From the Desk of Deborah Weinswig

The Amazon-Walmart Delivery Wars Continue with Lockers, Pickup Towers and In-Home Delivery

Amazon and Walmart continue to one-up each other in delivery and collection, offering new and innovative ways for customers to receive their orders. Amazon customers can retrieve orders from lockers or choose one- or two-hour delivery in many markets. Amazon also has electronic keys to some customers’ door locks and is investigating delivery by drone. Meanwhile, Walmart is building Pickup Towers inside its stores, exploring speedy delivery and testing delivery by employees on their way home from work.

Amazon launched its locker program in September 2011 in New York, Seattle and London. The lockers enable customers who are wary of theft by “porch pirates” to have their packages sent to and stored in public locations that include parking garages and retail stores. 7-Eleven offers Amazon lockers in more than 300 stores, and Spar stores in Germany and US Whole Foods stores (which Amazon acquired in August 2017) also house pickup lockers. Customers are not charged extra to pick up their Amazon order from a locker, and as of the end of 2017, the company had lockers in more than 2,000 locations in more than 50 cities. Delivery personnel place an order in a locker at the customer’s chosen location, and then the customer receives an email with the locker number and a code to unlock the door. Customers can also return packages to selected lockers. In addition, Amazon has been beta testing Hub, a delivery locker for apartment building lobbies that accepts packages from all carriers, since 2017.

Installing lockers in Whole Foods stores in order to drive additional store traffic was a natural next step for Amazon after it acquired the grocery chain, and the move appears to have been successful. Location-based marketing firm InMarket studied 98 Whole Foods stores in major cities to assess how in-store lockers affect store traffic. Of the stores the firm studied, 76 had lockers, representing 16% of Whole Foods’ fleet of 473 stores. The firm found that “micro” visits (i.e., visits of up to five minutes) increased by 11% at stores with lockers during the study period, versus a 7% increase in stores without lockers. These micro visits have accounted for 9% of all grocery store visits so far this year, but for only 6.5% of visits to Whole Foods, implying there is room for improvement.

Following initial testing in Chicago in November 2017, Macy’s is installing lockers as well in order to expedite the pickup of items purchased online. At one New Jersey Macy’s store, the lockers are located adjacent to the Macy’s “At Your Service” counter. To encourage the use of lockers, Macy’s offers customers who use them a 20% discount on their next visit.

Walmart is constructing in-store towers rather than lockers to expedite collection of online orders, in addition to offering drive-through pickup and other expedited delivery options. The company has deployed 200 Pickup Towers in stores across the US, and customer response has been overwhelmingly positive, with shoppers collecting a total of 500,000 orders already. Walmart recently announced plans to add another 500 towers by the end of this year. The company says the towers function like “giant vending machines,” and that customers can scan a barcode or enter a numerical code to retrieve their items. A robotic arm grabs each customer’s items within the tower—even goods as large as TVs—and brings them to the customer. Walmart estimates that following the expansion, Pickup Towers will be available to 40% of the US population.

Amazon and Walmart are also testing various smart-lock technologies that enable delivery agents to enter customers’ homes and leave purchased items inside. Amazon recently announced its Amazon Key service, which uses a combination of a security camera, a smart lock and an app to facilitate the keyless access to customers’ homes by trusted individuals. Amazon Prime members in selected cities and 37 metro areas can elect to receive in-home delivery through the service, which works with eight compatible smart locks from leading manufacturers such as Kwikset and Yale. Customers can enable the app to unlock a door and they can check in at any time via live view in addition to watching clips of who entered and exited their home. In February, Amazon also acquired Ring, which makes smart doorbells, for $1 billion.

Similarly, Walmart is partnering with smart-lock company August and delivery company Deliv to enable delivery personnel to leave purchased groceries in customers’ refrigerators. The program supplements Walmart’s testing of order delivery by employees on their way home from work.

We expect Amazon, Walmart and other retailers to continue to escalate their collection and delivery options in order to offer ever-increasing levels of convenience and service for busy consumers.

