albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

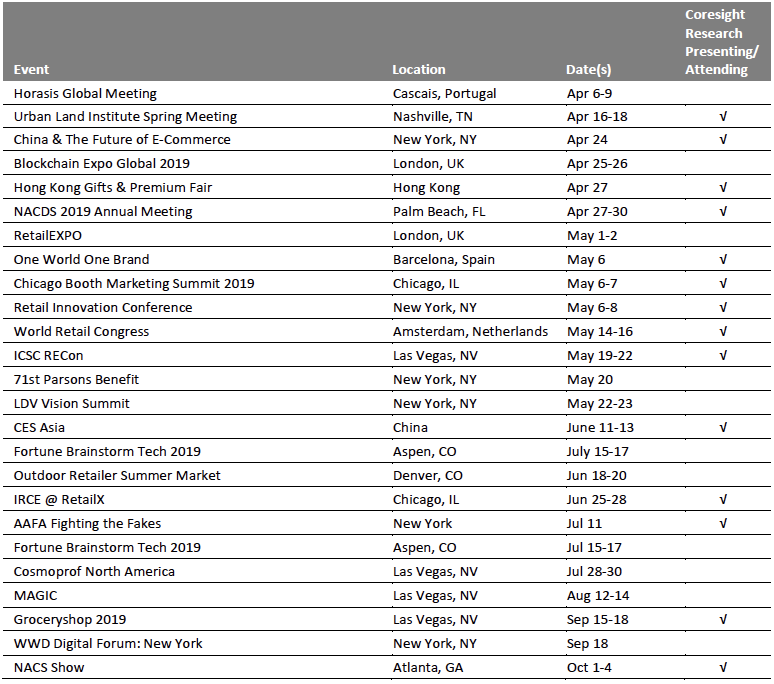

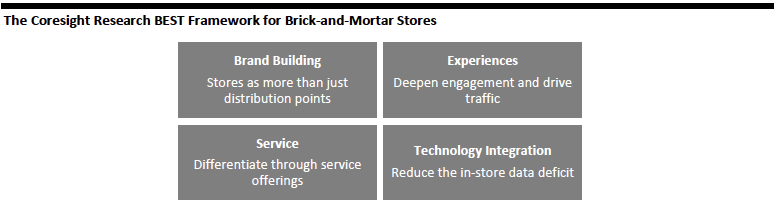

2019 Likely to See Further US Retail Bankruptcies and a Jump in Store Closures Three months into 2019, US retail looks set for another year marked by a raft of bankruptcies and store closures. In the past two years, more than 50 retailers have filed for bankruptcy protection, including household names such as Sears Holdings and Toys“R”Us. This year, some store-based retailers continue to face the headwinds of declining store traffic, a liquidity crunch, weakened competitive positions and ailing credit ratings. Reflecting these challenges, retailers account for about one-fifth of total distressed borrowers in the US, according to Bloomberg analysis in February. Year to date, seven major retailers have filed for bankruptcy in the US. [caption id="attachment_82819" align="aligncenter" width="782"] Source: Company reports/Coresight Research[/caption]

As of March 29, major US retailers had announced 5,480 store closings, with Payless ShoeSource contributing 2,100 of these. That year-to-date closures total is up 68% year over year. This rapid shift in the brick-and-mortar landscape comes against a backdrop of concerns over macroeconomic risks:

Source: Company reports/Coresight Research[/caption]

As of March 29, major US retailers had announced 5,480 store closings, with Payless ShoeSource contributing 2,100 of these. That year-to-date closures total is up 68% year over year. This rapid shift in the brick-and-mortar landscape comes against a backdrop of concerns over macroeconomic risks:

- According to a recent survey from the National Association of Business Economics, about 75% of business economists expect a recession to hit the US by 2021, though only 10% expect a recession in 2019.

- According to a 2019 BDO survey of 300 US retail executives, 52% believe retail bankruptcies will rise in 2019 and nearly 51% are actively preparing for an economic downturn.

- For 2019, the NRF expects US retail sales to grow at 3.8–4.4%, at the midpoint slower than 2018: According to our analysis of data from the US Census Bureau, retail sales excluding automobiles and gasoline grew 4.3% year over year in 2018.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

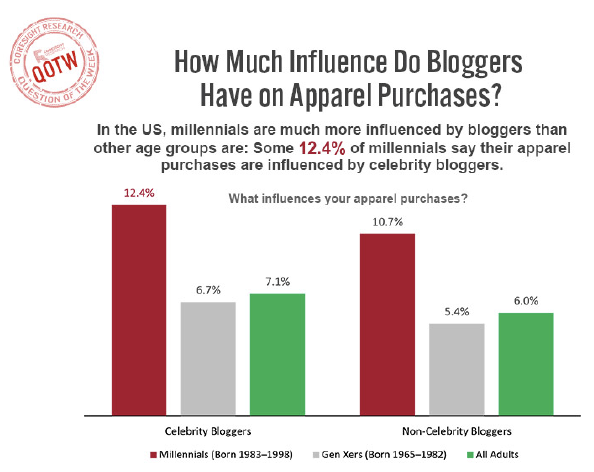

QUESTION OF THE WEEK

[caption id="attachment_82821" align="aligncenter" width="594"]

