albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

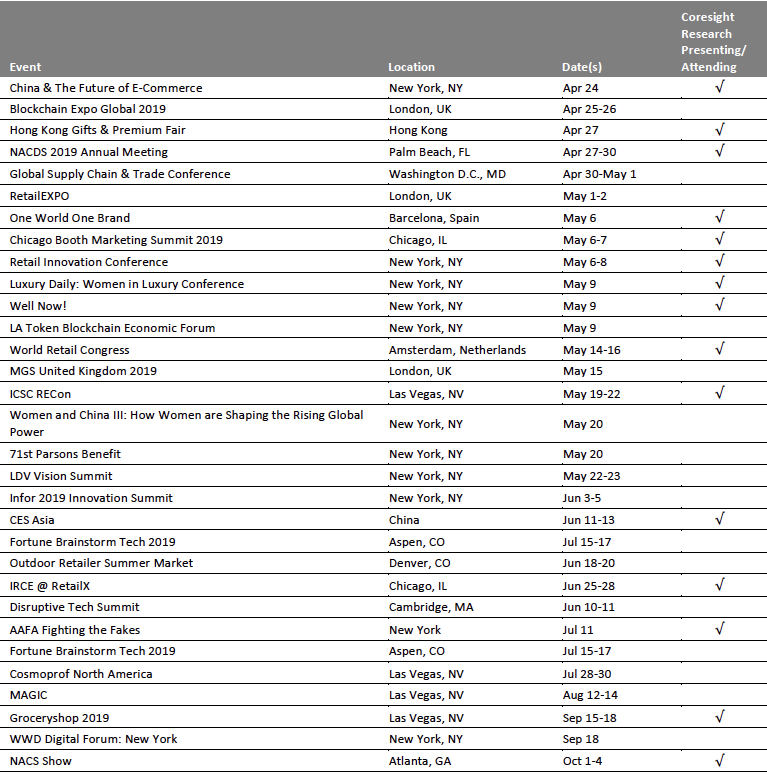

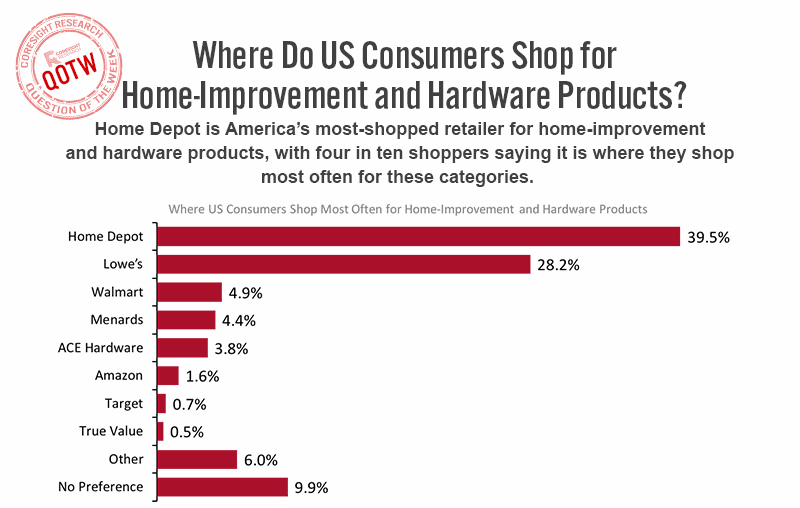

Why Millennials Can No Longer Be Treated as a Single Generation This week, we published our latest report on millennials and grocery. At the heart of our analysis was the observation that, when measured by behaviors and attitudes, millennials can no longer be treated as a single generation. The millennial age group spans 20 years, with the oldest members turning 39 years old in 2019 while its youngest members are still not even 20. This generation is no longer a demographic group united by a youthful nature, meaning the gap between the oldest and youngest millennials — in attitudes and behavior — is wider than ever. Coresight Research data shows the differences when it comes to grocery retail: Younger millennials are the peak age group for buying groceries at mass merchandisers: More than any other age group, they are spending more on wellbeing and fitness. Younger millennials are also more conscious shoppers: They have the highest rates of buying from retailers with good environmental records. Meanwhile, these sub-30 millennials show slightly-below-average rates of shopping for groceries online. Older millennials aged 30 and above are more likely than their younger peers to look for savings such as by clipping coupons and are the peak age group for shopping at traditional supermarkets such as Kroger and Albertsons. They are also the age group showing the greatest propensity to buying groceries online, reflecting a combination of time pressure, rising income, relatively settled professional and family lives, and familiarity with digital channels (we will soon be publishing our 2019 online grocery consumer survey report which will provide further data and analysis on those shopping online). [caption id="attachment_84256" align="aligncenter" width="782"] *Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug

*Incl. Harris Teeter, Fred Meyer and Smith’s Food & DrugBase: 1,813 US Internet users aged 18+ who have bought groceries in store in the past 12 months, surveyed in March 2018

Source: Coresight Research[/caption] Millennials remain a highly attractive cohort for retailers: They comprise around 22% of the US population according to the US Census Bureau and make up around 35% of the workforce according to the Pew Research Center. And their incomes are rising as they enter their peak earning years — even if they are not the highest-earning age group (which is the 45–54 age group, according to the Bureau of Labor Statistics). Retailers will therefore continue to pursue these valuable consumers. But, more than ever, marketers must take a nuanced approach that reflects the diversity represented by the age gap — and that does not include all the other non-age diversity factors, such as social background, ethnicity or income. The divergence in lifestyles and behaviors will be manifested across retail, from the size of shoppers’ grocery baskets to their tastes in fashion, and retailers should be ready to cater to their increasingly varied demands.

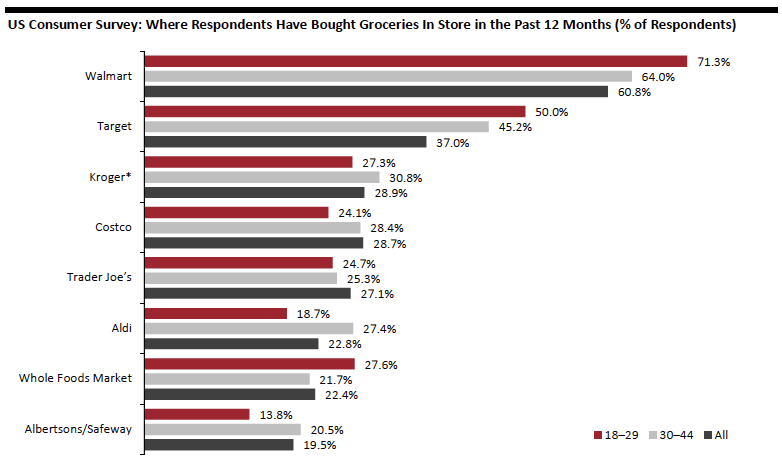

QUESTION OF THE WEEK

[caption id="attachment_84258" align="aligncenter" width="800"] Respondents could select one option only.

Respondents could select one option only.Base: 7,388 US consumers ages 18+, surveyed in March 2019

Source: Prosper Insights & Analytics[/caption]

US RETAIL & TECH HEADLINES

- Retailing giant Walmart announced a partnership with KIDBOX to offer Walmart.com customers an exclusive, curated stylebox for kids.

- Walmart said customers also have the option to receive curated clothing each season without having to pay a styling fee. Customers get access to personalized styles from more than 120 premium kids brands. The stylebox will include four to five fashion items for $48.

- Popular US retailer Ulta Beauty has been expanding quickly in the US, and appears to be ready to move north. The Globe and Mail reports that Ulta Beauty has retained Sam Winberg of Retail CND to find space for the retailer’s first Canada locations.

- Ulta Beauty has been described a one-stop shop for mass and prestige beauty, skincare, and hair care products.

- J.Crew Group said it is “actively exploring strategic alternatives” for itself, including a possible initial public offering for its Madewell brand of women’s clothing and accessories.

- The privately held retailer said it has hired legal and financial advisers to weigh in its options, and a Madewell IPO, if pursued, could be completed as early as the second half of 2019.

- Fred's on Thursday announced it has retained PJ Solomon "to evaluate strategic alternatives to maximize value for all shareholders."

- The discount retailer also said that it will shutter underperforming and unprofitable stores and has commenced liquidation sales at 159 stores slated for closure by the end of May, following "a comprehensive evaluation of the company's store portfolio.”

- Amazon.com has acquired warehouse robotics startup Canvas Technology for an unspecified amount. When Amazon acquired Kiva Systems for $775 million in 2012, it took one of the early leaders in mobile robots for logistics off the market.

- As a result, the so-called Amazon effect prompted other startups to develop and offer automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) to retailers and third-party logistics (3PL) companies.

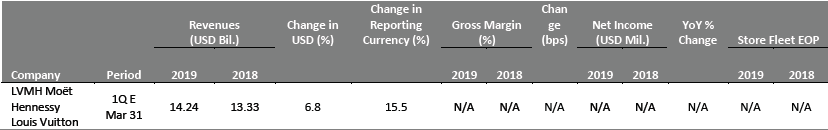

EUROPE RETAIL EARNINGS

[caption id="attachment_84262" align="aligncenter" width="828"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

- Footasylum’s shareholders have approved the sportswear and sneaker retailer’s takeover by British sports fashion retailer JD Sports for £90 million ($118 million). JD Sports first announced the takeover bid in March.

- Over 78 million Footasylum shareholders, representing around 75% of issued share capital, accepted JD Sports’ offer of 82.5p ($1.08) per share.

- Berlin-based e-commerce company Zalando this week said it expects to post positive adjusted EBIT in the single-digit millions in the first quarter, above the consensus estimate, which called for a loss before interest and tax of €10 million ($11.31 million), as of April 15.

- Zalando also said it expects GMV and revenue growth to be consistent with market expectations of 23.0% and 15.2%, respectively, as of April 15, and that these are in line with the company’s full-year outlook. Zalando reports first quarter results on May 2.

- Puma has introduced the world’s first augmented reality (AR) shoes, called LQD Cell Origin Air. The limited-edition shoes are priced at €130 ($146.96) and can be purchased at Puma.com and selected retailers worldwide.

- The sneakers are entirely covered in geometric patterns made of QR codes, which unravel a range of AR experiences when scanned with Puma’s LQD Cell app. Users scanning the codes will see their sneakers catch fire, or explode into a deconstructed virtual model of the shoe, or be thrown into an AR game called “LQDASH.”

- British fashion retailer Topshop has introduced a 100% vegan-friendly shoe range with prices ranging from £42 to £59 ($55 to $77). The 12-piece summer collection includes six separate sandal styles, each presented in two distinctive colors.

- As demand for ethically made apparel and accessories is rising, Topshop has crafted the shoe range as well as its packaging with non-animal materials and non-fish glue. The collection has received approval from animal rights group People for the Ethical Treatment of Animals (PETA).

- Byland UK, the Chinese franchise partner of LK Bennett, has purchased the majority of the assets of the British luxury brand for an undisclosed sum, after it fell into administration in March.

- The deal saves 21 LK Bennett stores, all the group’s concessions and 325 jobs, but LK Bennett will still close 15 of its 36 stores across the UK and Ireland, leading to the loss of 110 jobs.

ASIA RETAIL & TECH HEADLINES

- The US National Basketball Association (NBA) has partnered with Chinese sports retailer Topsports and the NBA’s official on-court apparel provider Nike to open a two-floor, 12,325-square-foot store at Intime Mall in Beijing. This will be the NBA’s largest store outside North America, featuring a design inspired by NBA courts with a hardwood floor.

- The store features a range of products from jerseys and footwear to basketballs and memorabilia with designs that reflect Beijing-specific themes, such as Chinese opera masks and local food.

- Indian e-commerce company Flipkart has deployed 100 robots, which it calls automated guided vehicles (AGVs), at its shipment sorting center in Bengaluru. The robots sort and move packages to designated areas with little human intervention.

- The AGVs can process up to 4,500 shipments per hour compared to 500 per hour when this is done manually. Flipkart has also deployed a “promise engine” to calculate accurate delivery dates and times for products and uses a route optimization network to ensure timely delivery.

- Alibaba is offering its sellers “video fingerprint” technology in a bid to curb piracy on its e-commerce platforms Taobao and Tmall. Short videos are a popular form of advertisement on these platforms, but many sellers use videos created by other sellers without permission.

- The “video fingerprint” technology automatically generates a unique coded identity once a video is uploaded. Alibaba’s algorithm will search more than one million videos each day to find videos using the same footage. If the system finds copied videos, it will report the unauthorized use to the creator of the original.

- Japanese shoe company Onitsuka Tiger has opened its fifth mono-brand store in India, occupying just 1,098 square feet in Ambience Mall, Gurugram (just south of New Delhi), and includes a children’s collection that is a first for Onitsuka Tiger’s India stores.

- The store will also have the brand’s signature collection of shoes, the latest spring/ummer 2019 collection and apparel for men and women.

- Japanese lingerie brand Wacoal plans to expand its business in India and open stores in 30 cities, to reach 70 exclusive stores and 80 shops-in-shops over the next three years. It already operates 12 stores in six major cities and sells through e-commerce platforms such as Myntra, Jabong and Tata Cliq, and its own website.

- The brand will invest INR 1 billion ($14.4 million) over the next three years to boost its presence in India as part of its global growth strategy.

LATAM RETAIL & TECH HEADLINES

- Argentine online travel company Despegar has announced it has entered into an agreement to buy Viajes Falabella, the travel arm of Chile’s department store Falabella. The deal is valued at $27 million and includes Viajes Falabella’s operations across Latin America and a license to use the brand name.

- Despegar has also entered into an agreement with Falabella’s financial products vertical Falabella Financiero under which Falabella Financiero will support Despegar’s payment processing and financing offerings. The deal is slated to last 10 years and cover operations in Chile, Colombia, Peru and Argentina.

Bancolombia Announces Digital Payments Partnership with Vlipco

(April 13) Latamlist.com

Bancolombia Announces Digital Payments Partnership with Vlipco

(April 13) Latamlist.com

- Colombia banking services provider Bancolombia has announced a partnership with fintech startup Vlipco under which Vlipco will support the launch of Bancolombia’s new digital payments platform.

- Vlipco CEO David Peláez said the alliance will be beneficial to the emerging enterprises and to the users that seek to buy financial products in a fast and efficient manner.

- Colombian supermarket chain Carulla has emerged as the most successful retail brand in Colombia, as measured by sales per square meter in 2018, according to a study by marketing consultant Mall & Retail. The per square meter profitability is expected to help retailers develop a set of strategies to increase sales per square meter.

- Carulla’s monthly sales per square meter were $474, followed by retailer Almacenes Éxito at $308 per square meter during the same period.

- Chilean retailer Cencosud has announced it will invest $300 million in 2019, which exceeds the 2018 investment plan capital expenditure by $20 million. The top two investment themes across its businesses are adding new technologies and automating processes, in addition to strengthening online operations.

- The company expects to spend 50% of the total funds on store remodeling and organic growth, 33% on e-commerce capabilities and 17% on maintaining and recurring capex.

- Brazil’s Itaú Unibanco has announced plans to roll out facial biometrics to stop auto loan fraud.

- The system will now require loan applicants to send a photo of themselves after they receive an automated message on their phones.

MACRO UPDATE

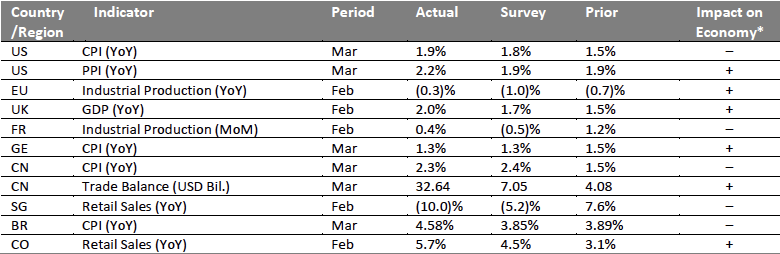

Key points from global macro indicators released April 10–16, 2019: 1) US: The US consumer price index (CPI) rose 1.9% year over year in March, above the 1.8% consensus estimate and the 1.5% rise in February. The US producer price index (PPI) increased 2.2% year over year in March after advancing 1.9% in February, above the consensus estimate of 1.9%. 2) Europe: Eurozone industrial production fell 0.3% year over year in February versus the consensus estimate of a 1.0% decline and against a 0.7% drop recorded in January. In the UK, GDP grew 2.0% year over year in February, up from revised January growth of 1.5% year over year. 3) Asia-Pacific: In China, the CPI rose 2.3% year over year in March, the fastest pace since October 2018, lower than the consensus estimate of a 2.4% increase, but higher than February’s 1.5% rise. In Singapore, retail sales plunged 10.0% year over year in February, reversing sharply from a 7.6% increase in January and worse than the consensus estimate of a 5.2% decline. The decline in retail sales was due to deteriorating consumer sentiment owing to growing uncertainty over slowing GDP growth and the prospects for a US-China trade deal. 4) Latin America: Brazil’s CPI increased 4.58% year over year in March, from 3.89% in February and versus the consensus estimate of 3.85%. Colombia’s retail sales rose 5.7% year over year in February, higher than both the consensus estimate of a 4.5% rise and the revised 3.1% increase reported for January.

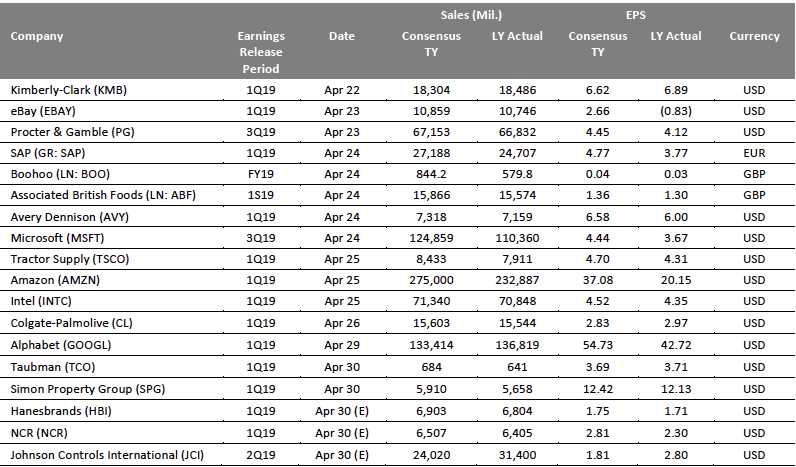

EARNINGS CALENDAR

EVENT CALENDAR