albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

China’s Booming E-Commerce Makes It Easier to Break into the China Market China’s booming economy and increasingly affluent younger generation present huge opportunities for Western brands. China’s retail market size caught up to the US in 2018 – and is expected to be bigger than the US retail market in 2019. But reaching consumers in China can pose a challenge for traditional retailers. Fortunately, consumer trends in China that are driving massive amounts of spending online are making it easier for Western brands (or any foreign brand) to break into the booming China market: Online accounted for almost 29% of China’s total retail sales in 2018, compared to under 10% in the US. These days, there’s far less need to invest in a costly physical presence if you don’t need one. Both trends are likely to continue: We expect China’s retail sector to continue growing rapidly, and for more retail sales to go online in the coming years – and for both metrics to grow more quickly than in the US. China’s Internet retail sales are expected to grow at a 15% CAGR in the five years through 2023, to reach $1.2 trillion, according to Euromonitor International. And, online marketplaces that feature imported goods and international sellers are popular. Alibaba’s cross-border platform Tmall Global was cited as the most popular channel for buying imported products by 58.2% of the 2,253 people who responded to an iiMedia Research survey. China’s e-commerce is also highly concentrated: Top players Tmall and JD.com accounted for 60% and 26% of gross merchandise volume (GMV) in the online retail business-to-consumer (B2C) market in China in the third quarter of 2018, respectively, according to China Internet Watch and Analysis. This makes it relatively easier for brands looking to enter China on a digital platform: Not only can one company deliver a huge pool of potential customers, they also offer a variety of support services to help brands selling on their online malls. China is a large, fast-growing and fast-changing consumer market that largely works with unique dynamics compared to other markets. International brands and retailers looking to succeed in this complex environment can benefit from partnering with an established player with deep knowledge of the local market and extensive local operational capabilities. Tmall platforms offer companies a valuable channel to access consumers in China. Get more information from our report Success in China E-Commerce: Your Tmall 101.QUESTION OF THE WEEK

[caption id="attachment_85217" align="aligncenter" width="824"] Respondents could select one option only. Ten most popular options shown.

Respondents could select one option only. Ten most popular options shown.Base: 7,388 US consumers ages 18+, surveyed in March 2019

Source: Prosper Insights & Analytics[/caption]

US RETAIL & TECH HEADLINES

- Walmart plans to open 40 of its membership Sam’s Club stores in China by 2020 as it continues to expand its retail footprint. The US retail giant currently operates 23 Sam’s Club stores across 19 cities in China and boasts around two million members.

- Walmart is looking to grow its footprint: Last year it opened 33 new stores, including four Sam's Clubs, 21 hypermarkets and eight compact supermarkets.

JCPenney Drops Apple Pay Support from Retail Stores and App

(April 22) 9to5mac

JCPenney Drops Apple Pay Support from Retail Stores and App

(April 22) 9to5mac

- Department store giant JCPenney has dropped support for Apple Pay from both its retail stores and its app. The chain has so far not provided any explanation for the decision.

- JCPenney first started trialing Apple Pay in 2015, with a full rollout in 2016. Former Apple retail head Ron Johnson left Apple back in 2011 to become CEO of JCPenney, a role he held for just two years.

- US retail sales surged in March at the fastest pace since late 2017, as spending on autos, gasoline, furniture and clothing jumped. The US Commerce Department said that sales increased a seasonally adjusted 1.6% from February, the strongest increase since September 2017.

- Sales at gas stations climbed 3.5%, while spending at auto dealers jumped 3.1%. Clothiers reported a 2% gain and furniture enjoyed a 1.7% bump.

- Pinterest and Zoom made their stock market debuts, with eager investors lifting both closely watched tech unicorns well above IPO pricing.

- Pinterest, an image-sharing site, closed at $24.40, up 28% from its $19 pricing. Last week, when Pinterest released a lower-than-expected IPO price, analysts speculated the company was adopting a more conservative approach to avoid replicating Lyft’s disappointing debut.

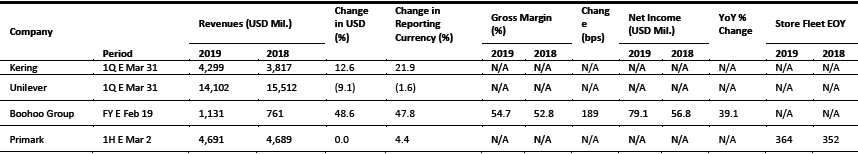

EUROPE RETAIL EARNINGS

[caption id="attachment_85218" align="aligncenter" width="858"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL AND TECH HEADLINES

- The Office for National Statistics (ONS) reported a strengthening of UK retail growth to 4.4% year over year in March from 4.0% in February, supported by a 4.0% increase in volumes. Growth was supported by a reported 8.9% increase in sales at small retailers. Larger retailers, which include well-known chains and major online retailers, grew sales 3.2%.