US RETAIL & TECH HEADLINES

Nordstrom Opens a New York Store as Other US Retailers Downsize (April 10) AFR.com

(April 10) AFR.com

- The Nordstrom family has run stores for more than a century, first selling shoes in the Pacific Northwest and later introducing fashion-forward clothing to wealthy suburbanites across the US. But the Nordstroms had never made a big bet in the nation’s retailing capital until now.

- This week, the Seattle-based company arrives in New York, opening its first full-line store in Manhattan at an inauspicious time for retailers. Its competitors are selling off or converting some of their grandest stores. But the Nordstroms think they can buck the trend, even as many investors on Wall Street have grown wary of brick-and-mortar retailing.

Retail Defaults Soar to Record High in 2018 (April 10) CNNMoney.com

(April 10) CNNMoney.com

- Moody’s said in a report on Tuesday that retail sector defaults hit a record high during the first three months of 2018 as the rise of e-commerce and decline of malls continues to eat away at profits. Retailers have accounted for one-third of all corporate defaults this year, underscoring the pain this business feels as customers flock to Amazon and other online shopping hubs.

- “Stresses in the retail sector have weighed on the operating earnings of department stores, discount stores and drugstores in particular,” said Moody’s Senior Credit Officer Sharon Ou in the report.

Champion Opens First US Brick-and-Mortar Store in Los Angeles (April 9) RetailDive.com

(April 9) RetailDive.com

- Champion Athleticwear recently opened its first US store, in the La Brea shopping district in Los Angeles. The brand has helped parent company Hanesbrands return to growth. In November, the company reported organic sales growth for the first time in eight quarters.

- The store will feature on-site customization and specialized product assortments, including some products exclusive to the La Brea store that were inspired by its Southern California location or designed through partnerships with local influencers.

Reports of Retail’s Death Are Premature (April 9) Bloomberg.com

(April 9) Bloomberg.com

- For all the talk of the “Death of Retail,” reports of store chains going bust and malls closing, the stock market appears to be telling a more upbeat story. In many cases, the headlines overstate the weakness in the sector, but structural issues in the retail industry aren’t a new phenomenon.

- There is a widely held belief that the rise of e-commerce has led to widespread job losses in the retail industry. However, employment in the trade has been declining as a share of private sector employment since the mid-1980s. At 12.7%, retail’s share is at its lowest point since the 1970s.

Brookstone Launches New Retail Platform (April 10) Company press release

(April 10) Company press release

- Brookstone announced the launch of its Brookstone PLUS Innovation & Retail Platform, which gives makers and tech brands faster access to stores in US malls and accelerates the collection of customer feedback essential to product development.

- The platform also helps makers and brands sell products in A-level malls at low cost structures that are competitive versus selling through online marketplaces.

