From the Desk of Deborah Weinswig

Amazon’s Key Service Now Delivers Packages Inside Your Home or the Trunk of Your Car

Amazon has long led the way in developing innovative package delivery services. The company originally made free, two-day shipping table stakes for e-commerce companies, and then upped the ante by offering one- and two-hour delivery for Prime members through Amazon Prime Now. This week, Amazon expanded its Amazon Key delivery program, which first enabled customers to have packages delivered inside their home, but now includes the option of having packages delivered directly to the trunk of a car. One benefit of this program is that it will help thwart “porch pirates,” the thieves who steal packages that have been left in front of residences, because more deliveries will be locked up in the relative safety of customers’ cars.

Last October, Amazon announced its Amazon Key service, which offers secure home access for couriers delivering packages and professionals making service calls to a home. The service was initially rolled out to 37 cities, with the in-home delivery option available to Prime members. At that time, Amazon offered an Amazon Key Home Kit, which included an Amazon Cloud Cam and a smart lock made by Yale or Kwikset, for a price of $249.99. The program was recently expanded to support eight smart lock vendors. The smart lock that comes with the kit provides entry access to the home, and the deliverer’s entry and exit are recorded on the camera. Customers can also use the security setup to allow other trusted individuals, such as family members, house cleaners and dog walkers, to enter their home.

Amazon reiterated its strong support for this home-delivery concept by acquiring video doorbell maker Ring for $1 billion, its second-largest acquisition after its $13.7 billion purchase of Whole Foods Market. These recent announcements and acquisitions round out a slew of services that Amazon began rolling out much earlier. In March 2015, the company announced Amazon Home Services, which provides professional services such as TV wall mounting, housecleaning and garbage disposal by handpicked professional workers.

Amazon rival Walmart is also competing on in-home and speedy delivery. The company has been testing package delivery by employees on their way home from work and an in-home delivery service with smart-lock maker August Home. Walmart also recently announced a partnership with DoorDash to offer same-day delivery of groceries. The service will initially be available in the Atlanta area, but Walmart’s goal is to be able to offer the service to 40% of US households by the end of the year. In a similar move, Target announced plans in December to acquire same-day delivery company Shipt for $550 million, and Target recently announced same-day delivery across the Northwest and Colorado.

Amazon jumped ahead in the delivery game this week by announcing that it has partnered with General Motors (GM) and Volvo to expand its Amazon Key service to include in-car delivery for Prime members in 37 cities. Prime members who park their car in a publicly accessible area can use the Amazon Key app to schedule same-day, two-day or standard delivery of their packages directly to their car trunk.

The app connects to the owner’s connected car account and tracks that the car has been unlocked, the package delivered and the car relocked. The process is entirely keyless, and couriers do not need to enter any security codes to deliver the packages. To increase security, the whole process is encrypted and Amazon’s platform also verifies that the delivery driver is in the right location, with the right package. To further mitigate any security concerns that car owners might have, Amazon offers a reassuring Happiness Guarantee.

The in-car delivery service is currently available to Prime members who own a 2015 or later model GM brand car with an OnStar account, such as a Chevrolet, Buick, GMC or Cadillac, or a 2015 or later model Volvo with an On Call account. Amazon plans to add more carmakers to the service over time. GM estimates that 7 million of its car owners are eligible to sign up for the service.

Amazon has raised the bar for innovative package delivery yet again. Customers who are not able to receive packages at work or home, or who don’t live close to an Amazon Locker pickup location, can now choose to have their packages delivered and safely locked in the trunk of their parked car, ready to be driven home. The array of delivery options Amazon currently provides will have to do until the company perfects its drone delivery technology that will deliver packages from large, beehive-like structures directly into our hands for even faster service.

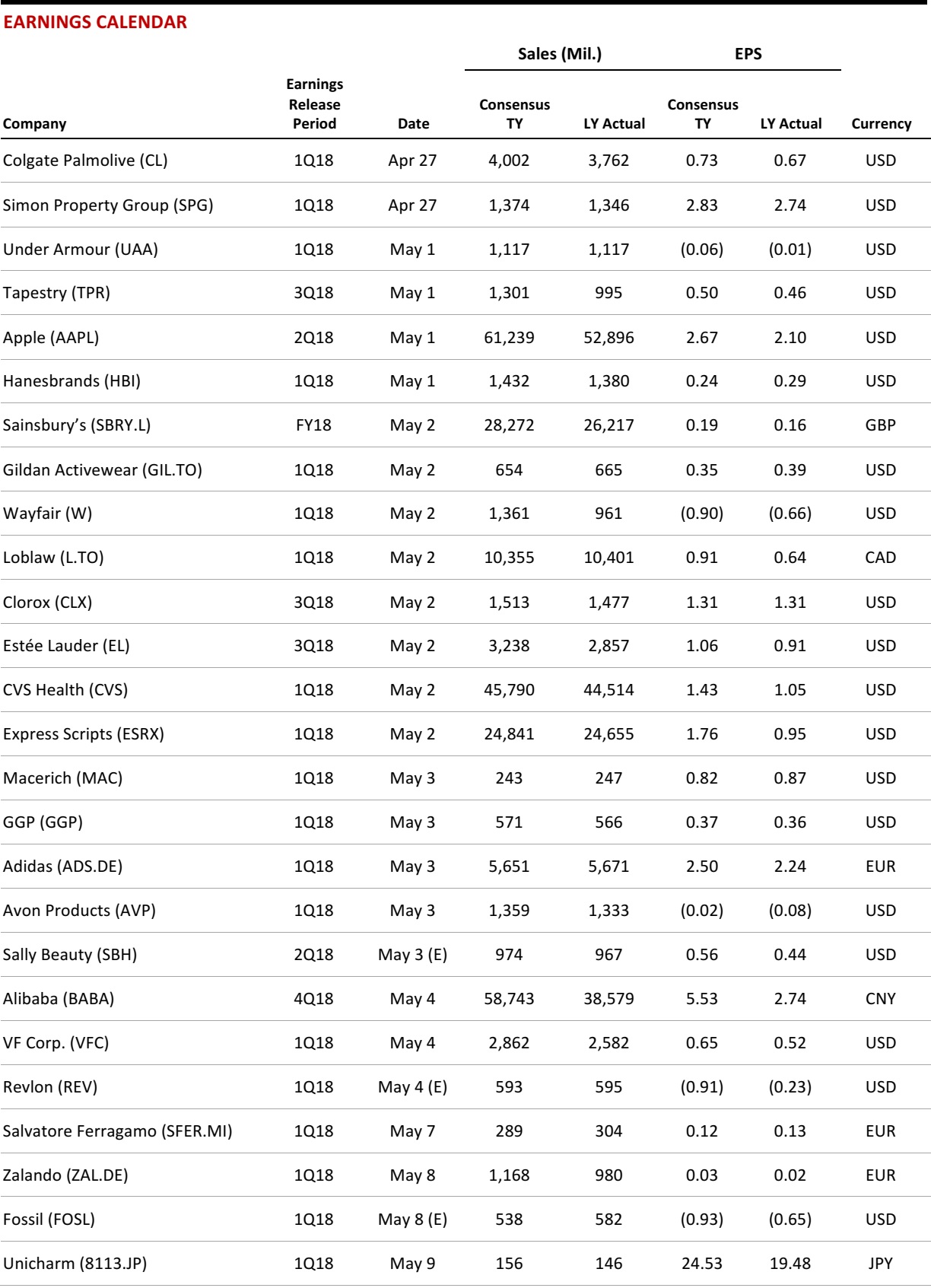

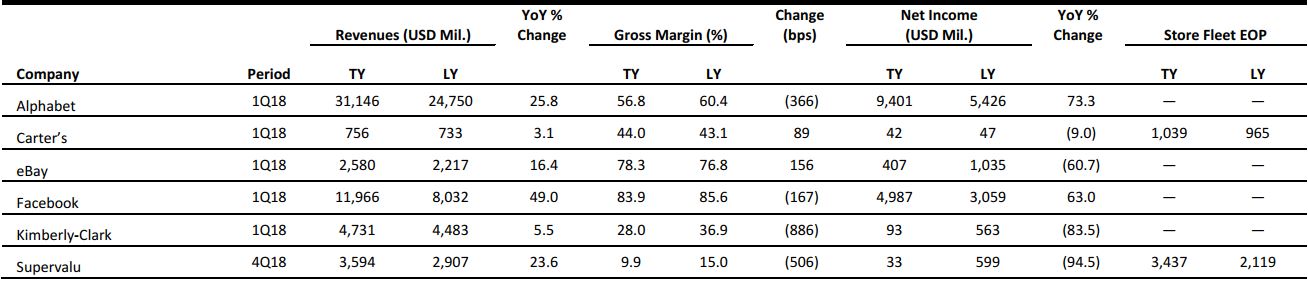

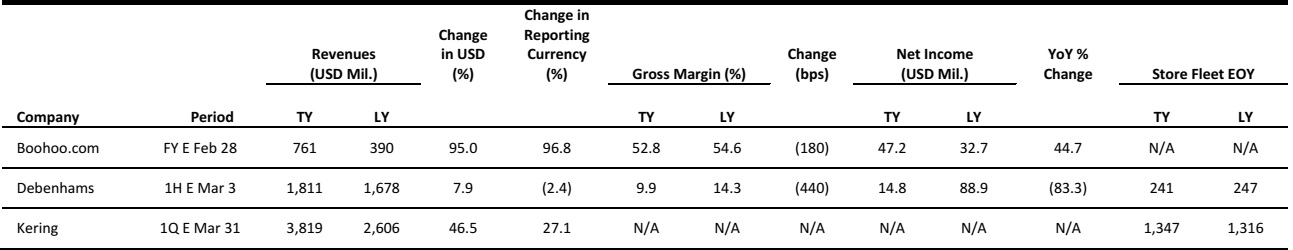

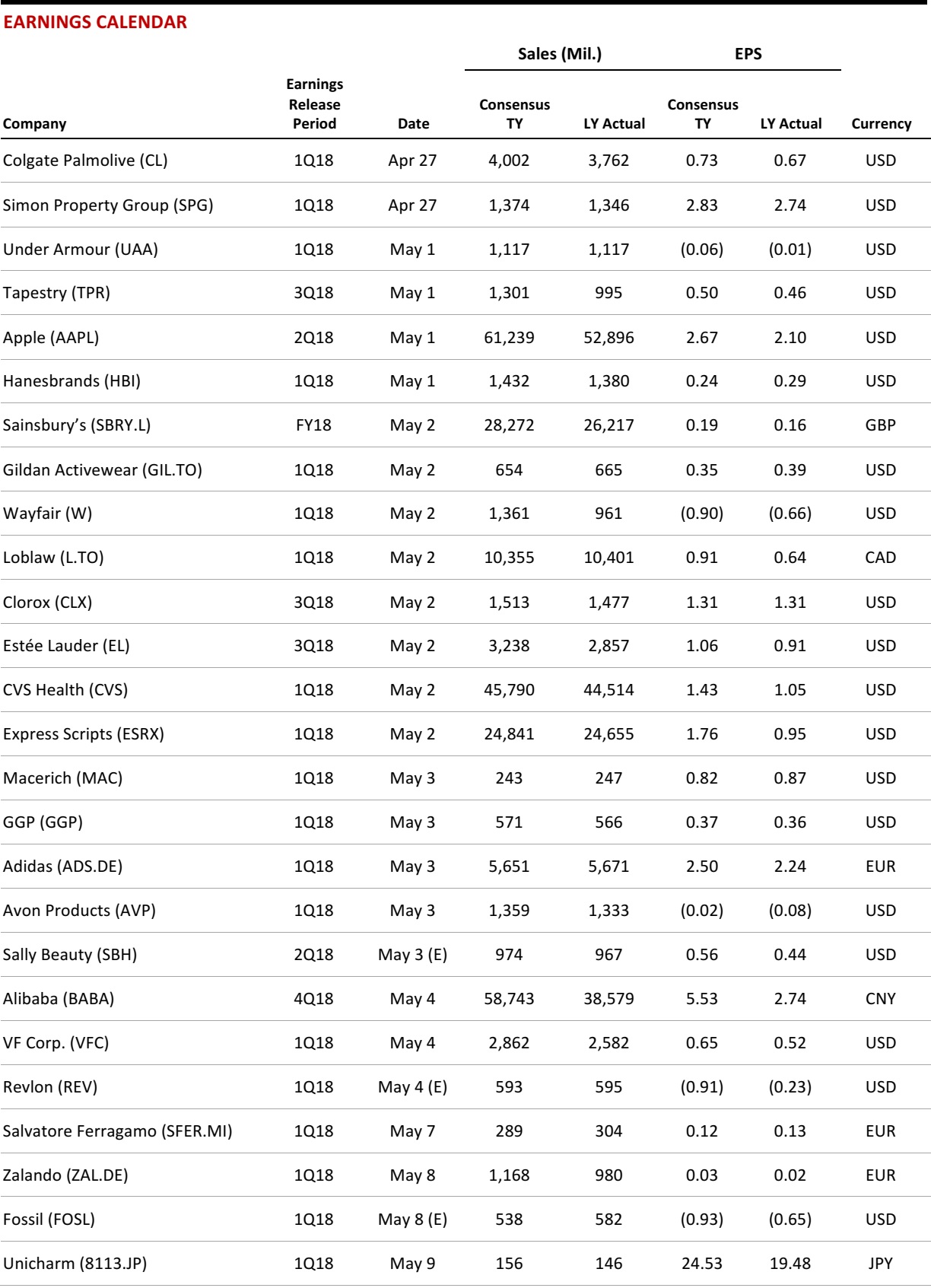

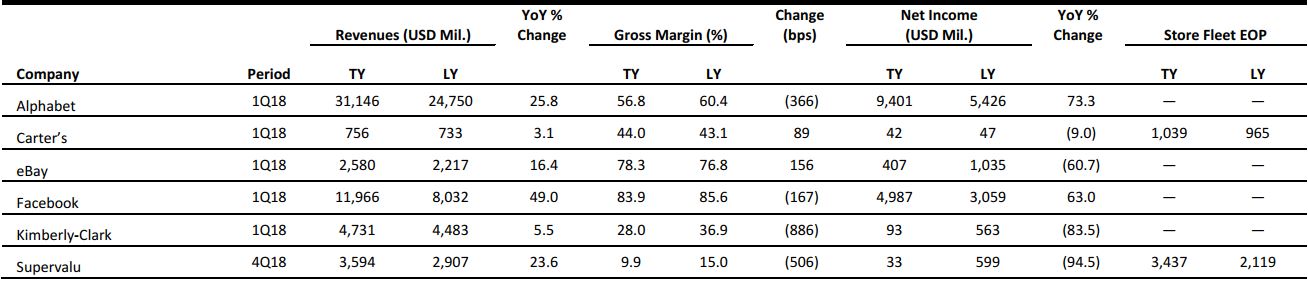

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Amazon Could Lead US Apparel Retail by the End of this Year

(April 24) BusinessInsider.com

Amazon Could Lead US Apparel Retail by the End of this Year

(April 24) BusinessInsider.com

- Amazon is expected to be the leading US apparel retailer in 2018, according to a report from Morgan Stanley. The company had a 7.9% share of US apparel retail sales in 2017, coming in second after Walmart, which had an 8.6% share. Third place Target held a 4.8% market share.

- Amazon’s market share grew by 1.5 percentage points in 2017, and Morgan Stanley expects it to continue to rise as department stores flounder and brands look to Amazon for help.

Toys“R”Us Bankruptcy Hits Hasbro’s Sales

(April 24) Pymnts.com

Toys“R”Us Bankruptcy Hits Hasbro’s Sales

(April 24) Pymnts.com

- After failing to meet Wall Street’s expectations, Hasbro blamed the Toys“R”Us bankruptcy for a drop in revenues in the first quarter. But the toymaker said the collapse of one of its largest customers would impact the company less after the first half of the year, Reuters reported.

- “We anticipate the revenue impact will be most pronounced in the first half of the year, with a lesser impact in the third and fourth quarters, including the important holiday season,” said Hasbro CEO Brian Goldner.

Bon-Ton Is Closing All 256 of Its Department Stores

(April 23) DaytonDailyNews.com

Bon-Ton Is Closing All 256 of Its Department Stores

(April 23) DaytonDailyNews.com

- 2018 is shaping up to be another difficult year for traditional retailers. After shutting down more than 5,000 stores in 2017, retailers have announced more than 2,000 store closures over the past few months.

- Bon-Ton, a department store chain, announced in mid-April that it’s going out of business. The liquidation process in all Bon-Ton stores began on April 20 and is expected to run for approximately 10–12 weeks.

Walmart Said Close to $12 Billion-Plus Deal for Flipkart, India’s Leading E-Commerce Company

(April 23) Bloomberg.com

Walmart Said Close to $12 Billion-Plus Deal for Flipkart, India’s Leading E-Commerce Company

(April 23) Bloomberg.com

- Walmart is close to finalizing a deal to buy a majority stake in India’s leading e-commerce company for at least $12 billion and may complete the agreement in the next two weeks, according to people familiar with the matter.

- All the major investors in Flipkart Online Services are now on board with the Walmart purchase, following an earlier debate over an Amazon.com acquisition, said the people, asking not to be named because the matter is private.

US Online Retail Sales to Surpass $700 Billion by 2022

(April 19) Pymnts.com

US Online Retail Sales to Surpass $700 Billion by 2022

(April 19) Pymnts.com

- A recent study says that US e-commerce sales will exceed $506 billion this year. By 2022, online retail sales will go beyond $712 billion. According to news from Retail Dive, the study shows that 98% of American adults already go online at least once a day.

- Many shoppers are choosing e-commerce because the information they find online is often more helpful than what’s available in the store. And, by shopping online, consumers don’t have to deal with certain frustrations, such as not being able to locate sales help.

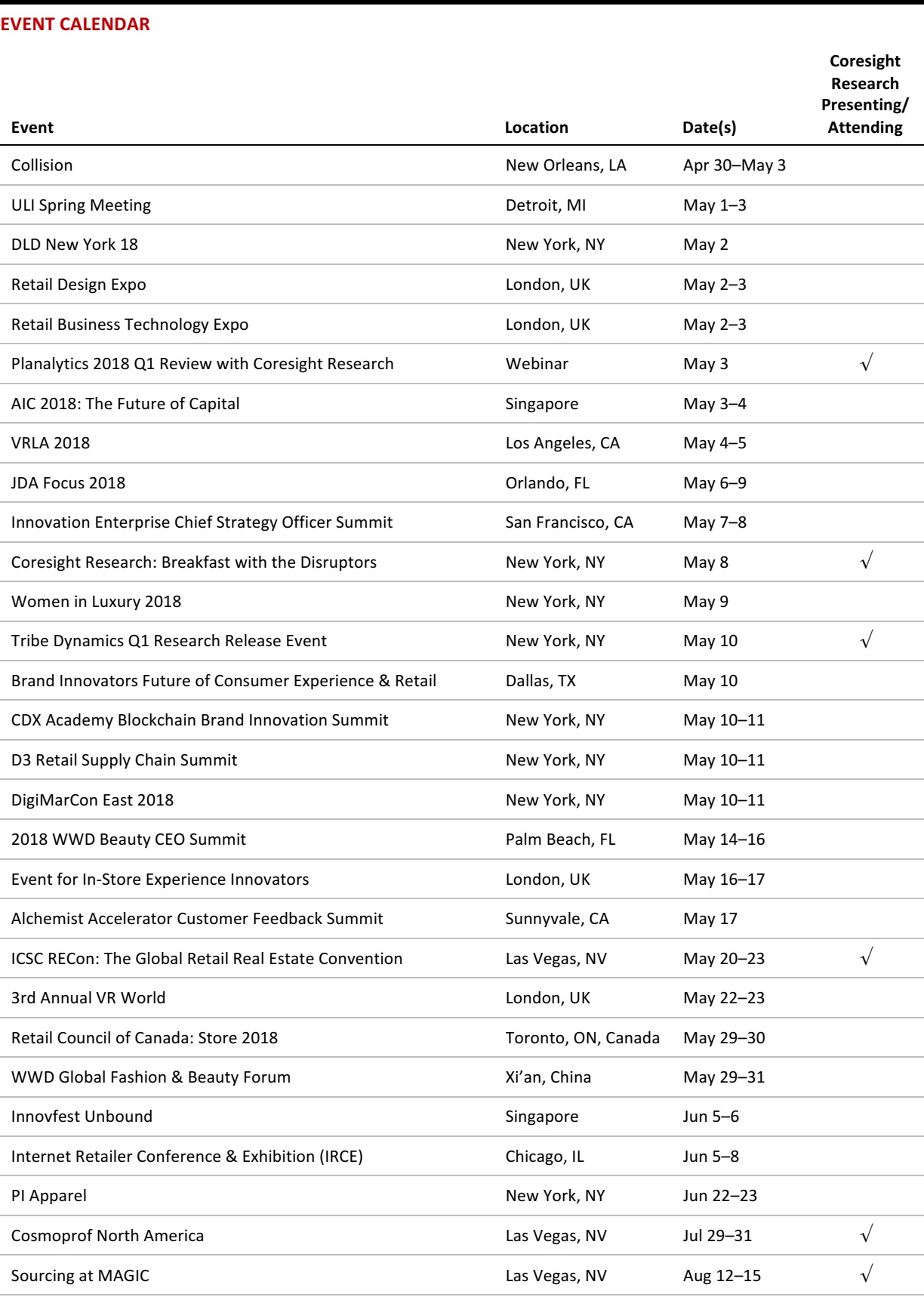

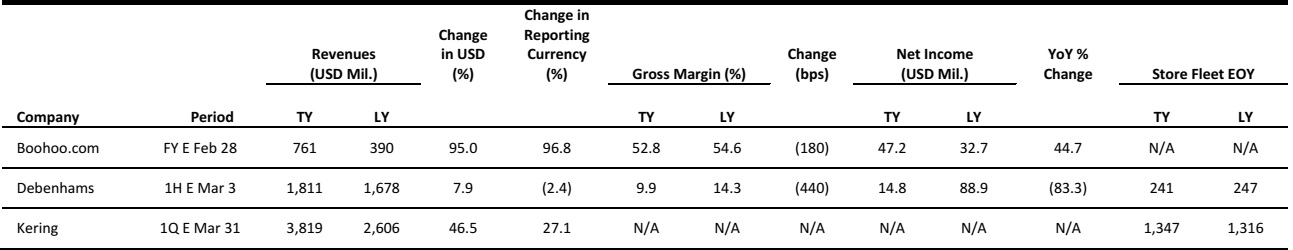

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

An Earlier Easter Boosts UK Retail Sales Volume Growth in March

(April 19) ONS press release

An Earlier Easter Boosts UK Retail Sales Volume Growth in March

(April 19) ONS press release

- Total UK retail sales value growth was 5.2% in March, the highest rate seen since last August, according to the Office for National Statistics (ONS). Volume sales growth was 3.1%. The earlier timing of Easter this year pulled forward some holiday spending from April to March, but unusually cold weather at the start of March held back retail growth for the month.

- Sales at clothing specialists declined by 0.1%, driven by small chains and independent stores; retail sales at larger chains grew by 0.9%. Footwear retailers saw an exceptionally weak month, while sales at grocery retailers grew by 4.7% and total Internet retail sales grew by 13.5% year over year.

Smyths Toys Acquires Toys“R”Us in Central Europe

(April 23) RetailDetail.eu

Smyths Toys Acquires Toys“R”Us in Central Europe

(April 23) RetailDetail.eu

- Irish toy retailer Smyths has announced a deal with bankrupt Toys“R”Us to acquire all of the latter’s 93 stores and e-commerce sites in Germany, Austria and Switzerland. The company did not disclose financial terms of the deal.

- The agreement is subject to the approval of the US court and relevant authorities. Last month, Toys“R”Us announced the closure of its toy stores in the US, just a few weeks after it announced the liquidation of its British business.

East Expected to Stop Trading May 4

(April 24) RetailGazette.co.uk

East Expected to Stop Trading May 4

(April 24) RetailGazette.co.uk

- Administrators failed to find a buyer for high-street womenswear retailer East, and the firm is expected to stop trading on May 4, putting nearly 300 staff at risk of redundancy.

- In January this year, East announced that it was in administration, with FRP Advisory handling the proceedings, and FRP is still open to a last-minute sale of all or part of the business. East’s creditors are still owed £10.1 million ($14.1 million).

Concept Store for Budding Designers to Open in London

(April 19) FashionUnited.uk

Concept Store for Budding Designers to Open in London

(April 19) FashionUnited.uk

- London-based art organization Something & Son has created a new experimental concept store called 50m to support emerging designers. Something & Son said this store will help budding designers tackle “sky-high” shop rents in London.

- By paying an “affordable monthly fee,” new designers can use 50 meters of rail space in the shop to showcase their work, hence the name 50m. The shop, which opens in late May, also offers a hot-desking area, event space, a café and a social meeting spot.

Farfetch Launches Technology Accelerator

(April 19) WWD.com

Farfetch Launches Technology Accelerator

(April 19) WWD.com

- London-based fashion e-commerce platform Farfetch has launched a technology accelerator called Dream Assembly, which will offer a 12-week program in Lisbon, Portugal. The program will offer mentorship, networking opportunities and access to early-stage funding.

- Burberry and San Francisco–based venture capital firm 500 Startups will partner with Farfetch for the inaugural program, which is set to begin in September. Farfetch plans to run two programs every year and have up to 10 startups participate in each program.

ASIA RETAIL & TECH HEADLINES

Ping An Good Doctor Starts Preparing $1.1 Billion Hong Kong IPO

(April 22) Bloomberg.com

Ping An Good Doctor Starts Preparing $1.1 Billion Hong Kong IPO

(April 22) Bloomberg.com

- Ping An Good Doctor attracted cornerstone investors including GIC and Khazanah Nasional to a Hong Kong IPO that could raise as much as $1.1 billion. The Chinese online healthcare platform is offering about 160 million shares at HK$50.80–HK$54.80 apiece, according to terms for the deal obtained by Bloomberg. The Ping An Insurance (Group) subsidiary will take investor orders from Monday through April 26, the terms show.

- Shares of Ping An Insurance have risen by more than 90% over the past 12 months, giving it a market value of about $188 billion, and the company is now preparing listings for its technology units. Its OneConnect financial management portal has picked banks for a Hong Kong IPO that could raise as much as $3 billion, people familiar with the matter said in March.

Razer Doubles Down on Southeast Asia and Payments with Acquisition of MOL

(April 23) TechCrunch.com

Razer Doubles Down on Southeast Asia and Payments with Acquisition of MOL

(April 23) TechCrunch.com

- Gaming hardware maker Razer, which went public in a big IPO in Hong Kong last year, announced a deal to acquire MOL, a company that offers online and offline payments in Southeast Asia. Razer made an initial, $20 million investment in MOL last June to supercharge its zGold virtual credit program for gamers by allowing them to buy using MOL’s online service or its offline, over-the-counter network of retailers, which includes 7-Eleven.

- Razer now aims to acquire the remaining 65% of MOL. That will allow Razer to grow its alternative revenue streams by pushing fully into payment services by merging MOL’s virtual payment platform with zGold. The transaction gives MOL the same, $100 million valuation it held at the time Razer made its initial investment.

The Future of E-Commerce in India Increasingly Looks Like an All-American Affair

(April 23) TechCrunch.com

The Future of E-Commerce in India Increasingly Looks Like an All-American Affair

(April 23) TechCrunch.com

- India’s technology industry is bracing itself for the next era of e-commerce warfare, which looks set to be waged and bankrolled by two gigantic corporations located halfway across the world: Amazon and Walmart. Amazon is already deeply committed to India, where it has pledged to deploy more than $5 billion to grow its business, and now US rival Walmart is said to be inching closer to a deal to buy Flipkart.

- Bloomberg reported that Walmart is poised to acquire 60%–80% of the company for $12 billion. The deal could potentially value Flipkart at $20 billion, a major jump from its $12 billion valuation last year when it landed a $1.4 billion investment from Microsoft, Tencent and eBay. Amazon was said to have made a last-minute move to conduct talks with Flipkart, but it seems now that Walmart intends to take the deal, with Flipkart’s founders said to be in favor.

Bank of China Embracing Blockchain Use in Hong Kong

(April 23) SCMP.com

Bank of China Embracing Blockchain Use in Hong Kong

(April 23) SCMP.com

- Bank of China Hong Kong is now handling almost all of its real estate appraisals via blockchain as part of a concerted push into fintech and smart banking, officials revealed on Monday. The lender is processing 85% of its mortgage-related property valuations using its own digital ledger, according to General Manager of Information Technology Rocky Cheng Chung-ngam.

- “Property valuations are needed to calculate monthly mortgage payments, but can now be done faster and in a more transparent way using blockchain. In the past, banks and real estate appraisers had to exchange faxes and emails to produce and deliver physical certificates,” Cheng said. “Now the process can be done on blockchain in seconds.”

LATAM RETAIL & TECH HEADLINES

China’s Didi Chuxing Launches Its Ride-Hailing Service in Mexico

(April 23) TechCrunch.com

China’s Didi Chuxing Launches Its Ride-Hailing Service in Mexico

(April 23) TechCrunch.com

- China’s ride-sharing leader, Didi Chuxing, has continued its global march by officially launching in Mexico, expanding its battle with Uber to a new front. Didi raised $4 billion in December to expand overseas. Hot on the heels of moves into Brazil, Taiwan and Japan, the company has launched its UberX-style Express service in the city of Toluca, Mexico.

- The company said that it plans to expand its services into “other major cities” in Mexico later this year. Uber entered the country in 2013, and it currently operates in more than 40 cities there. Didi initially began hiring drivers in Mexico in April last year. It said its teams in Beijing and California—where it opened an AI office last year—were involved in developing its service for the Mexican market, which looks like a litmus test for future expansion.

Brazil Sees Launch of Cryptocurrency and Blockchain Association

(April 23) ZDNet.com

Brazil Sees Launch of Cryptocurrency and Blockchain Association

(April 23) ZDNet.com

- A new association, started by Brazilian fintech firm Atlas Project, has launched in São Paulo with the aim of fostering debate within the government regarding digital currencies. The Brazilian Association of Cryptocurrencies and Blockchain (ABCB) wants to lead projects focused on absorbing global advances in cryptocurrencies and the blockchain technology that supports them.

- Fernando Furlan will lead ABCB. He was previously a president at the Brazilian Administrative Council for Economic Defense, an independent agency reporting to the Ministry of Justice, and has held senior roles in the Ministry of Development, Industry and Foreign Trade and the Brazilian Development Bank.

Brazil’s Nubank Introduces Facial Biometrics to Increase Security

(April 17) ZDNet.com

Brazil’s Nubank Introduces Facial Biometrics to Increase Security

(April 17) ZDNet.com

- Brazilian fintech firm Nubank is using facial biometrics to improve security in the processing of credit card requests. The mobile-centric credit card and payment services provider is using the AcessoBio tool, provided by local technology firm Acesso Digital, to add to the data analytics tool set the firm already employs.

- AcessoBio is considered to be the largest privately run biometric database in Brazil. It records biometric details of 1 million Brazilians monthly and aims to capture the details of the entire economically active population in the country within the next three years.

International Coffee House and Mexican Partner Open First Store in Montevideo

(April 19) En.Mercopress.com

International Coffee House and Mexican Partner Open First Store in Montevideo

(April 19) En.Mercopress.com

- Starbucks has opened its first store in Uruguay, at the Montevideo Shopping mall in the capital city of Montevideo. The store has a unique design and offers a wide range of Starbucks beverages and food.

- Mexico-based international retail and restaurant operator Alsea exclusively owns and operates Starbucks stores in Uruguay. “Our first store in Uruguay marks a key milestone for our expansion in Latin America,” said Ricardo Rico, Starbucks’ VP and General Manager for Latin America, who attended the store’s opening celebration.

