Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

Gearing Up for Singles’ Day — But It’s Not the Only Shopping Festival in Town It is now only two and a half months until Singles’ Day — or the 11.11 Global Shopping Festival, to give it its full name. Alibaba Group, which created the festival back in 2009, last year recorded Singles’ Day GMV of $30.8 billion across its platforms, up 27% year over year. The event represents a key opportunity for retailers and brands to raise consumer awareness and drive engagement, and for companies new to China to break into this fast-growing consumer market. While Alibaba did not disclose sales volumes for the subsequent 2018 12.12 Shopping Festival, e-commerce platform Pinduoduo said it saw a 370% increase in the number of orders compared to the previous year. Major brands participate in 12.12: For example, in 2018, Huawei was among those offering discounts on selected models of smartphones. Preparing for Singles’ Day 2019 So, what should retailers and brands be doing to prepare for Singles’ Day 2019? Here’s a timeline for those looking to participate on Alibaba’s Tmall or Taobao platforms:- Late August to mid September: Application period: Merchants have to apply to participate and pass through a multi-layered vetting process. The platforms review merchant qualifications and confirm the list of participating merchants around mid-September.

- Late September to early October: Product registration for the pre-sales period. Merchants apply to sell the products they have selected for the pre-sales period, which usually starts from the last week of October until November 10.

- Mid to late October: Product registration for sale on Singles’ Day. Rules vary from one year to the next, but sometimes merchants are required to sell different products on November 11 than during the pre-sales period.

- Late October to November 10: Pre-sales period. The preliminary round of sales and promotions starts, as companies step up marketing and promotional activities.

- November 11: The 24-hour 11.11 Global Shopping Festival officially begins!

US RETAIL & TECH HEADLINES

Kroger, Walgreens Expand Retail Pilot

(August 19) Supermarket News

Kroger, Walgreens Expand Retail Pilot

(August 19) Supermarket News

- Kroger and Walgreens are broadening their retail partnership, including the launch of Walgreens health and beauty brands in Kroger stores.

- Kroger and Walgreens said the expanded retail pilot will bring the Kroger Express curated grocery assortment and Kroger Pickup service to 35 Walgreens drugstores in the Knoxville, Tennessee, market. In addition, Walgreens own-brand health and beauty products will be sold in a Walgreens-bannered section in 17 Kroger supermarkets in Knoxville.

- Amazon is designating products sold by certain companies as “top brands,” a test that if widely implemented could ease tension between the online retail giant and big-name companies used to more favorable positioning at brick-and-mortar retailers.

- The company confirmed it is testing the label on fashion items, awarding the designation to brands popular with customers, asserting brands don’t pay for the label.

Target Is Launching Grocery Brand Good & Gather in Bid to Boost its Food Business

(August 19) CNBC

Target Is Launching Grocery Brand Good & Gather in Bid to Boost its Food Business

(August 19) CNBC

- Target is starting a new grocery brand, Good & Gather, which will hit Target stores beginning September 15.

- The retailer said by the end of 2020, the brand will have more than 2,000 items — everything from organic pizza crusts, milk and eggs, hazelnut and peanut butter spreads, to frozen veggies, salad mixes and pastas. Target said it expects Good & Gather to be a multibillion-dollar brand — and the largest of its private labels.

- As consumers grow more selective of the items they own, they turn to rental subscription services for clothing — and Banana Republic is the latest retailer to tap into the trend.

- The retailer announced the launch of Style Passport, a service that gives users unlimited access to Banana Republic’s women’s — and soon men’s — apparel. For a flat monthly fee of $85, users can choose three garments from around 100 different styles a month.

- Revlon has retained financial advisers from Goldman Sachs to explore strategic alternatives for the cosmetics company, according to a person with knowledge of the matter.

- The makeup company, backed by billionaire Ronald Perelman and under pressure from smaller rivals, is exploring all options, including potential sales of parts or all of the business.

EUROPE RETAIL AND TECH HEADLINES

- British department store chain House of Fraser (HoF) has prolonged its administration for another year. Its creditors have approved an additional 12 months, ending August 10, 2020.

- In its 2019 annual results, Sports Direct stated HoF’s problems were “nothing short of terminal in nature.” It acquired HoF for £90 million ($109 million) in August 2018 through a pre-pack administration.