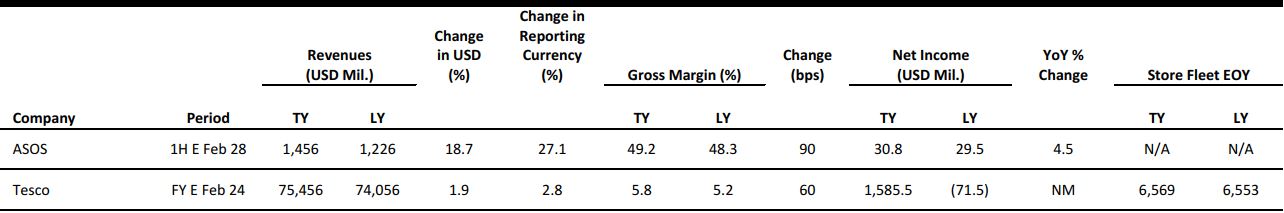

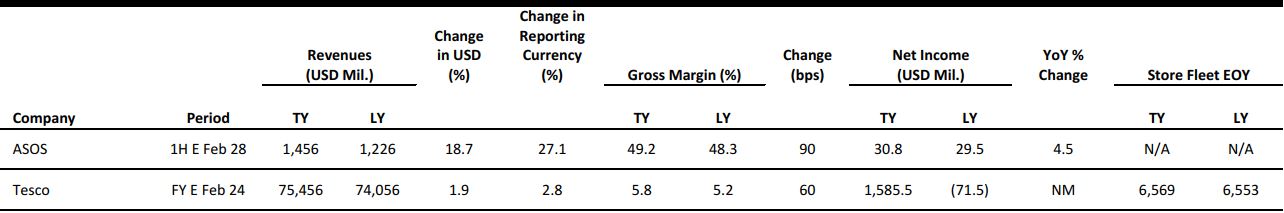

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

UK Retail Sales Growth Supported by Timing of Easter (April 10) BRC press release

(April 10) BRC press release

- UK total retail sales grew by 2.3% in March against a decline of 0.2% in March last year and were positively distorted by the timing of Easter, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales increased by 1.4% year over year versus a decline of 1.0% in March 2017.

- The BRC splits food and nonfood retail sales only on a rolling three-month basis. In the three months ended March, food sales rose by 4.2% on a comparable basis and by 5.3% on a total basis, above the 12-month average of 4.4%. Nonfood retail sales fell by 1.8% on a comparable basis and fell by 1.0% on a total basis, below the 12-month average of 0.0%.

Mothercare Seeking to Close Loss-Making Stores (April 8) TheTimes.co.uk

(April 8) TheTimes.co.uk

- British maternity products retailer Mothercare is seeking to shut loss-making stores and reduce rents in an attempt to survive tough trading conditions. This news comes less than a week after the retailer appointed former Kmart and Tesco executive David Wood as its new chief executive, forcing out Mark Newton-Jones from the position.

- The company is considering an insolvency process known as a company voluntary agreement (CVA). If Mothercare agrees to a CVA with its lenders, it could close up to 47 of its 143 stores.

French Connection to Sell Its Toast Brand (April 9) TheRetailBulletin.com

(April 9) TheRetailBulletin.com

- British fashion retailer French Connection is set to sell its Toast brand to Danish fashion house Bestseller. French Connection owns 75% of the issued share capital of Toast, while the brand’s founders, Jamie Seaton and Jessica Seaton, own the remaining 25%.

- French Connection remarked that the sale will enable it to focus on its own brand in the retail, wholesale and licensing businesses. The sale proceedings will be used to support the brand’s turnaround and return to profitability, French Connection said.

Ahold Delhaize Crosses €500 Million Mark in Its Share Buyback Program (April 10) Company press release

(April 10) Company press release

- Dutch retailer Ahold Delhaize announced that it has crossed the half-billion-euro line in a €2 billion ($1.7 billion) share buyback program that it initiated on November 8, 2017. The retailer said that it has repurchased 27,648,644 common shares to date, for a total consideration of €501.7 million ($620.5 million).

- The company hopes to complete the share buyback program by the end of 2018 and reduce its capital by canceling all or part of the common shares acquired through the program.

City Pantry Raises £4 Million for Its Catering Marketplace (April 9) TechCrunch.com

(April 9) TechCrunch.com

- City Pantry, a London-based office-catering marketplace, has raised £4 million ($5.7 million) in a new funding round led by Octopus Investments, with participation from Newable Private Investing and its existing investors.

- City Pantry, which was founded in 2013 and now serves more than 20,000 meals per week to employees of more than 500 companies, intends to use the new funds to expand across the UK over the next 18 months. Currently, the marketplace offers catering from 300 popular London caterers and restaurants.

ASIA RETAIL & TECH HEADLINES

Tencent Partners with Age of Learning for English Learning Apps in China (April 8) VentureBeat.com

(April 8) VentureBeat.com

- Tencent and educational games startup Age of Learning have teamed up to bring English learning apps to China. Tencent and Los Angeles–based Age of Learning will launch ABCmouse, an immersive English learning program for children in China. The aim is to make it more fun for Chinese kids to become fluent in English.

- Age of Learning’s team of child development and language learning experts created the ABCmouse curriculum, currently comprising more than 5,000 learning activities organized into hundreds of lessons and a structured learning path. Tencent has integrated this curriculum into a new ABCmouse mobile app and website, and is responsible for product development, marketing, sales and customer support.

China’s SenseTime, the World’s Highest-Valued AI Startup, Raises $600 Million (April 9) TechCrunch.com

(April 9) TechCrunch.com

- China now has the world’s highest-valued artificial intelligence (AI) startup, following SenseTime’s announcement that it has secured a $600 million series C investment round, which values the company at over $4.5 billion. That marks a hefty increase from the company’s most recent, $1.5 billion valuation after it raised a $410 million series B round last year. SenseTime was founded in 2014.

- SenseTime CEO Li Xu said that the company plans to use the capital to expand its presence overseas and to “widen the scope for more industrial application[s] of AI.” Beyond the high figures involved—the round is a worldwide record for fundraising by an AI company—SenseTime’s investment efforts are notable because of the names that have backed it.

Grab Delays Shuttering Uber App as Singapore Probes Merger Deal (April 6) TechCrunch.com

(April 6) TechCrunch.com

- Grab, the rival that is acquiring Uber’s business in Southeast Asia, agreed to extend the life of the Uber app until April 15 while the Competition and Consumer Commission of Singapore (CCCS) reviews the merger deal. Grab had originally intended to close the Uber app by April 8, but that has been delayed in Singapore by one week following a request from the CCCS, which is continuing to assess the implications of the tie-up.

- This agreement only covers Singapore, however, so the Uber app will be closed in the seven other countries where it was operational on April 8. Uber Eats is also being transitioned to Grab, as part of the Grab Food platform, and it will be closed at the end of May. The CCCS said that it has “reasonable grounds” to suspect that the deal may fall afoul of section 54 of Singapore’s Competition Act.

Dubai Cryptocurrency Firm Denies Alibaba Trademark Infringement (April 8) Reuters.com

(April 8) Reuters.com

- A Dubai-based cryptocurrency company called Alibabacoin Foundation has rebuffed allegations of trademark infringement brought against it by Alibaba Group in a US lawsuit last week. A judge at the US District Court in Manhattan imposed a temporary restraining order on Alibabacoin Foundation after Alibaba filed a complaint accusing it of making “prominent, repeated and intentionally misleading” use of its trademarks.

- In response, Alibabacoin Foundation’s lawyers said that the company had no intention to infringe on Alibaba’s intellectual property and that the lawsuit’s demand for it to shut down and restart with another name was “neither a reasonable [n]or proportionate response to our client’s entirely legitimate use of an inherently generic word which emanates not from China, but indeed from the very region in respect of which your client would seek to prohibit its use.”

LATAM RETAIL & TECH HEADLINES

Apple Pay Launches in Brazil with Itaú (April 6) ZDNet.com

(April 6) ZDNet.com

- Apple has launched its mobile payment and digital wallet service in Brazil in partnership with local bank Itaú. The Apple Pay partnership, launched last Wednesday, will be exclusive for 90 days and involves local retailers such as supermarket chain Pão de Açúcar and restaurants, which will offer discounts to those using the app.

- As part of the deal, Itaú customers also get discounts on Apple products. According to Itaú, the main goal of the partnership is to reduce friction for customers and avoid issues such as payment delays in retail outlets. Itaú has a customer base of about 60 million. The initial aim of the Apple Pay partnership is to reach 1.2 million of them.

Avaya Brazil Eyes SME Growth (April 5) ZDNet.com

(April 5) ZDNet.com

- Enterprise communications systems firm Avaya is looking to grow its presence in the small and medium enterprise (SME) sector in Brazil as local organizations look at increasing their IT budgets. According to Managing Director Marcio Rodrigues, Avaya’s Brazilian clients are now resuming conversations that had been left on the back burner for the last couple of years due to the recession, but the focus areas are rather different.

