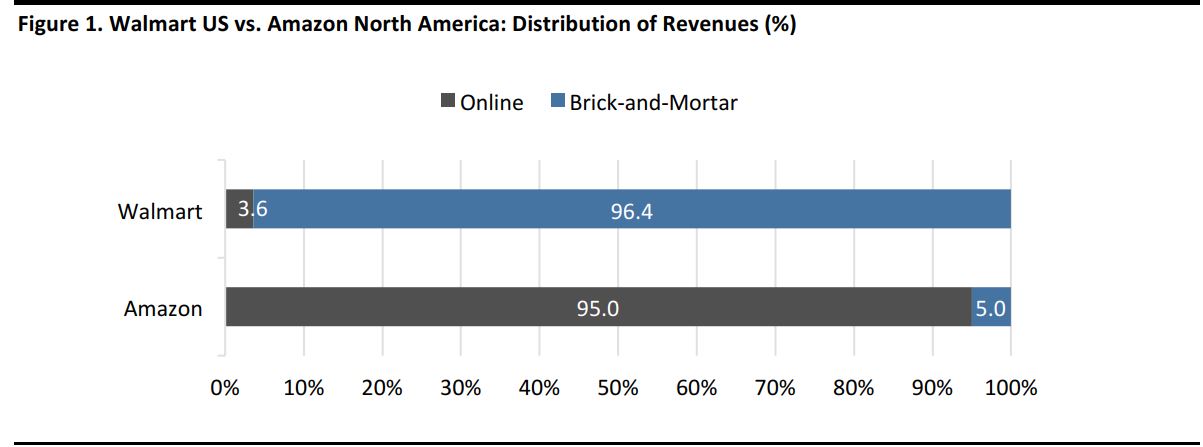

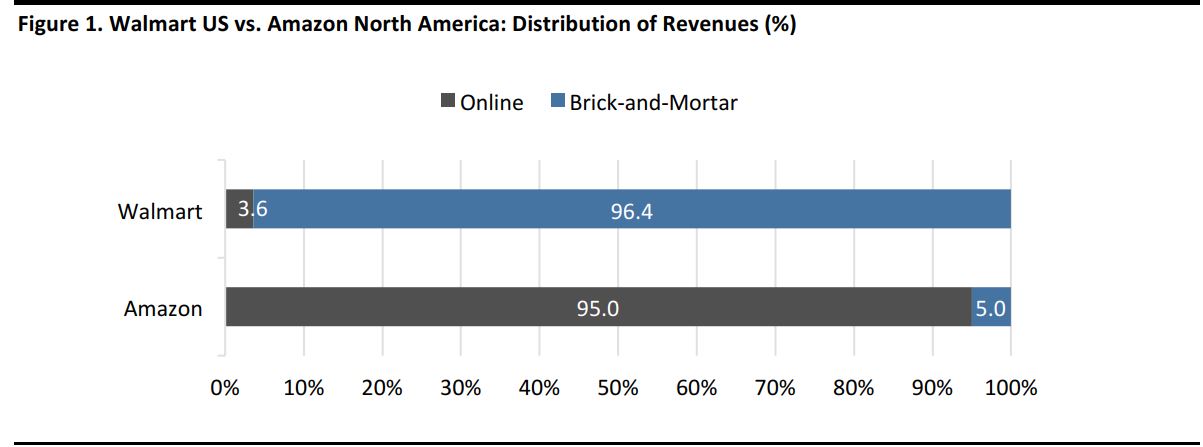

Walmart versus Amazon is perhaps the biggest retail battle of our times—and Amazon’s encroachment into brick-and-mortar grocery retailing with its Whole Foods Market acquisition has only heightened the competition. Coincidentally, both of these retail giants have recently made the unusual move of splitting out numbers for their online versus offline revenues. At Walmart’s annual Investment Community Meeting in October, management noted that it expects the Walmart US segment to see $11.5 billion in online sales in the year ending January 2018. When Amazon reported its third-quarter results in October, management said that the company had booked $1.28 billion in revenue during the quarter from its physical stores—mainly, its Whole Foods stores. From these numbers, we can see that the two companies’ online/offline splits are polar opposites:

Data are based on revenues, not gross merchandise volumes. Walmart figures are for FY18 and are estimates; Amazon figures are actual results for 3Q17.

