Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

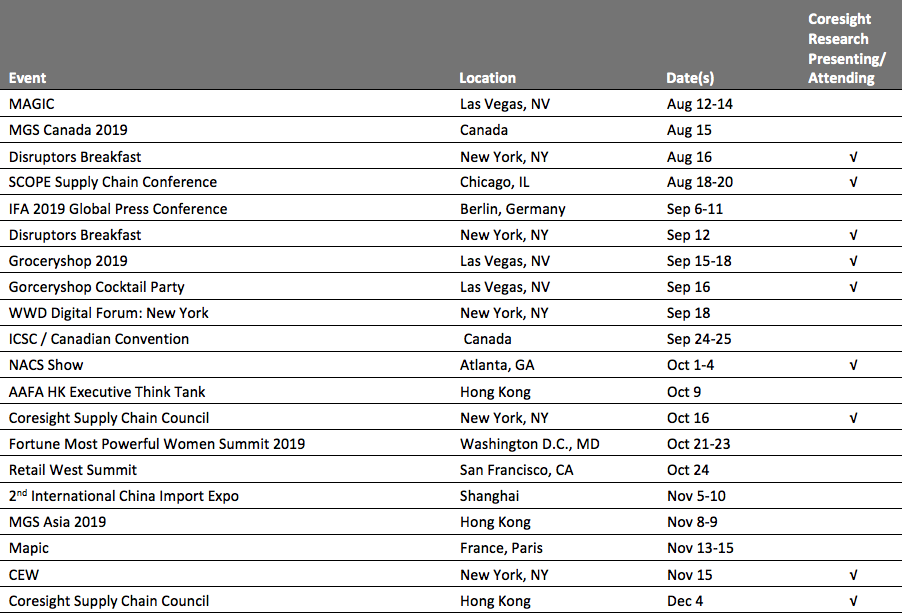

A Falling Pound Is Good News to Some The UK pound has been falling, spelling bad news for many retailers and consumers. Between July 1 and August 6, the pound fell 4% against the dollar and around 3% against the euro as expectations of a managed exit from the EU waned. Cumulative falls mean the pound is now at its lowest level against the dollar since the UK’s June 2016 vote to leave the EU. [caption id="attachment_94373" align="aligncenter" width="700"] To August 6, 2019

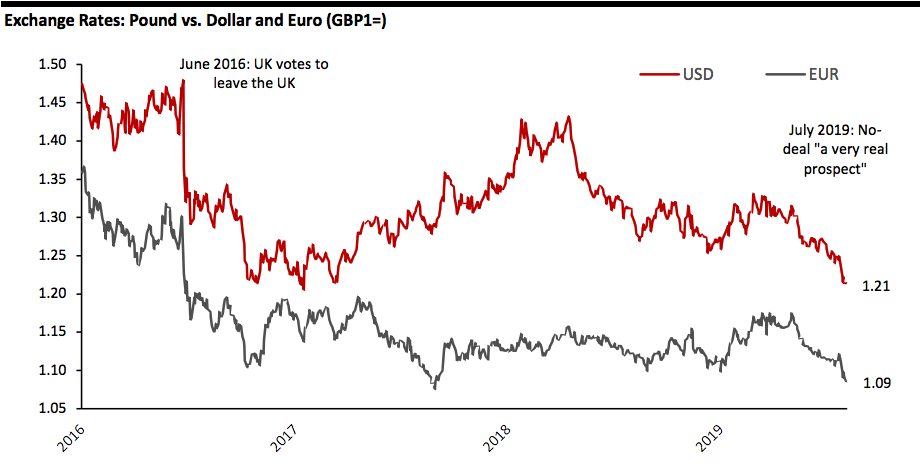

To August 6, 2019Source: S&P Capital IQ/Coresight Research[/caption] At the same time, those UK-domiciled firms that generate substantial sales abroad will enjoy a boost in reported revenues. Below, we show the proportion of revenues generated outside of the UK for UK-domiciled retailers in the Coresight 100, our company coverage list. The leadership of Burberry reflects the global nature of the luxury business, while the positions of ASOS and Boohoo illustrate the comparative ease of global expansion for pure-play fashion retailers. The data in the chart is for the latest fiscal year, and it varies by company. For Boohoo, any gains will come on top of already stellar international growth: in British pounds, the company grew US revenues 64% and rest of Europe revenues 72% in the three months ended May 31. For ASOS, the benefits will flatter reported US and continental Europe growth, which have recently been weaker due to operational issues: In the four months to June 30, ASOS grew US sales 12% and rest of Europe sales 5% (growth was weaker at constant exchange rates). Primark aside, major store-based mass-market retailers, who are perhaps the most in need of crutches amid highly competitive UK trading, will see limited impacts — as we show below, companies such as Tesco, Marks & Spencer and Next generate much less revenue overseas. [caption id="attachment_94374" align="aligncenter" width="700"]

*ABF provides a revenue split at group level, including nonretail operations; revenue split estimated for Primark from UK subsidiary accounts.

*ABF provides a revenue split at group level, including nonretail operations; revenue split estimated for Primark from UK subsidiary accounts.**Tesco international sales exclude Ireland, which is included in its UK & Ireland reporting segment.

***Represents Next International Retail and excludes international online sales.

Source: S&P Capital IQ/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- Sportswear retailer Nike has completed the acquisition of US-based retail predictive analytics and demand sensing firm Celect. Established in 2013, Celect has an intellectual property portfolio across data science and software engineering.

- The company’s cloud-based analytics platform offers hyper-local demand predictions to enable retailers to optimize inventory across omnichannel portfolios. The deal is expected to strengthen the retailer’s consumer direct offense strategy.

- FedEx is snipping another tie with Amazon.com as the e-commerce giant emerges as a competitor by building its own shipping network. The ground-delivery contract with Amazon won’t be renewed when it expires at the end of this month.

- FedEx is reducing its dependence on Amazon as the online retailer builds out its own logistics network and adds next-day air capacity with leased jets. Amazon is also starting a home-delivery service modeled after the contractor-based ground unit at FedEx.

Sears and Kmart to Close 26 Stores in October

(August 7) CNN

Sears and Kmart to Close 26 Stores in October

(August 7) CNN

- More than two dozen Sears and Kmart stores are closing as the company continues to struggle after emerging from bankruptcy. The parent company of Sears and Kmart said it plans to close five Kmart and 21 Sears stores across the US and Puerto Rico.

- Liquidation sales will begin in mid-August and the stores will close in late October. The company blamed "a generally weak retail environment" for the closures. It also attributed some of the company's problems to its ongoing court battle with Sears Holdings.

- Barneys New York, an icon of New York retail, filed for bankruptcy on August 6, with a plan to significantly reduce its footprint as it looks for a buyer to stave off liquidation. The retailer said it will focus on running only five of its more than 10 namesake stores.

- It plans to close stores in Chicago, Las Vegas and Seattle, as well as five smaller concept stores and seven Barneys Warehouse stores. Barneys said it has raised $75 million to support a sale process.

- CVS has a plan to win over millennials and it looks a lot like Amazon Prime: Free home delivery of products from shampoo to cold medicine, all for an annual membership fee of $48. CVS announced its CarePass program will expand nationwide.

- The company tested the membership in Boston, Philadelphia and Tampa (Florida). Consumers pay $5 a month or $48 annually for free delivery of drugstore products and prescription drugs, discounts on CVS-branded items, a monthly $10 coupon and access to a pharmacy hotline.

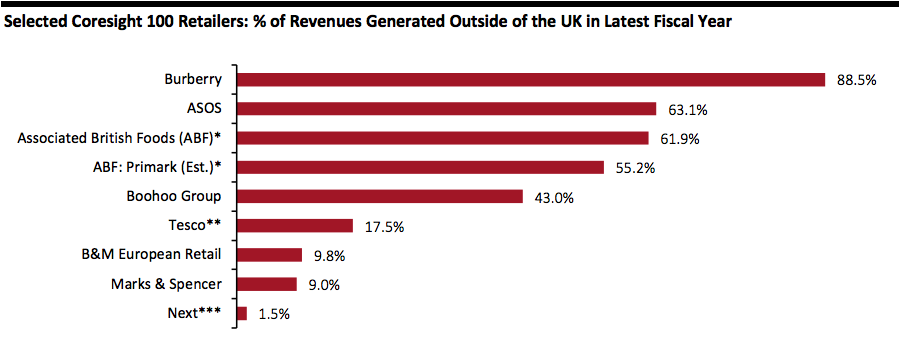

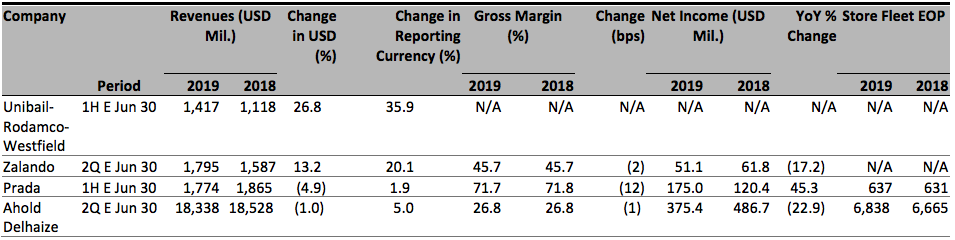

EUROPE RETAIL EARNINGS

[caption id="attachment_94381" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL AND TECH HEADLINES

