Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

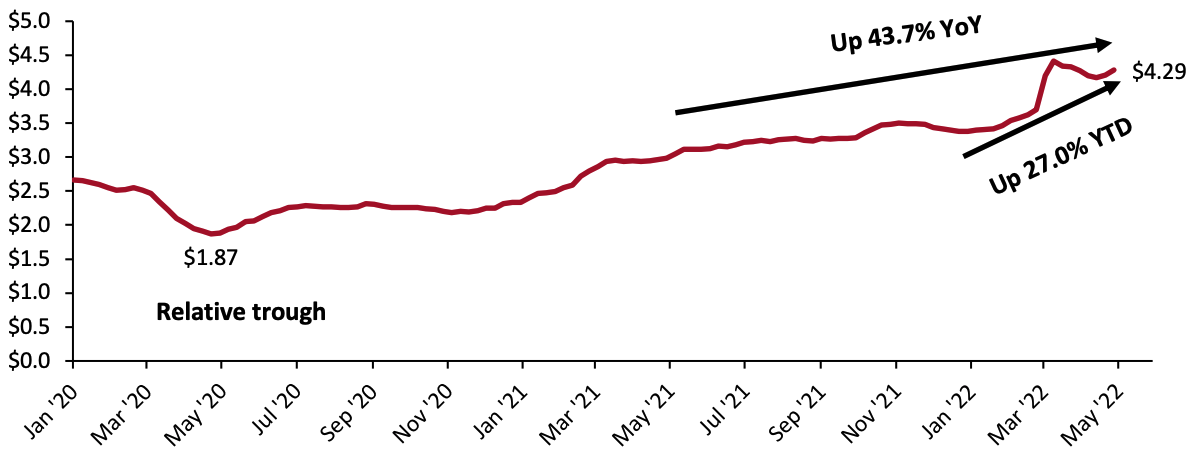

Buckle Up, Consumers—Higher Shipping Charges Are Likely Coming Down the Pike It should not come as a surprise to US consumers that they may see higher shipping prices: amid ever-increasing examples of inflation, retailers are pondering what costs they can absorb and what costs they can pass on to consumers without causing them to trade down to cheaper products. Price increases have already been announced and levied, particularly for consumer packaged goods. Meanwhile, apparel resale site ThredUP is hiking shipping charges for consumers, following the example set by Amazon, which raised the price of its Prime membership by $20 to $139 in February 2022. US gas prices are a likely contributor to shipping price increases. The figure below shows that gas prices have more than doubled since the early stages of the pandemic, and prices are up by a stunning 27.0% in year-to-date 2022.Figure 1. US Gasoline Prices at Retail (USD) [caption id="attachment_146769" align="aligncenter" width="700"]

Source: US Energy Information Administration/Coresight Research[/caption]

Consumers understand that it is not just gasoline prices that are going up, with the US inflation rate hitting 8.5% in March. Furthermore, wage increases are hitting retailers and shippers—for instance, the average US hourly wage reached $31.73 an hour in March, up 5.6% year over year, according to the St. Louis Fed.

Some of the hikes in shipping prices were already planned: carriers such as DHL, FedEx and UPS had announced an average 5.9% rate increase for 2022, following rate hikes of 4.9%–5.9% for 2021, according to the companies and Supply Chain Dive. Still, the rate increases announced for this year did not anticipate the war in Ukraine, and its effect on fuel prices and have not kept pace with the above-mentioned 27.0% increase in gas prices. Moreover, we are now entering the summer vacation season, in which automobile-based vacations generate seasonal gasoline demand.

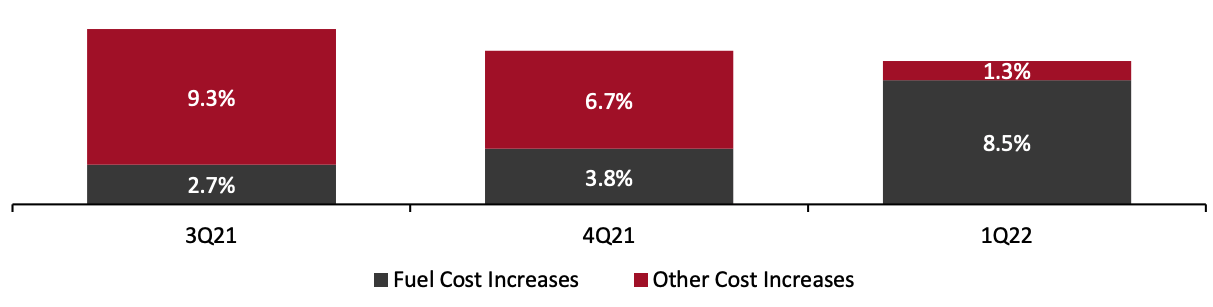

Shippers are benefiting from higher prices, which are not only driven by fuel price increases. The figure below shows changes in prices per parcel, year over year, with the contribution from fuel broken out. We can see that increases in fuel prices were not the major contributor to growth in parcel costs until the first quarter of 2022, based on data from UPS.

Source: US Energy Information Administration/Coresight Research[/caption]

Consumers understand that it is not just gasoline prices that are going up, with the US inflation rate hitting 8.5% in March. Furthermore, wage increases are hitting retailers and shippers—for instance, the average US hourly wage reached $31.73 an hour in March, up 5.6% year over year, according to the St. Louis Fed.

Some of the hikes in shipping prices were already planned: carriers such as DHL, FedEx and UPS had announced an average 5.9% rate increase for 2022, following rate hikes of 4.9%–5.9% for 2021, according to the companies and Supply Chain Dive. Still, the rate increases announced for this year did not anticipate the war in Ukraine, and its effect on fuel prices and have not kept pace with the above-mentioned 27.0% increase in gas prices. Moreover, we are now entering the summer vacation season, in which automobile-based vacations generate seasonal gasoline demand.

Shippers are benefiting from higher prices, which are not only driven by fuel price increases. The figure below shows changes in prices per parcel, year over year, with the contribution from fuel broken out. We can see that increases in fuel prices were not the major contributor to growth in parcel costs until the first quarter of 2022, based on data from UPS.

Figure 2. Growth in Parcel Revenue per Piece (YoY %) [caption id="attachment_146770" align="aligncenter" width="700"]

Source: UPS/Coresight Research[/caption]

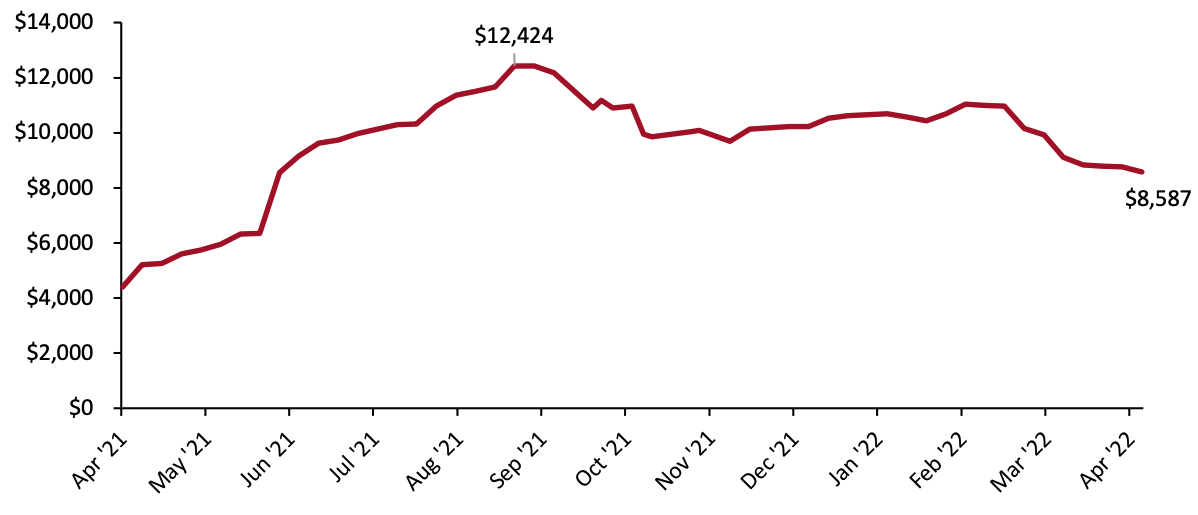

There could be a silver lining for retailers and consumers, though. Although terrestrial delivery costs are rising along with labor and fuel costs, the cost of sea freight appears to have plateaued and is on a downward trend, owing to a combination of seasonal factors and reduced demand, with prices down 30% from the peak in autumn 2021 to present (see Figure 3).

Source: UPS/Coresight Research[/caption]

There could be a silver lining for retailers and consumers, though. Although terrestrial delivery costs are rising along with labor and fuel costs, the cost of sea freight appears to have plateaued and is on a downward trend, owing to a combination of seasonal factors and reduced demand, with prices down 30% from the peak in autumn 2021 to present (see Figure 3).

Figure 3. Freight Rates per 40-Foot Container, Shanghai to Los Angeles (USD) [caption id="attachment_146771" align="aligncenter" width="700"]

Source: Drewry[/caption]

The shipping rate situation, like many things, is complex. Higher gasoline prices are somewhat offset by lower container rates, amid inflation in other sectors. Notwithstanding the Fed’s decision to hike US interest rates this week, the effects of inflation are likely to ripple through the retail sector, leading other retailers to hike shipping charges to consumers to cover their increased costs.

Source: Drewry[/caption]

The shipping rate situation, like many things, is complex. Higher gasoline prices are somewhat offset by lower container rates, amid inflation in other sectors. Notwithstanding the Fed’s decision to hike US interest rates this week, the effects of inflation are likely to ripple through the retail sector, leading other retailers to hike shipping charges to consumers to cover their increased costs.

US RETAIL AND TECH HEADLINES

Albertsons Expands Uber Grocery Delivery to More Than 2,000 Stores (May 3) SupermarketNews.com- Supermarket chain Albertsons Companies has expanded its online grocery-delivery partnership with food-ordering and delivery platform Uber Eats to nearly 800 more stores, bringing the total number of locations on Uber Eats to more than 2,000.

- With the expansion, customers of Albertsons’ banners in Connecticut, Indiana, New Hampshire, Rhode Island, Utah and Vermont will be able to find the grocery retailer for the first time on Uber Eats. Along with Albertsons’ banners being under the grocery section, customers can also order items from Albertsons under the “express” lanes within the convenience section of the Uber Eats app.

- Beauty brand owner Estée Lauder has reported revenue growth of 10.0% year over year in its third quarter of fiscal 2022 (ended March 31, 2022). Its organic sales increased by 9.0% year over year. Adjusted EPS (earnings per share) increased by 17.0%. The company’s operating margin increased by 110 basis points year over year, to 21.6%, reflecting higher net sales and a favorable impact from a stronger US dollar.

- For fiscal 2022, due to Covid-19 related restrictions in China and the impact of the Russia-Ukraine conflict, the company revised down its guidance for year-over-year revenue growth to high single digits in percentage terms, compared to prior guidance of double-digit growth. The company expects adjusted EPS growth to be 8.0%–10.0% on a constant-currency basis.

- Home-improvement retailer Home Depot has launched a $150 million venture capital fund, called Home Depot Ventures, to identify, invest in and collaborate with emerging early-stage tech companies focused on improving the customer experience and shaping the future of home improvement.

- According to the company, the new Home Depot Ventures fund will invest in companies that will help Home Depot create a more seamless interconnected shopping experience and build new and differentiated capabilities. The fund will look for opportunities to invest in businesses at various stages of development, with a focus on early growth-stage companies that solve problems for Home Depot's customers and have the potential to scale.

- Department store chain Macy’s has announced the expansion of its partnership with sports brand Reebok to include a wider range of merchandise. Starting from spring 2023, Macy’s will debut an enhanced assortment of Reebok apparel for men, women and kids, online and in its stores.

- Sam Archibald, General Business Manager of Apparel at Macy’s, said, “Our partnership with ABG will expand our assortment and offer our customers high-quality styles from Reebok apparel in the US.”

- The agreement with Macy’s is the latest in a series of wholesale agreements that Reebok has entered into under its new owners, Authentic Brands Group (ABG). In February 2022, Reebok expanded its partnership with Foot Locker.

- Women’s fashion retailer Torrid Holdings has appointed Lisa Harper as its new CEO. Harper succeeds Liz Muñoz, who has been appointed to the new role of Chief Creative Officer. In addition to serving as CEO, Harper will remain a member of the Torrid Board of Directors.

- Prior to serving as CEO of department store retailer Belk for five years, Harper served as CEO of Torrid (the predecessor of the current company) and its then-parent company Hot Topic for five years. Previously, she also held the position of CEO at Gymboree Corp., a children’s fashion retailer, for five years. She also held merchandising and design positions with several other clothing retailers, including Esprit, GapKids, Levi Strauss, Limited Too and Mervyn’s.

EUROPE RETAIL AND TECH HEADLINES

Bol.com Acquires a Majority Stake in Cycloon (May 2) Company press release- Ahold Delhaize has announced that its online subsidiary in the Benelux region, Bol.com, acquired a majority stake in last-mile delivery startup Cycloon. Following the acquisition, Cycloon will carry out deliveries of Bol.com packages, starting in the second half of 2022. The company noted that Bol.com would retain Cycloon’s current management team, and it will continue to operate as an independent brand.

- Cycloon operates a network of bicycle couriers and mail deliverers to customers in the Netherlands. The company claims to save an estimated 1,600 tonnes of CO2 annually in last-mile delivery.

- Sporting goods retailer Decathlon will install Quadient’s automated parcel lockers at dozens of its stores in France as the retailer looks to accelerate the development of e-commerce fulfillment through 24-hour delivery, drive-thru pickup and other innovative pickup options to serve its customers across the country.

- Decathlon partnered with Quadient in 2015 and has since equipped 62 of its French stores with Quadient’s smart locker solutions, including in-store models, 24/7 outdoor pickup units and “Parcel Pending Lite” lockers.

- French fashion brand DistriCenter has announced a partnership with supply chain management platform RELEX Solutions to automate and optimize supply chain planning. RELEX will enhance forecast accuracy and drive stock replenishment efficiency throughout DistriCenter’s distribution network, which comprises more than 170 stores in France as well as its online channel.

- According to DistriCenter, the partnership will take its supply chain planning process to the next level and help allocate inventory smartly and efficiently across its stores through RELEX’s advanced forecasting solutions.

- Department store chain John Lewis has announced that it is recruiting 150 tech roles as part of major investments in its e-commerce business. The company is seeking to hire engineers to bring expertise across software, cloud platform and native app technologies. The roles will help John Lewis to make the omnichannel experience for its customers more seamless.

- The company noted that the John Lewis and Waitrose (the supermarket subsidiary of the John Lewis Partnership) websites together attract more than 55 million visits per month. Online sales now contribute almost 70% of John Lewis sales and nearly 20% of Waitrose sales—up from 40% and 5%, respectively, two years ago.

- Tesco has teamed up with Uber Eats to bolster its Whoosh rapid delivery service, which aims to deliver groceries in under 60 minutes. Uber Eats riders will now fulfill Whoosh orders placed on Tesco.com or Tesco’s grocery and Clubcard apps. The service will initially go live in 20 stores across the country.

- Tesco launched the Whoosh service in May 2021, and it is now available across 200 Express stores in the UK. The Uber Eats partnership will allow Tesco to roll out Whoosh to 600 stores by the end of the year, according to the company.

ASIA RETAIL AND TECH HEADLINES

Lenskart Raises $25 million in Series I Round (May 4) Retail.EconomicTimes.IndiaTimes.com- Lenskart, a multichannel Indian eyewear company, has secured another $25 million in a Series I round headed by Epiq Capital. This is the second tranche of the Series I round this month; the company has already raised $100 million from Alpha Wave Incubation (previously Falcon Edge). Since its launch in 2010, Lenskart has raised nearly $925 million.

- Lenskart has over 1,000 locations in addition to a strong web presence. The eyewear retailer has established its 1,000th store in Delhi's Karol Bagh, has locations in 223 cities across India, and plans to open more than 500 locations across the country in the fiscal 2023, with a concentration on Tier 2 and 3 cities.

- LinkieBuy, a China-based cross-border e-commerce firm, has announced plans to bring 100 Japanese retailers to the Chinese market, including Sogo & Seibu, Komehyo, Daimaru Matsuzakaya Department Stores and Tsuruha, among others.

- The strategy focuses on introducing offline retailers, travel retail stores, duty-free stores and other associated industry retailers to China’s retail sector. The partnership with LinkieBuy includes cross-border mini-program malls within the WeChat ecology, online marketing for e-commerce operations and cross-border warehousing and logistics.

- Chinese e-commerce giant JD Retail has pledged to lower operating costs for its merchants to increase their return on investment by at least 20%, as part of supportive measures for small businesses during its annual flagship shopping festival, “6.18,” held on June 18.

- The firm expects to release a new version of its app to provide merchants with a simpler, more transparent and uniform operating experience. JD Retail has announced a total of 30 supportive measures for merchants, which include reductions in costs and risks, as well as optimized services and efficiency.

- South Korean AR (augmented reality) startup Recon Labs has raised $4.4 million. In South Korea, the company serves more than 22 small and medium-sized businesses, and it is in talks with potential customers in the fashion, toy and food industries.

- The company will use the Series A funding to grow its headcount and improve its PlicAR platform, which helps turn 2D images of products into 3D images without special 3D modeling abilities. Recon Labs claims to have transformed over 10,000 products from 2D to 3D.

- Saturdays, an Indonesian eyewear brand, has raised an undisclosed sum in a round led by Altara Ventures and joined by DSG Consumer Partners and other affiliates. The company uses an online-to-offline strategy to market a variety of affordable eyewear. It has a website, an app and 15 physical locations. Users can try on eyewear digitally using the company’s virtual storefronts.

- Saturdays plans to use the new funds to expand across Indonesia, develop its tech-enabled omnichannel experience and expand its product range.