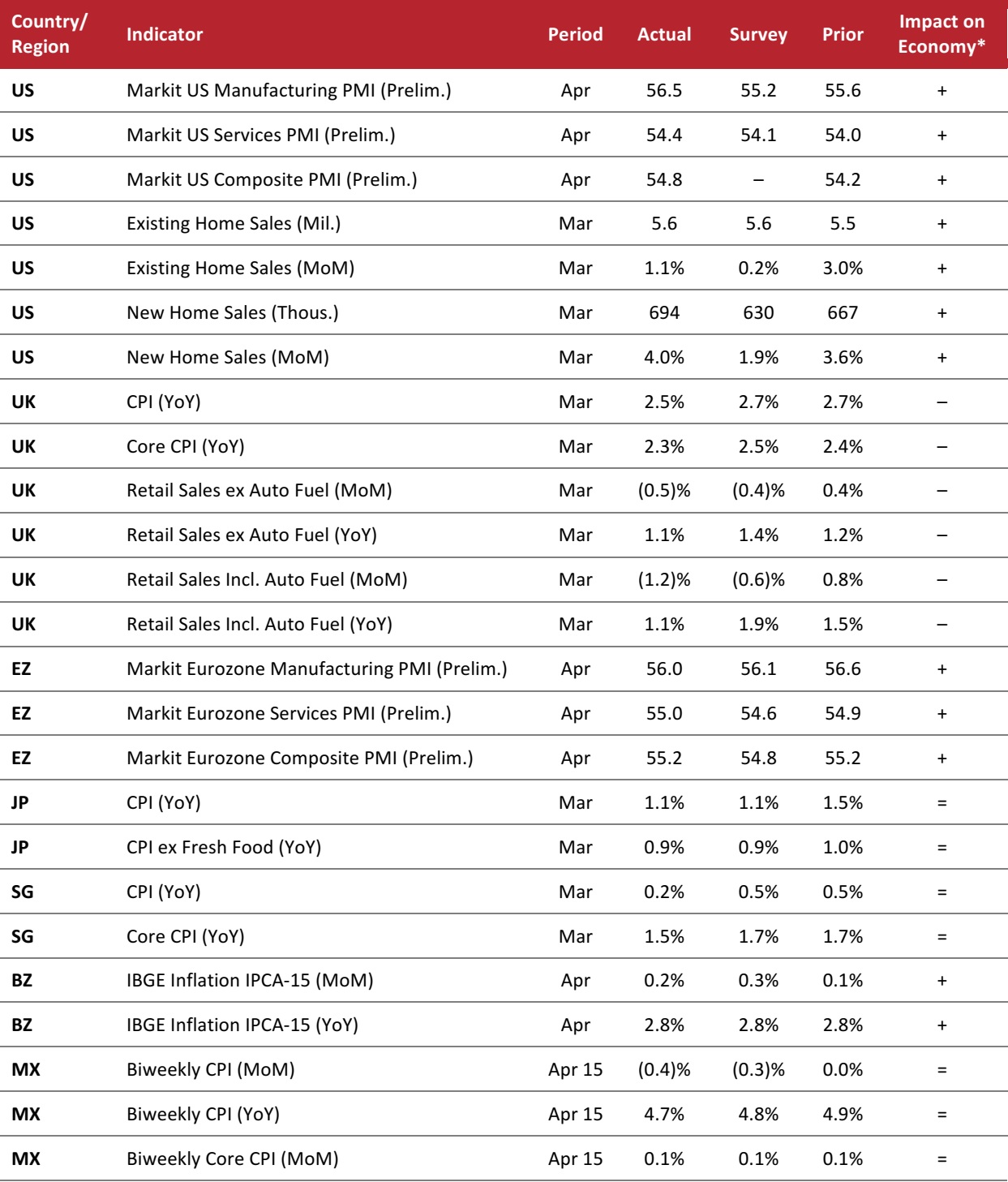

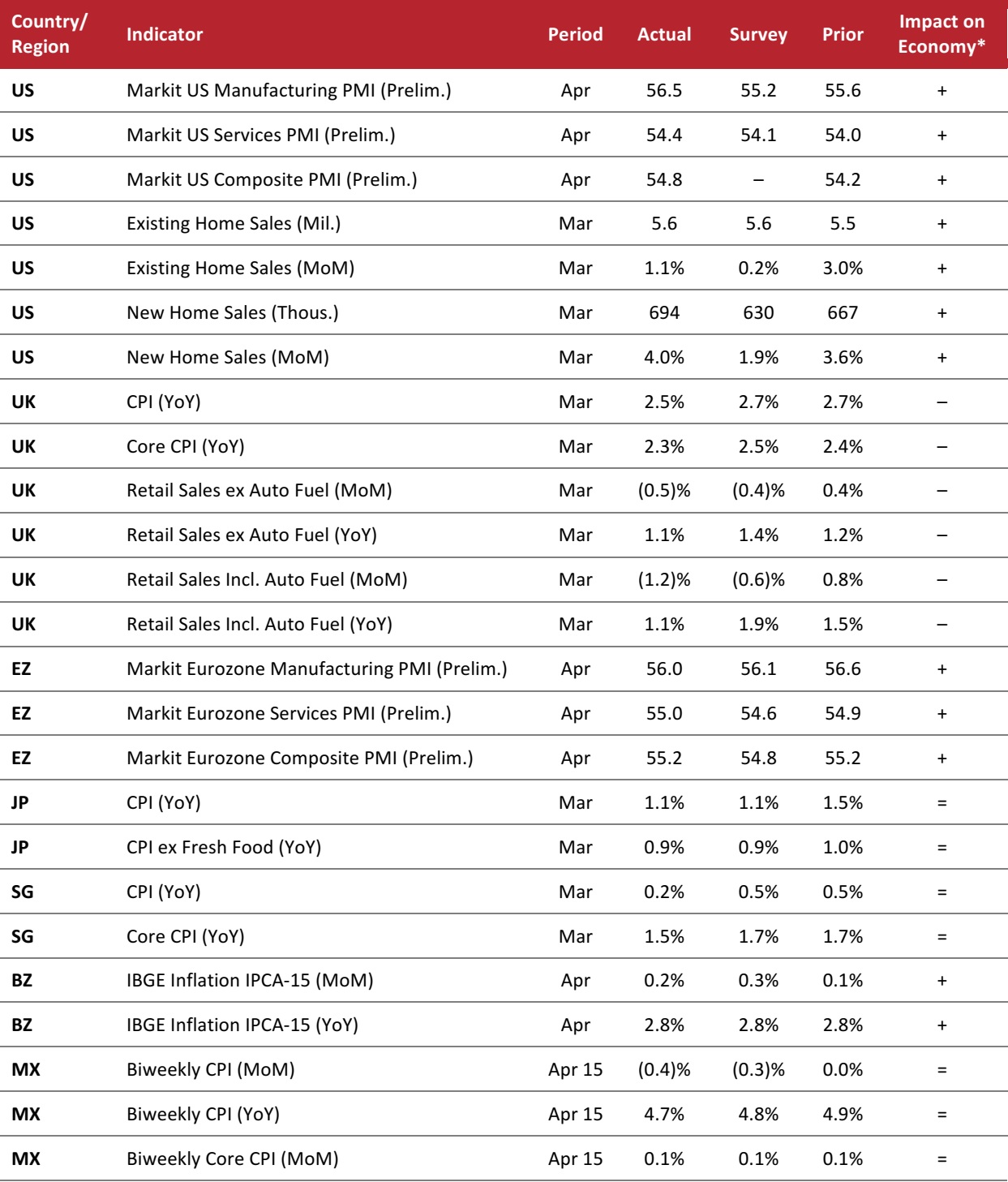

MACRO UPDATE

Key points from global macro indicators released April 18–25, 2018:

- US: In April, the Markit US Manufacturing Purchasing Managers’ Index (PMI) ticked up to 56.5,which was above the consensus estimate. Existing home sales increased to 5.6 million in March, rising by 1.1% month over month, a rate that was above the market’s expectation. New home sales in March increased by 4.0% month over month.

- Europe: In the UK, the Consumer Price Index (CPI) increased by 2.5% year over year in March and the core CPI increased by 2.3% year over year. UK retail sales increased by 1.1% year over year in March, missing the consensus estimate of 1.4%. In the eurozone, the Markit Eurozone Manufacturing and Services PMIs stayed above the expansion threshold in April.

- Asia-Pacific: In Japan, the CPI increased by 1.1% year over year in March, in line with the consensus estimate. In Singapore, the CPI increased by 0.2% year over year in March and the core CPI increased by 1.5% year over year.

Latin America: In Brazil, the IBGE Inflation IPCA-15 indicator increased by 2.8% year over year in April, signaling a healthy price environment. In Mexico, the CPI increased by 4.7% year over year in mid-April, slightly below the market’s expectation.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit/National Association of Realtors/US Census Bureau/UK Office for National Statistics/Eurostat/Japan Director-General for Policy Planning/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit/National Association of Realtors/US Census Bureau/UK Office for National Statistics/Eurostat/Japan Director-General for Policy Planning/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

Amazon Could Lead US Apparel Retail by the End of this Year

(April 24) BusinessInsider.com

Amazon Could Lead US Apparel Retail by the End of this Year

(April 24) BusinessInsider.com

Toys“R”Us Bankruptcy Hits Hasbro’s Sales

(April 24) Pymnts.com

Toys“R”Us Bankruptcy Hits Hasbro’s Sales

(April 24) Pymnts.com

US Online Retail Sales to Surpass $700 Billion by 2022

(April 19) Pymnts.com

US Online Retail Sales to Surpass $700 Billion by 2022

(April 19) Pymnts.com

Smyths Toys Acquires Toys“R”Us in Central Europe

(April 23) RetailDetail.eu

Smyths Toys Acquires Toys“R”Us in Central Europe

(April 23) RetailDetail.eu

East Expected to Stop Trading May 4

(April 24) RetailGazette.co.uk

East Expected to Stop Trading May 4

(April 24) RetailGazette.co.uk

Concept Store for Budding Designers to Open in London

(April 19) FashionUnited.uk

Concept Store for Budding Designers to Open in London

(April 19) FashionUnited.uk

Razer Doubles Down on Southeast Asia and Payments with Acquisition of MOL

(April 23) TechCrunch.com

Razer Doubles Down on Southeast Asia and Payments with Acquisition of MOL

(April 23) TechCrunch.com

The Future of E-Commerce in India Increasingly Looks Like an All-American Affair

(April 23) TechCrunch.com

The Future of E-Commerce in India Increasingly Looks Like an All-American Affair

(April 23) TechCrunch.com

Bank of China Embracing Blockchain Use in Hong Kong

(April 23) SCMP.com

Bank of China Embracing Blockchain Use in Hong Kong

(April 23) SCMP.com

China’s Didi Chuxing Launches Its Ride-Hailing Service in Mexico

(April 23) TechCrunch.com

China’s Didi Chuxing Launches Its Ride-Hailing Service in Mexico

(April 23) TechCrunch.com

Brazil Sees Launch of Cryptocurrency and Blockchain Association

(April 23) ZDNet.com

Brazil Sees Launch of Cryptocurrency and Blockchain Association

(April 23) ZDNet.com

Brazil’s Nubank Introduces Facial Biometrics to Increase Security

(April 17) ZDNet.com

Brazil’s Nubank Introduces Facial Biometrics to Increase Security

(April 17) ZDNet.com

International Coffee House and Mexican Partner Open First Store in Montevideo

(April 19) En.Mercopress.com

International Coffee House and Mexican Partner Open First Store in Montevideo

(April 19) En.Mercopress.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit/National Association of Realtors/US Census Bureau/UK Office for National Statistics/Eurostat/Japan Director-General for Policy Planning/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit/National Association of Realtors/US Census Bureau/UK Office for National Statistics/Eurostat/Japan Director-General for Policy Planning/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research