Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

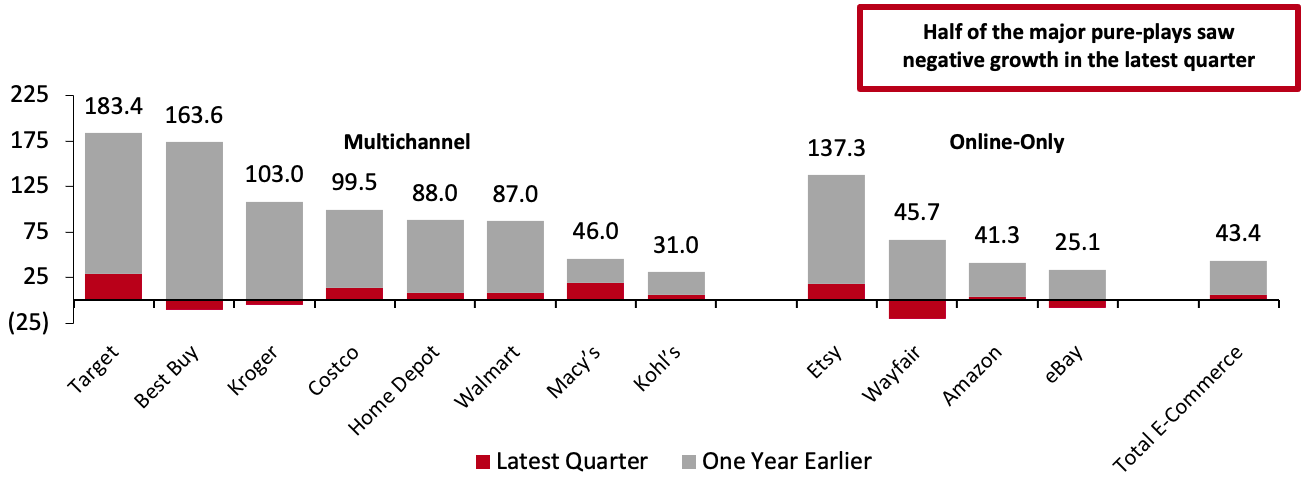

Are Digital-First Retailers Losing the Battle for Online Shoppers? The e-commerce boom should have been a heyday for digital-first retailers, yet one of the most striking features of this trend has been the general failure of online-only (or online-predominant) retailers to seize the opportunity to outperform in the only channel in which they compete. In the US in 2020 and 2021, the picture has, in general, been of multichannel retailers expanding their online sales considerably faster than the biggest online-only rivals, including marketplaces. As a result, in a still-growing US e-commerce market, the online-only (or online-predominant) retail segment is losing aggregate share to those multichannel rivals. This is not a case of retailers with stores playing catch-up online: Names such as Best Buy, Home Depot, Kroger, Target and Walmart are among the 10 biggest online retailers in the US. Most recently (for the third quarter of 2021), eBay reported an 8.4% decline in US GMV; Wayfair registered a 20.8% US sales slump and Amazon reported soft, 3.3% growth in its Online Stores segment. At multichannel majors, recent growth was typically slower than it had been, but it was generally positive and sometimes solidly so: 27.0% growth at Macy’s and a 28.9% increase at Target led the year-over-year expansion. Etsy was an outlier among the major digital-only retailers, with a 17.9% year-over-year sales gain cementing its strong two-year growth stack.Figure 1. Online/Digital Sales at Selected Retailers and in Total US Retail, by Quarter: YoY % Change and Two-Year Growth Stack (Values Shown; %) [caption id="attachment_138209" align="aligncenter" width="700"]

Data are US-specific where available. Amazon data are for its Online Stores segment, representing first-party sales. Figures for Etsy and eBay are gross merchandise volume. For most retailers, the latest quarter ended in late October or early November, but for Etsy, Wayfair, Amazon and eBay, it ended on September 30 and for Costco, it ended on November 21. Total E-Commerce is for the third calendar quarter.

