Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

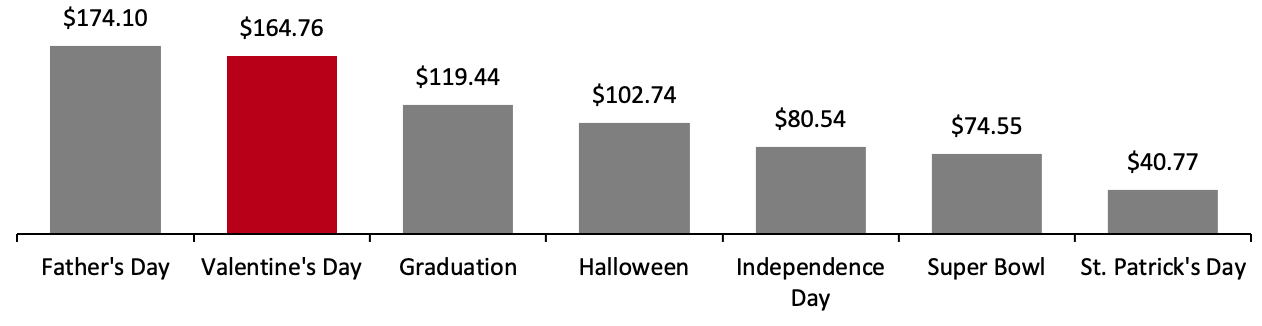

Could This Valentine’s Day Mark the Real Return to Normal? While the Valentine’s Day holiday originated as a celebration of love and affection on February 14 each year, it has become as retail-centric as it is sentimental, driving sales of gifts including flowers and candy, in addition to curated restaurant dinners. Valentine’s Day represented the second-largest consumer spending event in 2021, with average spending of nearly $165 per person, falling just behind Father’s Day but with quite a large gap ahead of graduation (in third place), according to survey data collected by the National Retail Federation (NRF), as shown in the figure below.Figure 1. Selected US Consumer Spending Events (USD per Person) [caption id="attachment_141493" align="aligncenter" width="700"]

Source: NRF[/caption]

Significant for the retail industry is that more than three-quarters of consumers that plan to celebrate this year said that they felt it was important to do so given the current state of the Covid-19 pandemic, according to a January 2022 Valentine’s Day NRF survey—showing consumers’ awareness and willingness to support the economy, particularly the retail and restaurant industries.

Coresight Research’s US Consumer Tracker survey on January 24, 2022, found that 54.1% of consumers plan to spend on celebrating the holiday this year. The proportion of Valentine’s Day spenders planning to spend more in 2022 than in the prior year outweighed those planning to spend less by more than four percentage points. In terms of channel, 31.1% of Valentine’s Day spenders plan to shop in-store only, in line with the 32.4% who plan to shop both online and in-store.

Our subsequent survey on January 31, 2022, found that avoidance of shopping centers and malls has bottomed out and remains flattish, whereas avoidance of shops in general decreased by 1.5 percentage points, week over week—indicating that consumers may be more open to in-person Valentine’s Day shopping. Looking at consumer activity, we saw a notable increase in restaurant visits, suggesting that many consumers will feel comfortable celebrating by having a meal out.

As we go to press, the worst of the Omicron variant’s spread appears to be behind us, and many US regions and institutions are relaxing restrictions; New York State allowed its indoor masks and proof-of-vaccination mandates to expire on February 10, 2022. Coresight Research attended both CES 2022 and the NRF 2022: Retail’s Big Show in January, which were highly successful despite cancellations from some large companies and lower attendance figures, and we look forward to attending Shoptalk at the end of March.

We are optimistic that developments will remain positive, that consumers will embrace this good news and that the three-quarters of those expecting to celebrate will indeed follow through with their Valentine’s Day plans to support the retail and restaurant industries and shower gifts and affection on their loved ones.

Source: NRF[/caption]

Significant for the retail industry is that more than three-quarters of consumers that plan to celebrate this year said that they felt it was important to do so given the current state of the Covid-19 pandemic, according to a January 2022 Valentine’s Day NRF survey—showing consumers’ awareness and willingness to support the economy, particularly the retail and restaurant industries.

Coresight Research’s US Consumer Tracker survey on January 24, 2022, found that 54.1% of consumers plan to spend on celebrating the holiday this year. The proportion of Valentine’s Day spenders planning to spend more in 2022 than in the prior year outweighed those planning to spend less by more than four percentage points. In terms of channel, 31.1% of Valentine’s Day spenders plan to shop in-store only, in line with the 32.4% who plan to shop both online and in-store.

Our subsequent survey on January 31, 2022, found that avoidance of shopping centers and malls has bottomed out and remains flattish, whereas avoidance of shops in general decreased by 1.5 percentage points, week over week—indicating that consumers may be more open to in-person Valentine’s Day shopping. Looking at consumer activity, we saw a notable increase in restaurant visits, suggesting that many consumers will feel comfortable celebrating by having a meal out.

As we go to press, the worst of the Omicron variant’s spread appears to be behind us, and many US regions and institutions are relaxing restrictions; New York State allowed its indoor masks and proof-of-vaccination mandates to expire on February 10, 2022. Coresight Research attended both CES 2022 and the NRF 2022: Retail’s Big Show in January, which were highly successful despite cancellations from some large companies and lower attendance figures, and we look forward to attending Shoptalk at the end of March.

We are optimistic that developments will remain positive, that consumers will embrace this good news and that the three-quarters of those expecting to celebrate will indeed follow through with their Valentine’s Day plans to support the retail and restaurant industries and shower gifts and affection on their loved ones.

US RETAIL AND TECH HEADLINES

Aldi To Expand Its Presence in the US with 150 New Stores (February 8) Company press release- German discount grocery giant Aldi has announced plans to open approximately 150 new retail locations in the US, aiming to become the country’s third-largest food retailer by store count by the end of 2022. Over the previous decade, Aldi has opened 1,000 new locations across the US.

- Aldi entered its 38th state on February 10, 2022, with an opening in Lafayette, Louisiana. The company plans to open two more Gulf Coast locations in early March, and 20 more by the end of the year. Aldi is looking to hire 300 retail associates and 200 warehouse associates to support its expansion in the southeast.

- Amazon has expanded its healthcare platform, Amazon Care. The hybrid healthcare service platform, which combines virtual care with the option of an in-home visit, will be accessible in 20 additional cities.

- The new locations will include Chicago, Miami, San Francisco and New York City. The app offers services including Covid-19 testing, flu testing, treatment of illnesses and injuries, prescription requests, and vaccinations. If an issue cannot be resolved by an app-embedded video call in cities where in-person care is available, a nurse will visit the patient’s home.

- E-commerce technology startup Bold Commerce has introduced a new checkout service, “Bold Checkout: Buy Now,” providing brands with an alternative to third-party digital wallets and pay-now options, such as Apple Pay, Google Pay and PayPal—without compromising customer connections or checkout customizations, according to the company.

- While these third-party solutions help retail businesses enable faster checkout, they also create fragmented experiences for shoppers, forcing brands to abandon their customers at the most critical point in their shopping experience.

- Coco, a robotic delivery service based in Los Angeles, has expanded to Austin, Texas. The company stated that the city is a natural fit for its fast, low-cost and traffic-free delivery service as one of the most distinctive and diversified food cities in the US.

- Coco stated that it plans to expand to Dallas, Houston and Miami in the coming months.

- Through the expansion, Coco expects to achieve a 97% on-time delivery rate and a 30% decrease in time-to-customer. Coco stated that its latest $56 million Series A funding round will help its expansion.

- Supermarket company Rouses Markets has partnered with eGrowcery, an e-commerce platform for supermarkets and retailers, to launch its e-commerce service for curbside pickup.

- Rouses’ customers can use eGrowcery technology to shop, make an order and select a curbside pickup time via Rouses’ app or website. Customers pay the same amount for groceries as they do in the company’s stores, and there will be no curbside pickup fee on purchases over $35.

EUROPE RETAIL AND TECH HEADLINES

Colruyt Group Plans To Expand Its Offering Online (February 8) ESMMagazine.com- Belgian family-owned retail supermarket chain Colruyt has acquired a 41.4% stake in Belgian food e-commerce company Smartmat.

- The company specializes in meal boxes via its brands 15gram and Foodbag. Korys, Colruyt’s investment company, already owns a stake in Smartmat.

- Bulgarian supermarket chain Fantastico Group has announced plans to invest in solar panels to generate energy for its businesses. The project will cost €0.9 million ($1.03 million) and will generate 4.2 gigawatt hours of green energy per year, saving 1,800 tons of carbon emissions, according to the company.

- Fantastico also plans to invest €12 million ($13.7 million) in a logistics facility for refrigerated goods in Elin Pelin, Bulgaria, which is set to complete in 2023.

- Dutch supermarket chain Jumbo has started supplying German on-demand grocery delivery app Gorillas in Antwerp, Belgium as part of the two company’s strategic partnership, which began in January 2022.

- Jumbo’s private-label products and its La Place range will be available via the Gorillas app. Gorillas will also extend the service to the Netherlands in the near future.

- UK-based online grocery retailer Ocado has reported a 7.2% year-over-year increase in revenue, reaching £2.5 billion ($3.4 billion) for its fiscal 2021, ended November 2021. Its retail sales increased by 4.6% year over year to £2.3 billion ($3.1 billion) and by 41.5% compared to pre-pandemic 2019.

- Ocado’s EBITDA declined by 12.1% year over year to £61 million ($82.7 million), and its loss before tax widened by 124.6% to £176.9 million ($239.8 million), which the company attributed to increased investment in its solutions business, particularly the rollout of the Ocado Smart Platform.

- British e-commerce platform Very has expanded its range of beauty and self-care brands by 94% since the beginning of the pandemic. The company announced that it has added 77 new beauty and personal care brands, taking the category total to 159, following rising demand for wellbeing products.

- Recent launches on the platform include sustainable and vegan beauty brand Beauty Kitchen, vitamin producer Hello Day, and beauty gel and mask maker Patchology. The company also plans to launch new high-profile brands in the category in the coming months.

ASIA RETAIL AND TECH HEADLINES

Bananas Raises $1.5 Million in Total Seed Funding (February 8) TechNode.Global- Indonesia-based quick commerce startup Bananas has secured $1 million in seed funding, led by East Ventures, an Indonesian early-stage venture capital firm. Bananas also received $500,000 in investment from US technology startup accelerator Y Combinator—taking its total seed round funding to $1.5 million.

- Bananas will use the funding to expand its talent and support its operations, including its technology-enabled micro-hubs (dark stores), its customer service and inventory. Bananas aims to operate at least 50 dark stores in the near future, mainly located in Jakarta and other Tier-1 Indonesian cities.

- Cettire, an Australian online luxury apparel and accessories retailer, has partnered with Chinese e-commerce giant JD.com, aiming to expand into mainland China. It plans to launch in the country in the second half of 2022.

- Chinese consumers will gain access Cettire’s luxury selection, which includes products from Alexander McQueen, Fendi, Off-White and Valentino. The company stated that it may also take advantage of JD.com’s logistics capabilities for distribution in the region.

- Indonesian online grocery platform HappyFresh has launched its HappyFresh Supermarket in Bangkok, Jakarta and Kuala Lumpur, aiming to offer competitive pricing and provide customers with strong value for money.

- HappyFresh is also looking to expand its grocery availability by increasing its number of dark stores in Southeast Asia.

- Vietnamese social commerce platform Selly has raised $2.6 million in pre-Series A funding from venture capital firms CyberAgent Capital, Do Ventures, Genesia Ventures, Jafco Asia and Kvision. Selly hosts 300,000 resellers and it has grown its gross merchandise value (GMV) by 300 times since it began operations 10 months ago, according to the company.

- Selly’s Founder and CEO, Tuan Thong, stated that the company will use the funding to improve product features and expand its presence in remote areas of Vietnam.

- Indian e-commerce company Snapdeal has partnered with GoKwik, an e-commerce enablement platform to gain access to latter’s artificial intelligence (AI) and machine learning services for customized shopping experiences.

- GoKiwk’s AI model analyzes customer behavior throughout their journey, studying more than 200 parameters, including historical data.