Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

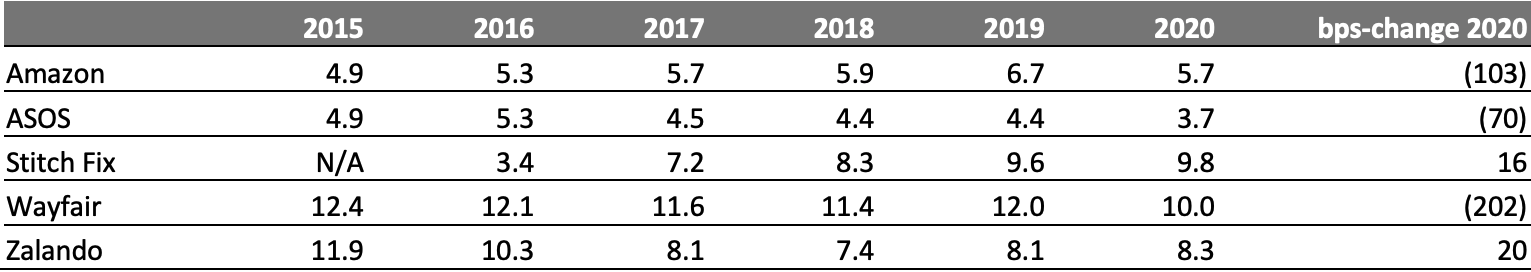

As E-Commerce Surged, How Did Retailers’ Variable Costs Shape Up? 2020 was the year for which online-only retailers were born. In terms of top-line trajectory, few can expect a year of similar magnitude again. In most businesses, enhanced scale should leverage costs and, therefore, bring about a disproportionate jump in margins. However, the variable-cost basis of online-only or online-predominant formats is an inherent disadvantage versus the more fixed-cost nature of store-based retailing. With 10-Ks in and analyst days (broadly) done, this week, we take stock of a handful of digital-first retailers—we have picked major nonfood online retailers (excluding pure marketplaces or consignment sites) from our Coresight 100 coverage list. What Happened with Marketing Costs? Our first benchmark is the marketing-cost ratio (marketing or advertising costs as a proportion of revenue): Customer acquisition costs have long been flagged up as a challenge for digital retailers that do not have the marketing advantages that come with physical storefronts. Over a number of years, the marketing-cost ratio has tended to come down in the pure-play space, supported by more cost-effective means of marketing, such as social media, automation, and direct marketing through emails and messages enabled by burgeoning customer databases. This downward trend is shown in the table below, although we note a blip across retailers in 2019. With bumper underlying demand, we would expect to see marketing-cost ratios fall—which was the case in 2020 for three of the five major retailers included in the table below. Amid lockdowns, ASOS “deliberately and aggressively” pulled back on marketing spend in the four months ended June 30, 2020, to prevent stimulating demand that it could not fulfill and to protect the health and safety of its staff and suppliers. However, CFO Mathew Dunn remarked that that spend will be restored in its current fiscal year. Stitch Fix grew marketing spend relative to revenues in its fiscal year ended July 2020, with management pointing to an advertising strategy driven by return on investment (ROI): At the end of its fourth quarter, CEO and Founder Katrina Lake noted that the company was “really, really pleased” with the impact on sales of advertising. More recently, Stitch Fix increased its advertising spend in January 2021, which CFO Dan Jedda stated as “contributing to our strongest month-over-month growth in revenue and active client additions of any January on record.” Amid strong consumer demand for furniture, Wayfair pushed down its marketing-cost ratio by a full two percentage points in 2020. Wayfair’s Co-Chairman, CEO and Co-Founder Niraj Shah noted that its advertising remains ROI-driven and that, in the long term, it expects to see “further efficiencies and leverage on the advertising line.” At Zalando, marketing spend was weighted toward its first quarter (which was largely precrisis) and its fourth quarter, when it ran brand marketing campaigns for the holiday season. Selected E-Commerce Retailers: Marketing-Cost Ratio [caption id="attachment_125288" align="aligncenter" width="720"] Year-ends are February for Boohoo Group (next table), July for Stitch Fix, August for ASOS and December for Amazon, Wayfair and Zalando. Figures are based on costs for marketing apart from Stitch Fix and Wayfair, which are for advertising specifically.

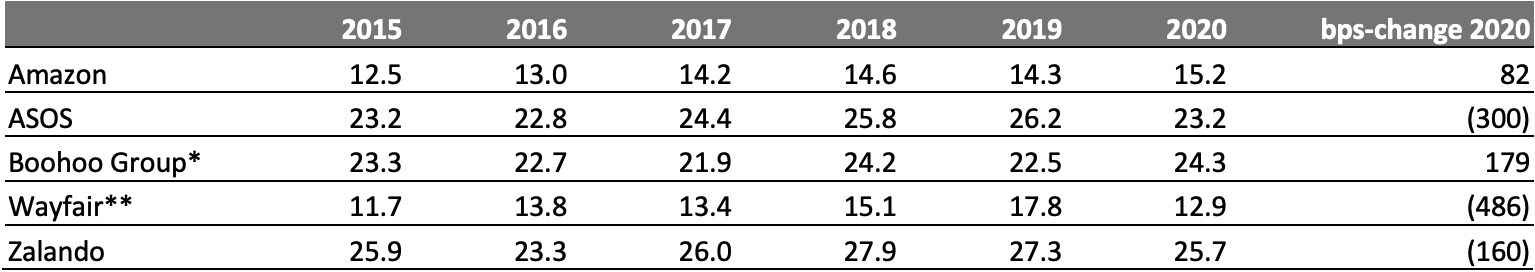

Year-ends are February for Boohoo Group (next table), July for Stitch Fix, August for ASOS and December for Amazon, Wayfair and Zalando. Figures are based on costs for marketing apart from Stitch Fix and Wayfair, which are for advertising specifically.Source: Company reports/S&P Capital IQ/Coresight Research[/caption] What Happened with Fulfillment Costs? Fulfillment costs have proved a more significant challenge than marketing costs for digital retailers—whereas the latter have generally dwindled as a share of revenues, the former have tended to increase, fueled by consumer demand for free delivery and (variously) two-day, one-day, same-day and two-hour delivery. Online retailers have poured money into fulfillment to compete, sending fulfillment-cost ratios upward. The margin advantage of strong organic demand is less apparent in fulfillment than in marketing. Yet, in 2020, we did see some apparent benefits of the jump in scale: Of the five retailers shown, three managed to drive down the fulfillment-cost ratio, and by meaningful amounts.

- An increase in the ratio at Amazon was in the context of the company growing its fulfillment and logistics square footage by around 50% in 2020.

- ASOS noted that it saw greater efficiencies in its automated Europe hub but greater fulfillment from its manual US warehouse proved a counterbalancing drag on margins.

- For parts of 2020, lockdowns gifted online apparel retailers lower rates of product returns: Management at ASOS and Boohoo pointed to this trend in their half-years ended August 31, 2020. Boohoo’s CFO Neil Catto remarked on returns rates: “We saw in the first lockdown in the first half of the year, you go very low and then increase toward the end of the first half of the year. And then it remains an increased level, just slightly below a normal level for about four weeks.”

- Management at Zalando also noted that gains in its fulfillment-cost ratio in 2020 overall were supported by more favorable return rates. Elsewhere in fulfillment, Zalando management remarked on higher utilization of its fulfillment centers as demand increased.

*Half-year ended August 2020

*Half-year ended August 2020**Wayfair does not break out fulfillment costs—this is the ratio for "selling, operations, technology, general and administrative," which is SG&A minus customer service and merchant fees and advertising costs.

Stitch Fix is not included in this table due to the absence of relevant disclosure; Boohoo Group is not included in the earlier table for the same reason.

Source: Company reports/S&P Capital IQ/Coresight Research[/caption] As demand normalizes during 2021 and into 2022, marketing spend will likely normalize, too—and digital-first retailers will need to continue to spend to remain front of mind among shoppers. While pure-play retailers have long struggled to keep a lid on fulfillment costs as they expand, 2020’s disruption underscored that there can be greater benefits of scale where distribution centers (DCs) are highly automated compared to where they rely heavily on manual processes. This was exhibited by the highly automated Zalando and by ASOS management pointing to the efficiency opportunities from automating its US DC—although that will not happen until 2024.

US RETAIL AND TECH HEADLINES

Albertsons Companies Partners with Google To Enhance Online Shopping Experience (March 30) MarketingDive.com- US-based grocer Albertsons Companies has entered into a multi-year partnership with Google on a suite of digital innovations, which will include integrating with Google functions to boost consumer-centric enhancements.

- The company stated that key improvements for shopper convenience include integrating with Google Search to improve access to information on pickup and delivery, making it easier to shop with Google Pay, and developing predictive grocery list building tools.

- Bed Bath & Beyond has appointed Jill Pavlovich as Senior Vice President of Digital Commerce and Jake Griffith as Vice President of Product Management, effective April 4, 2021. The appointments are aimed at accelerating growth in the company’s $3 billion digital business.

- Pavlovich joins Bed Bath & Beyond from Wayfair, where she served as General Manager and Head of Exclusive Brands and Merchandising. Pavlovich has more than 15 years of experience in omnichannel merchandising. Griffith most recently served as the General Manager for Sport and Fitness at Walmart, and has over 15 years of strategic retail experience.

- Lululemon Athletica has reported sales growth of 22% in its fourth quarter, ended January 31, 2021, which is in line with the prior quarter. The company’s comparable sales increased by 20%, versus 19% growth in the prior quarter. Notably, Lululemon’s direct-to-consumer sales surged by 92%, accounting for 52% of the company’s total revenues, versus 33% in the same quarter last year.

- For its first quarter of fiscal 2021, Lululemon forecasts sales growth of 69–73%. For fiscal 2021, the company expects to see sales growth of 26–29%.

- PVH Corp. reported a revenue decline of 20% in its fourth quarter, ended January 31, 2021, versus an 18% decline in the prior quarter. By brand, sales at Heritage Brands declined most significantly, dropping by 41% versus a 36% decline in the prior quarter. Moreover, sales at Tommy Hilfiger declined by 20% versus a 12% decrease in the prior quarter and Calvin Klein’s sales declined by 20% versus an 18% fall in the prior quarter.

- For fiscal 2021, the company expects to see revenue growth of 19–21%. PVH Corp. stated that it anticipates that 2021 sales and earnings will be adversely impacted by the coronavirus crisis in its first quarter and in Europe, in particular, owing to ongoing store closures.

- Walgreens has entered into a partnership with global payments technology company InComm Payments to provide customers digital Metabank accounts with a Mastercard debit card. The new financial services offering will serve shoppers both online and in-store and allow them to earn myWalgreens Cash rewards on all purchases as part of the company’s new customer loyalty program, which launched in November 2020.

- This partnership reflects Walgreens’ alternative profit strategy and is part of its broader initiative to launch new financial products and services that offer differentiated benefits and services to its customers.

EUROPE RETAIL AND TECH HEADLINES

Asda Appoints Carl Dawson as New Chief Information Officer (March 30) Company press release- Asda has announced the appointment of Carl Dawson as its new Chief Information Officer (CIO). Dawson will join the supermarket chain in April from M&S, where he led various technology modernization and digital transformation projects in his six-year term as CIO.

- Dawson will replace former CIO Phil Tenney, who left the organization in December 2020. Interim CIO Anna Barsby will continue to work with the retailer on its technology function on a fixed-term basis.

- Deliveroo’s share price plummeted by 30% within the first hour of the company’s debut on the London Stock Exchange. Its share price dropped below £3 ($4.13) from the offer price of £3.90 ($5.36) per share, wiping more than £2 billion ($2.76 billion) off the company’s valuation.

- Some large investors were put off ahead of the initial public offering by recent publicity regarding the working conditions of Deliveroo’s self-employed riders.

- Investment holding company EP Corporate Group, owned by Czech billionaire investor Daniel Kretinsky, has acquired a 50% stake in Spanish supermarket chain Supratuc 2020, which operates under the banners Caprabo, Cecosa and Eroski in Spain.

- The deal will allow the food retailer to repay its debt of $370 million by the end of the year, strengthening its financial position and facilitating new investments to modernize the chain.

- M&S has officially launched branded clothing ranges, including Phase Eight, Hobbs and Sosandar, on its online fashion platform under the banner “Brands at M&S.” The move is a part of its “Never the Same Again” transformation program, which aims to boost the retailer’s online clothing sales.

- The official launch follows the onboarding of sustainable womenswear brand Nobody’s Child to the M&S fashion platform in October 2020, marking the first independent label to sell through the M&S website.

- Unibail-Rodamco-Westfield (URW) has signed a strategic agreement with Zalando to gain access to Zalando’s online fashion platform in Europe. With this collaboration, materialized through Zalando’s Connected Retail initiative, URW’s retail clients in Spain will have access to a new channel to make sales and expand their customer base.

- Zalando’s Connected Retail program enables physical stores to access Zalando’s customer base and sell through its platform. Through this initiative, retailers with a limited online presence can leverage online demand while shoppers get to access a broader range of products on the Zalando platform.

ASIA RETAIL AND TECH HEADLINES

Amazon Acquires Indian Retail-Tech Startup Perpule (March 31) TechCrunch.com- Amazon has announced its acquisition of Indian startup Perpule, a point of sale (POS) solution provider for offline retailers in an all-cash deal valued at $14.7 million.

- Perpule enables offline retailers to accept digital payments through its handheld POS device. The company also assists offline retailers in establishing a store presence on platforms such as Google Business and Instagram.

- Japanese convenience store retailer Family Mart has launched its first apparel collection, which it describes as “convenience wear,” with prices ranging from $3 to $9.

- The apparel range was designed in collaboration with Hiromichi Ochiai, Creative Director of Tokyo-based fashion brand Facetasm and features t-shirts, shorts, socks and vests.

- Luxury brand Louis Vuitton has launched an exhibition in Hong Kong to introduce the latest edition of its Objects Nomades collection. Hosted in Hong Kong’s landmark Peddar Building, the exhibition will run through April 8.

- The exhibition spans two floors and features different rooms designed in the style of historical mansions that can be found throughout the city. The exhibition also showcases new products by items in the collection, including works by designer Atelier Biagetti.

- Thai conglomerate Central Group has announced a $32 million investment plan to renovate its existing retail network, with a focus on its Central and Robinson stores, to capitalize on improving consumer sentiment in Thailand.

- Under this plan, Central Group will renovate seven of its existing Central department stores, of which there are one each in Pattaya and Udon Thani and five in Bangkok. In addition, Central Group plans to renovate its existing Robinson department stores in seven locations across Thailand by the end of 2021.