Data are US-specific where available. Amazon data are for its Online Stores segment, representing first-party sales. Figures for Etsy and eBay are gross merchandise volume. For most retailers, the latest quarter ended in late October or early November, but for Etsy, Wayfair, Amazon and eBay, it ended on September 30 and for Costco, it ended on November 21. Total E-Commerce is for the third calendar quarter.Source: Company reports/US Census Bureau/Coresight Research[/caption] We see little reason for this pattern to change in the near future. As shoppers continue their return to stores in 2022, we expect them to seek out the omnichannel services that complement those visits—specifically, BOPIS (buy online, pick up in store), curbside pickup and in-store returns—as well as general cross-channel convenience in the consideration and research stages of shopping (such as try in-store, buy online). Shoppers’ return to physical retail amplifies stores’ position as marketing channels for the websites of those retailers—while stores serve as a billboard for a retailer’s website, online-only rivals are forced to pour money into advertising. And, should those return visits to brick-and-mortar retail prove unexpectedly strong and ultimately depress online sales, it is a win-win for omnichannel retailers who can serve the demand regardless of channel. Nonstore retailers could be further challenged by a probable softening in US discretionary/nonfood growth—we expect much slower discretionary spending expansion in 2022 as we annualize the bumper spending of 2021. Yet, the pure-play sector is predominantly nonfood-focused, so will be fighting over a possibly weaker segment in the total consumer market. As a result, we expect nonstore rivals to be compelled to invest a greater share of revenues in advertising. Marketing costs have traditionally been a major negative for online-only companies, and we see the potential for raised marketing cost ratios to drag on margins in 2022. A second traditional cost burden in digital retail is fulfillment and there, too, companies may see higher cost ratios. A tight labor market is likely to continue to push up fulfillment costs, providing an unwelcome second pinch on online-only retailers’ margins. Omnichannel retailers selling online will not be immune to those cost rises, but they can use the contact point of stores to alleviate the pressures—such as with fulfillment from store, BOPIS and curbside pickup. Of course, multichannel retailers cannot rest easy on their laurels. Even while they are outperforming online, in a higher-cost, lower-growth retail market, they must continue to review how they can use their stores as a lever to solidify their gains in e-commerce, across marketing, distribution and fulfillment.

US RETAIL AND TECH HEADLINES

Albertsons Launches Two New Options for Online Shopping (December 14) BusinessWire.com- Grocery company Albertsons has introduced two new digital offerings—Meal Planning Solutions and Schedule & Save—providing Albertsons’ loyalty program members with integrated menu planning and shopping list creation services, plus automatic restocks of items on their lists.

- Through the Meal Planning feature, members have access to thousands of shoppable recipes, created by expert chefs and dietitians. Schedule & Save is an online auto-replenishment service that helps members restock their frequently purchased items across categories.

- Amazon has been testing a grocery delivery service in the UK over the last year, known internally as Amazon Fresh Marketplace. The e-commerce giant plans to expand the service across the US and Europe in 2022.

- The service allows UK Prime members to order groceries from two major UK supermarkets via the Amazon app or website. Orders will be fulfilled on the same day using Amazon Flex drivers, the company’s independent contractor delivery drivers.

- Grocery and medicine retailer Hy-Vee has launched RedBox Rx, a new subsidiary that delivers low-cost telehealth and online pharmacy services, and ships medicines to homes across the US.

- The company stated that RedBox Rx will make it easy for consumers to access treatment—it provides accessible, confidential and fast access to a physician who can prescribe medication, which is shipped to the patient for free.

- Department store JCPenney has launched an assortment from apparel brand Forever 21 in 100 of its US stores and online.

- JCPenney stated that the move bolsters the department store’s position as a national retailer for teens and young adults. Chief Brand Officer of Lifestyle at Authentic Brands Group, owner of Forever 21, Jarrod Weber stated, “Forever 21’s relationship with the Generation Z customer is a perfect alignment for JCPenney, who is also committed to bringing innovation, excitement and fashion to a young consumer that understands the quickly evolving trends in fashion.”

- Beauty retailer Sally Beauty has collaborated with DoorDash to offer two-hour delivery for online orders during the holiday season.

- The new service is available for all of the retailer’s 7,000 products and is available for free during December on orders placed before 4:00 pm.

