From the Desk of Deborah Weinswig

Hearing from JD.com and Alibaba’s Tmall on the Distinctions of Chinese Retail

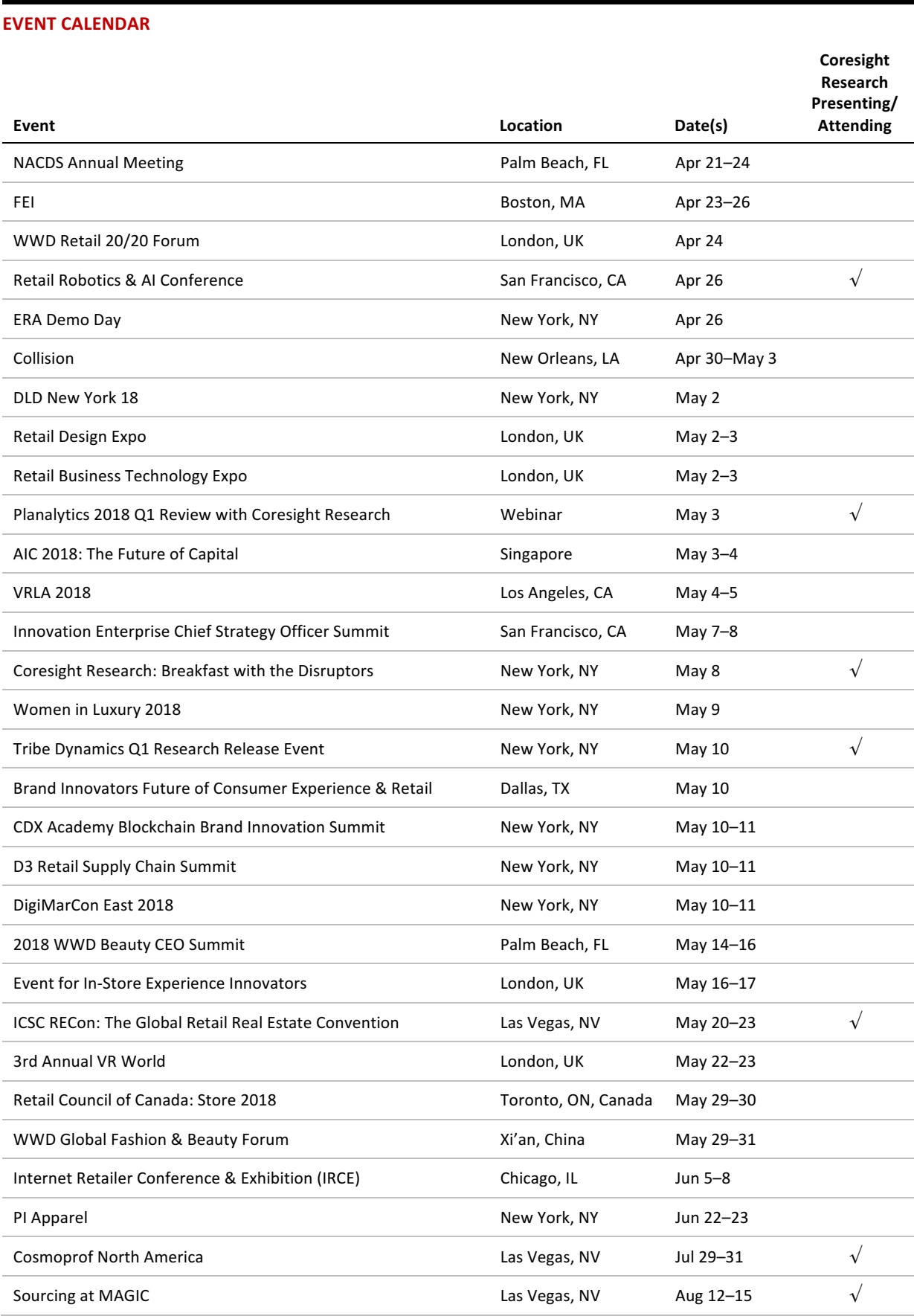

This week, the Coresight Research team was at World Retail Congress 2018 in Madrid. There, we heard senior executives from China’s two e-commerce giants—JD.com and Alibaba—speak about what makes Chinese retail unique and what the future of retail could hold.

Richard Liu, Founder, Chairman and CEO of JD.com, talked through some of the factors that make Chinese retail distinct and offered his views on the future of retail. He said that European retail tends to change more slowly than Chinese retail does, and he pointed to a lack of loyalty among Chinese consumers as one of the reasons for this. He noted that shoppers in China are more likely to try out a new store when it opens than shoppers in Western markets are. Liu also said that Chinese consumers have shifted from looking for low-price products to opting for premium brands.

Looking ahead, Liu pointed to the brick-and-mortar formats that JD.com is rolling out, including a new fresh-food supermarket format. Liu noted that the first two stores were “not in the best locations,” as international retailers such as Walmart and Carrefour had already captured those locations, but he said that the supermarkets’ positioning as a “lifestyle” format will encourage younger shoppers to drive to them. JD.com also plans to put convenience stores in thousands of Chinese villages. The company’s ambitions are staggering: last year, Liu stated that JD.com aimed to open 1 million convenience stores over five years. Earlier this week, he said that the company aims to open 1,000 such stores every day by the end of this year.

In spite of this push into “old” retail formats, Liu predicted that, in the future, the retail industry will be operated by artificial intelligence and robots, rather than by humans. He could not predict when this change will come, saying only that it will be “sooner or later.”

We also heard from an executive at JD.com’s biggest rival, Alibaba. Jet Jing, President of Alibaba’s Tmall marketplace, highlighted the appeal of Tmall and its sister site, Tmall Global, for those Western brands and retailers that are seeking to capture a share of the high-growth Chinese market. Jing said that Tmall is the “gateway to China” and that Western retailers don’t have to put up with just surviving with Amazon, because they can thrive with Tmall. Some 18,000 international brands have sold on Tmall in the past few years, and they are reaping the rewards of China’s continued strong spending growth. Jing pointed out that there has been a major switch from a “made in China” market to a “consumer in China” market, and that firms selling on sites such as Tmall are benefiting from a 40-year opening up of the Chinese market.

However, brands and retailers need to cater to Chinese consumers’ taste for product newness and innovation, Jing said. He suggested that brands need to undertake rapid product innovation and predicted that those that do not innovate in China will die. Happily, Tmall can help these brands innovate, according to Jing. He noted that consumer packaged goods giant Procter & Gamble used big data analytics to identify consumer trends in China and then rapidly tested dozens of new products by listing them on Tmall. The company saw a sharp reduction in the time needed to develop products and enjoyed a significant boost to its Chinese sales from the test products.

Jing commented that it has never been so easy to run a business in China. At the same time, his comments on innovation are a reminder that, in categories such as consumer packaged goods, selling successfully on marketplaces such as Tmall requires greater commitment than simply listing products.

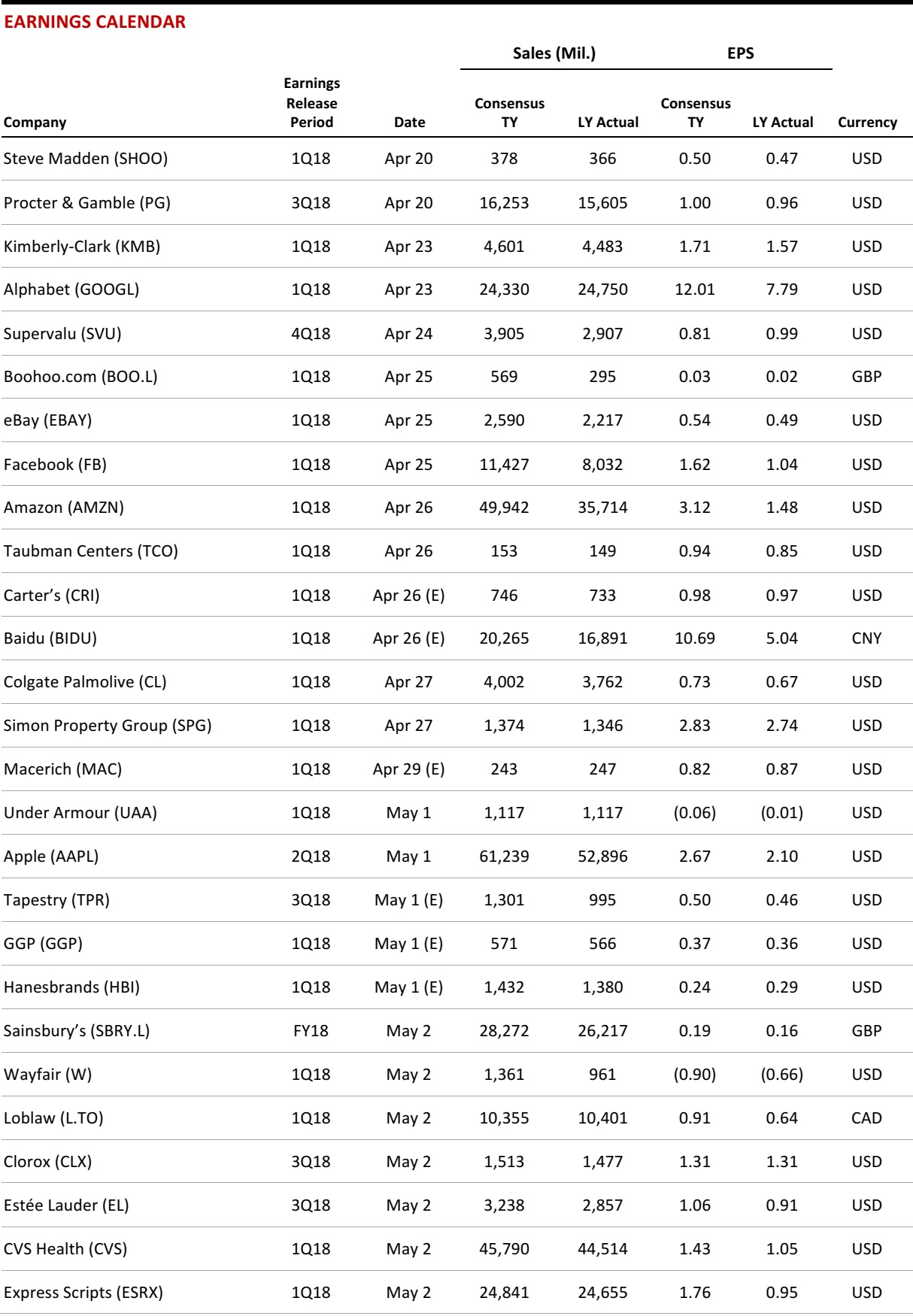

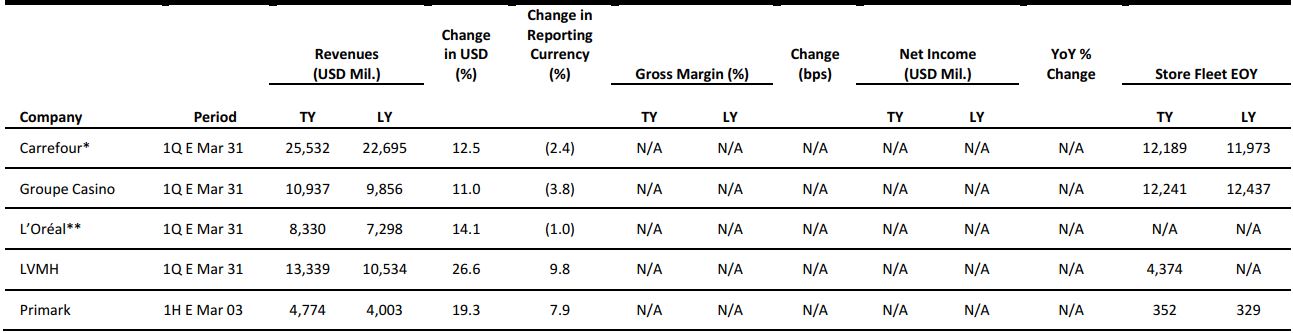

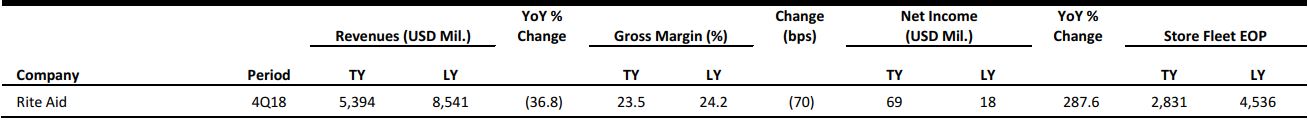

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Amazon Simplifies International Purchases of US Goods

(April 17) RetailTouchPoints.com

Amazon Simplifies International Purchases of US Goods

(April 17) RetailTouchPoints.com

- Amazon has launched its International Shopping platform on the Amazon Shopping app, allowing shoppers in more than 100 countries to browse more than 45 million items from the US.

- The app is currently available in five languages—Spanish, English, Simplified Chinese, Brazilian Portuguese and German—as well as in 25 currencies. More options will be added throughout 2018. The app displays pricing, shipping and import duty estimates to help shoppers understand the full cost of their purchase.

Walmart to Roll Out Redesigned Website Next Month

(April 17) CNBC.com

Walmart to Roll Out Redesigned Website Next Month

(April 17) CNBC.com

- Walmart is close to unveiling an entirely redesigned website as it battles Amazon.com for shoppers’ dollars online. The company said Tuesday that a new Walmart.com site will be rolled out to customers as soon as next month.

- The new design will be much more personalized, starting on the homepage. Shoppers will soon see top-selling items based on their locations. They will also see a profile of their local store, telling them if that store has online grocery or easy reorder, for example.

The Retail Real Estate Glut Is Getting Worse

(April 17) Bloomberg.com

The Retail Real Estate Glut Is Getting Worse

(April 17) Bloomberg.com

- The fall of the Toys“R”Us chain, with more than 700 US stores, shows how much retail real estate has changed in just the last decade. When KKR, Bain Capital and Vornado Realty Trust took over the company in 2005, the buyers justified the $7.5 billion price, in part, because of the supposedly valuable properties that came with the deal.

- Even though retailers have been retreating for years, the country still has about 24 square feet of shopping space per person, many times more than any other developed nation, and consumers aren’t spending enough offline to support such a generous amount.

Automobiles Power US Retail Sales in March

(April 16) Reuters.com

Automobiles Power US Retail Sales in March

(April 16) Reuters.com

- US retail sales rebounded in March after three straight monthly declines as households boosted purchases of motor vehicles and other big-ticket items, suggesting that consumer spending was heading into the second quarter with some momentum.

- The US Commerce Department said on Monday that retail sales increased by 0.6% last month after an unrevised 0.1% dip in February. January data were revised to show sales falling 0.2% instead of the previously reported 0.1% drop.

Macy’s Is the No. 1 Online Clothing Retailer in the US, According to a New Study

(April 16) FootwearNews.com

Macy’s Is the No. 1 Online Clothing Retailer in the US, According to a New Study

(April 16) FootwearNews.com

- Amazon might have the upper hand in general merchandise, but it looks like Macy’s has beat out the e-tail giant to become the top online clothing retailer in the country, according to a study by digital marketing research firm SimilarWeb. Analyzing digital brands’ performances on desktop and mobile in its quarterly index report, the firm found that Macy’s earned the top spot among apparel shopping websites, garnering 24% of the traffic to the top 10 sites in the apparel category.

- Other notable retailers that made SimilarWeb’s list include Nordstrom and Gap—each of which moved up one spot, to third and fifth, respectively—while Zulily dropped two spots from its post at fourth. JCPenney peaked at No. 2 with 12.5% of traffic share, and Nike found its way to No. 4 at a competitive 10.9%.

