From the Desk of Deborah Weinswig

Athleisure and Sneaker Culture Are Changing Mainstream Fashion

The athleisure apparel and sportswear categories continue to grow at above-market rates, and they are exerting significant influence on mainstream fashion. In the US, consumers increasingly prefer to dress in outfits that they can wear to the office, the gym and after work as well. These kinds of clothes are often more comfortable than traditional workwear, and not having to switch outfits based on activity or setting saves people time. The technology sector was where athleisurewear first found acceptance in the workplace, but the trend has now spread to more traditional industries such as advertising and business. Athleisure’s expanding influence is even affecting fashion categories such as denim and formalwear. Meanwhile, sneaker culture is impacting the broader footwear market, from the mass-market segment to the luxury space. Both of these trends underlie the increasing casualization of fashion.

Market forecasts call for growth of the athleisure and sportswear categories to continue to outpace growth of the broader apparel market. Sales of sportswear (an umbrella category encompassing athleisurewear) will hit nearly $116 billion this year, Euromonitor International forecasts, and grow at a 3.0% CAGR from 2018 to 2020—more than twice as fast as the combined US apparel and footwear market, which the firm forecasts will grow at a 1.3% CAGR over the period.

Athleisure’s influence is expanding beyond sportswear into traditional categories such as workwear and denim, in many cases supplanting denim entirely. Athleisure bottoms—especially leggings and yoga pants—have replaced jeans at a 1:1 ratio, according to The NPD Group. Back in 2000, premium denim jeans went for $200–$300 a pair, but this year, the average price for a pair of jeans is expected to be $32, driven by an expected 1.8% price decrease and a 5% annual market decline, according to Euromonitor International. Rather than purchasing a pair of designer jeans, many women today are electing to purchase a more comfortable and less-expensive pair of yoga pants, and new athleisure brands at both ends of the pricing spectrum have followed Lululemon Athletica’s lead as they seek to meet this demand. Yet rumors of the demise of jeans appear to be exaggerated: Levi’s reported an 8% sales gain in 2017 and many designers have been developing hybrid products that combine the durability of denim with the style and comfort of athleticwear.

Meanwhile, sneaker culture is invading many segments of footwear—from the mass market to luxury—and lifting the entire footwear market. As part of the continuing casualization of fashion, shoes that people historically wore only for sports are now often seen in more formal arenas, and this is particularly true for sports footwear styles from luxury brands such as Balenciaga, Coach, Fendi, Gucci and Prada.

Sock sneakers are one of the latest footwear trends. Originally designed by traditional sports apparel makers Adidas and Nike, these shoes have a minimal, stretchy knit upper attached to a sole, and no laces. Luxury sock sneaker brands include Balenciaga, DKNY, Fendi, Marni and Rick Owens. Demand for this style has been on fire: from the first quarter through the early part of the third quarter in 2017, the number of sock-like sneaker luxury brands increased by 220%, and the shoes had an average price of $410 in the third quarter last year, according to fashion researcher Edited.

Major athletic brands are down, but not out, in terms of competing with athleisure brands. In their respective latest quarterly earnings reports, Nike reported that its digital sales had climbed over the quarter, while Adidas reported a 10% increase in quarterly sales and Under Armour reported that sales had stabilized during the period.

Another driver of athleisurewear demand is the rising popularity of wellness as the new status symbol. Many health-minded individuals participate in aspirational fitness classes and social fitness events; enjoy healthy, organic and natural food; and use devices to quantify their health and track their fitness. The global wellness market was already worth $3.7 trillion back in 2015, according to the nonprofit Global Wellness Institute.

As consumers increasingly adopt sportswear as daily wear, apparel brands will add functionality to their products to ride this trend. More new brands are likely to enter the athleisure market and existing brands will likely continue to expand their product offerings to address more of the market. Thus, the athleisure category will continue to grow as the line between activewear and daywear blurs further. The combination of cultural trends, favorable demographics and innovation should continue to drive above-market growth for the athleisure category, which could generate $130 billion in sales by 2020.

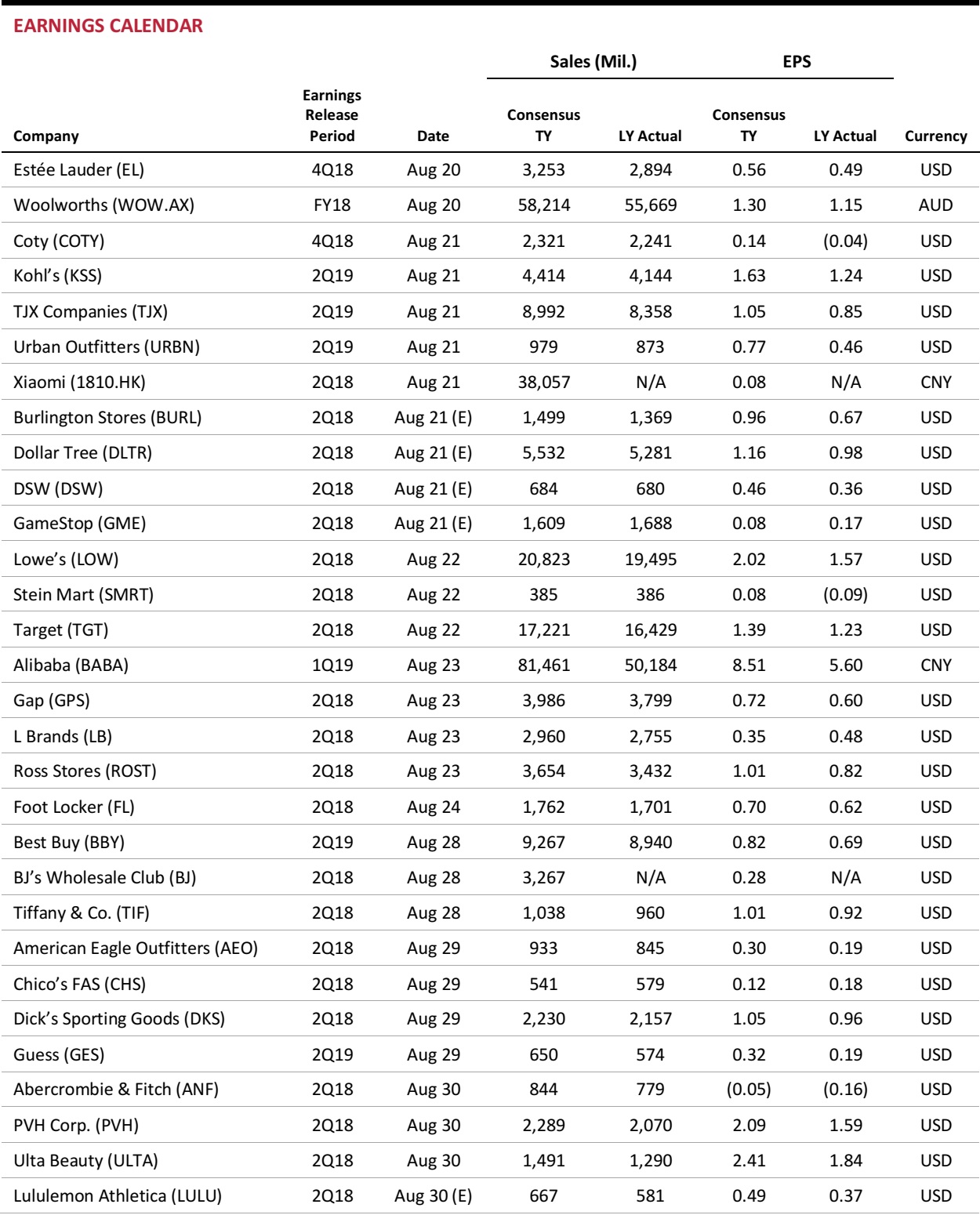

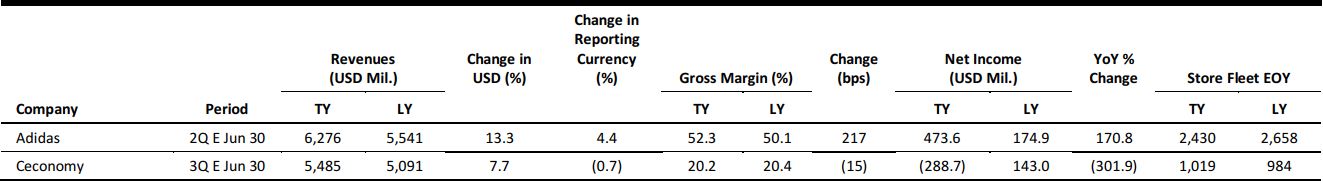

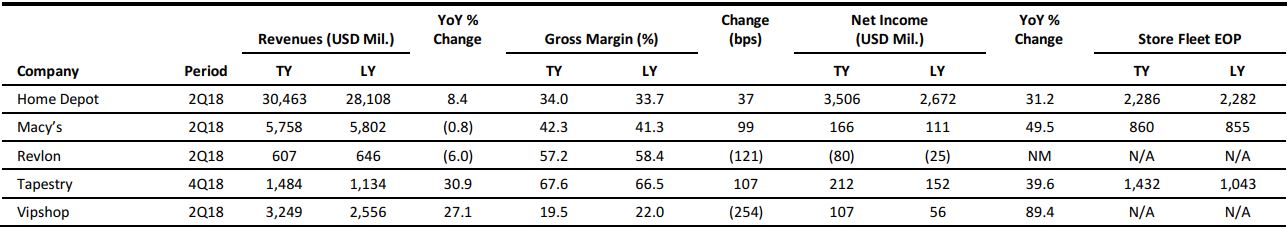

US RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

NRF Lifts 2018 US Retail Sales Forecast on Strong Job Market, Tax Reform

(August 13) Reuters.com

NRF Lifts 2018 US Retail Sales Forecast on Strong Job Market, Tax Reform

(August 13) Reuters.com

- The National Retail Federation (NRF) raised its US retail sales forecast for 2018, citing higher wages, gains in disposable income and a strong job market that have boosted consumer spending.

- The trade body now expects retail sales for 2018, excluding automobiles, gasoline stations and restaurants, to rise by a minimum of 4.5% over 2017, compared with the 3.8%–4.4% growth it forecast earlier this year.

Coworking Spaces May Be the Answer to Retailers’ Foot Traffic Problem

(August 13) RetailDive.com

Coworking Spaces May Be the Answer to Retailers’ Foot Traffic Problem

(August 13) RetailDive.com

- As the number of remote workers in various industries grows—43% of employed Americans work remotely at least some of the time—flexible coworking spaces will grow to account for 30% of all office stock by 2030, according to a report from commercial real estate firm JLL.

- The highest concentration of coworking spaces in retail is in malls (21.3%) and street-front properties (20%), while 54.7% are in suburbs. The average household income within a three-mile radius of such spaces is about $100,000.

US Inflation Balloons: 2.9% over Past 12 Months

(August 13) Pymnts.com

US Inflation Balloons: 2.9% over Past 12 Months

(August 13) Pymnts.com

- Core inflation spiked 2.9% over the last 12 months, essentially flattening wage gains that had edged into the last several months’ economic reports. The core measure of the Consumer Price Index (CPI), which excludes items such as food and fuel, was up 2.4% from the same time last year—the largest annual increase since September 2008.

- The previous month’s CPI was up a scant .2%. The July jump is the biggest pickup the inflation index has seen in a decade.

BCBG Opens Concept in SoHo a Year After Exiting Bankruptcy

(August 13) RetailDive.com

BCBG Opens Concept in SoHo a Year After Exiting Bankruptcy

(August 13) RetailDive.com

- New BCBG Max Azria owners Marquee Brands and Global Brands Group have added to the brand’s store count with a new location in New York City’s SoHo neighborhood. They also maintain the brand’s original flagship on Fifth Avenue in Manhattan.

- The 5,200-square-foot space features an updated store concept and layout and sells sportswear, dresses, shoes, handbags, jewelry and a new denim line. Marquee and Global Brands acquired the iconic fashion brand at auction about a year ago.

Amazon Captures 5% of American Retail Spending. Is That a Lot?

(August 8) Bloomberg.com

Amazon Captures 5% of American Retail Spending. Is That a Lot?

(August 8) Bloomberg.com

- Last year, Americans bought about $200 billion worth of stuff from Amazon and its Whole Foods grocery stores. If that’s accurate, Amazon captured about 5% of Americans’ retail spending, excluding cars and car parts and visits to restaurants and bars.

- Those worried about Amazon’s heft could arm themselves with a different figure: 49%. That’s the share of Americans’ online spending that Amazon is expected to grab this year, up from 43.5% in 2017, according to eMarketer.

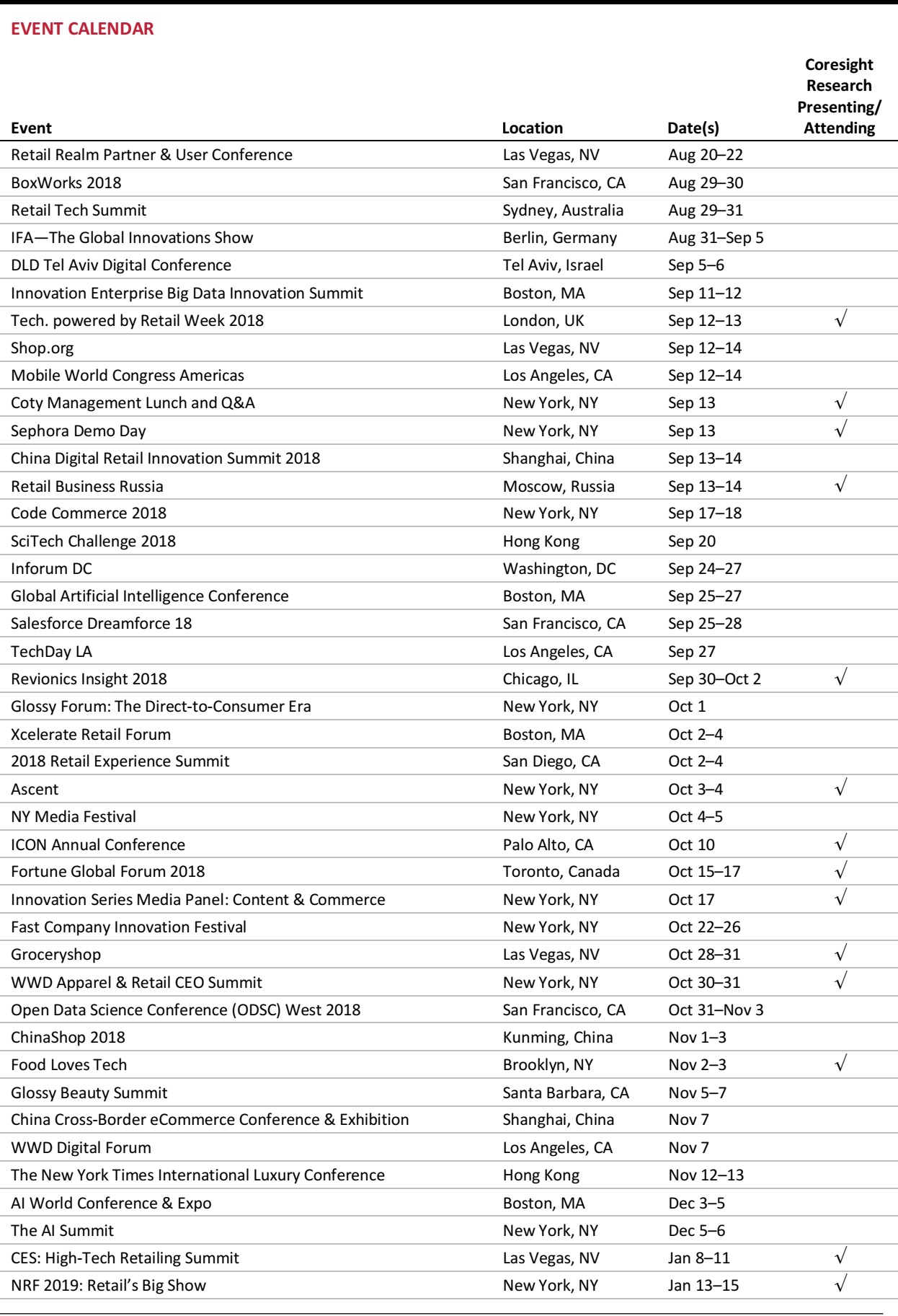

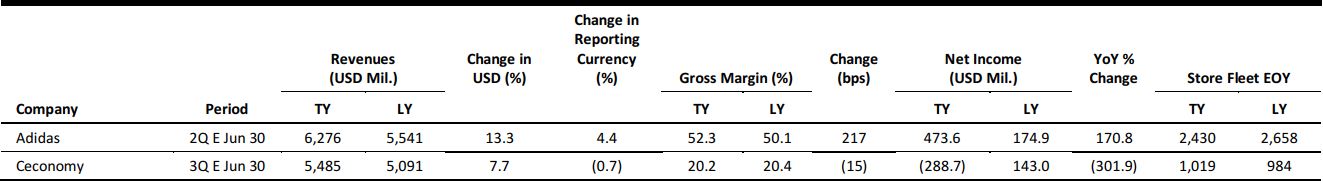

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Marks & Spencer Closes Seven More Stores

(August 13) RetailGazette.co.uk

Marks & Spencer Closes Seven More Stores

(August 13) RetailGazette.co.uk

- British retailer Marks & Spencer closed seven stores last weekend as it moved ahead with its restructuring plan to close 100 stores by 2022.

- The latest closures are in Falkirk, Kettering, Northampton, Stockton, Newmarket, New Mersey and Walsall. The retailer is seeking to cut its costs by £350 million ($447 million) by 2021.

Sports Direct Seals an Agreement to Buy House of Fraser for £90 Million

(August 10) TheRetailBulletin.com

Sports Direct Seals an Agreement to Buy House of Fraser for £90 Million

(August 10) TheRetailBulletin.com

- Retailer Sports Direct, owned by Mike Ashley, has agreed to take over all of House of Fraser’s stores and stock, as well as its brand name, for £90 million ($115 million). The deal was struck within six hours after the accountancy firm Ernst & Young took over the administration process.

- Ashley, who already held an 11% stake in the company, surpassed retail entrepreneur Philip Day, owner of Edinburgh Woollen Mill Group, to secure the deal.

Decathlon Acquires Switzerland’s Third-Largest Sports Chain, Athleticum

(August 9) RetailDetail.eu

Decathlon Acquires Switzerland’s Third-Largest Sports Chain, Athleticum

(August 9) RetailDetail.eu

- Decathlon has agreed to acquire Swiss sports chain Athleticum for an undisclosed sum and a minority stake in Decathlon’s Switzerland subsidiary. Decathlon opened a test store in Athleticum near Geneva before the acquisition, and considered the store a success.

- Decathlon now has 23 Swiss stores under its brand and is planning to open around 30 stores and increase its number of employees.

DIA Exits China, Sells Operations in Shanghai to Suning.com

(August 10) Company press release

DIA Exits China, Sells Operations in Shanghai to Suning.com

(August 10) Company press release

- Spanish retailer DIA announced that it has sold 100% of its shares in Chinese entities Shanghai Dia Retail and DIA (Shanghai) Management Consulting Services to Nanjing-based retailer Suning.com.

- DIA stated that it has formally exited the Chinese market with the divestment of its operations in Shanghai.

SenSat Raises $4.5 Million in Seed Funding

(August 10) TechCrunch.com

SenSat Raises $4.5 Million in Seed Funding

(August 10) TechCrunch.com

- SenSat, a UK artificial intelligence startup, has raised $4.5 million in seed funding backed by three investors, Force Over Mass, Round Hill Venture Partners and Zag.

- The company plans to use the money to develop its technology, which helps computers understand physical dimensions using visual and spatial data. SenSat also plans to invest in its US office.

ASIA RETAIL & TECH HEADLINES

Crocs Announces the Launch of E-Commerce Website in Philippines

(August 9) RetailNews.Asia

Crocs Announces the Launch of E-Commerce Website in Philippines

(August 9) RetailNews.Asia

- Footwear manufacturing company Crocs announced the launch of its e-commerce website in the Philippines. The website was developed by Chinese e-commerce enabler aCommerce.

- Mark Christian Chan, President of Crocs Philippines, said, “Having worked with aCommerce to launch and operate our flagship store on Lazada Philippines, it was easy to extend our collaboration.”

Alipay Launches Group-Buy Function on Its Payment Application

(August 9) SCMP.com

Alipay Launches Group-Buy Function on Its Payment Application

(August 9) SCMP.com

- Alibaba-backed mobile wallet Alipay launched a group-buy function to compete with Pinduoduo, a social commerce startup.

- The group-buy feature, called Pintuan, allows consumers to purchase goods at a discounted price if users purchase the items together. The products are sourced from Alibaba’s Taobao e-commerce platform.

Amazon Invests $386 Million in India Business

(August 13) Livemint.com

Amazon Invests $386 Million in India Business

(August 13) Livemint.com

- Amazon has invested fresh funds of $386 million in its e-commerce business in India. This takes its cumulative investment to $4 billion since the company began operations in the country.

- So far, Amazon has been spending on its warehouses, a large logistics unit, marketing, deep discounts and a broader product offering.

Walmart and JD.com Invest $500 Million in Dada-JD Daojia

(August 8) CNBC.com

Walmart and JD.com Invest $500 Million in Dada-JD Daojia

(August 8) CNBC.com

- Chinese online grocery delivery company Dada-JD Daojia announced that it has raised $500 million from Walmart and JD.com in its latest round of funding.

- Wern-Yuen Tan, President and CEO of Walmart China, said, “By working with strong partners, and investing in digital capabilities, we will create easier and more convenient shopping experiences for customers.”

LATAM RETAIL & TECH HEADLINES

Tambo to Expand Its Store Network in Peru

(August 13) LaRepublica.pe

Tambo to Expand Its Store Network in Peru

(August 13) LaRepublica.pe

- Convenience store chain Tambo plans to expand its footprint in Peru by opening at least 10 new stores each month. The chain was established in 2015 and currently has 223 stores in Lima.

- Tambo’s food line manager, Jorge Palomino, said that the chain plans to expand to other provinces in Peru in 2019.

Peru Venture Capital Conference Scheduled for September

(August 7) LatamTech.com

Peru Venture Capital Conference Scheduled for September

(August 7) LatamTech.com

- Peru will hold its second annual Peru Venture Capital Conference in September this year. The conference enables entrepreneurs to meet cofounders and helps investors find interesting startups.

- Around 800 attendees are expected, including entrepreneurs, incubators, investors, big businesses and representatives of the Peruvian government.

Spotify Brazil Partners with Ebanx and Worldline

(August 7) BrazilReports.com

Spotify Brazil Partners with Ebanx and Worldline

(August 7) BrazilReports.com

- Music streaming platform Spotify has partnered with Ebanx, a Brazilian fintech startup, and Worldline, a payment services company, to enable Spotify users to pay for their subscriptions via debit card.

- Currently, the payment channels for subscribers are limited to credit cards and “boleto bancário,” a cash voucher service that constitutes more than two-thirds of payments made in Brazil.

SAP to Invest in Brazil’s Innovation Capability

(August 13) ZDNet.com

SAP to Invest in Brazil’s Innovation Capability

(August 13) ZDNet.com

- Software company SAP Labs has announced a $30.8 million investment in its innovation lab in São Leopoldo, Brazil.

- The investment is expected to be used to expand the firm’s research and development space by 45% and to provide employment opportunities to an additional 1,000 staff by 2022.

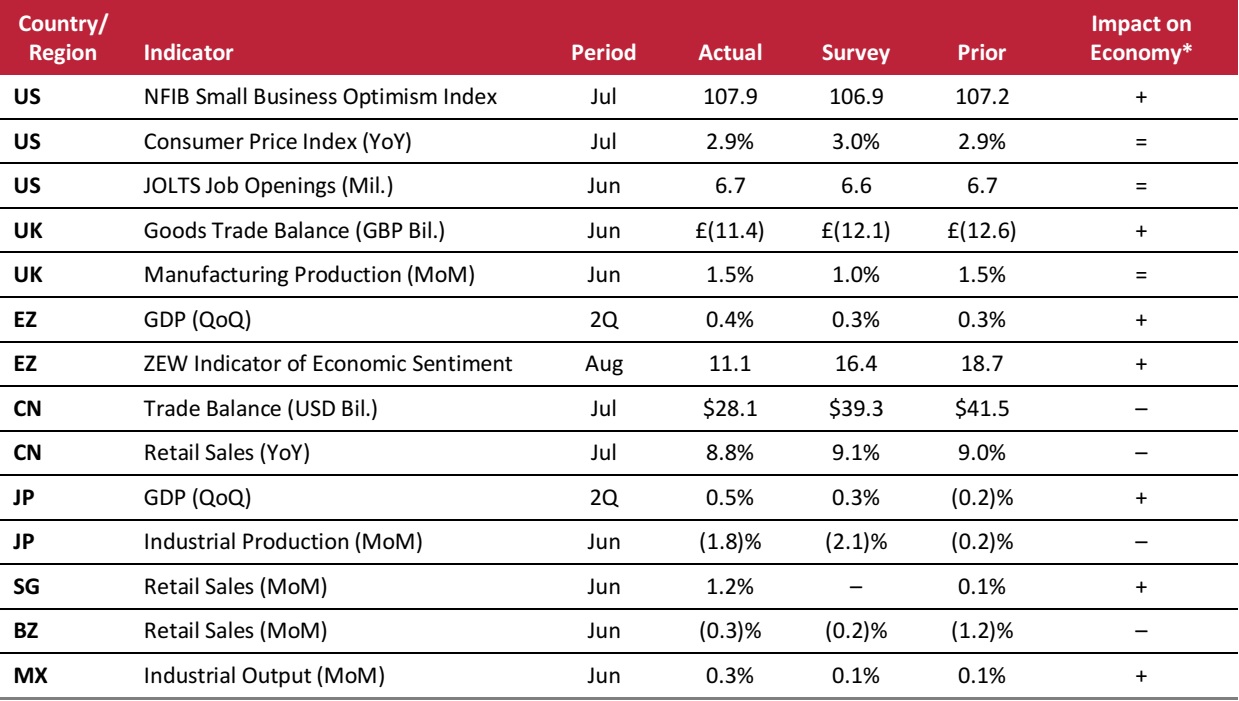

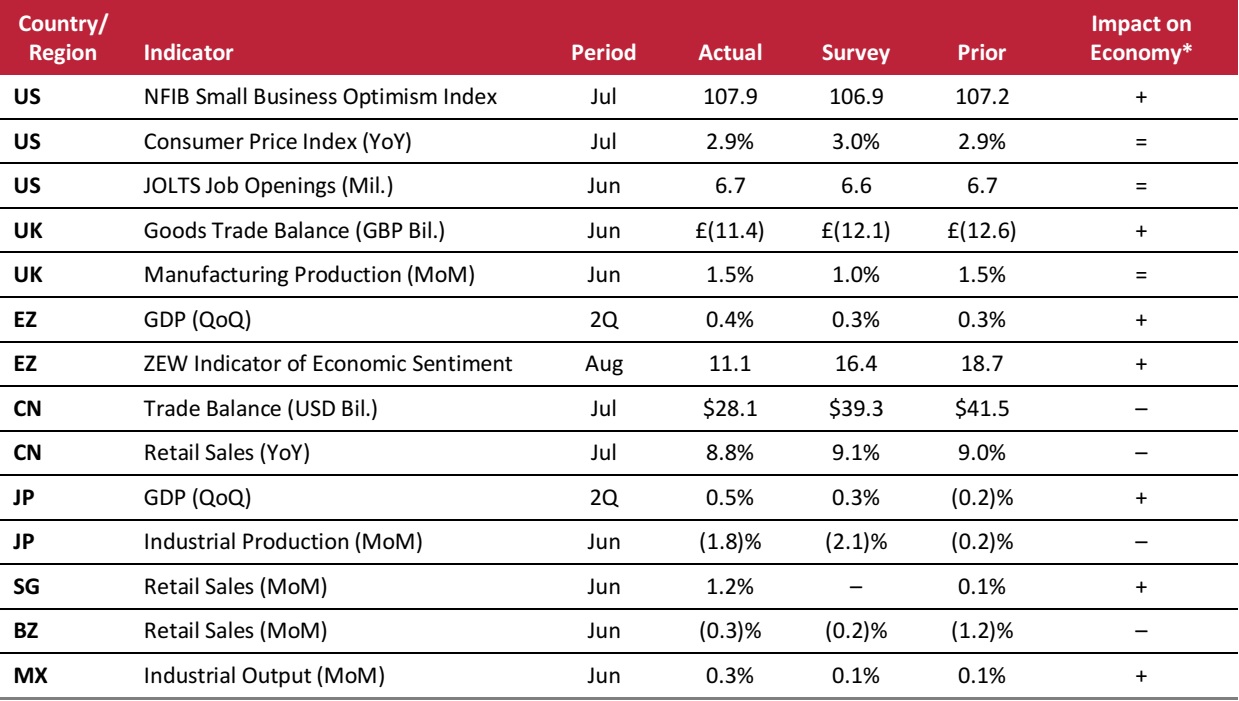

MACRO UPDATE

Key points from global macro indicators released August 8–14, 2018:

- US: In July, the NFIB Small Business Optimism Index rose to 107.9, its second-highest level since the survey began. The reading exceeded the consensus estimate, implying that economic activity is improving despite downside speculation by analysts.

- Europe: In the UK, the goods trade balance totaled £(11.4) billion in June, an improvement from the previous month’s £(12.6) billion. In the second quarter, eurozone GDP increased by 0.4% quarter over quarter; the rate was slightly higher than the 0.3% reported for the first quarter.

- Asia-Pacific: The most recently released indicators for the Asia-Pacific region were largely positive, except for in China, where indicators pointed to a shrinking trade balance and sluggish July retail sales. Retail sales in the country increased by 8.8% year over year in July, versus 9.0% in June.

- Latin America: Retail sales in Brazil were down 0.3% month over month in June, compared with a 1.2% decline in the previous month. June marked an improvement in Mexico’s industrial output, which increased by 0.3% month over month, surpassing both the consensus estimate and the previous month’s 0.1% increase.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: NFIB/US Census Bureau/US Bureau of Labor Statistics/Bank of England/GfK/European Commission/China Federation of Logistics & Purchasing/Japan Ministry of Economy, Trade and Industry/Singapore Economic Development Board/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: NFIB/US Census Bureau/US Bureau of Labor Statistics/Bank of England/GfK/European Commission/China Federation of Logistics & Purchasing/Japan Ministry of Economy, Trade and Industry/Singapore Economic Development Board/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

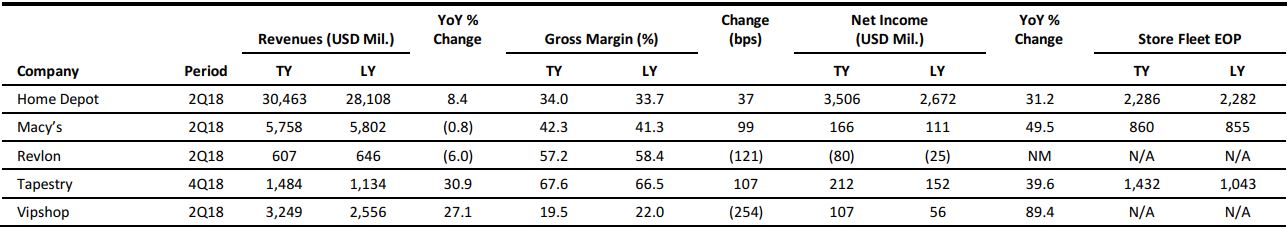

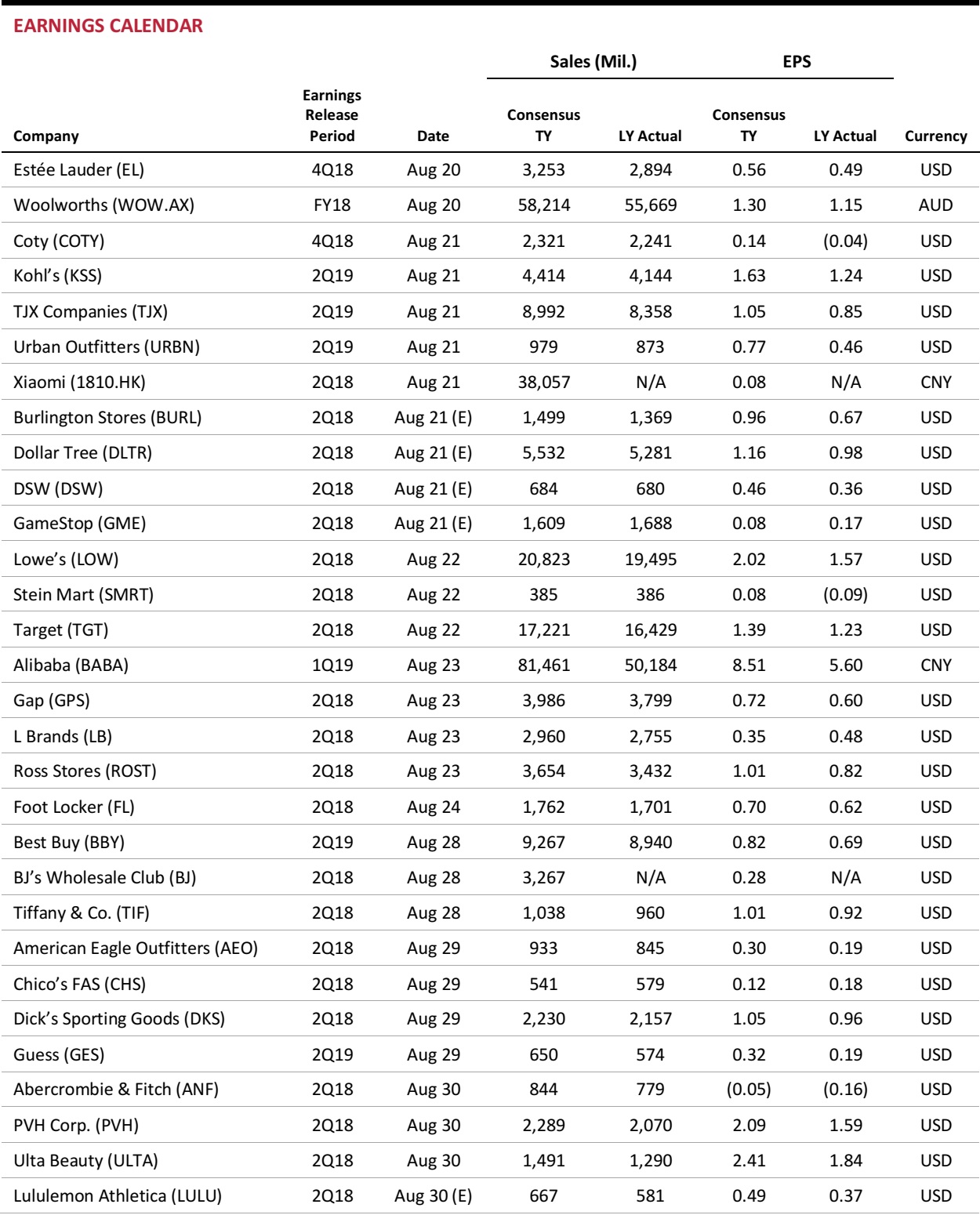

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: NFIB/US Census Bureau/US Bureau of Labor Statistics/Bank of England/GfK/European Commission/China Federation of Logistics & Purchasing/Japan Ministry of Economy, Trade and Industry/Singapore Economic Development Board/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: NFIB/US Census Bureau/US Bureau of Labor Statistics/Bank of England/GfK/European Commission/China Federation of Logistics & Purchasing/Japan Ministry of Economy, Trade and Industry/Singapore Economic Development Board/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research