Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

US Back to School 2019: Slower Growth than Last Year, but Still Up We expect a solid increase in US back-to-school sales this year, following on the heels of a strong increase last year, amid mixed, but more positive than negative, economic indicators. We estimate a 2.0-2.5% year-over-year increase in our back-to-school retail benchmark this year — total sales by nonfood retailers from July to September; this benchmark reflects that back-to-school spending spans a wide range of nonfood categories, including apparel, electronics and stationery. This estimate represents a meaningful slowdown from last year, when nonfood retailer sales grew 4.4% in the three-month period. This year’s back-to-school shopping season is taking place against a mixed economic backdrop. Higher wage growth and lower gas prices point to the potential for higher sales. While nonfood retailer sales have risen 3.2% year to date (through June), this figure represents a significant slowdown from the 5.1% growth in the same period of 2018. Moreover, total retail sales growth has slowed this year: sales were up a modest 2.1% year over year in June (latest), whereas a year ago, sales were growing at twice that pace. A June survey by Prosper Insights & Analytics found that only 17.1% of back-to-school shoppers expect to spend more this year, while about 60% said they will spend the same as last year. Last year, a net 22.8% of back-to-school consumers expected to spend more, indicating a slowdown in spending growth. Positive economic indicators for this back-to-school season versus last year include:- Lower gas prices.

- A higher S&P CoreLogic Case-Shiller 20-City Composite Home Price Index.

- Lower unemployment.

- Higher University of Michigan Index of Consumer Sentiment.

- Higher wage growth.

- A slightly lower savings rate.

- Slowing growth for nonfood retailers and total retail sales.

- Three fewer tax-free shopping day than last year.

US RETAIL & TECH HEADLINES

- Under Armour reported mixed results for the fiscal second quarter and lowered its forecast for the year.

- The athletic apparel retailer now expects sales in North America to decline slightly in 2019. Previously, it expected revenue on its home turf to be “relatively flat.” Under Armour has been struggling to keep pace with rivals Nike, Lululemon and Adidas in the US, and has been forced to use heavy promotions to clear unsold merchandise.

- US consumer confidence rebounded this month to the highest level since November after drooping in June. The Conference Board, a business research group, said Tuesday that its consumer confidence index rose to 135.7 in July from 124.3 in June. The bounce back from last month's drop was much stronger than economists expected.

- The index measures consumers' assessment of current economic conditions and their expectations for the next six months. Both rose substantially in July.

- First Washington Realty Inc. has expanded its footprint in metropolitan Washington, D.C., by 800,000 square feet in one fell swoop. The real estate investment and management company purchased a five-property shopping center portfolio from Washington Real Estate Investment Trust in a $485 million transaction.

- First Washington had been eyeing the group of open-air, grocery-anchored shopping centers for some time.

- Walmart has partnered with autonomous vehicle company Gatik to pilot its grocery pick-up and delivery service in Bentonville, Arkansas. The partnership is part of the company’s efforts to pilot projects in customer delivery and transporting goods.

- Last month Walmart announced it is testing driverless cars to transport goods from warehouse to warehouse.

- Amazon's ramped up spending on speedier delivery for Prime customers helped accelerate sales in the second quarter – but also crimped profits.

- The Seattle-based company reported Thursday that its sales soared a better-than-expected 20% in the quarter, but it posted a profit for the three-month period of $5.22 per share, below analysts’ expectation of $5.56. The company spent more than the $800 million on one-day delivery for Prime members.

EUROPE RETAIL AND TECH HEADLINES

Sports Direct’s Auditor Grant Thornton to Resign

(July 30) FinancialTimes.com

Sports Direct’s Auditor Grant Thornton to Resign

(July 30) FinancialTimes.com

- Grant Thornton, the auditor of Sports Direct, has announced its resignation following concerns over the disclosure of a £605 million ($736 million) tax bill in Belgium. The US accounting firm, which has audited Sports Direct since 2007, will step down after the annual general body meeting in September.

- Sports Direct blamed the tax bill as the reason for the further delay in announcing annual results. The results were originally due on July 18, but were re-scheduled to July 26 as the company and its auditor needed more time to prepare the accounts.

Mellby Gard Plans to Acquire Sweden's KappAhl

(July 29) Reuters.com

Mellby Gard Plans to Acquire Sweden's KappAhl

(July 29) Reuters.com

- On July 29, Swedish investment firm Mellby Gard said it plans to buy the remaining shares in Sweden’s fashion retailer KappAhl for SEK 1.54 billion ($162 million).

- Currently, Mellby Gard is the biggest shareholder in KappAhl with a 29.6% stake. The deal represents a 43% premium to the shares’ closing price on July 2.

- Fashion retailer Primark has requested landlords cut rents 30% on dozens of stores in a bid to bridge the gap between competitors that have used bankruptcy to cut costs.

- The Sunday Times reported that Primark has requested rent cuts on stores with longer lease periods and has offered to extend the leases or spend on refurbishment in return.

Ocado to Open New Customer Service Hub

(July 28) RetailGazette.com

Ocado to Open New Customer Service Hub

(July 28) RetailGazette.com

- British online supermarket Ocado plans to set up a new customer service hub in Sunderland, creating 300 jobs. Ocado has signed a 15-year lease for the top two floors of a newly renovated building in the center of Sunderland.

- The new hub will prepare Ocado for its joint venture with Marks & Spencer (M&S) which launches September 2020. In February, M&S partnered with Ocado in a 50/50 joint venture to extend its online delivery service.

LOWA Acquires Riko Sport

(July 29) FashionNetwork.com

LOWA Acquires Riko Sport

(July 29) FashionNetwork.com

- German footwear firm LOWA has acquired Italian shoemaker Riko Sport, making it a wholly owned subsidiary of LOWA.

- Riko Sport has worked with LOWA since 1992 to manufacture a majority of the brand’s shoes in Italy and Slovakia. The acquisition will boost LOWA’s workforce from 250 to nearly 2,000.

- German perfume and cosmetics retailer Douglas has launched a “Beauty Mirror,” a digital virtual make-up mirror. The mirror is available in a pilot store in Düsseldorf and in the Douglas app.

- Through augmented reality technology, the tool helps customers test color shades. Users can buy products and share several looks directly from the smartphone.

- UK supermarket chain Morrisons has announced a partnership with US market research company IRI to enhance its customer loyalty program.

- Morrison’s currently uses its “More” loyalty card to offer personalized rewards for members. IRI will assist Morrisons to predict and understand customer behavior and provide personalized marketing to its loyalty card holders.

ASIA PACIFIC RETAIL AND TECH HEADLINES

- Japanese chat app Line plans to launch an online grocery delivery service in Thailand called Line Man Grocery by the end of 2019. Customers can use the app to order food and other items to be picked up from sellers and delivered to them.

- Line will also launch its platform, Line Shopping, that connects buyers and sellers via chat and verifies account deposits.

- Indian e-commerce company Flipkart announced on July 28 it has launched its first Furniture Experience Center in Bengaluru, India.

- Customers can get product details by scanning the Flipkart Furniture icon on a product. Flipkart is also working to integrate Google Lens into the experience center to create a virtual viewing experience.

- com will acquire a 9% stake in Beijing Digital Telecom. The financial details of the acquisition have not yet been made public.

- Beijing Digital Telecom operates more than 3,000 stores in China selling electronics. This acquisition will expand JD’s offline presence in China, especially in the lower tier cities.

Amazon Plans to Acquire Uber Eats India

(July 29) IndianRetailer.com

Amazon Plans to Acquire Uber Eats India

(July 29) IndianRetailer.com

- Amazon India is reportedly in discussions to acquire food ordering and delivery app Uber Eats India, entering the food delivery business in India.

- Amazon India plans to add Uber Eats to its Prime membership to increase daily transactions and users on its Prime app, which currently has over 10 million users.

- Sephora has reopened its store in the Takashimaya Shopping Center in Singapore after a two-month renovation. Products from brands Jo Malone London, Aerin, Miller Harris and Loewe will be exclusively available at the store.

- The store also offers a fragrance discovery bar featuring perfumes. Customers can book personalized skin consultations using the Skincredible app. The store also offers its loyalty program members a Gold Member Concierge service which includes a personal-shopper experience from the time the members enter the store and until they leave.

LATIN AMERICA RETAIL AND TECH HEADLINES

- US clothing brand Tommy Hilfiger will expand in Rio de Janeiro, Brazil, with the opening of a concept store at the Américas Shopping Mall on August 1.

- Entrepreneurs Manoela Araújo Dantas and Diogo Araújo have entered into a franchise agreement with Tommy Hilfiger to launch the new store.

- Brazilian children’s clothing brand Brandili plans to invest $10 million in technology this year. The investment will be used to fund its newly launched e-commerce site and business transformation.

- Leandro Vieira, Brandili’s National Sales Manager, stated that the company wants to expand sales channels to serve customers 24 hours a day throughout the year.

C&A Expands in Mexico

(July 26) FashionNetwork.com

C&A Expands in Mexico

(July 26) FashionNetwork.com

- European retail company C&A has expanded operations in Mexico with a new store launch at the Puerta La Victoria complex in the state of Querétaro on July 24.

- C&A, which operates more than 70 stores across 29 states of Mexico, has used an innovative and eco-friendly design store format for the new outlet.

- US sportswear firm Nike has widened its offering in Uruguay with the launch of a plus-size women’s sports line in the local market.

- Nike included over 300 pieces and has incorporated new colors, styles, prints and designs in its plus-size collection.

- Argentinian women’s fashion brand Amaro Amore plans to launch in 30 multi-brand stores across Argentina by the end of 2019.

- Amaro Amore merchandise is now sold through its own three outlets in Córdoba, El Calafate and La Rioja. It also has an online store and its products are available in concessions at several multi-brand stores in the province of Córdoba and the south of Argentina.

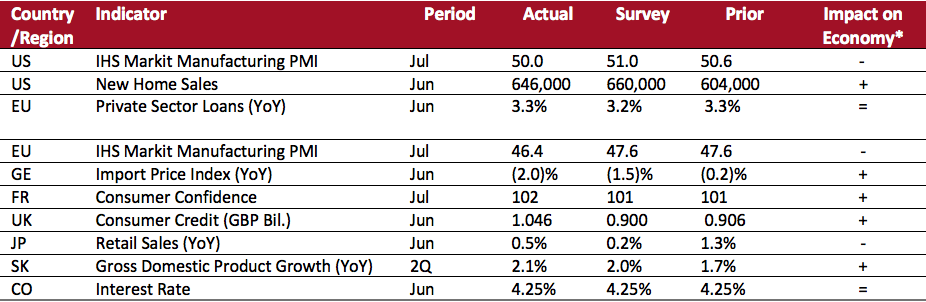

MACRO UPDATE

Key points from global macro indicators released July 24–30, 2019:- US: The IHS Markit manufacturing Purchasing Managers’ Index (PMI) decreased to 50.0 in July from 50.6 in June, below the consensus estimate of 51.0. New home sales increased to 646,000 in June from 604,000 in May, also below the consensus estimate of 660,000.

- Europe: The eurozone IHS Markit manufacturing PMI decreased to 46.4 in July from 47.6 in June and was below the consensus estimate of 47.6. In Germany, the import price index fell 2.0% year over year in June, following the 0.2% year over year drop in May.

- Asia Pacific: In Japan, retail sales grew 0.5% year over year in June, a decrease from the 1.3% year over year growth in May and above the consensus estimate of 0.2%. In Korea, second-quarter GDP growth was 2.1% year over year, in line with the previous quarter.

- Latin America: The interest rate in Colombia was 4.25% in June, in line with the level in May.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: IHS Markit Economics/US Census Bureau/European Central Bank/Destatis/INSEE/Bank of England/Ministry of Economy, Trade and Industry, Japan/Bank of Korea/Central Bank of Colombia/Coresight Research[/caption]

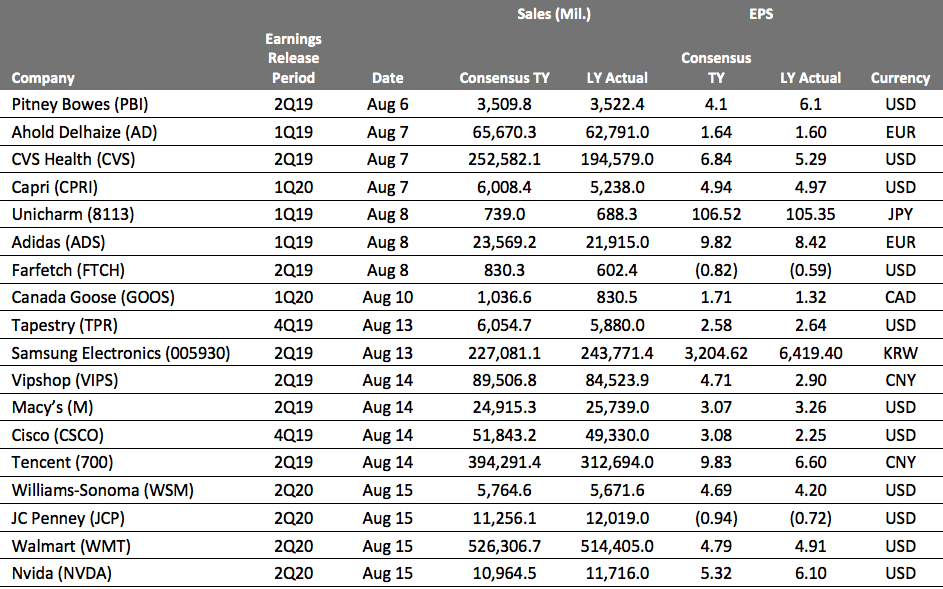

EARNINGS CALENDAR

[caption id="attachment_94073" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

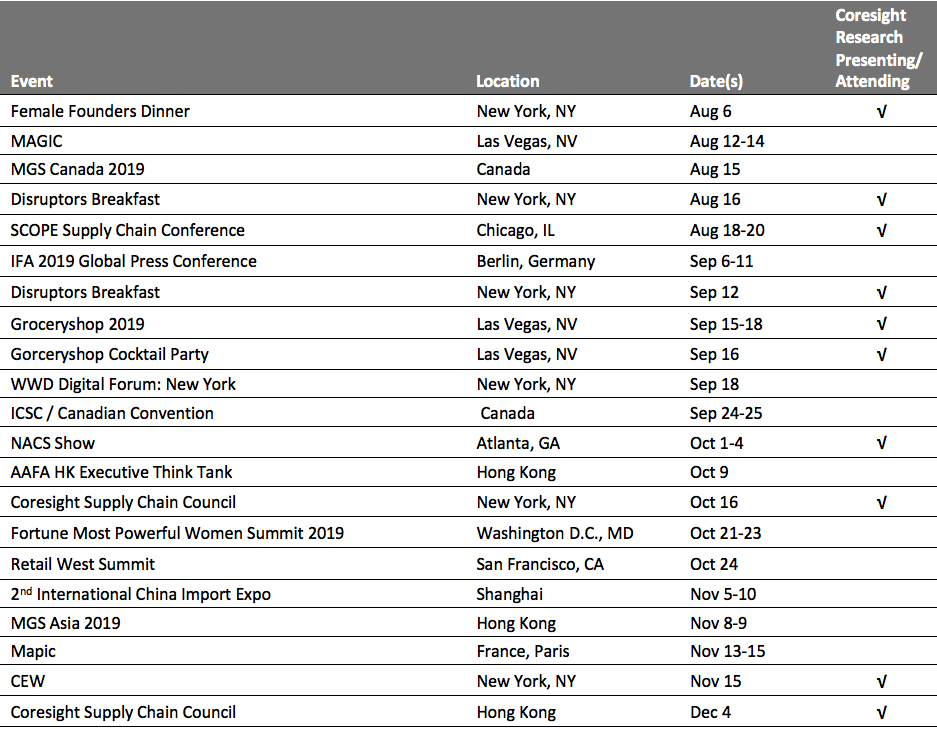

EVENT CALENDAR