- Groupe Casino plans to target €2 billion ($2.2 billion) of asset sales by the first quarter of 2021 to cut debt.

- This is in addition to Casino’s existing plan to sell off €2.5 billion ($2.7 billion) of assets by the first quarter of 2020, for which it has already signed deals worth €2.1 billion ($2.3 billion) consisting of non-core supermarkets or property assets to private equity investors.

Zalando to Deliver Purchases for Adidas.fr

(August 19) Company press release

Zalando to Deliver Purchases for Adidas.fr

(August 19) Company press release

- German fashion pure play Zalando will fulfill orders placed on adidas.fr, in a trial partnership with Adidas. This will be Zalando’s first attempt to allow brands to use its logistics operation outside of the Zalando shop.

- Zalando will deliver Adidas products on the same or next day from its own logistics center in Moissy-Cramayel to customers in Paris. Zalando said it intends to offer its brand partners additional and easier ways to link to the Zalando platform.

Casper Teams Up with John Lewis

(August 19) TheRetailBulletin.com

Casper Teams Up with John Lewis

(August 19) TheRetailBulletin.com

- US-based online mattress brand Casper has announced its first brick-and-mortar retail partnership in the UK, with department store chain John Lewis. Customers can now buy Casper products at 24 John Lewis stores across England, Wales and Scotland as well as on the John Lewis website.

- John Lewis will offer the original Casper mattress, pillow and the company’s newest product — the Casper Hybrid mattress. Customers can and test Casper products in store.

- Danish fashion brand Ganni has entered the UK market with the opening of its first brick-and-mortar store in London. The flagship store, located at Beak Street in Soho, London, covers an area of 2,750 square feet.

- To celebrate the opening, Ganni is offering three exclusive London styles available only to UK customers. Earlier this year, Ganni also announced plans to open two US flagship stores, in New York and Los Angeles, in autumn.

Fielmann Acquires Slovenia’s Optika Clarus

(August 19) Company press release

Fielmann Acquires Slovenia’s Optika Clarus

(August 19) Company press release

- German eyewear firm Fielmann has acquired a 70% stake in Slovenian optician Optika Clarus for an undisclosed sum as part of its international expansion strategy. The transaction is effective September 1, 2019.

- Tihomir Krstič, founder of Optika Clarus, continues to hold a 30% equity stake and will remain involved in the business. Optika Clarus plans to open two new stores in Slovenia by the end of 2019 and operate more than 30 stores across Slovenia in the medium term.

Ted Baker Signs Up Next as Childrenswear License Partner

(August 16) Company press release

Ted Baker Signs Up Next as Childrenswear License Partner

(August 16) Company press release

- On August 15, British luxury fashion company Ted Baker announced a new product license agreement with British fashion retailer Next for the development of Ted Baker's childrenswear collections, launching in spring 2020. Under the five-year agreement, Next will create and sell Ted Baker childrenswear products including clothing, shoes and accessories in collaboration with the creative team at Ted Baker.

- Ted Baker’s current childrenswear product association with Debenhams will conclude on February 29, 2020. Debenhams will continue as license partner for lingerie and nightwear.

ASIA RETAIL AND TECH HEADLINES

Grofers Raises $70 Million in Ongoing Series F Round

(August 20) DealStreetAsia.com

Grofers Raises $70 Million in Ongoing Series F Round

(August 20) DealStreetAsia.com

- Indian grocery delivery company Grofers has raised $70 million from Japan’s SoftBank Vision Fund in an ongoing $200 million Series F round. Grofers is valued at $567.34 million after the $70 million fundraising.

- In a recent round, Grofers raised $10 million from Abu Dhabi Capital Group (ADGC) in July.

JD.com To Reportedly Raise $500 Million in US IPO

(August 16) TheInformation.com

JD.com To Reportedly Raise $500 Million in US IPO

(August 16) TheInformation.com

- com is reportedly planning to launch a US initial public offering (IPO) for its online supermarket joint venture Dada-JD Daojia in May 2020, hoping to raise $500 million, to be confirmed.

- The joint venture raised $500 million from Walmart and JD last year. The company is looking for additional resources to bolster its position amid an increasingly competitive online grocery delivery market.