EUROPE RETAIL AND TECH HEADLINES

Axfood Partners with Mathem (December 14) ESMMagazine.com- Swedish food retail group Axfood has partnered with Swedish online grocery retailer Mathem I Sverige AB (Mathem). Axfood plans to divest the operations of its online grocery business Mat. Se to Mathem in exchange for newly issued shares in the latter.

- The merger is valued at around SEK 688 million ($75.3 million) in cash and is debt free.

- UK-based fashion rental platform Hurr Collective has raised £4.1 million ($5.4 million) in seed funding from US-based Octopus Ventures. Launched in 2019, Hurr Collective operates a hybrid business model—it has over 85 exclusive fashion partners, offers a rental service for retailers and has a physical presence in department store Selfridges.

- Hurr Collective plans to use the funding to invest in technology for its platform and operational expansion, as well as grow its subscriber base and the number of companies it partners with.

- Dutch supermarket chain Jumbo has opened a new home-delivery hub in Eindhoven, the Netherlands.

- The new hub has a floor space of around 14,000 square feet, offering a wide range of products and short delivery times. The company plans to extend delivery to other areas, including Helmond, Nuenen, Venlo, Venray and Weert in 2022.

- UK-based supermarket chain Morrisons is working with its own-brand food and drink suppliers to reduce greenhouse gas emissions as part of its commitment to reduce carbon emissions in its wider supply chain—aiming to achieve a 30% reduction in supply chain emissions by 2030.

- The company stated that it will provide 400 of its own-brand suppliers with access to a software platform called “Manufacture 2030” to help them accurately measure, track and forecast their operational carbon emissions.

- Fashion brand Zara, owned by Spain-based apparel retailer Inditex, has partnered with biotech company LanzaTech to launch a partywear collection created using yarn made from carbon emissions.

- LanzaTech’s CarbonSmart technology uses a biological process to capture and convert carbon emissions, turning them into ethanol via fermentation and then into yarn. The party dress collection will be available for sale through Zara.com from the third week of December 2021.

ASIA RETAIL AND TECH HEADLINES

Flipkart-Owned Shopsy To Offer Groceries (December 14) BusinessInsider.in- Shopsy, an Indian social-commerce platform owned by e-commerce company Flipkart, has launched a grocery category on its platform. Shopsy will capitalize on Flipkart’s supply chain infrastructure and technology capabilities to cater to 700 cities across India.

- Shopsy’s grocery platform will provide over 6,000 products in 230 categories, including pantry products and fast-moving consumer goods (FMCG), mirroring Flipkart Grocery’s offering.

- China-based grocery retail chain T11 Food Market has raised $100 million in a funding round led by Alibaba. T11 was founded in 2018 and has opened eight stores across Beijing, Shanghai and Wuhan. The company offers fresh produce, including baked goods and fruits and vegetables, in stores and online.

- The money raised will be used to develop its core retail business and technologies, expand its e-commerce platform, and improve its supply chain.

- Food and beverage retailer The CrownX, owned by the Vietnamese conglomerate Masan Group, has raised $350 million from a consortium of investors, comprised of private-equity firm Texas Pacific Group, Platinum Orchid and Temasek-owned Seatown Master Fund.

- The CrownX plans to launch an international initial public offering (IPO) in 2023 or 2024. The retailer has raised $1.5 billion since late 2020, including $400 million in May 2021 from an Alibaba-led consortium and $340 million in November 2021 from South Korea’s SK Group. After its latest round of funding, The CrownX is valued at $8.2 billion.

- Grofers, an Indian grocery-delivery service backed by Zomato, has rebranded as Blinkit—shifting its focus toward the quick commerce sector, which is growing rapidly in India. While traditional e-commerce takes two to three days to deliver products, quick commerce facilitates small deliveries in under an hour.

- The move follows India-based food-delivery company Swiggy’s recent $700 million investment in its quick commerce business, Instamart. Grofers raised $100 million from Zomato in August 2021, although Softbank of Japan remains its largest shareholder with a 50.0% share. The company is reportedly in discussions with Zomato to raise a further $500 million.