DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Beauty Expands Boundaries into Bold New Areas with New Ingredients, Indications and Business Models The global beauty market is expanding to include mind and body. Consumers are choosing beauty, health and wellness as a holistic lifestyle, to include prevention, nutrition and mental wellbeing. Major beauty players are evolving and new brands emerging to take a more holistic approach to beauty that includes a more scientific approach to mind and body with formulations and apps to support overall health and wellness. Traditional beauty and cosmetics are still relevant, but the market is expanding to offer opportunities for new entrants that focus on products in solution-based skin care, prevention, self-care, mental health and edibles. The global skin care market is evolving as consumers prioritize skin health and beauty wellness. Consumers around the world are increasingly focusing on beauty products that integrate health and wellness aspects, such as anti-aging properties, sun protection, protection against the effects of pollution and overall skin care. Increasingly, consumers are realizing their skin is a living, breathing organ that needs care just as the rest of their bodies do. Consumers are turning to solution-based beauty products, also known as dermo-cosmetics, often recommended by a dermatologist or medical professional. The brands offer healing, relief or medical treatment of skin ailments. The products include claims from experts, are endorsed by dermatologists or other professionals. This implies that beauty companies are collaborating with, and acquiring, health labs and research firms to make the most of the expertise they offer and that traditional health labs, medical and research companies are entering the beauty space with their own products. Prevention and skin protection are beauty values. Consumers are increasingly turning to skin care routines to lessen sun damage, reduce the impact of pollution and prevent premature aging. Sunscreen, once a used at the pool or beach, is now working its way into everyday products as consumers value prevention and protection against the sun’s rays. According to the NPD Group, the prestige beauty market saw a 29% increase in spending on skincare products with SPF last year. Consumers are also eating and drinking beauty benefits. In the spirit of feeling healthy and looking radiant from the inside out, consumers are eating and drinking powders and supplements for healthier skin, hair and bodies. According to a Mintel study in 2017, 41% of US women aged 18-34 use an oral supplement to enhance their appearance. Asia Pacific accounted for the highest share of the global beauty supplements market and is expected to continue to dominate the market to the end of 2024, according to Research and Markets. Japan is the largest, followed by China and Korea – due in large part to rising male interest in beauty supplements. Europe has a more than 25% share of the global beauty supplements market, with Western European countries such as France, Germany and the UK accounting for a major share. The Europe beauty supplements market is driven by rising concerns over health, according to the study. Europe is closely followed by North America, due to similar disposable income levels and celebrity endorsement. Technology apps and beauty videos promote mental wellbeing with self-care apps and detox videos. As the definition of beauty expands to include health and happiness from within, technology companies are launching apps to encourage users to incorporate routines that “detox” negative routines and replace them with positive ones. Self-care apps encourage consumers to reduce anxiety, feel calm and sleep well. Consumers are choosing beauty health and wellness as a holistic lifestyle, encompassing prevention, nutrition, and mental wellbeing – offering opportunities for new entrants to the category. Consumers are also eating and drinking powders and supplements for healthier skin, hair and bodies, which is also drawing a new wave of entrants into the beauty space. Get more insights on beauty’s shifting landscape from our deep dive Beauty Wellness.

US RETAIL & TECH HEADLINES

Shoemaker Cole Haan Preps IPO as Athleisure Focus Boosts Sales

(August 26) Bloomberg

Shoemaker Cole Haan Preps IPO as Athleisure Focus Boosts Sales

(August 26) Bloomberg

- Premium shoemaker Cole Haan, acquired in 2013 by private equity firm Apax Partners from Nike, is preparing for an initial public offering following robust sales and profit growth. The company is starting discussions with investment banks, timing was not disclosed.

- Cole Haan boosted revenue 14% to $687 million in the fiscal year ended June 1, according to company statements. Adjusted earnings before interest, taxes, depreciation and amortization jumped 56% to $95.3 million.

7-Eleven Introduces Mobile Checkout in NYC

(August 26) Retail Dive

7-Eleven Introduces Mobile Checkout in NYC

(August 26) Retail Dive

- 7-Eleven announced it has launched mobile checkout in New York City stores. Customers who use the 7-Eleven app and accompanying 7Rewards loyalty program can skip the checkout counter and pay for purchases via the app.

- Mobile checkout is integrated into the chain's loyalty program, allowing users to earn and redeem rewards when they use the new feature. Mobile checkout works for “most 7-Eleven merchandise that has a bar code,” according to the company.