- Japanese retailer Uniqlo opened its first “

- The new store is located at Westgate Alabang and is surrounded by local residential areas, offices and schools. The company also plans to open roadside stores in Korea, Taiwan and Thailand.

- Indian B2B e-commerce retail startup ShopKirana has raised $10 million in series B round funding. The company will use the funds to expand its operations in tier two cities in India.

- Currently, ShopKirana has 100,000 stores in 30 cities across 6 states in India. Cofounder Sumit Ghorawat stated that the company is building the biggest and quickest market channel for FMCG brands to reach Indian customers via Kirana (local convenience) stores.

Gucci Makeup by Alessandro Michele Set to Launch in Singapore

(August 19) InsideRetail.Asia

Gucci Makeup by Alessandro Michele Set to Launch in Singapore

(August 19) InsideRetail.Asia

- Gucci will launch a makeup line Gucci Makeup by Alessandro Michele in Singapore’s Takashimaya Department Store on September 12.

- According a Gucci statement, the makeup line, designed by Gucci’s creative director Alessandro Michele, is created to celebrate flaws rather than hide them.

Alibaba Reportedly Plans to Acquire Kaola

(August 19) Finance.Yahoo.com

Alibaba Reportedly Plans to Acquire Kaola

(August 19) Finance.Yahoo.com

- Alibaba Group reportedly has plans to acquire e-commerce company Kaola for approximately $2 billion. Kaola is owned by NetEase and sells items such as household appliances, apparel and personal care products.

- An acquisition would help Alibaba further consolidate its e-commerce presence in China.

LATIN AMERICA RETAIL AND TECH HEADLINES

- Chilean department store Ripley plans to sell its stake in the Mall del Centro de Concepción in Chile to real estate development firm Marina Group for Chilean 26 million ($208 million). Marina Group is controlled equally by Parque Arauco and Ripley Group.

- Ripley will use the funds to strengthen the company’s capital structure and invest in its operations in Chile and Peru.

Aerie Opens its First Latin American Store

(August 16) FashionNetwork.com

Aerie Opens its First Latin American Store

(August 16) FashionNetwork.com

- American Eagle Outfitters-owned apparel retailer Aerie opened its first stand-alone Latin America store in Guatemala on August 13. The new outlet, operated in association with Panamanian Grupo David, is located at the Oakland shopping center in Guatemala City.

- The new store offers an assortment of underwear, tops, shorts, leggings and sportwear. Previously, Aerie merchandise was available at the two American Eagle stores in Guatemala.

Roberto Cavalli Unveils New Collection for Falabella

(August 16) America-Retail.com

Roberto Cavalli Unveils New Collection for Falabella

(August 16) America-Retail.com

- Italian fashion brand Roberto Cavalli has released its spring-summer 2020 collection for Chilean department stores chain Falabella. The collection, with ready-to-use designs for women and men, will be available at select Falabella stores in Peru, Chile, Colombia and Argentina, and on Falabella’s online store.

- The women’s collection includes three lines: Animalier, After Six and Graphic City. Similarly, the men’s collection also includes three lines: Jungle, Graphic City and Urban Animal.

Cornershop Launches in Peru

(August 19) America-Retail.com

Cornershop Launches in Peru

(August 19) America-Retail.com

- Latin American grocery delivery service Cornershop has launched its app in Lima, Peru. Cornershop recently launched its app in Toronto and operates in Chile and Mexico.

- The company chose Peru as it is a large country with similar market characteristics as Chile. Cornershop has plans to begin operations in Colombia and Brazil in the future.