- “In a growth scenario, the main focus tends to be expansion, whereas now Brazilian companies are looking to spend again, but on projects that generate business efficiency and optimization,” Rodrigues said, noting that Avaya is currently approaching these clients and assessing the state of their technology portfolios in order to pitch total refreshes or progressive renovations that integrate with existing systems.

Mexico’s Walmex Says Same-Store Sales Up 13.5% in March (April 6) Reuters.com

(April 6) Reuters.com

- Walmart de Mexico said last Thursday that same-store sales rose in March by the biggest margin in more than 12 years on holiday shopping. Sales at Mexican stores open for at least a year rose by 13.5% from March last year, Walmex said. The growth was the strongest since January 2006, when such data was first available.

- Sales rose in the days leading up to Easter Sunday, known as Holy Week, as many people went on vacation. The holiday fell in April last year. “In addition to the Holy Week holidays, Walmex’s sales were supported by the company’s promotional campaigns...which have helped it gain market share,” said Marisol Huerta, an analyst at brokerage Multiva.

Sally Beauty Slashes Undisclosed Number of HQ Jobs (April 5) RetailDive.com

(April 5) RetailDive.com

- Sally Beauty is expanding a previously announced restructuring plan by cutting an undisclosed number of jobs, mostly at its corporate headquarters in Denton, TX. The changes are expected to generate $14–$15 million in annualized benefits, with benefits of $6–$7 million in fiscal year 2018, Sally Beauty spokesman Jeff Harkins said.

- Savings from cost-cutting initiatives will be reinvested into “market-competitive store wages,” technology to improve the customer experience and e-commerce growth. The company is also doubling down on its commitment to haircare and color, which make up about half of its assortment. Harkins said that the percentage will increase as the company scales back offerings in appliances such as hairdryers and flatirons.

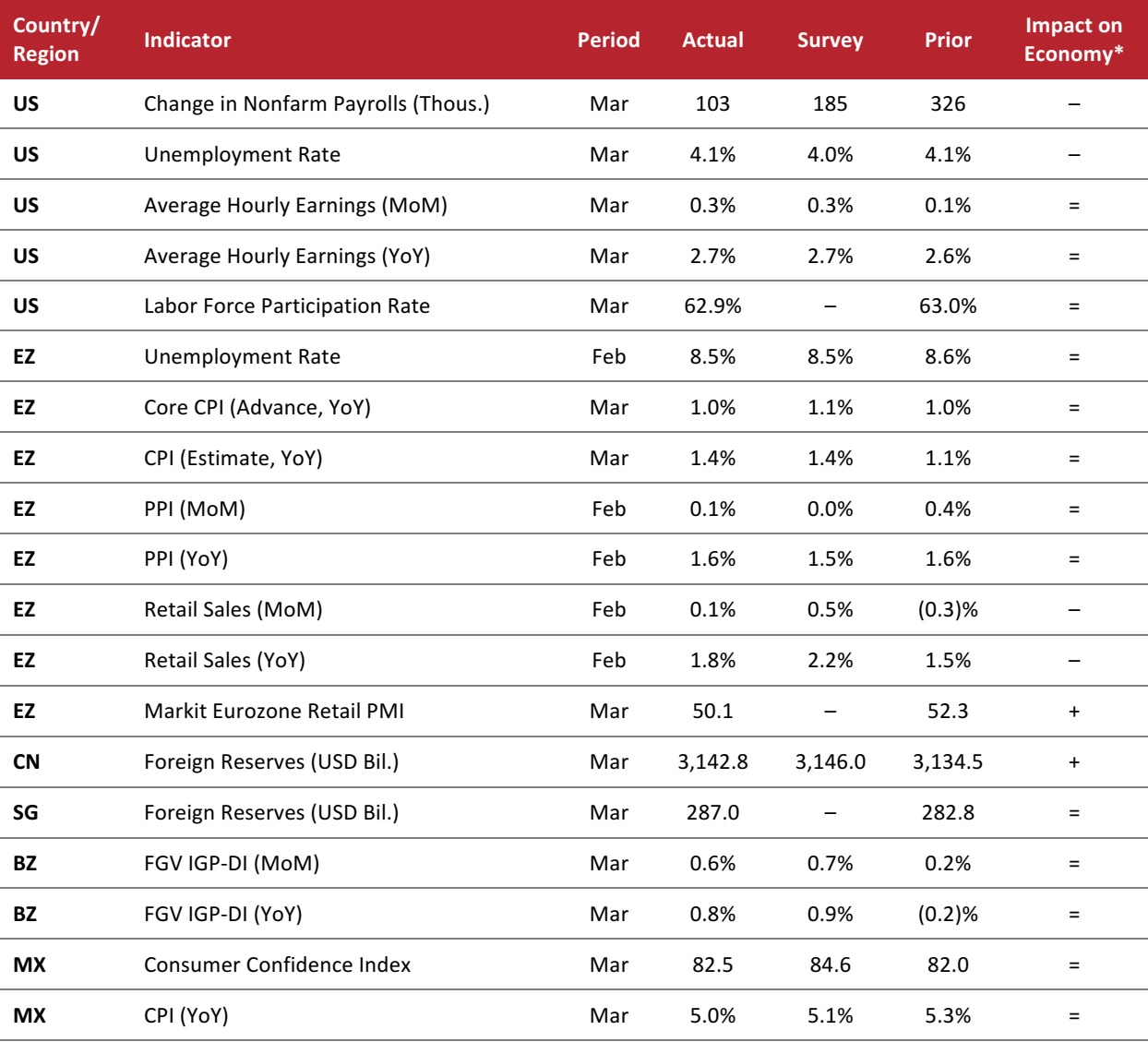

MACRO UPDATE

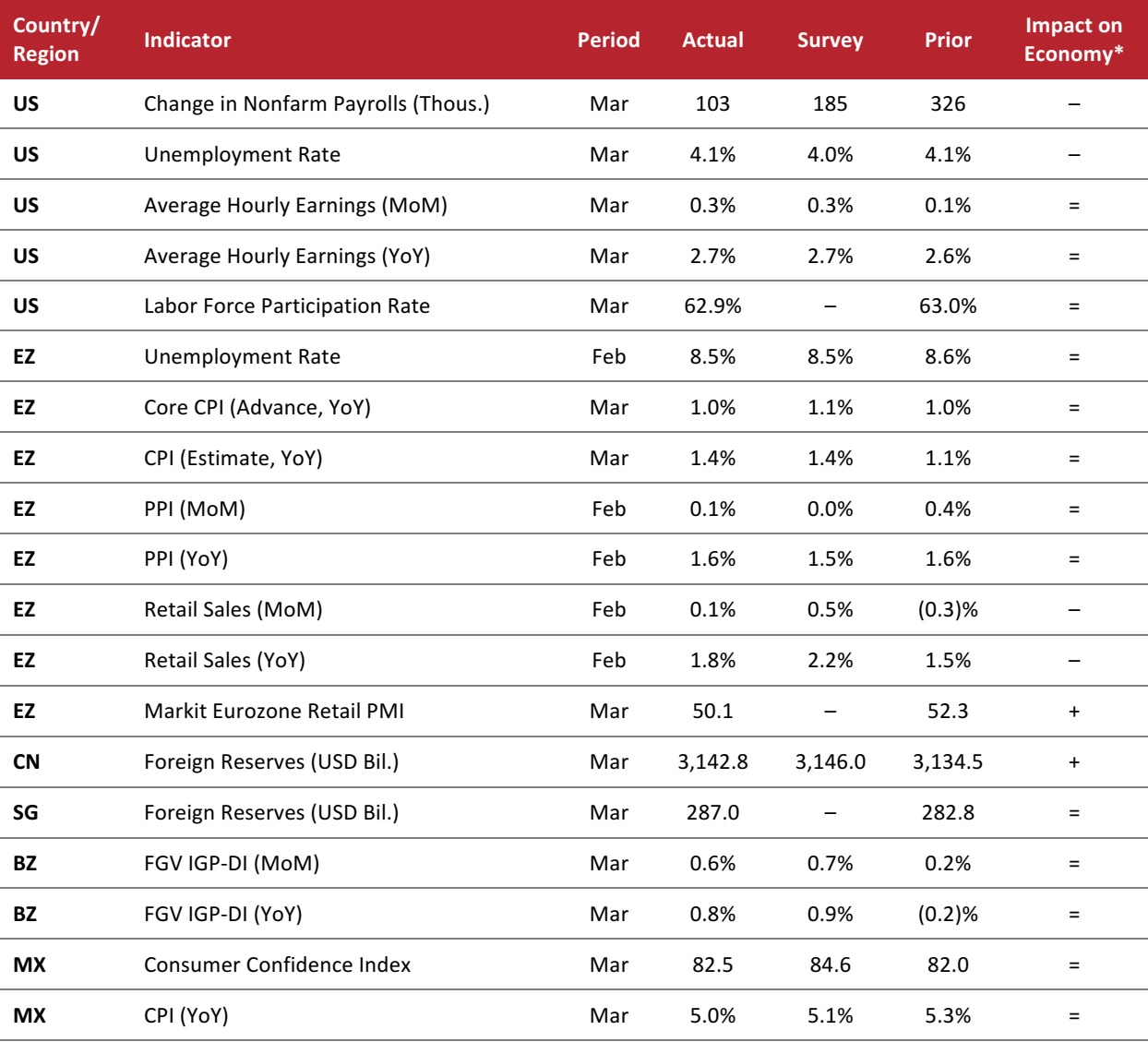

Key points from global macro indicators released April 4–11, 2018:

- US: In March, nonfarm payrolls increased by 103,000, coming in below the consensus estimate of 185,000. The US unemployment rate stayed at 4.1% in March. Average hourly earnings increased by 2.7% year over year in March, in line with the consensus estimate.

- Europe: In the eurozone, the unemployment rate edged down to 8.5% in February, in line with the consensus estimate. The eurozone Consumer Price Index (CPI) increased modestly in March and the eurozone Producer Price Index (PPI) increased modestly in February. Retail sales in the eurozone increased in February by 1.8% year over year, which was below the market’s expectation.

- Asia-Pacific: In China, foreign reserves stayed at $3.1 trillion in March, in line with the consensus estimate. In Singapore, foreign reserves increased slightly in March, to $287.0 billion.

- Latin America: In Brazil, the FGV IGP-DI Index, a measure of inflation, increased by 0.8% year over year in March. In Mexico, the Consumer Confidence Index edged up to 82.5 in March, while the CPI increased by 5.0% year over year, which was just below the market’s estimate.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Eurostat/Markit/Halifax/The People’s Bank of China/Monetary Authority of Singapore/Fundação Getulio Vargas/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Eurostat/Markit/Halifax/The People’s Bank of China/Monetary Authority of Singapore/Fundação Getulio Vargas/Instituto Nacional de Estadística y Geografía/Coresight Research

(April 10) CNNMoney.com

(April 10) CNNMoney.com

(April 9) Bloomberg.com

(April 9) Bloomberg.com

(April 10) BRC press release

(April 10) BRC press release

(April 10) Company press release

(April 10) Company press release

(April 9) TechCrunch.com

(April 9) TechCrunch.com

(April 8) Reuters.com

(April 8) Reuters.com

(April 6) ZDNet.com

(April 6) ZDNet.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Eurostat/Markit/Halifax/The People’s Bank of China/Monetary Authority of Singapore/Fundação Getulio Vargas/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Eurostat/Markit/Halifax/The People’s Bank of China/Monetary Authority of Singapore/Fundação Getulio Vargas/Instituto Nacional de Estadística y Geografía/Coresight Research