Disney Will Put Dozens of Stores Inside Target Locations, Target Set to Open at Walt Disney World

(August 25) CNBC

Disney Will Put Dozens of Stores Inside Target Locations, Target Set to Open at Walt Disney World

(August 25) CNBC

- Target announced it will open dozens of permanent Disney stores within its own stores over the next year, as it invests in more unique ways to lure customers. By early October, 25 Disney stores will open inside Target stores across the country, in cities including Philadelphia, Denver and Chicago.

- Target will also launch a Disney-themed experience on its website, that lets shoppers buy products from the Pixar, Marvel and Star Wars brands, among others.

Afterpay’s Buy Now, Pay Later Option Adds New Merchants

(August 26) PYMNTS

Afterpay’s Buy Now, Pay Later Option Adds New Merchants

(August 26) PYMNTS

- Afterpay, a company provides financing so shoppers can buy now and pay later (without the use of a credit card), has partnered with J.Crew and Ulta Beauty to bring the payment option to their customers.

- The two join some 6,500 other US retailers the company says already use the service. Afterpay, based in Australia and part of Afterpay Touch Group, reported a sales volume run rate of upwards of $1.2 billion from two million customers in July.

- Costco is diving into the thorny area of food retail in China with its first store opening this week, but analysts warn it faces a tough ride as it looks to succeed where a series of international retailers have failed.

- China has proved a brutal battleground for overseas food retailers in recent years, with many failing to understand consumer habits and tastes as well as local competitors building a stronger presence. That said, Costco’s foray seems to have proven popular: The store was so overwhelmed with customers it was forced to close.

EUROPE RETAIL AND TECH HEADLINES

Carpetright’s Revolving Credit Facility Bought by Shareholder

(August 27) RetailGazette.co.uk

Carpetright’s Revolving Credit Facility Bought by Shareholder

(August 27) RetailGazette.co.uk

- British flooring retailer Carpetright has announced that its biggest shareholder, Meditor, has agreed to buy its revolving credit facility from creditors NatWest and Allied Irish Banks.

- The contract will see asset manager Meditor take over the £40.7 million ($50 million) facility.

Topshop and Topman Added to Shop Direct’s Portfolio of Brands

(August 27) TheRetailBulletin.com

Topshop and Topman Added to Shop Direct’s Portfolio of Brands

(August 27) TheRetailBulletin.com

- British online retailer Shop Direct has added Arcadia-owned fashion brands Topshop and Topman to its portfolio of more than 500 fashion names. It is the first UK retailer outside the Arcadia Group to stock Topshop Beauty products.

- Shop Direct’s retail brands Very and Littlewoods began offering over 500 Topshop fashion lines and 200 Topshop beauty products, and is due to expand to 2,000 product lines during the autumn/winter season.

Boohoo Parts Ways with Karen Millen’s Top Crew

(August 25) Telegraph.co.uk

Boohoo Parts Ways with Karen Millen’s Top Crew

(August 25) Telegraph.co.uk

- UK-based online fashion retailer Boohoo Group has parted ways with Karen Millen’s top management, including CEO Beth Butterwick, just weeks after buying it out of administration. Boohoo Group has considered shutting 32 stores and 177 concessions, putting a further 1,000 jobs at stake.

- Earlier this month, Boohoo paid £18 million ($22 million) for the online business of British brands Karen Millen and Coast, together with all associated intellectual property rights.

Schuh Benner Acquires Schuh Sauer

(August 23) FashionNetwork.com

Schuh Benner Acquires Schuh Sauer

(August 23) FashionNetwork.com

- German footwear retailer Schuh Benner has announced it will acquire Frankfurt-based shoe and workwear retailer Schuh Sauer. All employees of Schuh Sauer, stock and facilities will be transferred to Schuh Benner on November 1, 2019.

- Schuh Benner plans a complete renovation of the stores by March 2020. The acquisition will help Schuh Benner reach Schuh Sauer’s oversized and undersized category.

Albert Heijn Launches Savings Campaign with New Digital Feature

(August 26) Company press release

Albert Heijn Launches Savings Campaign with New Digital Feature

(August 26) Company press release

- Dutch supermarket chain Albert Heijn has launched a digital savings feature in its AH app to support a new promotional campaign over 13 weeks starting August 26. During the campaign, customers can collect digital savings stamps based on purchases and redeem them for crystal glasses.

- Shoppers will receive a stamp for every €10 ($11) spent at Albert Heijn stores or online, 20 stamps plus a €2.99 ($3.3) surcharge gets a set of two glasses.

Folli Follie Authorizes Financial Advisers to Mull Possible Sale of UK Unit

(August 26) Reuters.com

Folli Follie Authorizes Financial Advisers to Mull Possible Sale of UK Unit

(August 26) Reuters.com

- Greece-based Folli Follie has asked financial advisers to consider selling its British luxury jewelry brand Links of London. Last month, an audit found that Folli Follie overstated revenues for 2017 by more than €1 billion ($1.1 billion).

- Folli Follie has presented an alternative restructuring proposal for creditors after its previous proposal failed. Its founder Dimitris Koutsolioutsos resigned after Folli Follie was fined by Greece’s securities watchdog and its shares suspended from trading.

ASIA RETAIL AND TECH HEADLINES

China’s Antitrust Authorities Approve Suning’s Acquisition of Carrefour China

(August 26) Company press release

China’s Antitrust Authorities Approve Suning’s Acquisition of Carrefour China

(August 26) Company press release

- The State Administration for Market Regulation (SAMR), a body that regulates market competition in China, has approved retail group Suning.com’s bid to acquire an 80% stake in Carrefour’s China business.

- The transaction is expected to close by September 2019. After the acquisition, five out of the seven seats on Carrefour China’s supervisory board will be filled by Suning.

Everlane Launches Store on Tmall Global

(August 26) Alizila.com

Everlane Launches Store on Tmall Global

(August 26) Alizila.com

- US clothing retailer Everlane launched a store on Alibaba’s Tmall Global platform on August 26. It is the company’s first third-party sales channel in China; Everlane also sells through its own website.

- Everlane’s Tmall Global store offers a range of menswear, womenswear, footwear and accessories. Tmall currently sells over 20,000 brands on its site and plans to double that number in the next three years.

Monocle Launches Its First Travel Retail Store at Hong Kong Airport

(August 27) InsideRetail.Asia

Monocle Launches Its First Travel Retail Store at Hong Kong Airport

(August 27) InsideRetail.Asia

- Global media brand Monocle has partnered with Paris-based Lagardere Travel Retail to open its first travel retail concept store at Hong Kong International Airport.

- The 2,045-square-foot store offers travel essentials, books, apparel and accessories tailored to local Hong Kong customers as well as international visitors.

IKEA China Plans to Invest $1.4 Billion in Expansion

(August 26) InsideRetail.Asia

IKEA China Plans to Invest $1.4 Billion in Expansion

(August 26) InsideRetail.Asia

- IKEA China plans to invest $1.4 billion to digitalize and strengthen the company’s business operations by the next financial year.

- IKEA China will open four new stores by the end of this year as well, as it also works to expand its online presence.

Alibaba Halts Fresh Investments in India

(August 25) LiveMint.com

Alibaba Halts Fresh Investments in India

(August 25) LiveMint.com

- Alibaba Group, which has invested in many Indian startups, has reportedly paused investment in the country as it reviews its India strategy.

- Alibaba’s current investment portfolio in India includes e-commerce payment company Paytm, online food delivery service Zomato, online grocery service BigBasket, e-commerce shopping site Snapdeal and logistics firm Xpressbees.

Shopee App Is Singapore’s Most Downloaded Shopping App

(August 26) InsideRetail.Asia

Shopee App Is Singapore’s Most Downloaded Shopping App

(August 26) InsideRetail.Asia

- The Singapore e-commerce platform Shopee app is now the most downloaded shopping app in Singapore, and the most actively used shopping app in Southeast Asia.

- On average, the app had 2.8 million visitors per month in the second quarter ended June 2019, an 11% increase from the previous quarter, according to the company.

Price Rite’s New Hong Kong Store Embraces Omnichannel – and Accepts Cryptocurrency

(August 26) InsideRetail.Asia

Price Rite’s New Hong Kong Store Embraces Omnichannel – and Accepts Cryptocurrency

(August 26) InsideRetail.Asia

- US supermarket chain Price Rite has opened a new store in Hong Kong’s MegaBox shopping center, claiming to be the first retail chain store in Hong Kong to accept cryptocurrency.

- The store has a smart kiosk which provides information on the availability of products at the store and suggests alternative stores for unavailable products. The store also features an updated version of Softbank’s humanoid robot Pepper.

LATIN AMERICA RETAIL AND TECH HEADLINES

Linio Offers New Products and Services in Colombia

(August 25) FashionNetwork.com

Linio Offers New Products and Services in Colombia

(August 25) FashionNetwork.com

- E-commerce site Linio, owned by Chile-based retailer Falabella, has launched new products and services in Colombia as it aims to become the largest virtual shopping center in the country, using the slogan “It’s not online, it’s on Linio.”

- Linio now offers BOPIS that lets shoppers to buy online and collect at Falabella and Home Center stores in Colombia. It currently offers over 1.5 million products from 2,000 companies and affiliated brands online.

Mercado Libre Introduces QR Code-Based Payments in Chile

(August 23) America-Retail.com

Mercado Libre Introduces QR Code-Based Payments in Chile

(August 23) America-Retail.com

- Argentinian e-commerce firm Mercado Libre has launched a new form of payment via QR codes in Chile.

- Merchants will get a unique QR code that consumers scan to pay through the Mercado Libre or Mercado Pago apps, no point of sale device needed.

Walmart to Invest in Chile to Boost Omnichannel Experience

(August 23) America-Retail.com

Walmart to Invest in Chile to Boost Omnichannel Experience

(August 23) America-Retail.com

- Walmart plans to allocate nearly $700 million to investments in Chile over the next three years and boost its omnichannel presence in the country. Walmart hopes to open 50 new stores and 150 pickup stations as well as remodel 60 stores.

- Walmart Chile CEO Horacio Barbeito said that Walmart will allocate around $100 million to technology and new platform developments.

Rappi Opens in Concepción, Chile

(August 26) America-Retail.com

Rappi Opens in Concepción, Chile

(August 26) America-Retail.com

- Colombian delivery services startup Rappi has launched in Concepción, Chile. Deliveries from supermarkets and restaurants began on August 28 and deliveries from convenience stores and liquor stores will begin in September.

- Rappi will initially provide limited delivery coverage of just 10 square kilometers (less than four square miles) that mainly cover the Plaza Trébol Mall and the center of Concepción, with plans to extend its coverage in the future.

Americanino Plans Omnichannel Expansion in Colombia

(August 26) FashionNetwork.com

Americanino Plans Omnichannel Expansion in Colombia

(August 26) FashionNetwork.com

- Italian fashion house Americanino, which will mark 30 years Colombian this year, plans an omnichannel expansion.

- Americanino will now offer BOPIS. The company has 55 stores and has operated an online store for the last five years in Colombia.

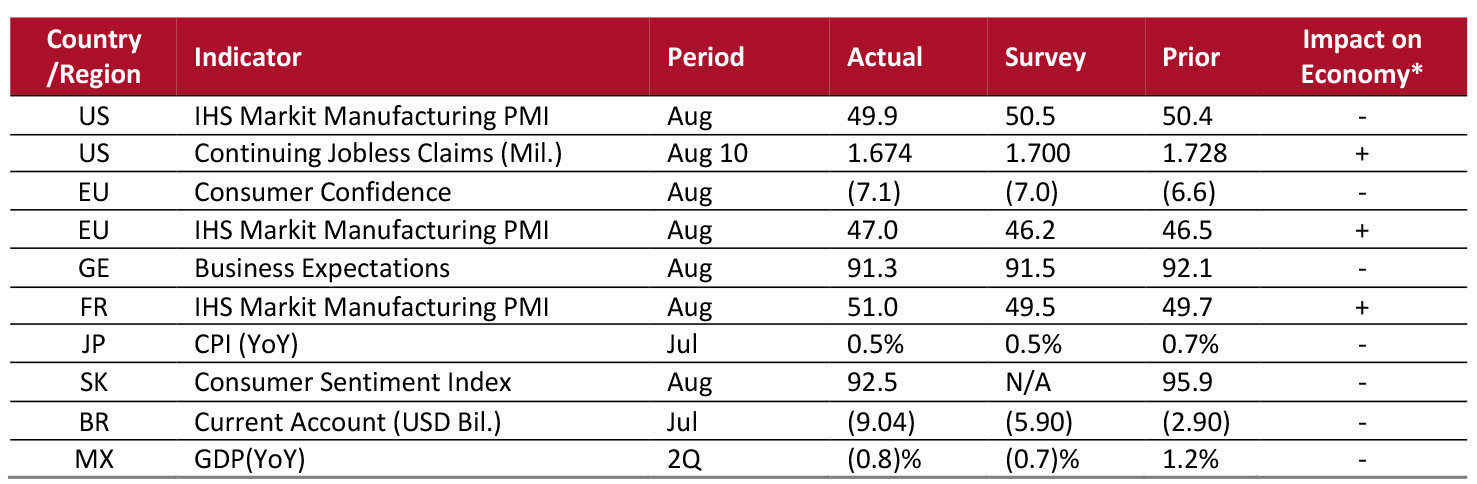

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: Markit Economics/US Department of Labor/European Commission/ifo Institute/Statistics Bureau of Japan/Bank of Korea/Banco Central do Brasil/INEGI/Coresight Research [/caption] EARNINGS CALENDAR [caption id="attachment_95401" align="aligncenter" width="700"]

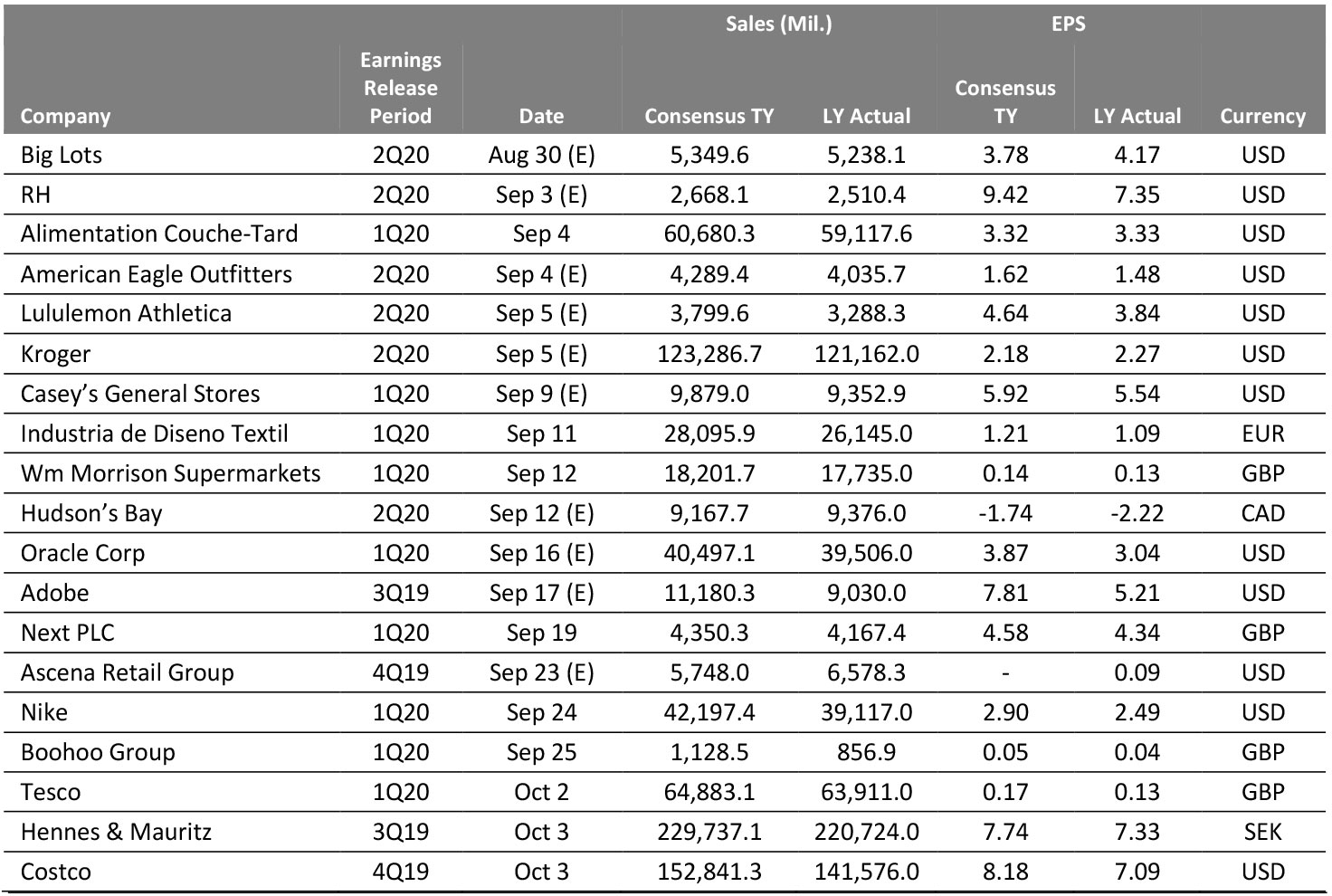

Source: Bloomberg[/caption]

EVENT CALENDAR

Source: Bloomberg[/caption]

EVENT CALENDAR