Base: 16,619 US Internet users ages 18+, surveyed in January 2019

Source: Prosper Insights & Analytics[/caption]

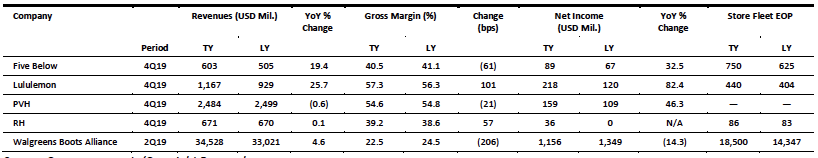

US RETAIL EARNINGS

[caption id="attachment_82823" align="aligncenter" width="818"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- Whole Foods Market said it will lower prices on hundreds of grocery items this week, the latest effort to reshape the grocer’s pricey image.

- The Seattle retail giant had touted a round of price cuts immediately after buying Whole Foods in August 2017 and over the past year worked to roll out grocery delivery from store locations and introduce discounts for Prime members. Whole Foods said the latest price cuts average about 20%.

- Spending at US retailers declined month over month in February, signaling some hesitation among consumers as the first quarter progressed. Retail sales including restaurants declined a seasonally adjusted 0.2% in February from a month earlier.

- That was well below the 0.2% increase that economists expected. Still, retail sales for January were revised higher, to a 0.7% month-over-month increase from an earlier reading of 0.2%.

- RH posted its fiscal fourth-quarter results, which were mixed as revenue fell short of expectations. RH cited the downturn in the high-end housing market, which has weighed on demand for its products.

- RH said it will continue to reshape the company and promote it as a high-end lifestyle brand, saying, “Leaders have to be comfortable making others uncomfortable.”

- Simon Malls announced the opening of seven more Untuckit stores in key centers throughout the US.

- The company specializes in shirts designed specifically to be worn untucked. In recent years, the brand has expanded its offerings to include T-shirts, polos, sports jackets and pants, along with a selection of shirts, dresses, and blazers for women. It currently operates more than 50 locations.

- Walgreens will sell CBD creams, patches and sprays in nearly 1,500 stores in select states. The drugstore chain will sell offer the cannabis-based products in Oregon, Colorado, New Mexico, Kentucky, Tennessee, Vermont, South Carolina, Illinois and Indiana.

- Rival drugstore chain CVS introduced CBD-containing topicals, including creams and salves, to stores in eight states earlier in March.

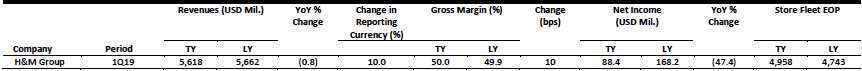

EUROPE RETAIL EARNINGS

[caption id="attachment_82824" align="aligncenter" width="862"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

- On March 29, British department-store chain Debenhams confirmed a £200 million ($265 million) refinancing plan, of which £101 million ($134 million) will be available immediately to begin its restructuring process that includes closing stores.

- The remaining funds will be made available only if one of the following occurs by April 8: Sports Direct or a shareholder with a stake of more than 25% makes an offer for Debenhams, including refinancing its debt; or Sports Direct agrees to underwrite a rights issue or provides funds. If either of these fails to happen, the funds will be available only if lenders take over the business.

- Dutch supermarket chain Albert Heijn unveiled a new delivery robot developed by Swiss company TeleRetail at the Digital Food 2019 conference held in Amsterdam on March 26.

- Albert Heijn said that the robot will work with customers as part of pilot trials at High Tech Campus, Eindhoven through the summer. Visitors to the campus can place orders on the AH To Go app, and the robot will use a virtual map to chart its course and deliver items to customers.

- British home shopping retailer Findel said that it received a letter of support on Monday from Schroders Investment Management, its second-largest shareholder, for its rejection of a buyout offer from Sports Direct. Schroders holds an 18.85% stake in Findel.

- “Schroders agrees with the conclusion of the Findel Board that the offer significantly undervalues the future prospects of Findel,” the company said in a statement and restated its intention not to accept the offer, which values Findel at £139.2 million ($182.5 million).

- H&M has announced plans to open a new 785,765-square-foot warehouse in Milton Keynes, England, that will create about 800 new jobs. The warehouse will provide increased capacity for orders in the region and feature new technology to meet shopper demands with a flexible and efficient product flow.

- The warehouse will service H&M’s online customers as well as stores across the UK and Ireland, making it the group’s first omnichannel distribution center.

- Online electrical-goods retailer AO World has collaborated with housing associations in England and Scotland to commence a trial of a new appliance rental service. As part of the trial, customers can rent appliances for as little as £2 ($2.65) per week. The rental service will include insurance and the recycling of any old appliances.

- AO World said that, after five years, customers can replace a rented product with a new one and have the old one sent for refurbishment or recycling. CEO John Roberts said that the retailer is also considering offering repair services at customers’ homes.

ASIA RETAIL & TECH HEADLINES

JD.com Launches Price Optimization Tool in Partnership with Nielsen

(Mar. 29) Consumergoods.com

JD.com Launches Price Optimization Tool in Partnership with Nielsen

(Mar. 29) Consumergoods.com

- JD.com has launched a tool called the Online Pricing Optimizer in collaboration with American market measurement company Nielsen. The product has been designed to help brands evaluate their pricing strategy on JD.com’s platform.

- The Online Pricing Optimizer combines the order and browsing data generated by more than 300 million active online customers on JD.com, along with Nielsen’s monitoring data on omnichannel retail, and is meant to help fast-moving consumer goods brands understand online consumers and drive sales.

- Alibaba has completed the full acquisition of Shanghai-based project management software startup Teambition via its investment arm. Teambition, which was founded in 2011, has two flagship products: enterprise knowledge base software called “Thoughts” and collaborative customer relationship management software called “Bingo.”

- The deal is in line with Alibaba’s strategy to forge a significant position in enterprise services in China.

- India’s biggest online supermarket, Big Basket, is in the midst of raising $150 million in a fresh round of funding from Alibaba, its largest shareholder, as well as South Korean financial services firm Mirae Asset and the UK’s development finance institution CDC group.

- The company plans to allocate the funds toward its expansion plans in India’s major metros, acquisition of smaller startups and expansion in categories such as beauty products and meat.

Fung Group and Ruyi Group Announce Partnership for Textile Business Expansion in Africa

(Mar. 28) DrapersOnline.com

Fung Group and Ruyi Group Announce Partnership for Textile Business Expansion in Africa

(Mar. 28) DrapersOnline.com

- The Fung Group and textiles firm Ruyi Group have announced a partnership geared toward the development of growth opportunities in the global textile and garment sector with a specific focus on the emerging African market.

- “The partnership will jointly develop the African market—an emerging market with promising growth potential—creating there one of the biggest end-to-end textile and apparel ecosystems in the world,” according to a statement from the two companies.

Baume & Mercier Reenters Singapore and Malaysia via FJ Benjamin

(Apr. 1) InsideRetail.asia

Baume & Mercier Reenters Singapore and Malaysia via FJ Benjamin

(Apr. 1) InsideRetail.asia

- Swiss watch brand Baume & Mercier has reentered Singapore and Malaysia under a new distribution agreement with Singaporean fashion retailer FJ Benjamin Holdings.

- The deal is valid for three years, with the possibility of another two-year extension based on certain commitments, the company said in a regulatory filing on March 29.

LATAM RETAIL & TECH HEADLINES

- Mexican supermarket chain Soriana has announced that it has entered into a partnership with Payback, a subsidiary of American Express, with a view to providing additional benefits to the users of the company’s existing loyalty program “Rewards Soriana.”

- This initiative will “provide greater added value for the more than 8.8 million current Soriana customers who already participate in this program, as well as for the more than 8 million customers and more than 20 participating companies that are currently managed by the members enrolled in the Payback program,” according to the company.

- Mexican department store chain El Palacio de Hierro has expanded its commercial offering by adding seven new brands, primarily in its Polanco flagship store.

- Women’s fashion firms Red Valentino and Zimmerman, jewelry brand Cult Guia and men’s fashion brands Herno, Lardini, Incotex and Zanone are the latest additions to the retailer’s commercial portfolio.

- Chilean home improvement store chain Sodimac has received the approval of the Ministry of Environment and Territorial Planning (MVOTMA) for the construction of the Hyper Sodimac in the Mendoza Plaza Shopping center.

- The Civil Justice dismissed the appeal of a group of neighbors in the area who had filed an injunction to stop the construction, and MVOTMA approved the Declaration of Environmental Impact made by the company.

- Hugo Boss has announced that it plans to open three new Hugo stores in Lima in the next two years as part of its expansion plans in Peru.

- The brand, which operates in the country through Peruvian distributor Grupo Yes, recently opened its third store in the country in Lima’s Jockey Plaza shopping center, a store in which it has invested more than $500,000.

- Argentinian retail chain Musimundo is continuing to shut stores, with its Fisherton branch in Rosario being the latest to close. The retailer has closed more than 12 stores recently.

- The company attributed the store closures to a sharp drop in sales, tariffs and high rents, in addition to a lack of financing.

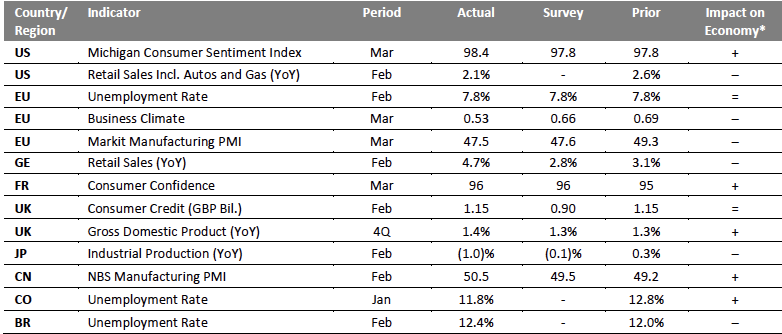

MACRO UPDATE

Key points from global macro indicators released March 26–April 2, 2019: 1) US: Retail sales including automobiles and gasoline increased 2.1% year over year on a seasonally adjusted basis in February, versus a 2.6% increase registered in January. The University of Michigan consumer sentiment index was 98.4 in March, above the consensus estimate and previously recorded value of 97.8. 2) Europe: In the eurozone, the unemployment rate remained unchanged in February at 7.8% and was in line with the consensus estimate. In the UK, Gross Domestic Product (GDP) grew 1.4% year over year in the fourth quarter of 2018, above the 1.3% growth recorded in the previous quarter and above the consensus estimate of 1.3% year-over-year growth; this is the second estimate of fourth-quarter GDP. 3) Asia-Pacific: In Japan, industrial production shrank 1.0% year over year in February, compared with a 0.3% increase in January and consensus estimate of a 0.1% year-over-year decline. In China, the NBS Purchasing Managers’ Index (PMI) increased to 50.5 in February from 49.2 in January and came in above the consensus estimate of 49.5. 4) Latin America: Colombia’s rate of unemployment was 11.8% in January, improving from 12.8% in December. In Brazil, the unemployment rate stood at 12.4% in February, increasing from 12.0% in January. [caption id="attachment_82826" align="aligncenter" width="782"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impactSource: Markit Economics/US Census Bureau/University of Michigan/European Commission/Statistisches Bundesamt, Germany/INSEE, France/Bank of England/UK Office for National Statistics/Ministry of Economy, Trade and Industry, Japan/National Bureau of Statistics, China/Banco de la República de Colombia/Instituto Brasileiro de Geografia e Estatisticais/Coresight Research[/caption]

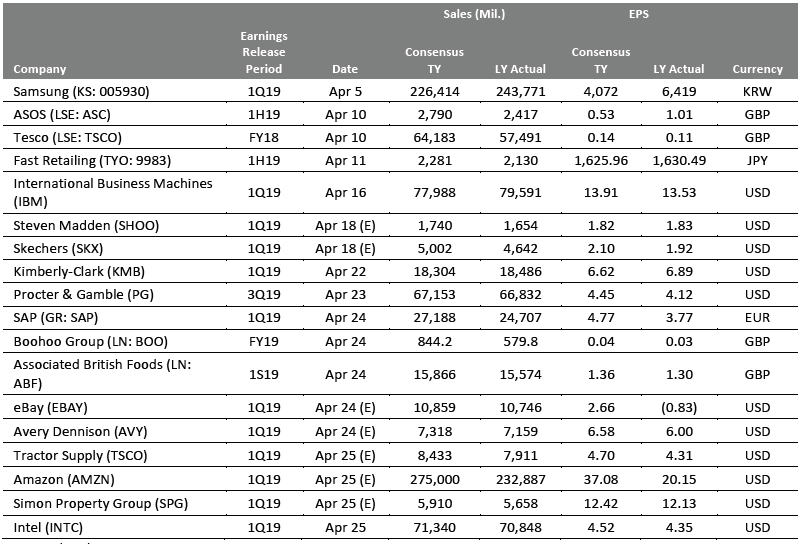

EARNINGS CALENDAR

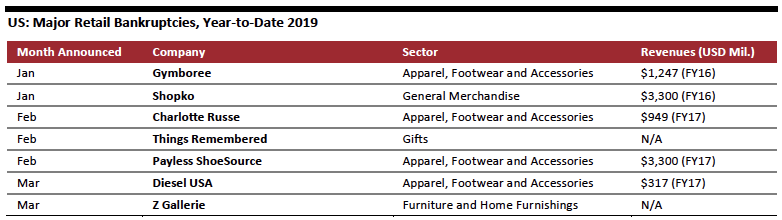

EVENT CALENDAR