From the Desk of Deborah Weinswig

Pure-Play Profitability: Customer Acquisition Is Not the Problem; Fulfillment Is

For a number of years, commentators have pointed to the unfavorable economics of Internet-only retailing. Higher customer acquisition costs, substantial fulfillment costs and high product return rates have raised alarm bells among commentators and some investors. Yet the hefty valuations of low- or no-margin Internet pure-play retailers are based on the notion that those companies are eroding such costs as a proportion of their revenues. In this week’s note, we take a look at trends in two major line items for online-only retailers: marketing and fulfillment.

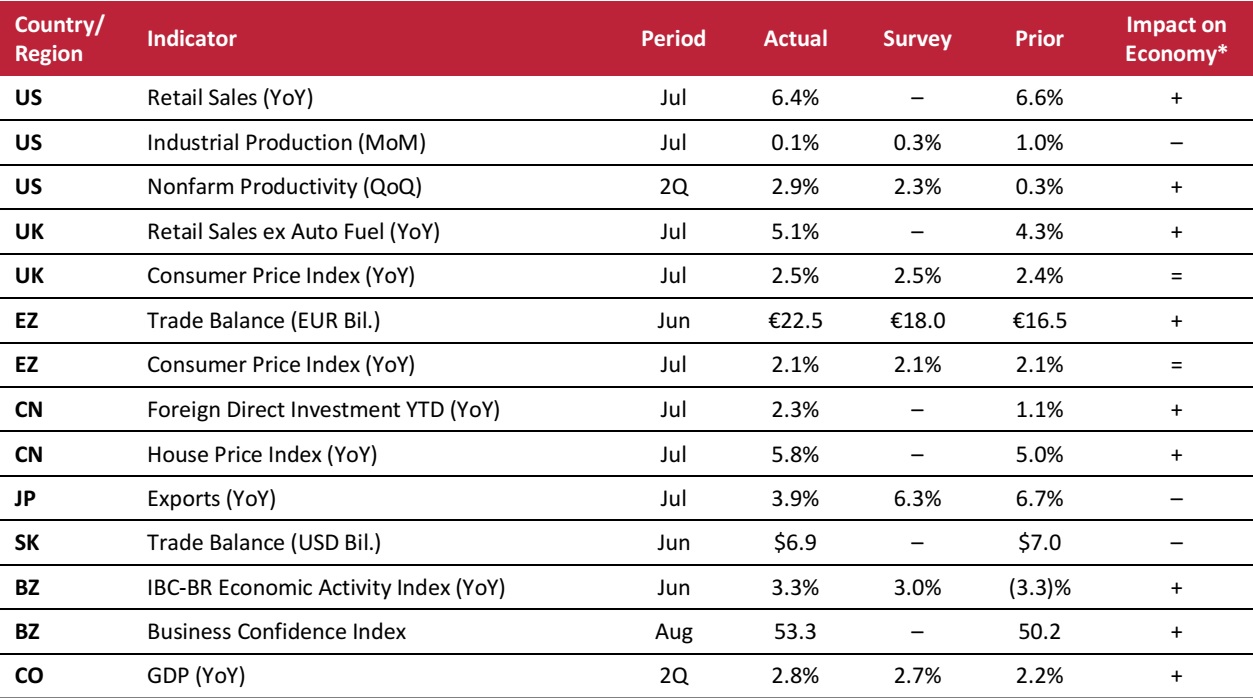

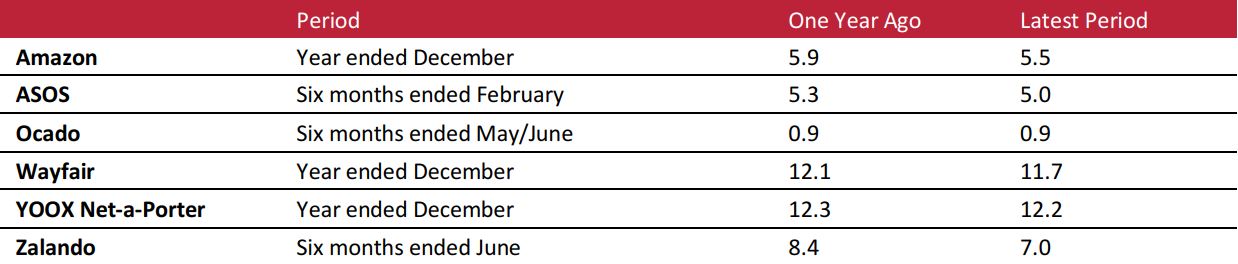

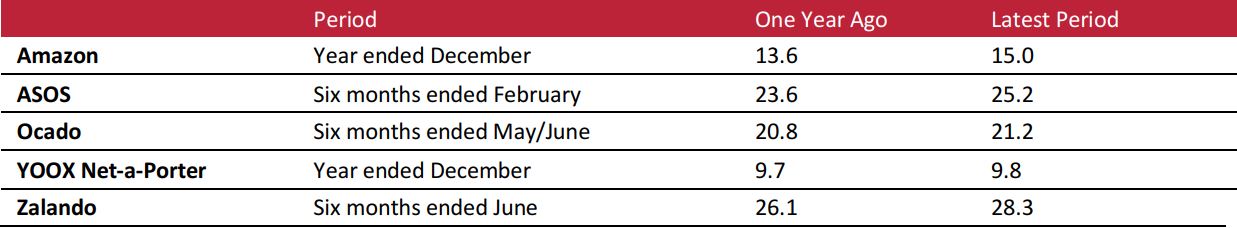

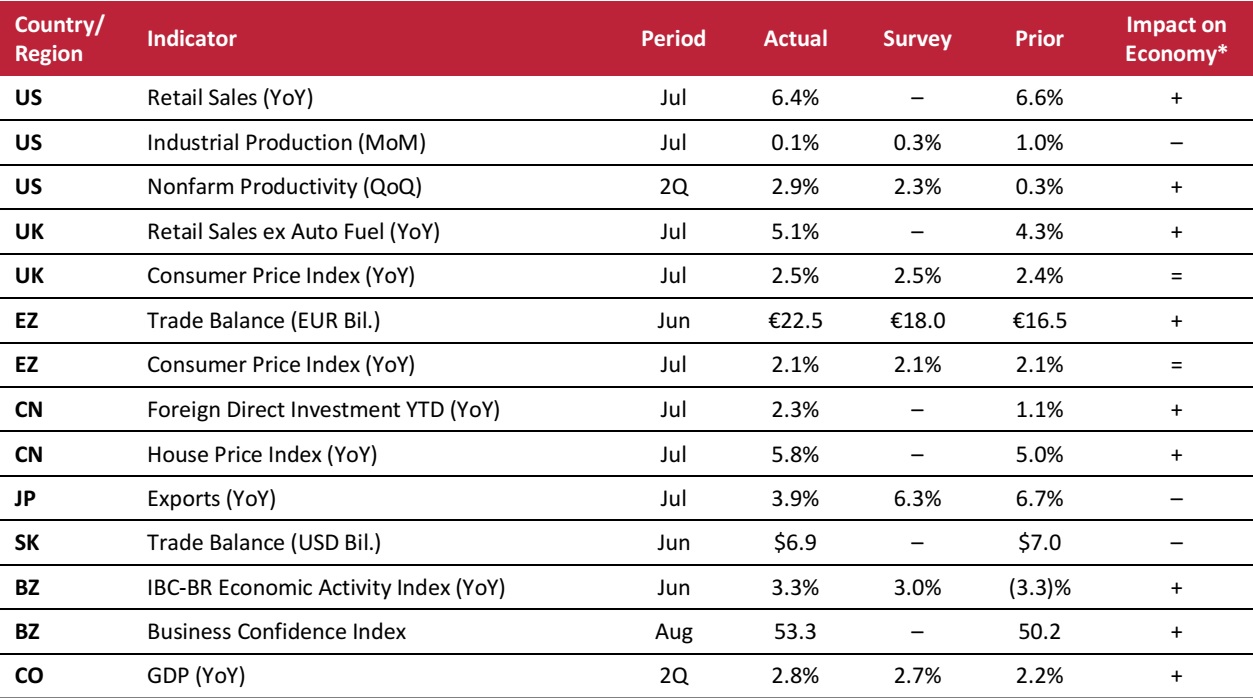

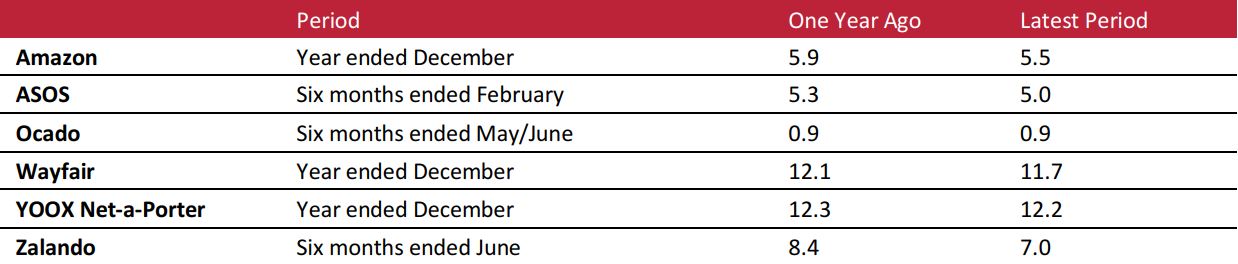

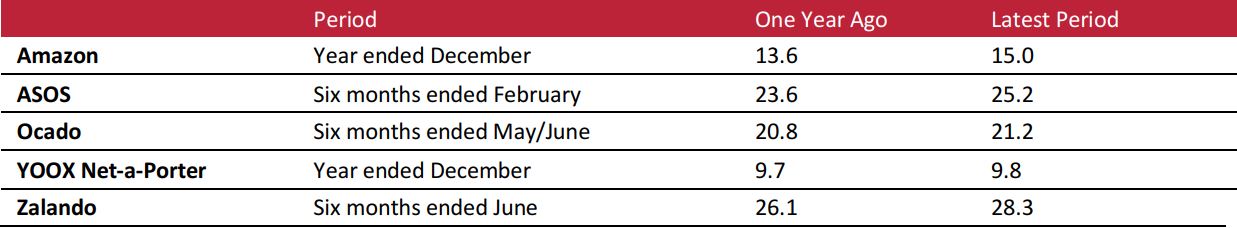

Marketing Expense-to-Sales Ratios Are Declining as Pure Plays Scale Up…

With no physical storefronts to entice passing shoppers, online-only retailers must spend more on advertising to get and keep their name in front of potential customers. Such customer acquisition costs have traditionally been one reason that analysts have been skeptical of the pure-play model’s viability. However, we view marketing costs as the lesser challenge to Internet retailers’ profitability. We aggregated data on a handful of Internet-only retailers and found that marketing costs have tended to decline year over year at major pure plays, as shown in the table below.

This relative decline has been supported by greater adoption of more cost-effective means of marketing such as social media, personalization and, crucially, direct marketing through emails and messages enabled by burgeoning customer databases.

Marketing Costs as % of Revenues

Wayfair is for advertising costs. YOOX Net-a-Porter is for sales and marketing costs.