- Total UK Internet retail sales were up 12.4% year over year in March, versus 11.8% growth in February. In March, Internet sales were down 1.5% at food retailers. The last time the ONS reported a decline in food retailers’ online sales was May 2011.

- French retailer Groupe Casino has strengthened its partnership with Amazon by allowing the US tech giant to install Amazon lockers, where customers can pick up online orders rather than having them shipped, in 1,000 Groupe Casino locations across France by the end of the year.

- The partnership will boost Groupe Casino’s omnichannel strategy as Amazon and Monoprix will extend their Prime Now grocery delivery service partnership outside Paris and to additional cities over the next year. In addition, more Casino-branded products will be offered on Amazon.

- German e-commerce company Zalando has introduced a new campaign, called “Unleash your Beauty,” to mark the launch of its beauty range in Belgium, Denmark, France, Italy and Sweden. The new range includes over 6,500 skincare and makeup products from international brands.

- Zalando said it hopes to help shoppers buy a “total look” in one go by offering apparel, footwear, accessories and beauty products on its site. Zalando will also target male customers, and has included over 200 international and niche brands for men in the new range.

- UK-based online furniture retailer and homeware Made.com has launched a new innovation lab, called Made Labs, at its headquarters in London’s Shoreditch area.

- The new Made Labs team will work with innovative start-ups to create tools that can help shoppers better select the right product.

- Sergio Bucher has resigned as CEO of UK department store Debenhams following its collapse into administration last week. Chairman Terry Duddy will act as interim CEO until a replacement is found.

- Debenhams said in a statement that Bucher’s resignation would allow “new leadership to carry through the restructuring and turnaround of the business.”

- India’s retail giant Reliance Retail is reportedly in talks to buy 259-year-old British toymaker Hamleys, according to sources that spoke to Indian news website MoneyControl.com. Reliance already has a license to sell Hamleys products in India.

- Hamley’s is owned by China’s fashion conglomerate C.banner International. Buying Hamleys, whose flagship store is on London’s Regent Street, would be a substantial boost for Reliance Retail’s global ambitions.

ASIA RETAIL AND TECH HEADLINES

- Amazon.com Inc said it will shut its China online store by July 18. Customers in China will be able to buy only from Amazon’s global store. The exit comes 15 years after Amazon entered the market by purchasing local online store Joyo.com for $75 million and later rebranding to its own banner later.

- Amazon said the company would continue to invest in China through its Amazon Global Store, Global Selling, Kindle e-readers and online content, in addition to Amazon Web Services, the company’s cloud computing unit.

Go-Jek Introduces E-Commerce Feature Go-Mall in Partnership with JD

(April 22) kr-asia.com

Go-Jek Introduces E-Commerce Feature Go-Mall in Partnership with JD

(April 22) kr-asia.com

- Indonesian transport network and logistics startup company Go-Jek has partnered with JD.com’s Indonesian e-commerce website to launch a new feature, called Go-Mall, on the Go-Jek app. The feature allows Go-Jek users to browse and shop for various categories from electronics to groceries through the Go-Jek app.

- Go-Jek users can log in with their JD.id credentials or create an account. This collaboration between Go-Jek and JD.id developed after JD invested $100 million in Go-Jek in a Series E funding round.

- British maternity fashion label Seraphine plans to open its first store in India at Select CityWalk Mall in New Delhi by the end of April 2019. Seraphine India will be led by Rajat Kapoor, the master franchisee and India head.

- Seraphine also plans to launch an online store shortly after the physical store launch to reach expectant mothers across India.

- Canadian outdoor lifestyle brand Roots Canada has opened its first Hong Kong store in collaboration with its Hong Kong-based retail partner Fung Retailing’s Branded Lifestyle. It also launched an online store with e-commerce retailer Zalora.

- Roots Canada says it brings together “cabin comforts and city conveniences.” The brand’s collection is curated into four main areas in the store, each telling a different story of the brand’s history and products.

- Hong Kong technology innovation platform Mills Fabrica has launched its first retail store, Techstyle X, which merges technology and style to create a new retail experience.

