Nitheesh NH

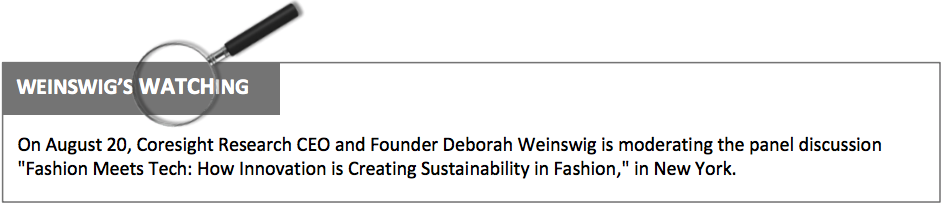

FROM THE DESK OF DEBORAH WEINSWIG

Retail Stores Are Bursting with Technology Retail stores are bursting with technology: on the store floor, on the walls and shelves and ceilings, in sales associates’ hands, in the back room and in the warehouse. US retailers will likely spend about $100 billion in capital improvements in 2019, we estimate from US Census Bureau data, and IT-related expenses and services are also significant. In-store technology enables retailers to communicate with consumers, offering a quicker, smoother, more pleasant and entertaining shopping experience. Shoppers are increasingly interacting with technology inside stores, as they view products, place orders on kiosks or tablets and view computer-generated images. Product displays can provide information or videos that play when a product is picked up, and smart displays and magic mirrors can react to data gathered from the customer, even sensing the shopper’s emotional state, and provide augmented reality images of what he or she looks like wearing a garment. Retailers can suggest products based on neurological data obtained from the consumer, and customers in the dressing room can use smart mirrors to order a different size or even a beverage. The combination of a human being armed with a tablet loaded with product or customer information represents a powerful way to provide richer customer service. With a handheld tablet, sales associates can efficiently acquire customer and product information to provide richer, more informed and personalized information. Moreover, customers are now pitching in to speed the sales process, performing many of the tasks previously performed by sales associates. Customers can now obtain product information, scan price tags and bag their own purchases at self-checkout stations, with an array of machine-vision cameras monitoring their activity and preventing theft. Hardware in the store can gather an enormous amount of data on who enters the store, where they go and how long they linger, validating the effectiveness of promotions. Technologies to track customers in the store are based on optical and thermal imaging, Wi-Fi, GPS and cell tower triangulation. RFID Sensors can continuously monitor inventory, offering the precise, real-time view necessary for ship-from-store functions, and even track items left out of place. Knowing that a particular style has frequently been left unpurchased in a dressing room could alert a retailer to a sizing problem. Electronic shelf labels can change automatically or even continuously, enabling retailers to update prices to match parameters like temperature, competitors’ prices or customer demand and help manage inventory and expiration dates. Transmission technologies include radio, visible light (from modulating the overhead lighting) and even infrared light. Robots, once confined to factory floors, now greet customers, guide them inside the store, fetch items, take inventory of items on the shelf and mop the floors. These machines perform repetitive, labor-intensive tasks, freeing the humans to spend more time on the store floor, building customer relationships and improving service. Additional robots are at the back of the store, helping workers unload goods, and in warehouses and fulfillment centers, some completely automated and some using human-robot teams. Some of the most powerful in-store tech in retail is brought into and taken out of the store again by consumers, in the form of the miniature supercomputers called smartphones in their pockets or bags. Consumers can research products and gather information, scan barcodes, run store apps and interact with in-store beacons, though beacons have not yet seen widespread use in retail stores. Physical stores contain an enormous amount of technology on the sales floor as well as in the back room. The deployment of technology is only likely to increase as retailers digitalize and seek to improve services and experiences in a continuing effort to bring customers into the store.- Get more information from our recent deep dive RetailTech: In-Store Technology.

US RETAIL & TECH HEADLINES

- Allbirds, the San Francisco-based brand that’s amassed a cult-like following of people who wear its comfy wool sneakers, is expanding beyond shoes — starting with socks. The shoemaker said it will begin selling three styles of socks, retailing between $12 and $16, online and at its five bricks-and-mortar shops in the U.S.

- Like its existing line-up of shoes, the socks will be made from sustainable materials — including plants and recycled plastic bottles. And they’re 100% carbon neutral.

Nike Offers its Mobile Technology to Foot Locker

(August 12) Essential Retail

Nike Offers its Mobile Technology to Foot Locker

(August 12) Essential Retail

- Trainer retailer Foot Locker opened a new store in the US over the weekend that is supported by the Nike mobile app. The so-called community “Power Store” in Washington Heights was unveiled on Saturday 10 August, offering consumers various new features – including a connection to the Nike app.

- To mark the collaboration with Nike, Foot Locker will host a series of events this week for its members and NikePlus members, including workshops and group runs.

Rite Aid Taps Healthcare Executive as its New CEO

(August 12) Reuters

Rite Aid Taps Healthcare Executive as its New CEO

(August 12) Reuters

- Rite Aid Corp named Heyward Donigan as Chief Executive Officer, hoping to use her expertise in managing healthcare companies to stem sales declines at the drugstore chain due to intense competition.

- Donigan, who most recently served as CEO at Sapphire Digital, a website that analyzes healthcare plans, will succeed John Standley, who has led the company since 2010. She has also held executive roles at Cigna Corp, General Electric Co and U.S. Healthcare.

NYC's Camp Family Experience Store Comes to Dallas

(August 9) The Dallas Morning News

NYC's Camp Family Experience Store Comes to Dallas

(August 9) The Dallas Morning News

- Camp, a toy store that opened in New York City's Flatiron District last December, is opening only its second store, in Dallas in October. The front of the store looks like a cool specialty toy store, but this one has a magic door that opens up into Base Camp, filled with themed play areas where merchandise for sale isn't on shelves.

- In New York, families spend an average of 1 to 1.5 hours, and those who live in the neighborhood come in three or four times a week.

- Private equity firm Oaktree Capital Management has invested $200 million in a new venture called WHP Global that was created to acquire and manage global consumer brands.

- Its first acquisition is Anne Klein, a global fashion brand founded in 1968, which has its own lines of jewelry and watches designed, manufactured and distributed by E. Gluck, which supplies watches to retailers including Macy’s, Kohl’s, Walmart, Dillard’s, JCPenney, Nordstrom, and Lord & Taylor.

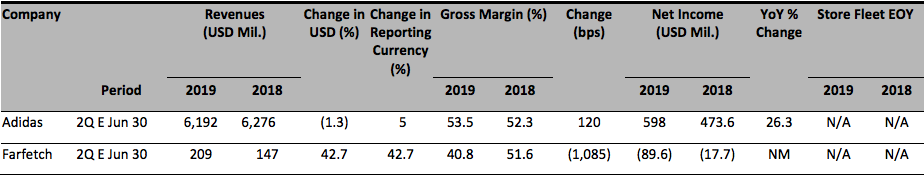

EUROPE RETAIL EARNINGS

[caption id="attachment_94661" align="aligncenter" width="700"] NM = not meaningful

NM = not meaningfulSource: Company reports/Coresight Research[/caption]

EUROPE RETAIL AND TECH HEADLINES

UK Retailers Push for Revamp of Business Rates System

(August 13) RetailGazette.co.uk

UK Retailers Push for Revamp of Business Rates System

(August 13) RetailGazette.co.uk

- The heads of over 50 major UK retailers including Sainsbury’s, Harrods and Marks & Spencer have written to Sajid Javid, the UK Chancellor of the Exchequer, calling for fundamental reforms to the existing business rates system. The move was coordinated by the British Retail Consortium (BRC).

- The BRC said that the retail sector accounts for 5% of the UK economy but pays 10% of all business taxes and 25% of business rates. The heads have called for support and incentives as well as a reduction in tax bills.

- British footwear retailer Schuh has sought the help of restructuring experts from KPMG to assess its options after a period of tough trading. The news comes after Schuh’s exit from Germany in June with the closures of its only three stores in order to focus on its British and Irish markets.

- Schuh does not intend to implement a company voluntary arrangement nor shut any stores immediately. The retailer has requested landlords reduce rents across its stores in the UK.

Deliveroo to Exit German Market

(August 12) TechCrunch.com

Deliveroo to Exit German Market

(August 12) TechCrunch.com

- UK-based food delivery platform Deliveroo this week announced its decision to exit the German market on August 16. It had already revised services in Germany a year ago by shuttering operations in several smaller cities.

- Deliveroo announced compensation and goodwill payments to its affected employees and riders. It intends to redeploy resources and investment to fast-track growth and expansion across Asia Pacific and Europe.

Eve Sleep and Simba Start Preliminary Merger Talks

(August 11) RetailGazette.co.uk

Eve Sleep and Simba Start Preliminary Merger Talks

(August 11) RetailGazette.co.uk

- UK-based online mattress firms Eve Sleep and Simba are in the preliminary stages of merger negotiations. Both the ailing retailers are currently looking for an approach to make their firms profitable again.

- On August 11, Eve Sleep stated that there is no assurance that the potential deal will proceed, but that any transaction would result in it acquiring Simba. It has temporarily suspended trading on the Alternative Investment Market (AIM) under market rules.

Maxima Grupė Divests its Poland-Based IT Arm

(August 12) ESMMagazine.com

Maxima Grupė Divests its Poland-Based IT Arm

(August 12) ESMMagazine.com

- Emperia Holding, owned by Lithuanian retail group Maxima Grupė, has announced the sale of its Poland-based IT systems provider Infinite to a Polish fintech company DialCom24 Group for an undisclosed sum.

- Arūnas Zimnickas, the head of Emperia Holding, said that the funds received from the deal will be allocated to focus and develop its retail business activities in Poland.

- Spanish apparel retailer Zara plans to launch its new customization feature, Edited, on its online platform. The feature allows shoppers to personalize any items in a newly released 28-piece collection with embroidery of up to 11 letters, free of charge.

- Customers can type their chosen phrase and see a visual representation of their item in real time. Following successful pop-up trials in Amsterdam, Barcelona and Milan, it will be introduced in the US, China, the UK, Italy, the Netherlands and Spain this week.

Delhaize and Bol.com Strengthen Collaboration

(August 12) RetailDetail.eu

Delhaize and Bol.com Strengthen Collaboration

(August 12) RetailDetail.eu

- Belgian food retailer Delhaize and Dutch online retailer bol.com, both subsidiaries of Ahold Delhaize, have strengthened their collaboration with their first promotional campaign together.

- The first 10,000 Delhaize customers who spend at least €75 ($84) on its online site will receive a €10 ($11) discount at bol.com. On the other hand, shoppers who spend at least €75 ($84) in the “Back to School” section of bol.com will receive a €10 ($11) discount at Delhaize.be.

Colruyt Tests Artificial Intelligence Recognition on Fruit and Vegetables

(August 12) ESMMagazine.com

Colruyt Tests Artificial Intelligence Recognition on Fruit and Vegetables

(August 12) ESMMagazine.com

- Belgian retailer Colruyt has partnered with Belgian tech firm Robovision to test a new artificial intelligence-based technology that identifies products in supermarkets. The technology aims to create a more efficient checkout process.

- The pilot project will be carried out for three months in a Colruyt supermarket in Kortrijk. The store will use a smart camera, placed above the weighing scale, which can identify about 120 varieties of fruit and vegetables.

ASIA RETAIL AND TECH HEADLINES

JD Expands Partnership with a2 Milk

(August 13) Insidefmcg.com.au

JD Expands Partnership with a2 Milk

(August 13) Insidefmcg.com.au

- com has expanded its partnership with New Zealand-based milk products company a2 Milk. JD will bring more of a2 Milk’s dairy products to Chinese customers and introduce marketing campaigns on JD’s online and offline platforms.

- a2 Milk was introduced to Chinese customers through JD.com in 2015. JD has already provided assistance in promotions, marketing campaigns and identifying target audiences to a2 Milk in China.

- Hong Kong-based online shopping service Goxip will launch in Singapore on August 19. The service allows customers to search, compare and shop for products from global retailers.

- The service is already available in other parts of the Asia Pacific region and has over 600,000 monthly users in Hong Kong. As part of the Singapore launch, Goxip will redesign its website and app to appeal to customers in Singapore.

Alibaba’s 88VIP Members to Get Additional Perks and Privileges

(August 11) Alizila.com

Alibaba’s 88VIP Members to Get Additional Perks and Privileges

(August 11) Alizila.com

- Alibaba Group has announced that it will offer a bigger range of benefits to the members of its paid loyalty program, 88VIP. Members can take advantage of 88VIP loyalty benefits on all Alibaba platforms, such as Tmall, Taobao, AliHealth and Mei.com.

- Members will get a 5% discount throughout the year on purchases made on Alibaba’s Tmall, Taobao, Tmall supermarket, Tmall Global, AliHealth and Mei.com. Fliggy, Alibaba’s online travel platform, has for the first time offered special perks to the 88VIP members.

- Japanese retailer Aeon will open an online grocery delivery service in China in early 2020. The company will launch a mobile app that customers can use to order groceries from the 70-plus Aeon stores.

- The online delivery service is the first service created by Aeon’s research and development hub that was established in China in April. At present, Aeon delivers groceries online through third-party e-commerce sites such as JD.com.

Tiffany Partners with Reliance Brands to Launch in India

(August 12) Warc.com

Tiffany Partners with Reliance Brands to Launch in India

(August 12) Warc.com

- US luxury jewelry brand Tiffany and India’s Reliance Brands have announced a joint venture to launch Tiffany in India. Tiffany plans to open stores in Delhi in the second half of 2019 and stores in Mumbai in the second half of 2020.

- Philippe Galtié, Tiffany’s EVP of Global Sales, stated that the company sees India’s growing luxury customer base as a unique opportunity and looks to develop and expand its brand equity in the Indian market.

LATIN AMERICA RETAIL AND TECH HEADLINES

FEMSA to Acquire a 50% Stake in Raízen’s Convenience Store Business

(August 12) America-Retail.com

FEMSA to Acquire a 50% Stake in Raízen’s Convenience Store Business

(August 12) America-Retail.com

- The commerce division of Mexican conglomerate Fomento Económico Mexicano (FEMSA) plans to acquire a 50% stake in the convenience store business of Brazilian energy firm Raízen for 2,750 million pesos ($140 million) by the end of 2019.

- After the acquisition, FEMSA, which presently operates Oxxo convenience stores in Latin America, plans to grow the number of Raízen convenience stores and enter new markets.

Vestem and Lycra Launch Plus-Size Fitness Collection

(August 12) FashionNetwork.com

Vestem and Lycra Launch Plus-Size Fitness Collection

(August 12) FashionNetwork.com

- American fashion brand Lycra has partnered with Brazilian fitness fashion brand Vestem to launch a plus-size fitness collection, called Powerful, in Brazil. The new collection, priced between R$129.90 ($32.60) to R$299.90 ($75.26), will be available at the Vestem stores in Sao Paulo and on its e-commerce site.

- The Powerful collection will range in sizes 50 to 58 and consist of 15 types of garments with tailored fits.

Gap Launches First Store in Argentina

(August 9) America-Retail.com

Gap Launches First Store in Argentina

(August 9) America-Retail.com

- US clothing retailer Gap has opened its first Argentinian store at Jorge Newbery Airport’s Shop Gallery in capital city Buenos Aires.

- The new store, spanning 538 square feet, has clothing ranges for infants to adults with about 70% of the clothing being children’s wear.

- Walmart Chile has opened a SuperBodega aCuenta store in Cabildo, the first supermarket to arrive at the Valparaíso Region in Chile. The hallmark of the SuperBodega aCuenta store format is to offer a wide variety of products at low prices.

- The new supermarket will have self-checkout points where customers can check out up to 20 products and make payments through cash or card.

Victorinox Launches its Online Platform Store in Mexico

(August 11) FashionNetwork.com

Victorinox Launches its Online Platform Store in Mexico

(August 11) FashionNetwork.com

- Swiss accessories brand Victorinox has launched its online store in Mexico. The new e-commerce platform offers a range of knives, watches, luggage and fragrances.

- In addition, shoppers can find care tips with the collections, as well as exclusive promotions on the platform.

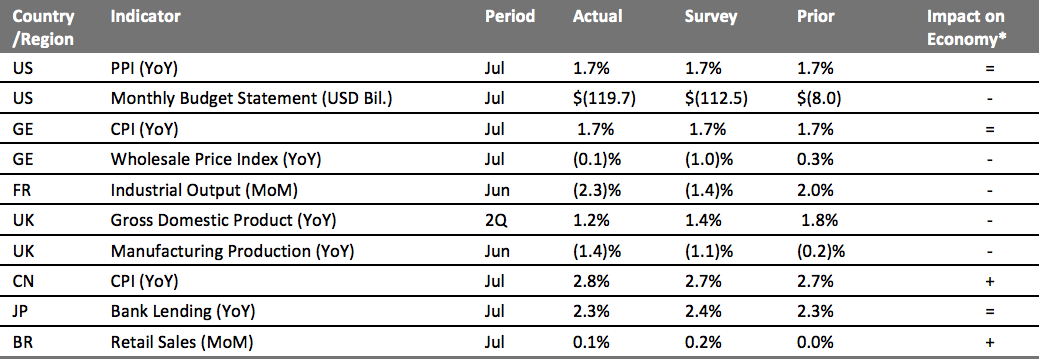

MACRO UPDATE

Key points from global macro indicators released August 7–13, 2019: 1) US: The Producer Price Index (PPI) was 1.7% in July, in line with the level in June. The monthly budget deficit was $119.7 billion in July, compared with an $8.0 billion deficit in June. 2) Europe: In Germany, the consumer price index (CPI) was 1.7% year over year in July, in line with the level in June and the consensus estimate of 1.7%. In France, the industrial output fell 2.3% month over month in June, below the 2.0% growth in May. 3) Asia-Pacific: In China, CPI came in at 2.8% year over year in July, slightly higher than the 2.7% growth in June and the consensus estimate of 2.7%. In Japan, bank lending was 2.3% in July, in line with the level in June. 4) Latin America: Retail sales in Brazil were up 0.1% month over month in July from the flat growth in June, but below the consensus estimate of 0.2%. [caption id="attachment_94681" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Bureau of Labor Statistics/US Department of the Treasury/Destatis/INSEE/Office for National Statistics/National Bureau of Statistics of China/Bank of Japan/IBGE/Coresight Research [/caption]

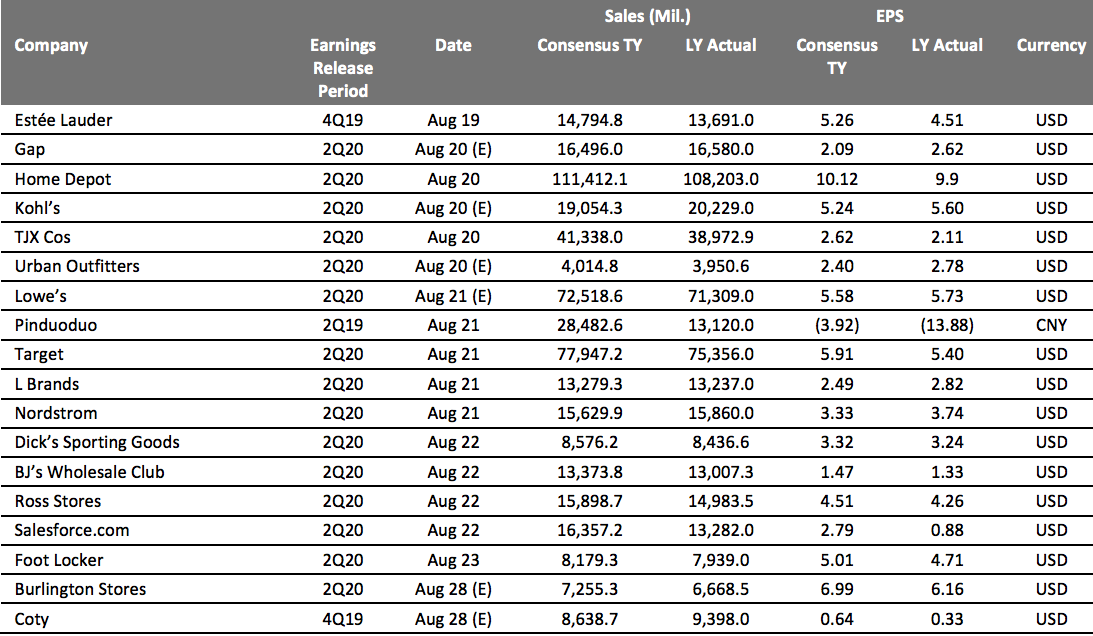

EARNINGS CALENDAR

[caption id="attachment_94682" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

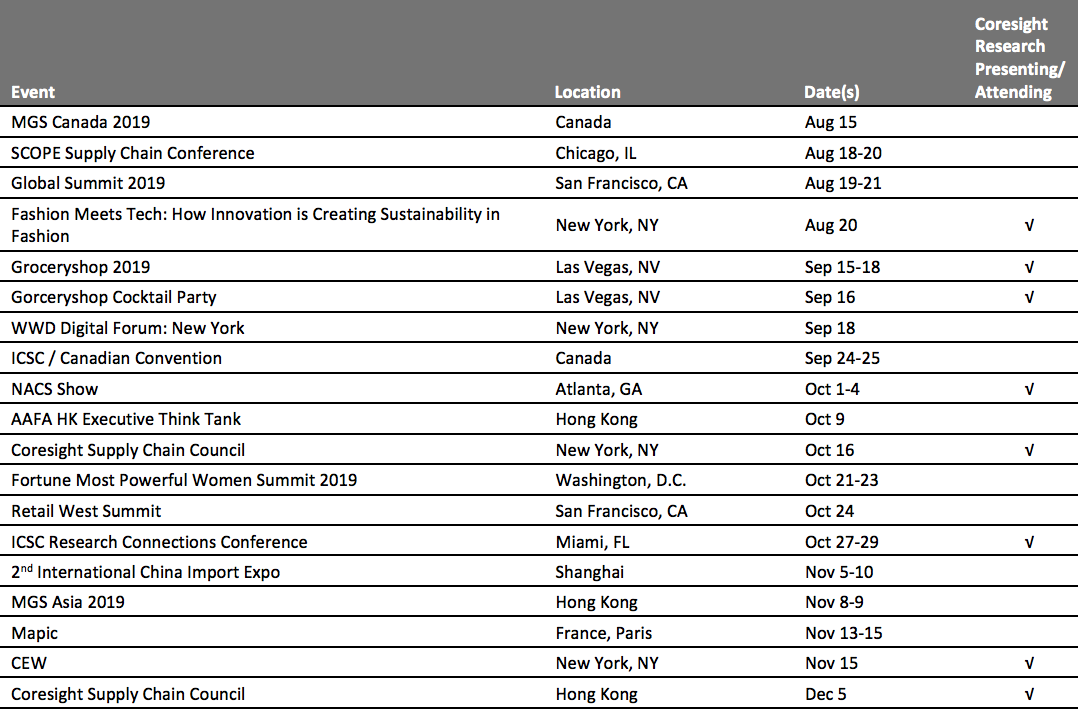

EVENT CALENDAR