Source: Company reports

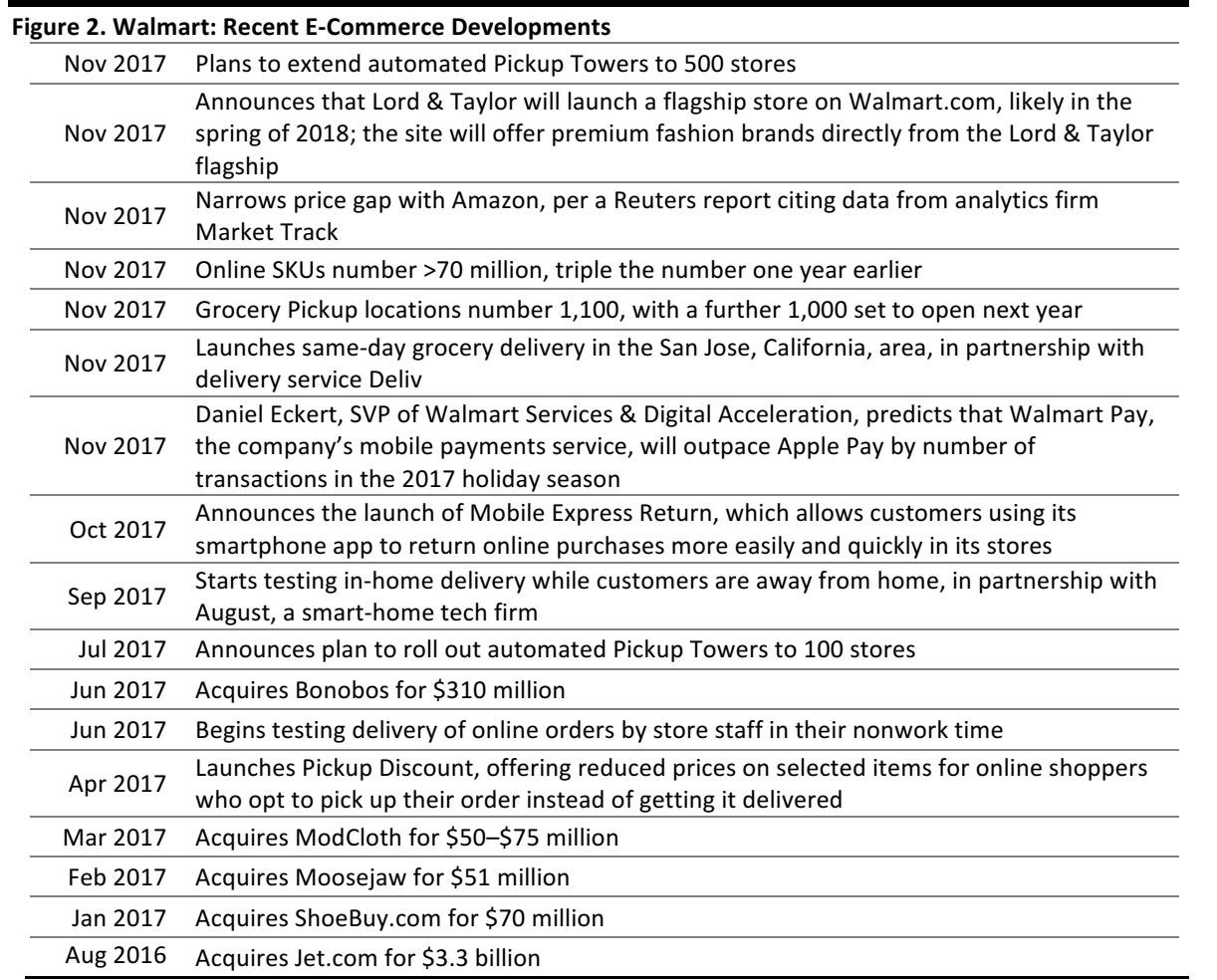

Both companies are likely to grow those small percentage shares—brick-and-mortar sales will probably become more important for Amazon, just as online sales will for Walmart. And while much attention has focused on Amazon’s move into physical retail, we have been impressed with how Walmart has performed online over the past year, and note that the company has implemented a series of initiatives and acquisitions that have strengthened its hand in the competition for online dollars.

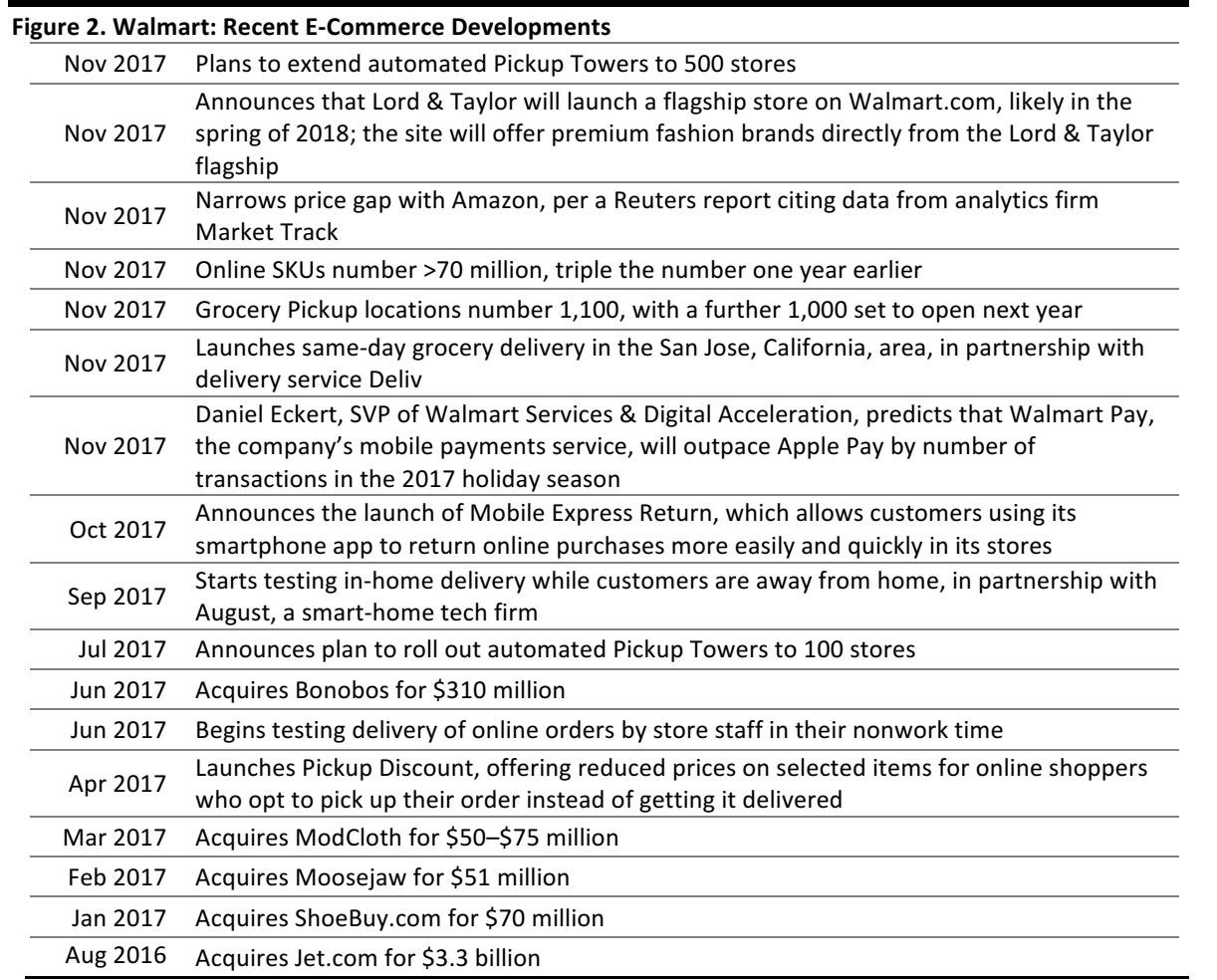

We provide a full timeline of Walmart’s notable e-commerce developments over the past 15 months at the end of this note. These are a few of the company’s most recent moves:

- Walmart has doubled its number of online grocery pickup locations year over year, to 1,100 as of the end of its fiscal third quarter. The company aims to add another 1,000 locations next year.

- The company is rolling out its automated Pickup Towers to around 500 stores, according to news website Bisnow.

- Walmart has followed Amazon in pushing aggressively into third-party sales, tripling the number of stock-keeping units (SKUs) on its site year over year by the end of the third quarter by building out its marketplace site.

- As part of the build-out of its marketplace, Walmart will host a Lord & Taylor fashion store on its site beginning in 2018.

How Do We See the Battle Shaping Up?

The Walmart-Amazon battle is no longer simply about Walmart taking the fight online to prevent loss of share in nongrocery categories. Since Amazon’s acquisition of Whole Foods, the battle has been about winning across channels and across categories, from food to fashion. We expect to see no letup in innovation from either company—but if Amazon pushes into physical retail more aggressively, Walmart may shift its position from pushing aggressively online to defending its brick-and-mortar core.

Source: Company reports

Source: Company reports

US RETAIL & TECH HEADLINES

What the Holidays Are Telling Us About the Future of Work

(November 29) CBSNews.com

What the Holidays Are Telling Us About the Future of Work

(November 29) CBSNews.com

- While high-profile collapses have prompted talk of a “retail apocalypse” and fears of massive job losses, some experts think predictions of retail’s demise have been greatly exaggerated. “In fact, total retail employment—having fallen in the 2008–2009 recession—has bounced back to recently hit a new high,” said Dan Wang, an analyst at Gavekal Research.

- Warehousing and fulfillment jobs have increased by about 85%, to 1 million positions, since 2000, according to his report. Couriering jobs have grown by about 15%, while nonstore retailers now employ about 600,000 people, up from 500,000 in 2000.

Why Shoppers Ditch Traditional Stores for Online in Their Twenties

(November 29) Qz.com

Why Shoppers Ditch Traditional Stores for Online in Their Twenties

(November 29) Qz.com

- In its 2017 Future of Retail report, Walker Sands found that younger people actually prefer to shop in-store, seeking out discounts, personalized service, product demonstrations, and food and drink. By contrast, less than half (46%) of 26–45-year-olds want to shop in stores.

- This gets even more pronounced the younger you get. A report cosponsored by the IBM Institute for Business Value and the National Retail Federation found that 67% of kids under 21 prefer to shop in physical stores most of the time.

Thanksgiving Weekend Retail Results In: Shoppers Will Have Merry Christmas, Retailers Get Coal

Thanksgiving Weekend Retail Results In: Shoppers Will Have Merry Christmas, Retailers Get Coal

(

November 29) Forbes.com

- The National Retail Federation (NRF) reported that more than 174 million Americans shopped from Thanksgiving through Cyber Monday. The figure beat the association’s preholiday prediction that 164 million consumers would indulge.

- The NRF reported that shoppers spent $335, on average, over the five-day weekend, with 75% of that devoted to gift purchases. But, and this is a huge but, some 60% of holiday shoppers said a majority of their weekend purchases were driven primarily by sales.

Cyber Monday Chalks Up the Biggest US Online Retail Day to Date

(November 28) Diginomica.com

Cyber Monday Chalks Up the Biggest US Online Retail Day to Date

(November 28) Diginomica.com

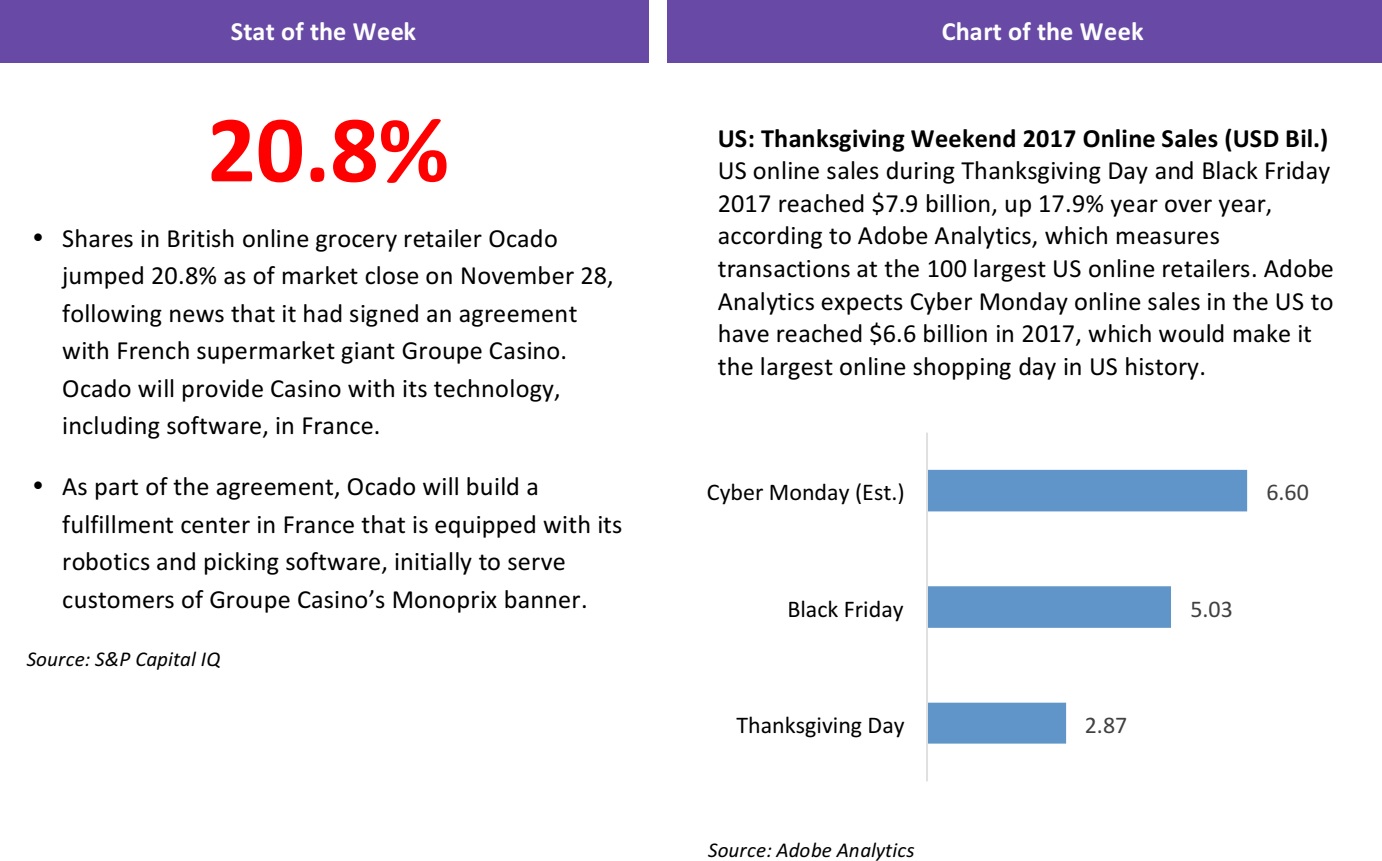

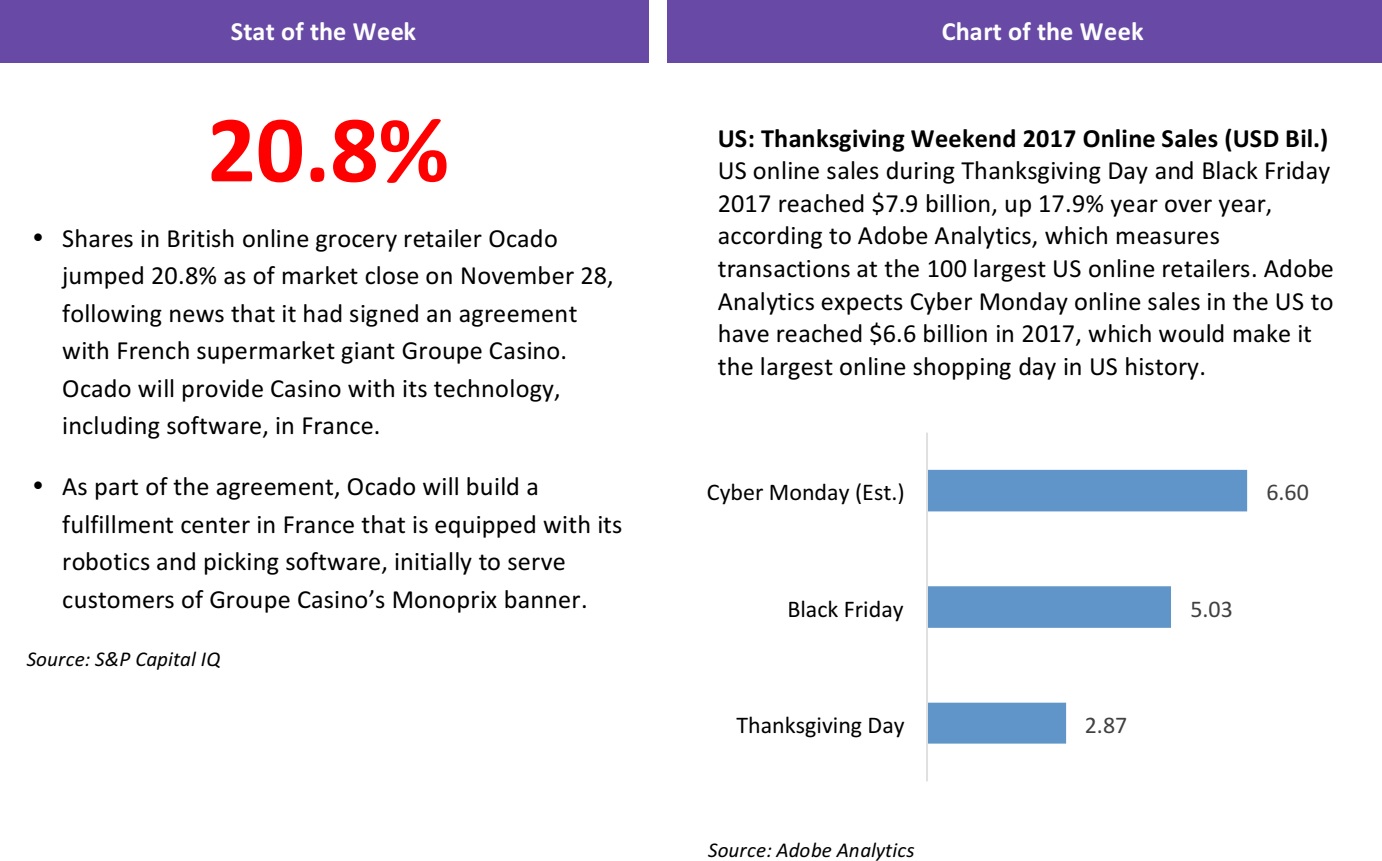

- It was predicted that Cyber Monday would be the biggest online shopping day to date. And so it came to pass. According to Adobe Digital Insights, Cyber Monday online sales hit a record $6.59 billion, topping Black Friday’s $5.03 billion.

- Sales from November 23–26 totaled $13.03 billion, a 14.4% increase year over year. Thanksgiving Day spending totaled $2.87 billion (18.3% growth year over year), while Black Friday spending hit $5.03 billion (up 16.9% year over year). Thanksgiving weekend (November 25 and 26) saw $5.12 billion in revenue.

Thanksgiving Day Grows in Importance for Shoppers

(November 23) USAToday.com

Thanksgiving Day Grows in Importance for Shoppers

(November 23) USAToday.com

- As retailers roll out deals earlier and earlier to grab a greater chunk of holiday shoppers’ dollars, Thanksgiving Day has grown in importance, with sales kicking off before the dinner dishes have been cleared away.

- About 58% of shoppers said they planned to shop this Thanksgiving, up from 40% who intended to do so last year, according to consultancy PwC. Meanwhile, a separate survey by Deloitte found that roughly 73% of respondents planned to shop on the holiday.

EUROPE RETAIL & TECH HEADLINES

(November 28) Company press release

(November 28) Company press release

- UK online grocery retailer Ocado announced that it has signed an agreement to provide online grocery technology to French grocery retailer Groupe Casino. Ocado will provide its Smart Platform service to Casino using an automated customer fulfillment center that will be built to serve the Greater Paris area. The build and launch is expected to take at least two years.

- This is Ocado’s first overseas signing for its Smart Platform service. In June 2017, the company signed a software and technology licensing deal with an unnamed regional European grocer, but the deal did not include the adoption of Ocado’s automated fulfillment technology.

UK Shoppers Switch Spend to Lower-Value Goods on Black Friday

(November 27) BBCNews.com

UK Shoppers Switch Spend to Lower-Value Goods on Black Friday

(November 27) BBCNews.com

- British shoppers made fewer trips to stores, bought more overall and bought more lower-value items on Black Friday this year than they did on the same day last year, according to reports from data providers. Springboard, which records shopper traffic, noted a 3.6% year-over-year decline in footfall on Black Friday. However, Barclaycard estimated that total spending on Black Friday jumped 8% in value.

- Barclaycard noted a 32% increase in transaction numbers on Black Friday, suggesting that UK shoppers bought a greater number of lower-value items than they did on the same day last year. That, in turn, implies a shift in some spending away from electronics.

Multiyork and Feather & Black Enter Administration

(November 27) Retail-Week.com

Multiyork and Feather & Black Enter Administration

(November 27) Retail-Week.com

- UK furniture and homewares retailers Multiyork and Feather & Black have entered administration. Both are part of Wade Furniture Group. The businesses will continue to operate while buyers are sought.

- Multiyork has 50 stores and 547 staff. Feather & Black operates 25 stand-alone stores and concessions in Multiyork stores and employs 123 staff.

Suitsupply Raises €300 Million in Funding

(November 27) RetailDetail.eu

Suitsupply Raises €300 Million in Funding

(November 27) RetailDetail.eu

- Dutch men’s formalwear retailer Suitsupply has raised €300 million ($356 million) in funding from NPM Capital and four major banks. The company plans to use the funds to remodel existing stores, expand further and refinance debt.

- Suitsupply has 91 stores in 73 cities. It currently generates €300 million ($356 million) in revenue and is growing sales at 25% a year.

Zalando Opens Zalon Pop-Up Store

(November 27) RetailDetail.eu

Zalando Opens Zalon Pop-Up Store

(November 27) RetailDetail.eu

- Zalando has opened a pop-up store in Berlin to provide one-on-one stylist advice in order to promote its Zalon service. The store will be open for three weeks.

- The pop-up allows shoppers to try Zalon’s curated shopping service in person and order products for home delivery. Zalon has provided a personal shopping service online since 2015.

ASIA RETAIL & TECH HEADLINES

China’s Top Uber-for-Trucks Apps Agree on a Merger

(November 27) Bloomberg.com

China’s Top Uber-for-Trucks Apps Agree on a Merger

(November 27) Bloomberg.com

- Huochebang and Yunmanman, China’s two biggest apps for Uber-like truck services, have agreed to merge, thereby creating a company valued at more than $2 billion. Wang Gang, a backer of Yunmanman and an angel investor in ride-hailing giant Didi Chuxing, will become the CEO of the new entity.

- The merger would end a costly and frosty battle and create a dominant player in a domestic trucking market estimated to be worth ¥5 trillion ($753 billion). It is the latest corporate tie-up to emerge from an increasingly competitive technology sector, the most prominent being the marriage of Didi Chuxing and Uber’s Chinese business.

Baidu and Electric Vehicle Startup NIO Lead $195 Million Investment in Chinese Limo-Booking App

(November 21) TechCrunch.com

Baidu and Electric Vehicle Startup NIO Lead $195 Million Investment in Chinese Limo-Booking App

(November 21) TechCrunch.com

- Chinese Internet giant Baidu is continuing its push into the automotive space after leading a $195 million series B investment in Shouqi Limousine & Chauffeur, an offshoot of the state-owned Shouqi Group, which was Beijing’s first licensed ride-hailing app. NIO Capital, the investment arm of billion-dollar electric car startup NIO, and Silk Road Huachuang joined the round, adding $105 million to an original $88 million series B announced in July.

- Shouqi Limousine & Chauffeur competes with ride-hailing giant Didi Chuxing but differs in its approach—preferring to own its fleet of cars rather than encouraging drivers to provide a vehicle themselves, the approach that Didi, Uber and others favor. Shouqi claims a fleet of 60,000 cars, which cover 53 cities and districts across China, and has 2.4 million active users.

Tencent Becomes the First Chinese Tech Firm Valued over $500 Billion

(November 20) TechCrunch.com

Tencent Becomes the First Chinese Tech Firm Valued over $500 Billion

(November 20) TechCrunch.com

- Tencent has become the first Chinese company to be valued at more than $500 billion. Tencent’s market cap has more than tripled since March 2014, when it reached $150 billion, surpassing Intel in the process. Writing then, The Wall Street Journal opined that the company “isn’t yet a household name in the US, but it should be,” and that still applies today.

- WeChat, its messaging app, which is China’s top social service, is closing in on 1 billion users overall, but it has not managed to replicate that success overseas. Tencent has instead focused on investing itself into global positions. Its gaming business is the heartbeat of revenue, accounting for $5 billion in the last quarter alone, thanks to smash hits such as Honor of Kings, 2017’s top-grossing game.

SoftBank Bids to Buy Uber Shares for 30% Less than Current Value

(November 28) Bloomberg.com

SoftBank Bids to Buy Uber Shares for 30% Less than Current Value

(November 28) Bloomberg.com

- SoftBank and a group of investors are trying to buy a stake in Uber at a sizable discount to the company’s $69 billion valuation, seeking to clinch what would be one of the largest purchases of stock in a private company.

- SoftBank and partners that include investment firms Dragoneer Investment Group and General Atlantic are offering to spend more than $6 billion for a stake that would value the ride-hailing company at $48 billion, or about 30% lower than the valuation it fetched in its most recent round of fundraising, according to people familiar with the deal.

LATAM RETAIL & TECH HEADLINES

VMware Appoints New Brazil Head

(November 27) ZDNet.com

VMware Appoints New Brazil Head

(November 27) ZDNet.com

- Virtualization and cloud services company VMware has appointed José Duarte as the new president for its Brazil operations, to replace Fabio Costa, who left the company in October to become a commercial vice president at Microsoft Brazil.

- Duarte has 25 years of experience in the technology industry and has served as VMware’s head of professional services for Latin America for the last three years. Prior to that, he worked at TIM, the Brazilian subsidiary of Telecom Italia, for 13 years.

Brazil to Introduce Electronic Patient Records

(November 24) ZDNet.com

Brazil to Introduce Electronic Patient Records

(November 24) ZDNet.com

- The Brazilian government has launched a public tender for several IT services underpinning the digitization of patient records at over 42,000 public health clinics across the country. Technology services required for the project, which will aim to record patient information such as prescriptions, exams and appointments, will include Internet connectivity, IT equipment, support and training.

- Investment in the project includes an initial budget of R$1.5 billion ($465 million), with spending projected to reach R$3.4 billion ($1.05 billion). The World Bank estimates that digitizing patient records will generate yearly savings of R$22 billion ($6.8 billion) to the federal government.

Brazil Rolls Out Digital Driving Licenses

(November 22) ZDNet.com

Brazil Rolls Out Digital Driving Licenses

(November 22) ZDNet.com

- The Brazilian government is rolling out digital driving licenses across the country, following the green-lighting of the initiative in July. Aimed at reducing document fraud, the digital driving licenses will feature digital signature certificates and will be as legally valid as physical documents, which will continue to exist.

- The rollout of the mobile-based license app has already started in the state of Goiás and was extended to other states this week. All 27 Brazilian states are expected to be able to offer the digital licenses by February 2018. The government hopes that approximately 1.5 million drivers will be using digital licenses by 2022.

Black Friday Becomes Major Retail Sales Event in Brazil

(November 24) RioTimesOnline.com

Black Friday Becomes Major Retail Sales Event in Brazil

(November 24) RioTimesOnline.com

- Black Friday was expected to be one of the main sales dates for Brazilian retail. A recent survey estimated that Black Friday sales in Brazil would be close to R$2.2 billion ($670 million), 20% greater than during Black Friday in 2016.

- According to the survey, conducted by the Credit Protection Service and the National Confederation of Shopkeepers, more than 39% of Brazilian consumers intended to make purchases this Black Friday. Of those interviewed, 72% said that they consider the date a good time to get something they need at a low price.

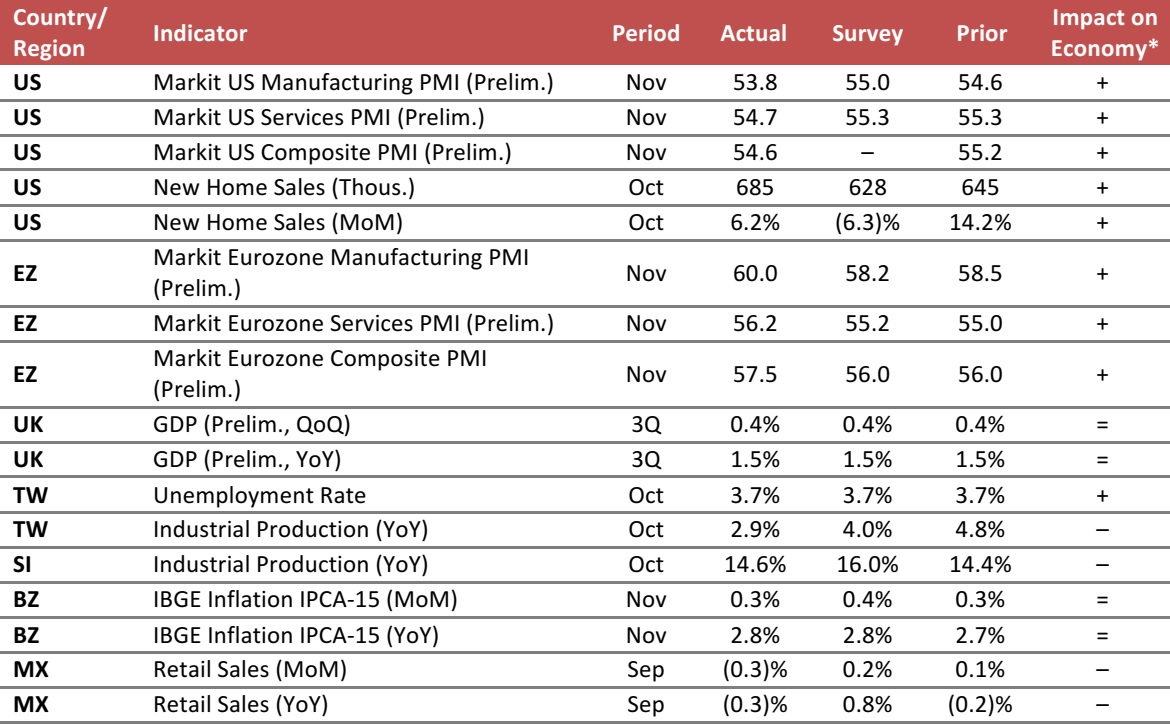

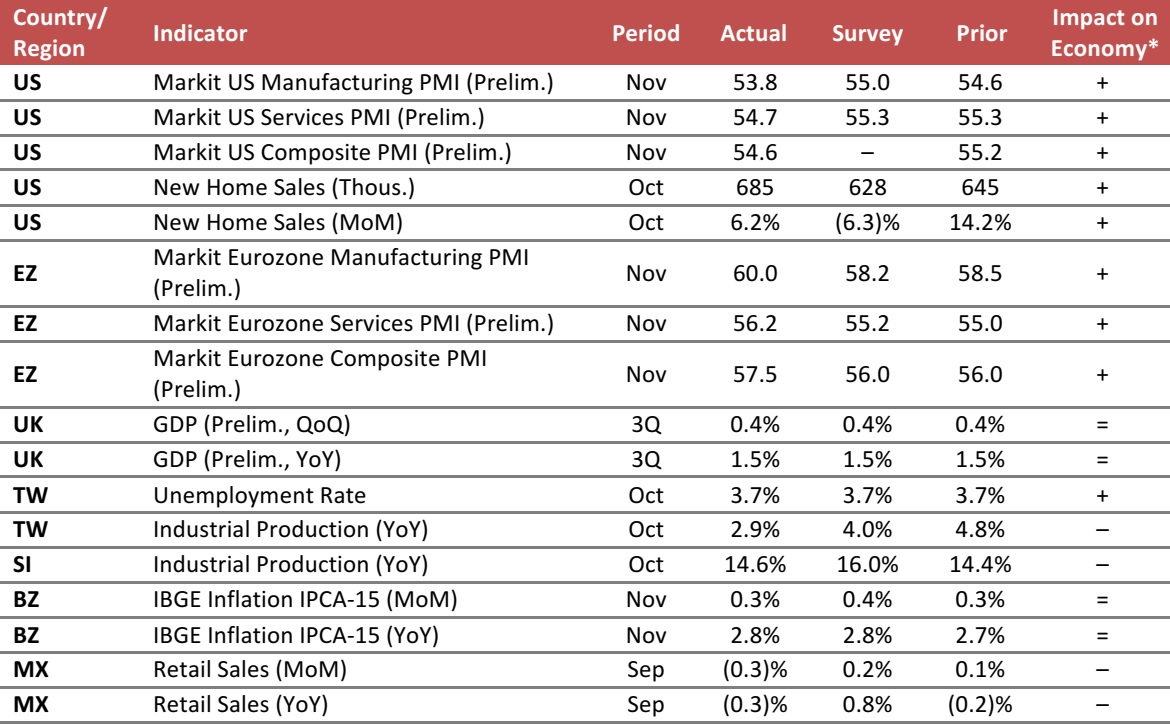

MACRO UPDATE

Key points from global macro indicators released November 22–29, 2017:

- US: The Markit US Purchasing Managers’ Indexes (PMIs) stayed above the expansion threshold of 50.0 in November, indicating that the economy remained in a healthy state. New home sales increased by more than the market had expected in October, rising by 6.2% month over month.

- Europe: In the eurozone, the Markit Eurozone Manufacturing PMI increased to 60.0 in November, beating the consensus estimate of 58.2. The Services PMI also increased, rising to 56.2. In the UK, GDP increased by 1.5% year over year in the third quarter.

- Asia-Pacific: In Taiwan, the unemployment rate was unchanged at 3.7% in October. Industrial production in Taiwan increased by 2.9% year over year in October; the rate was weaker than the consensus estimate. In Singapore, industrial production increased by 14.6% year over year in October.

- Latin America: In Brazil, inflation as measured by the IBGE IPCA-15 edged up by 0.3% month over month in November, slightly below the consensus estimate. In Mexico, retail sales decreased by 0.3% month over month in September.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit/US Census Bureau/UK Office for National Statistics/Taiwan Directorate General of Budget, Accounting and Statistics/Monetary Authority of Singapore/Singapore Economic Development Board/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/FGRT

Source: Company reports

Source: Company reports