- UK-based online fashion group Boohoo Group has purchased the online business and intellectual property rights of fashion brands Karen Millen and Coast from administrators for £18.2 million ($22.1 million).

- Boohoo believes the acquisition will complement its multi-brand platform and help the group lead the global fashion e-commerce market. Boohoo funded the purchase with existing cash resources.

- UK retail sales picked up 0.3% year over year in July, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales increased 0.1%. The BRC noted this is the lowest figure recorded for a July and comes after the worst June on record.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended July, total food sales declined 0.3% and total nonfood sales were down 2.1%. The 12-month average sales total fell to a new low of 0.5%. In July, the nonfood online penetration rate stood at 29.8%.

Sports Direct Buys Jack Wills for £12.75 Million

(August 5) News.Sky.com

Sports Direct Buys Jack Wills for £12.75 Million

(August 5) News.Sky.com

- Sky News reported that Sports Direct has acquired the ailing British fashion retailer Jack Wills for £12.75 million ($15.5 million) after the latter went into administration. The transaction includes Jack Wills stock, distribution center, 100 stores and its workforce across the UK and Ireland.

- Sky News also disclosed that Mike Ashley-owned Sports Direct and Edinburgh Woollen Mill Group, headed by Philip Day, were involved in a battle to purchase Jack Wills.

- Tesco will simplify operations across its 153 UK Metro stores to provide improved service in an increasingly competitive retail environment. The retailer also plans to make changes at 134 of its 1,750 Express stores by shortening opening hours at times when customer traffic is lower and by streamlining stock practices.

- Tesco stated that the changes will lead to around 4,500 job cuts. The retailer said it will help find alternative positions within Tesco for as many impacted employees as possible.

Ocado and Marks & Spencer Complete Joint Venture

(August 5) Company press release

Ocado and Marks & Spencer Complete Joint Venture

(August 5) Company press release

- British online supermarket Ocado has announced the completion of the sale of 50% of its retail business to Marks & Spencer (M&S). In February, M&S announced a 50/50 joint venture with Ocado to offer an online grocery delivery service, which launches September 2020.

- Ocado Retail has appointed M&S Strategy Director Melanie Smith as CEO, and interim Ocado Retail Managing Director Lawrence Hene as interim deputy CEO, until he transfers to a senior role with Ocado Group.

Hero Obtains $10 Million Series A Funding

(August 2) FashionNetwork.com

Hero Obtains $10 Million Series A Funding

(August 2) FashionNetwork.com

- On August 2, London-based startup Hero secured $10 million for its omnichannel retail technology in a Series A funding, managed by San Francisco venture capital firm S28 Capital in association with Vectr Ventures in Hong Kong and DIP Capital in London.

- Hero is designing a new app for its online customers to mirror the human interactions that take place in a physical retail environment. The investment will help Hero’s retail partners create new innovations and fast-track digitalization.

ASIA PACIFIC RETAIL AND TECH HEADLINES

- On the 70th anniversary of Onitsuka Tiger, Japanese sportswear brand Asics opened its largest Onitsuka Tiger flagship store in Shanghai. The new 5,060-square-foot store, opened on August 2, offers a full line of men’s, women’s and children’s footwear, and children’s apparel.

- Onitsuka Tiger also announced it has launched a cooperation project with seven designers from Japan and overseas.

- Indian e-commerce firm Flipkart, owned by Walmart, plans to add a free video streaming service to its app. The app, accessed by 160 million Flipkart customers in India, will showcase movies, short videos and web series.

Drunk Elephant to Expand its Footprint in Hong Kong and China

(August 5) WWD.com

Drunk Elephant to Expand its Footprint in Hong Kong and China

(August 5) WWD.com

- US-based skincare brand Drunk Elephant plans to expand its international footprint in Hong Kong and China this coming September. Earlier this year, the brand invited five influencers to New York to experience its products, and plans to expand product seeding to about 400 influencers in Hong Kong and China.