MACRO UPDATE

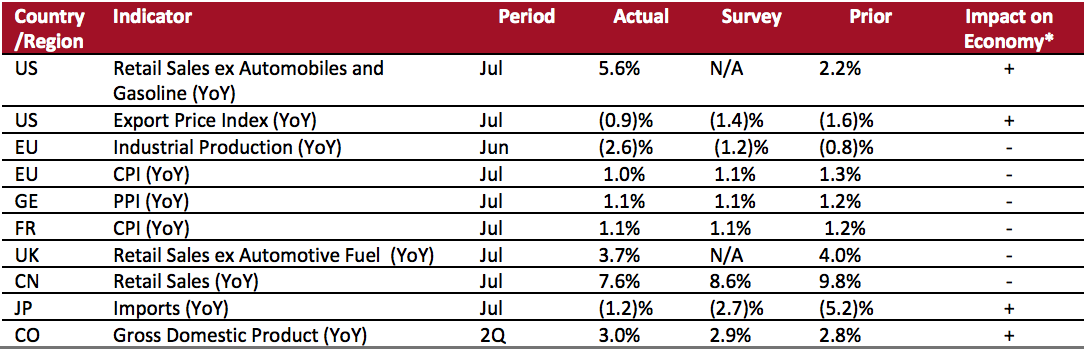

Key points from global macro indicators released August 14–20, 2019:- US: Retail sales growth came in at 5.6% year over year in July, higher than the 2.2% growth in June. The export price index fell 0.9% year over year in July but an improvement from the 1.6% drop in June.

- Europe: In the eurozone, the consumer price index (CPI) grew 1.0% year over year in July, slightly lower than the 1.3% growth in June and below the consensus estimate of 1.1%. In Germany, the producer price index (PPI) was up 1.1% year over year in July, slightly lower than the 1.2% growth in June but meeting the consensus estimate of 1.1%.

- Asia Pacific: In China, retail sales grew 7.6% year over year in July, lower than the 9.8% growth in June and below the consensus estimate of 8.6%. In Japan, imports fell 1.2% year over year in July, compared to a 5.2% drop in June.

- Latin America: Gross domestic product in Colombia came in at 3.0% year over year in the second quarter from the 2.8% growth in the previous quarter, and above the consensus estimate of 2.9%.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Census Bureau/US Bureau of Labor Statistics/Eurostat/Destatis/INSEE/Office for National Statistics/National Bureau of Statistics of China/Trade Statistics of Japan/DANE/Coresight Research[/caption]

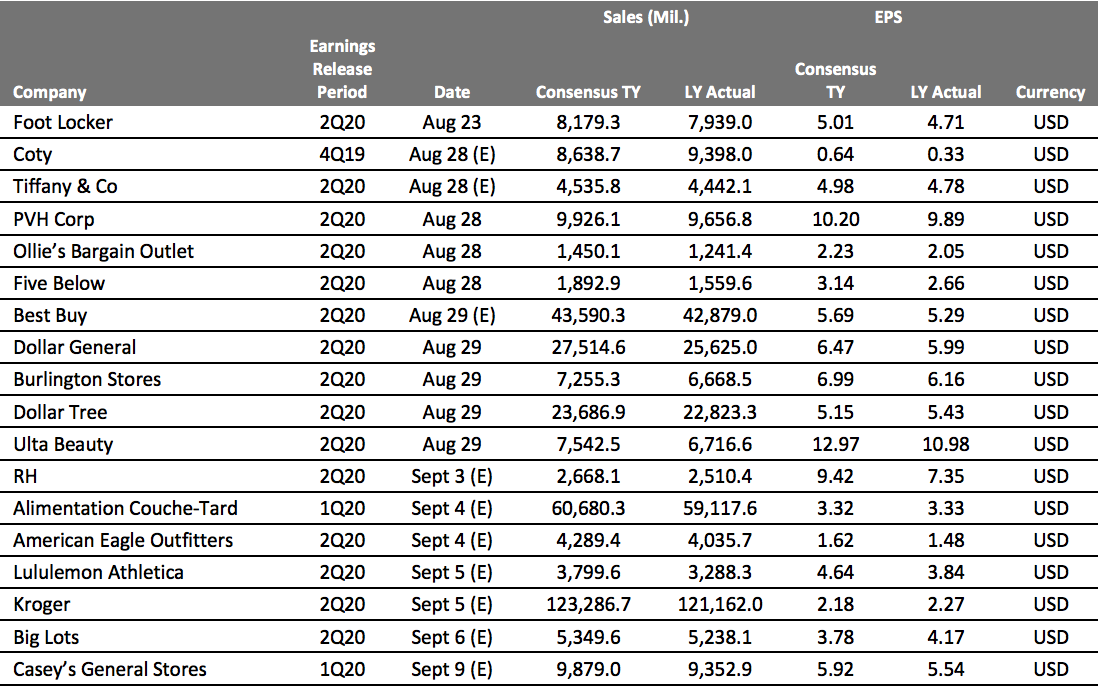

EARNINGS CALENDAR

[caption id="attachment_95111" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR