DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

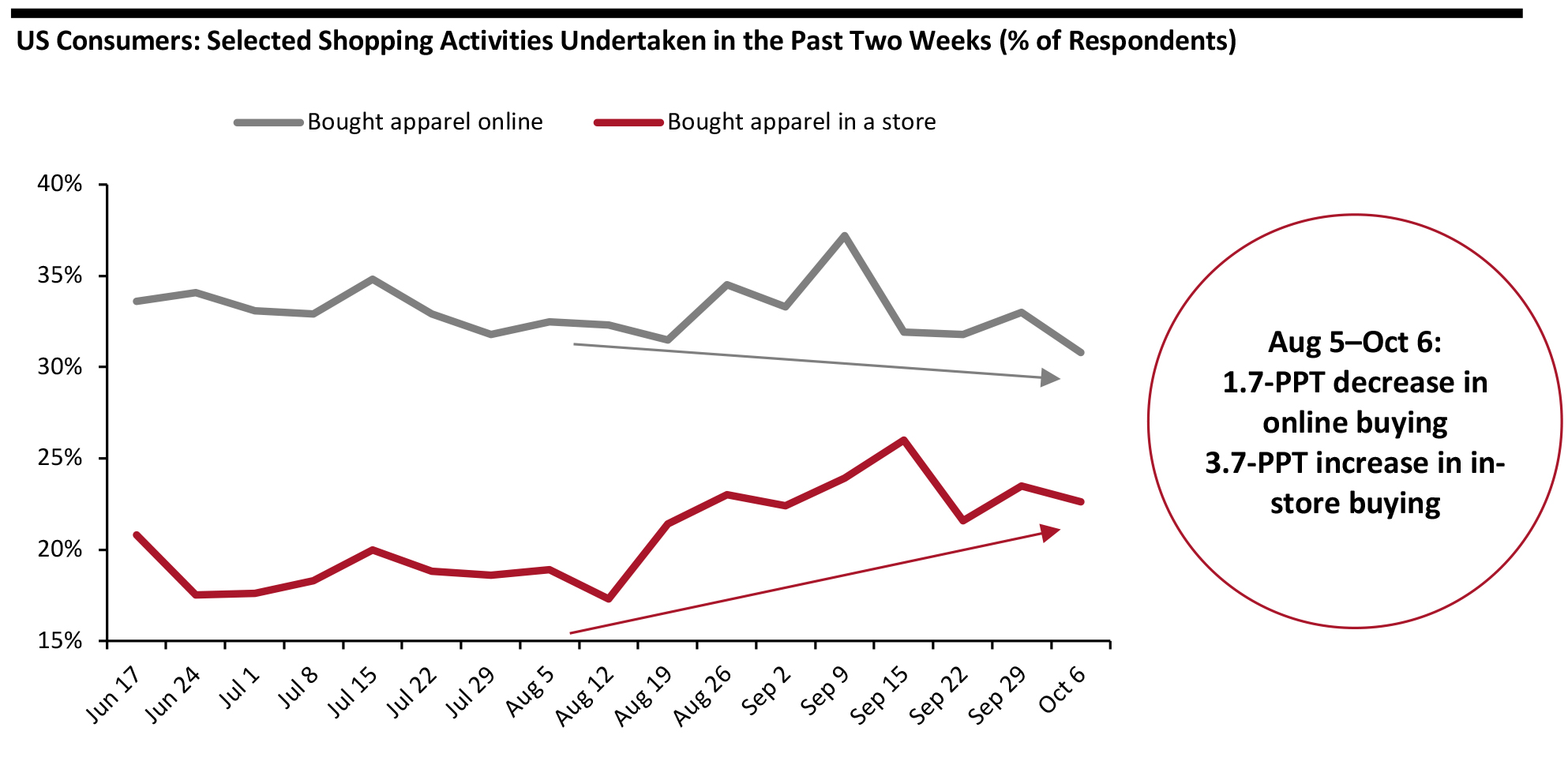

Are US Shoppers Returning to Apparel? Apparel has been one of the major retail casualties of the Covid-19 crisis. In the US, deep declines in clothing sales have been followed by sluggish recovery and sustained consumer behaviors of buying more online and less through traditional in-store channels. This week, we look at recent demand data points and consider the prospects for the holiday season and into 2021. Recent Trends Our weekly surveys confirm that US shoppers are returning to stores for apparel purchases—albeit only gradually. In the two months to October 6, we recorded a 3.7-percentage-point increase in the proportion of respondents saying that they had recently bought clothing or footwear in a store. This was only partially offset by a 1.7-percentage-point decline in the proportion buying clothing or footwear online over the same period. [caption id="attachment_117714" align="aligncenter" width="700"] Base: US respondents aged 18+

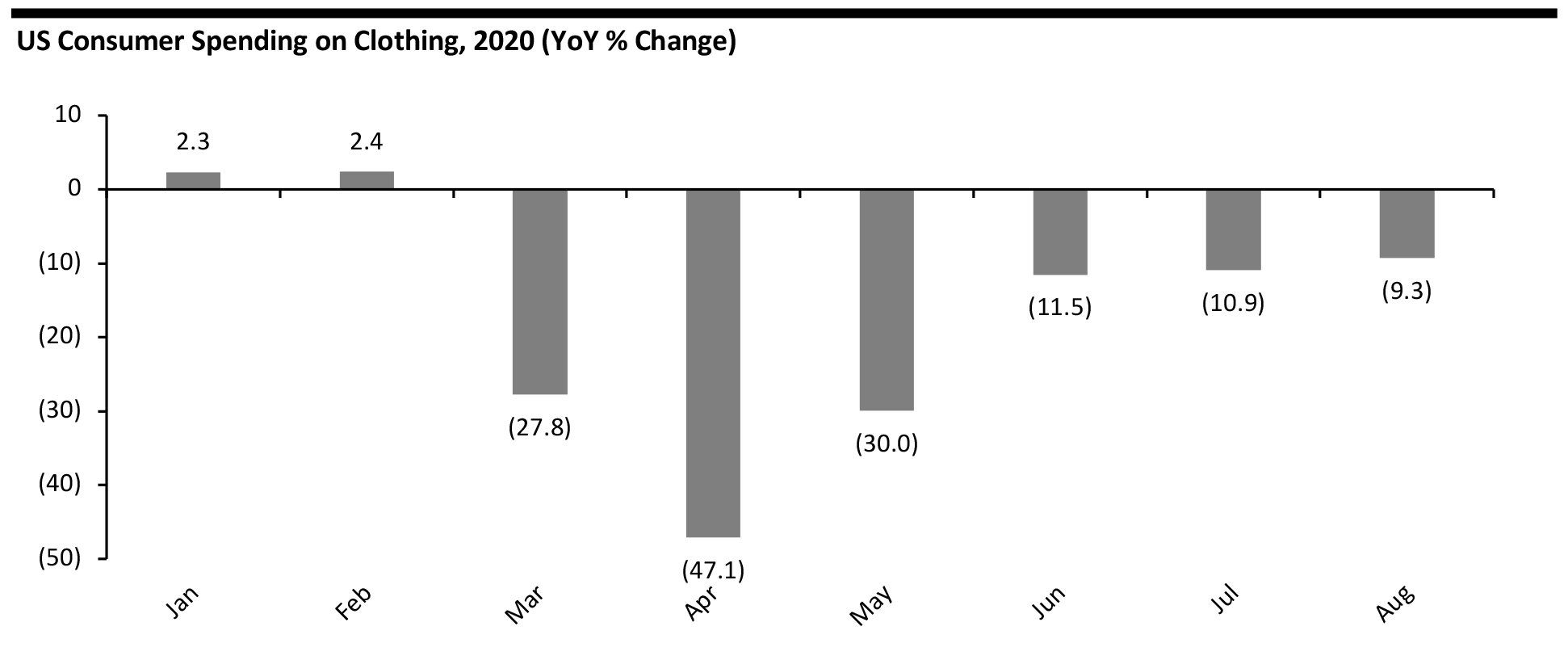

Base: US respondents aged 18+ Source: Coresight Research [/caption] Coresight Research estimates that consumer spending on clothing (through all channels) will fall by 13.2% in 2020 overall. Recent consumer spending and retail sales data suggest that underlying demand for clothing remains stubbornly negative—rather than following a smooth upward trend path, negative growth in spending has remained at circa (10)% in recent months. Depressed underlying demand reflects the context of fewer visits to workplaces and fewer social events. [caption id="attachment_117715" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Holiday-Season Prospects

In October, we expect an early start to holiday shopping, with a number of shopping festivals and events providing a boost to performance. Many consumers plan to start their holiday shopping earlier this year, according to Coresight Research surveys, and we expect the pull-forward of holiday demand to ease the declines in October but at the expense of November and December.

Benefitting performance in the final quarter, we anticipate holiday gifting demand to be stronger than underlying demand for clothing. Practical, immediate clothing needs, such as those tied to visiting workplaces or attending social events, are less important for those buying apparel as gifts for the festive season. As a result, we expect year-over-year declines in clothing spend to ease to the mid-single digits in the holiday quarter. See our new Apparel Retail: Post-Crisis Outlook—Fall 2020 Update for further details on our forward estimates.

However, store-focused clothing specialty retailers will continue to underperform total category spending, not only due to the retained habit of buying more online but also the impact of physical constraints on store capacity (number of shoppers in stores) in the holiday peak. During the busiest time of the year, managing fixed store capacity to maintain social distancing implies a more substantial year-over-year decline in in-store shopper numbers than at less busy times during the year.

Looking to 2021

Against very undemanding comparatives, and assuming a return to more normal ways of living and working, we estimate a solid bounce in total US clothing spending in 2021. However, even with this jump, total clothing spending would still be below the pre-crisis level in 2019. Drivers of demand in 2021 will include:

Source: US Bureau of Economic Analysis/Coresight Research[/caption]

Holiday-Season Prospects

In October, we expect an early start to holiday shopping, with a number of shopping festivals and events providing a boost to performance. Many consumers plan to start their holiday shopping earlier this year, according to Coresight Research surveys, and we expect the pull-forward of holiday demand to ease the declines in October but at the expense of November and December.

Benefitting performance in the final quarter, we anticipate holiday gifting demand to be stronger than underlying demand for clothing. Practical, immediate clothing needs, such as those tied to visiting workplaces or attending social events, are less important for those buying apparel as gifts for the festive season. As a result, we expect year-over-year declines in clothing spend to ease to the mid-single digits in the holiday quarter. See our new Apparel Retail: Post-Crisis Outlook—Fall 2020 Update for further details on our forward estimates.

However, store-focused clothing specialty retailers will continue to underperform total category spending, not only due to the retained habit of buying more online but also the impact of physical constraints on store capacity (number of shoppers in stores) in the holiday peak. During the busiest time of the year, managing fixed store capacity to maintain social distancing implies a more substantial year-over-year decline in in-store shopper numbers than at less busy times during the year.

Looking to 2021

Against very undemanding comparatives, and assuming a return to more normal ways of living and working, we estimate a solid bounce in total US clothing spending in 2021. However, even with this jump, total clothing spending would still be below the pre-crisis level in 2019. Drivers of demand in 2021 will include:

- An expected incremental return to more normal ways of living—spurring demand for apparel for workplaces and social events.

- Renewal, as consumers this year deferred renewal in some clothing categories.

- Clothing for children, which is driven much more by renewal, given that they outgrow clothing.

US RETAIL AND TECH HEADLINES

Ascena Retail Group Enters Agreement To Sell Its Justice Brand (October 13) Company press release- Bankrupt apparel retailer Ascena Retail Group has entered into an asset purchase agreement with Premier Brands Justice to sell the e-commerce business, intellectual property and other assets of its Justice brand.

- Ascena Retail Group’s CEO Gary Muto said in the press release that the sale “brings us closer to the completion of our restructuring process. With a reduced store footprint and a more focused collection of go-forward brands, we believe that Ascena will emerge from Chapter 11 better to strategically invest in our future and generate sustainable, profitable growth.”

- Financial technology company Afterpay has announced that its in-store “buy now, pay later” offering is now available to shoppers at various major retail stores across the US. Consumers can use the Afterpay card—a virtual, contactless card stored in their digital wallet—to buy items in select retail stores. Shoppers can pay for their in-store purchases in four installment payments, without any upfront fees or interests.

- Nick Molnar, Afterpay's Cofounder and North America CEO, said in the press release, “Afterpay customers can now choose either physical or online shopping to buy holiday gifts, which brings new customers and drives more sales conversion to retailers without any additional set-up or integration costs.”

- Kroger has launched Chefbot, an original artificial intelligence (AI)-powered Twitter recipe tool, to provide mealtime inspiration and personalized recommendations to suit the groceries consumers have in their kitchens and reduce food wastage. Developed alongside technology partners Coffee Labs and Clarifai and integrated creative and media agency 360i, Kroger’s Chefbot recognizes nearly 2,000 ingredients across a database of around 20,000 recipes.

- To get a personalized recipe recommendation from Chefbot, the user clicks a photo to select three ingredients and tweets their photo to “KrogerChefbot.” Chefbot identifies the ingredients using AI and then scans thousands of unique recipes on Kroger.com to delivers a list of personalized recipe recommendations within seconds.

- Apparel retailer Urban Outfitters has announced key changes to the company’s management structure to support its future growth and strategic initiatives. Meg Hayne has been promoted to Co-President and will continue to operate as Chief Creative Officer. Frank Conforti has been promoted to Co-President and COO and will remain CFO until the company finds a successor.

- Sheila Harrington, President of the Free People Group, has been promoted to CEO of the Free People Group, while Hillary Super, President of Anthropologie, has been promoted to CEO of the Anthropologie Group. Calvin Hollinger, COO of Urban Outfitters brand, will be leaving the company by the end of October to pursue other opportunities.

- Walgreens’ airborne drone delivery program, operated in partnership Alphabet Inc company Wing, saw April 2020 deliveries increase fivefold compared to February 2020. The retailer said that it takes less than 10 minutes to deliver an order through this delivery program.

- Walgreens has expanded the eligible product list for drone deliveries from 100 to 155 items. This includes food items, such as pasta and canned goods; kid-friendly products, such as crayon and games; and household supplies, such as toilet paper and tissues.

EUROPE RETAIL AND TECH HEADLINES

September Retail Sales Underline British Retailers’ Resilience (October 13) BRC.org.uk- UK retail sales increased by 5.6% year over year in September—the strongest growth since December 2009, excluding Easter distortions, according to the British Retail Consortium’s BRC-KPMG Retail Sales Monitor. Comparable sales rose 6.1%.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended September 2020, total food sales grew 5.6% and total nonfood sales were up 3.2%.

- Total revenues of the British online fashion and cosmetic retailer ASOS grew 19% to £3.3 billion ($4.2 billion) for the full year ended August 31, 2020. ASOS grew UK retail sales to £1.2 billion ($1.5 billion), up 18% year over year and international retail sales were up 20% to £2 billion ($2.5 billion). Profit before tax rose 329% to £142.1 million ($180.5 million) from £33.1 million ($42.0 million) in the previous year.

- ASOS highlighted momentum in customer engagement and high levels of customer acquisition. In the fiscal year, the retailer added 3.1 million active customers, taking its count up by 15% to 23.4 million active customers.

- IKEA will roll out a new scheme called “Buy Back” on November 27, allowing customers from the UK and Ireland to exchange their used furniture for refund cards—without any expiration date—which can be used to shop in-store.

- Customers can receive anything between 30% and 50% of the original value of the item that they wish to exchange, depending on the condition of the product. The company will sell the used furniture in a new “As Is” section, which was previously named “Bargain Corner.”

- German trade union Verdi has called on Amazon warehouse workers for a two-day strike starting Tuesday, in the name of its quest for improved working conditions and salary. Verdi cited that Amazon introduced a coronavirus bonus for its workers in March this year, but it was scrapped in May.

- According to an Amazon spokesperson, the majority of employees have continued to work despite the strike. He said that the company offers “excellent salaries” and working conditions similar to other relevant employers.

- British grocery retailer Waitrose has started e-commerce operations in the UAE, its first e-commerce location outside the UK. The newly launched web shop will offer over 15,000 grocery products and 400 delivery slots each day.

- Waitrose has added 12 delivery vans and will create 14 driver jobs in the UAE. Orders will be picked and packaged from two of its 12 shops across Dubai and Abu Dhabi.

- Swedish retailer H&M has installed a recycling machine called “Looop” in its Stockholm store. The initiative supports H&M’s objective to become fully circular and climate positive by 2040.

- Customers can bring their old clothes to the store and watch them be turned into a new item. The whole process takes around five hours and does not require any water or chemicals.

- Indian multinational conglomerate Tata Group is in discussions related to acquiring a 20% stake in the online grocery company BigBasket, to strengthen its digital expertise in India’s growing online grocery market.

- The decision on the potential transaction would be taken by the end of October. BigBasket is backed by investors including Alibaba, CDC Group and Mirae Asset.

- Walmart and Flipkart announced making an additional investment of around $30 million in fresh produce sourcing startup Ninjacart. Flipkart will leverage Ninjacart’s fresh produce supply chain expertise to strengthen its online grocery offering (Supermart) and hyperlocal delivery service (Flipkart Quick).

- The deal is expected to close by the end of October. The second round of funding follows the investment made by Walmart and Flipkart in December 2019.

- JD Health, the online healthcare arm of JD.com, has announced that it will invest CN¥150 million ($22.2 million) to acquire a 7.71% stake in insurtech firm Shanghai Kingstar Winning Software Science and Technology.

- Shanghai Kingstar Winning will use the new capital to strengthen its core business, develop national and local medical insurance products and scale up its commercial insurance actuary and compensation platform.

- L'Oréal-owned luxury perfumes and cosmetics company Lancôme has teamed up with Lotte Duty Free to launch the Lancôme x Lotte Duty Free smart store in Myeongdong, Seoul. The store spans 5,597 square feet and features augmented reality technology and AI-driven contactless digital experiences.

- The store features a range of skincare and makeup products and allows customers to test products through virtual mirrors using an iPad or by scanning a QR code.

- Cainiao Smart Logistics Network, the logistics arm of Alibaba, has announced a partnership with cargo airline Atlas Air, to support Alibaba’s growing e-commerce business and expansion in South America.

- Beginning in November, Atlas Air will operate three charter freight flights each week to Brazil and Chile for Cainiao, reducing the shipping time from one week to three days. Cainiao noted that its parcel volume to Latin America has reached over 8 million packages in the third quarter of 2020, double the number of orders shipped in the second quarter.