- Drunk Elephant will enter China through cross-border e-commerce with online retailer Tmall. The brand will launch its entire range of products in Hong Kong at the new Sephora stores in the IFC Mall and Causeway Bay, along with a two-day pop-up shop.

- Irish fashion label Simone Rocha has entered Asia with a new outlet on Ice House Street in Hong Kong’s central business district. This is its third standalone store globally: its other two are in London and New York.

- The 900-square-foot store aims to target customers from the greater China market and features the designer’s characteristic perspex furniture and hand-crafted sculptures that will be revamped each season.

Reliance Industries to Acquire 87.6% Stake in Fynd

(August 3) Reuters.com

Reliance Industries to Acquire 87.6% Stake in Fynd

(August 3) Reuters.com

- Indian conglomerate Reliance Industries plans to acquire an 87.6% stake in online store Shopsense Retail Technologies, also known as Fynd, for INR 2.95 billion ($42.33 million). Reliance Industrial Investments and Holdings, a wholly-owned subsidiary of Reliance Industries, may invest up to INR 1 billion ($14.2 million) more by the end of 2021.

- The Fynd platform allows offline vendors to sell merchandise directly to customers through its online store. Merchants can also manage inventory and sales across multiple demand channels.

Amazon in Early Talks to Buy Stake in India’s Reliance Retail

(August 1) EconomicTimes.com

Amazon in Early Talks to Buy Stake in India’s Reliance Retail

(August 1) EconomicTimes.com

- On August 1, the Economic Times reported that Amazon is in talks with Reliance Industries to acquire a 26% stake in Reliance Retail, India’s largest retailer in terms of revenue.

- Last year, Reliance was in talks with Alibaba to sell a stake in Reliance Retail, but a deal could not be sealed due to variances in valuation.

LATIN AMERICA RETAIL AND TECH HEADLINES

Crocs Opens New Store in Uruguay

(August 5) FashionNetwork.com

Crocs Opens New Store in Uruguay

(August 5) FashionNetwork.com

- US footwear brand Crocs has continued its expansion in Uruguay with the opening of a new store in the city of Las Piedras at the end of July. The store, located on the first floor of Las Piedras shopping mall, is the brand’s first exclusive location in the region.

- Crocs has its largest presence in the capital Montevideo, and in the Maldonado region. It also has an e-commerce site with national coverage.

- American lingerie brand Victoria’s Secret has launched its first Beauty & Brassieres concept store in Costa Rica in association with Panama-based conglomerate Grupo David. The Beauty & Brassieres concept currently operates only in Chile and Singapore.

- The expansion plan includes opening five outlets in Lima, including a flagship store in Jockey Plaza, which opened August 8. Gerardo Marcano, Retail Director of Grupo David, stated that in the coming months, Victoria’s Secret will open at least seven establishments in Peru, Panama and Colombia.

- Brazilian retail group GPA plans to open 15 Minuto Pão de Açúcar stores in office buildings by the end of 2019. The stores will cover a maximum area of 1,615 square feet and aim to offer customers a quick shopping experience.

- This concept is being tested using a pilot store at the company’s headquarters in São Paulo, which offers more than 2,000 items including drinks, snacks, cold and hot dishes. The store features self-checkout and scan-and-go payment options.

- Colombian menswear studio STF Man, a subsidiary of Studio F Group, opened a new 1,076-square-foot store in Cali, Colombia, on August 3. The store is at the Jardin Plaza de Cali shopping center and is part of the company’s development plan.

- STF Man also offers a complete collection of merchandise through the Studio F e-commerce platform. Customers can purchase online and receive deliveries throughout the country.

- Colombian luxury beauty chain Blind, a subsidiary of ProSalon Group, plans to expand in Colombia with at least seven store openings by the end of 2020.

- Blind currently has 13 stores in seven cities in Colombia. It intends to open two new stores in Bogotá by end of the year.

- Argentinian footwear company John Foos has developed a new online store that uses the Brazilian e-commerce platform Vtex. Customers can purchase all designs directly through the site with free shipping.

- John Foos has also integrated the online payment system Mercado Pago, developed by Mercado Libre, into its new platform so users can make payments via interest-free installments.

