Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

BNPL—Bubble Now Popping Loudly? Recent changes have been surfacing amid the buy now, pay later (BNPL) payment service boom:- Klarna has announced a loss of $748 million for 2021 and is set to lay off 10% of its workforce as of May 2022. The company is also reportedly considering obtaining additional funding at a $15 billion valuation, less than half of its $46 billion valuation in 2021, according to the Wall Street Journal.

- Tech giant Apple announced its own BNPL service, called Apple Pay Later, in partnership with the Mastercard Installments program

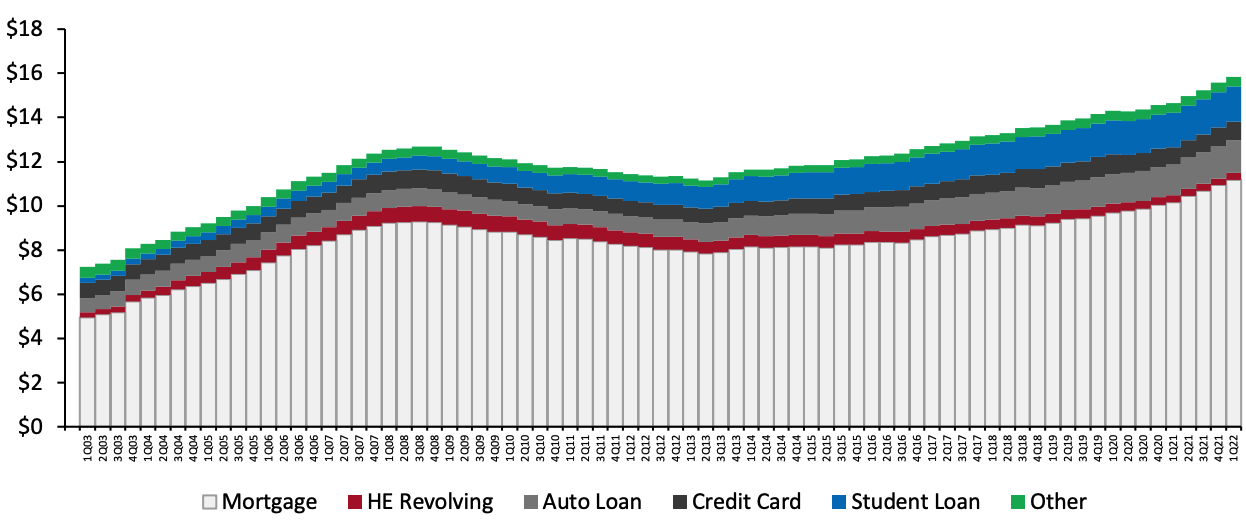

Figure 1. Total Debt Balance and Its Composition (USD Trl.) [caption id="attachment_150595" align="aligncenter" width="700"]

Source: Federal Reserve Bank of New York[/caption]

Apple’s announcement of its entry into BNPL has received a great deal of fanfare; and throughout its history, many of its major product releases have unleashed an army of imitators. The move comes amid Apple’s continuing diversification into subscription-based and service businesses, and perhaps more importantly, it signals that big tech is becoming interested in consumer finance.

Growing pains are natural in growing, innovative industries such as BNPL, with recent events showing that it is susceptible to economic and credit cycles. Still, the payment service has resonated with consumers with its unique offerings, and as BNPL’s scope broadens to include B2B customers, it could see a more stable customer base on the horizon.

Source: Federal Reserve Bank of New York[/caption]

Apple’s announcement of its entry into BNPL has received a great deal of fanfare; and throughout its history, many of its major product releases have unleashed an army of imitators. The move comes amid Apple’s continuing diversification into subscription-based and service businesses, and perhaps more importantly, it signals that big tech is becoming interested in consumer finance.

Growing pains are natural in growing, innovative industries such as BNPL, with recent events showing that it is susceptible to economic and credit cycles. Still, the payment service has resonated with consumers with its unique offerings, and as BNPL’s scope broadens to include B2B customers, it could see a more stable customer base on the horizon.

US RETAIL AND TECH HEADLINES

Dollar Tree Announces Changes in Top Executive Ranks (June 28) Company press release- Discount variety store Dollar Tree has announced the departure of its Chief Legal Officer, William Old; Chief Operating Officer, Thomas O’Boyle; Chief Strategy Officer, David Jacobs; and Chief Information Officer, Andy Paisley.

- The search for successors to these posts is underway, and the company is in “advanced discussions” with several candidates.

- Apparel specialty retailer Foot Locker plans to sell its Team Sales business, which is part of its Champs Sports banner, to sporting goods distributor BSN Sports. The deal is set to close in the coming weeks but the financial terms have not been disclosed.

- Team Sales is a prominent supplier of athletic footwear, apparel and sports equipment to US high school and college athletes. The business has historically accounted for less than 1% of Foot Locker’s annual sales, according to the company.

- In partnership with autonomous technology developer Waymo, North American supply chain solutions provider J.B. Hunt has onboarded home goods company Wayfair to its autonomous trucking program.

- The pilot will span six to eight weeks over July and August and will take place along the I-45 corridor between Houston and Dallas with Waymo’s Class 8 autonomous trucks. While the trucks operate without a driver, they will be supervised by two Waymo employees, a commercially licensed driver and a software engineer, from the vehicle’s cab.

- Grocery retailer Kroger has opened a customer fulfillment center (CFC) spanning 336,840 square feet in Pleasant Prairie, Wisconsin, in partnership with British technology provider Ocado. The automated facility will serve customers in Wisconsin, northern Illinois and northwest Indiana.

- Kroger currently operates CFCs in Ohio, Florida, Georgia, Texas and Wisconsin, with additional fulfillment centers planned for California, Maryland, Arizona, Michigan, North Carolina, Colorado and the Northeast region.

- Sportswear company NIKE has reported a sales decline of 1% year over year in its fourth quarter of fiscal 2022, ended May 31, 2022. NIKE-owned store sales declined by 2% and its diluted EPS was down 3%. The company’s gross margin decreased by 80 basis points (bps) to 45% due to elevated freight and logistics costs and higher obsolete inventory reserves in Greater China.

- NIKE gave guidance of low double-digit revenue growth on a currency-neutral basis for fiscal 2023. It expects gross margin to range from flat to a decline of up to 50 bps compared to the prior year.

EUROPE RETAIL AND TECH HEADLINES

Boohoo Introduces “Modest” Clothing Collection (June 27) ChargedRetail.co.uk- UK-based online fashion retailer Boohoo has introduced a “modest collection” in association with Graduate Fashion Week contest winner and student at the University of Central Lancashire, Sameera Mohmed.

- Mohmed’s collection has been designed with “modesty in mind” and aims “to create a diverse, more sustainable and modest clothing range that caters to all women no matter their race and belief.” The move comes as part of Boohoo’s commitment to mentorship and education in the fashion industry.

- Swedish fashion retailer H&M’s net sales increased by 20% year over year in the first half of fiscal 2022, ended May 31, 2022, driven by well-received collections that saw high full-price sales and lower costs for markdowns. The company reported a gross margin of 52.2%, up from 50.9% in the same period last year.

- For June 2022, the company expects sales to decline by 6% year over year, mainly due to paused sales in Belarus, Russia and Ukraine. H&M stated that it is accelerating its presence in Latin America and has signed numerous leases for new stores.

- Spanish apparel retailer and manufacturer Mango has announced plans to accelerate its Mango Kids business through the rollout of over 40 new Mango Kids stores globally by the end of this year.

- Mango is also set to roll out a Mango Teen store concept, following the opening of its first store for adolescents, in Barcelona in June. The company aims to have a network of 11 Mango Teen stores in Spain by the end of this year.

- UK-based high-street fashion retailer New Look has partnered with cloud-based headless commerce platform Commercetools to improve its e-commerce experience.

- Commercetools will help the retailer to update its checkout journeys, improve cart functionality and optimize pricing. New Look plans to phase out its existing system over the next 12 months.

- American online furniture and home goods company Wayfair plans to launch an online store in Ireland, offering more than one million home goods for Irish customers. It will also offer home-improvement products and a wide range of furniture and homeware from over 4,000 suppliers.

- Head of Wayfair Europe, Jens Uwe Intat, said that the company is “delighted that Irish shoppers can now join our 25 million strong active global customer base in accessing the very broadest selection of homewares to suit every home, style and budget.”

ASIA RETAIL AND TECH HEADLINES

Arzooo Raises $70 Million in Series B Funding Round (June 29) Inc42.com- Arzooo, an Indian business-to-business (B2B) retail tech start-up, has raised $70 million in its Series B fundraising round from Trifecta Leaders Fund and SBI Investment Japan. Arzooo has raised $83.5 million since its formation in 2018.

- The company will use the money to build out its technological base and grow its business. The firm stated that it will also keep increasing its stake in India's consumer electronics sector.

- Furniture company Castlery plans to open a new flagship store in Liat Towers in Singapore in the third quarter of 2022. The two-story store will span 24,000 square feet and provide jobs for 100 new employees by 2023.

- Declan Ee, Co-Founder of Castlery, said, “Even as we continue to plant more Castlery flags on the globe, the flagship store serves to anchor our presence in Singapore and reflects our unwavering commitment to staying true to our roots.”

- Bangladesh-based business-to-business (B2B) commerce start-up ShopUp has raised $65 million in a B4 funding round.

- The company raised $109 million in a Series B round six months ago, with participation from Valar Ventures, Tiger Global, Prosus Ventures, Flourish Ventures, Sequoia Capital and Veon Ventures. This follows a $34 million Series B extension round in January 2022 and a $75 million Series B round in September 2021.

- Solv, an Indian B2B digital marketplace, has raised $40 million in its latest round of funding led by SBI Holdings. With this round, Solv's total fundraising reached $80 million.

- The company plans to utilize the funding to expand to more than 300 cities across the country, create new, high-margin product categories, and accelerate the growth of its BNPL loans, particularly in the new-to-credit market. The company is also constructing an international tech stack to support the expansion of operations in a number of African and Southeast Asian countries.