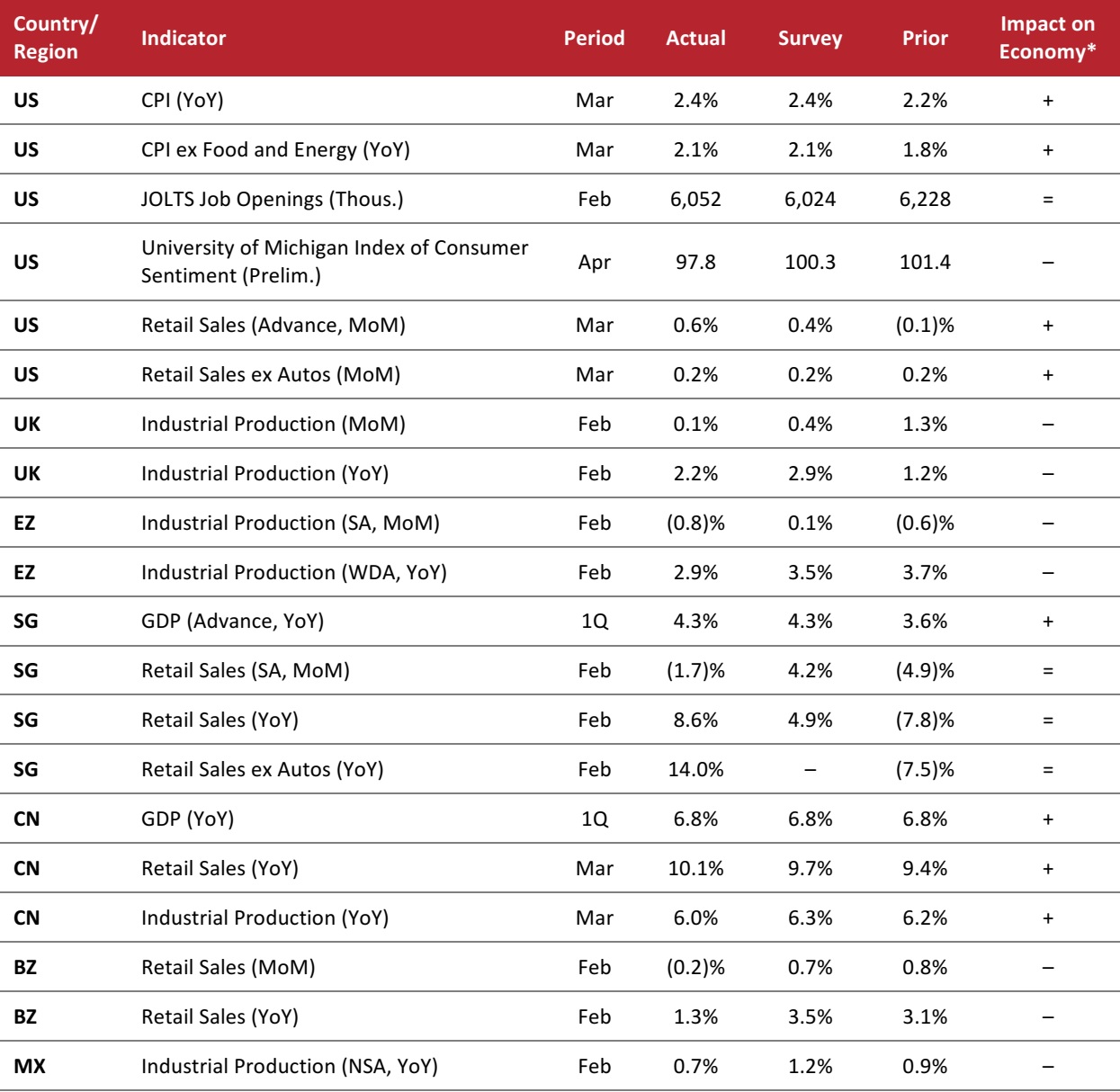

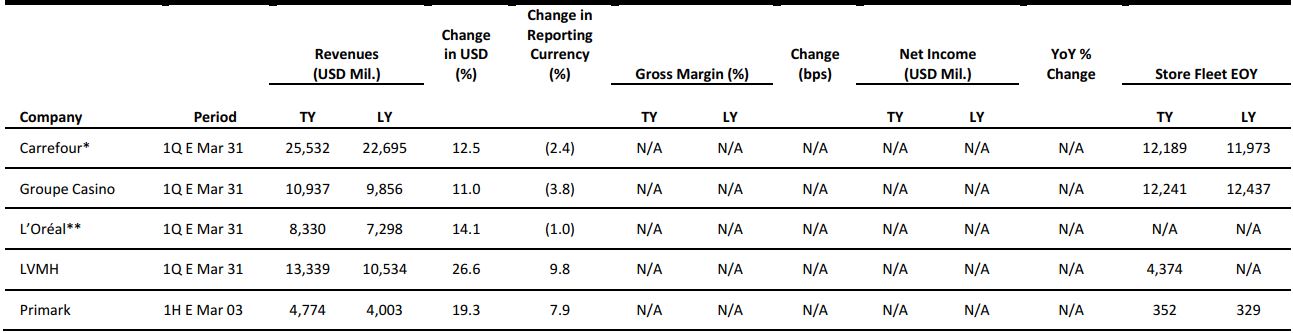

EUROPE RETAIL EARNINGS

*Revenues include VAT.

**LY’s revenue excludes The Body Shop, which L’Oréal sold in September 2017.

Source: Company reports/Coresight Research

*Revenues include VAT.

**LY’s revenue excludes The Body Shop, which L’Oréal sold in September 2017.

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

JD Sports Revenue, Profits Soar in Year of “Significant Progress”

(April 17) Company press release

JD Sports Revenue, Profits Soar in Year of “Significant Progress”

(April 17) Company press release

- UK firm JD Sports Fashion recorded a 33% surge in revenue, to £3.2 billion ($4.6 billion), in the fiscal year ended February 3, 2018. The company’s operating profit increased by 25% and its profit before tax jumped 24%, driven by expansion of its store network.

- Group comparable sales, including online sales, grew by 7%. The company remarked that in-store sales growth was complemented by online sales growth, which was in excess of 30%. During the year, JD Sports opened 56 new stores across Europe and nine stores in the Asia-Pacific region, including its first stores in Australia and South Korea.

Quiz Trials Men’s Clothing Line

(April 17) TheRetailBulletin.com

Quiz Trials Men’s Clothing Line

(April 17) TheRetailBulletin.com

- British fashion chain Quiz is set to launch a menswear line called Quizman. It will trial its first men’s capsule collection online on Quizman.com.

- The transitional day-to-evening collection includes shirts, blazers, denim, trousers and smart outfits with prices starting at £14.99 ($21.45). To support the launch, the retailer has unveiled dedicated social media channels where shoppers can get style inspiration and receive updates on the latest looks.

Spar Austria Launches Startup Initiative to Encourage Product Innovation

(April 16) ESMMagazine.com

Spar Austria Launches Startup Initiative to Encourage Product Innovation

(April 16) ESMMagazine.com

- Supermarket group Spar Austria has announced a startup program called Young & Urban by Spar to encourage innovation by young entrepreneurs. The initiative aims to expand Spar’s existing range of products in the food, household and leisure categories.

- Startups can submit their product ideas for review and selection by Spar on its website. The company will work with successful startups to further develop these products and sell them in its 1,500 Spar, Interspar and Eurospar stores across Austria.

Net-A-Porter Founder Launches Retail Investment Fund

(April 17) RetailGazette.co.uk

Net-A-Porter Founder Launches Retail Investment Fund

(April 17) RetailGazette.co.uk

- Natalie Massenet, the founder of luxury e-commerce site Net-A-Porter, has partnered with venture capitalist Nick Brown to form Imaginary Ventures, a new retail investment fund aimed at “challenging the retail status quo.” The fund has now closed its first $75 million in funding.

- The fund aims to invest in innovative retail brands and startups that are using new technologies. It has already invested in several brands, including Appear Here, Dirty Lemon, Everlane, Farfetch and Glossier.

H&M’s Monki Lets Influencers Earn Money

(April 16) RetailDetail.eu

H&M’s Monki Lets Influencers Earn Money

(April 16) RetailDetail.eu

- Monki, a subsidiary of Swedish fashion group H&M, is set to launch a program in collaboration with influencers—social media users who have established credibility with a large number of followers.

- Social media influencers who post Monki advertisements on their channels will be rewarded for promoting the brand. If the ads lead to their followers buying the promoted product, the influencers will be given a percentage of the sales.

ASIA RETAIL & TECH HEADLINES

US Early-Stage Investment Share Shrinks as China Surges

(April 17) TechCrunch.com

US Early-Stage Investment Share Shrinks as China Surges

(April 17) TechCrunch.com

- The global early-stage investment pie is getting bigger. Just four years ago, investors were putting less than $10 billion per quarter into early-stage deals (series A and B). In the past two quarters, however, investments have totaled more than twice that figure, and the first quarter of 2018 looks as if it will set a record, with Crunchbase projecting $25 billion in global early-stage investment. But while overall investment is on the rise, the US’s share is dwindling.

- The rise of China’s startup scene, combined with Chinese investors’ penchant for jumbo-sized series A rounds, goes a long way toward explaining the shift. Venture ecosystems in Southeast Asia, Brazil and elsewhere have also been in growth mode and, thus, have been accounting for a larger share of global early-stage investment.

Sinovation Nabs $50 Million from BBVA for Its $500 Million AI Fund

(April 17) TechCrunch.com

Sinovation Nabs $50 Million from BBVA for Its $500 Million AI Fund

(April 17) TechCrunch.com

- Sinovation Ventures, a Chinese venture capital firm cofounded by the former head of Google China, Kai-Fu Lee, has raised a new, $500 million fund to invest in artificial intelligence (AI) startups in the region. The first tranche of investment has been announced as $50 million from Spanish bank BBVA, but a statement from BBVA makes it sound like the larger, $500 million total has already been committed.

- Sinovation has about $1.7 billion under management. Its two most recent funds totaled $675 million. Crunchbase notes that Sinovation has made 164 investments to date and that investments have focused on Chinese startups such as bike-sharing company Mobike and education app Vipkid. Sinovation has also invested in startups that are tied to the Chinese tech ecosystem, such as California-based Wonder Workshop, which makes robots that help kids learn to code and counts other Chinese and Asian investors among its backers.

Alibaba Confirms Self-Driving Car Tests, Joining Baidu and Tencent in China’s Autonomous Car Race

(April 16) SCMP.com

Alibaba Confirms Self-Driving Car Tests, Joining Baidu and Tencent in China’s Autonomous Car Race

(April 16) SCMP.com

- Alibaba is now running road tests of autonomous cars on a regular basis, and it has the capabilities for open road trials. The company is also looking to hire 50 more self-driving vehicle specialists for its AI research lab, an Alibaba spokeswoman said, confirming an earlier report by Caixin. Its goal is to achieve Level 4 autonomous capability, which refers to cars that can self-drive in most conditions without human intervention.

- “Our vision is to build an intelligently connected world through transformative [Internet of Things] technologies,” Simon Hu Xiaoming, President of Alibaba Cloud, said on the sidelines of a cloud-computing conference last month, adding that the company’s plan is to build a network of 10 billion connected devices within the next five years.

A Tencent-Backed Fashion App Is Seeking a $4 Billion US IPO

(April 16) Bloomberg.com

A Tencent-Backed Fashion App Is Seeking a $4 Billion US IPO

(April 16) Bloomberg.com

- Meilishuo, an online fashion retailer backed by Tencent, is in talks with several investment banks about a US IPO that could value the startup at about $4 billion. Meilishuo, which merged with rival Mogujie in 2016 to form a company with $3 billion in sales, was said to have been valued at $3 billion at the time of that deal. The company, whose name means “beauty talk,” is a popular fashion and cosmetics online retailer.

- “Tencent wants to develop e-commerce via its partners, so Meilishuo could get a lot of resources and help,” said Li Yujie, an analyst with RHB Research Institute in Hong Kong. “It still depends on how the overall market performs, but e-commerce sector-wise, it would be a good year to fetch a good valuation.”

LATAM RETAIL & TECH HEADLINES

Brazil Demands Rules on Data Flows from WTO

(April 16) ZDNet.com

Brazil Demands Rules on Data Flows from WTO

(April 16) ZDNet.com

- Brazil is pushing for the establishment of rules covering Internet data flows. Last week, Brazil presented a document on the subject to the World Trade Organization (WTO) to stress the urgency of starting a more objective debate. This is a follow-up to discussions about e-commerce rules at the latest WTO ministerial conference, which was held in Argentina in December. There, online data governance was one of the most sensitive topics discussed.

- The debate includes the situations and conditions under which regulators can restrict data flows, and regards not only user privacy, but also cybersecurity and the spread of false information online. Brazil is also pushing for rules detailing online platforms’ responsibility regarding the data they handle and for the WTO to define who owns information generated across jurisdictions.

Santander Brazil Launches Blockchain-Based International Wire Transfer Service

(April 13) ZDNet.com

Santander Brazil Launches Blockchain-Based International Wire Transfer Service

(April 13) ZDNet.com

- Santander has launched the first blockchain-based service for consumers in Brazil. Dubbed Santander One Pay FX, the service aims to significantly reduce the time it takes to complete international transfers. Currently, international wires take two days, on average, but the Santander product aims to deliver transfers within two hours. Depending on the receiving bank, transfers can even be made instantly.

- To build the service, Santander used xCurrent, the enterprise software system used by California-based fintech Ripple to instantly settle cross-border payments with end-to-end tracking. The service was already available in Spain, the UK and Poland, and it should be extended to other countries in the next few months. In this initial phase, customers will not pay tariffs to use the service.

Uber Executive Plays Down Deal Prospects in Brazil, Citing Scale

(April 17) Reuters.com

Uber Executive Plays Down Deal Prospects in Brazil, Citing Scale

(April 17) Reuters.com

- Uber’s robust growth in Brazil, its biggest market outside the US, has given it a far stronger position in Brazil than it had in Asian markets that it recently exited, a senior executive said on a visit to South America. Andrew Macdonald, who runs Uber’s operations in Latin America, played down the prospects of a merger with Brazilian rival 99, a subsidiary of Didi Chuxing, which absorbed Uber’s Chinese operations in late 2016.

- Macdonald also runs Uber’s operations in the Asia-Pacific region, where the company agreed to sell its Southeast Asian business to larger rival Grab last month. “I think the scale [of operations in Brazil] is at a level that is different from those other markets…both on an absolute and relative basis,” Macdonald said, when asked if there could be a merger or acquisition in Brazil next.

Marcolin and Moendi Announce Joint Venture Agreement in Mexico

(April 13) AOP.org.uk

Marcolin and Moendi Announce Joint Venture Agreement in Mexico

(April 13) AOP.org.uk

- Marcolin Group has signed a joint venture agreement with Mexico’s largest independent eyewear distributor, Moendi Group. Moendi has over 25 years’ experience in the wholesale and retail distribution of luxury sunglasses and eyeglasses in the 32 states of Mexico. The joint venture, named Marcolin Mexico, is 51% owned by Marcolin. Its headquarters will be in Naucalpan, in the State of Mexico.

- Under the partnership, the company will distribute the eyewear collections of some of the designer brands that are part of the Marcolin portfolio. Marcolin CEO Massimo Renon said, “We are proud to establish this joint venture with the Goldwasser family. Their long-lasting experience in wholesale and retail eyewear distribution across Mexico will allow Marcolin Group to further grow and strengthen its presence in that area.”

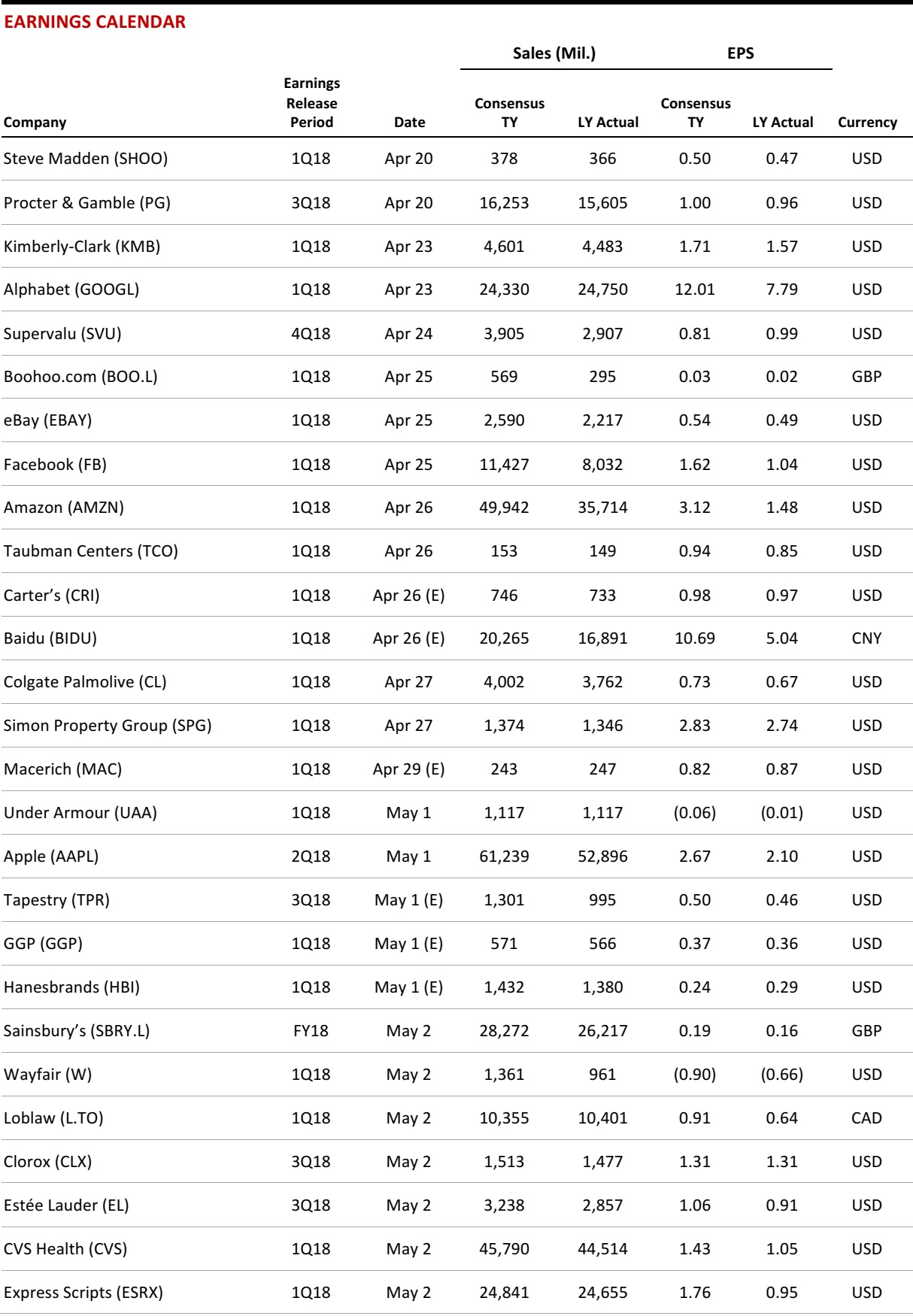

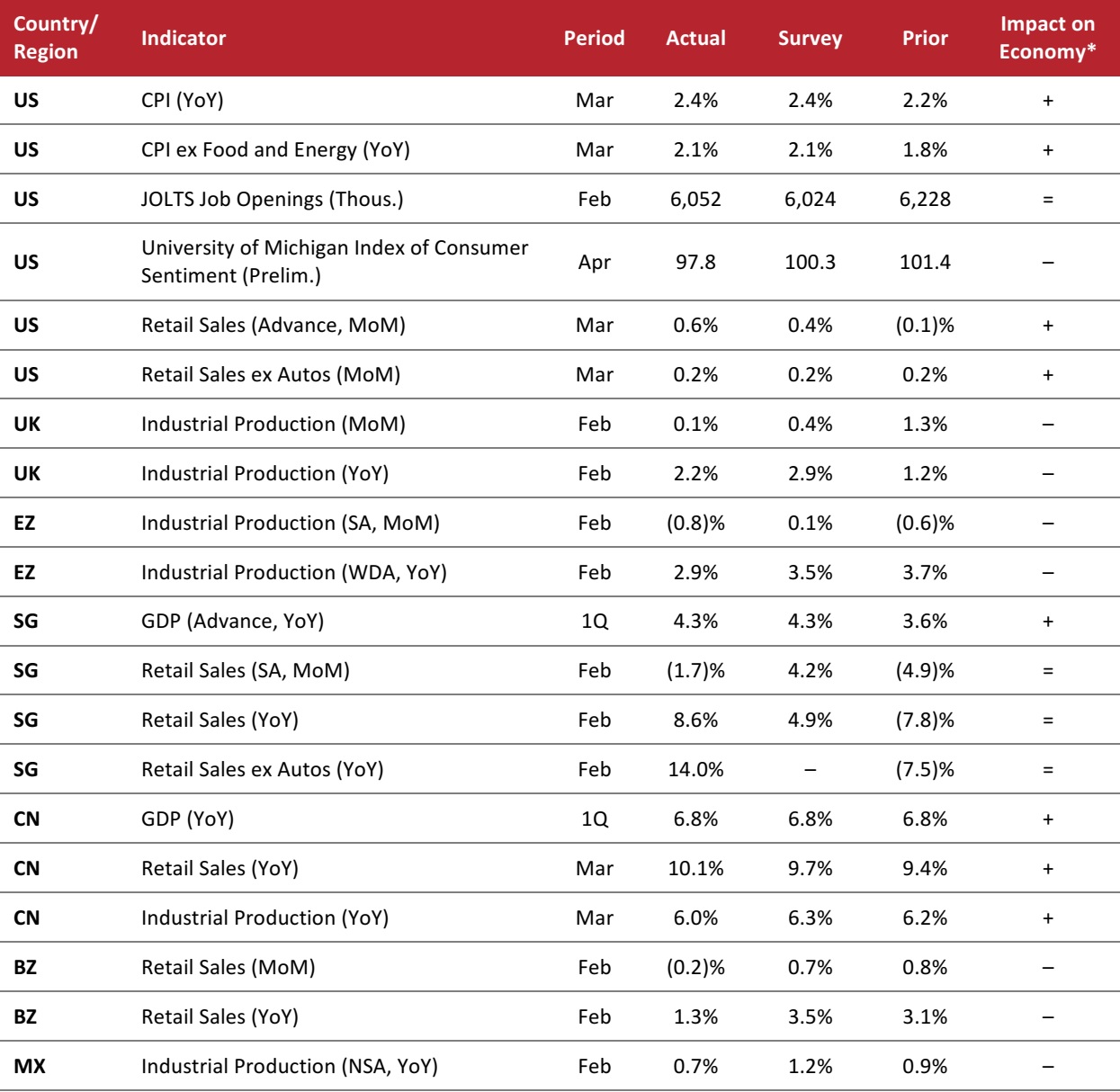

MACRO UPDATE

Key points from global macro indicators released April 11–18, 2018:

- US: The Consumer Price Index (CPI) increased by 2.4% year over year in March, in line with the consensus estimate. The number of JOLTS job openings dropped to 6,052,000 in February. Consumer sentiment weakened in April. Retail sales increased by 0.6% month over month in March.

- Europe: In the UK, industrial production increased by 2.2% year over year in February, versus the consensus estimate of 2.9%. In the eurozone, industrial production increased by 2.9% year over year in February.

- Asia-Pacific: In Singapore, GDP increased by 4.3% year over year in the first quarter. Retail sales in Singapore increased by 8.6% year over year in February. In China, GDP increased by 6.8% year over year in the first quarter. Retail sales in China increased by 10.1% year over year in March.

Latin America: In Brazil, retail sales increased by 1.3% year over year in February, missing the consensus estimate of a 3.5% increase. In Mexico, industrial production increased by less than analysts had expected in February, rising by 0.7% year over year.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/University of Michigan/US Census Bureau/UK Office for National Statistics/Eurostat/Singapore Department of Statistics/Singapore Ministry of Trade and Industry/National Bureau of Statistics of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/University of Michigan/US Census Bureau/UK Office for National Statistics/Eurostat/Singapore Department of Statistics/Singapore Ministry of Trade and Industry/National Bureau of Statistics of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

Amazon Simplifies International Purchases of US Goods

(April 17) RetailTouchPoints.com

Amazon Simplifies International Purchases of US Goods

(April 17) RetailTouchPoints.com

Walmart to Roll Out Redesigned Website Next Month

(April 17) CNBC.com

Walmart to Roll Out Redesigned Website Next Month

(April 17) CNBC.com

Automobiles Power US Retail Sales in March

(April 16) Reuters.com

Automobiles Power US Retail Sales in March

(April 16) Reuters.com

*Revenues include VAT.

**LY’s revenue excludes The Body Shop, which L’Oréal sold in September 2017.

Source: Company reports/Coresight Research

*Revenues include VAT.

**LY’s revenue excludes The Body Shop, which L’Oréal sold in September 2017.

Source: Company reports/Coresight Research JD Sports Revenue, Profits Soar in Year of “Significant Progress”

(April 17) Company press release

JD Sports Revenue, Profits Soar in Year of “Significant Progress”

(April 17) Company press release

Spar Austria Launches Startup Initiative to Encourage Product Innovation

(April 16) ESMMagazine.com

Spar Austria Launches Startup Initiative to Encourage Product Innovation

(April 16) ESMMagazine.com

Net-A-Porter Founder Launches Retail Investment Fund

(April 17) RetailGazette.co.uk

Net-A-Porter Founder Launches Retail Investment Fund

(April 17) RetailGazette.co.uk

H&M’s Monki Lets Influencers Earn Money

(April 16) RetailDetail.eu

H&M’s Monki Lets Influencers Earn Money

(April 16) RetailDetail.eu

US Early-Stage Investment Share Shrinks as China Surges

(April 17) TechCrunch.com

US Early-Stage Investment Share Shrinks as China Surges

(April 17) TechCrunch.com

Sinovation Nabs $50 Million from BBVA for Its $500 Million AI Fund

(April 17) TechCrunch.com

Sinovation Nabs $50 Million from BBVA for Its $500 Million AI Fund

(April 17) TechCrunch.com

Alibaba Confirms Self-Driving Car Tests, Joining Baidu and Tencent in China’s Autonomous Car Race

(April 16) SCMP.com

Alibaba Confirms Self-Driving Car Tests, Joining Baidu and Tencent in China’s Autonomous Car Race

(April 16) SCMP.com

A Tencent-Backed Fashion App Is Seeking a $4 Billion US IPO

(April 16) Bloomberg.com

A Tencent-Backed Fashion App Is Seeking a $4 Billion US IPO

(April 16) Bloomberg.com

Uber Executive Plays Down Deal Prospects in Brazil, Citing Scale

(April 17) Reuters.com

Uber Executive Plays Down Deal Prospects in Brazil, Citing Scale

(April 17) Reuters.com

Marcolin and Moendi Announce Joint Venture Agreement in Mexico

(April 13) AOP.org.uk

Marcolin and Moendi Announce Joint Venture Agreement in Mexico

(April 13) AOP.org.uk

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/University of Michigan/US Census Bureau/UK Office for National Statistics/Eurostat/Singapore Department of Statistics/Singapore Ministry of Trade and Industry/National Bureau of Statistics of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/University of Michigan/US Census Bureau/UK Office for National Statistics/Eurostat/Singapore Department of Statistics/Singapore Ministry of Trade and Industry/National Bureau of Statistics of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research