Source: Company reports/S&P Capital IQ/Coresight Research

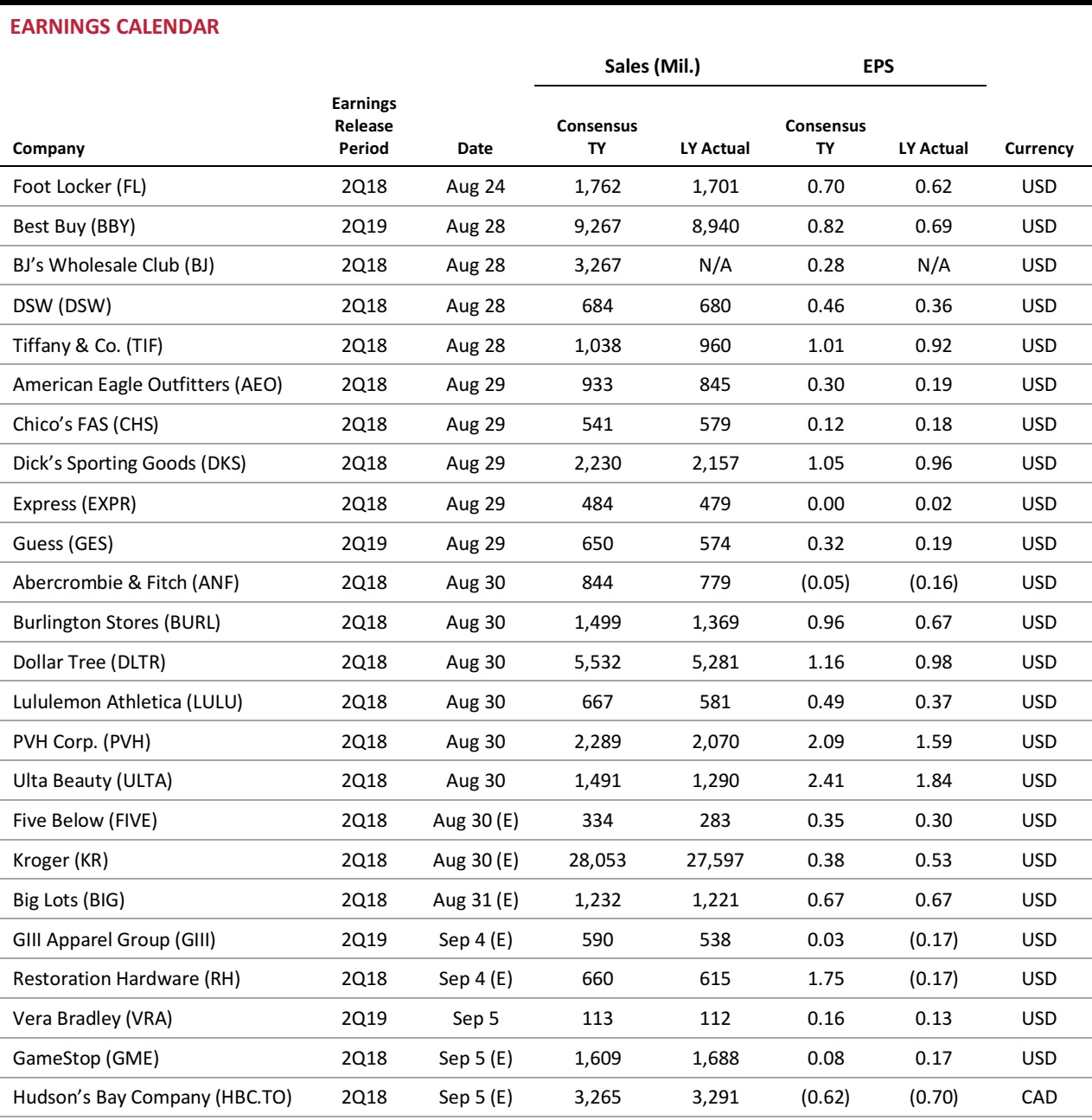

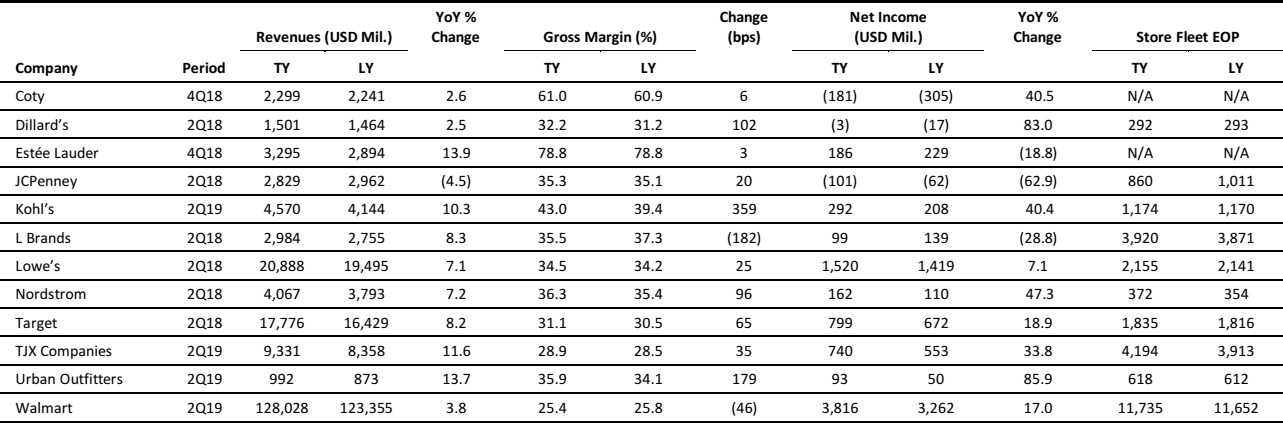

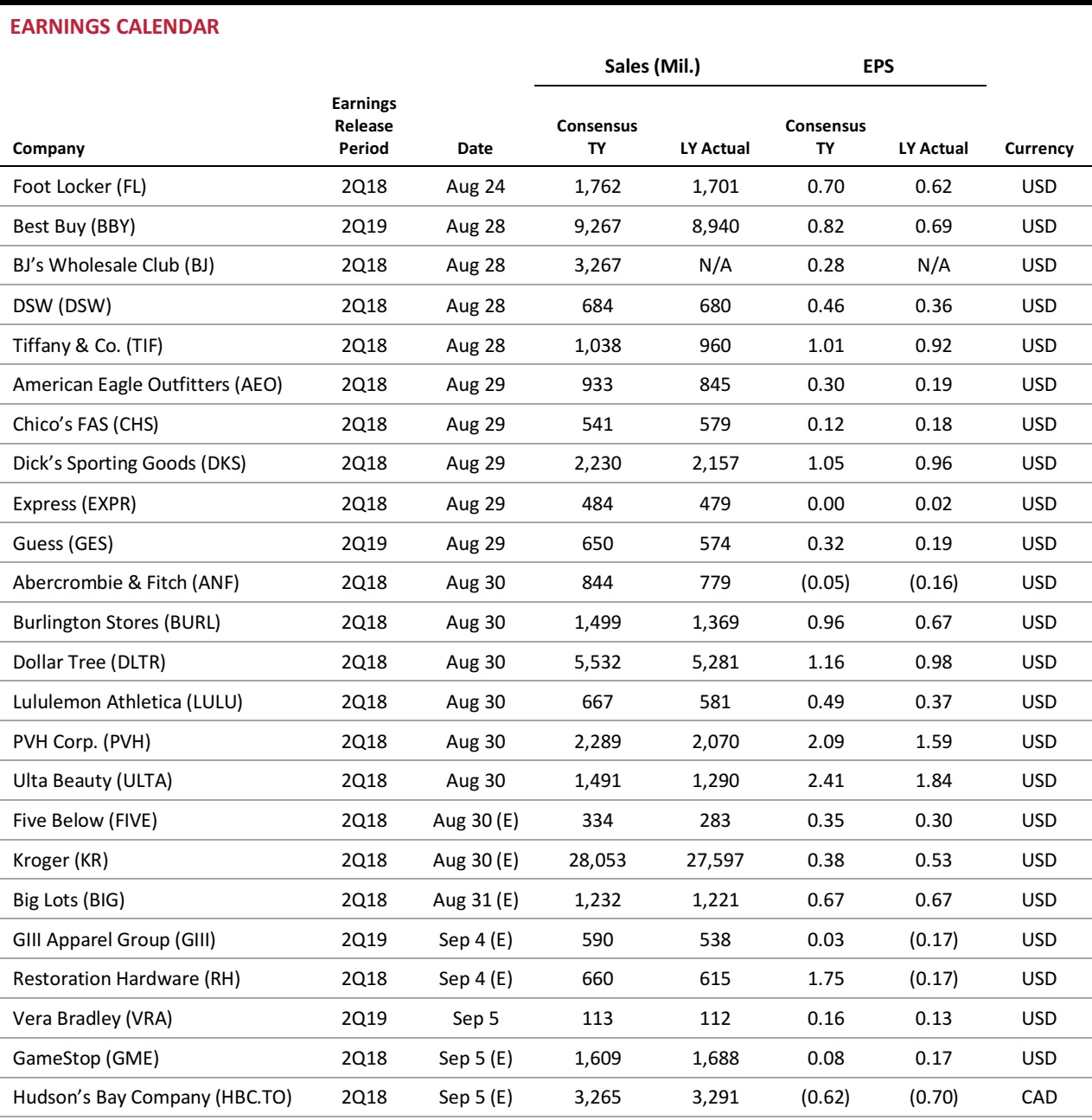

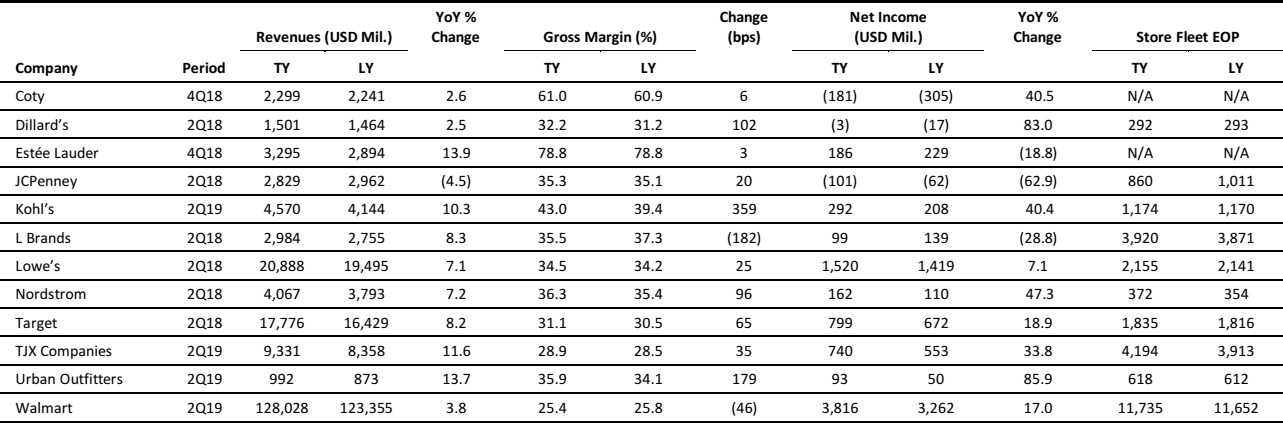

…but Fulfillment Costs Are Growing Faster than Sales

Keeping a lid on the cost of fulfilling customer orders is proving a much greater challenge for Internet-only retailers. As these firms scale up, investments in new or enlarged distribution centers translate into greater depreciation costs or higher rents.

Getting orders from distribution centers to customers can be costly, too, and those costs look to be increasing as the relentless cycle of innovation leads consumers to continually raise their delivery expectations. Those expectations force retailers to move from two-day to next-day to same-day delivery options and, often, to subsidize those additional costs for shoppers. Product returns pile on the costs, too, and enhanced choice in reverse logistics—such as the one-hour courier returns pickup service offered by German fashion pure play Zalando—affects costs in the same way that more advanced delivery options do.

So, even while marketing expense-to-sales ratios have tended to decline, the general trend in the fulfillment costs ratio is upward, as we show below.

Fulfillment/Warehousing and Distribution Costs as % of Revenues

No comparable data are available for Wayfair. Data are for “fulfillment” with the following exceptions: ASOS data are for warehousing and distribution and Ocado data are for customer fulfillment centers, trunking and delivery.

Source: Company reports/S&P Capital IQ/Coresight Research

Zalando is among the pure plays that have outlined a strategy of growing revenues now and growing margins later. At the company’s

latest Capital Markets Day, management pointed to the trend at tech firms (notably, not at retailers) that underwent high-growth phases with little margin expansion and subsequently recovered margins once growth slowed. This appears to be the rationale for many Internet-only retailers that are investing to support rapid growth.

Expectations of future margin expansion at pure plays appear to generally rely on two assumptions. The first is that current and anticipated fulfillment centers will reach peak capacity, resulting in a leveraging of fixed costs. This expectation broadly relies on demand flattening out as peak capacity is reached—otherwise, investment in further distribution centers is needed, leading to a renewed cycle of higher fixed costs. And the analyst consensus supports this assumption: per S&P Capital IQ, analysts expect that depreciation as a percentage of sales will tend to decline in the next several years at most of the pure plays we discuss here. Ocado and Zalando are exceptions, as the consensus is that depreciation will increase as a percentage of sales at those two companies over coming years.

The second assumption is that investments in service improvements and innovations such as rapid delivery and return services will plateau, resulting in variable costs leveling out or even declining. Firms such as Zalando frequently point to spending on improvements to the customer proposition as a reason for increased fulfillment costs. However, we question whether there is any end in sight for investments in service improvements.

For now, we think that there are questions about Internet-only retailers’ aggregate ability to cap the costs of fulfilling orders. However, there is good news to be found in an evident downward trend in the relative cost of customer acquisition, which has long been a cloud over Internet-only retailers.

We think that the real supporting force for margins will, in fact, be a diversification away from the pure-play retail model. Amazon’s margins are supported by its high-margin Amazon Web Services business and Zalando is growing its nonretail marketplace of third-party sellers as well as new revenue streams such as digital marketing. Should hoped-for retail margins not materialize, these kinds of diversification will prove essential supports to pure plays’ profitability.

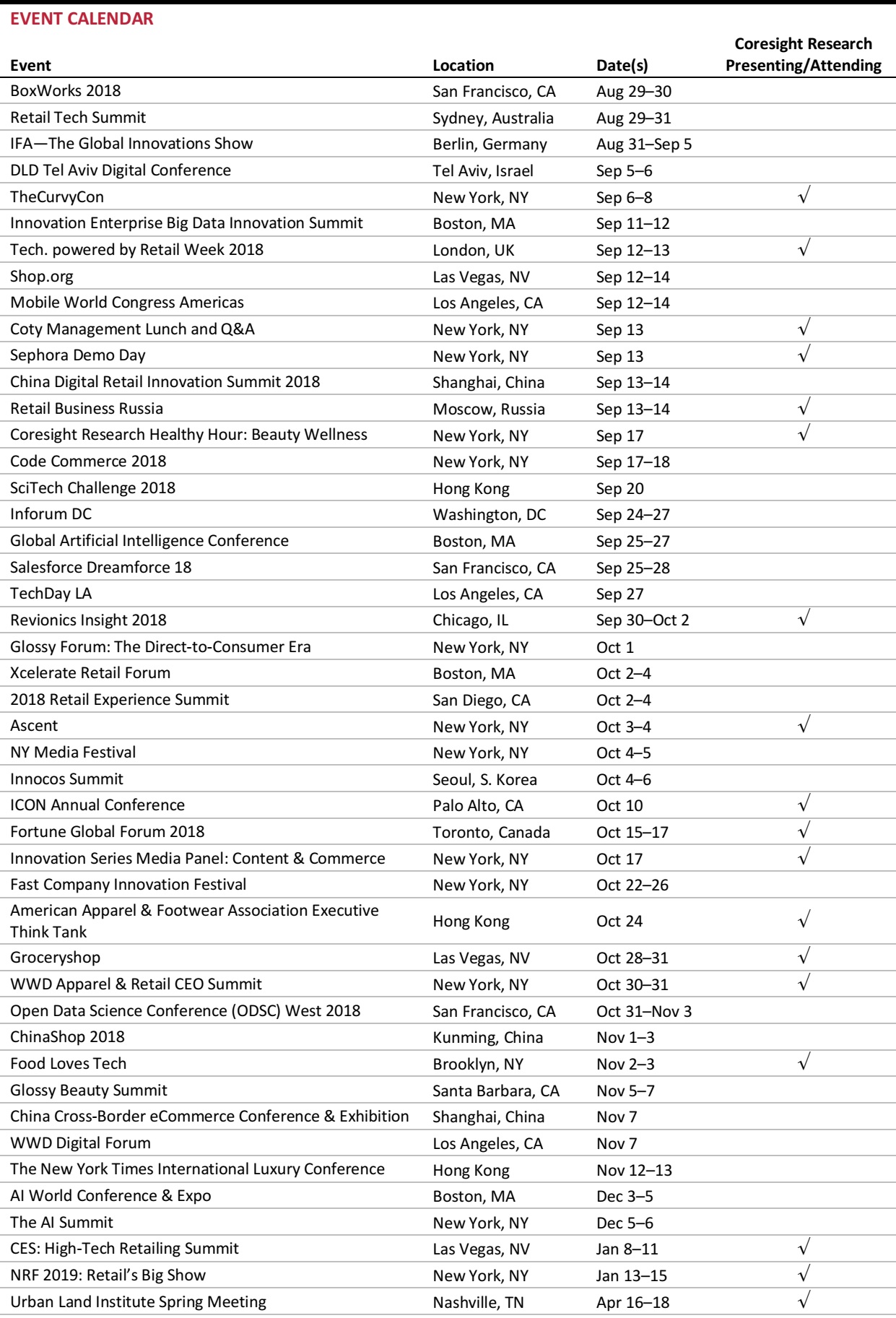

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Amazon’s Ripple Effect on Grocery Industry: Rivals Stock Up on Startups

(August 21) NYTimes.com

Amazon’s Ripple Effect on Grocery Industry: Rivals Stock Up on Startups

(August 21) NYTimes.com

- Interest in Boxed, a grocery e-commerce company that is not profitable and that crossed $100 million in revenue in 2016, was lukewarm until Amazon bought Whole Foods Market a year ago. The $13.4 billion deal shook the grocery world, setting off a frenzy of deals and partnerships.

- Food shopping is one of the last major holdouts to online retail. Groceries are unique in that their inventory is perishable, fragile and heavy. Grocery customers often shop at the last minute, like to see the food they are about to eat and don’t want to pay high delivery fees.

E-Commerce Accounts for an Estimated 13.3% of US Retail Sales in the Second Quarter

(August 20) InternetRetailer.com

E-Commerce Accounts for an Estimated 13.3% of US Retail Sales in the Second Quarter

(August 20) InternetRetailer.com

- US online retailers saw sales growth decelerate slightly in the second quarter compared with the first quarter and 2017 as a whole. US online retailers generated $120.45 billion in sales during the quarter, a 15.4% increase over the $104.41 billion generated in the second quarter of 2017.

- This is a slightly lower growth rate than e-commerce registered in 2017, when US online sales rose by 16.0%, to $453.46 billion from $390.99 billion in 2016. It’s also a slightly lower growth rate than that seen in the first quarter, when online sales grew by 16.4%.

Amazon’s Empire Is Close to Capturing Half of All US Retail E-Commerce Sales

(August 21) DailyMail.com

Amazon’s Empire Is Close to Capturing Half of All US Retail E-Commerce Sales

(August 21) DailyMail.com

- Amazon’s share of American online retail sales has reached 49.1%, dominating what would otherwise be considered market giants. The only other major retailers to rise above even 2% of the market share are eBay, Apple and Walmart, in that order.

- The competitors are fighting for a slice of the total $252.7 billion US e-commerce retail sales pie. Behind Amazon, eBay is the next closest behemoth in the US online retail space, with a 6.6% market share.

Walmart’s Best Sales in a Decade Show US Consumer May Be Strongest in Years Because of the Tax Cut, Jobs Growth

(August 16) CNBC.com

Walmart’s Best Sales in a Decade Show US Consumer May Be Strongest in Years Because of the Tax Cut, Jobs Growth

(August 16) CNBC.com

- Walmart stock surged more than 10% after the company reported fiscal second-quarter earnings and sales that beat estimates along with its best comparable growth in a decade. Sales were boosted by groceries, apparel and seasonal merchandise, and the company’s e-commerce sales popped 40%.

- Sales at US Walmart stores open at least a year rose by 4.5%, well above the 2.4% increase expected by analysts. For the quarter ended July 31, the company registered sales of $128 billion, a gain of 3.8%.

US Retail Sales Increase Strongly in July

(August 15) Reuters.com

US Retail Sales Increase Strongly in July

(August 15) Reuters.com

- US retail sales rose by more than expected in July as households boosted purchases of motor vehicles and clothing, suggesting that the economy remained strong early in the third quarter.

- The US Commerce Department said that retail sales excluding automobiles, gasoline, building materials and food services advanced 0.5% last month after a downwardly revised 0.1% dip in June. These so-called core retail sales correspond most closely with the consumer spending component of GDP.

EUROPE RETAIL & TECH HEADLINES

Zalando to Open Two New Outlet Stores

(August 16) RetailDetail.eu

Zalando to Open Two New Outlet Stores

(August 16) RetailDetail.eu

- Online fashion retailer Zalando plans to open two new outlet stores, in the German cities of Leipzig and Hamburg, later this year.

- The stores will offer around 20,000 products from 500 different brands, including Zalando’s own private labels. Zalando said that it will offer discounts of up to 70% on products that cannot be sold online due to minor defects or because they are out of season.

House of Fraser Owes Millions to Major Brands

(August 17) WWD.com

House of Fraser Owes Millions to Major Brands

(August 17) WWD.com

- The collapse of British retailer House of Fraser leaves it owing millions in payments to its creditors, including luxury brands such as Mulberry and Giorgio Armani, according to a recent report by Ernst & Young.

- The news surfaced after a payment dispute arose between House of Fraser’s new owner, Sports Direct, and warehouse operator XPO Logistics, which is owed £30.4 million ($39.03 million).

Sainsbury’s and Asda Merger May Shut 300 Stores

(August 20) TheTimes.co.uk

Sainsbury’s and Asda Merger May Shut 300 Stores

(August 20) TheTimes.co.uk

- Sainsbury’s and Asda may have to shut 300 or more stores if their proposed merger goes ahead, according to an analysis by The Times and trade bodies that was based on modeling methods typically used by the UK Competition and Markets Authority.

- The merger is expected to result in the two grocers gaining the biggest market share in the UK and generating revenues of £51 billion ($65.4 billion).

Farfetch Plans to List Its Shares on the New York Stock Exchange

(August 20) BBC.com

Farfetch Plans to List Its Shares on the New York Stock Exchange

(August 20) BBC.com

- Luxury online marketplace Farfetch announced plans to list on the New York Stock Exchange and said that it has filed a registration statement with the US Securities and Exchange Commission.

- The London-based company has not yet decided the number of shares to be issued and the price level. Industry analysts suggest that the company is aiming for a valuation as high as $5 billion.

Threads London Raises $20 Million in Funding Drive

(August 17) TechCrunch.com

Threads London Raises $20 Million in Funding Drive

(August 17) TechCrunch.com

- British e-commerce startup Threads London, which uses messaging apps such as WeChat, WhatsApp, Snapchat, Instagram and Apple’s iMessage to offer luxury fashion to millennials, has raised $20 million in its latest funding drive.

- The company plans to use the funds to expand its business internationally and to add more product categories to its platform.

ASIA RETAIL & TECH HEADLINES

Alibaba-Backed Babytree Group Plans to Raise Up to $1 Billion

(August 16) Reuters.com

Alibaba-Backed Babytree Group Plans to Raise Up to $1 Billion

(August 16) Reuters.com

- Chinese online parenting firm Babytree Group is planning to raise up to $1 billion in a Hong Kong IPO in October this year.

- The Alibaba-backed company is aiming for a valuation in the range of $3–$5 billion. It has not yet received approval from the Hong Kong Stock Exchange’s listing committee.

Sendo Raises $51 Million from Asian Investors

(August 16) Kr-Asia.com

Sendo Raises $51 Million from Asian Investors

(August 16) Kr-Asia.com

- Vietnamese online marketplace Sendo has raised $51 million in a funding round led by SBI Holdings, Daiwa PI Partners, SoftBank Ventures Korea and Beenos.

- The company plans to use the funds to launch a business-to-consumer marketplace called SenMall and to expand its SenPay mobile wallet.

Fred Segal to Expand Business in Asia

(August 18) FashionatingWorld.com

Fred Segal to Expand Business in Asia

(August 18) FashionatingWorld.com

- American luxury fashion retailer Fred Segal is planning to expand across Asia, including in Taiwan, Malaysia and India.

- The company will initially open two stores, one in Kuala Lumpur with 3,200 square feet of retail space and another in Taipei covering two floors over 7,000 square feet.

COS Opens Second Store in Malaysia

(August 20) RetailNews.Asia

COS Opens Second Store in Malaysia

(August 20) RetailNews.Asia

- COS, a brand from Swedish fashion company H&M’s portfolio, has opened a new store in Malaysia’s Klang Valley.

- The store is the brand’s second in Malaysia. COS opened its first store in the country in the Pavilion Elite shopping center approximately 18 months ago.

LATAM RETAIL & TECH HEADLINES

Makro Opens Its First Eco-Friendly Store in Per

(August 20) LaRepublica.pe

Makro Opens Its First Eco-Friendly Store in Per

(August 20) LaRepublica.pe

- Cash-and-carry chain Makro has invested 16 million soles ($4.8 million) in its first eco-friendly store, located in Ica, Peru.

- The store complies fully with global ecological building standards and has been awarded a LEED certification from the US Green Building Council, a body that verifies whether buildings are environmentally efficient.

Walmex to Open Gas Stations in Mexico

(August 17) Reuters.com

Walmex to Open Gas Stations in Mexico

(August 17) Reuters.com

- Walmex, Mexico’s biggest retailer, is expanding its presence in the fuel retail market. The company has announced that it will open gas stations alongside its domestic stores in Mexico.

- The first six gas stations will open in Sam’s Club, Walmart and Bodega Aurrerá stores in the states of Tabasco, Nuevo Leon, Veracruz and Mexico.

Groupon Peru Changes Its Name to Groupon Peixe

(August 19) ElComercio.pe

Groupon Peru Changes Its Name to Groupon Peixe

(August 19) ElComercio.pe

- Global e-commerce marketplace Groupon has merged its Latin America business with Brazilian company Peixe. The new entity will be called Groupon Peixe for all its operations in the region.

- The company will primarily focus on technological developments and on launching an app to offer a better shopping experience to its customers.

Uber Plans to Open a New Technology Center in São Paulo

(August 17) Latam.Tech

Uber Plans to Open a New Technology Center in São Paulo

(August 17) Latam.Tech

- Uber announced that it will open a new technology center in São Paulo before the end of 2018. Tech specialists will use the center to improve safety features for both passengers and drivers. The company will invest R$250 million ($63 million) in the center over a period of five years.

- Brazil is Uber’s second-largest national market after the US, so addressing issues of security is a top priority for the company.

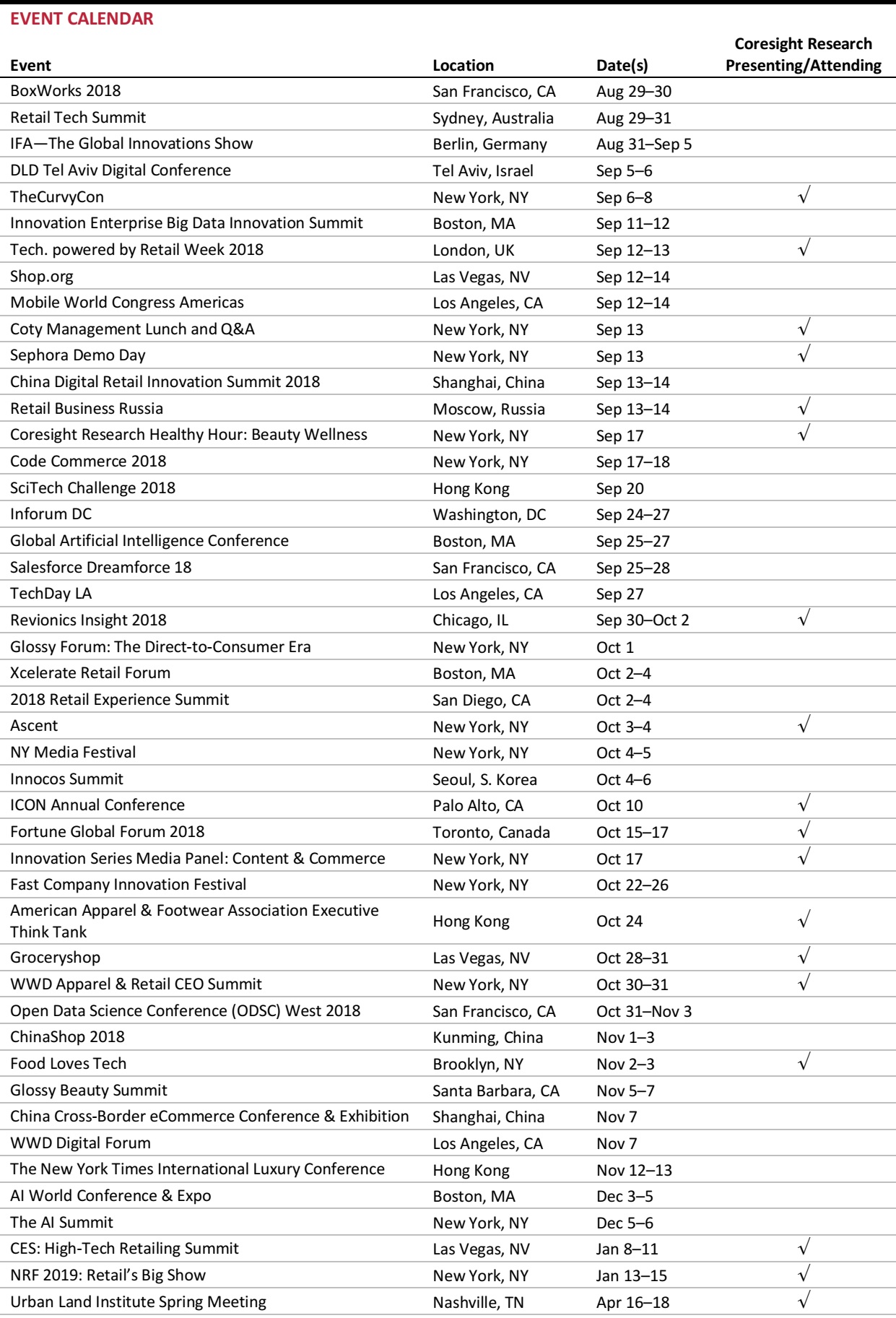

MACRO UPDATE

Key points from global macro indicators released August 15–21, 2018:

- US: Retail sales in the US increased by 6.4% year over year in July. Industrial production was up just 0.1% month over month in July, versus the 0.3% consensus estimate. Other indicators fared better than in prior periods, continuing the positive run of economic data from the previous week.

- Europe: In the UK, retail sales excluding auto fuel continued to grow strongly in July, rising by 5.1% year over year. In the eurozone, the trade balance expanded to €22.5 billion in June from €16.5 billion in May.

- Asia-Pacific: Unlike last week’s, this week’s economic indicators for China appeared positive, signaling that foreign direct investment and house prices rose in July.

- Latin America: Brazil’s economic revival continued in June, with the IBC-BR Economic Activity Index rising by 3.3% during the month compared with a decline of 3.3% in May. Colombia’s GDP increased by 2.8% year over year in the second quarter, surpassing the consensus estimate and the previous period’s 2.2% growth

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Census Bureau/US Bureau of Labor Statistics/UK Office for National Statistics/European Commission/China Federation of Logistics & Purchasing/Japan Ministry of Economy, Trade and Industry/Statistics Korea/Banco Central do Brasil/Fundação Getulio Vargas/Departamento Administrativo Nacional de Estadística/Coresight Research

Farfetch Plans to List Its Shares on the New York Stock Exchange

(August 20) BBC.com

Farfetch Plans to List Its Shares on the New York Stock Exchange

(August 20) BBC.com

Alibaba-Backed Babytree Group Plans to Raise Up to $1 Billion

(August 16) Reuters.com

Alibaba-Backed Babytree Group Plans to Raise Up to $1 Billion

(August 16) Reuters.com

Fred Segal to Expand Business in Asia

(August 18) FashionatingWorld.com

Fred Segal to Expand Business in Asia

(August 18) FashionatingWorld.com

Walmex to Open Gas Stations in Mexico

(August 17) Reuters.com

Walmex to Open Gas Stations in Mexico

(August 17) Reuters.com

Groupon Peru Changes Its Name to Groupon Peixe

(August 19) ElComercio.pe

Groupon Peru Changes Its Name to Groupon Peixe

(August 19) ElComercio.pe