From the Desk of Deborah Weinswig

Retail-Tech Partnerships Are the Wave of the Future

Although retail and high-tech companies may appear on the surface to have little in common, they are increasingly forming partnerships in order to provide each other with needed expertise and market access. These collaborations are necessary because no single entity from either sector has the comprehensive knowledge or expertise to integrate retail and tech platforms.

Thus, retailers are increasingly turning to tech companies for solutions that use artificial intelligence (AI), machine learning and the Internet of Things (IoT) to improve operational efficiency and the customer experience and to offer consumers more shopping channels. At the same time, many tech firms are seeking to partner with retailers in order to expand beyond the traditional tech space into other vertical markets to fuel growth as product categories such as mobile phones mature.

The growing number of major partnerships also appears to be a response to the increasing threat from Amazon, whose e-commerce and technology platforms are creating serious competition for both retailers and tech companies. Two significant retail-tech partnerships were recently announced, one between Walmart and Microsoft and one between French retailer Carrefour and Google.

Walmart and Microsoft announced their strategic partnership in early June. The goal is to accelerate Walmart’s digital transformation, enabling the retailer to embrace cloud computing, AI and IoT technologies as well as enhance its retail operations. Walmart is undertaking a series of cloud innovation projects that leverage machine learning, AI and data solutions for customer-facing services and internal business applications. The company also plans to use these technologies to enhance the customer experience by providing convenient ways to shop. Walmart will use Microsoft’s Azure platform to provide cloud-powered checkout on its e-commerce sites. It will also build a global IoT platform to connect heating, ventilation, and air conditioning and refrigeration units in order to reduce energy consumption. The company plans to use machine learning to route its supply chain trucks more efficiently and to use Microsoft apps to enable its associates to be more productive.

Also in June, Carrefour announced a strategic partnership with Google. The collaboration is designed to help Carrefour digitally transform its operations by introducing technologies such as AI, cloud computing, the IoT and new shopping interfaces. The partnership aims to open three new shopping channels for French consumers, the first through the AI-powered Google Assistant device, the second via Google Home smart-home technology and the third through the Google Shopping e-commerce platform. The companies expect to offer these three channels to shoppers in France in 2019. In addition, Carrefour plans to implement Google Cloud, the tech company’s cloud suite, and G Suite, its business productivity platform, in order to increase collaboration and enhance productivity. Carrefour also announced that it plans to open an innovation lab this summer in Paris, where the two companies will develop new ways to improve the customer experience.

Through these retail-tech partnerships, the retailers are also looking to reduce costs and increase productivity. In a recent survey conducted by the Consumer Technology Association, the top three expected benefits from the application of AI are cost savings, increased productivity and increased revenue. The Carrefour-Google partnership will enable Carrefour to offer shoppers new and more convenient ways to shop, which should boost conversion and encourage customer loyalty. The system will offer Carrefour customers the same ability to order groceries via intelligent assistant that Amazon Prime customers already possess via Alexa.

These two partnerships are likely just the beginning. In another notable collaboration, French retail giants Auchan, Casino and Schiever recently announced an alliance with German retailer Metro, with the goal of launching a purchasing platform called Horizon that will help the retailers coordinate purchasing in France and internationally. We expect to see more retailers and tech companies pair up in the future in order to compete with Amazon.

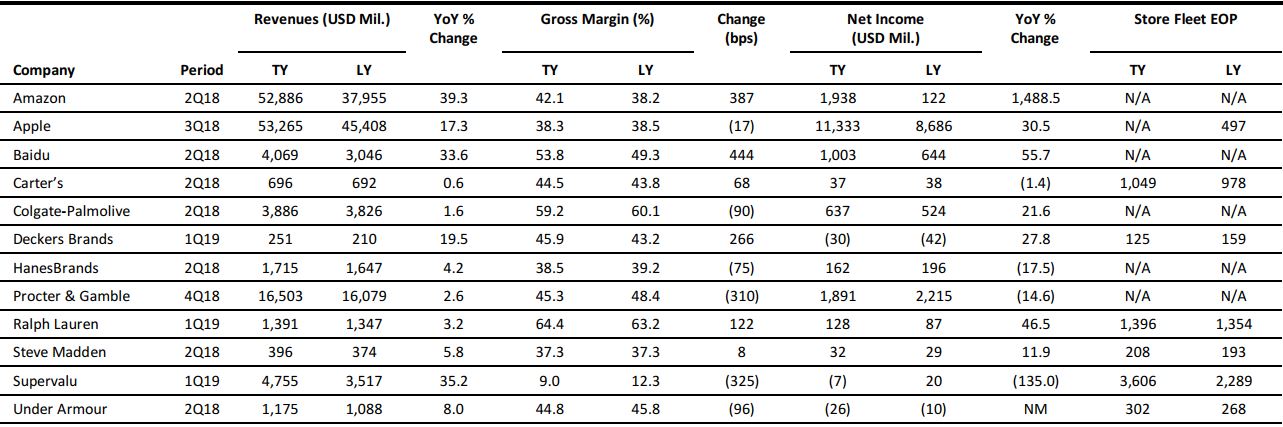

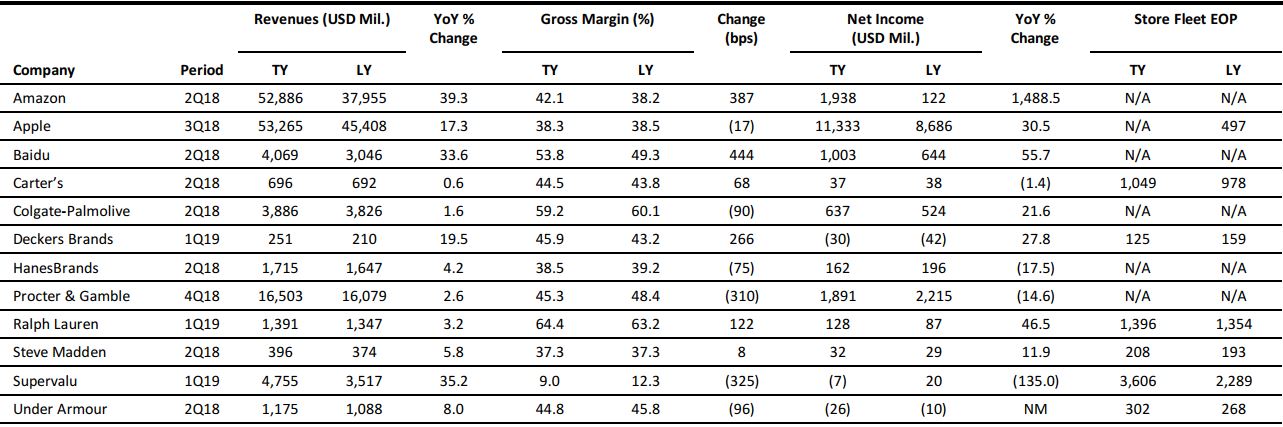

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Nike Has a Plan to Survive Retail’s Existential Crisis—and It’s Working

(July 30) Qz.com

Nike Has a Plan to Survive Retail’s Existential Crisis—and It’s Working

(July 30) Qz.com

- Retail has been in a state of flux, particularly in the US. Nike has seen the disruption as an opportunity to pull back from all the “undifferentiated, mediocre retail” out there and take more control of its sales by increasing its own direct-to-consumer business.

- To fuel direct sales, Nike continues to invest in its own stores and its fast-growing digital business, which CEO Mark Parker highlighted as being particularly strong on the company’s recent call with investors. It’s also trying to bring the two increasingly together.

Walmart Discovers Why the “Last Mile” Is the Hardest

(July 30) CNBC.com

Walmart Discovers Why the “Last Mile” Is the Hardest

(July 30) CNBC.com

- Last year, Walmart executives described a radical plan to help the company fend off Amazon and other online delivery services stealing its customers. Walmart’s own store employees would bring online orders directly to shoppers’ homes after completing their usual shifts.

- But months later, Walmart quietly retreated from its original vision for the pilot program—launched in New Jersey and Arkansas—and ended it altogether in January, according to company documents and interviews with more than two dozen Walmart employees.

Online Out-of-Stocks Cost $22 Billion in Sales

(July 30) RetailDive.com

Online Out-of-Stocks Cost $22 Billion in Sales

(July 30) RetailDive.com

- Worldwide, consumer brands and retailers could gain $22 billion by recapturing sales lost when customers can’t find what they’re looking for, according to a new report from the Grocery Manufacturers Association. At the same time, the potential losses for manufacturers and retailers are likely to double unless retailers take corrective action.