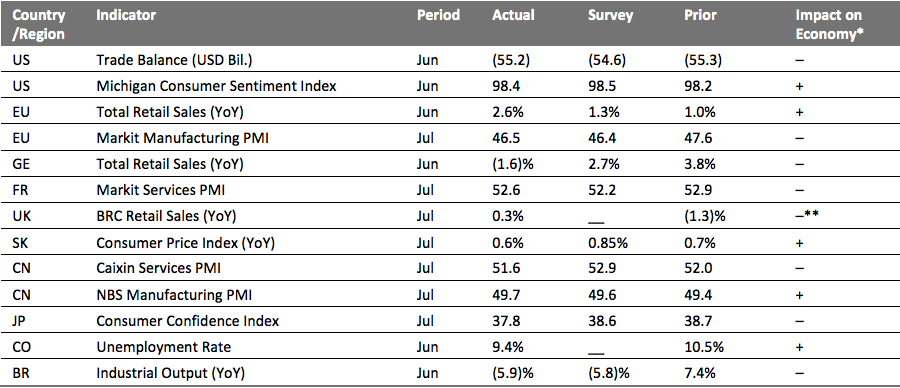

MACRO UPDATE

Key points from global macro indicators released July 31– August 6, 2019:- US: In June, the US registered a trade deficit of $55.2 billion, improving slightly over the $55.3 billion deficit in May. The University of consumer sentiment index increased slightly to 98.4 in June, from 98.2 in May.

- Europe: Total retail sales by volume in the eurozone increased 2.6% year over year in June, ahead of the consensus estimate of 1.3% and above the 1% growth in May. In Germany, total retail sales in real terms fell 1.6% year over year in June, below the consensus estimate of 2.7% and the 3.8% growth in May.

- Asia Pacific: Korea’s consumer price index increased 0.6% year over year in July, falling marginally from the 0.7% growth recorded in June. In China, the manufacturing Purchasing Managers’ Index (PMI) improved by three percentage points from 49.4 in June to 49.7 in July, narrowly missing the consensus estimate of 49.6.

- Latin America: In June, Colombia registered a 9.4% unemployment rate, an improvement over the 10.5% rate in May. Brazil recorded a steep decline of 5.9% in its year-over-year industrial output, contrasting the robust 7.4% growth in May.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.**Despite an improvement over total retail sales recorded in June, the total retail sales growth in July has a negative impact on the economy because it is the lowest figure for July since BRC started its survey. This is over and above the lowest figure for June recorded last month.

Source: Bureau of Economic Analysis/University of Michigan/EuroStat/IHS Markit/Statistisches Bundesamt Deutschland/British Retail Consortium/National Statistical Office, South Korea/Cabinet Office, Japan/DANE, Colombia/IBGE, Brazil[/caption]

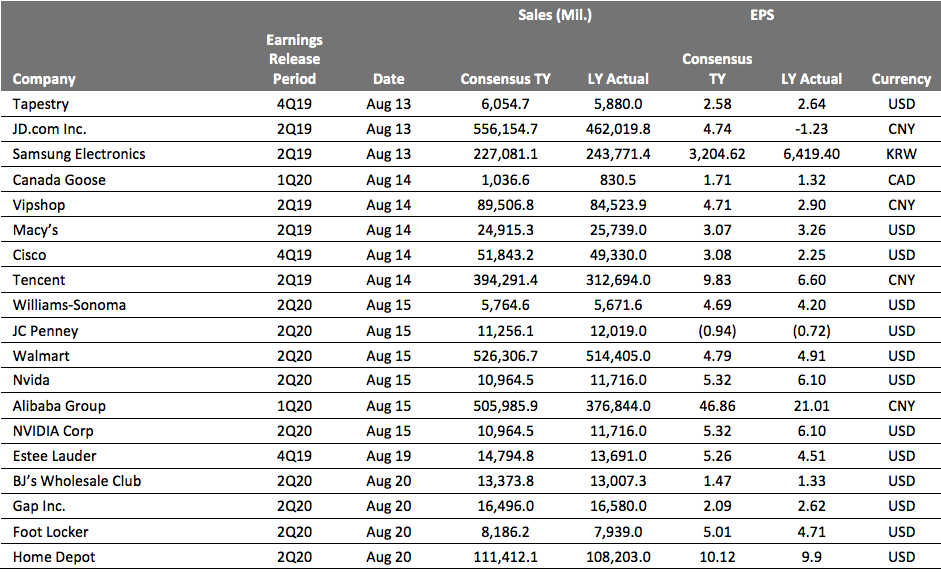

EARNINGS CALENDAR

[caption id="attachment_94406" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR