From the Desk of Deborah Weinswig

Five Reasons We’re Optimistic About This Year’s Back-to-School Shopping Season

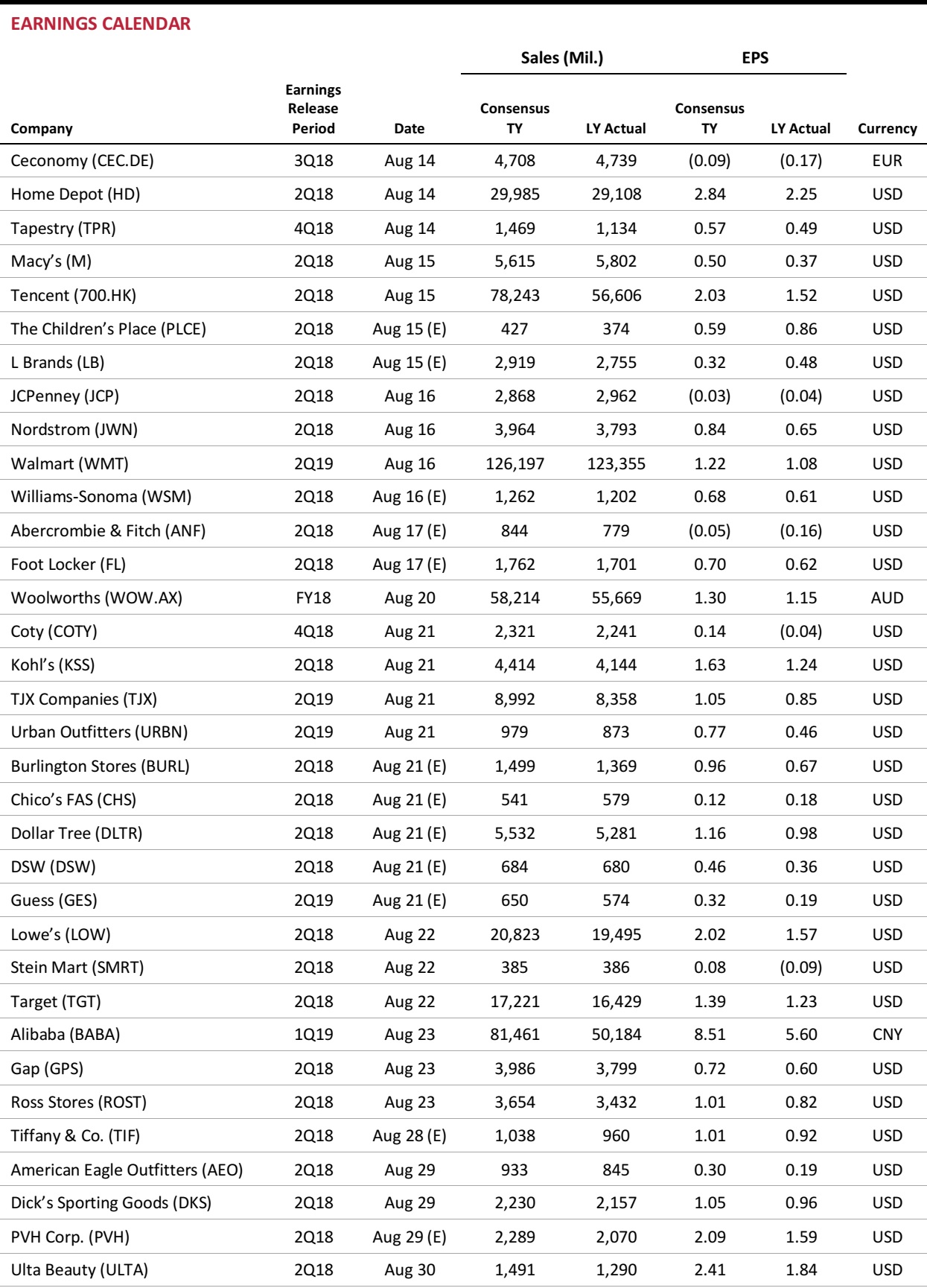

In the US, the back-to-school season is in full swing, and the National Retail Federation (NRF) forecasts that shoppers will shell out a total of $28 billion on school-related items this year. This total excludes back-to-college spending, which the NRF predicts will be worth another $55 billion to US retail. As substantial as these estimates are, the NRF expects back-to-school spending to be down marginally versus last year, when it reached an estimated $30 billion. The NRF bases its forecasts on its consumer surveys, which asked shoppers to predict how much they would spend on school- and college-related items this year.

Given the broader economic context, we are less pessimistic about back-to-school sales, and we see little reason for shoppers, in aggregate, to cut back. In fact, we forecast a 3%–4% year-over-year uplift in back-to-school sales, for five primary reasons:

- Most importantly, we are seeing strong demand in US retail. Total retail sales excluding autos and gasoline were up 4.5% in the first half of the year, and sales of discretionary goods such as apparel, electronics and furniture accelerated even as gas prices rose and threatened to pinch consumer spending.

- Unemployment is low, registering at 3.9% in July, versus 4.3% a year earlier.

- Consumer confidence is up, measuring 97.9 in July versus 93.4 last July, per the University of Michigan Index of Consumer Sentiment.

- Wage growth is solid, registering 2.7% in July, versus 2.5% a year earlier.

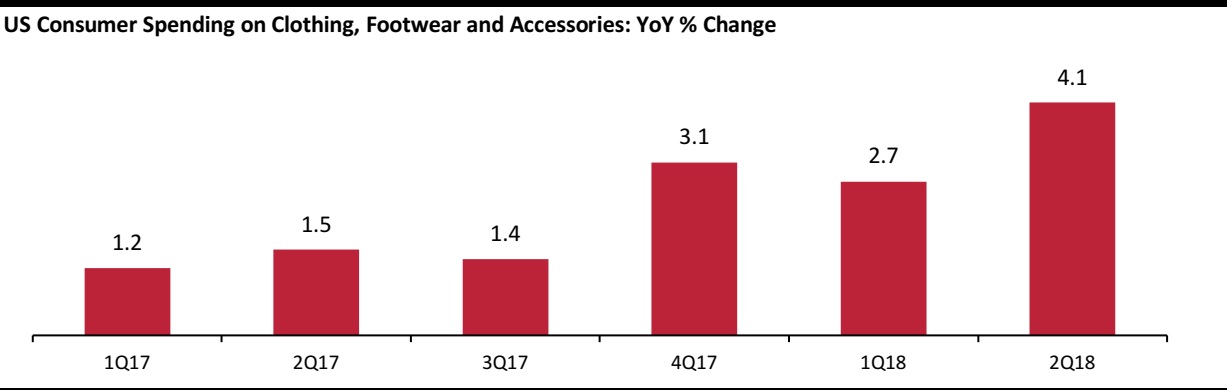

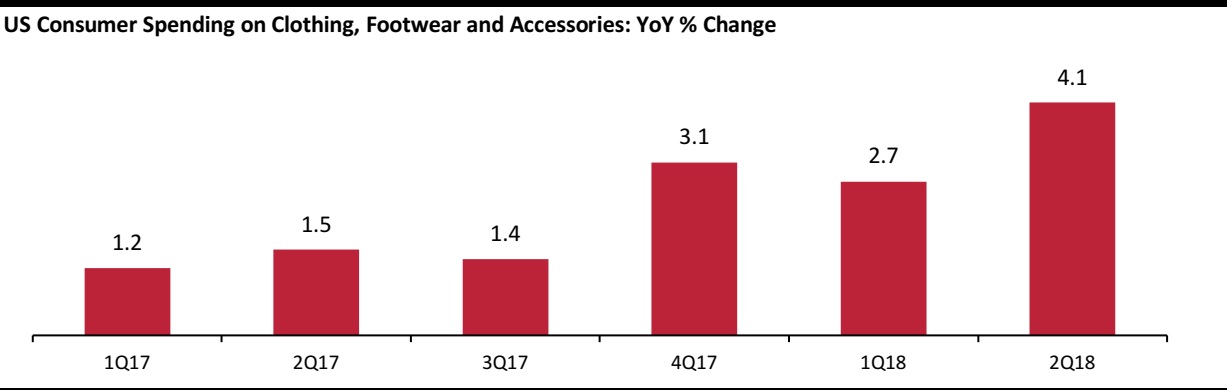

- Critically, total spending on clothing and footwear is accelerating, according to the US Bureau of Economic Analysis. This long-moribund category saw consumer demand jump by 4.1% year over year in the second quarter. Apparel is a core back-to-school category, accounting for an estimated 35% of total spending, per the NRF.

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research

So, what are the negatives? And in a retail sector growing at around 4.5%, why are we forecasting “only” a 3%–4% increase in back-to-school sales? We consider two factors as potential negatives:

- Gas prices have been rising strongly and were up 24% year over year in June. Traditionally, higher gas prices act as a strong drag on discretionary retail sales. So far this year, we have seen a countercyclical trend of strengthening discretionary sales, but sustained increases in gas prices could take the edge off further discretionary growth.

- Retail sales increases are being supported by big-ticket categories that are unrelated to back-to-school season. Home improvement and furniture are among the categories supporting total retail growth, and few shoppers will be visiting these kinds of stores for back-to-school purchases.

Overall, though, we see many more reasons to be optimistic than pessimistic this season. One final data point that underscores this positivity is a survey finding from Prosper Insights & Analytics: when the firm surveyed US shoppers in June about their back-to-school spending intentions, a net 22.8% said that they expect to spend more this year than they did last year.

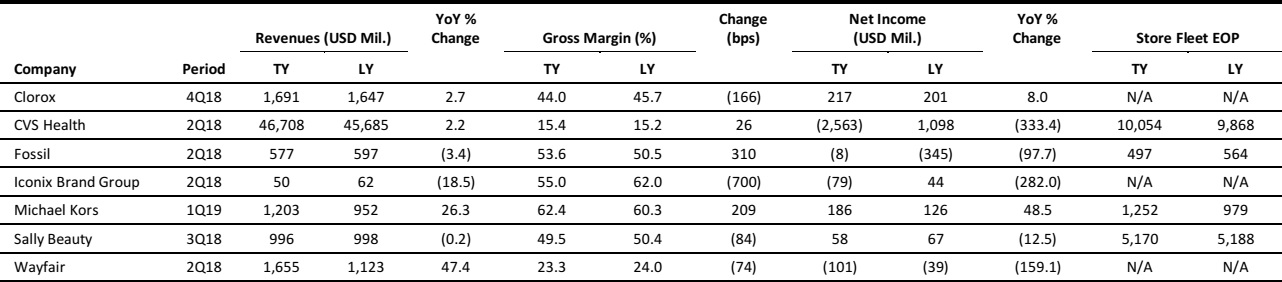

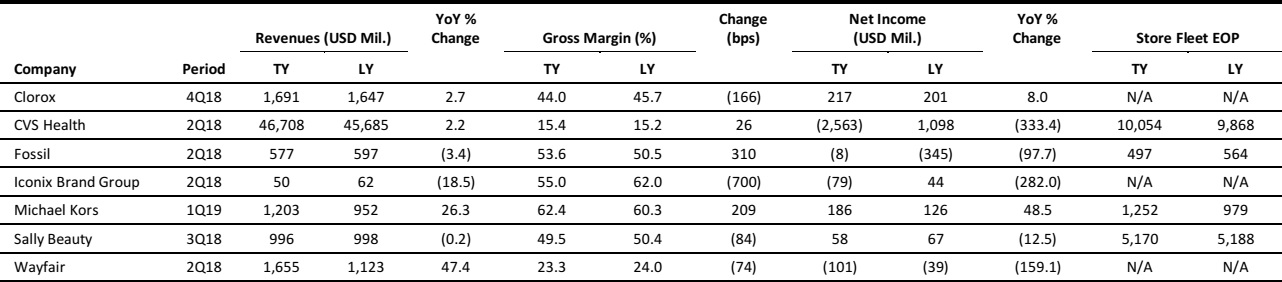

US RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Walmart Builds Global Alliances with Tech Players to Battle Amazon

(August 7) Bloomberg.com

Walmart Builds Global Alliances with Tech Players to Battle Amazon

(August 7) Bloomberg.com

- Walmart, which ranks No. 3 in the Internet Retailer 2018 Top 500, has created a formidable e-commerce business by investing billions to hire engineers and data scientists, building automated distribution centers tailored for web orders, and rolling out the curbside pickup for online grocery orders at more than 2,000 stores.

- But Walmart knows it can no longer go it alone and is “learning to partner with others,” according to CEO Doug McMillon. Amazon now captures 49% of the US e-commerce market, and its acquisition of upscale grocer Whole Foods Market last year threatens a business that makes up more than half of Walmart’s US sales.

Walmart, Target Lead for BTS Destinations

(August 7) RetailDive.com

Walmart, Target Lead for BTS Destinations

(August 7) RetailDive.com

- Back-to-school shopping is moving earlier, according to data compiled by Bazaarvoice and sent to Retail Dive in an email. According to data compiled from a network of retailers, July 24, July 31, August 6 and September 4 (Labor Day) were the biggest back-to-school shopping days in 2017.

- Shopping early and shopping simply are two important factors for parents this year. Consumers who participated in a recent JLL Retail survey pegged Walmart (50.3%) and Target (47.4%) as their favored back-to-school shopping destinations, with only 15.8% ofrespondents naming Amazon as their top choice.

Online Retailers Are Using Empty Mall Spaces to Test  (August 6) Digiday.com

(August 6) Digiday.com

- The retail apocalypse may have a silver lining after all: malls are now being repurposed as startup incubation hubs. Mall operators are teaming up with startup programs to offer startups coworking spaces, networking and mentorship possibilities.

- With big-box retailers closing stores, operators are exploring new uses for mall spaces to cope with a six-year high in mall vacancy rates. Beyond giving new digital companies an entry point to the physical world, companies can use the spaces to test products with mall customers.

Gump’s Survived the San Francisco Earthquake, but Not E-Commerce  (August 4) Bloomberg.com

(August 4) Bloomberg.com

- Gump’s, the San Francisco retail landmark that survived the 1906 earthquake, filed for Chapter 11 bankruptcy protection after succumbing to the rise of online shopping and shifting consumer habits.

- After years of losses, the 157-year-old Bay Area department store had been trying to find a buyer or additional financing since May, to no avail. The closely held company and its affiliates had assets of $61 million and liabilities of $64 million, according to filings.

Amazon, NRF Forge New Group to Lobby Around USP (August 3) RetailDive.com

(August 3) RetailDive.com

- The National Retail Federation (NRF) and a group of retailers and e-commerce and logistics companies that includes Amazon announced the formation of “The Package Coalition” to support the US Postal Service’s package delivery services.

- The coalition’s aim is “to work proactively with policymakers and the public to highlight the importance of the postal package delivery services.” USPS is “the only daily delivery service that connects every one of America’s 157 million addresses,” the group said in a press release.

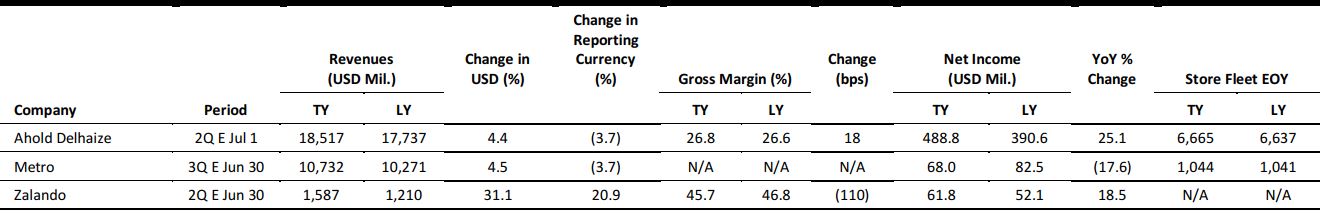

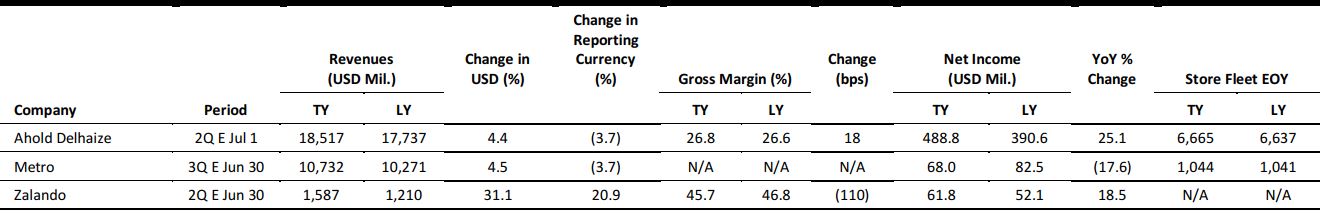

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

UK Retail Sales Growth Slows in July amid Consistently Warm Weather; Food Sales Prove Solid

(August 7) BRC press release

UK Retail Sales Growth Slows in July amid Consistently Warm Weather; Food Sales Prove Solid

(August 7) BRC press release

- UK retail sales grew by 1.6% year over year in July, fueled largely by a consistently warm summer and food and drink sales, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. The sales growth in July was below the three-month average of 2.7%. Comparable sales increased by 0.5% year over year in July.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended July, total food sales grew by 4.5% and total nonfood sales grew by 1.2%.

Tesco-Carrefour Alliance to Start Functioning in October

(August 6) RetailGazette.co.uk

Tesco-Carrefour Alliance to Start Functioning in October

(August 6) RetailGazette.co.uk

- British grocery retailer Tesco and its French peer Carrefour have confirmed that their strategic alliance, governed by a three-year operational framework, will become operational in October. The global purchasing alliance ultimately aims to cut costs for the two retailers as they attempt to claw back market share in their respective countries from German discount grocers Aldi and Lidl.

- French competition authority Autorité de la Concurrence said last month that it will investigate if the alliance could threaten competition rules and will review outcomes for the food sector.

Marks & Spencer Partners with True to Drive Digital Innovation Agenda

(August 6) Company press release

Marks & Spencer Partners with True to Drive Digital Innovation Agenda

(August 6) Company press release

- British retailer Marks & Spencer (M&S) announced a partnership with True, an investment company that focuses on the consumer sector, to gain preemptive access to the latter’s consumer expertise, emerging technologies, and proprietary research.

- M&S CEO Steve Rowe said, “As M&S seeks to become a digital-first retailer, we will be on the front foot thanks to True’s deep sector knowledge and the exposure they will give us to new enterprise-ready technologies which will benefit our customers and make us fit for the future.”

House of Fraser Settles Landlords’ Legal Challenge Out of Court

(August 6) RetailGazette.co.uk

House of Fraser Settles Landlords’ Legal Challenge Out of Court

(August 6) RetailGazette.co.uk

- House of Fraser has settled a legal challenge by a group of landlords out of court. This is expected to take some pressure off the retailer and make it easier for the company to secure a rescue deal to fund its quarterly rent and ensure adequate inventory levels.

- Mark Fry and Charlotte Coates, legal advisors to the group of landlords, said, “Although we will not have our day in court, we are pleased with the outcome and hope that our landmark legal challenge sends a clear message to any other companies considering a CVA.” House of Fraser did not, however, explicitly state if this means it can proceed with its store closure plan.

Coop Lombardia Partners with Pricer to Introduce Electronic Labels in Stores

(July 31) ESMMagazine.com

Coop Lombardia Partners with Pricer to Introduce Electronic Labels in Stores

(July 31) ESMMagazine.com

- Italian consumer cooperative Coop Lombardia is planning to introduce digital shelf-edge labels equipped with HD+ e-paper graphics display using technology from Pricer, a digital shelf label provider.

- The shelf-edge labels are equipped with the flash capability and can be switched on in real time to report specific actions of employees or customers.

ASIA RETAIL & TECH HEADLINES

South Korea Retail Sales Up in First Half of 2018 (August 1) RetailNews.Asia

(August 1) RetailNews.Asia

- South Korea retail sales increased by 7.4% in the first half of the year, according to the country’s Ministry of Trade, Industry and Energy. A solid e-commerce performance contributed to the growth.

- Online sales rose by 16.3% year over year, in contrast to offline sales, which increased by only 2.7%. Grocery e-commerce sales increased by 20.8% during the period, while large discounters reported a sales decline of 1.8%.

Walmart to Expand Headcount for Technology Operations in India (August 6) Retail.EconomicTimes.com

(August 6) Retail.EconomicTimes.com

- Walmart is planning to increase its headcount by 1,000 in India to drive technology development and maintenance in the country and to hold off competition from e-commerce rival Amazon.

- Walmart CIO Clay Johnson said, “We have taken whole projects and moved them over to drive the Indian ownership of the product. We think that is helping, but this will help even more (in retaining talent).”

Didi Chuxing Announces Investment in One-Stop Car Services Business

(August 6) SCMP.com

Didi Chuxing Announces Investment in One-Stop Car Services Business

(August 6) SCMP.com

- Chinese ride-hailing service provider Didi Chuxing announced an investment of $1 billion in Xiaoju Automobile Solutions, its automotive services business. The investment aligns with the company’s rebranding goals and an anticipated public listing by 2019.

- Xiaoju Automobile Solutions provides Didi drivers and car owners across China with services such as leasing and trading, refueling, maintenance and repairs, and car rentals.

E-Land Halts Coffee Bean & Tea Leaf Business

(August 6) RetailNews.Asia

E-Land Halts Coffee Bean & Tea Leaf Business

(August 6) RetailNews.Asia

- South Korean fashion retail group E-Land announced that it was closing down its Coffee Bean & Tea Leaf business in China to improve strained cash flow.

- The group’s liquidity is significantly stressed, and that has forced the company to abandon its resorts and cruise businesses as well.

LATAM RETAIL & TECH HEADLINES

Falabella to Purchase Linio for $138 Million

(August 1) Reuters.com

Falabella to Purchase Linio for $138 Million

(August 1) Reuters.com

- Chilean department store chain Falabella announced that it will purchase Latin American e-commerce firm Linio for $138 million.

- Falabella added in a regulatory filing that it was looking for $800 million in funds for the acquisition and to develop its partnerships with IKEA in Chile, Colombia, and Peru. The deal is pending approval by Falabella shareholders.

Advent International Acquires Majority Stake in Walmart Brazil (August 1)ChainStoreAge.com

(August 1)ChainStoreAge.com

- Global private equity firm Advent International has acquired a majority stake of 80% in Walmart Brazil, while the retailer retains the remaining 20%. Walmart did not disclose the value or details of the deal.