- Companies can rent display space in the store to launch products, test the market and share innovations. Shoppers will get a chance to use self-serve 3D scanning stations to get a digital model of themselves with key measurements, which they can then use to customize clothing from personalized suits to sustainably-sourced denim jeans.

- Alibaba’s third-party mobile and online payment platform Alipay has launched a new version of its POS facial recognition payment tool called Dragonfly 2. Alipay plans to spend ¥3 billion ($448 million) to promote Dragonfly 2 across China.

- Dragonfly 2 is two inches smaller, at eight inches, is a third of the thickness and less than half the weight of its predecessor. The 3D cameras are also more precise and have a wider angle and is priced at ¥1,999 ($298.50), nearly 30% less than the previous version.

LATAM RETAIL & TECH HEADLINES

- Sportmex, which distributes premium international brands in Mexico such as Harmont & Blaine, EA7 Emporio Armani and Scotch & Soda, has set itself a target to open 36 new stores by 2021.

- The company will operate a total of 66 stores in Mexico by 2021, according to its expansion plan. Sportmex also intends to include new international brands to its portfolio.

Cencosud Takes Over Carrefour’s Colombia Operations

(April 22) America-Retail.com

Cencosud Takes Over Carrefour’s Colombia Operations

(April 22) America-Retail.com

- Chile’s multinational retail company Cencosud has reached an agreement to acquire Carrefour’s operations in Colombia for $2.6 billion.

- The deal will expand Cencosud’s presence in Colombia by 92 stores, including 72 hypermarkets, 16 convenience stores and four cash-and-carry stores, plus gas stations.

- Swiss footwear group Bata has announced it will invest $5 million to expand its presence in Colombia, including opening 35 new stores. Bata now has 313 stores in Colombia.

- Bata also plans to introduce two new store concepts this year, one of which will cater to the youth segment while the other will be a casual outdoor concept, according to Justo Fuentes, President of Bata Latin America.

- Swedish clothing retailer H&M has announced it will open three new stores in Colombia this year.

- Of the three new stores, two will be in the El Tesoro and Viva Envigado shopping centers in Medellín, and one in the Plaza Mayor shopping center in the capital city Bogotá.

- US luggage and travel bag manufacturer Tumi Holdings has announced it will open two new stores in Mexico this year, which will increase its store network in the country to ten.

- Of the two new stores planned, both will be in Mexico City, one at the airport the other in the Perisur shopping center.

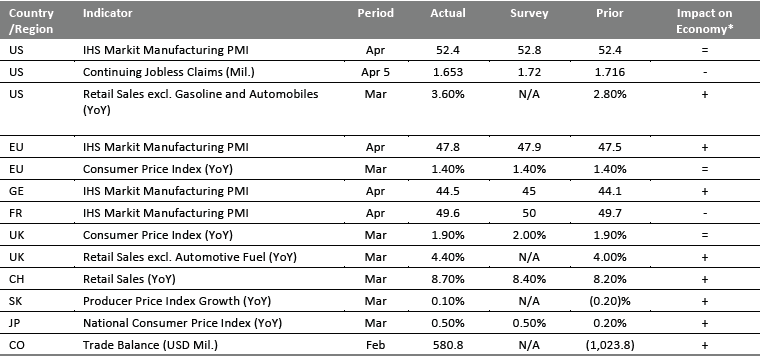

MACRO UPDATE

Key points from global macro indicators released April 17–22, 2019:- US: The IHS Markit manufacturing Purchasing Managers’ Index (PMI) was recorded at 52.4 in April, unchanged from March and below the consensus estimate of 52.8. Continuing jobless claims in the US fell to 1.65 million in the week ended April 5 from 1.71 million in the previous week.

- Europe: The IHS Markit manufacturing PMI increased to 47.8 in April from 47.5 in March and below the consensus estimate of 47.9. In the UK, retail sales excluding automotive fuel grew 4.4% year over year in March, above the 4.0% growth recorded in February.

- Asia-Pacific: China’s retail sales grew 8.7% year over year in March, above the 8.2% growth in February, and below the consensus estimate of 8.4%. The national consumer price index in Japan increased 0.5% year over year in March, above the 0.2% climb in March, and below the consensus estimate of 0.5%.

- Latin America: Colombia recorded a trade surplus of $580.8 million in February, versus the $1.02 billion deficit recorded in January.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: Markit Economics/US Bureau of Labor Statistics/US Census Bureau/Eurostat/GfK/INSEE, France/Office for National Statistics/National Bureau of Statistics of China/Bank of Korea/Ministry of Internal Affairs & Communication, Japan/DANE/Coresight Research[/caption]

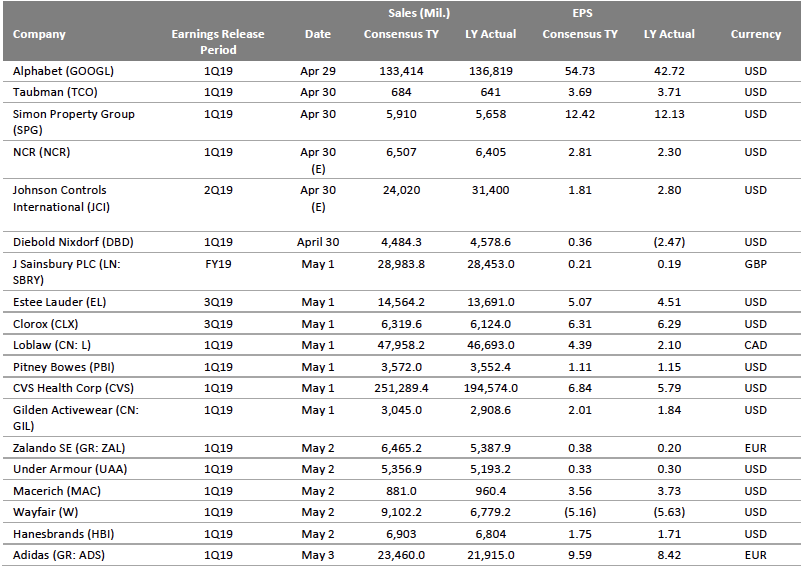

EARNINGS CALENDAR

[caption id="attachment_85415" align="aligncenter" width="804"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

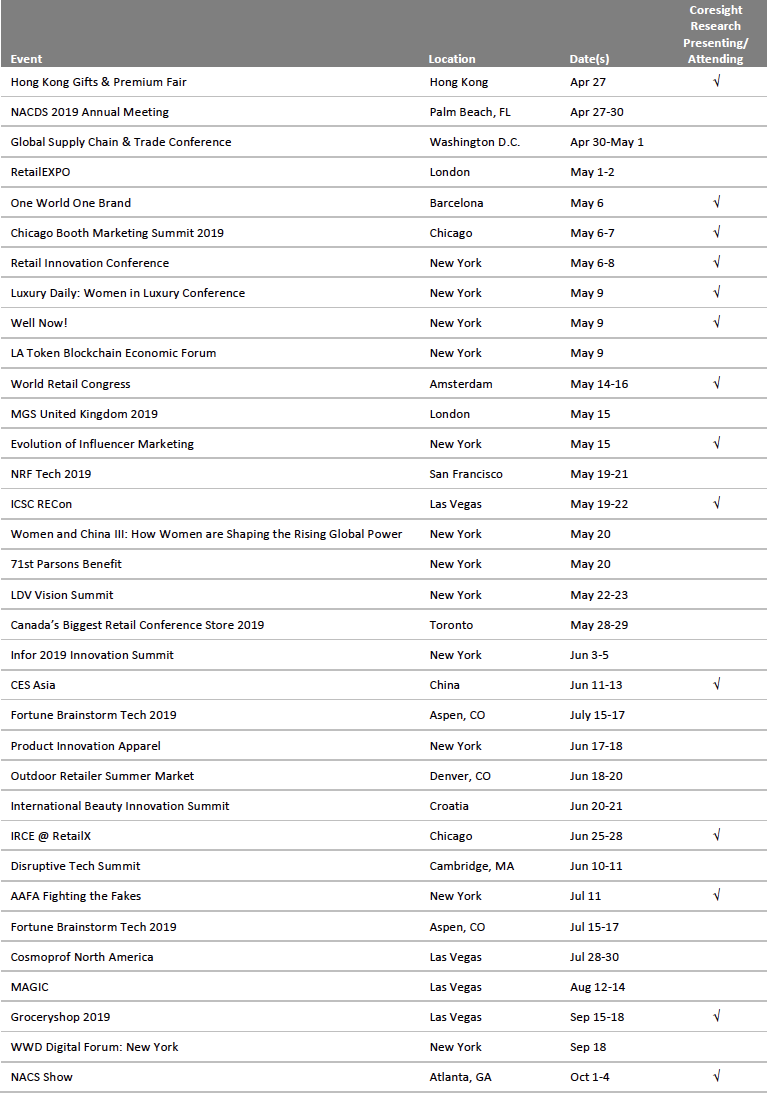

EVENT CALENDAR