- In the US, 15% of consumers encountering an out-of-stock online switched sites to buy the item, while 60% bought a substitute from the same online merchant. Of that 60%, half switched brands and half found a substitute from the same brand.

Amazon’s E-Commerce Now Delivering More to Bottom Line

(July 27) EssentialRetail.com

Amazon’s E-Commerce Now Delivering More to Bottom Line

(July 27) EssentialRetail.com

- Amazon reported second-quarter profit of $2.53 billion for the three months ended June 30. An analyst at market intelligence group eMarketer commented that “the bigger story coming out of earnings is the significant margin expansion being driven by the acceleration in the cloud and advertising businesses. There’s still a lot of runway for both of these businesses.”

- Marketplace sales currently represent 68% of Amazon’s worldwide and US sales. eMarketer forecasts that Amazon will own a 49.1% share of all e-commerce spending in the US this year, and 4.9% of all retail spending across online and physical retailing.

American Retailers Are Using Alipay to Attract Chinese Tourists

(July 26) Digiday.com

American Retailers Are Using Alipay to Attract Chinese Tourists

(July 26) Digiday.com

- American retail brands are using Alipay in hopes it will attract more Chinese customers. This week, apparel brand Guess announced that 50 of its stores began accepting Alipay. San Francisco shopping center Pier 39 added 43 merchants to the platform.

- With 870 million users, Alipay is quickly becoming one of the world’s largest mobile payment platforms. For Guess, adding Alipay is also part of its China growth strategy; by letting Chinese customers use Alipay in the US, the company is creating a similar experience to shopping at Guess locations in China.

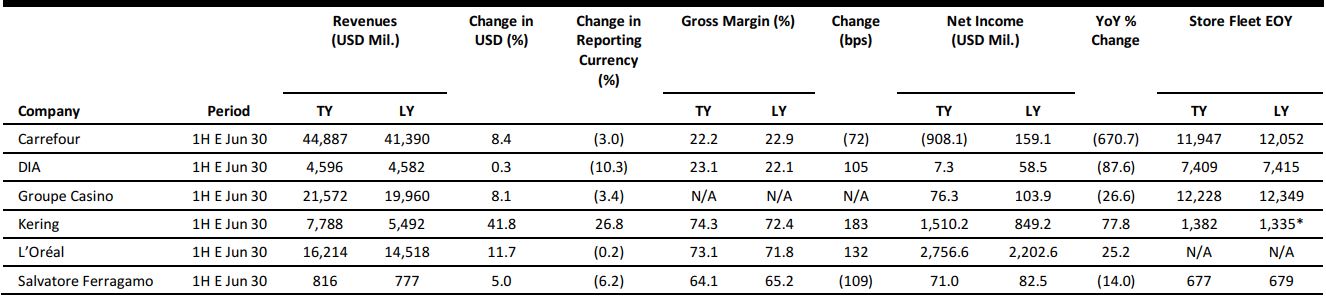

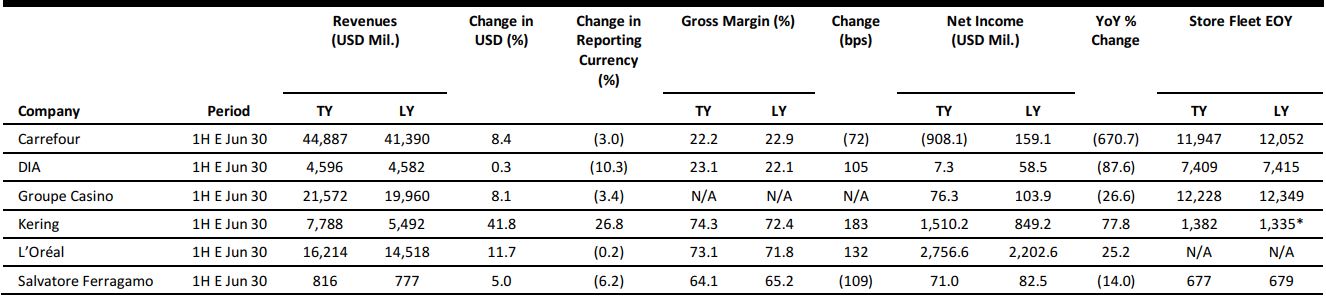

EUROPE RETAIL EARNINGS

*Store numbers are as of the end of fiscal year 2017.

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

H&M Partners with GP & J Baker to Launch a New Apparel Range

(July 30) TheRetailBulletin.com

H&M Partners with GP & J Baker to Launch a New Apparel Range

(July 30) TheRetailBulletin.com

- Swedish fashion retailer H&M has partnered with British textile and wallpaper brand GP & J Baker to launch a new apparel range. The collection will be available in stores and online beginning August 2.

- The collection features apparel with silhouettes, puff shoulders, balloon sleeves, lace inserts and contrast print trims. The range focuses on sophisticated and romantic pieces.

Marks & Spencer (M&S) Partners with Decoded to Launch Retail Data Academy

(July 30) Company press release

Marks & Spencer (M&S) Partners with Decoded to Launch Retail Data Academy

(July 30) Company press release

- British retailer M&S and technology education provider Decoded have partnered to launch M&S Data Academy, an initiative aimed at familiarizing more than 1,000 M&S employees with technologies such as artificial intelligence and machine learning.

- Decoded Founder Kathryn Parsons said, “This is a pioneering and inspiring commitment to lifelong learning and future-facing skills. Every leader in business today should take note. Education is the answer to the fourth Industrial Revolution.”

Beter Bed Reports Net Fall in Financials; Germany Business Shrinks Results

(July 30) RetailDetail.eu

Beter Bed Reports Net Fall in Financials; Germany Business Shrinks Results

(July 30) RetailDetail.eu

- Dutch retail chain Beter Bed reported a 3.9% revenue decline and a 7.9% profit decline in the first half of its fiscal year. Turnover in Germany fell by 9.4%, due to a scandal involving toxins detected in mattresses and pillows sold by the retailer.

- Belgium posted the highest growth in turnover in the first half, at 48.6%, while Sweden registered a 13.8% hike in turnover. Beter Bed anticipates unprofitable business in Spain and plans to sell its local unit there later this year.

House of Fraser in Talks with Mike Ashley for Rescue Bid

(July 31) RetailGazette.co.uk

House of Fraser in Talks with Mike Ashley for Rescue Bid

(July 31) RetailGazette.co.uk

- Bankers acting for House of Fraser held discussions with executives representing Mike Ashley, a retail businessman who holds an 11% stake in the British department store, regarding the possibility of Ashley providing House of Fraser with a £50 million ($59 million) loan.

- The news surfaced as it was revealed that Chinese international retailer C.banner has delayed its promised payment of £70 million ($91 million) to House of Fraser until October 31 amid legal filings by a group of landlords against House of Fraser.

Albert Heijn and Jumbo Launch Dutch-Specific Google Assistant Apps

(July 27) ESMMagazine.com

Albert Heijn and Jumbo Launch Dutch-Specific Google Assistant Apps

(July 27) ESMMagazine.com

- Albert Heijn and Bol.com, subsidiaries of Ahold Delhaize, and supermarket chain Jumbo have launched voice recognition–enabled applications aimed at Dutch-speaking consumers.

- Albert Heijn’s Appie app, for example, can be opened through voice command. It enables users to write shopping lists and add ingredients for specific recipes to their shopping cart.

ASIA RETAIL & TECH HEADLINES

Alibaba’s Ele.me Partners with Starbucks to Deliver Coffee

(July 30) SCMP.com

(July 30) SCMP.com

- Alibaba’s Ele.me meal delivery app has partnered with Starbucks to provide on-demand coffee delivery in China.

- The partnership comes in the context of Starbucks’ falling revenues in China; the company reported a 2% decline in comparable-store sales in China in its most recent fiscal quarter. The venture is also expected to strengthen Ele.me’s foothold as an on-demand service provider.

Tanduay Partners with Shopee to Open a New Online Fashion Store

(July 27) RetailNews.Asia

Tanduay Partners with Shopee to Open a New Online Fashion Store

(July 27) RetailNews.Asia

- Philippines rum-distiller-turned-fashion-brand Tanduay has launched an online fashion store in partnership with Shopee, a Singaporean e-commerce platform.

- Tanduay CEO Paul Lim said, “We are excited about the opportunities that our partnership will open for our business. As of now, the move is consistent with our core strategies to reach a growing global market of online shoppers.”

Lacoste Launches New Le Club Store in Bangkok

(July 27) TRBusiness.com

Lacoste Launches New Le Club Store in Bangkok

(July 27) TRBusiness.com

- French clothing brand Lacoste has opened a new, 1,615-square-foot travel retail concept store called Le Club in Bangkok’s King Power Srivaree duty-free complex, a shopping center close to Suvarnabhumi Airport.

- The store is the second of its kind in the Asia-Pacific region; Lacoste opened a similar outlet in Tokyo earlier in July.

Amazon Leads $11 Million Series B Funding Round in Shuttl

(July 23) TheIndependent.sg

Amazon Leads $11 Million Series B Funding Round in Shuttl

(July 23) TheIndependent.sg

- Indian urban mobility startup Shuttl raised $11 million in its latest funding round, which was led by Amazon. Shuttl currently provides bus shuttle service in the Delhi metropolitan region and is running pilots in Pune and Kolkata.

- Shuttl CEO Amit Singh said that the investment will be used to improve the customer experience, design more routes and dignify commuting for millions of people.

LATAM RETAIL & TECH HEADLINES

Falabella Claims 100% Stake in Brazilian Firm Construdecor

(July 25) LaTercera.com

Falabella Claims 100% Stake in Brazilian Firm Construdecor

(July 25) LaTercera.com

- Chilean department store chain Falabella announced that it will buy a 35% share of Brazilian home improvement firm Construdecor, currently held by Dimitrios Markakis. Falabella already held a 65% stake in the firm.

- The deal is expected to be finalized by the end of August. It involves a disbursement of $60 million by Falabella in exchange for full ownership of Construdecor.

Convenience Stores Set to Displace Supermarkets in Peru

(July 30) Peru21.pe

Convenience Stores Set to Displace Supermarkets in Peru

(July 30) Peru21.pe

- The Peruvian Economy Institute (IPE) reported that Peruvian consumers are more loyal to minimarkets and convenience stores than to supermarkets.

- Diego Macera, General Manager of IPE, remarked that new players, such as Tambo, and hard discounters, such as Makro, have taken market share away from traditional retailers.

Mercado Libre Expands Advertising Tool Offerings for Clients

(July 31) AmericaRetail.com

Mercado Libre Expands Advertising Tool Offerings for Clients

(July 31) AmericaRetail.com

- Mercado Libre, an Argentinian company that operates online marketplaces, has expanded its advertising solutions portfolio to influence consumers in the early stages of a purchase. The inititiative is designed to take advantage of the increased traffic on its online portal.

- Fernando Rubio, Mercado Libre’s Senior Director of Advertising, said, “We have the opportunity to impact potential buyers with advertising when they still do not know what to choose, are comparing prices or are simply browsing the platform. Today, 91% of Argentines believe that their purchase was influenced by previous online research.”

Nokia on the Lookout for Internet of Things (IoT) Startups in Brazil

(July 27) ZDNet.com

Nokia on the Lookout for Internet of Things (IoT) Startups in Brazil

(July 27) ZDNet.com

- In the sixth edition of its Open Innovation Challenge, Finnish mobile phone maker Nokia is seeking ventures focused on new products and services in the IoT vertical.

- The finalists from the program will receive a grant of $175,000 and access to Nokia’s development facilities. According to the company, the objective of the program is to find a firm to potentially partner with on joint innovative solutions.

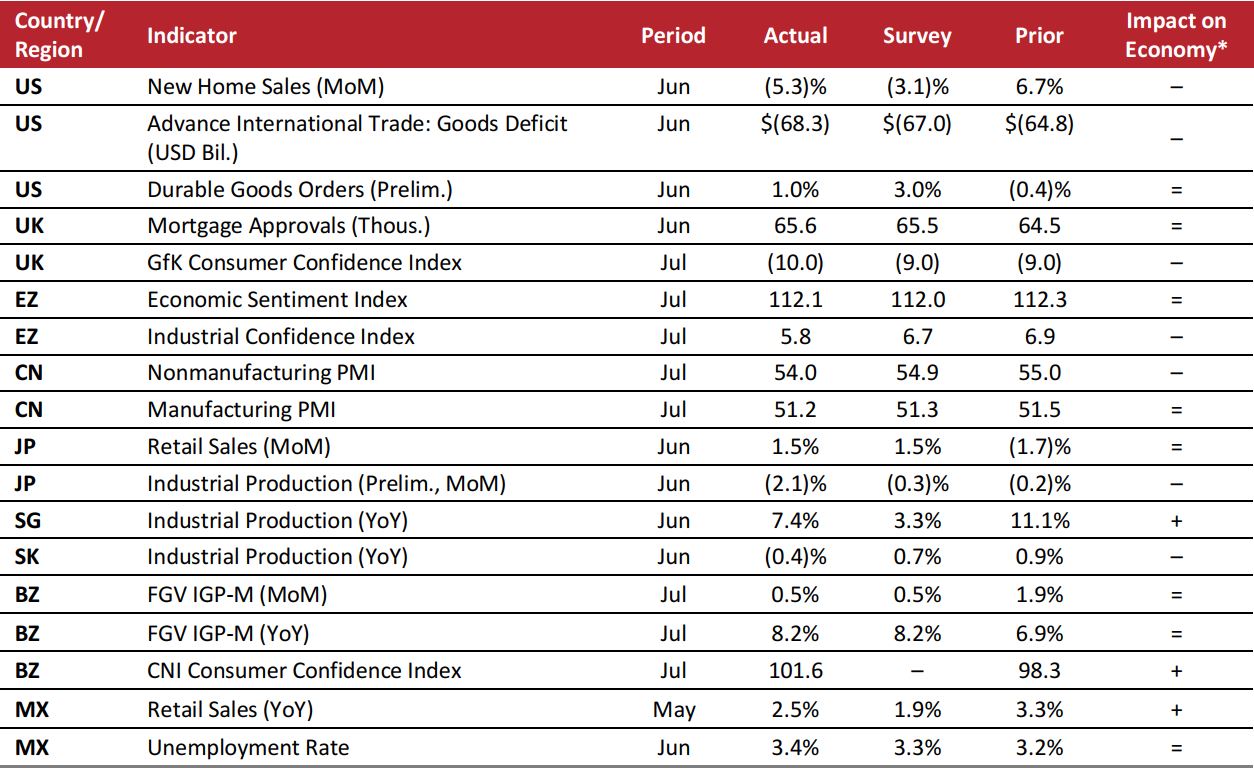

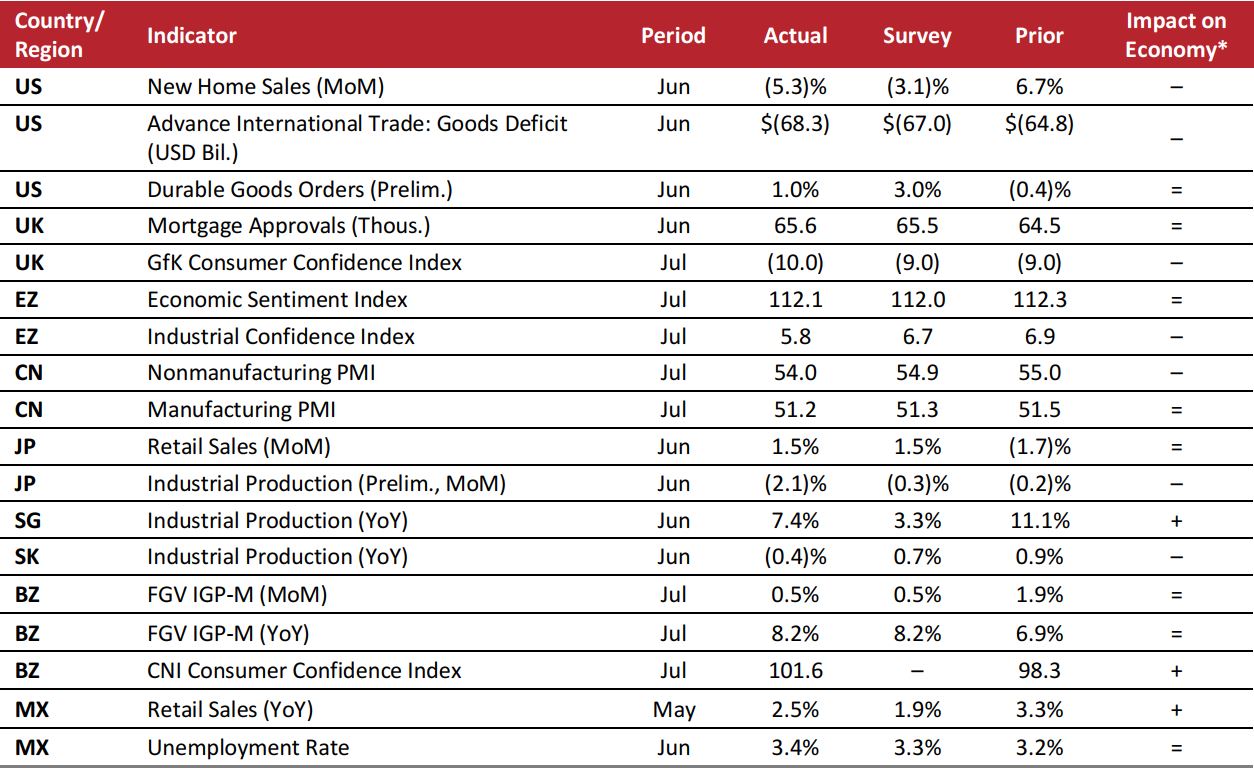

MACRO UPDATE

Key points from global macro indicators released July 25–August 1, 2018:

- US: New home sales decreased by 5.3% month over month in June; the decline was worse than analysts expected and versus a 6.7% increase in May. The US advance goods trade deficit was $68.3 billion in June, versus $64.8 billion in May.

- Europe: In the UK, June mortgage approvals numbered 65,600, which was slightly higher than the consensus estimate. The UK GfK Consumer Confidence Index dropped to (10.0) in July. In the eurozone, the Economic Sentiment Index stood at 112.1 in July, slightly above the 112.0 consensus estimate. The eurozone Industrial Confidence Index decreased to 5.8 in July.

- Asia-Pacific: In China, the Nonmanufacturing Purchasing Managers’ Index (PMI) decreased to 54.0 in July from 55.0 in June, but remained above the 50.0 expansion threshold. In Japan, retail sales rose by 1.5% month over month in June, in line with the consensus estimate. In Singapore, industrial production rose by 7.4% year over year in June, exceeding the consensus estimate. In South Korea, industrial production fell by 0.4% year over year in June.

- Latin America: In Brazil, the FGV General Market Price Index (IGP-M) increased by 0.5% month over month in July, in line with the consensus estimate. In Mexico, retail sales rose by more than analysts had expected in May, increasing by 2.5% year over year.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/Bank of England/GfK/European Commission/China Federation of Logistics and Purchasing/Japan Ministry of Economy, Trade and Industry/Singapore Economic Development Board/Statistics Korea/Fundação Getulio Vargas/Confederação Nacional da Industria/Instituto Nacional de Estadística y Geografía/Coresight Research

Online Out-of-Stocks Cost $22 Billion in Sales

(July 30) RetailDive.com

Online Out-of-Stocks Cost $22 Billion in Sales

(July 30) RetailDive.com

American Retailers Are Using Alipay to Attract Chinese Tourists

(July 26) Digiday.com

American Retailers Are Using Alipay to Attract Chinese Tourists

(July 26) Digiday.com

H&M Partners with GP & J Baker to Launch a New Apparel Range

(July 30) TheRetailBulletin.com

H&M Partners with GP & J Baker to Launch a New Apparel Range

(July 30) TheRetailBulletin.com

Beter Bed Reports Net Fall in Financials; Germany Business Shrinks Results

(July 30) RetailDetail.eu

Beter Bed Reports Net Fall in Financials; Germany Business Shrinks Results

(July 30) RetailDetail.eu

Falabella Claims 100% Stake in Brazilian Firm Construdecor

(July 25) LaTercera.com

Falabella Claims 100% Stake in Brazilian Firm Construdecor

(July 25) LaTercera.com