- When Walmart announced the deal in May, it expected Advent to grow its operations in Brazil. The retailer currently operates 438 stores in the country.

BrainHi Chosen to Be Part of Y Combinator

(August 6) Latam.tech

BrainHi Chosen to Be Part of Y Combinator

(August 6) Latam.tech

- Puerto Rican artificial intelligence startup BrainHi has been chosen to be part of San Francisco–based accelerator Y Combinator.

- BrainHi works as a virtual receptionist for booking doctor appointments and answering nonmedical questions. The startup currently works with private practices in Puerto Rico and hopes to use the funds from Y Combinator to expand internationally.

Magazine Luiza Grows Sales, Doubles Net Income in the Second Quarte (August 6) Company press release

(August 6) Company press release

- Brazilian electronics and home appliances retailer Magazine Luiza grew total sales by 43%, to R$4.7 billion ($1.3 billion), in the second quarter ended June 2018. Same-store sales jumped 27%.

- The retailer’s net income doubled, while its EBITDA grew by 32.5% during the period. Magazine Luiza expects the second half of the year to be more challenging than the first.

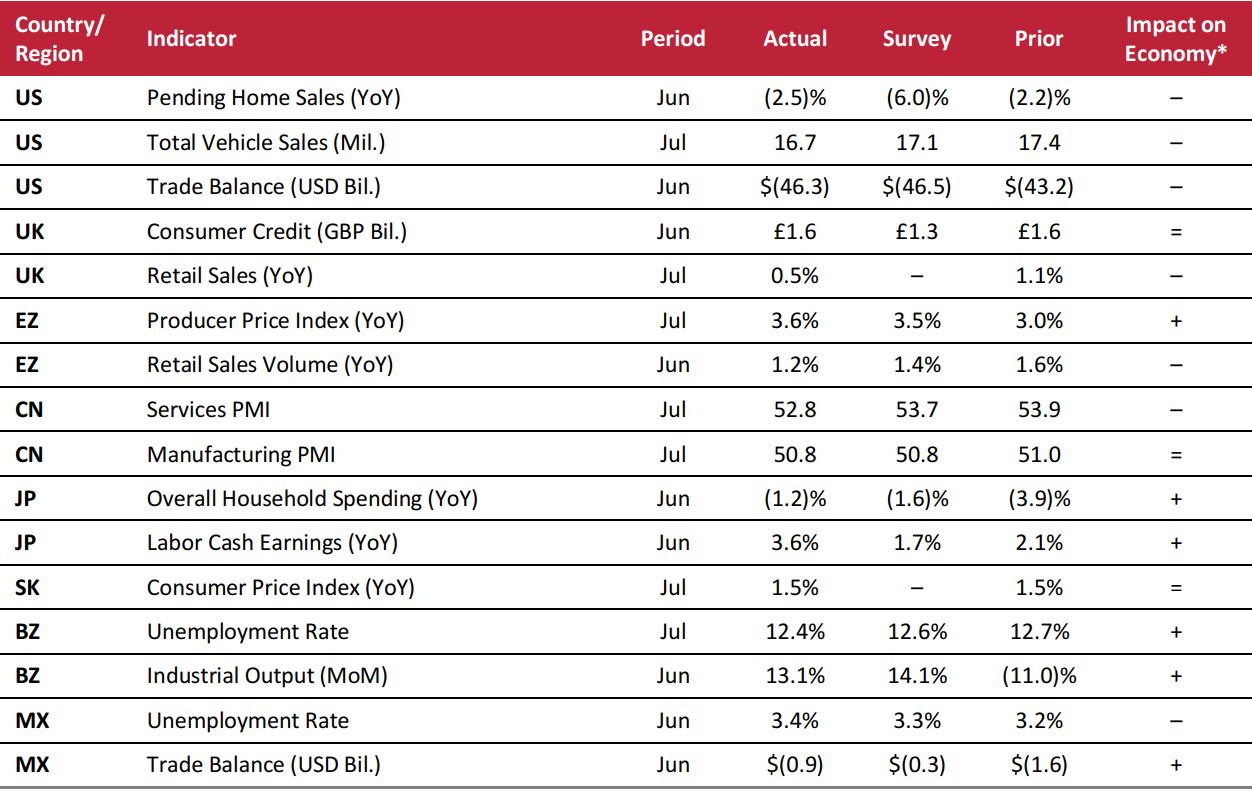

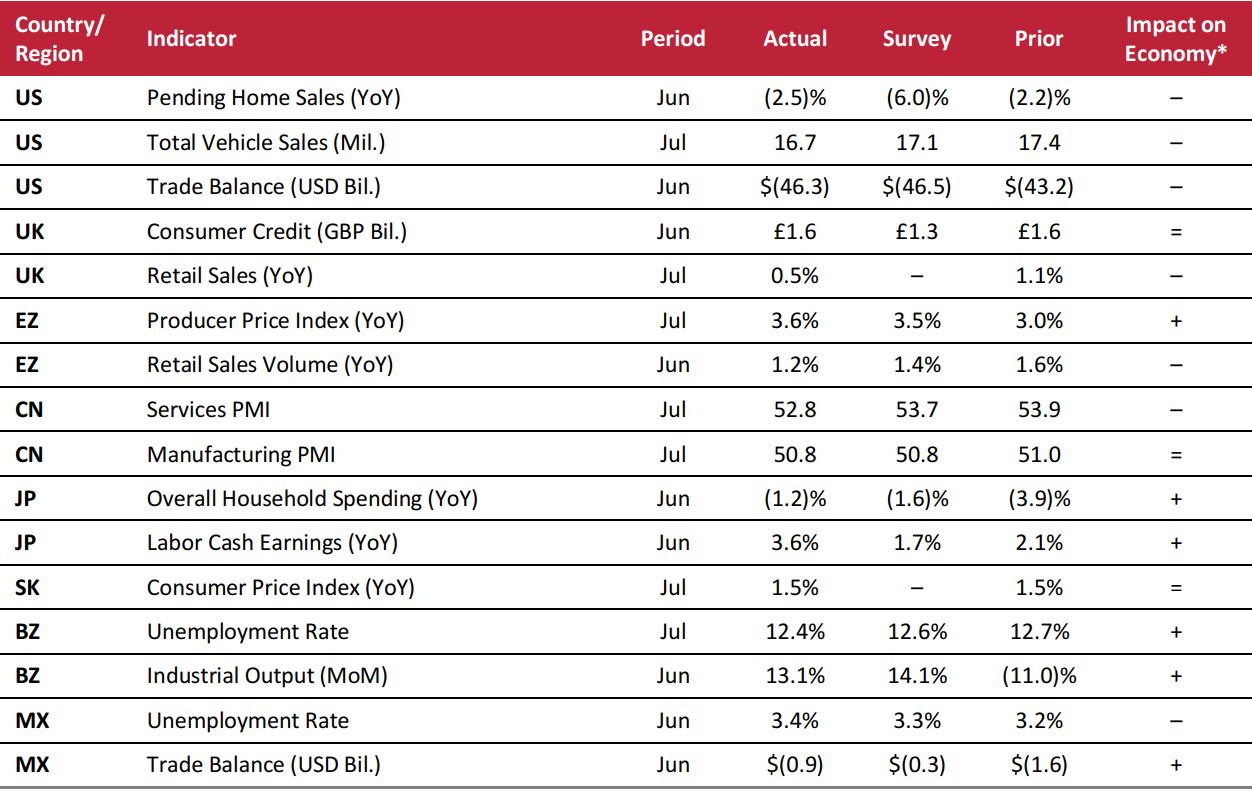

MACRO UPDATE

Key points from global macro indicators released August 1–8, 2018:

- US: Pending home sales decreased by less than analysts anticipated in June, falling by 2.5% year over year after declining by 2.2% year over year in May.

- Europe: In the eurozone, retail sales volume increased by 1.2% year over year in June, versus the consensus estimate of 1.4%.

- Asia-Pacific: In China, the Services Purchasing Managers’ Index (PMI) decreased to 52.8 in July from 53.9 in June. In Japan, overall household spending decreased by 1.2% year over year in June, versus the consensus estimate of a 1.6% decline.

- Latin America: In June, Brazilian industrial output increased by 13.1% month over month. In Mexico, the trade deficit narrowed to $0.9 billion in June from $1.6 billion in May.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/Bank of England/British Retail Consortium/European Commission/China Federation of Logistics & Purchasing/Japan Ministry of Economy, Trade and Industry/Statistics Korea/Fundação Getulio Vargas/Confederação Nacional da Indústria/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/Bank of England/British Retail Consortium/European Commission/China Federation of Logistics & Purchasing/Japan Ministry of Economy, Trade and Industry/Statistics Korea/Fundação Getulio Vargas/Confederação Nacional da Indústria/Instituto Nacional de Estadística y Geografía/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research

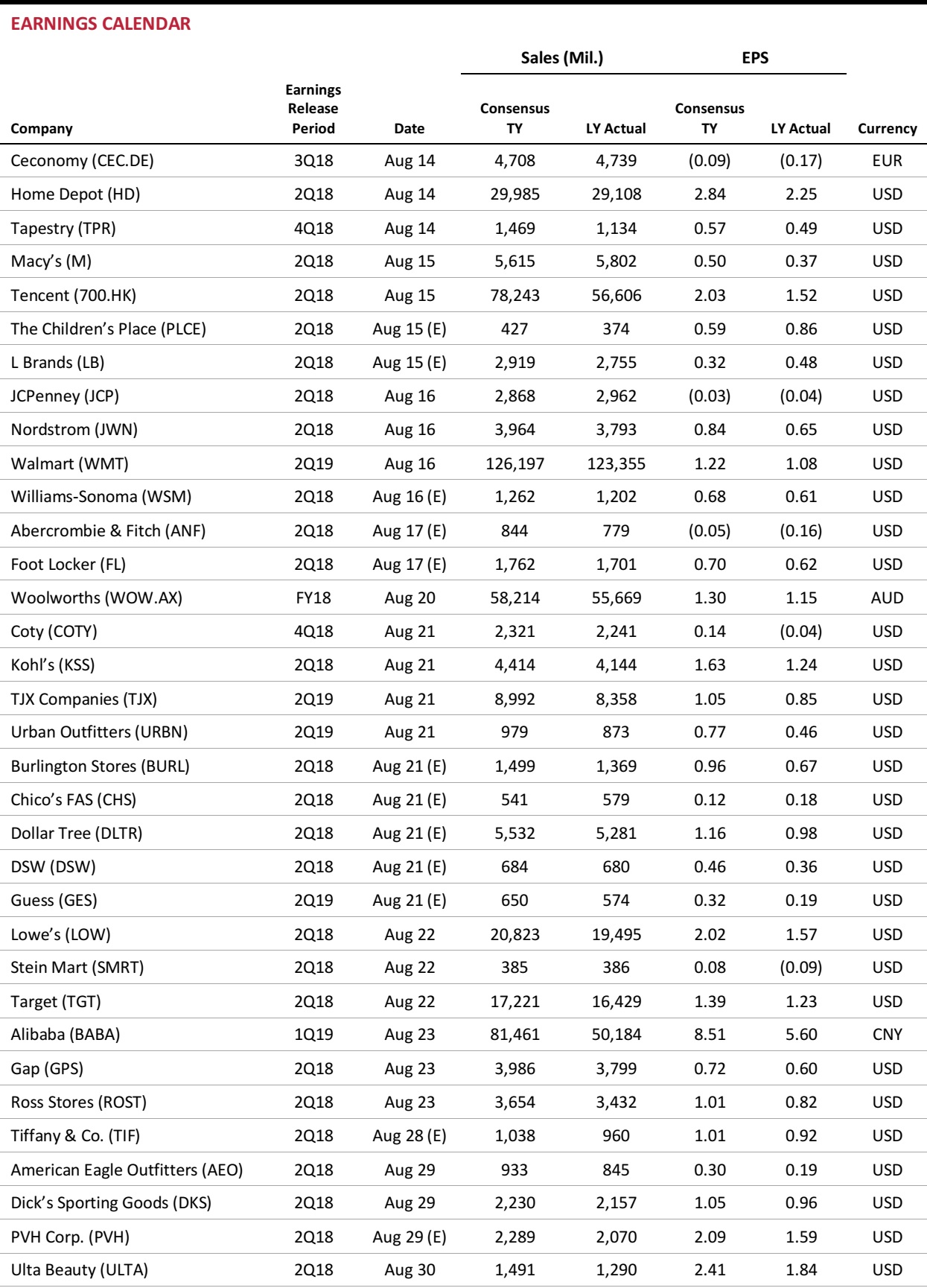

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Walmart, Target Lead for BTS Destinations

(August 7) RetailDive.com

Walmart, Target Lead for BTS Destinations

(August 7) RetailDive.com

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Tesco-Carrefour Alliance to Start Functioning in October

(August 6) RetailGazette.co.uk

Tesco-Carrefour Alliance to Start Functioning in October

(August 6) RetailGazette.co.uk

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/Bank of England/British Retail Consortium/European Commission/China Federation of Logistics & Purchasing/Japan Ministry of Economy, Trade and Industry/Statistics Korea/Fundação Getulio Vargas/Confederação Nacional da Indústria/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/Bank of England/British Retail Consortium/European Commission/China Federation of Logistics & Purchasing/Japan Ministry of Economy, Trade and Industry/Statistics Korea/Fundação Getulio Vargas/Confederação Nacional da Indústria/Instituto Nacional de Estadística y Geografía/Coresight Research